Link: Learn more about the Citi Strata Elite℠ Card, Citi Strata Premier® Card, or Citi Double Cash® Card

If you want to maximize your credit card rewards, I always recommend earning transferable points currencies with your credit cards whenever possible. This maximizes your flexibility and shields you from points devaluing. Earning points is one thing, but how should you redeem them? In this post, I’d like to take a look at the best uses of Citi ThankYou points.

In this post:

Citi ThankYou points are easy to earn

There are several credit cards that earn Citi ThankYou points. In general, you’ll want to get one of the two Citi ThankYou “hub” cards, if possible, as these allow you to maximize the value of all your Citi ThankYou points:

- The Citi Strata Elite℠ Card (review) has a $595 annual fee, has some lucrative bonus categories, and also offers credits, benefits, and lounge access, which can help offset the annual fee

- The Citi Strata Premier® Card (review) has a $95 annual fee, and also features a great return on spending, plus offers a $100 annual hotel credit

Beyond that, I’d recommend getting one or more no annual fee Citi ThankYou “booster” cards, which can help you maximize your points:

- The no annual fee Citi Strata℠ Card (review) offers 3x points on supermarkets, select transit, gas stations & EV charging, and self-select categories, and 2x points on restaurants

- The no annual fee Citi Double Cash® Card (review) offers 1x points when you make a purchase and 1x points when you pay for that purchase, making it one of the best cards for everyday spending

- The no annual fee Citi Custom Cash® Card (review) offers 5x points on your top eligible spending category each billing cycle, on up to $500 of spending per billing cycle; potential categories include drugstores, fitness centers, gas stations, grocery stores, home improvement stores, live entertainment, restaurants, select streaming services, select transit, and select travel

Between those cards, Citi ThankYou points should rack up pretty quickly.

How much Citi ThankYou points are worth

Based on my methodology of valuing points currencies, I value Citi ThankYou points at 1.7 cents each. For that matter, that’s how much I value all major transferable points currencies. There’s no science to that, but rather I think it’s a fair but conservative valuation for how much value you could get if you’re maximizing your rewards.

How you can redeem Citi ThankYou points

Let’s take a brief look at how you can redeem Citi ThankYou points, and then we’ll talk about how you should redeem points to maximize value. Citi ThankYou points can be transferred to airline and hotel partners. The program has the below 19 partners, including 15 airlines and four hotel groups, and most (but not all) transfer at a 1:1 ratio.

Airline Partners | Hotel Partners |

|---|---|

Aeromexico Club Premier | |

Let me emphasize that the above transfer partners and ratios assume that you have the Citi Strata Elite℠ Card and/or Citi Strata Premier® Card (review). If you have either of those cards, then you can transfer all your points at the best possible ratio.

There are various other ways to redeem Citi ThankYou points, though they generally offer around 0.75-1.0 cents of value per point. Among other things, you can redeem Citi ThankYou points in the following ways:

- Toward the cost of a flight through the Citi Travel portal

- Toward a statement credit, direct deposit, or check

- Toward a gift card with a variety of retailers

- Toward shopping directly with popular retailers, ranging from Amazon to Best Buy

This isn’t how I’d recommend using your points, since that’s not really a way to maximize rewards.

The best uses of Citi ThankYou points

Admittedly with each Citi ThankYou partner, some niche redemptions allow you to maximize value. However, I’d like to cover what I consider to be the most valuable transfer partners in terms of the general appeal. Keep in mind that we sometimes see transfer bonuses from Citi ThankYou, which can stretch your points even further, and make the math even better.

It’s important to understand that you’ll usually get the most value by redeeming your points for international flights, especially in first and business class. Also, if you’re new to redeeming points, check out my top 10 tips for redeeming points, so you can hopefully get the best value. Below are my favorite Citi ThankYou partners, in no particular order.

