I often get asked how much I value various miles & points currencies, including those issued with credit cards, airlines, and hotels. The truth is that there’s no valuation for these currencies that everyone will agree on. That’s because the value that you’ll get from rewards points will vary significantly based on how you redeem them, and that’s also largely based on your travel goals.

Nonetheless, I try to use my knowledge of these programs to assign a value to each currency, which can fluctuate over time. Below I’ll share my updated valuations of many major miles & points currencies, and then afterwards I’ll explain my methodology. Note that I’ve adjusted my valuation of many currencies, to reflect the devaluations we’ve seen over time.

In this post:

Value of bank & credit card points January 2026

To me, transferable credit card points are the gold standard of rewards currencies. They offer a ton of flexibility, since you can transfer them to all kinds of partners. On top of that, there are so many lucrative credit cards that offer generous rewards structures for earning these points.

Personally, I always try to earn transferable points currencies with my credit card spending. Unlike other points currencies, I value these more or less the same, given just how many partners each program has.

Below are my valuations of the major transferable points currencies.

Program | Value |

|---|---|

1.7 cents/point | |

1.7 cents/point | |

1.7 cents/point | |

1.7 cents/point | |

1.7 cents/point |

Value of airline miles January 2026

There are lots of ways to earn airline miles, from actually flying, to using co-branded airline credit cards. The value of airline miles does vary significantly between programs. It’s important to keep in mind that major airlines have lots of partners, so the value of these miles isn’t just based on the ability to redeem for travel on that particular airline, but also based on the ability to redeem for travel on partner airlines.

Below are my valuations of the major airline mileage currencies.

Program | Value |

|---|---|

1.3 cents/mile | |

1.3 cents/mile | |

1.5 cents/mile | |

1.3 cents/mile | |

1.5 cents/mile | |

1.4 cents/mile | |

1.5 cents/mile | |

1.3 cents/mile | |

1.3 cents/mile | |

1.2 cents/mile | |

1.1 cents/mile | |

1.2 cents/mile | |

1.1 cents/mile | |

1.3 cents/mile | |

1.3 cents/mile | |

1.3 cents/mile | |

1.3 cents/mile | |

1.5 cents/mile | |

1.2 cents/mile | |

1.4 cents/mile | |

1.2 cents/mile | |

1.3 cents/mile | |

1.1 cents/mile | |

1.1 cents/mile |

My valuation of rewards currencies are intended to be conservative by design, so that people don’t unnecessarily or unrealistically hoard their points.

Value of hotel points January 2026

Much like with airline miles, hotel points can be earned either through staying at hotels, or by using co-branded hotel credit cards. Generally hotel points are easier to redeem than airline miles, given that there aren’t as many capacity controls or restrictions when redeeming them. That’s one of the reason many prefer to earn hotel points rather than airline miles.

Below are my valuations of the major hotel points currencies.

Program | Value |

|---|---|

2.0 cents/point | |

0.5 cents/point | |

0.6 cents/point | |

0.5 cents/point | |

0.5 cents/point | |

0.7 cents/point | |

0.3 cents/point | |

1.5 cents/point | |

0.7 cents/point |

I haven’t lowered my valuations of any of these currencies for quite some time. Why? While more points are now needed for many hotel stays, revenue rates have also gone up considerably.

Some might argue “well flight costs have gone up as well.” That’s not untrue in economy, but generally my valuation of miles is based on aspirational redemptions, and the cost of first and business class tickets hasn’t necessarily gone up. Quite to the contrary, they’re largely priced more reasonably than a decade ago.

How to go about valuing miles & points

With the above out of the way, how do I actually go about coming up with a value for miles & points? First of all, let me share that I’ve been obsessed with miles & points for around 20 years. Keeping track of these programs is my passion (and my job), and I’ve also helped people redeem well over a billion miles over the years. I’d like to think I have a bit of experience.

Even so, that’s not to say that you should value miles & points the same way I do. Let me share some basics on how I go about valuing miles & points, and everyone can decide for themselves how they want to go about it.

Miles & points can’t be valued objectively

Miles & points are ultimately a form of currency, so you might be wondering why we can’t value them objectively. After all, there are exchange rates between monetary currencies, even though different factors impact their valuations.

