If you’re collecting miles & points through credit card spending, I always recommend doing what you can to accrue transferable points currencies. That’s because these points are much more flexible than when you’re earning an individual airline or hotel points currency. You have the ability to transfer these points to all kinds of travel partners, and you’re safeguarded from a devaluation in a specific points currency.

With that in mind, in this post I wanted to address all the basics of transferring Capital One miles to the program’s airline and hotel partners. Personally I value Capital One miles at 1.7 cents each, thanks to all the great ways there are to redeem them.

This is a currency that has become increasingly popular, thanks to the Capital One Venture X Rewards Credit Card (review) and Capital One Venture X Business (review) (Rates & Fees), which are Capital One’s amazing premium cards.

Let’s go over all of the basics, including how many transfer partners Capital One has, how long it takes to transfer points, who you can transfer points to, etc.

In this post:

How many loyalty partners does Capital One have?

Capital One has 19 transfer partners, including 16 airline programs and three hotel programs. These include the following:

Airline Partners | Hotel Partners |

|---|---|

Aeromexico Club Premier | |

How long does it take to transfer Capital One miles in July 2025?

Below is a chart with how long it typically takes to transfer Capital One miles to airline and hotel partners:

Capital One Transfer Partner | Transfer Ratio | Transfer Time |

|---|---|---|

1000 : 500 | ~ 24 to 48 hours | |

Aeromexico Club Premier | 1000 : 1000 | Instant |

1000 : 1000 | Instant | |

1000 : 1000 | Instant | |

1000 : 1000 | Instant | |

1000 : 1000 | Instant | |

1000 : 1000 | ~ 3 to 5 days | |

1000 : 1000 | Instant | |

1000 : 1000 | Instant | |

1000 : 1000 | ~ 12 to 24 hours | |

1000 : 750 | ~ 24 to 48 hours | |

1000 : 1000 | Instant | |

1000 : 600 | Instant | |

1000 : 1000 | ~ 24 to 48 hours | |

1000 : 1000 | ~ 24 to 48 hours | |

1000 : 1000 | Instant | |

1000 : 1000 | ~ 24 to 48 hours | |

1000 : 1000 | Instant | |

1000 : 1000 | Instant |

As you can see, transfers to over half of Capital One’s partners are instant, while transfers to the remaining programs typically take anywhere from several hours to a couple of days.

Are there fees associated with transferring Capital One miles?

Nope, there are no fees associated with transferring Capital One miles, regardless of which partner you transfer points to. However, there may be ticketing or other fees with specific programs when it comes time to redeem points.

Can you transfer Capital One miles to someone else’s Capital One account?

If you have a card earning Capital One miles, you can transfer your miles to anyone else’s Spark or Venture account. It doesn’t need to be a family member, there are no limits on how many miles you can transfer to others, and the miles don’t expire any sooner.

In order to take advantage of this, you need to phone up Capital One, as this isn’t a feature that’s available online just yet.

Can you transfer Capital One miles to someone else’s loyalty account?

No. While you can transfer your Capital One miles to someone else’s Capital One account and then they can transfer it to their preferred loyalty program, you can’t transfer your Capital One miles directly to someone else’s loyalty program account.

The name of the Capital One account and loyalty program account have to match.

How soon after spending do Capital One miles post to your account?

One of the unique things about Capital One miles is that the miles post to your Capital One account within days of when you spend money on the card. Talk about instant gratification. With most other card issuers, miles post either after the statement closes, or even sometimes two statements later.

That means that within days you could be redeeming the miles associated with your spending today.

What credit cards earn Capital One miles?

There are several cards that earn Capital One miles that can be transferred to airlines or hotels:

- Unlimited 2x miles per dollar

- No Foreign Transaction Fees

- Capital One Travel Portal

- $0 intro for first year; $95 after that

However, there are really two best options as of now:

- The Capital One Venture X Rewards Credit Card (review) has a $395 annual fee and is the best personal card, as it offers a minimum of 2x miles per dollar spent, and all kinds of great perks, including a $300 annual travel credit, 10,000 anniversary bonus miles, access to Capital One Lounges, a Priority Pass membership, Plaza Premium Lounge access, generous authorized user perks, Hertz President’s Circle status, and more

- The Capital One Venture X Business (review) has a $395 annual fee (Rates & Fees) and is the best business card, as it offers a minimum of 2x miles per dollar spent, and all kinds of great perks, including a $300 annual travel credit, 10,000 anniversary bonus miles, access to Capital One Lounges, a Priority Pass membership, Plaza Premium Lounge access, and more

Should you transfer Capital One miles to travel partners?

