Link: Apply now for the Citi Double Cash® Card

In this post I wanted to take a look at the Citi Double Cash® Card, which I consider to be the single most valuable no annual fee credit card out there for everyday spending. It’s a card that I have, and it’s a card that I’ve historically spent quite a bit of money on.

The Citi Double Cash is in a league of its own among no annual fee cards, both in terms of how rewarding it is, and in terms of how flexible it is.

In this post:

Citi Double Cash Card Basics For April 2025

The Citi Double Cash offers amazing flexibility, whether you’re looking to earn cash back or travel rewards. It’s rewarding as a cash back card, and with a bit of effort, it can be an industry-leading travel rewards card as well.

Below I’ll cover what you need to know about the card, including the basics, and what makes it so awesome.

Welcome Bonus Of 20,000 Points ($200)

The Citi Double Cash is currently offering a welcome bonus of 20,000 ThankYou points after spending $1,500 within the first six months. You can redeem those points for $200 cash back. Alternatively, you can get even more value from those points if you’re savvy, which I’ll talk more about below.

I know that bonus might not sound like much, but it’s the best publicly available offer we’ve seen on the card, and back in the day the card didn’t even have a welcome offer.

When it comes to eligibility for the bonus, it follows standard Citi application rules, including the 48-month rule, meaning you can’t earn a bonus on this card if you’ve received a bonus on this exact card in the past 48 months.

Earn Up To 2x ThankYou Points

The Citi Double Cash offers 1x ThankYou points when you make a purchase, and 1x ThankYou points when you pay for that purchase, for a total of up to 2x ThankYou points (after paying your bill). Each ThankYou point can be redeemed for one cent cash back, or a variety of other ways, which can potentially get you even more value.

No Annual Fee

The Citi Double Cash has no annual fee, which you can’t beat. A lot of people sacrifice credit card rewards because they don’t want a card with an annual fee, so here you’re getting a valuable card that won’t cost you anything to hold onto.

0% Intro APR

The Citi Double Cash is offering a 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 18.24% - 28.24%, based on your creditworthiness. Keep in mind that there is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first four months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

This won’t be for everyone, but I know that this is something that some people take advantage of. While some cards offer 12 months 0% APR, 18 months is quite a long time.

As always, in general I only recommend getting a credit card if you’ll be able to pay off your balance in full every month and use it responsibly, or else the rewards won’t outweigh the cost.

Mastercard Benefits

The Citi Double Cash is a Mastercard, which is worth mentioning because Mastercard has excellent acceptance with merchants. The same is true of Visa, though this is an area where American Express is still improving. There is something to be said for getting a Mastercard that will be accepted virtually everywhere.

3% Foreign Transaction Fees

The Citi Double Cash isn’t a card you’re generally going to want to use for international purchases. The card has 3% foreign transaction fees, so the rewards you earn wouldn’t compensate for the fees you’re paying. Fortunately, there are lots of other great cards with no foreign transaction fees.

Citi Application Restrictions

Every credit card issuer has different policies for approving new cardmembers. With Citi, the main restriction to be aware of is that you’ll be approved for at most one Citi card every eight days, and at most two Citi cards every 65 days.

Product Change To The Citi Double Cash

While it can make a lot of sense to apply for the card directly (that’s exactly what I did), there are potentially some other pathways by which you can acquire this card. Citi is among the most generous issuers in letting people product change between cards:

- You can typically downgrade any personal Citi credit card to the Citi Double Cash; this even includes co-brand cards

- You can generally only product change if you’ve had a card for at least 12 months, so you can’t do this with a new card

- You’ll want to call Citi to see all the options available to you

The benefit of product changing rather than applying outright is that you can maintain your credit line, and also that it often won’t count as a further inquiry on your credit report. Whether you apply for the card outright or product change to it, you have options. Remember, if you product change, you aren’t eligible for any associated welcome bonus that a new cardmember would receive.

