If you want to maximize your credit card rewards, I always recommend earning transferable points currencies with your credit cards whenever possible. This maximizes your flexibility and shields you from points devaluing. Earning points is one thing, but how should you redeem them? In this post I wanted to take a look at the best uses of Citi ThankYou points.

In this post:

Citi ThankYou points are easy to earn

There are several credit cards that earn Citi ThankYou points, and the most popular is the $95 annual fee Citi Strata Premier℠ Card (review), which is currently offering a welcome bonus of 60,000 ThankYou points after spending $4,000 within three months.

There are lots of reasons to get this card beyond the initial bonus, including the card offering excellent bonus categories of 3x points on dining, gas and EV charging, at supermarkets, airfare, and hotels, plus the card offering a $100 annual hotel credit.

There are a few no annual fee cards you can complement this with to really maximize value:

- The Citi Double Cash® Card (review) offers 1x ThankYou points when you make a purchase and 1x ThankYou points when you pay for that purchase, making it one of the best cards for everyday spending

- The Citi Rewards+® Card (review) has an innovative “rounding up” feature on spending, and the card also offers a 10% rebate on redemptions, which can net you up to 10,000 ThankYou bonus points per year

- The Citi Custom Cash® Card (review) offers 5x points on your top eligible spending category each billing cycle, on up to $500 of spending per billing cycle; potential categories include drugstores, fitness centers, gas stations, grocery stores, home improvement stores, live entertainment, restaurants, select streaming services, select transit, and select travel

Between those cards, Citi ThankYou points should rack up pretty quickly. Read about my Citi credit card strategy here.

How much Citi ThankYou points are worth

Based on my methodology of valuing points currencies, I value Citi ThankYou points at 1.7 cents each. For that matter, that’s how much I value all major transferable points currencies. There’s no science to that, but rather I think it’s a fair but conservative valuation for how much value you could get if you’re maximizing your rewards.

How you can redeem Citi ThankYou points

Let’s take a brief look at how you can redeem Citi ThankYou points, and then we’ll talk about how you should redeem points to maximize value. Citi ThankYou points can be transferred to airline and hotel partners. The program has the below 18 partners, including 14 airlines and four hotel groups, and most transfer at a 1:1 ratio.

Airline Partners | Hotel Partners |

|---|---|

Aeromexico Club Premier | |

There are various other ways to redeem Citi ThankYou points, though they generally offer at most one cent of value per point. Among other things, you can redeem Citi ThankYou points in the following ways:

- Toward the cost of a flight through the Citi Travel Portal

- Toward a statement credit, direct deposit, or check

- Toward a gift card with a variety of retailers

- Toward shopping directly with popular retailers, ranging from Amazon to Best Buy

The catch is that aside from points transfers, you’ll get at most one cent of value per ThankYou point.

The best uses of Citi ThankYou points

Admittedly with each Citi ThankYou partner, some niche redemptions allow you to maximize value. However, I wanted to cover what I consider to be the eight most valuable transfer partners in terms of the general appeal.

It’s important to understand that you’ll generally get the most value by redeeming your points for international flights, especially in business class. Also, if you’re new to redeeming points, check out my top 10 tips for redeeming points, so you can hopefully get the best value.

Below are my favorite Citi ThankYou partners in alphabetical order.

Transfer to Air France-KLM Flying Blue

If you want to fly across the Atlantic in business class, it’s tough to beat Flying Blue, as this is the key to unlocking Air France business class and KLM business class awards. Not only is this great if you’re looking to travel to Amsterdam and Paris, but the two airlines have extensive route networks throughout Europe and beyond. You can even add a stopover to an award at no extra cost.

You can generally expect that transatlantic business class awards will start at 50,000 miles one-way, with mild fuel surcharges (around $200 one-way). You can sometimes get even better pricing if you can book a Flying Blue Promo Rewards offer.

