There are credit cards out there at all kinds of price points — there are some fantastic no annual fee cards, there are some rewarding mid-range cards (with annual fees of under $100), and then there are premium cards (with annual fees of $300+).

For many consumers, premium credit cards can be the hardest to justify, since many people just don’t think it’s worth spending hundreds of dollars per year on a single credit card. That’s fair enough, but I also think it’s worth discussing how we’ve seen a fundamental shift in the value of premium credit cards.

Going back a decade, premium credit cards had a pretty niche value proposition, and many people got these cards primarily for the prestige. However, the premium credit card space has become much more competitive in recent years, and this has caused the value proposition on these cards to improve considerably.

While premium credit cards aren’t for everyone, nowadays I’d say they’re pretty easy to justify for many people who like to travel. Yes, you’ll pay a high fee upfront, but the perks typically more than justify that. In this post I wanted to look at that in more detail for those who might be skeptics.

In this post:

Why premium credit cards are worth having

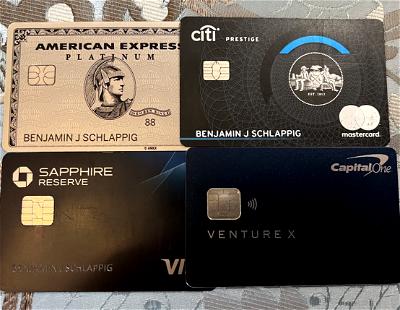

Let’s take a closer look at some of the most popular premium cards on the market. We’ll take a look at the annual fee, and then how I go about justifying the ongoing cost of holding onto these cards. I won’t even discuss the welcome offers, which can get you a ton of value upfront, and are all the more reason to consider these cards.

Capital One Venture X Credit Card

The Capital One Venture X Rewards Credit Card (review) (Rates & Fees) has a $395 annual fee, and it’s also the premium card with the easiest to justify annual fee, in my opinion.

How do I justify the annual fee? The card offers a $300 annual travel credit (good as cash through the Capital One Travel portal) plus 10,000 anniversary bonus miles (I value Capital One miles at 1.7 cents each, so that’s $170 worth of value right there). By my math, you’re getting $470 worth of value on a $395 annual fee card with those two benefits alone.

But that’s only the tip of the iceberg:

- The card offers 2x miles per dollar spent, making it one of the most rewarding cards for everyday spending

- The card offers a Priority Pass membership and access to the Capital One Lounges

- The card offers perks like primary rental car coverage and cell phone protection

- The card offers incredible authorized user perks, as you can add up to four authorized users to the card at no cost, and they each get the same lounge access perks

As you can see, it’s really easy to make the math on the Capital One Venture X work, even if you’re not someone who would usually consider a premium credit card.

If you’re looking for a business card instead, the Capital One Venture X Business (review) (Rates & Fees) has a lot of similarities, and can absolutely be worth it.

Chase Sapphire Reserve Card

The Chase Sapphire Reserve® Card (review) has a $550 annual fee, and is probably the most popular premium card with younger generations.

On the most basic level, the card offers a $300 annual travel credit, which is automatically applied to any travel purchase. That should be good as cash to anyone who has this card, meaning this card should really only be costing you $250 per year.

What do you get for that $250 investment?

- The card offers excellent bonus categories for spending, including 3x points on all dining and travel purchases

- The card gives you the ability to redeem all of your Ultimate Rewards points for 1.5 cents each toward travel purchases through the Chase Travel portal (in addition to the ability to transfer them to airline and hotel partners)

- The card offers a Priority Pass membership, giving you access to 1,300+ lounges around the globe

- The card offers excellent travel and rental car coverage, which can come in handy if you travel a lot (especially with how unreliable travel has become nowadays)

Independently I wouldn’t say the Chase Sapphire Reserve is quite as easy to justify as the Capital One Venture X, but the major benefit of this card is all the other cards you can maximize in the Ultimate Rewards ecosystem by having the Sapphire Reserve.

Amex Platinum Card

The Platinum Card® from American Express (review) has a $695 annual fee (Rates & Fees), so it’s the highest annual fee personal card of the bunch. Arguably the card set the standard for premium cards, though nowadays its value proposition can be pretty polarizing.

