I often get asked how much I value various miles & points currencies, including those issued with credit cards, airlines, and hotels. The truth is that there’s no valuation for these currencies that everyone will agree on. That’s because the value that you’ll get from rewards points will vary significantly based on how you redeem them, and that’s also largely based on your travel goals.

Nonetheless I try to use my knowledge of these programs to assign a value to each currency, which can fluctuate over time. Below I’ll share my updated valuations of many major miles & points currencies, and then afterwards I’ll explain my methodology. Note that I’ve adjusted my valuation of many currencies, to reflect the devaluations we’ve seen recently.

In this post:

Value of bank & credit card points July 2025

To me, transferable credit card points are the gold standard of rewards currencies. They offer a ton of flexibility, since you can transfer them to all kinds of partners. On top of that, there are so many lucrative credit cards that offer generous rewards structures for earning these points.

Personally I always try to earn transferable points currencies with my credit card spending. Unlike other points currencies, I value these more or less the same, given just how many partners each program has.

Below are my valuations of the major transferable points currencies.

Program | Value |

|---|---|

1.7 cents/point | |

1.7 cents/point | |

1.7 cents/point | |

1.7 cents/point | |

1.7 cents/point |

Value of airline miles July 2025

There are lots of ways to earn airline miles, from actually flying, to using co-branded airline credit cards. The value of airline miles does vary significantly between programs. It’s important to keep in mind that major airlines have lots of partners, so the value of these miles isn’t just based on the ability to redeem for travel on that particular airline, but also based on the ability to redeem for travel on partner airlines.

Below are my valuations of the major airline mileage currencies.

Program | Value |

|---|---|

1.3 cents/mile | |

1.3 cents/mile | |

1.5 cents/mile | |

1.3 cents/mile | |

1.5 cents/mile | |

1.4 cents/mile | |

1.5 cents/mile | |

1.4 cents/mile | |

1.3 cents/mile | |

1.2 cents/mile | |

1.1 cents/mile | |

1.2 cents/mile | |

1.1 cents/mile | |

1.3 cents/mile | |

1.3 cents/mile | |

1.3 cents/mile | |

1.5 cents/mile | |

1.2 cents/mile | |

1.4 cents/mile | |

1.2 cents/mile | |

1.4 cents/mile | |

1.1 cents/mile | |

1.1 cents/mile |

My valuation of rewards currencies are intended to be conservative by design, so that people don’t unnecessarily or unrealistically hoard their points.

Value of hotel points July 2025

Much like with airline miles, hotel points can be earned either through staying at hotels, or by using co-branded hotel credit cards. Generally hotel points are easier to redeem than airline miles, given that there aren’t as many capacity controls or restrictions when redeeming them. That’s one of the reason many prefer to earn hotel points rather than airline miles.

Below are my valuations of the major hotel points currencies.

Program | Value |

|---|---|

2.0 cents/point | |

0.5 cents/point | |

0.6 cents/point | |

0.5 cents/point | |

0.5 cents/point | |

0.7 cents/point | |

0.3 cents/point | |

1.5 cents/point | |

0.7 cents/point |

I haven’t lowered my valuations of any of these currencies for quite some time. Why? While more points are now needed for many hotel stays, revenue rates have also gone up considerably. Some might argue “well flight costs have gone up as well.” That’s not untrue in economy, but generally my valuation of miles is based on aspirational redemptions, and the cost of first and business class tickets hasn’t necessarily gone up.

How to go about valuing miles & points

With the above out of the way, how do I actually go about coming up with a value for miles & points? First of all, let me share that I’ve been obsessed with miles & points for 15+ years. Keeping track of these programs is my passion (and my job), and I’ve also helped people redeem well over a billion miles over the years. I’d like to think I have a bit of experience.

Even so, that’s not to say that you should value miles & points the same way I do. Let me share some basics on how I go about valuing miles & points, and everyone can decide for themselves how they want to go about it.

Miles & points can’t be valued objectively

Miles & points are ultimately a form of currency, so you might be wondering why we can’t value them objectively. After all, there are exchange rates between monetary currencies, even though different factors impact their valuations.