There are a few reasons miles & points (at least for non-revenue based programs) can’t be valued objectively in a useful way:

- There are so many different ways to redeem miles & points, which will give you vastly different valuations

- There’s typically not a way to “cash out” your miles & points, and when there is, that’s generally not the most efficient way to use them

- Everyone has different travel goals, and you’ll get different value depending on whether your priority is taking the family to Disney World, or flying first class to Singapore

- Miles & points can be devalued over time, and are generally the property of the loyalty program rather than the member, so really we’re just playing by the programs’ games

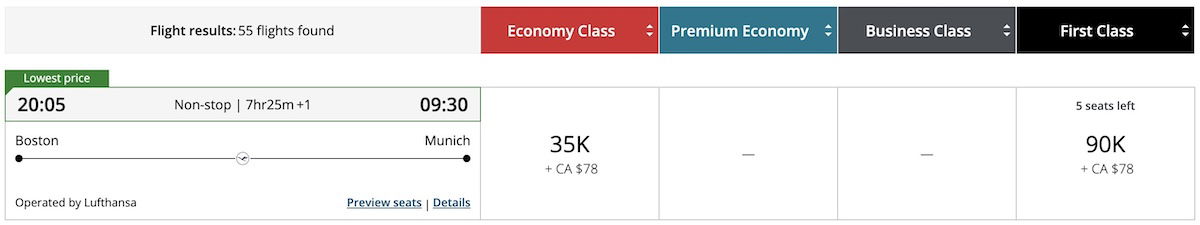

Let me give a concrete example of why there’s no correct objective valuation of rewards points. Let’s say you have Capital One miles, which I value at 1.7 cents each, and you transfer those to Air Canada Aeroplan. You could redeem 90,000 points for a one-way ticket in Lufthansa first class from Newark to Frankfurt.

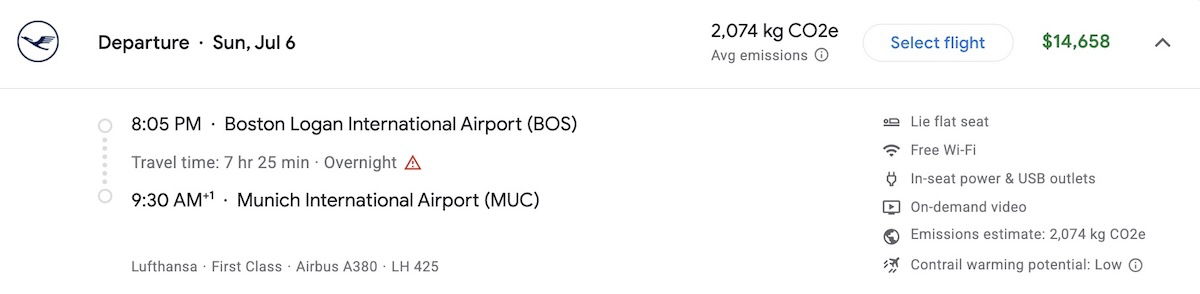

Meanwhile if paying cash, that ticket would cost over $14,000.

