Link: Apply now for the Capital One Venture X Rewards Credit Card

The Capital One Venture X Rewards Credit Card (review) is Capital One’s premium credit card. I applied for the card on launch day back in late 2021, and was instantly approved.

I wanted to share my experience, and also share some trends I’m noticing based on all the application data points provided by OMAAT readers since the card opened for applications (and please continue to share your application approvals and denials in the comments section, so we can get as many data points as possible).

In this post I wanted to go over everything you need to know about getting approved for the Capital One Venture X.

In this post:

Why you should apply for the Capital One Venture X

The Capital One Venture X is worth applying for, plain and simple. The card has a $395 annual fee , but has so much to offer:

- The Venture X has a solid welcome bonus of 75,000 bonus miles after spending $4,000 within the first three months; I consider this to be one of the best credit card welcome bonuses out there, and value this at $1,275

- In the long run, the Venture X offers two perks that should more than offset the annual fee — a $300 annual travel credit, plus 10,000 bonus anniversary miles (redeemable for a minimum of $100 worth of travel)

- The Venture X offers incredible lounge access perks, including a Priority Pass membership, access to Plaza Premium Lounges, and access to Capital One Lounges (the DFW lounge is amazing)

- You can add up to four authorized users to the Venture X at no extra cost, and they receive many of the same great perks, including lounge access

- The Venture X also offers Hertz President’s Circle elite status, primary rental car coverage, cell phone protection, a TSA PreCheck or Global Entry fee credit, and more

- The card offers 2x Capital One miles per dollar spent, which can be converted into 2x airline miles with a variety of programs; that makes this the best card for everyday spending, in my opinion

The math more than checks out here — this really is an unbelievably rewarding card, and competes favorably with the best premium cards out there.

Capital One Venture X eligibility requirements

I know for some people in the travel space, the Capital One Venture X may be the first Capital One product that they’re applying for. There are a lot of rumors about Capital One’s application restrictions, so let’s go over the basic eligibility requirements you need to be aware of. I’d say overall it’s surprisingly good news, and that this card is anecdotally easier to get approved for than some other Capital One cards.

What are Capital One’s approval restrictions?

Capital One doesn’t officially publish any restrictions around being approved for new cards.

Many suggest that you can only be approved for one Capital One card every six months (it doesn’t matter whether it’s personal or business). However, there are several data points of people being instantly approved despite having picked up another Capital One card more recently than that. Heck, I was approved for the Capital One Spark Cash Plus (review) (Rates & Fees) within several weeks of being approved for the Venture X.

There has also in the past been a rumor that you typically can’t have more than two Capital One personal credit cards at a time (excluding co-brand cards). There are many data points suggesting that this is no longer a policy (with several people reporting getting more than two cards), so personally, I wouldn’t put much weight on that.

I’d say that’s all good news — it doesn’t seem like there are any hard-and-fast rules around Capital One card approvals in this case.

What credit score do you need to be approved for the Venture X?

There’s not a consistent rule as to what credit score you need to be approved for the Capital One Venture X, though I’d recommend having a credit score in the “good” to “excellent” category if you’re going to apply for this card.

Personally, I probably wouldn’t apply if my credit score were under 700, and ideally, I’d hope to have a credit score of 740 or higher. That being said, some people with scores lower than that report being approved, and some people with scores higher than that report being rejected. There are lots of factors that go into approval — your income, your credit history, how much credit Capital One has already extended you, etc.

Can you get the Venture X if you have the Venture?

Yep, you sure can. You are eligible for the Capital One Venture X, including the welcome bonus, even if you have another version of the Capital One Venture. Just apply for the card outright, and hopefully you’ll be approved. While it may also be possible to product change, note that you wouldn’t be eligible for the new cardmember bonus then.

Does Capital One deny people with excellent credit?

There’s a rumor out there that Capital One denies many people with excellent credit, because Capital One allegedly wants customers who carry a balance and finance charges (after all, that’s one way that credit card issuers make money).