Transfer to Avianca LifeMiles

If you want to redeem your Citi ThankYou points for travel on a Star Alliance airline, Avianca LifeMiles is your best bet. The program gives you access to all Star Alliance airlines without fuel surcharges, so this could be useful whether you’re looking to fly to Europe on Lufthansa, or fly to South America on Copa.

For example, a transatlantic business class award will generally start at 63,000 miles one-way, while a business class award to Southeast Asia will start at 78,000 miles one-way.

Transfer to Emirates Skywards

Emirates Skywards is the best way to book most Emirates tickets with miles. This could be useful whether you want to take one of Emirates’ fifth freedom flights (from Newark to Athens or New York to Milan), or whether you’re looking to fly with the airline to Dubai and beyond.

It’s even possible to redeem miles for Emirates first class, though it could take some work. A shower in the sky is a worthwhile reward, though! A first class award between the United States and Europe costs 102,000 Skywards miles one-way, if you can find award availability.

Transfer to EVA Air Infinity MileageLands

One big advantage of Citi ThankYou is that the program partners with EVA Air Infinity MileageLands, as no other transferable points currencies allow 1:1 transfers (Capital One also partners with EVA Air, but transfers are at a 2:1.5 ratio).

What makes this program great is that it’s the key to unlocking EVA Air business class awards. EVA Air releases more award availability to members of its own frequent flyer program than to members of partner frequent flyer programs, and there’s huge value in that.

You can redeem just 75,000-80,000 miles for a one-way EVA Air business class award across the Pacific, which is an excellent value, especially given the good availability.

Transfer to JetBlue TrueBlue

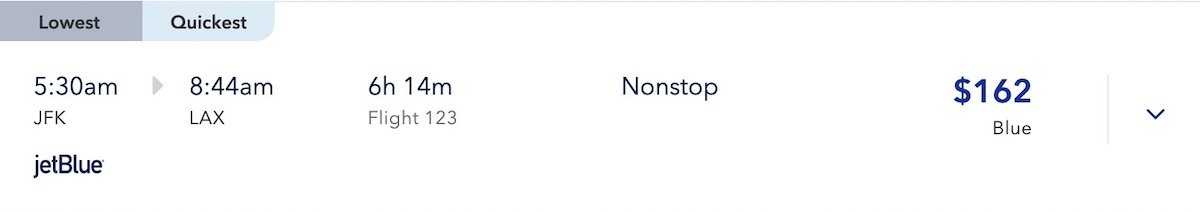

JetBlue TrueBlue is a revenue based currency when it comes to redemptions, at least for travel on JetBlue metal. If you transfer Citi points to JetBlue TrueBlue, you can generally expect that each TrueBlue point will get you around 1.5 cents toward the cost of a JetBlue economy ticket. For example, take the below flight from New York to Los Angeles, which costs either $162 or 10,300 points plus $5.60 in taxes.

Another awesome perk of JetBlue TrueBlue is that partner redemptions are now possible, so you can redeem these points for travel in Qatar Airways business class, and that could be a good value.

Transfer to Qatar Airways Privilege Club

Citi ThankYou partners with Qatar Airways Privilege Club, though keep in mind that it’s possible to transfer rewards between the various “flavors” of Avios. So this is also a way to indirectly earn Avios with programs like British Airways Executive Club, Iberia Plus, and Aer Lingus AerClub, as each have their respective sweet spots.

Fortunately there are also lots of great uses of Avios with Qatar Airways Privilege Club Avios. Not only is this one of the best way to redeem rewards for Qatar Airways business class, but Privilege Club also has all kinds of unique partnerships, with airlines ranging from JetBlue to RwandAir.

Transfer to Singapore Airlines KrisFlyer

Singapore Airlines restricts most of its first class and business class award space to members of its own KrisFlyer program. So while the airline is in the Star Alliance, don’t expect to be able to snag Singapore Airlines long haul premium cabin awards through most other programs.