Transfer to American AAdvantage

The most exciting development with the Citi ThankYou ecosystem is that it’s now possible to transfer these rewards to American AAdvantage. The AAdvantage program has lots of sweet spots, both for travel on American, and for travel on partner airlines.

You can travel across the Atlantic for just 57,500 AAdvantage miles one-way in business class, which is a great deal. I also love the ability to redeem on Etihad Airways and Qatar Airways, though you’ll generally find the best availability for flights not touching the United States. For example, you could redeem just 50,000 AAdvantage miles to fly Etihad’s amazing A380 first class from Abu Dhabi to Singapore.

Transfer to Air France-KLM Flying Blue

If you want to fly across the Atlantic in business class, Flying Blue is one of the most useful programs, as this is the key to unlocking Air France business class and KLM business class awards. Not only is this great if you’re looking to travel to Amsterdam and Paris, but the two airlines have extensive route networks throughout Europe and beyond. You can even add a stopover to an award at no extra cost.

You can generally expect that transatlantic business class awards will start at 60,000 miles one-way, with mild fuel surcharges (around $200 one-way). You can sometimes get even better pricing if you can book a Flying Blue Promo Rewards offer.

Transfer to Avianca Lifemiles

If you want to redeem your Citi ThankYou points for travel on a Star Alliance airline, Avianca Lifemiles is a good option. The program gives you access to all Star Alliance airlines without fuel surcharges, so this could be useful whether you’re looking to fly to Europe on Lufthansa, or fly to South America on Copa.

For example, a transatlantic business class award will generally start at 80,000 miles one-way, while a first class award to Japan starts at 120,000 miles one-way. You can also get award discounts and waived fees if you become a Lifemiles+ member.

Transfer to EVA Air Infinity MileageLands

One big advantage of Citi ThankYou is that the program partners with EVA Air Infinity MileageLands, as no other transferable points currencies allow 1:1 transfers (Capital One also partners with EVA Air, but transfers are at a 2:1.5 ratio).

What makes this program great is that it’s the key to unlocking EVA Air business class awards. EVA Air releases more award availability to members of its own frequent flyer program than to members of partner frequent flyer programs, and there’s huge value in that.

You can redeem just 75,000-80,000 miles for a one-way EVA Air business class award across the Pacific, which is an excellent value, especially given the good availability.