I can’t personally speak to that. I’ve definitely seen some data points about people with excellent credit being denied for Capital One cards, though both of the Capital One cards I’ve applied for have been instant approvals (and I have excellent credit and don’t carry a balance).

The data points we’ve seen since the card launched suggest that lots of people are receiving an instant approval, including some people who had previously been rejected for the “standard” Venture.

I’ll take it a step further — anecdotally it almost seems that the Venture X might just be easier to be approved for than some other Capital One cards, especially for those with excellent credit. While there are some mysterious reports of denials, overall people who have excellent credit and don’t carry a balance are reporting that they’re being approved.

That’s not to say some people won’t be denied (obviously that will happen, and there are reports of that), but it does seem people are being approved at a higher rate than we were expecting. That’s great news.

Does Capital One still pull from all three credit bureaus?

Capital One is one of the only card issuers that pulls credit from all three credit bureaus when you apply for a card. That’s still the case, though personally I don’t view this as a big deal at all.

Your score will typically be dinged a few points temporarily when you apply for a card, and it really shouldn’t matter with how many bureaus your credit is pulled. At least that’s my take — this restriction has never really bothered me, though I know others feel differently.

Can you apply for the Venture X if you’ve frozen your credit?

Some people choose to freeze their credit reports as a way of preventing identity theft (it’s not personally something I do, for what it’s worth). You have to unfreeze your credit in order to apply for a card, so I’ve had some people ask what happens if they unfreeze their credit with just one or two of the three bureaus.

In general, I’d recommend unfreezing your credit with all three bureaus if you plan on applying for the Venture X. Most people who try to apply with frozen credit with one or more bureaus report denials, so that’s not a chance I’d take.

How long does it take to get approved for the Venture X?

It really depends. Some people report getting instant approvals on the Venture X, while others may have their application status go to “pending.” Don’t worry if you’re not instantly approved, sometimes applications require manual review, and that can take several days.

What happens if you get denied for the Venture X?

If you’re not sure if you’ll be approved for the Venture X, should you be worried about getting denied? Generally speaking, getting denied for a credit card isn’t a big deal at all. You can always apply again in the future, and it’s not like a denial is reported negatively on your credit report. Rather the inquiry as such will show on your credit report (and could temporarily lower your credit score a few points), but that’s about it.