The card’s annual fee can potentially be more than justified by the incredible number of credits offered, including the following (Enrollment is required for select benefits):

- Up to $300 in statement credits each year on a digital or club membership at Equinox

- Up to $300 in SoulCycle credits

- Up to $240 in annual digital entertainment credits

- Up to $200 in annual hotel credits (minimum two-night stay required for Amex Hotel Collection, and one night stay for Amex Fine Hotels & Resorts)

- Up to $200 in annual airline fee credits

- Up to $200 in annual Uber credits

- Up to $189 in annual CLEAR Plus credits

- Up to $155 in annual Walmart+ credits

- Up to $100 in annual Saks credits

As you can see, that’s potentially $1,800+ worth of annual credits. What’s the catch? These credits aren’t nearly as straightforward as the ones on Capital One and Chase cards. These credits are largely broken down by month, and come with lots of restrictions on what they can be redeemed for.

Some cardmembers will roughly breakeven on the annual fee with how they actually use these credits. Others may come out way ahead. Before you get the Amex Platinum Card, definitely do research on the terms associated with the credits, and how much value you’d get from them.

This is only one aspect of the card, though. The Amex Platinum Card also offers the most comprehensive airport lounge access of any card. You get a Priority Pass membership, access to Delta Sky Clubs (when flying Delta same day), Amex Centurion Lounge access, and much more.

If you’re looking for a business card instead, The Business Platinum Card® from American Express (review) is worth considering, though note that there are some differences between the two versions of the card.

Citi AAdvantage Executive Mastercard

While the above are all bank-branded cards, I thought it would be interesting to look at a premium airline card as well. The Citi® / AAdvantage® Executive World Elite Mastercard® (review) has a $595 annual fee. What do you get for that?

Well, the card offers an American Admirals Club membership for the primary cardmember, making this the best card for Admirals Club access. You’re already coming out ahead there compared to the cost of outright buying a membership.

What makes this card even better is that you can pay a total of $175 to add up to three authorized users to the card, meaning you’re potentially paying under $60 per authorized user. Those authorized users then also get Admirals Club access when traveling on American or a partner same day, and they can even bring guests.

The card offers several other great perks, like up to 20,000 bonus Loyalty Points per year, up to $120 in annual credits with Avis and Budget, up to $120 back annually with Grubhub, and more. If you fly American frequently, then I think this card is absolutely worth it.

Hilton Aspire Card

In addition to a premium airline credit card, let’s also take a look at a premium hotel credit card. The Hilton Honors American Express Aspire Card (review) has a $550 annual fee. While that’s no doubt steep, the card should be very easy to justify for anyone who stays at Hiltons with any frequency.

What are you getting for that annual fee?

- Hilton Honors Diamond status for as long as you have the card, which is Hilton’s top-tier status

- An anniversary free night award annually, which can be redeemed at a property costing up to 150,000 Hilton Honors points

- Up to $400 in annual Hilton resort credits, in the form of a $200 Hilton resort credit every six months

- Up to $200 in annual airline flight credits, in the form of a $50 airline credit every quarter

- Up to $189 in annual CLEAR Plus credits

Personally I think the Hilton Honors Diamond status and anniversary free night award alone justify the annual fee. Then if you add in the Hilton resort credits and airline flight credits, you can potentially come out way ahead with this card.

The information and associated card details on this page for the Hilton Honors American Express Aspire Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Bottom line

There are credit cards at just about all price points. While many people have no issue picking up a no annual fee or sub-$100 annual fee card, premium credit cards with high annual fees are a different story.

I’m not saying everyone should pick up a credit card with a $300+ annual fee, though I do think the cards are easier to justify than most would assume. That’s especially true with a card like the Capital One Venture X, which offers annual credits and perks that more than justify the annual fee.

Cards like the Chase Sapphire Reserve aren’t slam dunks in quite the same way, but make a lot of sense for those who want to earn travel rewards, value lounge access, and appreciate travel protection when things go wrong.

The Amex Platinum Card has the potential to be the most rewarding of the bunch, despite the high annual fee. However, maximizing it requires a lot more research and effort than with the other cards.

What’s your take on the value proposition of premium credit cards? Which do you find to be worthwhile?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Platinum Card® from American Express (Rates & Fees).

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

This article is clearly based on paid promotion not on personal opinion. You combine some credit cards with some airline and hotel cards but do not list others that provide much more value than their annual fee.

Not all priority passes are the same. The Chase issued one is significantly more beneficial. The problem with the Platinum benefits is 1) they are very specific and 2) they are not face value. It is divided into increments (e.g. monthly or per pride for Uber or two $50 for Saks). It is getting more difficult to justify the Platinum card.