Fortunately Singapore Airlines KrisFlyer has fair redemption rates, pretty good award availability in business class (and sometimes Suites and first class), and limited surcharges. For example, a one-way business class award on the world’s longest flight will cost you 111,500 miles, while a one-way business class award from New York to Frankfurt or Houston to Manchester will cost you 81,000 miles. You can get even more value by booking a Spontaneous Escapes ticket, which is a monthly discount on select awards.

Transfer to Turkish Airlines Miles&Smiles

Turkish Airlines flies to more countries than any other airline in the world, and it’s also one of my all-around favorite airline brands. While Turkish Miles&Smiles isn’t as lucrative as it used to be, the program still offers some solid redemption values.

For example, a one-way Turkish Airlines business class award between the United States and Istanbul starts at 65,000 miles one-way, which is quite a good value. While there are surcharges on these awards, they’re quite mild.

How not to redeem Citi ThankYou points

I tend to think that if you feel good about an award redemption then that should be enough. At the same time, I’d generally aim to get more than one cent of value per Citi ThankYou point, purely based on the other card ecosystems out there.

You’re typically going to get at most one cent of value per point if you redeem your Citi ThankYou rewards through the Citi ThankYou travel portal, or redeem them toward gift cards, statements credits, or purchases with retailers. Personally I’d try to avoid those redemptions, simply because there are better options if you’re looking to redeem your points as cash toward travel purchases, or are looking to earn cash back.

Bottom line

Citi ThankYou is a valuable transferable points currency, which I’ve been collecting for years. It’s hard to beat the combination of the Citi Strata Premier℠ Card and Citi Double Cash® Card, so that you can earn 2-3x points per dollar spent.

In general Citi ThankYou points are a currency that I’d recommend collecting if you intend to transfer points to airline partners, as that’s the way to maximize value. You can unlock some amazing international first & business class redemptions with these points, with options including Air France, Emirates, EVA Air, Singapore Airlines, and more. They can also be redeemed pretty efficiently on JetBlue.

To those who collect Citi ThankYou points, what are your favorite uses of the currency?

I’m still trying to determine my go forward strategy with the prestige, CSR, Amex Dl reserve, UA presidential plus and Hilton Aspire.

I’ve already decide to close the High end Marriott Amex. And feel a need to reduce the number of high end cards, Delta Reserve is likely to go following the lounge changes, This would leave me with the Prestige, Hilton and CSR.

Would appreciate anyone’s thoughts on whether to downgrade the prestige to one of their lower end cards

I wouldn't downgrade the Citi Prestige since you won't be able to upgrade if you change your mind later.

Nah..Turkish is off the list after the devalue. They basically have flyingblue surcharges with a higher points requirement.

As a Citi card holder I would say the Thank You Point program doesn’t allow clear following of the points you earn by checking online. They also have been problematic with the 10x point earning on the Travel Portal and are not awarding this consistently. If you get the Premier card you will need to keep a careful eye on points earnings so you don’t get shortchanged.

You keep recycling the same articles , but Citi is far from being unique transfer partner to QR, for instance Amex is as well…

@ Stan P -- Sorry, I got that one detail wrong! But I also don't think it's fair to call this content "recycled." I last wrote about the best uses of Citi ThankYou points about a year ago. A lot has changed since then -- Turkish Miles&Smiles devalued, Qatar Privilege Club added all kinds of new redemption options, JetBlue TrueBlue added redemptions on partners for the first time, etc.

I talk a lot about transferable...

@ Stan P -- Sorry, I got that one detail wrong! But I also don't think it's fair to call this content "recycled." I last wrote about the best uses of Citi ThankYou points about a year ago. A lot has changed since then -- Turkish Miles&Smiles devalued, Qatar Privilege Club added all kinds of new redemption options, JetBlue TrueBlue added redemptions on partners for the first time, etc.

I talk a lot about transferable points currencies, and it's worth understanding how to redeem them, so I think there's value in keeping this kind of content updated.

I absolutely love Citi TY points! Myself and P2 have opened the CP card as well as the CCC and CR+ cards and the trios have consistently earned us 100k pts/yr just through our organic spend...not to mention the 80k SUB back then. Great cards!