Capital One Venture X application guide

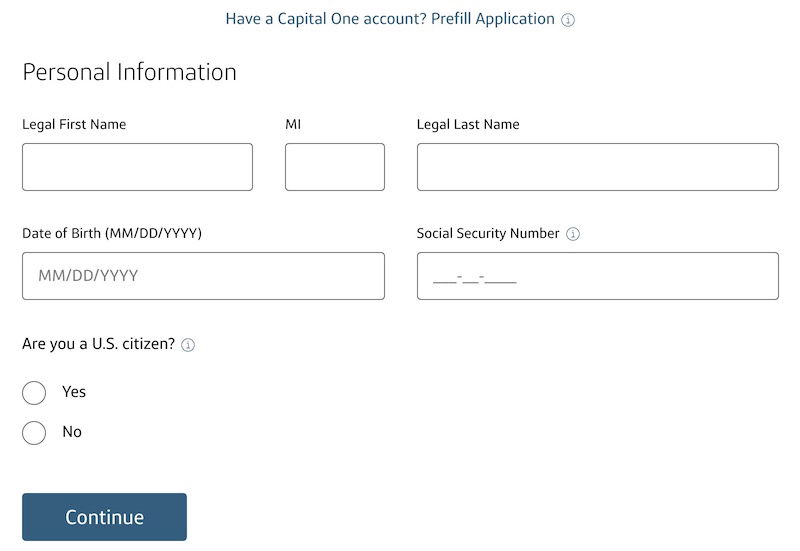

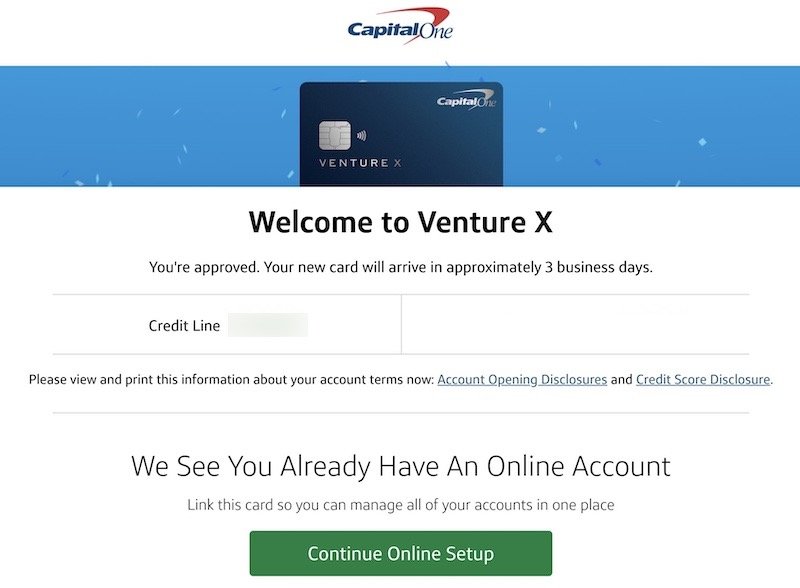

I applied for the Capital One Venture X when it launched, and wanted to share my experience with the application process. The application took all of two minutes to fill out. The first page asked for my name, date of birth, and social security number.

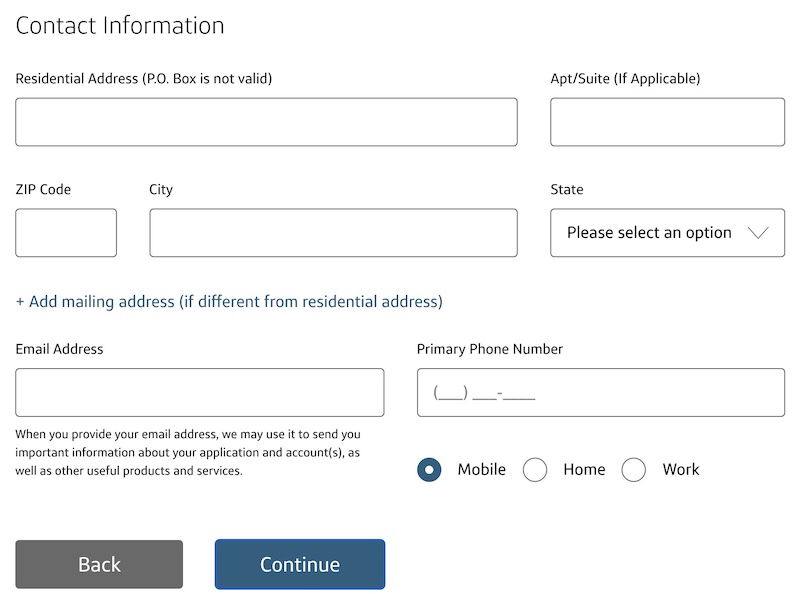

The next page asked for my mailing address details, plus my email address and phone number.