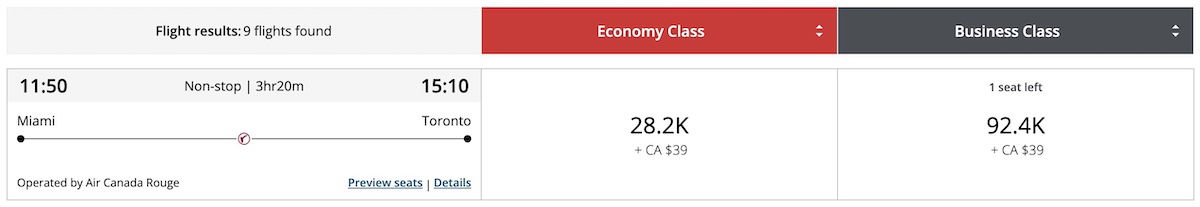

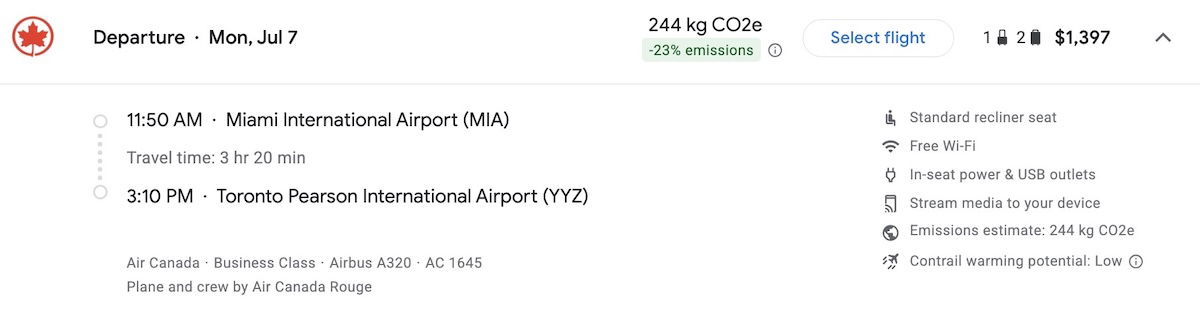

Alternatively, you could redeem 92,400 points for a one-way ticket in Air Canada business class from Miami to Toronto.

Meanwhile if paying cash, that ticket would cost under $1,400

As you can see, you can redeem fewer miles for a ticket that would cost more than 10x as much when paying cash. This is purely intended to be an example, but hopefully at least demonstrates the complexity of valuing these currencies, because both of those scenarios represent the ways some people redeem their points.

Be conservative when valuing miles & points

For a variety of reasons, I try to be conservative when it comes to valuing miles & points:

- Miles & points can be devalued by programs at any time, so you have to apply some sort of a discount to them to account for that; in general there’s much more of a risk of devaluation for an individual airline or hotel currency, rather than a transferable points currency

- With most programs, you don’t actually own your miles & points; they belong to the program, and you’re just allowed to use them as long as you have an account in good standing

- People should be encouraged to earn and burn, and creating an artificially high value for points discourages that

As you can see, I value credit card rewards points more than a vast majority of individual airline currencies, even though those are the best ways to redeem them. That’s because I’m willing to value the points at a premium for the added flexibility that they offer, in addition to the fact that we often see transfer bonuses, which can stretch your points even more.

Valuing miles & points is both absolute & relative

Coming up with a valuation of a mile or point is both an absolute and relative exercise:

- The valuation should be absolute in the sense that a currency should be valued somewhere between the typical acquisition cost and the typical redemption cost; at the end of the day, this is why I value most of these currencies at somewhere around one to two cents each

- It’s relative because the way I come up with differing valuations between currencies is based on the pros and cons of redeeming with each program in terms of redemption rates, routing rules, and more

How you’ll get the most value with your miles & points

Generally speaking, if you want to get the most value from miles & points, there are two key aspects to that:

- You should spend some time studying these programs, because the deals to be had are in some cases amazing

- In general you’ll get the most value from points if you’re looking for aspirational redemptions, like staying at five star hotels, or booking international first and business class flights, where the cash value would be disproportionately high

Admittedly that’s not how everyone wants to redeem, and that’s totally fine:

- If you don’t have a lot of points, it’s probably not worth investing the time to study these programs all that carefully

- If you have a family with toddlers, then understandably your priority might be traveling to somewhere close by and having a room with a lot of space, rather than flying halfway around the world to stay at a five star hotel

Don’t fall for the retail cost fallacy

I think it’s important not to get too carried away with points valuations. For example, above I showed a $14,000+ one-way first class ticket from Newark to Frankfurt on Lufthansa that could be booked with 90,000 Aeroplan points.

Yes, on the surface I suppose you are getting over 15 cents of value per point. However, don’t focus on that too much. For mental accounting purposes, personally I value redemptions based on how much I’d otherwise actually be willing to pay for that experience. I would never, ever drop that kind of cash on a one-way first class ticket.

So while on paper that might be the valuation, I always ask myself how much I’d be willing to pay for a first class ticket to Europe. Personally I’d estimate that I’d probably actually value that flight at $1,500, in terms of what I’d otherwise be willing to pay.

I’m not looking to get into a huge debate here about perceived value rather than retail value, but my point is that it’s important to consider how much you value these premium experiences, rather than just how much they cost.

Don’t take a trip just because it would cost a lot when paying cash, but rather do what you want to do, and try to maximize value along the way. At least that’s my take.