There are a few reasons miles & points (at least for non-revenue based programs) can’t be valued objectively in a useful way:

- There are so many different ways to redeem miles & points, which will give you vastly different valuations

- There’s typically not a way to “cash out” your miles & points, and when there is, that’s generally not the most efficient way to use them

- Everyone has different travel goals, and you’ll get different value depending on whether your priority is taking the family to Disney World, or flying first class to Singapore

- Miles & points can be devalued over time, and are generally the property of the loyalty program rather than the member, so really we’re just playing by the programs’ games

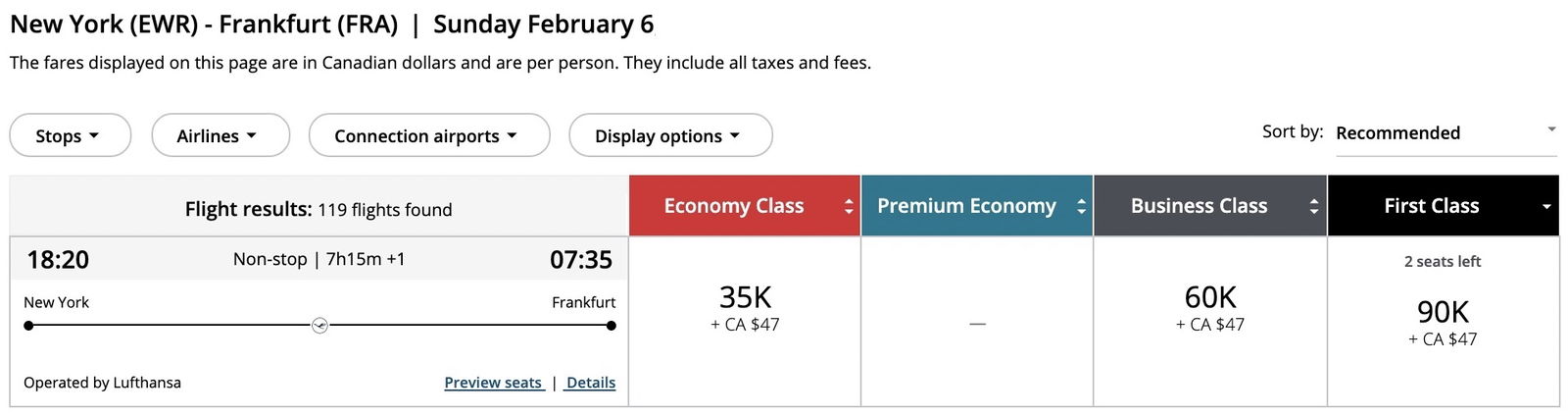

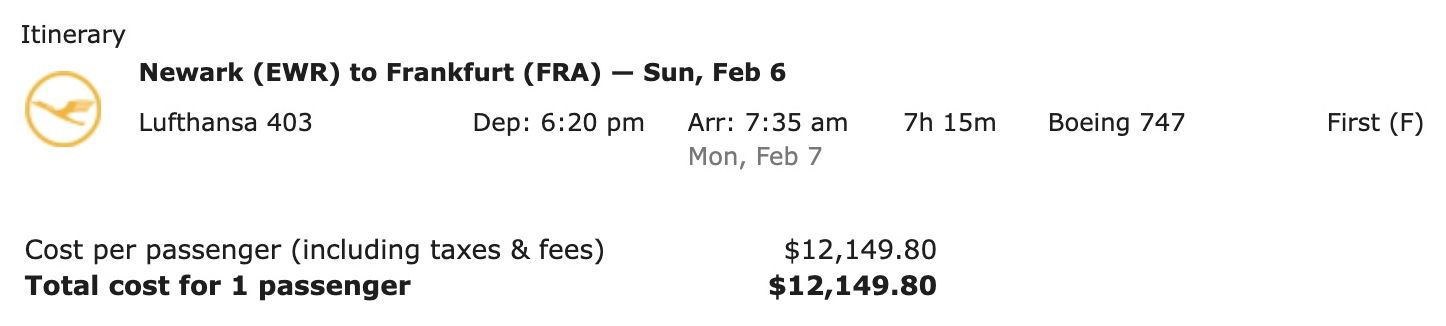

Let me give a concrete example of why there’s no correct objective valuation of rewards points. Let’s say you have Capital One miles, which I value at 1.7 cents each, and you transfer those to Air Canada Aeroplan. You could redeem 90,000 points for a one-way ticket in Lufthansa first class from Newark to Frankfurt.

Meanwhile if paying cash, that ticket would cost over $12,000.

