Link: Apply now for the Citi® / AAdvantage Business™ World Elite Mastercard®

The Citi® / AAdvantage Business™ World Elite Mastercard® (review) is the co-branded Citi and American Airlines business card. The card offers several valuable perks, and also has an excellent welcome bonus at the moment, making it an ideal time to apply.

However, when it comes to actually spending money on the card, there’s one thing that works very differently than on many other business credit cards. I want to discuss that in a bit more detail in this post, as it’s something that causes confusion… but you can make it work to your advantage!

In this post:

American’s business card rewards authorized users

On a vast majority of personal and small business credit cards, the primary cardmember is fully rewarded for the spending of authorized users. So just as the primary cardmember is on the hook for paying the bill, they also benefit by earning the rewards.

That’s not always the case, as some corporate cards do incentivize the individual employees, but it’s rare on small business cards. Now, I imagine that many people who are authorized users on business cards wish they were earning the rewards for their own spending.

That’s why there’s an interesting detail of the Citi AAdvantage Business Card that’s worth being aware of, as it also ties into the AAdvantage Business program, which is American’s small business rewards program. On the Citi AAdvantage Business Card:

- Redeemable AAdvantage miles earned from an authorized user’s card will be allocated to the AAdvantage Business account, which the primary cardmember has control over (and can then allocate however they’d like)

- Loyalty Points earned by authorized users are posted to the AAdvantage account of the authorized user, and not to the AAdvantage account of the primary cardmember

- Note that spending from both the primary cardmember and authorized users counts toward the welcome bonus and any spending requirements; however, some of the card perks (like a first free checked bag) are only available to the primary cardmember

One of the main reasons that people spend on American credit cards is to be able to earn Loyalty Points, as this is the metric by which you earn elite status, and qualify for Loyalty Point Rewards. It’s possible to earn elite status exclusively through credit card spending.

So if you’re a primary cardmember on this card, be aware that the spending of authorized users generally won’t help you qualify for elite status. What’s noteworthy is that this policy only applies on Citi’s co-branded AAdvantage business card. Meanwhile on Barclays’ co-branded AAdvantage business card, the primary cardmember is rewarded for authorized user spending (though that card portfolio will eventually be eliminated).

Is rewarding authorized users a good policy?

It goes without saying that if you’re a small business owner and like to be rewarded for the spending of your employees, this rewards structure isn’t ideal, and provides a strong incentive to use another card.

After all, one of the main reasons to spend on American’s co-branded cards is for the Loyalty Points, and that’s not something you’re benefiting from here, at least on an ongoing basis. You’re on the hook for the expenses, but aren’t receiving the rewards.

However, there are also some small business owners who like their employees to be rewarded for their spending, and it’s something that isn’t uncommon on corporate accounts. In that sense, the card offers a lot of flexibility — your authorized users not only earn Loyalty Points, but you can then allocate the redeemable AAdvantage miles to whichever account you’d like, directly from the central AAdvantage Business account. You could even use this as part of some sort of an incentive program for your business.

Personally I think most people won’t be a fan of this policy, so it’s worth being aware of this, as this is the only co-branded airline credit card in the United States I know of that allocates rewards in this way.

