Link: Apply now for the Capital One Venture X Business

The Capital One Venture X Business is Capital One’s popular premium travel business card. In this post, I want to take a look at everything you need to know about applying for and getting approved for the card.

Let’s start by talking about the basics of why you should consider the card, then we’ll cover the application restrictions, and then I’ll share my experience applying for the card. I’d appreciate if others who apply could also share their data points.

In this post:

Why you should apply for the Venture X Business

There are many reasons to apply for the Capital One Venture X Business. The card has a $395 annual fee, but that’s pretty easy to justify when you consider all of the perks of the card:

- The Venture X Business offers unlimited 2x miles on every purchase, all with no foreign transaction fees and no preset spending limit; you can even book through Capital One Travel to earn 5x miles on flights and 10x miles on hotels and rental cars

- The Venture X Business offers a $300 Capital One Travel credit plus 10,000 anniversary bonus miles every year, which in my opinion justifies the annual fee on an ongoing basis

- The Venture X Business offers a Priority Pass membership, Capital One Lounge access, and Capital One Landing access, for the primary cardmember

On top of that, the Venture X Business has a welcome bonus where you can earn 150,000 bonus miles after spending $30,000 within the first three months.

Premium business cards don’t get much more well rounded than this in terms of the value proposition. Read my full review of the Capital One Venture X Business.

Venture X Business eligibility requirements

For many small business owners, the Capital One Venture X Business may be the first Capital One business card that they apply for. There are some rumors about Capital One application restrictions that aren’t true, so I want to cover all of those details in this section.

Who is eligible for the Venture X Business bonus?

When you go to the application page for the Capital One Venture X Business, you’ll see the following restriction listed regarding earning the welcome bonus:

“The bonus may not be available for existing or previous Spark cardholders.”

Admittedly that’s pretty broad. A Capital One spokesperson has clarified to me that this refers specifically to having the Capital One Spark Cash Plus (review). So if you currently have the Capital One Spark Cash Plus, you won’t be eligible for the bonus on the Venture X Business. However, anecdotally (as I’ll share below), past Capital One Spark Cash Plus cardmembers are eligible for the Venture X Business, including the bonus.

You absolutely are eligible for the Capital One Venture X Business if you have any other Capital One business card, like the Capital One Spark Miles for Business (review).

Do you earn the bonus if you get approved for the Venture X Business?

If you get approved for the Capital One Venture X Business, does that mean you’re also eligible for the bonus? In my experience, the answer is yes — generally Capital One will decline you for a card if you’re not eligible for the bonus.

For example, when you submit the application, you’ll see the following warning:

“If you don’t qualify, we may consider you for other cards. We’ll only check your credit once, and it won’t affect your Venture X Business application. You’ll be able to accept or decline our offer.”

Part of that offer is the bonus, so in my experience if you get approved for the card, that also means you’re eligible for the bonus.

Can you get the Venture X Business if you have the Venture X?

If you have the Capital One Venture X Rewards Credit Card (review), which is the personal version of the card, you absolutely are eligible for the Capital One Venture X Business as well, including the bonus. There could be a lot of value to having both of these cards — see my comparison of the two products here.

Does the Venture X Business report to your personal credit?

Having the Capital One Venture X Business should not report to your personal credit report, as long as your account remains in good standing. When you apply for the card, there will be of course be an inquiry on your personal credit, but it won’t impact your score beyond that. In other words, applying for this card wouldn’t count as a further card toward Chase’s 5/24 limit.

What are Capital One’s application restrictions?

All card issuers have their own policies when it comes to approving people for cards. Along those lines, Capital One has among the fewest consistent restrictions, in my experience. I’ve found that it’s fine to have multiple Capital One business cards, there’s no strict limit as to how often you can be approved for cards, etc.

What credit score do you need to be approved for the Venture X Business?

There’s not a consistent rule as to what credit score you need to be approved for the Capital One Venture X Business, though I’d recommend having a credit score in the “good” to “excellent” category if you’re going to apply for this card.