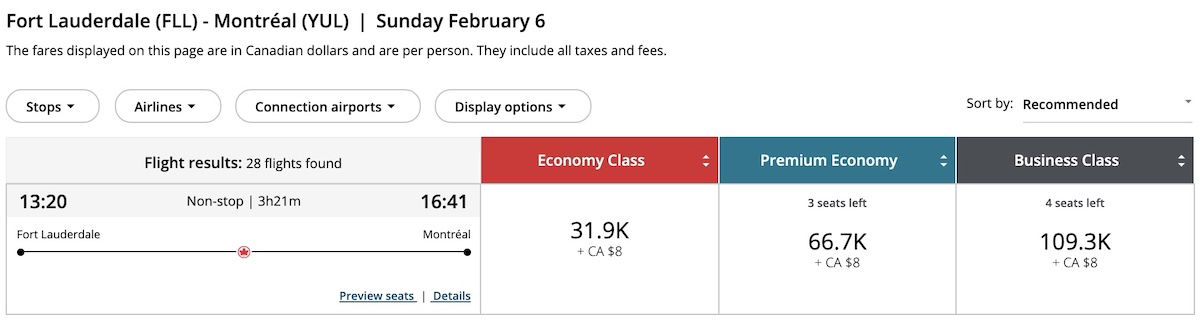

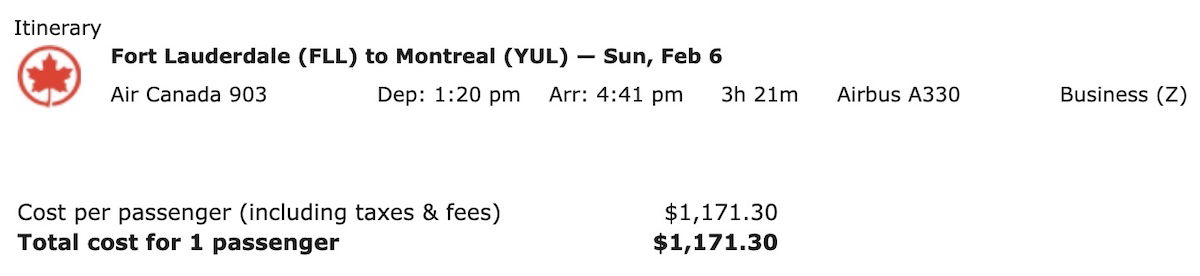

Alternatively, you could redeem 109,300 miles for a one-way ticket in Air Canada business class from Fort Lauderdale to Montreal.

Meanwhile if paying cash, that ticket would cost $1,171.

As you can see, you can redeem fewer miles for a ticket that would cost more than 10x as much when paying cash. This is purely intended to be an example, but hopefully at least demonstrates the complexity of valuing these currencies.

Be conservative when valuing miles & points

For a variety of reasons, I try to be conservative when it comes to valuing miles & points:

- Miles & points can be devalued by programs at any time, so you have to apply some sort of a discount to them to account for that; in general there’s much more of a risk of devaluation for an individual airline or hotel currency, rather than a transferable points currency

- With most programs, you don’t actually own your miles & points; they belong to the program, and you’re just allowed to use them as long as you have an account in good standing

- People should be encouraged to earn & burn, and creating an artificially high value for points discourages that

As you can see, I value credit card rewards points more than a vast majority of individual airline currencies, even though those are the best ways to redeem them. That’s because I’m willing to value the points at a premium for the added flexibility that they offer.

Valuing miles & points is both absolute & relative

Coming up with a valuation of a mile or point is both an absolute and relative exercise:

- The valuation should be absolute in the sense that a currency should be valued somewhere between the typical acquisition cost and the typical redemption cost; at the end of the day this is why I value most of these currencies at somewhere around one to two cents each

- It’s relative because the way I come up with differing valuations between currencies is based on the pros & cons of redeeming with each program in terms of redemption rates, routing rules, and more

How you’ll get the most value with your miles & points

Generally speaking, if you want to get the most value from miles & points, there are two key aspects to that:

- You should spend some time studying these programs, because the deals to be had are in some cases amazing

- In general you’ll get the most value from points if you’re looking for aspirational redemptions, like staying at five star hotels, or booking international first & business class flights, where the cash value would be disproportionately high

Admittedly that’s not how everyone wants to redeem, and that’s totally fine:

- If you don’t have a lot of points, it’s probably not worth investing the time to study these programs all that carefully

- If you have a family with toddlers, then understandably your priority might be traveling to somewhere close by and having a room with a lot of space, rather than flying halfway around the world to stay at a five star hotel

Don’t fall for the retail cost fallacy

I think it’s important not to get too carried away with points valuations. For example, above I showed a $12,000+ one-way first class ticket from Newark to Frankfurt on Lufthansa that could be booked with 90,000 Aeroplan points.