Generally speaking, your Capital One miles can either be redeemed for one cent each toward the cost of a travel purchase (either to erase the cost of a purchase, or through the Capital One Travel portal), or can be transferred to one of the airline and hotel partners. Transfers to a vast majority of partners are at a 1:1 ratio, which is excellent.

Which redemption option makes more sense depends on your spending patterns. Personally I value Capital One miles at 1.7 cents each, and that’s based on the ability to transfer them at a 1:1 ratio to an airline partner. I consider that to be a much better deal, at least for those seeking out aspirational travel.

However, I recognize not everyone wants to redeem their rewards that way, so let me simplify this a bit further:

- If you want to redeem your Capital One miles for anything other than flights, your best option is probably redeeming them at one cent each toward a purchase

- If you want to redeem your Capital One miles toward airfare, you’ll get more value for international first and business class tickets when transferring miles to an airline partner

- If you want to redeem your Venture or Spark miles toward economy airfare (especially if it’s reasonably priced), your best option might be redeeming them at one cent each toward a purchase

Those are very general guidelines, and the best solution very much depends on the specific circumstances. Personally I exclusively redeem my Capital One miles by transferring them to airline partners, and then I book international first & business class tickets, but I recognize not everyone is looking for those kinds of redemptions.

Read our guide on the best ways to redeem Capital One miles.

Bottom line

Capital One has created a great points program. The transfer function was first introduced in late 2018, and has been considerably improved since then. Not only has Capital One assembled a nice collection of partners, but we’ve seen transfer ratios improve, and we’ve also seen some transfer bonuses. Add in the Capital One Venture X Card and Capital One Venture X Business, and the program gets even more exciting.

The good thing about Capital One miles is that redeeming them as cash toward travel and transferring them to airline and hotel partners can both be a great deal, so you get a lot of flexibility with these points.

If you have any data points on how long Capital One mileage transfers have taken you, please share them below, so that I can keep the chart as accurate as possible!

| Want to learn more about points transfer times? See our series about how long points transfers take with Amex Membership Rewards, Capital One, Chase Ultimate Rewards, and Citi ThankYou. |

Upon enrollment, accessible through the Capital One website or mobile app, eligible cardholders will remain at upgraded status level through December 31, 2024. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g. at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

For what's its worth - I just requested a 5,000 mile transfer from Cap One to Turkish and it was instantaneous

It’s a terrible program. For the third time in a row the transfer is held up indefinitely. I am waiting on Air France and Ethihad transfers to go through. It really makes the program so much less valuable.

It seems to be hit or miss still. I tried a test transfer of 1k miles to my Singapore KrisFlyer account and it hit instantly. Encouraged by this, I tried a larger 270k transfer around 20 mins later and ... nothing. The balance is deducted from my CapOne account but there's no record of it yet (24 hrs and counting) on my Singapore Airlines account. Called CapOne and they told me the same thing others...

It seems to be hit or miss still. I tried a test transfer of 1k miles to my Singapore KrisFlyer account and it hit instantly. Encouraged by this, I tried a larger 270k transfer around 20 mins later and ... nothing. The balance is deducted from my CapOne account but there's no record of it yet (24 hrs and counting) on my Singapore Airlines account. Called CapOne and they told me the same thing others here have said - "we have no visibility after it's deducted, transfers can take up to 15 days, getting a response to a support ticket might take 10-15 days" etc. Thankfully have been able to place the itinerary on hold for the whole 15 day period, which is very generous of Singapore Airlines.

I agree that transferring needed miles is risky with Cap One. I found four business class seats for my family and it’s been 24 hours since I transferred my miles. Capital One is breaking my heart! I’ll never fully trust them again.

Transfer to Eva Air and Singapore Air was instant for me.

Cap 1 does seem to have some teething challenges as they get further into this points thing. Amex blows them out of the water here.

Tried transferring almost 300k to Aeroplan. Nothing. No email confirmation. Nothing. Waited 24 hours. Nothing. Just called C1 and the agent seemed to be clueless. Said she'd open a ticket that will take 10-12 days to get a reply. I asked that they cancel the transfer if they aren't willing...