Personally, I probably wouldn’t apply if my credit score were under 700, and ideally, I’d hope to have a credit score of 740 or higher. That being said, some people with scores lower than that report being approved, and some people with scores higher than that report being rejected.

There are lots of factors that go into approval — your income, your credit history, how much credit Capital One has already extended you, etc. Furthermore, since this is a business card, approval is also largely about your business details.

Does Capital One pull from all three credit bureaus?

Capital One is one of the only card issuers that pulls credit from all three credit bureaus when you apply for a card. That’s still the case, though personally I don’t view this as a big deal at all.

Your score will typically be dinged a few points temporarily when you apply for a card, and it really shouldn’t matter with how many bureaus your credit is pulled. At least that’s my take — this restriction has never really bothered me, though I know others feel differently.

Keep in mind that if you choose to freeze your credit report, you’ll need to unfreeze your credit with all three bureaus prior to applying for this card.

How long does it take to get approved for the Venture X Business?

You can potentially be approved for the Capital One Venture X Business nearly instantly, with an approval within a minute. However, in some cases you may get a pending decision, in which case it could take up to two weeks to get a decision on your card. Don’t worry, you could still get approved even if you don’t get an instant decision.

Why do people sometimes get denied for the Venture X Business?

There are the predictable reasons some people may be denied for new cards, like a low credit score, lack of income, etc. However, it’s worth noting that people do sometimes report denials with Capital One that aren’t necessarily so obvious.

We’re talking people with high incomes, high credit scores, not that many cards, etc. I don’t really have any insight as to why those denials happen, other than to acknowledge that they do happen. That ties into the next point, which is that denials shouldn’t be a huge deal, if they do happen.

What happens if you get denied for the Venture X Business?

If you’re not sure if you’ll be approved for the Capital One Venture X Business, should you be worried about getting denied? Generally speaking, getting denied for a card isn’t a big deal at all. You can always apply again in the future, and it’s not like a denial is reported negatively on your credit report. Rather the inquiry as such will show on your credit report (and could temporarily lower your credit score a few points), but that’s about it.

Let me take it a step further — I applied for the card back when it launched and was denied. I then applied less than two months later, and was approved.

Venture X Business application & approval experience

Ford and I have now both picked up the Capital One Venture X Business, for our respective businesses. We had very different experiences, but that’s because I was conducting a bit of an experiment with my first application. I’d say the results are just about best case scenario. Let’s first take a look at the basic details of the application, and then I’ll share how this played out for both of us.