Double dip Loyalty Points for a limited time

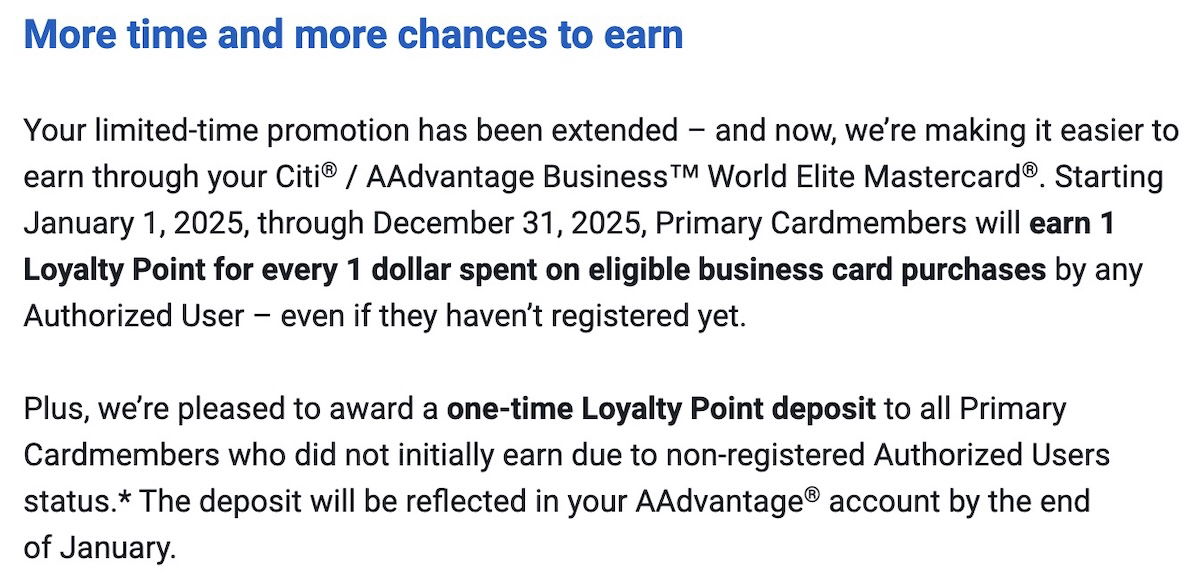

It’s worth noting that while the above reflects the standard policy, some people with the Citi AAdvantage Business Card are eligible for a limited time offer. Eligible cardmembers can essentially double dip — not only does the authorized user earn one Loyalty Point per dollar spent, but the primary cardmember also earns one Loyalty Point per dollar spent.

Now, this is technically only available to select accounts, so you’ll need to check your email to see if you’re eligible for this. Currently, this is available through December 31, 2025.

Honestly, this is a pretty lucrative promotion. For example, if you have an authorized user who spends $200K on a card, both the primary cardmember and authorized user would receive 200,000 Loyalty Points, enough for Executive Platinum.

Again, it’s possible not everyone is eligible for this, but I believe the offer is at least pretty widely targeted, as I’ve received several reports from readers indicating that they’re eligible. Personally, this is how I plan on qualifying for AAdvantage status this year.

I can’t help but wonder if this policy might even stick around, given that many primary cardmembers might not be a fan of the Loyalty Points only being awarded to authorized users, plus the emphasis that so many card issuers have on increasing their business card wallet share.

American business card authorized user logistics

There are often questions about authorized users logistics on the Citi AAdvantage Business Card. How do you add authorized users? Once you’ve added an authorized user, how do you actually add their AAdvantage number, to ensure they get the authorized user rewards? Let me address those questions…

How to add authorized users to the card

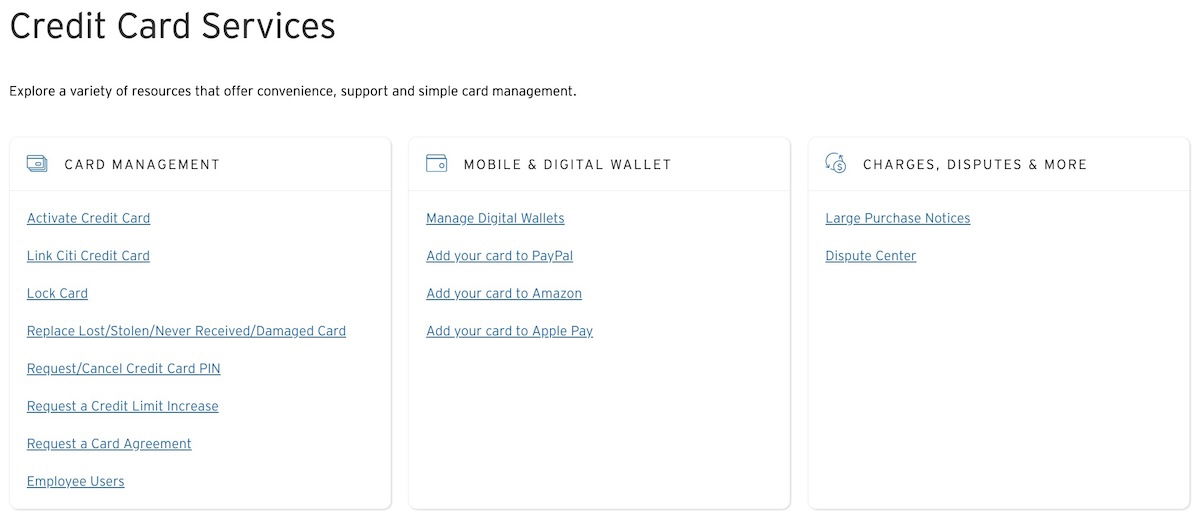

First, how do you add authorized users to the Citi AAdvantage Business Card? This is no different than virtually any other business card, so it’s not too complicated. There are two ways to do so:

- After you submit your application, you’ll have the option of adding authorized users

