Link: Apply now for the Capital One Venture X Rewards Credit Card

There’s a lot to love about the Capital One Venture X Rewards Credit Card (review), which is Capital One’s premium personal credit card.

On top of an excellent welcome bonus, the card offers many perks, like a $300 annual travel credit, 10,000 anniversary bonus miles, a Priority Pass membership, access to Capital One Lounges, access to Capital One Landings, Plaza Premium lounge access, Hertz President’s Circle elite status, primary rental car coverage, cell phone protection, and more. I applied for this card when it first launched, and was instantly approved.

Arguably the single most impressive aspect of the Venture X is how lucrative it is for authorized users. I’ve never seen a premium credit card that has such valuable and widely useful perks for authorized users, so let me explain in this post why this is so special.

In this post:

How much does it cost to add Capital One Venture X authorized users?

Capital One Venture X cardmembers can add authorized users to the card at no extra cost. That’s right, you can add friends or family members to your account, and it won’t cost you anything beyond the standard $395 annual fee for the primary cardmember.

You’re probably thinking “Well if it’s not costing anything, then authorized users probably aren’t getting many benefits?” Wrong. And that’s one of the things that makes this card so exceptional.

What benefits do Capital One Venture X authorized users receive?

Authorized users on the Capital One Venture X receive several perks, including:

- A Priority Pass membership, providing access to 1,300+ lounges around the world; Priority Pass memberships issued through Capital One allow you to bring up to two guests into lounges with you

- Access to 100+ Plaza Premium Lounges in the United States; you’re entitled to unlimited visits, and can bring up to two guests with you

- Access to Capital One Lounges, including the ability to bring up to two guests complimentary; as of now there are lounges at Dallas (DFW), Denver (DEN), and Washington Dulles (IAD), with future locations planned in Las Vegas (LAS) and New York (JFK)

- Access to Capital One Landings, including the ability to bring up to one guest complimentary; as of now there’s a location in Washington (DCA), with a future location planned in New York (LGA)

This is huge, as there’s not a single credit card out there that’s open to new applicants and that lets you add authorized users for free and give them a Priority Pass membership.

In addition to those two primary perks, Capital One Venture X authorized users also receive:

- Hertz President’s Circle status, offering rental car upgrades and much more

- The same 2-10x miles per dollar spent on the Capital One Venture X as the primary cardmember; of course the primary cardmember is responsible for paying the bill, but this can be useful for maximizing rewards for family members as well (also note that spending from authorized users counts toward the welcome bonus spending requirement)

- The same purchase protection offered on account of the Capital One Venture X being a Visa Infinite Card, including trip delay and lost baggage coverage

What benefits don’t Capital One Venture X authorized users receive?

What perks don’t Capital One Venture X authorized users receive?

- There’s no additional $300 travel credit for authorized users, though the travel credit can be used for anyone, including authorized users

- There’s no additional TSA PreCheck or Global Entry credit for authorized users, though a fee charged to an authorized user’s card could be reimbursed

- There are no additional 10,000 anniversary bonus miles for authorized users

How do you add Capital One Venture X authorized users?

The process of adding Capital One Venture X authorized users to your card is easy. The first option is to add authorized users during the application process. Toward the end of the application you’ll be asked if you want to add additional cardmembers.

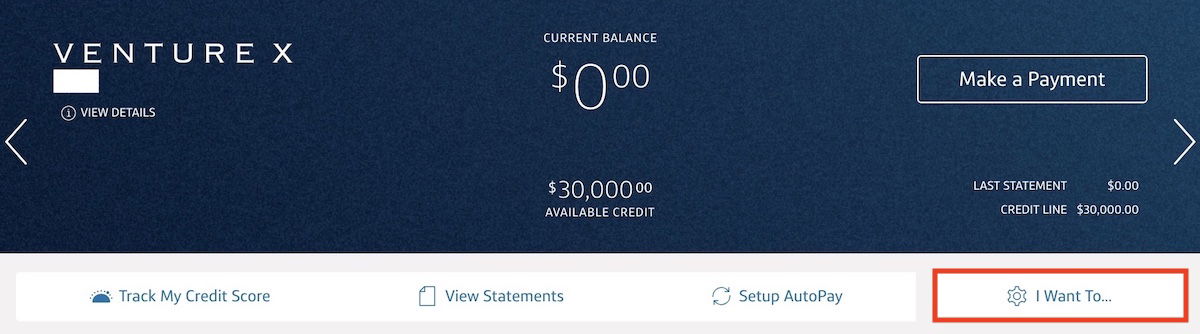

If you need a bit more time to think about who you want to add, you can instead add authorized users after you’ve opened your account (this is what I do, because when I’m applying for an account I’m focused on getting approved). Just log into your account, and on the account management page, click on the “I Want To…” button toward the top right of the page.