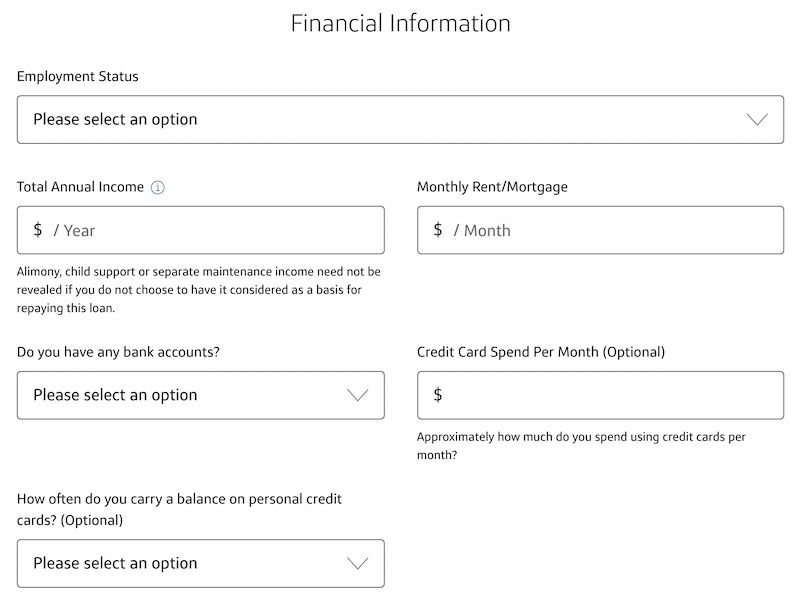

The next page asked for financial information, including employment status, income, my monthly rent or mortgage, basic information about what kind of accounts I have, how much I spend on credit cards, and if I typically carry a balance (those last two are optional, and I left them blank).

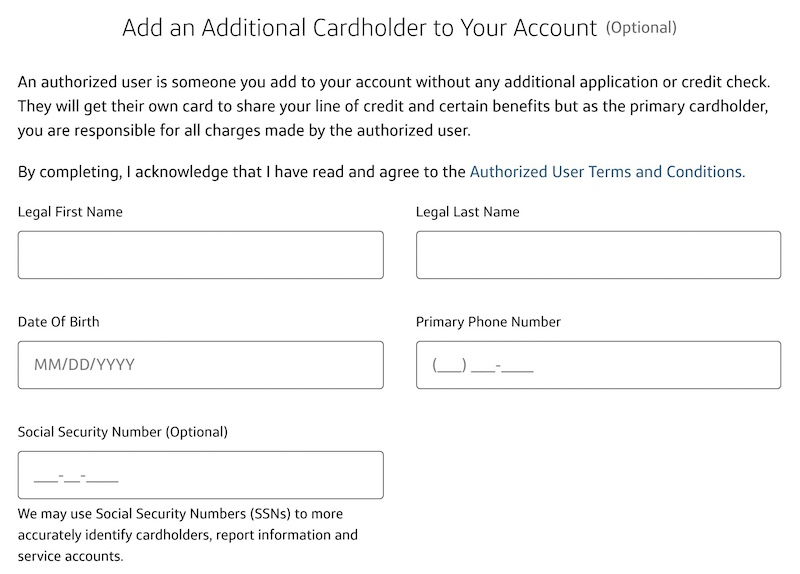

I was then asked if I wanted to add additional cardmembers in the event that I’m approved.

At that point I was asked to confirm that all the information I provided was accurate, and then my application was submitted — I was instantly approved, with a huge credit line no less. Ford had the same experience, and also got an instant approval. Woot!

Bottom line

The Capital One Venture X is a phenomenal card, both in terms of the welcome bonus, as well as in terms of the ongoing perks.

The card offers annual benefits that more than justify the annual fee (a $300 travel credit plus 10K bonus miles), and on top of that the card offers awesome lounge access perks, rental car status, a great return on everyday spending, unbeatable authorized user perks, and more.

Hopefully the above covers any of the things you may have wondered about the application process. The good news is that Capital One has very few consistent rules around credit card applications, and anecdotally people seem to have luck getting approved for this card.

More data points would be useful, so if you applied for the Venture X, what was your experience like? Instant approval, denial, or what? The more info OMAAT readers can share, the better!

Upon enrollment, accessible through the Capital One website or mobile app, eligible cardholders will remain at that status level through the duration of the offer. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g. at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

I went through the pre-approval procedure and was approved for the card. Then I applied for the card, and they turned me down, saying that I had too many cards (I had 8). But, I also had Capital One Quicksilver card, and over $100K in savings with them. They still turned me down. I closed my savings account with them and now I only have the Quicksilver card. I remember that during the application process,...

