Link: Apply now for the Citi® / AAdvantage Business™ World Elite Mastercard®

I’ve just been approved for my latest credit card, the Citi® / AAdvantage Business™ World Elite Mastercard® (review). In this post I wanted to explain why I applied, talk about the application restrictions, and share my experience getting approved.

In this post:

Why I applied for the Citi Business AAdvantage Card

At the moment, the Citi AAdvantage Business Card has a welcome offer of 65,000 AAdvantage miles after spending $4,000 within the first four months. This is a nice bonus, and there are lots of great uses of AAdvantage miles, and you can never have enough of them.

There are many reasons to consider picking up this card. In my case, it came down the bonus miles, plus the benefits that having this card offers in conjunction with the AAdvantage Business program. The AAdvantage Business program lets you earn bonus miles for your small business travel, and it’s easier to actually cash out those miles if you have the Citi AAdvantage Business Card (otherwise there are limits on how many people need to be on your account, and how much they need to spend).

Lastly, picking up the card is about as low risk as it gets, as the card’s $99 annual fee is even waived for the first 12 months. You can’t beat that!

The basics of Citi’s card application restrictions

When it comes to getting approved for the Citi AAdvantage Business Card, there are just a couple of main restrictions to be aware of:

- In line with Citi’s general application restrictions, you can typically be approved for at most one Citi card every eight days, and at most two Citi cards every 65 days

- In line with Citi’s 48-month rule, you can only earn the welcome bonus on this card if you haven’t received a welcome bonus on this exact card in the past 48 months (that timeline is based on when you received the bonus, and not based on when you opened or closed the card)

For what it’s worth, I haven’t had this exact card since July 2019, and that’s when I closed the card, rather than when I earned the bonus. So I was in the clear for picking up this card again, and being eligible for the bonus.

By the way, let me share one other consideration I had. I’m trying to stay under Chase’s 5/24 limit (even though there are mixed reports as to whether it’s still enforced). Fortunately applying for Citi business cards doesn’t count as a further card toward that limit.

My experience applying for the Citi Business AAdvantage Card

As I started my Citi AAdvantage Business Card application, I wasn’t sure what the result would be. My last Citi application was roughly a year ago, and I was outright denied, which was my first card denial in many years. I was worried that might happen again. However, that was a personal card, while this is a business card, and those can often lead to very different outcomes.

