If you want to maximize your credit card rewards, I always recommend earning transferable points currencies for your spending whenever possible. In this post I wanted to take a detailed look at how to redeem Chase Ultimate Rewards points, as this is one of the most popular points currencies out there.

In this post:

Chase Ultimate Rewards points are easy to earn

There are several credit cards that earn Chase Ultimate Rewards points. Arguably one of the best things about Ultimate Rewards is the portfolio of credit cards that you can create, to maximize both your personal and business credit card spending.

The following three cards directly earn Chase Ultimate Rewards points (I’m also listing their annual fees and rewards structures):

- The $795 annual fee Chase Sapphire Reserve® (review) offers 3x points on dining and 4x points on direct air/hotel bookings

- The $95 annual fee Chase Sapphire Preferred® (review) offers 3x points on dining, online groceries, and select streaming services, and 2x points on travel

- The $95 annual fee Ink Business Preferred® Credit Card (review) offers 3x points on the first $150,000 spent in combined purchases per account anniversary year on travel, shipping purchases, internet, cable, and phone services, and advertising purchases with social media sites and search engines

Meanwhile the following four cards earn points that can be converted into Ultimate Rewards points at a 1:1 ratio in conjunction with any of the above cards (I’m also listing their annual fees and rewards structures):

- The no annual fee Chase Freedom Unlimited® (review) offers 1.5x points on everyday spending

- The no annual fee Chase Freedom Flex℠ (review) offers 5x points in rotating quarterly categories on up to $1,500 of spending per quarter (8.5% return)

- The no annual fee Ink Business Unlimited® Credit Card (review) offers 1.5x points on everyday spending

- The no annual fee Ink Business Cash® Credit Card (review) offers 5x points on the first $25,000 spent in combined purchases per account anniversary year at office supply stores, and on internet, cable, and phone services (8.5% return), as well as 2x points on the first $25,000 of combined purchases per account anniversary year at restaurants and gas stations

Personally I have six of the above cards, so points rack up quickly. Read about my Chase credit card strategy here.

How much Chase Ultimate Rewards points are worth

Based on my methodology of valuing points currencies, I value Chase Ultimate Rewards points at 1.7 cents each. For that matter, that’s how much I value all major transferable points currencies. There’s no science to that, but rather I think it’s a fair but conservative valuation for how much value you could get if you’re maximizing your rewards.

How you can redeem Chase Ultimate Rewards points

Let’s take a brief look at how you can redeem Chase Ultimate Rewards points, and then we’ll talk about how you should redeem points to maximize value.

Chase Ultimate Rewards points can be transferred to airline and hotel partners. The program has the below 14 partners, including 11 airlines and three hotel groups, and all transfers are at a 1:1 ratio.

Airline Partners | Hotel Partners |

|---|---|

Aer Lingus AerClub | IHG One Rewards |

Air Canada Aeroplan | Marriott Bonvoy |

Air France-KLM Flying Blue | World of Hyatt |

British Airways Executive Club | |

Emirates Skywards | |

Iberia Plus | |

JetBlue TrueBlue | |

Singapore Airlines KrisFlyer | |

Southwest Rapid Rewards | |

United MileagePlus | |

Virgin Atlantic Flying Club |

The beauty of Chase Ultimate Rewards is that points can also efficiently be redeemed toward the cost of travel purchases, including for flights, hotels, and rental cars. This applies for bookings made through Chase Travel℠, and the maximum value you’ll receive depends on the most premium credit card you have.

There are a variety of other ways to redeem Chase Ultimate Rewards points, though they’re generally going to get you at most one cent of value per point, so this isn’t how I’d recommend redeeming them. Among other things, you can redeem Chase Ultimate Rewards points in the following ways:

- Toward cash, in the form of a direct deposit

- Toward shopping directly with popular retailers

- Toward a gift card with a variety of retailers

The catch is that aside from points transfers or travel booked through the Chase Travel Portal, you’ll get at most one cent of value per Ultimate Rewards point.

The best uses of Chase Ultimate Rewards points

There are lots of ways to efficiently redeem Chase Ultimate Rewards points, whether you’re looking to transfer points to a travel partner, or redeem toward the cost of a travel purchase. Below I wanted to share what I consider the best uses of Chase Ultimate Rewards points to be, roughly ranked starting with my favorite.