Transfer to JetBlue TrueBlue

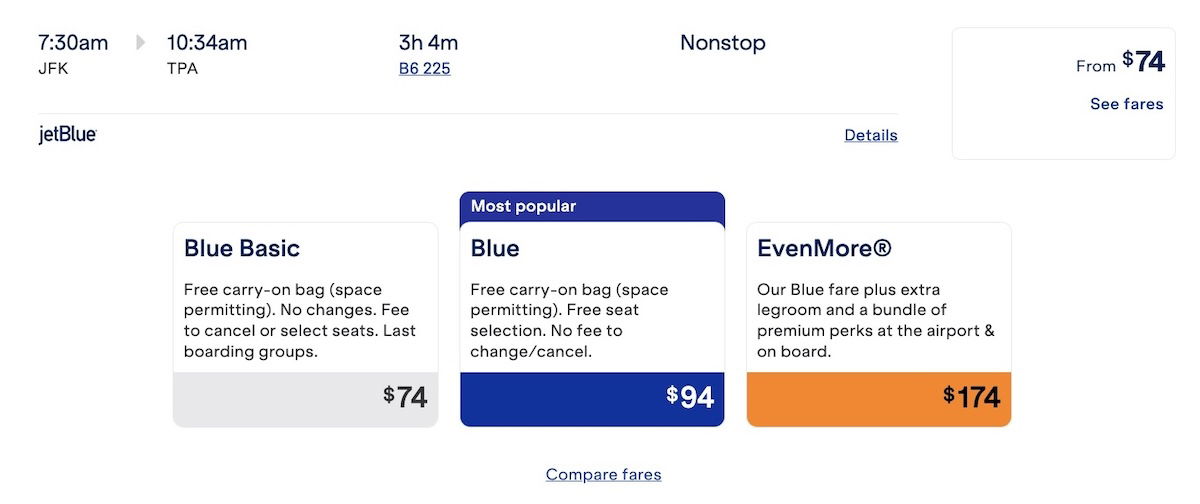

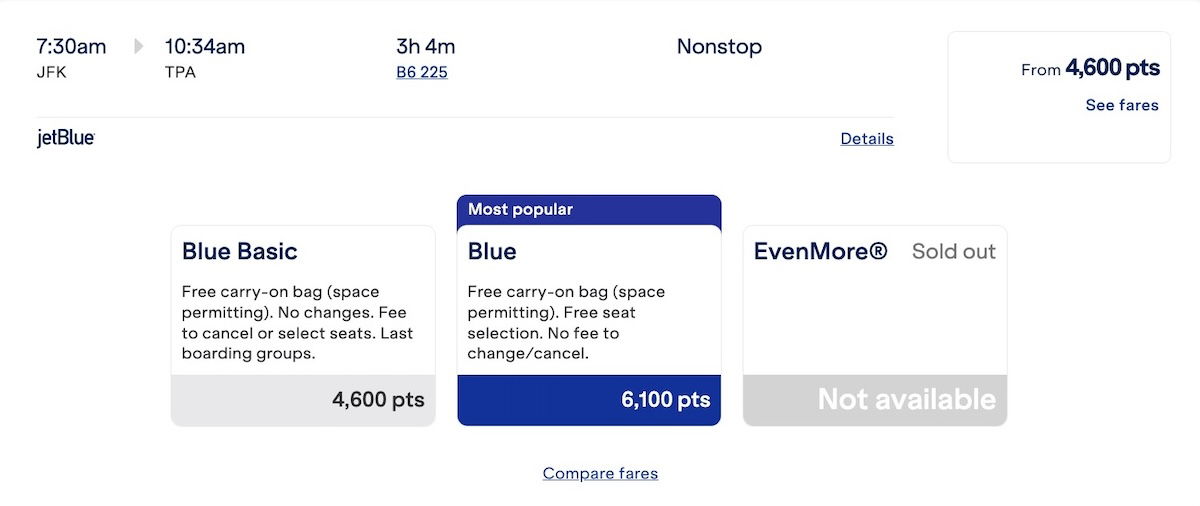

JetBlue TrueBlue is a revenue based currency when it comes to redemptions, at least for travel on JetBlue metal. If you transfer Citi points to JetBlue TrueBlue, you can generally expect that each TrueBlue point will get you around 1.4-1.5 cents toward the cost of a JetBlue economy ticket.

For example, take the below flight from New York to Tampa, which costs either $94 or 6,100 points plus $5.60 in taxes.

Another awesome perk of JetBlue TrueBlue is that partner redemptions are now possible, so you can redeem these points for travel in Qatar Airways business class, and that could be a good value. I consider Citi ThankYou to be the best program for JetBlue transfers, thanks to the 1:1 transfer ratio, plus lack of federal excise taxes being passed on to consumers.

Transfer to Qatar Airways Privilege Club

Citi ThankYou partners with Qatar Airways Privilege Club, though keep in mind that it’s possible to transfer rewards between the various “flavors” of Avios. So this is also a way to indirectly earn Avios with programs like British Airways Club, Iberia Club, Finnair Plus, and Aer Lingus AerClub, as each have their respective sweet spots.

Fortunately there are also lots of great uses of Avios with Qatar Airways Privilege Club Avios. Not only is this one of the best way to redeem rewards for Qatar Airways business class, but Privilege Club also has all kinds of unique partnerships, with airlines ranging from JetBlue to RwandAir.

Transfer to Singapore Airlines KrisFlyer

Singapore Airlines restricts most of its first class and business class award space to members of its own KrisFlyer program. So while the airline is in the Star Alliance, don’t expect to be able to snag Singapore Airlines long haul premium cabin awards through most other programs.