Earning Rewards With The Citi Double Cash

As I explained above, the Citi Double Cash offers 1x ThankYou points when you make a purchase, and 1x ThankYou points when you pay for that purchase.

After making a purchase and paying your bill, you’ll earn 2x ThankYou points, and those points can be redeemed for two cents cash back, either in the form of a statement credit or a direct deposit. A lot of people earn 1-1.5% cash back on their credit cards, so this is much better.

As far as I’m concerned, earning at least two cents back on every dollar is the gold standard for credit card rewards. As I’ll discuss below, there are potentially other ways to redeem your rewards as well, and get even more value.

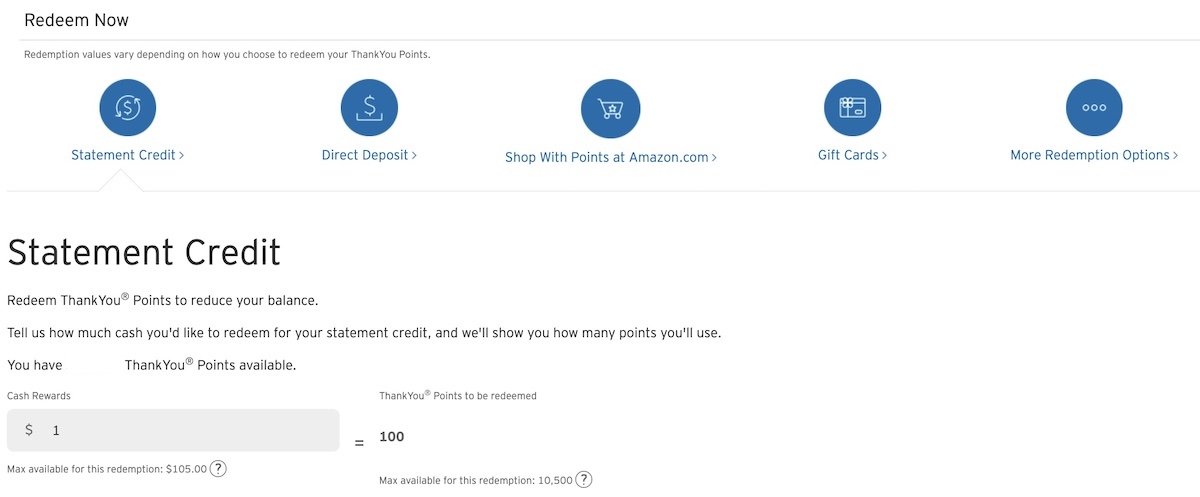

Redeeming Rewards With The Citi Double Cash

How do you go about actually redeeming the 2x ThankYou points that you earn per dollar spent (after paying your bill) with the Citi Double Cash? When you make purchases and pay your bill, you’ll see the ThankYou points post directly to your account. The rewards will appear in two columns — the 1x points you earn from spending, and the 1x points you earn from paying for your purchase.

There’s no minimum to redeem your rewards for cash, and you can choose whether you’d like a statement credit (which will post to your account in two to three days) or a direct deposit (which can be to a Citi account, or an account with another bank).

You can also use points for Amazon purchases or redeem them for gift cards. However, these redemption options don’t offer you more than one cent of value per point, so you might as well take the cash.