Cap 1 does seem to have some teething challenges as they get further into this points thing. Amex blows them out of the water here.

Tried transferring almost 300k to Aeroplan. Nothing. No email confirmation. Nothing. Waited 24 hours. Nothing. Just called C1 and the agent seemed to be clueless. Said she'd open a ticket that will take 10-12 days to get a reply. I asked that they cancel the transfer if they aren't willing to actually do it in a reasonable manner and I'll just transfer amex points.

We shall see, but this experience has me valuing my amex points even more now. C1 points are great in theory, but if transferring them when needed is a crapshoot then the value shrinks. Never had a problem with amex.

Perhaps people should be aware of the many issues people have had transferring from the Venture program due to security checks/fraud prevention. Personally I was blocked for two MONTHS in late 2023 due to the mobile phone text MFA not working, and others had the same issues.

Other people found their miles vanished and/or they forbidden from transferring due to fraud prevention measures.

Not sure if this is still an issue.

This can be...

Perhaps people should be aware of the many issues people have had transferring from the Venture program due to security checks/fraud prevention. Personally I was blocked for two MONTHS in late 2023 due to the mobile phone text MFA not working, and others had the same issues.

Other people found their miles vanished and/or they forbidden from transferring due to fraud prevention measures.

Not sure if this is still an issue.

This can be found in the relevant forum on FlyerTalk. E.g. https://www.flyertalk.com/forum/capital-one-rewards-miles/2139806-cannot-access-convert-miles-due-mobile-network-two-factor-authentication-failure.html and https://www.flyertalk.com/forum/capital-one-rewards-miles/2083200-capital-one-points-transfer-security-delay-issues.html

Hi Ben,

It would be useful to indicate in this type of article not only which airlines points don't transfer instantly to but which of those airlines allow holds on awards to give people time to make the transfer. And also how long the allowed hold might be.

Enjoy your blog very much. Thanks for all the hard work!

I transferred 100,000+ miles from my Capital One account to my Singapore Airlines Krisflyer account five days ago, along with a much-smaller number of points from my Chase account.

The Capital One points were in my Krisflyer account about two minutes after I made the transfer. The Chase points took 69 hours to arrive. That was a looong 69 hours, but fortunately, the saver award seats were still available when the points arrived.

I just transferred (last week of December) Cap1 points to Emirates for business class tickets for my wife and me. The transfer took a little over 24 hours. Cap1, when contacted, swears the delay was on Emirates end. Not surprisingly, Emirates begs to differ. I had to call Emirates and ask them to put the flights I wanted on hold, which they did, until the points arrived in my Emirates account.

So I echo...

I just transferred (last week of December) Cap1 points to Emirates for business class tickets for my wife and me. The transfer took a little over 24 hours. Cap1, when contacted, swears the delay was on Emirates end. Not surprisingly, Emirates begs to differ. I had to call Emirates and ask them to put the flights I wanted on hold, which they did, until the points arrived in my Emirates account.

So I echo what Ramon says in the comments: Don't bet your life on an instant transfer even to partners where the chart says the transfers are instant.

It took over 72 hours to transfer my C1 miles to Turkish and Flying Blue this last Nov.

I had previously always had instant transfers. I searched the topic and it is not an isolated incident as there are other C1 users that have had the same issue. Thankfully, once I realized the miles were not being transferred instantaneously I was able to call and get the flights out on hold.

Just want to warn people it is not always instantaneous.