Fortunately Singapore Airlines KrisFlyer has fair redemption rates, pretty good award availability in business class (and sometimes Suites and first class), and limited surcharges. For example, a one-way business class award on the world’s longest flight will cost you 111,500 miles, while a one-way business class award from New York to Frankfurt or Houston to Manchester will cost you 81,000 miles. You can get even more value by booking a Spontaneous Escapes ticket, which is a monthly discount on select awards.

Transfer to Virgin Atlantic Flying Club

The Virgin Atlantic Flying Club program can be useful for redemptions on Virgin Atlantic and partner airlines. On Virgin Atlantic, Flying Club has dynamic award pricing nowadays. The good news is that on the low end, redemption rates in business class are as cheap as they’ve ever been (of course that assumes you can find availability).

There are also some great partner redemption opportunities, including on SkyTeam airlines, and carriers like All Nippon Airways. I redeem through Flying Club with quite some frequency.

Transfer to Turkish Airlines Miles&Smiles

Turkish Airlines flies to more countries than any other airline in the world, and it’s also one of my all-around favorite airline brands. While Turkish Miles&Smiles isn’t as lucrative as it used to be, the program still offers some solid redemption values.

For example, a one-way Turkish Airlines business class award between the United States and Istanbul starts at 65,000 miles one-way, which is quite a good value. While there are surcharges on these awards, they’re quite mild.

Transfer to Leading Hotels of the World Leaders Club

Leading Hotels of the World (LHW) is a collection of over 400 luxury properties, most of which are independent. So I think this is a pretty underrated transfer option, especially if you value luxury hotel stays. Citi ThankYou to Leaders Club points transfers are at a 5:1 ratio, and each Leaders Club point typically gets you around 8.0 cents toward the cost of a hotel stay.

This means you can redeem Citi ThankYou points for roughly 1.6 cents each toward the cost of a luxury hotel stay, which I’d consider to be a solid value.

Transfer to Choice Privileges

On the other end of the hotel spectrum, it’s possible to transfer Citi ThankYou points to Choice Privileges at a 1:2 ratio. It’s rare to see a transferable points currency offer good value redemptions for budget hotels, but there’s quite a bit of upside to be had here.

This is true whether you’re looking to redeem at one of Choice’s brands, or at a higher end property through Choice Privileges’ partnership with Preferred Hotels.

How not to redeem Citi ThankYou points

I tend to think that if you feel good about an award redemption then that should be enough. At the same time, I’d generally aim to get more than one cent of value per Citi ThankYou point, purely based on the other card ecosystems out there.

You’re typically going to get at most one cent of value per point if you redeem your Citi ThankYou rewards through the Citi ThankYou travel portal, or redeem them toward gift cards, statements credits, or purchases with retailers. Personally I’d try to avoid those redemptions, simply because there are better options if you’re looking to redeem your points as cash toward travel purchases, or are looking to earn cash back.

Bottom line

Citi ThankYou is a valuable transferable points currency, which I’ve been collecting for years. It’s hard to beat having the Citi Strata Elite℠ Card or Citi Strata Premier® Card in combination with the Citi Double Cash® Card, so that you can earn an excellent return on your spending.

Citi ThankYou points are a currency that I’d recommend collecting if you intend to transfer points to airline or hotel partners, as that’s the way to maximize value. You can unlock some amazing international first & business class redemptions with these points, with programs like Air France-KLM Flying Blue, American AAdvantage, EVA Air Infinity MileageLands, and more.

To those who collect Citi ThankYou points, what are your favorite uses of the currency?

You forgot iprefer. Basically 2CPP redemptions.

Don't you need the Elite card to be able to redeem to AA?

@ Khatl -- It's possible with the Citi Elite, Citi Premier, or Citi Prestige (no longer open to new applicants).