I went through the pre-approval procedure and was approved for the card. Then I applied for the card, and they turned me down, saying that I had too many cards (I had 8). But, I also had Capital One Quicksilver card, and over $100K in savings with them. They still turned me down. I closed my savings account with them and now I only have the Quicksilver card. I remember that during the application process, (the real one, not the pre-approval thing), they asked me several questions... one of them being "are you going to do a balance transfer". Maybe if I had answered yes to that one, they would have approved me. My advice is to be careful with those questions

I have a credit score of 810 but I did open two non-Capital One credit cards within the last six months (BoA custom cash, mainly for the free museum access as that's a hobby of mine, along with a Citi Double Cash for everyday spending). I was rejected for the Venture X but instantly approved for the Sapphire Reserve. I am a longtime holder of both the Savor and the Freedom Flex. I suspect that...

I have a credit score of 810 but I did open two non-Capital One credit cards within the last six months (BoA custom cash, mainly for the free museum access as that's a hobby of mine, along with a Citi Double Cash for everyday spending). I was rejected for the Venture X but instantly approved for the Sapphire Reserve. I am a longtime holder of both the Savor and the Freedom Flex. I suspect that Capital One places more emphasis on number of recent new cards compared to Chase.

Hey All,

Are more people getting Approved when they answer the Optional questions...or Denied? Just curious.

I was denied with 830 score, 30+ years of history and 0% utilization of credit. Explanation was too many cards open=ed last two years. They offered no fee card. Not sure why

Only have 2 cards total, CSP and Ink Cash that I opened about 45 days ago. Credit score 728-749 (depending on Experian vs. TransUnion), no missed payments ever and carry no balance, income around 145k, instant approval just a moment ago.

I have a credit score over 800. I’ve never missed a payment anywhere. My other credit cards have very low interest rates. I was just approved for the venture X at their highest rate possible of 28.24% with a $30,000 limit. Why would they give me the highest rate possible?

I just applied for the venture x. I was instantly approved with a $20,000 limit.

I think there’s a good amount of BAD dp’s on this thread. There’s no way one can have an 800+ score with just 2 or 3 credit cards, Credit Karma supplies a scoring model that NO financial institution uses as part of their decision for extending credit (maybe Fingerhut) and finally, if you’re going on an app spree, of course that makes a difference. Ask yourself how it looks applying for an Amex Gold charge,...

I think there’s a good amount of BAD dp’s on this thread. There’s no way one can have an 800+ score with just 2 or 3 credit cards, Credit Karma supplies a scoring model that NO financial institution uses as part of their decision for extending credit (maybe Fingerhut) and finally, if you’re going on an app spree, of course that makes a difference. Ask yourself how it looks applying for an Amex Gold charge, Chase Saphire Reserve and the venture X all in the same time frame racking up $1,000+ in annual fees immediately? Does that sound like the actions of a responsible borrower or the recipe for Bust-Out Fraud?

I was rejected! I have 1 other Capitol One Card and 2 Bank of America cards. My credit rating is over 800 and I indicated I “Never” carry a balance. Was that a bad idea?

I applied online at the end of October. Since August I have gotten Sapphire Preferred, AMEX Gold, and Citi AAdvantage Platinum (have a few older ones). Credit dropped from 823 to 813 in the process (checks, maybe utilization). I have not run a CC balance for a long time, though I answered "sometimes" to the question about it. I was approved instantly with $30K limit.

I have applied twice, denied twice. credit score is 820+. instead, they offer me some low level products incl. secured credit cards as if I had a score of 500.

Denied - Reason given too many open lines of credit (14), closed (1). Their system said that my credit score was 790, while at credit Karma it's 830. I never carry a balance and had no prior relationship with Capital One. Income $75k/yr. Question: Before applying again in the future, do you think the Capital One Pre-Approval tool would be a useful gauge, so I wouldn't get dinged again with another denial?

I had nearly the same experience and outcome with nearly identical metrics just this week. I already hold an Amex Platinum and CSP, 0 missed/late payments ever on all accounts, and have a low utilization ratio. I did the pre approval tool, and they showed only two secured cards that required me to front deposits, which I thought was a mistake. I assume it’s too close to my opening two cards in the last 6...