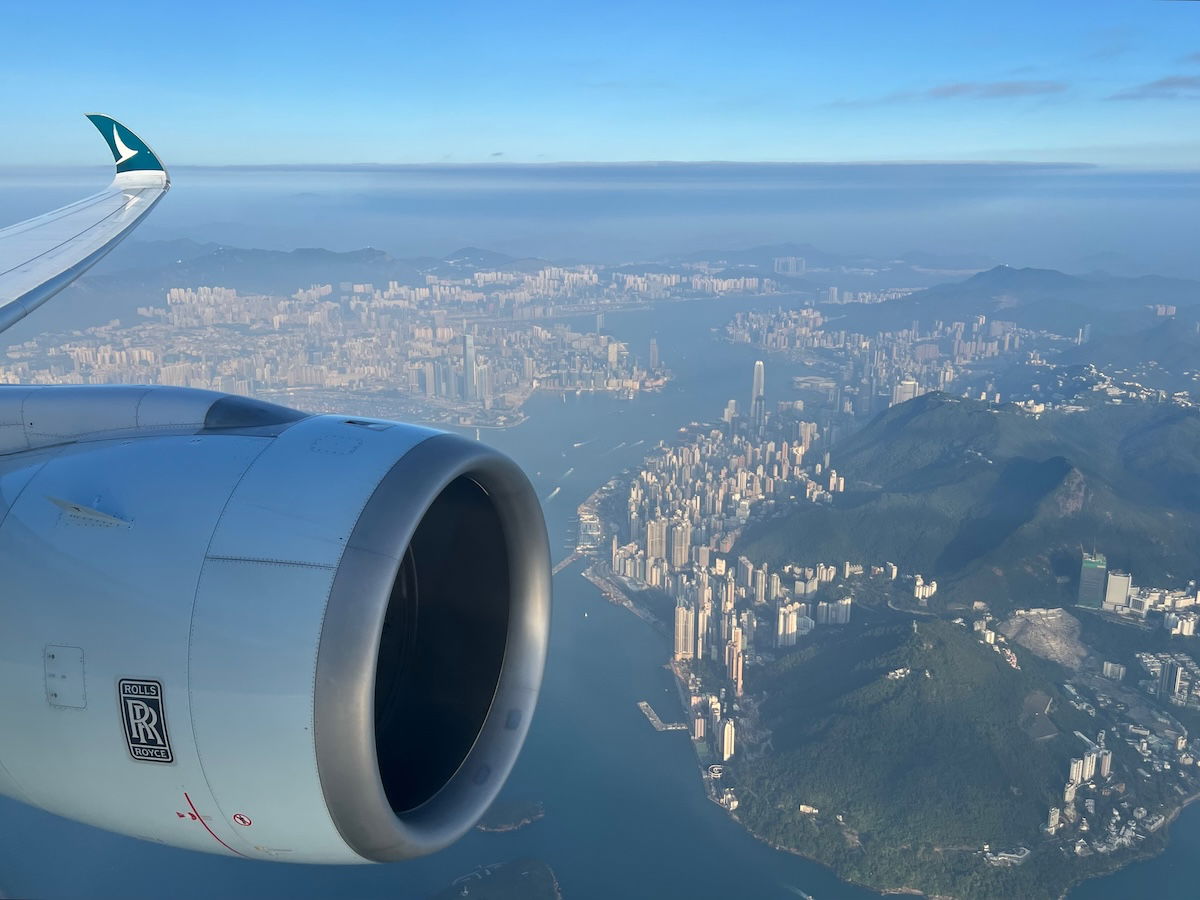

I just transferred to Cathay the other day and it was instant. Do note that to use Cathay miles for someone else, you first have to attach their name to your profile.

Just my experience, but on Jan 1 of this year I transferred to Turkish (first time transfer from my C1 account, and into my TK account) and it was instant for me.

Same for me on Jan 8.

same for me on Aug 14

Emirates is not always instant! I transferred last week and it took 4 days. Thank goodness the seats I wanted were still available. I called Venture X customer service to see if there was some issue with the transfer and there wasn't. The agent said sometimes it takes a while for Emirates to accept the transfer.

Hey Ben, I transferred to Cathay in September and it was instant. Not sure if anything changed since, but letting you know :)

I did a transfer to SQ in December and it was also instant. I was combining with miles from Citi and those took about 12 hours.

Where you going? I cashed 150,000 points to Cathay to book 2 Japan Air Business tickets from Boston to Bangkok. Thought that was a pretty good deal, but I am sure the pros on here think I got swindled lol

I actually like your redemption. I transferred 282K total for 2 SQ J from HKG-SIN and SIN-LAX. I know everyone would bring up using Aeroplan for 90K but it violated their no backtracking rule and even separately there was no availability when I needed it. I spent 168K CX points on 2 CX J tickets LAX-HKG. People act like you are wasting your points when you use them for the travel that suits you best,...

I actually like your redemption. I transferred 282K total for 2 SQ J from HKG-SIN and SIN-LAX. I know everyone would bring up using Aeroplan for 90K but it violated their no backtracking rule and even separately there was no availability when I needed it. I spent 168K CX points on 2 CX J tickets LAX-HKG. People act like you are wasting your points when you use them for the travel that suits you best, but I still have over 300K in transferrable points, so what was I saving them for? I'll earn another 100K before I take that trip.