Link: Apply now for the Capital One Spark Cash Plus with a $2,000 bonus offer

The Capital One Spark Cash Plus is one of the best business cards out there, whether you’re looking to earn cash back or travel rewards. If you’ve been considering this card but haven’t yet applied, now is the ideal time to do so, as the card is offering a best-ever bonus.

This was rolled out a few months ago, but I want to post a reminder that this deal is still live, as it’s anyone’s guess for how long it will stick around.

In this post:

Capital One Spark Cash Plus $2,000 bonus

The Capital One Spark Cash Plus is offering a welcome bonus where you can earn a one-time cash bonus of $2,000 once you spend $30,000 within the first three months. This bonus is excellent. Keep in mind it doesn’t factor in the typical 2% cash back that you earn, so really you’d earn a minimum of $2,600 cash back after spending $30,000.

Additionally, if you’re a very big credit card spender, you can earn an additional $2,000 cash bonus for every $500,000 spent during the first year. You can earn this bonus multiple times over the course of your first year of card membership. Obviously that’s not for everyone, but the card has an industry leading return on spending already, and this only makes it better.

As I’ll cover below, you can potentially get even more value by converting these rewards into Capital One miles.

How rewarding is the Capital One Spark Cash Plus?

For those not familiar with the $150 annual fee Capital One Spark Cash Plus, this is one of the most rewarding business cards out there, and one of the all-around best cash back cards:

- The card offers unlimited 2% cash back, making it one of the best cards for everyday spending

- The card offers an additional $150 cash back when you spend $150,000 on the card in a year, so it’s especially rewarding for big spenders; think of the card as offering a refund of the annual fee for big spenders

- The card is a charge card, so has no pre-set spending limit, making it ideal for big purchases

- The card has no foreign transaction fees, so you can earn 2% cash back globally

Read a full review of the Capital One Spark Cash Plus.

Convert cash back into Capital One miles

One awesome thing about the Capital One Spark Cash Plus is that you can convert cash back into Capital One miles at the rate of one cent per mile.

If you have the Capital One Spark Cash Plus in addition to a card like the Capital One Venture X Rewards Credit Card (review), Capital One Venture Rewards Credit Card (review), or Capital One Spark Miles for Business (review), then each cent can be converted into one Capital One mile.

Personally I value Capital One miles at 1.7 cents each, meaning that the $2,000 bonus is potentially worth $3,400 (based on my valuation of 200,000 Capital One miles). If you’re able to pull off the spending requirement, this is an excellent return for such a large amount of spending.

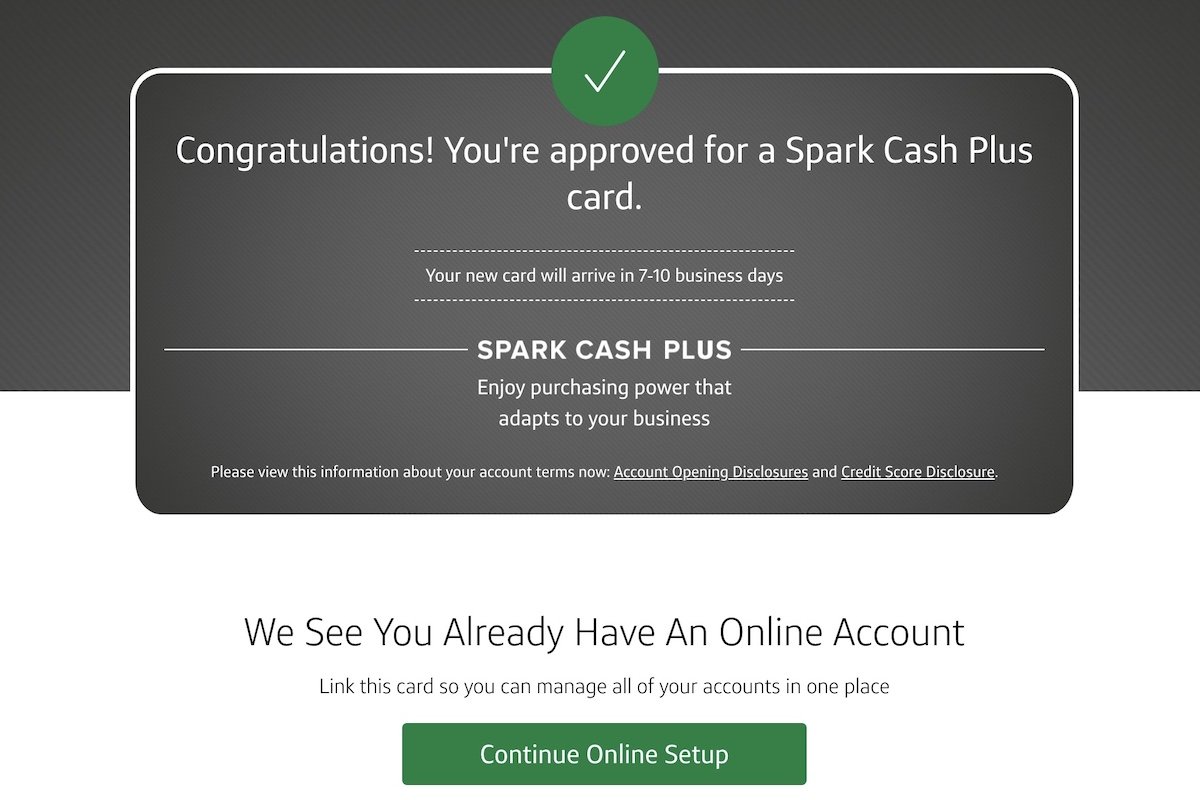

Can you get approved for the Capital One Spark Plus?

All card issuers have some general application restrictions. However, Capital One probably has among the fewest consistent restrictions.

Specific to the Capital One Spark Cash Plus, the welcome offer on the card isn’t available to those who already have the card, or those who who currently have the Capital One Venture X Business (review). Otherwise eligibility is unrelated to having any other Capital One card.

Read my guide to getting approved for the Spark Cash Plus.

Bottom line

The Capital One Spark Cash Plus has an excellent welcome bonus, which can earn you $2,000 cash back (or 200,000 Capital One miles).

If you are in a position to complete the spending requirement, this is a phenomenal bonus on a great card. The only other consideration is that there’s also merit to picking up the Capital One Venture X Business, which also has an excellent bonus, so that could be worth considering if you’re looking to use the card for travel.

Do you plan on picking up the Capital One Spark Cash Plus?

"Best ever" is misleading since the bonus has been $2k for many months. I wish OMAAT would include a bonus history section.

Tax season is coming up... this could be ideal for some.