I had nearly the same experience and outcome with nearly identical metrics just this week. I already hold an Amex Platinum and CSP, 0 missed/late payments ever on all accounts, and have a low utilization ratio. I did the pre approval tool, and they showed only two secured cards that required me to front deposits, which I thought was a mistake. I assume it’s too close to my opening two cards in the last 6 months (Plat in Feb, Citi AA card in June). I’ll call recon line this week and update my findings.

Same here - the Capital One pre-approval tool is a joke. It always shows me only secured cards, never any of the Venture cards. And then later they'll send me an email telling me I should check the pre-approval tool again, because "your pre-approved credit card options may have changed" - but they never do change, the results are always just the secured cards. I decided Capital One is a waste of time.

Here are data points that no one mentions: the number of CLOSED credit card accounts on one's credit report and the average time they were open when they were CLOSED. Lenders avoid those who are in it just for the sign-up bonus because they lose money on them. If someone has (say) a dozen or so closed credit card accounts that were all closed after being open only 12 or so months, I think Capital...

Here are data points that no one mentions: the number of CLOSED credit card accounts on one's credit report and the average time they were open when they were CLOSED. Lenders avoid those who are in it just for the sign-up bonus because they lose money on them. If someone has (say) a dozen or so closed credit card accounts that were all closed after being open only 12 or so months, I think Capital One declines.

In support of this, imagine a person with a high income, high credit score, etc., being declined for a Venture card but being approved for a different Capital One card that has no sign-up bonus. If the person actually wants the Venture as a keeper, the person will accept the other card and do a product change at the end of the first year. I don't think this is strictly a matter of Capital One avoiding the sign-up bonus. I think this is a matter of offering a way in to those who actually want the Venture as a keeper.

The data points no one mention is because they don't matter.

Lenders don't care about bonus hunters as much as you think. They can always invoke the Amex rule. So many people got approved easily too.

Your theory has too many hoops and red tape, makes Occam's razor too dull.

If the bank doesn't want your business, you shouldn't be stupid enough to put much effort to give them business.

There is a...

The data points no one mention is because they don't matter.

Lenders don't care about bonus hunters as much as you think. They can always invoke the Amex rule. So many people got approved easily too.

Your theory has too many hoops and red tape, makes Occam's razor too dull.

If the bank doesn't want your business, you shouldn't be stupid enough to put much effort to give them business.

There is a reason you don't see prostitutes paying you for a good time, regardless of your credit score or income.

Another Cap1 data point, though it’s for the Spark business version of this card. I recently applied and received an immediate approval. 800+ credit score, only 1 application within the last year, and I never carry a balance. Interestingly, I was honest about my business income and reported nearly nothing, since this is a business I created and then promptly got another job and have let it languish. They also asked about personal income, and...

Another Cap1 data point, though it’s for the Spark business version of this card. I recently applied and received an immediate approval. 800+ credit score, only 1 application within the last year, and I never carry a balance. Interestingly, I was honest about my business income and reported nearly nothing, since this is a business I created and then promptly got another job and have let it languish. They also asked about personal income, and they took my SSN. I unfroze all 3 credit bureaus, but they only queried one. As I recall, the first page of the application was several “I understand I’ll be denied if...” questions, one of them was if I’d opened, I believe 2, Cap One cards in the last 6 months. Overall I thought the process was very straightforward, easy to understand, and just overall easy.

I applied on a whim expecting a denial as I've opened three cards in the past three months and ~8 inquiries in the past 24 months. I was instantly approved with a $30,000 limit. 730 credit score and $130,000 income.

I've had a regular Venture for about four years so not sure if that made a difference.

Not sure what is going on with Cap One's stupid approval algorithm. 820 credit score, $200k income, no negative marks on the credit report. 1/24, application with Chase in January. Denied.

Maybe they're mad about a card that I accidentally opened with them, then closed right away, in 2014.

Was hoping to use the Plaza Premium membership for travel to Canada, grr.

0late payments and balance. denied for 813 credit score

840 credit score, make $350K a year, and haven't opened a single new card in 5+ years. They denied me. Not joking.