Yes, on the surface I suppose you are getting over 13 cents of value per point. However, don’t focus on that too much. For mental accounting purposes, personally I value redemptions based on how much I’d otherwise actually be willing to pay for that experience. I would never, ever drop that kind of cash on a one-way first class ticket.

So while on paper that might be the valuation, I always ask myself how much I’d be willing to pay for a first class ticket to Europe. Personally I’d estimate that I’d probably actually value that flight at $1,500, in terms of what I’d otherwise be willing to pay.

I’m not looking to get into a huge debate here about perceived value rather than retail value, but my point is that it’s important to consider how much you value these premium experiences, rather than just how much they cost.

Don’t take a trip just because it would cost a lot when paying cash, but rather do what you want to do, and try to maximize value along the way. At least that’s my take.

Don’t value miles & points based on one redemption

Another thing I consider with each points currency is how many good redemption options there are. The more flexibility and more options there are, the most I value those currencies. Don’t just value a points currency based on a single award ticket sweet spot.

For example, redeeming Virgin Atlantic Flying Club points on All Nippon Airways is a phenomenal value. However, last year we saw the first class redemption rates get devalued considerably, and on top of that, first and business class award availability on ANA can be really tough to come by.

So while you could get a ton of value from Virgin Atlantic Flying Club points if you manage to find availability, you don’t want to value a currency exclusively based on one redemption. I try to factor in these sweet spot redemptions while acknowledging that they provide limited flexibility.

Bottom line

Hopefully the above is a useful rundown of the value of various credit card, airline, and hotel points currencies. There’s no absolute right or wrong way to value points, and it’s totally reasonable if your valuation is different than mine. My goal is just to share my take, and provide a general framework for valuing these currencies.

I’ll keep my valuations updated over time, to reflect changes with these various points currencies.

How do you go about valuing miles & points, and are your valuations substantially different than any of mine?

I would love to know the point value of the independent hotel programs like LHW, I prefer, GHA Discovery, etc.

I read a lot about the benefits, but can’t find much about actual/compared point value per dollar. Would be great for your readers to know!

If I believed my miles were only worth 1.5-1.7 cents, I wouldn't put much effort into accumulating them. Like any commodity, miles are worth exactly what you are willing to accept for them. My family collects about 600K miles per year, mostly through credit cards. In most cases, the yield on points for USA domestic flights is pretty low, about 1.5 cents, so I rarely use them for domestic travel. The big yields are on...

If I believed my miles were only worth 1.5-1.7 cents, I wouldn't put much effort into accumulating them. Like any commodity, miles are worth exactly what you are willing to accept for them. My family collects about 600K miles per year, mostly through credit cards. In most cases, the yield on points for USA domestic flights is pretty low, about 1.5 cents, so I rarely use them for domestic travel. The big yields are on international flights, especially in premium cabins. As a college graduation gift for my daughter, I recently booked flights to Europe for 7 youngsters. They are departing from 4 cities, and returning to 5 cities, some on different dates. My miles are spread across several programs, so it was a logistical challenge to find award seats for everybody at a good yield. But I enjoy a challenge, and I found the flights. Everybody is in a premium cabin for at least one direction, which will be a first for most of these kids! The average yield for the entire trip is 4.8 cents. Most of these young travelers are broke, so I blew 220K miles on several short intra-European flights at very low yields, just to save them the cash outlay. For the long-haul portions, the average yield for this trip is 6.1 cents. I have booked trips to China, Vietnam, New Zealand, and round-the-world where the yields were over 7 cents. I cringe when friends tell me they booked a flight through Chase for just 1.25 cents!

ben: hey guys it's pretty hard to accurately nail down point values but people ask me a lot so here's my best stab at rough estimates

the comments: WHAT THE F*CK IS YOUR PROBLEM DUDE THIS SH*T SUCKS

PARTING SHOT

@DC or anyone else who wishes to learn something about hotel points currencies, please read the following. I mean, really read it with an open mind this time because, while none...

PARTING SHOT

@DC or anyone else who wishes to learn something about hotel points currencies, please read the following. I mean, really read it with an open mind this time because, while none of the it is new, the general confusion about points currencies that it repeatedly tried to address persists.

So, @DC, you asked, and I will deliver, yet again, by showing that I can calculate analytically (i.e., objectively) values of all the major hotel loyalty points currencies. I limit the calculations to hotel points because they are the only ones that I have modeled extensively.

As I wrote in a response to one of the comments below,

Here's the proof.

First, I will provide the base earn rates for top elites in all the major hotel loyalty programs, with bonus points from comparable co-branded CCs included (this is a must to maximize accuracy). The numbers are well established and not at all controversial.