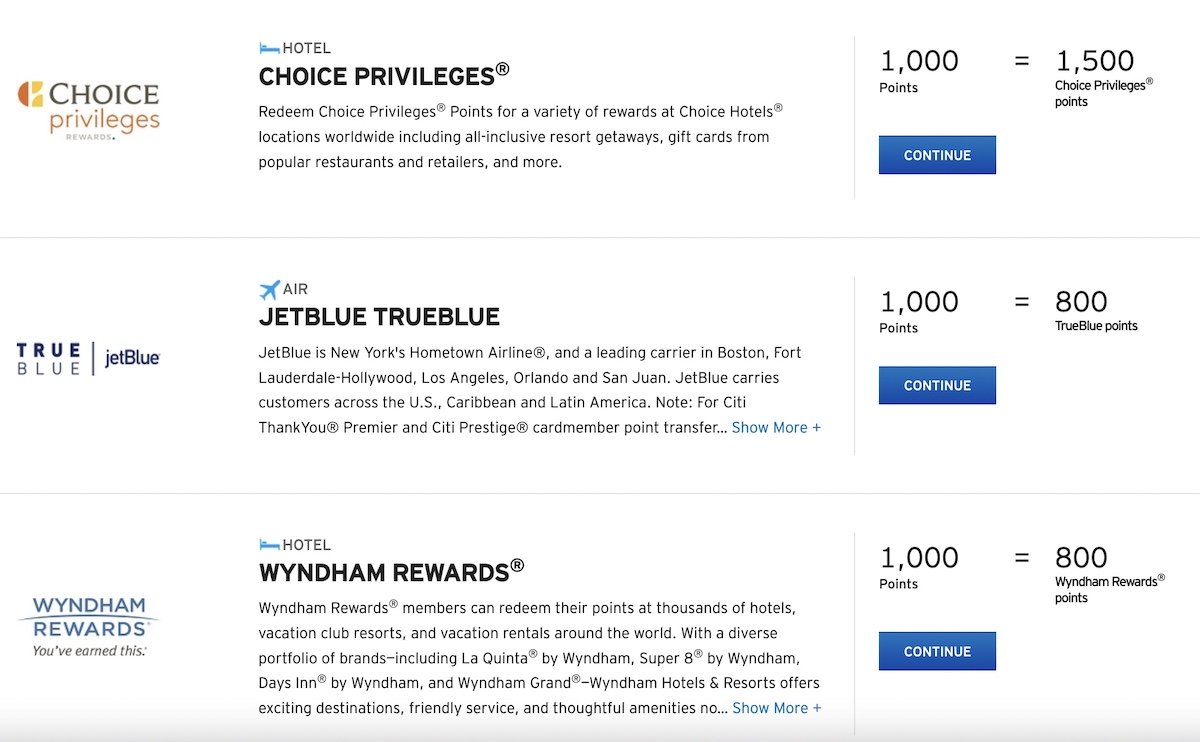

You can also transfer ThankYou earned on the Citi Double Cash directly to three travel partners, including the following:

- Choice Privileges, at a 1,000:1,500 ratio

- JetBlue TrueBlue, at a 1,000:800 ratio

- Wyndham Rewards, at a 1,000:800 ratio

However, that’s not how I’d recommend redeeming ThankYou points, since there’s a way to get more value for travel redemptions than that.

Maximize The Citi Double Cash With The Citi Strata Premier

If you want to truly maximize the value you get from the Citi Double Cash, I recommend having it in conjunction with the incredible Citi Strata Premier℠ Card (review). This is one of the best card duos out there. Why?

If you have the Citi Strata Premier and Citi Double Cash, you can transfer all points earned with both cards to Citi ThankYou’s full list of airline and hotel partners at a better ratio. Partners include Air France-KLM Flying Blue, Emirates Skywards, Etihad Guest, Singapore KrisFlyer, Virgin Atlantic Flying Club, and more.

This is a fantastic way to redeem for international first & business class experiences. Beyond that, the cards are just generally very complementary:

- The Citi Strata Premier has some incredible bonus categories, as the card offers 3x points on dining, gas, EV charging, groceries, airfare, and hotels; meanwhile, the Citi Double Cash can earn you 2x points on everyday spending, meaning you’ll earn 2-3x points on all your spending

- The Citi Strata Premier is extremely well rounded, as it has a reasonable $95 annual fee, and offers a big welcome bonus, and also offers some perks that could prove valuable, like a $100 annual hotel credit

Having these two cards really is an unbeatable combo. Between the two cards you’ll pay less than $100 in annual fees, and you’ll get an industry-leading rate of return on your spending.