My advice is to read the fine print. I was almost at the point to apply for the Amex Platinum (which comes at USD 1000 per year in my country) and includes a wealth of benefits, including travel insurance (by Allianz, which happens to be my current travel insurer).

But then I read the fine print of the insurance policy … which was unfortunately much more limited than my current Allianz policy …

I personally have almost every high fee card out there. I keep them because I get outsized value out of every one of them. It doesn’t take that much work to maximize your benefits and come out ahead.

The venture card is on my radar, I think the value proposition is solid.

I've been a Chase fan for years, the CSP is my go to card. I never upgraded to the CSR mostly because I wasn't going to pay the AF without any sign up bonus... and the biggest perk outside of a healthy sign up bonus is just an extra point on travel and dining. I do spend a chunk of money...

The venture card is on my radar, I think the value proposition is solid.

I've been a Chase fan for years, the CSP is my go to card. I never upgraded to the CSR mostly because I wasn't going to pay the AF without any sign up bonus... and the biggest perk outside of a healthy sign up bonus is just an extra point on travel and dining. I do spend a chunk of money in those categories, but I think for me it's one card or the other. Although if I grab the Venture X, I'll have to decide what the $95 AF on the CSP is getting me, because it's not extra points above the X. Right now though, I have too many points to just close the card and lose access to the travel partners.

If I stayed in Hiltons more, I'd grab the Aspire I think. But for my travel patterns (basically one blow out trip per year) I don't really want to be locked in to one particular brand.

But those AmEx perks? I've seen enough of those types of "perks" where they just become a turn off. I mean, the marketing shtick is exactly what you just did -- post a bunch of totals with "up tos" and proclaim "look how rewarding this card is!" And then when you dig in, it's a random mishmash of stuff that makes no sense collectively and probably has limited as to how they can be used. E.g., "up to $200 in uber credits" certainly means, "no you can't take a $200 uber ride and use the credit all at once."

I have zero desire to dig through all the fine print (thank you for doing so) to figure out how they all work.

Honorable mention US Bank altitude reserve, $400 annual fee, $325 travel credit that is very easy to use. Perks beyond that are limited but 3x for mobile wallet payments is very lucrative.

Not that I’m in the business of selling cards, but the Alaska airlines lounge entry in addition to AA clubs is one big selling point for me on the AA exec card.

Also, the Citigold discount lives on. My AF hit and the card cost me $450 this year.

Andrew, it is way better than that. Check out the Partner Club locations on the following link. The Citi AA Executive Card gets you into many overseas lounges (some of which are Priority Pass).

https://www.aa.com/i18n/travel-info/clubs/admirals-club-locations.jsp

Pretty much all of the Amex family of cards have ceased to be keepers.

You really have to put too much effort to claw back the AF. And in most cases you just cannot take advantage of all credits. Even road warriors as most travel is now booked on company card from company travel portal.

I think the Hilton Aspire card had some value but even that was watered down.

If you have...

Pretty much all of the Amex family of cards have ceased to be keepers.

You really have to put too much effort to claw back the AF. And in most cases you just cannot take advantage of all credits. Even road warriors as most travel is now booked on company card from company travel portal.

I think the Hilton Aspire card had some value but even that was watered down.

If you have Amex family card right now, you are looking long and hard at the benefits and however anecdotal, i am hearing a few cases amongst my friends of people who are walking away from their cards.

I walked away from the Plat for the reasons you mentioned. It’s either super hard to realize the value (airline credit) or requires you to make poor financial decisions (Uber anything is horrible these days, $300/mo gym fees is also sus)

I do think Amex green / $150 for Clear is worthwhile so I am keeping that.

The Green and the Gold are the only ones I can make sense of. I know you can work the credits on the Platinum, but 5x flights and not much of anything else is pretty hard to justify for some lounge access.

At least the Hilton credits are related to Hilton or to travel. If you use the card as intended, you should be picking up the credits. But with the Platinum, the credits seem completely unrelated to the designed use of the card.

Everyone needs to evaluate your spending patterns per card. I already spend $800+ on these categories. Add in lounge access, national car status, $200 hotel credit, and their FHR program. Easily justify the cost without 'working' it. Totally agree if that's not your case, definitely don't get the card.

Clawing back the AF hasn't been too hard - but it's always pretty close to break even. I don't consider lounge access part of the value anymore -- Centurion Lounges are just not a pleasant place to be, and Chase offers a better Priority Pass experience. Also their Sapphire Lounge in Logan is great (for the moment). Too bad Chase customer service sucks so badly.