Hilton: 32 pts/$

Hyatt: 10.5 pts/$

IHG: 30 pts/$

Marriott: 23.5 pts/$

Radisson Rewards: 45 pts/$

With just those base earn rates, I can calculate analytically the "face" values (FPV) of corresponding hotel programs' points currencies using the equation:

FPV = 16.0/(base earn rate).

I provided the base earn rates, you can easily calculate FPV by just plugging in the numbers.

For example

Value of a Hilton point

FPV = 16/32 = 0.50cpp

Value of a Hyatt point

FPV = 16/10.5 = 1.52cpp = 1.5cpp

To convince yourself, go ahead and calculate the point values for IHG, Marriott and Radisson by simply plugging in the numbers. Feel free to round off the results up or down to just 2 significant digits to match what travel bloggers publish.

See? Just like that I have debunked the forum host's axiom or claim that

Miles & points can’t be valued objectively.

At least for hotel loyalty points currencies, which I have modeled extensively, the claim or axiom is totally bogus: these values can be valued objectively. However, I can likewise show the forum host's other axioms/claims to be wrong or nonsensical because they are just a reflection of the general travel blogosphere failure to understand that points currencies have two distinct values:

a) "face" values that are assigned by the individual programs and are, thus, fixed and objective (these are the values that this site and other purport to publish),

and

b) "redemption" values that depend on how each person opts to redeem their points and are, thus, subjective, highly variable, and have values only after points have been redeemed.

The general confusion, which the forum host's set of "axioms" reflects, is due to the fact everyone in travel blogosphere lumps together those two concepts of points currencies.

Here's the confusion and the answer in a nutshell:

This site publishes a Hilton point as being worth 0.5cpp, and yet folk have reported redeeming Hilton points for 3.5cpp or higher at, e.g., WA Maldives. How is that possible? Given such highly different values, what exactly is the value of a Hilton point? Well now you know or you should know: a Hilton point, like all other hotel points currencies, has two different values:

-- 0.5cpp is the "face" value of a Hilton point. Hilton assigns this value and no blogger can "devalue" it, as they claim to be able to do when, e.g.. the cost of a standard award at WA Maldives went from 120K to 150K points per night.

-- 3.5cpp is the "redemption" value a Hilton for a specific redemption at WA Maldives. That value was known only after the points were redeemed according to individual preferences or circumsyances.

Anyway, the preceding is Q.E.D., but please feel free to chime in with a valid counterpoint or counterclaim.

G'day!

Oh, my dear, you never have a final "parting shot".....

Anyway, nice to see you finally admit there are two different principles- the "face value"/ acquisition cost, etc and the value derived from using these points. You should lead with that, you'd be taken more seriously.

Everyone here (and all the bloggers) are talking about the value derived from these points when redeemed to that person. No reason to blather on about the brilliant math...

Oh, my dear, you never have a final "parting shot".....

Anyway, nice to see you finally admit there are two different principles- the "face value"/ acquisition cost, etc and the value derived from using these points. You should lead with that, you'd be taken more seriously.

Everyone here (and all the bloggers) are talking about the value derived from these points when redeemed to that person. No reason to blather on about the brilliant math on acquisition cost/ "face value" which is on a different subject entirely!

"A cynic is a man who knows the price of everything, and the value of nothing."

LOL. Do you even realize that your stupid statement above is nullified by your very next statement below, which is just as stupid...

LOL. Do you even realize that your stupid statement above is nullified by your very next statement below, which is just as stupid...

...and that together, the two statements make it clear that you are still as confused as ever?

If "Everyone here (and all the bloggers) are [sic] talking about the value derived from these points when redeemed to that person" as you claim, then there would be no need or reason for travel bloggers to keep publishing their fixed values of points currencies for credit cards, hotels, airlines, etc, like those published in this blogpost because, according to you, theirs would be redemption values that (cutting and pasting from what I wrote above)

Instead. what travel bloggers publish to great fanfare, even though they are clueless about the values means, are face values of points currencies, which (cutting and pasting from what I wrote above)

All of which reveals just how confused is your statement that

The math is incontrovertible and unassailable in showing just how clueless are self-anointed "travel gurus" who believe that they can lecture the masses by spewing half-baked "words of wisdom" like

-- Miles & points can’t be valued objectively

-- Be conservative when valuing miles & points

-- Valuing miles & points is both absolute & relative

-- How you’ll get the most value with your miles & points

== Don’t fall for the retail cost fallacy

-- Don’t value miles & points based on one redemption

Again? So if I keep responding to this thread, will you keep monitoring and responding indefinitely? A month? A year?