If transferring to airline partners, it’s important to understand that you’ll generally get the most value redeeming for international flights, especially in business class. Also, if you’re new to redeeming points, check out my top 10 tips for redeeming points, so you can hopefully get the best value.

Transfer to World of Hyatt

World of Hyatt is my single favorite Chase Ultimate Rewards transfer partner, especially as a Hyatt Globalist member (or as someone with access to Guest of Honor bookings). Hyatt has some fantastic hotels, and a free night will cost you anywhere from 3,500 to 45,000 points, depending on the category and whether there’s peak pricing or not.

Many people struggle with redeeming airline miles, given the capacity controls. The beauty of World of Hyatt is that there are no blackout dates, so as long as a standard room is available for sale, you can redeem points for it. It should be really easy to get well over two cents of value per point with World of Hyatt, given all the great uses of these points.

Transfer to Air Canada Aeroplan

Air Canada Aeroplan is probably my single favorite frequent flyer program. Not only does Aeroplan have more airline partners than any other airline loyalty program, but you can also add stopovers to awards for 5,000 points one-way.

If you’re looking to redeem on Star Alliance, or a variety of other airline partners (ranging from Air Mauritius to Gulf Air), booking through Aeroplan is an excellent option. To get the best value and access to most airlines, in general I find Air Canada Aeroplan to be a more compelling transfer partner than United MileagePlus, even though both programs give you access to Star Alliance airlines.

Also keep in mind that if you have the Aeroplan® Credit Card (review), you can receive a 10% bonus when you transfer points from Ultimate Rewards to Aeroplan. This applies when transferring 50,000 or more Ultimate Rewards points in one transaction, and you can get a maximum of 25,000 bonus points per year this way.

Redeem for up to 2 cents each toward travel

There’s a huge learning curve to redeeming points efficiently, so there’s something to be said for an easy redemption. One of the best things about Chase Ultimate Rewards is the great rate at which you can redeem points directly toward travel purchases through Chase Travel℠.

If you have the Chase Sapphire Reserve®, then you can redeem for up to 2 cents each toward travel purchases through Chase Travel℠ with Points Boost, while if you have the Chase Sapphire Preferred® or Ink Business Preferred® Credit Card, then you can redeem for up to 1.75 cents each toward travel purchases through Chase Travel℠ with Points Boost. If you have multiple cards, you can redeem all your points at the highest rate available with any card.

The beauty of this is that you don’t have to look for award availability, but rather you can book the flight or hotel you want directly through Chase. While this isn’t how I choose to redeem my Chase points (I consistently get more value with World of Hyatt), I think it’s a great option for many.

Transfer to Singapore Airlines KrisFlyer

Singapore Airlines restricts most of its first class and business class award space to members of its own KrisFlyer program. So while the airline is in the Star Alliance, don’t expect to be able to snag Singapore Airlines long haul premium cabin awards through other programs.

Fortunately Singapore Airlines KrisFlyer has fair redemption rates, pretty good award availability in business class (and sometimes Suites and first class), and limited surcharges. For example, a one-way business class award on the world’s longest flight will cost you 111,500 miles, while a one-way business class award from New York to Frankfurt or Houston to Manchester will cost you 81,000 miles. You can get even more value by booking a Spontaneous Escapes ticket, which is a monthly discount on select awards.

Transfer to Emirates Skywards

Emirates is regarded as one of the world’s best airlines, and Emirates Skywards is the best way to book most Emirates tickets with miles. This could be useful whether you want to take one of Emirates’ fifth freedom flights (from Newark to Athens or New York to Milan), or whether you’re looking to fly with the airline to Dubai and beyond.

It’s even possible to redeem miles for Emirates first class, though it could take some work. A shower in the sky is a worthwhile reward, though! A first class award between the United States and Europe costs 102,000 Skywards miles one-way, if you can find award availability.

Transfer to Air France-KLM Flying Blue

If you want to fly across the Atlantic in business class, it’s tough to beat Flying Blue, as this is the key to unlocking Air France business class and KLM business class awards. Not only is this great if you’re looking to travel to Amsterdam and Paris, but the two airlines have extensive route networks throughout Europe and beyond. You can even add a stopover to an award at no extra cost.