Venture X Business application process

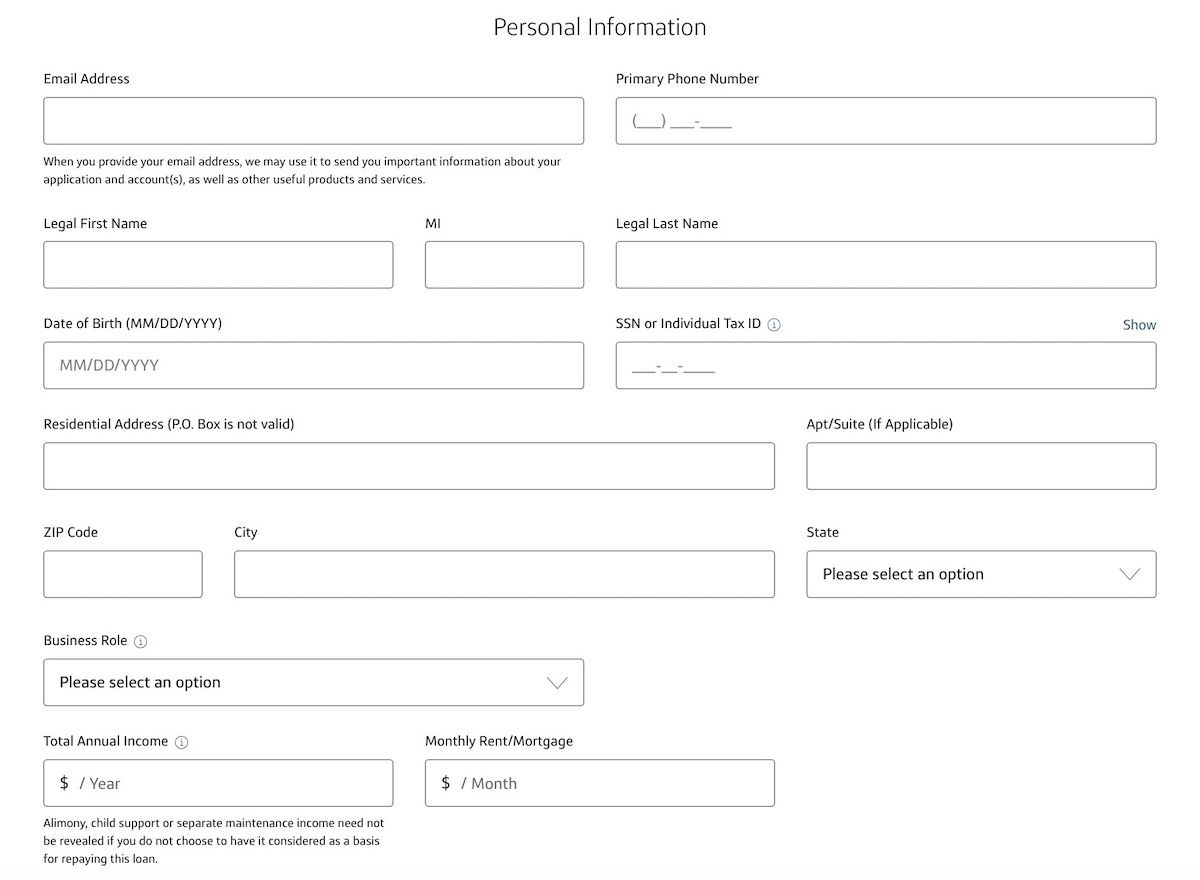

The application process for the Capital One Venture X Business is a single page, and is pretty straightforward. It’s made up of three sections. The first section asks for your personal information, including name, contact details, SSN, income, rent or mortgage payment, etc.