I find it odd that you get so bent out of shape about being (mostly) agreed with!

Your straw man argument is derived from your initial fallacy that bloggers are describing a "fixed" valuation with these articles; these points "values" are just guides to help people know they're getting a reasonable return. They all have...

Again? So if I keep responding to this thread, will you keep monitoring and responding indefinitely? A month? A year?

I find it odd that you get so bent out of shape about being (mostly) agreed with!

Your straw man argument is derived from your initial fallacy that bloggers are describing a "fixed" valuation with these articles; these points "values" are just guides to help people know they're getting a reasonable return. They all have disclaimers stating this.

It is only you saying these are "fixed" values and then arguing a different point entirely than the post in question. Leads to your circular logic and claims of "incontrovertible and unassailable" conclusions. It takes quite a bit of "mental gymnastics" to describe what I've written as "confused"- especially as it essentially agrees with much of what you've written!

Seems your big beef should just be on the definition of "valuation" so you're saying the same thing.

Clueless.

We're done here.

I think that valuations should be based on business class instead of both business and first because 1) very few international routes even have first class anymore and 2) good luck scoring an award first class seat on a long haul international route that works with your schedule.

The average person should just be getting cash back. Yes, those who read this blog can do a lot better, but they are the exception.

That is true for the miles collected on an ongoing basis, and for people who only travel domestically. However, the mileage cards offer big sign-up bonuses, which is just like free money, even if you choose to redeem those points at crappy yields. My wife and I earn around 600K per year in sign-up bonuses. Also, most mileage cards have bonus spending categories, which enable you to collect far more miles than the equivalent cash-back....

That is true for the miles collected on an ongoing basis, and for people who only travel domestically. However, the mileage cards offer big sign-up bonuses, which is just like free money, even if you choose to redeem those points at crappy yields. My wife and I earn around 600K per year in sign-up bonuses. Also, most mileage cards have bonus spending categories, which enable you to collect far more miles than the equivalent cash-back. For example, Chase Sapphire Preferred gives triple points on dining, and Chase Ink card gives triple points on utilities and cell phone service. Even if you believe the low valuations of 1.5 cents per point, I am getting 4.5 cents per dollar spent on these bonus categories. I don't think any cash back cards will give me 4.5%.

This is not first time you bragg about your annual 600K points earning.

To those of you who is NOT flying a lot here is possible points acquisition plan:

To earn with 3X points you have to spend $200,000.00 on dining or get merried 6 times to achieve a spousal sign up bonus per year!

At this point in time I value American miles in high regard and don’t put a price on them. I believe in not hoarding. I have just over 100k and have found that the upgrade competition is much less when flying international. I value waitlisting a a $350 plus 25k mileage co pay upgrade.

If I had the chance to go all in on a roundtrip to JNB for 150K in Q Suites or...

At this point in time I value American miles in high regard and don’t put a price on them. I believe in not hoarding. I have just over 100k and have found that the upgrade competition is much less when flying international. I value waitlisting a a $350 plus 25k mileage co pay upgrade.

If I had the chance to go all in on a roundtrip to JNB for 150K in Q Suites or BA I would. I’m frustrated that ICN is absurd ; AA J one way is 200K and up and I’m not making 2 stops for ultra long haul. I make 1 stop at most. My only exception will be IAH LAX HND SIN but a one time deal.

I disagree with valuing all credit card currencies the same. They have very different redemption values depending how you redeem and the card you use. For example, Amex is a much better transfer partner than Chase. Generally Amex has many more promotions for transfer bonuses. Chase has the option for redeeming with their travel center at 1.5x if you have the Reserve card. It costs A LOT of Amex points to redeem with their travel...

I disagree with valuing all credit card currencies the same. They have very different redemption values depending how you redeem and the card you use. For example, Amex is a much better transfer partner than Chase. Generally Amex has many more promotions for transfer bonuses. Chase has the option for redeeming with their travel center at 1.5x if you have the Reserve card. It costs A LOT of Amex points to redeem with their travel center. Furthermore, they all have a different number of partners. Some partners are the same some are not.

I also disagree with the idea of having one reward standpoint. I think it is a good idea to have a reward standpoint. If I spend 100,000 points for a value of $1400 then if I get less than that it is not a good idea to redeem. At least it builds a standard and should be done for programs or brands that you frequent.