Don’t value miles & points based on one redemption

Another thing I consider with each points currency is how many good redemption options there are. The more flexibility and more options there are, the most I value those currencies. Don’t just value a points currency based on a single award ticket sweet spot.

For example, redeeming Virgin Atlantic Flying Club points on All Nippon Airways is a phenomenal value. However, we’ve seen these redemptions devalued multiple times over the years, and on top of that, first and business class award availability can be really tough to come by.

So while you could get a ton of value from Virgin Atlantic Flying Club points if you manage to find availability, you don’t want to value a currency exclusively based on one redemption. I try to factor in these sweet spot redemptions while acknowledging that they provide limited flexibility.

Bottom line

Hopefully the above is a useful rundown of the value of various credit card, airline, and hotel points currencies. There’s no absolute right or wrong way to value points, and it’s totally reasonable if your valuation is different than mine. My goal is just to share my take, and provide a general framework for valuing these currencies.

I’ll keep my valuations updated over time, to reflect changes with these various points currencies.

How do you go about valuing miles & points, and are your valuations substantially different than any of mine?

@Ben re: "Don't fall for the retail cost fallacy." While I note that some people agree with your logic, I do not. You constantly talk of the "aspirational," and yet you claim you wouldn't pay $14,658 for that First Class ticket on Lufthansa, but only $1,500. Yet try to walk up to the Lufthansa ticket counter and offer to pay only $1,500 and see how far that gets you. (Fortunately they won't have you bail...

@Ben re: "Don't fall for the retail cost fallacy." While I note that some people agree with your logic, I do not. You constantly talk of the "aspirational," and yet you claim you wouldn't pay $14,658 for that First Class ticket on Lufthansa, but only $1,500. Yet try to walk up to the Lufthansa ticket counter and offer to pay only $1,500 and see how far that gets you. (Fortunately they won't have you bail out 1/10th of the way to Munich...)

For us mere mortals, Ben, a) most of the people who fly do so in Economy or PE if they're lucky, snd b) flying with a lie-flat seat in "the pointy end of the plane" doesn't happen very often if at all. But without points, I'm going to have to fork out the $14,658 for that First Class seat or else sit in the back. Those are my only choices if I want *that* seat on *that* plane (though, admittedly, I'm quite content to fly in Business with a lie-flat seat on international long-haul flights).

What about SAS Eurobonus points.

Interesting the comment about "reasonable redemption amounts" because that is the way I look at it too. I usually have a consistent redemption purchase which does not change that much in terms of the dollar value and number of points, so it is simple to see if it is worth redeeming.

There's some logical dissonance in the premise of not tying these values to actual cash redemption (a $15k ticket not being worth 110k United miles and vice versa) and holding the line that "it should be worth what you pay" but also stating that hotel value points rates have not budged because prices have gone up.

Frankly, I think assigning a dollar value to these points is similar to counting your car as part...

There's some logical dissonance in the premise of not tying these values to actual cash redemption (a $15k ticket not being worth 110k United miles and vice versa) and holding the line that "it should be worth what you pay" but also stating that hotel value points rates have not budged because prices have gone up.

Frankly, I think assigning a dollar value to these points is similar to counting your car as part of your net worth. Unless it's a collectable that will appreciate in value, you really should plan to leave it out... Because the next time you look, it's real value will be less.

The same argument could be made for money, after all the money printers haven't exactly been chilling out over the past five years. Calculating the time value of any currency, including miles, isn't an easy task.

Crypto people disagrees.

You can't have a meaningful conversation with those cultists. I'm not against crypto, but they're just naive about the risks (e.g. of central banks disliking the competition).

How dare you call crypto people naive cultists.

While you're still thinking of central banks, they're heading to the moon with diamonds.

Thanks for companion this post Ben. I found it very insightful. I just have one question. I noticed that all the airlines that use use Avion are valued at 1.3 and that Qatar is not on the list. Would the same value apply to Qatar in your opinion?

Meant compiling this post, not “companion” ;-)

Pardon the typo - meant compiling, not “companion” ;-)

Thanks for companion this post Ben. I found it very insightful. I just have one question. I noticed that all the airlines that use use Avion are valued at 1.3 and that Qatar is not on the list. Would the same value apply to Qatar in your opinion?