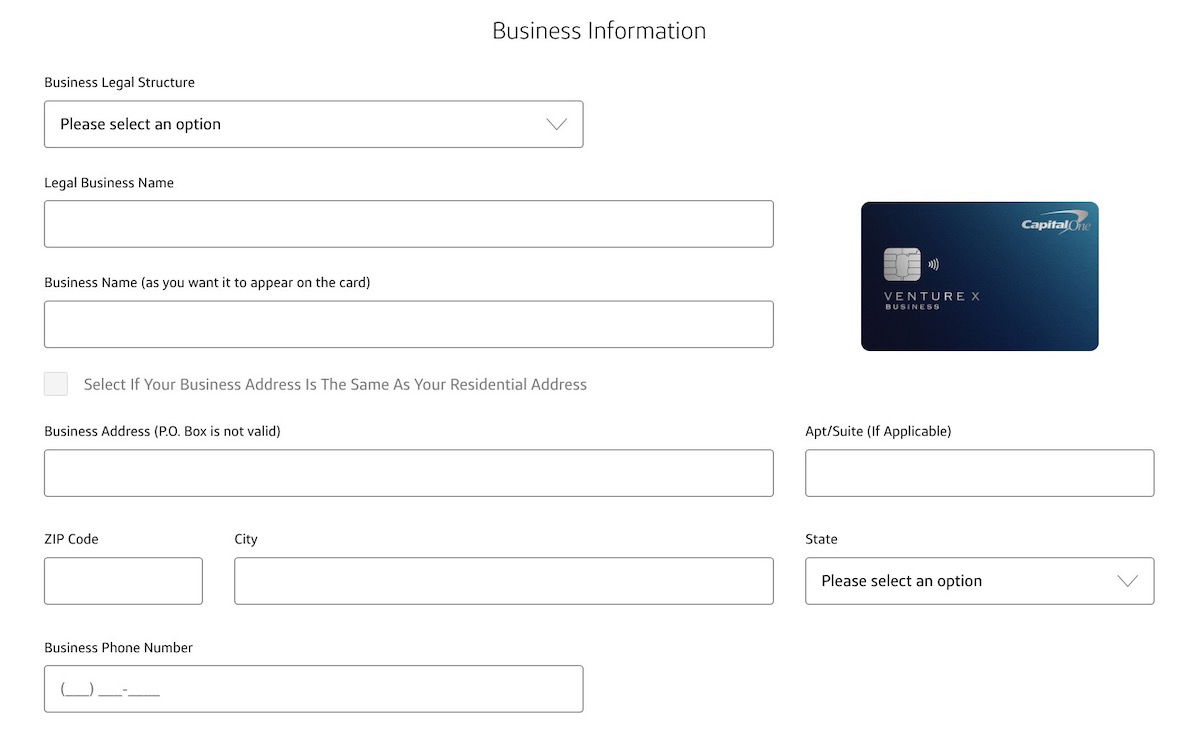

The next section asks for the basic details of your business, including the name, address, etc.