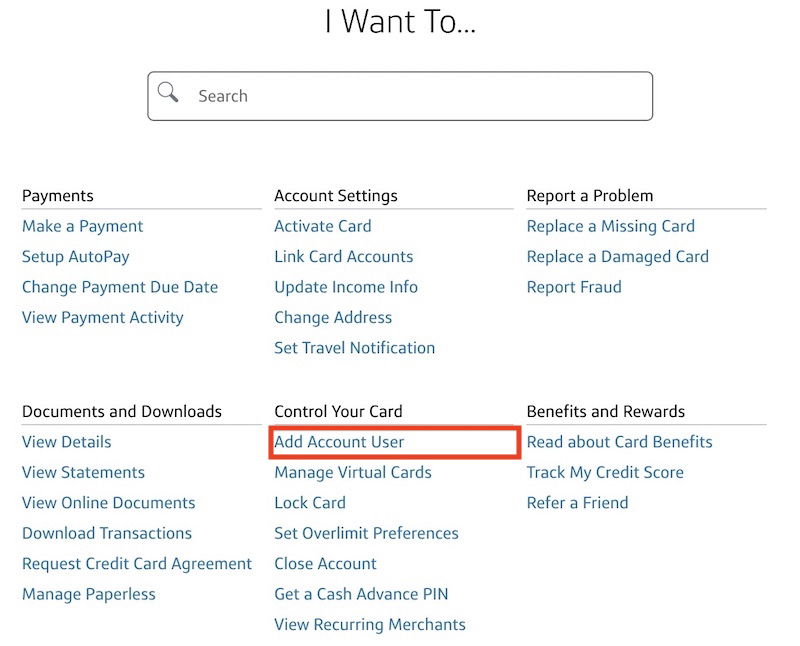

A window will pop up, and there you’ll want to select the “Add Account User” option, under the “Control Your Card” section.

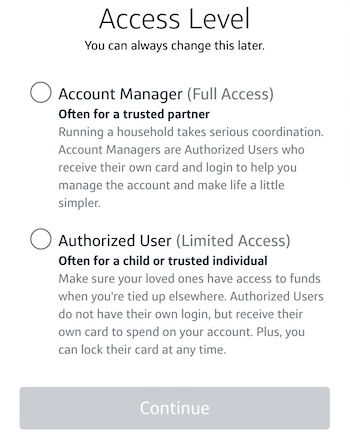

You can then select the “Access Level” for the user you’re adding:

- You can designate someone as an “Account Manager,” in which case they will receive their own online log-in and can help you manage the account

- You can designate someone as an “Authorized User,” in which case they’d only get their own card, but wouldn’t get an online log-in, so couldn’t in any way manage the account

Regardless of which option you choose, you’ll be on the hook for all the charges of your authorized users.

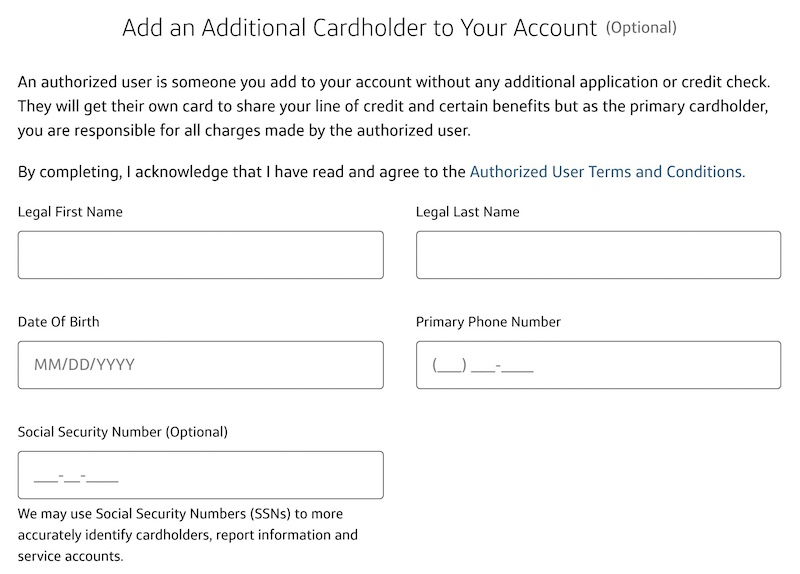

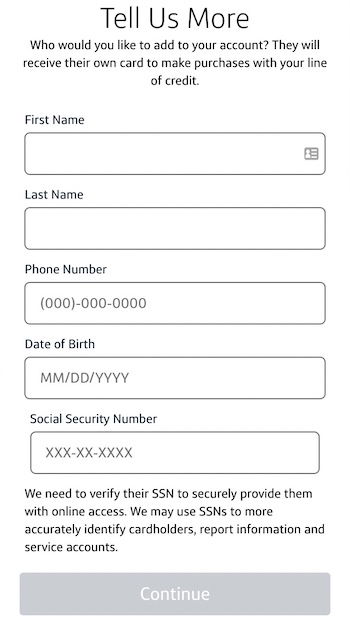

Once you select the type of authorized user you want to add, you’ll just have to share some basic details about them, including their first and last name, phone number, date of birth, and social security number. Adding a social security number is optional if you’re only adding someone as an authorized user rather than as an account manager.