You can generally expect that transatlantic business class awards will start at 50,000 miles one-way, with mild fuel surcharges (around $200 one-way). You can sometimes get even better pricing if you can book a Flying Blue Promo Rewards offer.

Transfer to British Airways Executive Club

British Airways Executive Club is a useful frequent flyer program, especially for oneworld redemptions. Executive Club has unique distance based award pricing, so it’s a particularly useful points currency if you’re trying to redeem for travel on Alaska or American from or within the United States. Avios can be a great deal for travel to Hawaii and the Caribbean. Avios are also useful for short haul redemptions in other regions, including within Asia and Australia.

Another great thing is that you can transfer rewards between the various “flavors” of Avios, and there’s value to all those programs, like Aer Lingus AerClub, Iberia Plus, and Qatar Airways Privilege Club.

Transfer to JetBlue TrueBlue

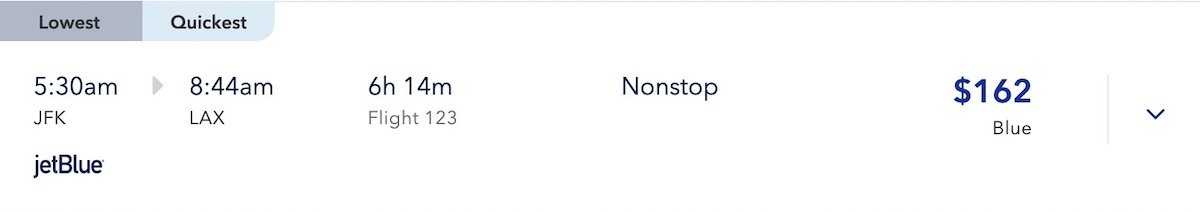

JetBlue TrueBlue is a revenue based currency when it comes to redemptions, at least for travel on JetBlue metal. If you transfer Chase points to JetBlue TrueBlue, you can generally expect that each TrueBlue point will get you around 1.5 cents toward the cost of a JetBlue economy ticket. For example, take the below flight from New York to Los Angeles, which costs either $162 or 10,300 points plus $5.60 in taxes.

Now, JetBlue flights also appear through the Chase Travel Portal, so you can redeem your points for 1.25-1.5 cents each toward the cost of a JetBlue ticket, depending on the card you have. Which redemption option is better depends on your specific situation.

Another awesome perk of JetBlue TrueBlue is that partner redemptions are now possible, so you can redeem these points for travel in Qatar Airways business class, and that could be a good value.

How not to redeem Chase Ultimate Rewards points

I tend to think that if you feel good about an award redemption then that should be enough. At the same time, I’d generally aim to get more than one cent of value per Chase Ultimate Rewards points, based purely on the easy ways there are to efficiently redeem these points for more value.

I’d highly recommend avoiding all the redemption options that give you at most one cent per point. This would include gift cards with retailers, cash, online shopping, etc.

On top of that, there are two Chase transfer partners I’d recommend avoiding — IHG One Rewards and Marriott Bonvoy. That’s not because there’s not value to be had with IHG One Rewards or Marriott Bonvoy, but rather because I value those individual points currencies at 0.5-0.7 cents each, yet the transfer ratio is still “only” 1:1.

In the same way monetary currencies have different values, travel points currencies also do, so this isn’t a lucrative way to redeem your points.

Furthermore, I’d probably avoid transferring points to Southwest Rapid Rewards. Southwest is of course an incredibly popular airline for domestic travel, and you can transfer points at a 1:1 ratio. However:

- Each Rapid Rewards point gets you around 1.2 cents toward the cost of a ticket on Southwest (you usually need 83 Rapid Rewards points per dollar of airfare)

- You’re better off instead booking Southwest flights through Chase Travel℠, and on top of that you’ll earn Rapid Rewards points for your purchase, so you’ll come out ahead in a vast majority of cases

Bottom line

Chase Ultimate Rewards is a popular points currency, and rewards add up quickly with cards like the Chase Sapphire Reserve®, Chase Sapphire Preferred®, and Ink Business Preferred® Credit Card.