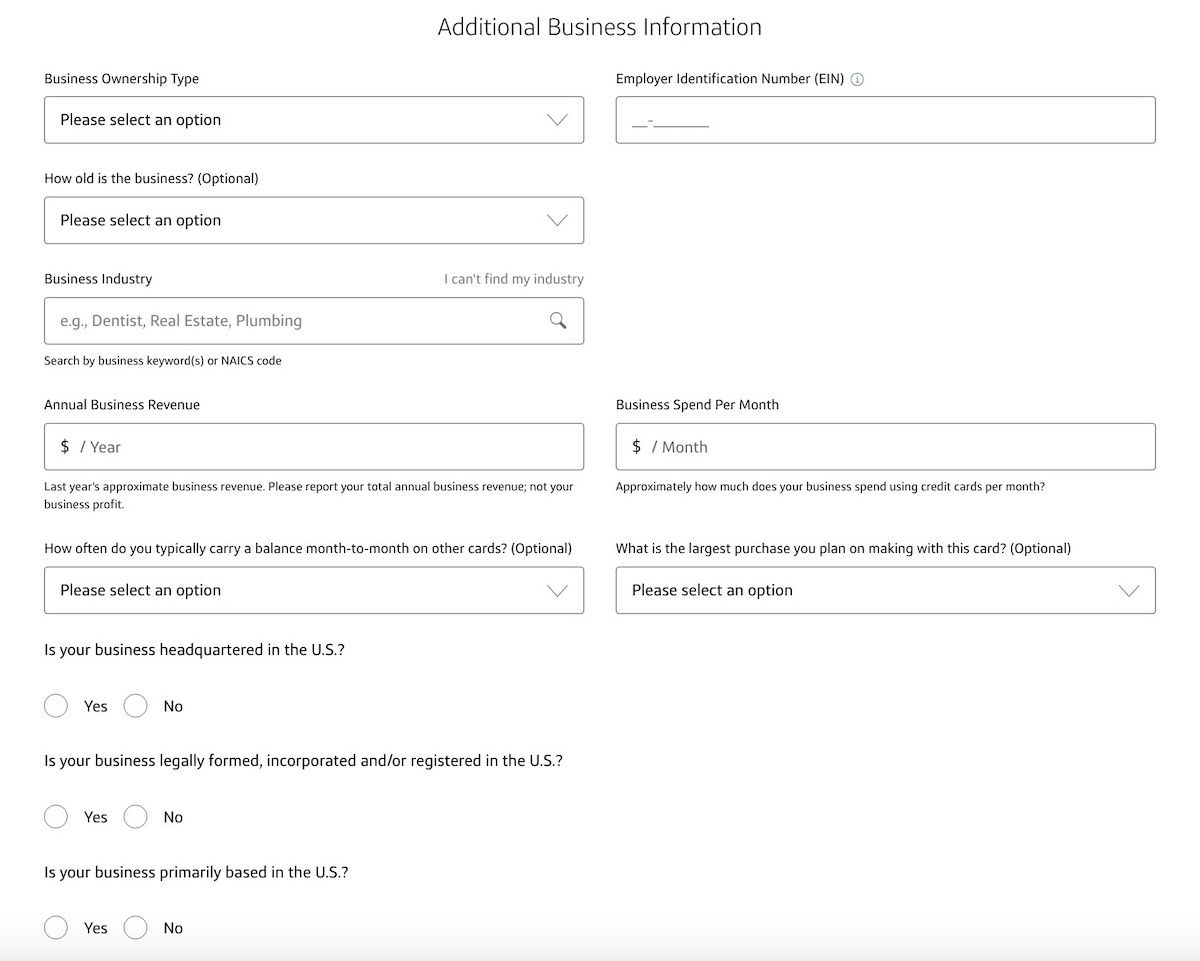

Then the third section asks for additional business information, like the business ownership structure, age of business, industry, annual business revenue, EIN, etc.

At that point you’ll be asked to agree to some disclosures and to review your application, and then you can submit your application. Hopefully you get an instant approval!