There is tremendous overlap between transfer partners for Amex and Chase, at least for airlines. Where there are gaps, they are easily covered by alliance partners. Chase does not include Delta and Etihad, but those are two of the crappiest FF programs out there. If you want an award flight on Delta, you are much better off booking it through FlyingBlue or Virgin Atlantic, which are both transfer partners of Amex and Chase. The biggest...

There is tremendous overlap between transfer partners for Amex and Chase, at least for airlines. Where there are gaps, they are easily covered by alliance partners. Chase does not include Delta and Etihad, but those are two of the crappiest FF programs out there. If you want an award flight on Delta, you are much better off booking it through FlyingBlue or Virgin Atlantic, which are both transfer partners of Amex and Chase. The biggest drawback with Amex is that you can only get one sign-up bonus. I have several Chase cards, which I cancel and renew every 2 years (4 years for Sapphire) and collect another sign-up bonus. Ka-ching!

Pretty sure that your UA valuation is very low. Sure, I get it, you can theoretically still book AA with QR for great rates. Or BA with a $1K fuel surcharges. AA barely ever. But in the scheme of things I have a hard time seeing such a disparity. I would maybe give AA a 1-2 cent advantage...only because of QR.

I think the most crucial factors now to go into the formula are:

...Pretty sure that your UA valuation is very low. Sure, I get it, you can theoretically still book AA with QR for great rates. Or BA with a $1K fuel surcharges. AA barely ever. But in the scheme of things I have a hard time seeing such a disparity. I would maybe give AA a 1-2 cent advantage...only because of QR.

I think the most crucial factors now to go into the formula are:

1. Availability for top tier flyers

2. Fuel surcharges.

3. Partners

That is more the matrix over actual redemption costs. The rest is just complete BS at this point.

It's actually a joke to think that the values of loyalty points currencies depend on what a blogger subjectively thinks the values ought to be, when the reality is that each program assigns its currency a "face" value that is fixed and independent of anyone's whim or bias.

No, each program does not assign a fixed value. Some attempt that for their own flights, but the best deals are usually found by booking partner flights. Delta may only give you 1.2 cents at Delta.com, but you can usually book Delta flights through Virgin Atlantic or FlyingBlue at a much higher yield.

I still use UA a lot, due to its great engine, flexible cancellation, instant customer service.

But the absolute value is definitely whacked after recent brutal devaluation.

@Ben - Something to consider including in the tables: Since most point earning is now revenue-derived, it might be useful to include the earn rates also. I know that can get wonky with elite bonuses and whatnot, but when comparing (for example) hotel programs, if program A gives me 10 points per $ and program B gives me 5 points per $, a per-point valuation is only half the picture.

Actually, for hotel loyalty programs, top elite members' base earn rates are 100% determinant of the "face" value of a program's points currency.

BTW, has anyone figured out how the site hots goes from a set of largely wrong axioms

...to the tabulated numerical values of miles and points?

That is, how does one go from...

...to the tabulated numerical values of miles and points?

That is, how does one go from...

...to a value of 1.5cents for a Hyatt point or 0.5 cent for an IHG point?

Inquiring minds wanna know!

PAY NO ATTENTION TO THE MAN BEHIND THE POINTS AND MILES CURTAIN.

@DCS

I knew you'd be posting something about this.

Yeah, that is because I remain totally baffled that anyone can continue to claim with a straight to be able to derive numerical values of points currencies based on a set of mostly wrong or nonsensical axioms. It's almost like alchemy, whose practitioners claimed to be able to turn lead into gold!

That's OK. You don't acknowledge (nor truly validate) the assumptions underlying your determination of value across multiple points currencies nor your grand "pronouncements" either. So I guess we can put as much stock in your assessment as the bloggers.

Oscar Wilde's Lord Darlington describes you well in his quip about the cynic. Cecil Graham's line about the sentimentalist applies to the bloggers

Lucky,

you consistently overestimate value of points to sell your card links.

If none of the airline points that can be transferred into are worth more than 1.3c (leave AA as Bilt will leave soon) No transferable program is worth that much more.

All points are worth 1.3c at most - ANA redemptions are poor and subject to transfer delays, Hyatt has a small footprint etc etc - each program has its gotchas.

You’re forgetting the magical transformation where transferable points become worth more than anything they can transform into!

It's not a "magical transformation" at all. Optionality has value. It's why (financial) options have extrinsic on top of intrinsic value.

Example: Of course you would rather hold MRs than Avios, as the former can redeem for everything the latter could but not vice versa. So it's nonsense to say they are valued the same, as long as the different points that MRs can be redeemed for are distinct and have different uses.