Meant compiling this post, not “companion” ;-)

Pardon the typo - meant compiling, not “companion” ;-)

With respect, don't you pay $1000+ cash per night for hotel rooms when you travel with family? Expecting to pay $1500 cash for a transatlantic first-class ticket is quite specious.

so you think 300k Delta miles are worth about $3,300, and also that 220k AA miles are also worth about the same $3,300? Because I would trade 300k DL for 220k AA literally every day of the week and its not particularly close. (I bet you would too)

When looking at award points, I try to think in terms of "reasonable redemption amounts." For instance, I can always find ways use Hilton points for at least 1/2 cent per point. So, I would not use them if I was getting less than that. I use a 1.9 to 2 cents a point for a redemption amount for Hyatt. I have no problem using up my Hyatt points at those redemption levels. For Delta,...

When looking at award points, I try to think in terms of "reasonable redemption amounts." For instance, I can always find ways use Hilton points for at least 1/2 cent per point. So, I would not use them if I was getting less than that. I use a 1.9 to 2 cents a point for a redemption amount for Hyatt. I have no problem using up my Hyatt points at those redemption levels. For Delta, I typically get about 1.4 t0 1.5 cents per point, with the 15% credit card discount. I am not sure who is only finding less than a penny a point redemptions for Delta, but if you plan ahead, you should be able to do much better. Of my last three big trips, my Delta One trips from my local Delta heavy airport both to ICN and MUC were 1.5 cents per point, with discount. My economy trip to HND was also 1.5 cents per point, with discount. (None of these involved positioning flights and additional airport hotel stays) I would not pay the referenced reasonably redemption amounts to buy the points, so I do not "value" them as such. But, if I am getting less than those amounts, I will likely pay cash. For me, that works. A lot of the points "value" may depend on where you live, where you like to travel, and how much time you have to spend in airports and airport hotels for positioning flights. Also, if you can stay somewhere else that is just a nice for a lot cheaper cost than the redemption hotel, a cents per point redemption is not that relevant.

A few comments

1) On SkyMiles - with the Delta credit card, almost anh flight on sale on Delta can be purchased reliably for about 1.1 to 1.3 cents per point. Need to fly the family of four from LGA to ORD, and tickets are $300 one way? It’ll cost 90K to 100K points for the family. Plus - each passenger will earn towards elite status, each ticket will be eligible to be upgraded based...

A few comments

1) On SkyMiles - with the Delta credit card, almost anh flight on sale on Delta can be purchased reliably for about 1.1 to 1.3 cents per point. Need to fly the family of four from LGA to ORD, and tickets are $300 one way? It’ll cost 90K to 100K points for the family. Plus - each passenger will earn towards elite status, each ticket will be eligible to be upgraded based on the purchaser’s status, etc. SkyMiles actually sets a pretty solid floor for value for airline miles.

2) There are a lot of domestic focused programs - like JetBlue - that offer similar reliable value

3) All that said, no one denies that programs like American, FlyingBlue, AirCanada, Alaska, etc offer much more consistent opportunities to get outsize value for international business and first class redemptions than Delta (or JetBlue or whatever)

4) Given this - if we accept Delta SkyMiles are worth 1.2 cents, which we should IMO - I think currencies like American and Flying Blue should be worth a bit more - closer to the upper 1s (1.6, 1.7, etc)

Try these Flying Blue one-way international biz redemptions per pointsyeah:

FRA-JED-NBO: 105,500 pts +$430.86

EZE-MIA-ATL: 98,000 pts+$166.61

DEL-MCT-BKK: 78,500 pts + $176.56

AFKL have absolutely gutted their saver award availability, so using FB miles on their own metal is often even more expensive than that, e.g. DAR-AMS-FCO on random dates in February is 197,000+$262.8! Not sure how one could justify valuing those miles more than anyone else's.

Hi Ben,

For those of us who are math challenged, would you mind going over an example of when it would be best to use miles (or cash) for a ticket. Here is a scenario. Say an airline wants 50,000 miles for a roundtrip ticket. If the airline valuation from your chart says 1.1 cents per mile, then the 50,000 miles would equate to $550. Is my math right for that (50000 x 0.011)?...