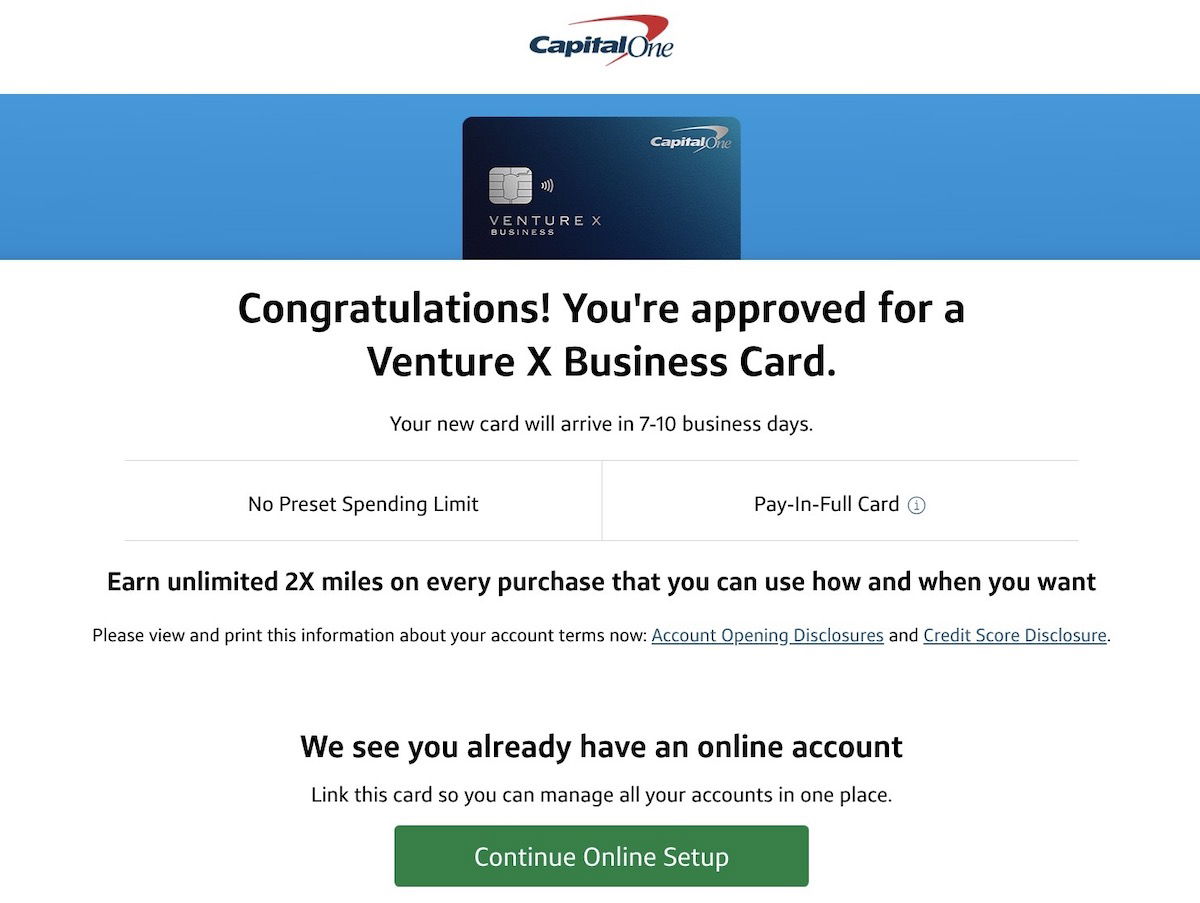

Venture X Business application approval

Back in September 2023, Ford applied for the Capital One Venture X Business for his small business. His application was instantly approved, which is great. While not everyone will have this experience, most reports I’ve seen suggest that instant approvals are common on Capital One cards without preset spending limits.

That was the straightforward application…

Venture X Business application denial & later approval

Back in September 2023, I had the Capital One Spark Cash Plus, so I wasn’t eligible for the Capital One Venture X Business bonus. However, I figured I should take one for the team, to see what would happen if I applied. Would I get rejected? Would I get approved but just not earn the bonus?

Well, I submitted my application, and once it was processed, I was informed that I had been denied for the card, as expected. Rather than being outright denied, I was actually approved for an alternative card — the no annual fee Spark Miles Select. I was even offered a bonus for that card.

The information and associated card details on this page for the Spark Miles Select been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

I could then either accept that offer, or reject the offer and exit the application.

I ultimately decided to reject the offer. Why? Well, because I still really wanted to get the Capital One Venture X Business at some point in the future, since I wanted to make it my go-to card for business spending. That was my focus.

Then in November 2023 I finally got around to canceling the Capital One Spark Cash Plus, after transferring all my rewards to other Capital One cards, since that’s a requirement in order to get approved for the Venture X Business.

I wasn’t sure how long you have to wait until you’re eligible for the Capital One Venture X Business. I figured I’d take a chance, so I applied six days later. I was pleasantly surprised to find that I was instantly approved, less than two months after my rejection.

So as you can tell, it’s fine if you’ve had the Capital One Spark Cash Plus in the past, you can just can’t be a current cardmember. At least in my experience, I was considered a previous cardmember less than a week after no longer having the Spark Cash Plus. I’m thrilled to finally have this card, and the personal and business version of the Venture X will now get the bulk of my card spending.

Bottom line

The Capital One Venture X Business is a lucrative business card, in terms of the welcome bonus, the return on spending, and the perks. The card’s benefits should more than offset the annual fee, so if you have an eligible small business, I’d highly recommend applying.

Hopefully the above covers any of the things you may have wondered about the application process. The good news is that there are fairly few restrictions surrounding eligibility for the Venture X Business, so many people should be able to get approved.

More data points would be useful, so if you applied for the Venture X Business, what was your experience like? Did you get an instant approval, denial, or…?

If I opened the Venture in December of 2025, do I need to wait 6 months to open the Venture X Biz? I have a lot of medical bills I am trying to pay.

@ exot2015 -- Nope, you don't need to wait six months, and should be good to go, if otherwise eligible.

I applied for this card, but using my non-US registered company as the business. Capital One asked for a bunch of additional documents like foreign tax registration etc.. for the business, but eventually approved the card after about a week based on a combination of my personal US credit score (800 range at the time) and the foreign business registration documents.