Very good article. Regarding the comparisons with the cash rate - those should also be made, and we should seriously consider our options. For example, would you rather pay 63k Avianca miles for a business ticket from USA to Europe, or would you pay $800 to buy those miles, when on sale, and then use them to buy the ticket? Would you pay 100k AA miles to fly business class from Boston to Honolulu, or...

Very good article. Regarding the comparisons with the cash rate - those should also be made, and we should seriously consider our options. For example, would you rather pay 63k Avianca miles for a business ticket from USA to Europe, or would you pay $800 to buy those miles, when on sale, and then use them to buy the ticket? Would you pay 100k AA miles to fly business class from Boston to Honolulu, or would you pay $1000? And, of course, let's not forget that, for many of us, we'd simply not afford to get to all sorts of places and stay in all kinds of hotels, if it wasn't for these points.

Except for transfer bonuses, the magic of transferable points being = 1.7¢ when nothing you can transfer them to = 1.7¢ continues!

Well yeah the transfer bonuses is what accounts for that difference. I don't think there's anything more to it, although it would be nice if Ben confirmed/clarified this as I agree it's a bit odd.

Why do you have the think line separating the name of the program from it a value. Unless you look closely at the first row, you can easily think the point value is above the program name.

Good article but it does vary A LOT. For example, I was able to book Air France business class one way for 70,000 Delta miles and Japan Airlines business class one way for 80,000 Alaska miles. The Air France flight is around $5,300 while the Japan Airlines flight is around $6,800 in USD according to Google Flights so I was able to get the Air France one for over 7.5 cents per Delta mile and...

Good article but it does vary A LOT. For example, I was able to book Air France business class one way for 70,000 Delta miles and Japan Airlines business class one way for 80,000 Alaska miles. The Air France flight is around $5,300 while the Japan Airlines flight is around $6,800 in USD according to Google Flights so I was able to get the Air France one for over 7.5 cents per Delta mile and the Japan Airlines one for over 8.5 cents per mile.

You just have to shop around a little and hope for some availability especially in business class to get the best bang for your buck.

I know you tried to be conservative in your valuation, and I'll say you largely succeeded. However, there're still a few (e.g. Citi ThankYou, SQ, TK) whose values are overestimated, IMO.

As you say, to get value out of points programs takes time. We all have 24 hours in a day. At the end of the day, the goal is to get the most value out of your life, not out of your points.

A better strategy for most people is not to study points. Instead, study for the LSAT. Get into a top law school, get into a top firm, and make partner. When your...

As you say, to get value out of points programs takes time. We all have 24 hours in a day. At the end of the day, the goal is to get the most value out of your life, not out of your points.

A better strategy for most people is not to study points. Instead, study for the LSAT. Get into a top law school, get into a top firm, and make partner. When your income is in the 7 or 8 figures, you need not concern yourself with making the most of your points. Points become incidental to your life. You start to see people concerned about points as schmucks.

And yet here you are, all the time.

disagree, V10 has a pretty good bit going, always brings me a chuckle

You’re a tiresome douche bag.

Congratulations! You're the classic definition of an American douchebag.

I'll take a funny BigLaw post over a "WHERE IS TIM???" post any day.

@V10

Pathetic. Some life you must have working 70 hrs a week. Sounds like my 45 yr old date who comes to the bar straight from the office on a Friday wearing a suit she obviously has been wearing for over a day. Or the 47 yr old corporate attorney who has travelled all over the world but claims she is 47 , a home owner , and can only find losers to date. Where is her Johnny Depp ?

These valuations seem out of whack with each other:

Delta SkyMiles - 1.1 cents

JetBlue - 1.3 cents

United - 1.1 cents

Yeah I think you're right. If I could trade skypesos for mileageplus miles at an even exchange, I'd take that trade all day long.

Good post, Ben. “People should be encouraged to earn & burn” really is the key take away message here and something you don’t want to learn the hard way.

I still chuckle when I hear “the average Joe” tell someone they have 300,000 SkyMiles as if it’s a point of pride.

If I had to do any bit-picking here, I suppose I’d argue Virgin points should be considered higher… alas, there are certainly many mediocre ways to redeem those miles too…

I think IHG should be valued higher than Hilton points.

You want to know the value of United miles, for example? Just look at the award chart and see where you could go... no, wait United doesn't publish a price list any more, the price is whatever United decides on the day. So that's the value of your miles, whatever the supplier tells you on the day.

What, you're still collecting them?

I agree that IHG points are more valuable than Hilton for low to medium range hotels. For aspirational properties I would say Hilton may still be more valuable.