Hi Ben,

For those of us who are math challenged, would you mind going over an example of when it would be best to use miles (or cash) for a ticket. Here is a scenario. Say an airline wants 50,000 miles for a roundtrip ticket. If the airline valuation from your chart says 1.1 cents per mile, then the 50,000 miles would equate to $550. Is my math right for that (50000 x 0.011)? So if the revenue ticket is greater than $550, and I have the miles to spare, then I should use miles for the ticket. Am I calculating this and thinking about this in the right way? If not, can you please let me know. Thank you. Cheers.

Welcome to the world of miles & jets ;)

No. The answer should be

lim (x) int_{0} ^ {π/2} {x * prod_{j = 1} ^ {∞} {cos(x / 2j )}} dx + (e^2ix + e^-2ix )/4 + e^2ln(sin(x)) + 1/2

That's the idea, but you need to factor in the taxes and charges. A $550 revenue ticket may consist of a base fare of $250, a fuel surcharge of another $250 and airport charges of $50. There will be some programmes which will charge you $50 on top of the miles, some others will charge you $300 while yet others may charge something in between the two sums (Flying Blue does that for AFKL flights,...

That's the idea, but you need to factor in the taxes and charges. A $550 revenue ticket may consist of a base fare of $250, a fuel surcharge of another $250 and airport charges of $50. There will be some programmes which will charge you $50 on top of the miles, some others will charge you $300 while yet others may charge something in between the two sums (Flying Blue does that for AFKL flights, the surcharge on a revenue ticket may be €400 and the award fees will only contain ca. €200 of that) or even amounts which are lower than $50 (I think that I once paid $5.60 for a redemption on one of the US flag carriers) or even higher than $300 (e.g. if they charge a phone booking fee and you can't get them to waive it for a booking that's not available online).

Thanks for the helpful info!

Wouldn’t most people here rather have 120k AA/AS miles than say 300k DL? Even if you’re not doing longhaul biz, the availability for 12.5k or under is staggering on AA/AS. Am I missing something in these evaluations? This is more looking at the comparative ratios than the exact valuations.

Trying to stay conservative, and including availability in my valuation, I’d go more like AA/AS 2.0, UA 1.5, DL 1.1

An interesting article would be...

Wouldn’t most people here rather have 120k AA/AS miles than say 300k DL? Even if you’re not doing longhaul biz, the availability for 12.5k or under is staggering on AA/AS. Am I missing something in these evaluations? This is more looking at the comparative ratios than the exact valuations.

Trying to stay conservative, and including availability in my valuation, I’d go more like AA/AS 2.0, UA 1.5, DL 1.1

An interesting article would be about why AA/AS are so much more valuable, why maybe they have to be, and how long it will last for.

As with everything, the value depends on routes, availability, surcharges and so on.

I played around with a few routes, and here's what I got: ICN-MNL in Y is 17.5k using DL miles or 25k AS ones. CGK-SYD in business is 65k AS or 70k DL, FRA-CMN in Y is 12.5k AA or 15k DL, MXP-BOG in J is 67.5k AA, 70k AS, while DL want 105k plus an enormous amount of YQ.

So, to answer your question, I would much rather have 300k DL miles than 120k AA ones, although I would prefer 120k AA miles over 120k DL ones.

Interesting post, good to have a quick reference point, particularly for programmes that one doesn't use frequently (in my case Best Western, I recently booked a room with them for an upcoming trip, discovered that I had 6k forgotten in my account and had no clue as to whether it was worth anything).

I am intrigued by your higher valuation of FB miles compared to VS points, particularly since VS offer some really cheap...

Interesting post, good to have a quick reference point, particularly for programmes that one doesn't use frequently (in my case Best Western, I recently booked a room with them for an upcoming trip, discovered that I had 6k forgotten in my account and had no clue as to whether it was worth anything).

I am intrigued by your higher valuation of FB miles compared to VS points, particularly since VS offer some really cheap redemptions on their own metal and both airlines use segment-based pricing for partner airlines, undermining the value proposition of awards that need connecting flights.

Paging @DCS

@Ben, IMHO, Hilton points should have lower values. The reward rates are so insanely overpriced that it often doesn't make sense unless you really don't want to pay cash. At least with IHG, using points is often a no-brainer, even without the 4th night free.

Hilton points scale really well for luxury properties, where 0.8-1.2+cpp is common. IHG is super close to cash nowadays.

1) Delta SkyPesos are not even worth a cent

2) Lufthansa’s first class is so tacky, and un befitting of even being called “first class.” Why do you promote it so relentlessly?