A couple of further things to note about adding authorized users:

- If an authorized user wants to pick up the Capital One Venture X as a primary cardmember in the future, they’d still be eligible, including for the welcome bonus

- If authorized users are concerned about their Chase 5/24 status, note that them receiving a card as an authorized user could count as a further credit card toward their 5/24 limit

Does it make sense to add Capital One Venture X authorized users?

The obvious answer is that of course it makes sense to add authorized users to the Capital One Venture X. At no additional cost, you can add authorized users, and they’ll suddenly get airport lounge access and more.

I’m sure everyone has friends and family who will be delighted to be gifted unlimited airport lounge access with Priority Pass and Plaza Premium. This perk is even more awesome for those who frequently travel through DCA, DEN, DFW, or IAD, all of which have Capital One Lounges or Capital One Landings.

I can’t overstate how generous it is that Capital One lets you add authorized users to the card at no cost. Just to compare this to some other premium cards offering Priority Pass memberships to authorized users:

- The Chase Sapphire Reserve® Card (review) charges $75 per authorized user

- The Platinum Card® from American Express (review) charges $195 per authorized user (Rates & Fees) (Enrollment required)

To be able to get those perks for authorized users without paying extra is simply unheard of.

Why you might not want to add Capital One Venture X authorized users…

You probably should add authorized users to the Capital One Venture X, as it costs nothing. But just to play devil’s advocate, let me give an example of why that might not always be the best option, at least for those of us who love maximizing value.

I could add Ford as an authorized user on my card, but instead, he applied for his own card. Why? The way I view it, Venture X is better than breakeven, even just for the primary cardmember. In the long run, the Venture X has a $395 annual fee, but the card offers:

- A $300 annual travel credit through Capital One Travel

- 10,000 anniversary bonus miles; I value Capital One miles at 1.7 cents each, so to me that’s worth $170

Not even factoring in everything else (like the welcome bonus), the card gets me roughly $470 worth of value every year with a $395 annual fee. For those who are engaged in miles & points and value things the way I do, I think there’s value in having people outright get their own card, rather than being added as an authorized user.

So this is a product where I think it can make sense for a couple to each pick up their own card as a primary cardmember, and then you can gift lounge access to a bunch of family members and friends. At least that’s the approach I’ve taken.

What about the Capital One Venture X Business?

In addition to the personal version of the card, there’s also the Capital One Venture X Business (review), which also has a $395 annual fee. There are similarities and differences between the personal and business versions of the card.

While many of the perks overlap, one area where the cards are very different is when it comes to authorized user perks. While you can also add authorized users to the business version of the card at no cost, note that authorized users don’t receive any of the lounge access perks.

So on the business version of the card, lounge access is reserved only for the primary cardmember. There are still lots of reasons to pick up the business card, but authorized user perks isn’t among them. It’s a card I also applied for, and one I use for my everyday business spending.

Bottom line

There are so many things to love about the Capital One Venture X. One of the best things about this card is that you can add authorized users at no extra cost.

What makes this so awesome is that authorized users get many of the same perks as the primary cardmember, including a Priority Pass membership, access to Capital One Lounges, Capital One Landings, and Plaza Premium Lounges, a great rewards structure, and top-notch purchase protection.

If you have the Capital One Venture X, have you added authorized users to the card?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Platinum Card® from American Express (Rates & Fees).

Upon enrollment, accessible through the Capital One website or mobile app, eligible cardholders will remain at that status level through the duration of the offer. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g. at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Wow just wow. Can't believe I didn't even think about this option. Was gonna add my significant other to my plat so that they could have lounge access when I am not travelling with them but this is way more cost effective and gives at least some lounge coverage. Granted if they will be flying Delta maybe the sky clubs would be a nice feature and the centurion lounges but between paying the money and...

Wow just wow. Can't believe I didn't even think about this option. Was gonna add my significant other to my plat so that they could have lounge access when I am not travelling with them but this is way more cost effective and gives at least some lounge coverage. Granted if they will be flying Delta maybe the sky clubs would be a nice feature and the centurion lounges but between paying the money and getting it for free it seems like the venture X is the better call. With the travel credit its a card I don't really mind holding on to in the long term whereas the platinum AF makes it iffy each year as to whether I want to hold on to it.

We have expat family living in the middle east, their home airport has a Plaza Premium lounge. While they really should get their own Venture X cards they've absolutely loved the lounge access from their auth user cards on my account... It's the gift that keeps on giving, Clark.

Can I transfer points to a program that is in the name of an AU ?

Big question is can you put a spending limit on the authorized user?

Ben, I have to thank you. While I don't know if the Venture X is in my future (due to Capital One's restrictive approvals), your coverage of the Capital One cards has pushed me to critically review my card strategy. Unless and until something happens with Capital One, no changes. But, your recent articles pushed me toward reaffirming things. Thanks again.