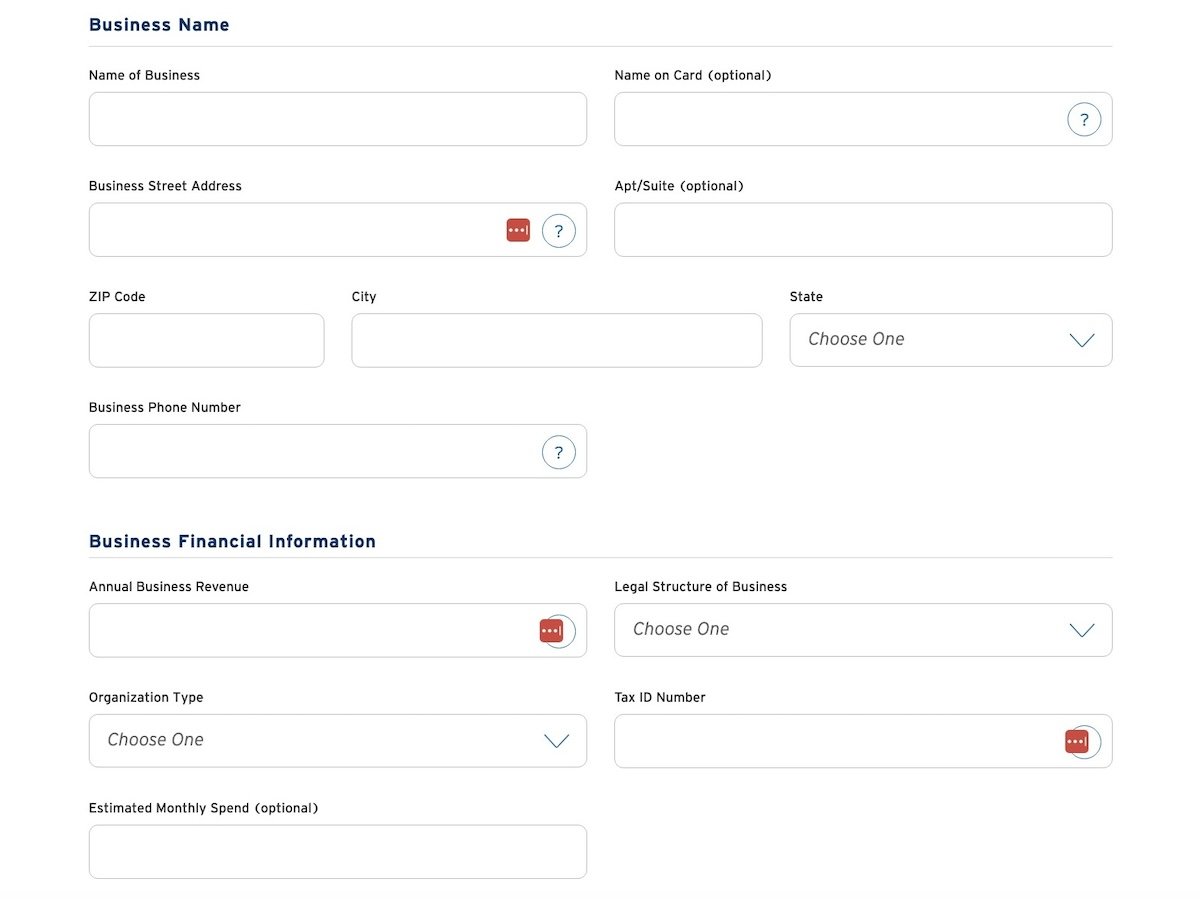

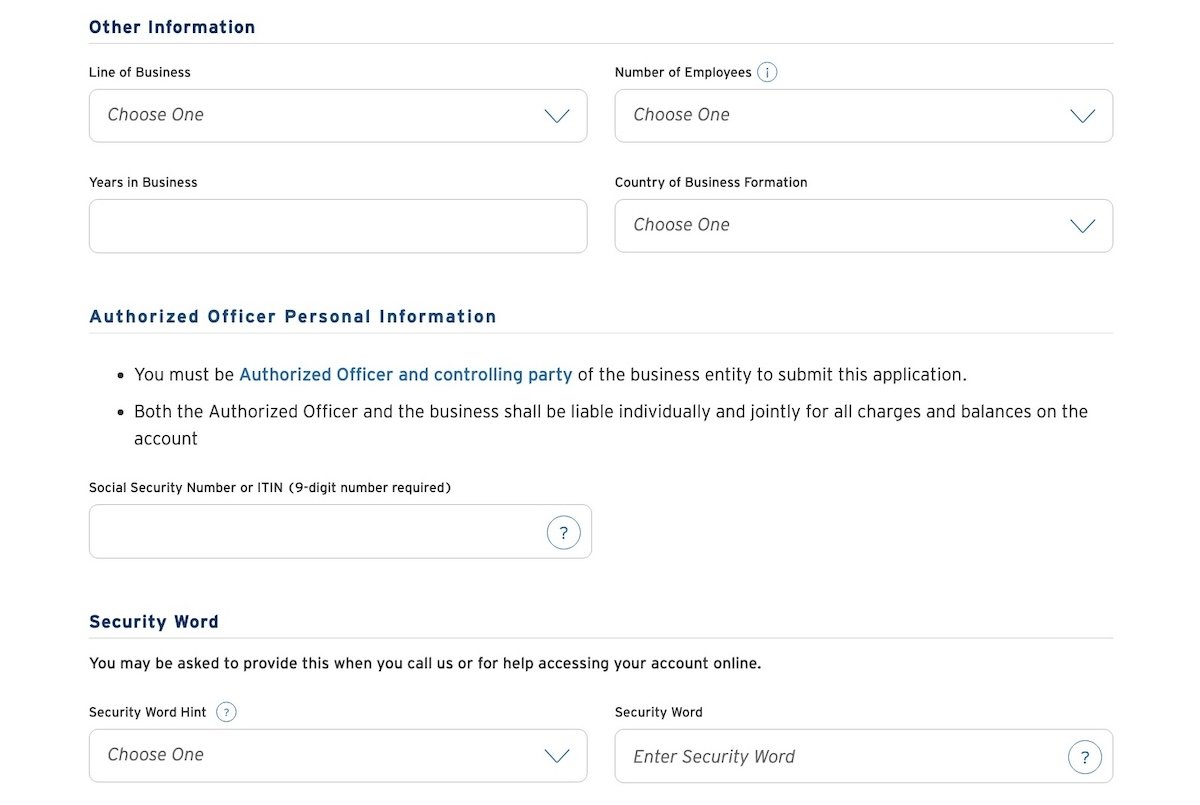

I found the Citi application experience to be straightforward. I just had to enter some basic business information, and then also some basic personal information.

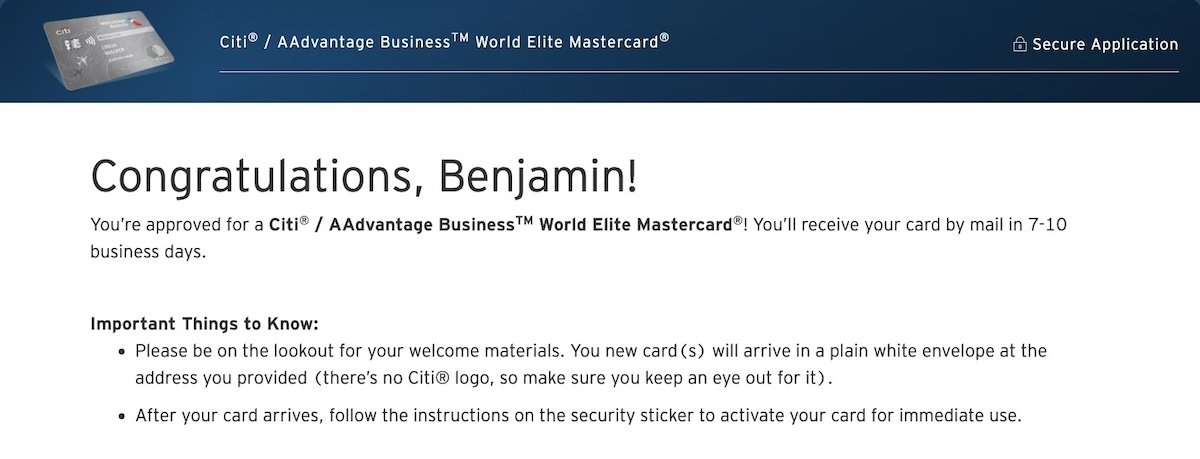

I was pleasantly surprised that upon submitting my application, I received instant approval!

Talk about an easy Welcome bonus with the annual fee waived the first year, plus no impact toward the 5/24 limit. I’ll take it!

Bottom line

I’ve been meaning to apply for the Citi AAdvantage Business Card due to the available welcome offer. I finally submitted an application, and was happy to learn that I was instantly approved, especially given my previous denial with Citi.

If you’ve applied for the Citi AAdvantage Business Card, what was your experience like?

Hi Ben,

Just curious. When you applied for the card, did you sign in to your Citibank login first to have your application prefilled? I'm curious if it is easier to get approved for the card if you sign in versus if you don't.

Thanks,

Derek

I was approved for the AA Platinum card 10 days ago for a 50K bonus after $2,500 spend in 3 months, that same card now offers 75K bonus after $3,500 spend in 4 months. I called Citi to see if they would honor the higher bonus since I haven't even received the card. They flat out said "No" claiming that 50K was the offer when I applied. I'm totally miffed about it as there's a...

I was approved for the AA Platinum card 10 days ago for a 50K bonus after $2,500 spend in 3 months, that same card now offers 75K bonus after $3,500 spend in 4 months. I called Citi to see if they would honor the higher bonus since I haven't even received the card. They flat out said "No" claiming that 50K was the offer when I applied. I'm totally miffed about it as there's a 25K difference which when added to my current balance would get me a JAL F award tix from HND-SFO. I've though about canceling the card that I haven't received and reapply but don't know if I'd get the higher bonus or even get approved. Has anyone had a similar experience and were you successful in getting the higher bonus?