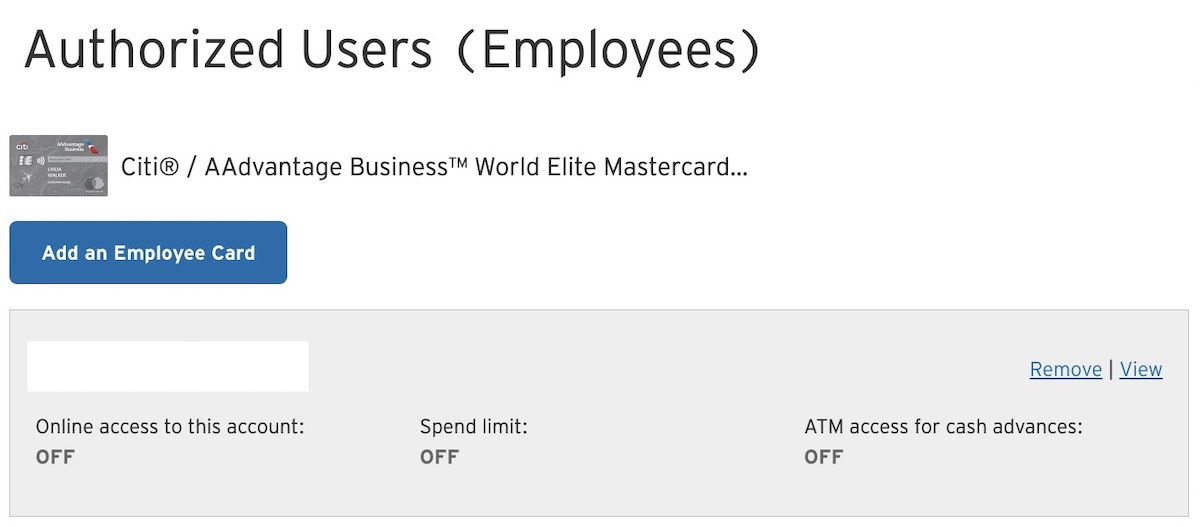

- If you want to add authorized users after opening your card, just log into your Citi account online, click on the “Services” heading, then the “Credit Card Services” prompt, and then in the “Card Management” section, select “Employee Users,” and then “Add an Employee Card”

How to link authorized user AAdvantage account info

Here’s the most common question related to this card. When you add an authorized user to the Citi AAdvantage Business Card, how do you actually link their AAdvantage account information so that Loyalty Points credit to them, since AAdvantage account info isn’t requested when adding authorized users?

This confused me when I added an authorized user, and I felt like customer support at both Citi and AAdvantage Business couldn’t give me a clear answer as to what to expect. So I’m happy to report back with my experience.

Long story short, some amount of time after you add an authorized user, they’ll receive an email either welcoming or inviting them to the AAdvantage Business program (you have to provide an email address when you add an authorized user, so that’s where the email goes). This email might come days after you add an authorized user, or it could come a full billing cycle (or more) later.

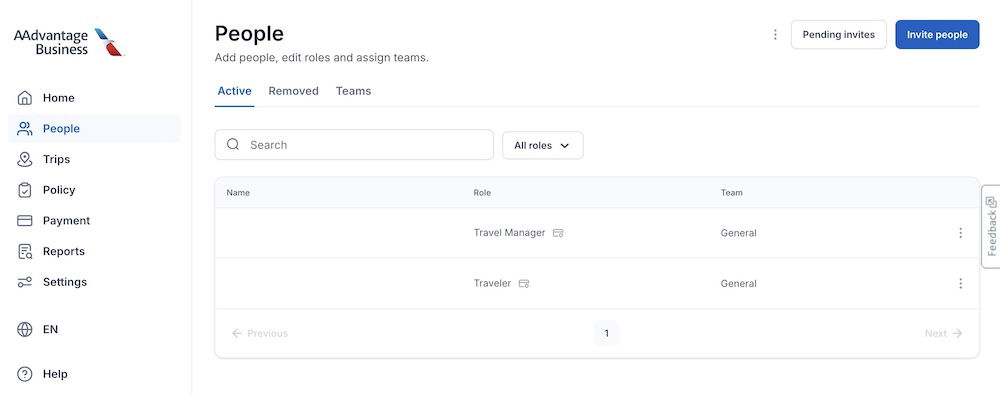

When the primary cardmember logs into their AAdvantage Business account (separate from their personal AAdvantage account or Citi account), they may then see that authorized user listed in the “People” section. Specifically, you’ll want to look for the card logo next to their name.