Similar outcome, $180k annual income, no new cards in half a decade (3 total), and 820 score with no other obvious red flags. What.

Hello, thank you for this article! I'm wondering if you know whether you can access your credit card number before receiving the physical card.

just a followup on my recent post... i had applied for 3 credit cards in one day one of which was the venture x card. I found out from another credit card lender (citi) that some banks have invoked rules to automatically deny applicants who have had more than one inquiry in 5 days. im thinking this led to my denial but could be for another applicants on this forum. just an FYI.

Did plenty of research before applying. Sorry I missed this site, but great information also. I received the offer in the mail, but waited until after the holidays when I canceled out the majority of my dept. Great credit utilization and only two cards with low limits. I figured I was a long shot, but was approved within seconds of applying. Had a 745 score, which has since risen, and was looking a larger limit...

Did plenty of research before applying. Sorry I missed this site, but great information also. I received the offer in the mail, but waited until after the holidays when I canceled out the majority of my dept. Great credit utilization and only two cards with low limits. I figured I was a long shot, but was approved within seconds of applying. Had a 745 score, which has since risen, and was looking a larger limit card extensively for travel. The mobile app is nice, helps me keep track of my spending and bonus totals. Only thing I'm a little dissapointed in is the travel portal. Not many options on certain flights, even though the carrier itself has numerous options on the same day. It has become my every day card, so spending 1700 a month for the next six months won't be a problem.

denied with a 750 credit score. had already gotten an approval from chase sapphire just before applying for venture X. no late payments etc. this is why i am always hesitant to apply for credit cards i hate rejections

Got shot down despite 830 credit score. But did apply for lots of other cards in last six months and already have two Cap One cards.

Thanks for the data point!!!

I was given a 80k credit line for my wife and I. It might be because lots of spending and longtime customer without missing payment. We were initially approved for 25k. Called and they upped limit which took about 5 minutes.

I’m moving from the chase trifecta fam (reserved, freedom unlimited and freedom) to capital one.

I got approved for the venture x instantly. However I got declined for Savor One. I really want to use the venture x and savor one big eta.

Anyone know how I can get approved for the savor one quicker than 6 months?

Self-employed and got approved instantly. Might be because we have a great payment history on our regular Venture card. The regular one is in my wife's name and the new one is mine so we have more flexibility - we can transfer to either of our frequent flier accounts.

Relatively new to the world of Credit Card Welcome Bonus.

I frozed my credit when Equifax was hacked and my information was compromised. Glad I did because it foiled indentity thieves who tried to applied for credit cards and cell phones under my name in 2019.

I do a temporary unfreeze of all 3 credit reports (takes about 15-20 mins) every time I apply for a card.

Applied and got instant approval on 02/13/2022....

Relatively new to the world of Credit Card Welcome Bonus.

I frozed my credit when Equifax was hacked and my information was compromised. Glad I did because it foiled indentity thieves who tried to applied for credit cards and cell phones under my name in 2019.

I do a temporary unfreeze of all 3 credit reports (takes about 15-20 mins) every time I apply for a card.

Applied and got instant approval on 02/13/2022. Card delivered via FedEx on 02/16/2022.

$30K Credit Limit + 20.99% APR.

Credit Score 820+ to 830+

I never ever carry any balances on any of my cards.

Cards approved in 2021:

(1) Chase Preferred 01/2021

(2) Amex Hilton Surpass 03/2021

(3) Barclays Wyndham 08/2021

(4) Barclays Aviator 12/2021

The only Capital One card that I have is the Walmart Credit Card. So Captial One does approve Venture X application for folls who don't carry a balance.

Ditto AC comment…800+ credit rating, many cards, pay off balance every month. They do not give this card anyone that will not generate interest income for them. Called twice…no teason given.

They will absolutely approve people who don’t carry a balance. I’m one of them: instant approval and I always, automatically pay all balances in full. I do however have a long relationship with Capital One Bank which may help. I believe their goal is to approve people who they predict will use this card daily instead of picking up the bonuses and using other cards most of the time.