Points potentially transfer at the following rates to the following programs:

Transfer Partners | Transfer Ratio |

|---|---|

Aeroméxico Club Premier | 1000 : 1000 |

1000: 1000 | |

1000 : 1000 | |

1000 : 1000 | |

1000 : 1000 | |

1000 : 1000 | |

1000 : 1000 | |

1000 : 1000 | |

1000 : 1000 | |

1000 : 1000 | |

1000 : 1000 | |

1000 : 1000 | |

1000 : 1000 | |

1000 : 1000 | |

1000 : 500 | |

1000 : 2000 | |

1000 : 200 | |

Preferred Hotels & Resorts I Prefer | 1000 : 4000 |

1000 : 1000 |

This is the only no annual fee credit card out there to offer an uncapped return of 2x transferable points per dollar spent. I value ThankYou points at 1.7 cents each, so to me that’s like a return of 3.4% on spending.

In some cases, you can do even better than that. Citi frequently has transfer bonuses, so you can potentially take advantage of those while earning 2x points on this card.

There are only a couple of cards that can potentially compete with the return on spending offered by the Citi Double Cash:

- The Blue Business® Plus Credit Card from American Express (review) offers 2x Membership Rewards points on the first $50,000 spent every calendar year, though it’s a business card

- The Capital One Venture X Rewards Credit Card (review) offers 2x Capital One miles on all spending, though the card has a $395 annual fee (this is largely offset by the $300 annual travel credit and 10,000 anniversary bonus miles, though, and the card offers lots of great perks)

Is The Citi Double Cash Right For You?

The Citi Double Cash is industry-leading, whether you’re looking to earn cash back or travel rewards. The best part is that you don’t have to decide which you want — you can earn rewards, and then later decide how you want to redeem them.

After you spend a dollar on the card and pay the bill you’ll have your choice of redeeming those rewards for:

- Two cents cash back

- Two transferable points, assuming you have the card in conjunction with a card earning ThankYou points, like the Citi Strata Premier Card

Earning 2x transferable points per dollar spent with no caps is unbeatable. What makes this card even more valuable is the flexibility it gives you — you can efficiently earn cash back, or can transfer points to ThankYou partners, should you want to redeem for outsized travel rewards.

Citi Double Cash Card Alternatives

The Citi Double Cash is as good as it gets, though there are still some other cards that may be worth considering:

- If you’re looking to earn flexible travel rewards, the Chase Sapphire Reserve® Card (review) and Chase Freedom Unlimited® (review) are an incredible duo that offer a great return on spending and valuable perks

- If you want a travel rewards card that offers flexible points, the Capital One Venture Rewards Credit Card (review) has a $95 annual fee, offers an excellent welcome bonus and 2x miles per dollar spent, has no foreign transaction fees, and more

- If you’re going the Capital One route, I think the Capital One Venture X Rewards Credit Card (review) is an even better option; yes, the card has a $395 annual fee, but there are so many incremental perks that justify the fee

Those are just a few of the options…

Bottom Line

The Citi Double Cash is a no annual fee card that offers unparalleled flexibility, whether you’re looking to earn cash back or travel rewards points. The card earns 2x ThankYou points per dollar spent. Those points can each be redeemed for one cent cash back, or in conjunction with the Citi Strata Premier Card, you can transfer the points to all kinds of airline and hotel partners.

I’ve had this card for several years, and it has been one of the cards that I’ve spent the most on, in particular for everyday, non-bonused spending. This is a great time to apply, as the card is offering a welcome bonus. For that matter, it’s also a great time to pick up the Citi Strata Premier Card.

If you want to learn more about the Citi Double Cash Card or want to apply, follow this link.

Is there an easy way to share points between the two cards?

I agree with you, Ben, and I love this card for everyday non-categorical spend. However... the fact that you need to link this card with another *AF* card to get true benefit from it might prevent me from calling it the best non-AF card out there. Ideally the best non-AF card would be one that stands pretty well on its own, no?