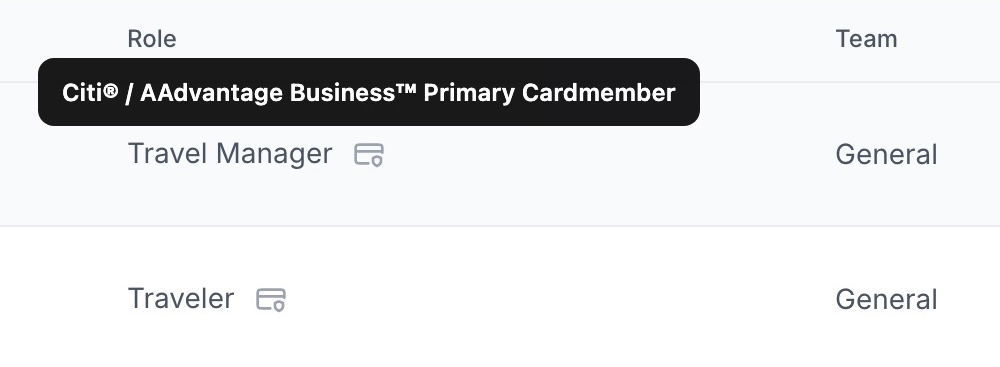

In the “Role” section, the primary cardmember will be listed as the “Travel Manager.”

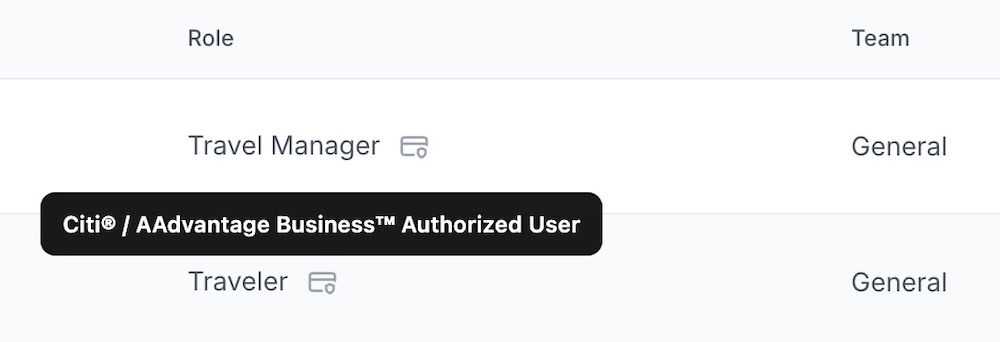

Meanwhile the authorized user will be listed as the “Traveler.”

If the authorized user doesn’t automatically show up listed there, check the “Pending invites” section at the top right, and you may see them listed there. You know that everything with the authorized user is linked correctly when the card logo appears next to their name.

Let me emphasize a couple of points about this, as someone who became a bit frustrated with the process:

- There’s no point in trying to rush the process, so it could take weeks for the authorized user to get the welcome email, so just be patient

- It was explained to me that even all spending prior to that process being successfully completed will still have Loyalty points post correctly, so don’t worry about that

Bottom line

The Citi AAdvantage Business Card takes an unusual approach to rewarding authorized users. Authorized user spending earns Loyalty Points for the authorized user, rather than the primary cardmember. Meanwhile the AAdvantage miles earned from spending go to the central AAdvantage Business account, and can then be allocated to the AAdvantage account of any employee (or the business owner), as desired.

However, there is a limited time promotion that many are eligible for, which essentially allows people to double dip, and earn Loyalty Points both for the authorized user and primary cardmember. I think that’s something that might interest many (including me!).

What do you make of the authorized user rewards structure on this card?

Everyone gets their bonus LPs?

First of all, I had zero communication from Citi/AA regarding this horrible switch-up.

Two of the primary reasons my company uses this card are because of the miles and LPs.

Citi will 100% lose my business over this — and we spend a LOT of money through this card.

In my opinion, the distribution of LPs should be at the sole discretion of the Primary Holder, just like the miles. After all,...

First of all, I had zero communication from Citi/AA regarding this horrible switch-up.

Two of the primary reasons my company uses this card are because of the miles and LPs.

Citi will 100% lose my business over this — and we spend a LOT of money through this card.

In my opinion, the distribution of LPs should be at the sole discretion of the Primary Holder, just like the miles. After all, we Primary Holders are the ones held responsible for every single penny spent through this card.

I'm PISSED

In my case, the LPs from spend on AU card posted on AU account without a problem a few weeks after the statement closed. However, those LPs are still missing on a primary user account. AA really created a mess here

Same here. T&Cs say it will take 8-10 weeks for LPs to post to primary cardmember’s account, which is annoying. I have a few more weeks to go until I am at 10 weeks and hoping this works as expected.