Ultimate Rewards points are an incredibly versatile currency. Not only can points be redeemed for up to 2 cents each toward the cost of a travel purchase through Chase Travel℠ with Points Boost, but Chase also has some valuable transfer partners.

Personally World of Hyatt is by far my favorite Chase transfer partner. After that, I appreciate the value of Air Canada Aeroplan. Then there are several other currencies that could be useful, though frankly almost all of my Chase points go to World of Hyatt.

To those who collect Chase Ultimate Rewards points, what are your favorite uses of the currency?

I have seen recommendations for LifeMiles and Aeroplan and so I always check them when looking for redemption opportunities but save the one time I was able to get a decent price on TAP for a trip to Italy (and that was subsequently cancelled by the airline with no reason provided) I have never found good redemptions at either. LifeMiles typically has no availability at all for business class.

Maybe I am doing something wrong but I find neither to be useful.

Confused that you don’t mention UA transfers at all in this article.

One problem is the cost of the ticket with the travel center is much higher than you can get from redeeming airline points or paying for the ticket.

Confused that you don’t mention UA transfers at all in this article.

Likely because the post is titled "the best" and United transfers are certainly an option but not considered the best use by most.

Ultimate Rewards is also useful for topping up a United Mileage Plus account. Not that UA ever offers great mileage redemptions anymore. But if you already have a cache of miles and want to use them - adding a small amount of UR points can be worthwhile. Sometimes its worth to pay up for business class and getting the exact flight you want, vs weird routings and stops. YMMV.

I was just checking out Emirates for a flight and there appear be be plenty of flights available to my destination (out of ORD) but they were adding $1,000 on to the ticket for those pesky surcharges. A pretty big downside.

Any way to avoid those?

No unless you can find an award on Emirates via a partner that does not tack on those fees.

@Ben/Lucky, after years of gaslighting, do you even know the difference between what started out as a fabrication and what is real anymore?

Given that World of Hyatt's T&C explicitly state that the classification of room/suite types for the purpose of award redemptions or elite...

@Ben/Lucky, after years of gaslighting, do you even know the difference between what started out as a fabrication and what is real anymore?

Given that World of Hyatt's T&C explicitly state that the classification of room/suite types for the purpose of award redemptions or elite room upgrades is "in the sole discretion" of the applicable hotel, the quoted claim is yet more gaslighting.

In the real world, WoH members can redeem points only for a subset of rooms that a hotel, in its sole discretion" classified as standard rooms, a process that is correctly referred to capacity control and not "no blackout dates" as it is referred to in the bogus claim.

How do we know the claim is bogus? Well, because, you see, when a Hyatt hotel runs out of the subset of rooms that it set aside for redeeming with points, it will let you know, quite explicitly, with a pop-up message that says:

...even when standard rooms are clearly available for sale! The way self-anointed "travel gurus" have tried to rationalize hotels not honoring the made-up claim that "as long as a standard room is available for sale, you can redeem points for it" has been to accuse hotels of "playing games with award availability"!

Don't take my word for it. Just search for "Hyatt hotels play games with award availability" to reveal the gallons of cyber-ink that have been spilled accusing World of Hyatt of duplicity when all their hotels do is to correctly interpret the program's T&C! One of my favorite is a thread over at FT titled, very à propos, "Unfortunately, this hotel is not accepting World of Hyatt points or award stays." Check it out...

We provide the facts, you decide!

I typically try to use them for Hyatt GP redemptions as I have found that to be the best use as you mentioned. I have also gone the route of using them to book a hotel room via their travel portal and some of the results have been a better value than using the hotels own points redemption. I can recall the exact example but I think it was a Hilton in Greece that HH...

I typically try to use them for Hyatt GP redemptions as I have found that to be the best use as you mentioned. I have also gone the route of using them to book a hotel room via their travel portal and some of the results have been a better value than using the hotels own points redemption. I can recall the exact example but I think it was a Hilton in Greece that HH wanted 90k per night for and because the nightly rate was under $200 so it was only like 13k UR points per night. Some hotels even run some deals so the redemption value can be better than the standard.