I find these promotional posts more than amusing. CC post today: “sign up! Huge welcome bonus!” Tomorrow’s post: “XYZ Airline’s huge award devaluation!!! What’s happening to the industry? Not lucrative anymore!!!” I wonder if there’s any causality behind this…

@ Endre -- You're welcome to be amused all you like, but I think I'm pretty clear with my stance on this. I always recommend earning and burning, as of course miles devalue.

Many people fund their luxury travel through the miles & points they earn with credit cards. They manage to do that despite all the devaluations we have to deal with. Just because something devalues over time doesn't mean it's not worth collecting,...

@ Endre -- You're welcome to be amused all you like, but I think I'm pretty clear with my stance on this. I always recommend earning and burning, as of course miles devalue.

Many people fund their luxury travel through the miles & points they earn with credit cards. They manage to do that despite all the devaluations we have to deal with. Just because something devalues over time doesn't mean it's not worth collecting, especially at a low acquisition cost.

Is the alternative you're suggesting that no one should apply for credit cards or bother earning miles because they will eventually devalue, or...?

"There are lots of great uses of AAdvantage miles, and you can never have enough of them." I have to laugh because then you say credit card points are more flexible and airlines are devaluing their points quicker and you suggest people should not hoard points.

@ iamhere -- The two aren't mutually exclusive. I earn and burn points as fast as I can. When there's an easy opportunity to pick up lots of points, I take advantage of that. Burning 75K AA miles doesn't exactly take years to do -- it's a simple premium cabin one-way international ticket.

Ben, do you have an idea how long such Citi offers are valid for ? I could not find an expiration date.

@ InternationalTraveler -- Unfortunately the expiration date isn't published. Historically these offers tend to stay around for several weeks (let's say two months or so), though it really does vary.

Over 4 years since I’ve had this card, so I applied again. I was instantly approved! Thx for the heads up on this promo!

Ben

Unless you really need AA miles from the SUB why pick this card long term over a chase ink business cash card that offers 5x phone / cable and 2x gas? Not arguing but just trying to understand long term strategies the deeper i get into the points / miles game. Thanks

@ John -- When it comes to everyday spending, a Chase Ink Card is definitely the better play, unless you're looking to spend your way to status. In this case, the card has a great bonus, and if you're engaged in AAdvantage, then just having the card unlocks more value with the AAdvantage Business program, which is another reason to pick it up. But you're on the right track, you should probably focus on spending on products like the Chase Ink portfolio.

@Ben, where in the application do you enter your Aadvanatage number as I want to be sure this links to my existing AA account. Would be awful if they created a new Aadvantage account.

@ Mike -- You should see a place at the bottom of the application to enter your AAdvantage number.

Hey Ben, any tips for the personal version? Planning to apply again soon about a year after first being denied like yourself. Stated reason was too many open credit lines which I’ve reduced substantially since then ($90k to $50k or so)

@ Willem -- I wish I did, because I'm in the same boat as you, having been denied. Sometimes there are quirks, and just being patient often does the trick. It sounds like you'd be better positioned now, with fewer open credit lines.

Are you already enrolled in the AA business program?

I did before applying, but my AA business account doesn't show any indication of this (still seems to think I need 5 travellers and $5k to transfer miles). I hope that's not unexpected...

@ Miles -- I did enroll in the program before. I just got approved for the card, so I'll report back, as hopefully it links correctly. Sorry to hear about your issue -- please report back if it's resolved on your end!

I was just approved so I don't have any miles yet. Maybe that option only unlocks when miles post from the AA biz card? No idea, not many data points, etc

Would love to hear your experience with the program.

If I may ask what credit limit did you get?

@ Eli -- It's $16K, for what it's worth. :-)

I was approved for the exact same credit limit when I applied for this card last August!

I got one a couple months back. It had been >48 months from SUB on previous Citi AA Biz which I still have open

It dose make the AA Biz program operate for me without signing up neighbors as the 4&5 employees ;-)

Took me awhile to figure out where the miles when, but then that’s a cool feature for using employee’s miles