Hey Lucky,

I was approved on 1/18/22 and I haven't received my priority pass card that comes with my Venture X. Has anyone else experienced this issue?

I have that comes with my Bonvoy Brilliant and Platinum, but both don't include restaurants.

Did you apply for the Pass at their site? There was only a two week window from receiving your card to do it. It was in the fine print. I applied, and got my physical crd about a week later, but was able to set up my digital pass.

Same result as AC. Declined for having too many cards. Only have less than 10. All paid off in full every month. Credit 800+.

I thought Cap 1 hated me (and I hated them). I had a Cap 1 card from college that was stuck with a $1k CL and a $49 annual fee, but it was one of my oldest accounts. Cap 1 refused to increase the CL, product change, or waive annual fee. So I finally closed it. I would always get mailers for terrible Cap 1 cards.

Because of this lackluster experience, I was against even...

I thought Cap 1 hated me (and I hated them). I had a Cap 1 card from college that was stuck with a $1k CL and a $49 annual fee, but it was one of my oldest accounts. Cap 1 refused to increase the CL, product change, or waive annual fee. So I finally closed it. I would always get mailers for terrible Cap 1 cards.

Because of this lackluster experience, I was against even applying for the Cap 1 Venture X. However, I applied last month and was instantly approved at $30k. 800+ credit score, two new accounts last year, $250k+ income, and a thick credit profile. Nothing negative on credit report at all. Pay in full every month. A good amount of inquiries from two mortgages last year but none in the past 6 months.

I was quite honestly shocked that Cap 1 gave me an instant approval after my many years with their terrible “platinum” card. So glad I finally dumped that thing.

Credit Score 734, annual household income 200k, two open credit cards with Capital one (quicksilver and venture one). Instant approval for 30k limit at 23.99% apr. Some have been saying you can only have up to 2 capital one consumer credit cards. This proves otherwise.

Well good luck actually using it. I got approved, got the card, used it to buy like 800 dollars worth of stuff. Also paid off my user fee within a few days of getting it.

But when I then tried to max purchase some IHG points to save money on some upcoming trips, and I got "RESTRICTED ACCESS." No explanation. No notification. Just something where I had to look at my account go "wait, this...

Well good luck actually using it. I got approved, got the card, used it to buy like 800 dollars worth of stuff. Also paid off my user fee within a few days of getting it.

But when I then tried to max purchase some IHG points to save money on some upcoming trips, and I got "RESTRICTED ACCESS." No explanation. No notification. Just something where I had to look at my account go "wait, this is weird" and call in.

After talking to someone, I had to send in bills with my address and pics of my drivers license and social security card. But fine, they're worried. I proved it. Unlock the card.

NOPE - 7 to 10 BUSINESS days. So that's up to two weeks without a new card. And a bunch of spending I deferred to hit my spend requirement has to be deferred further. Seriously CHASE doesn't have these problems. Or CITI. But Capital One? It's clear they're new to the high spend prestige card world. Because this is some BS.

Using Lucky's link, I applied and received instant approval as well, with the $30k limit. However, I did not see any mention of the $200 vacation credit either. Also, just a heads-up: while the card arrived the next day via Fedex, the activation process can be daunting. Their online sms verification is often full of errors and requires direct phone calls and can lead to being locked out for a while. I finally got it...

Using Lucky's link, I applied and received instant approval as well, with the $30k limit. However, I did not see any mention of the $200 vacation credit either. Also, just a heads-up: while the card arrived the next day via Fedex, the activation process can be daunting. Their online sms verification is often full of errors and requires direct phone calls and can lead to being locked out for a while. I finally got it resolved and the helpful customer service rep admitted that the system was having lots of problems and that my issue was not uncommon. May happen to some and not others, but be prepared. Maybe Lucky opened the floodgates with his post and overloaded the system :)

@ Ray -- Thanks for the support! The $200 vacation rental credit definitely still applies for everyone who has applied up until this point, even if it's not mentioned. Sorry to hear about the complicated activation process!

I just received a follow-up email from Cap One detailing the benefits, and it does include the $200 vacation rental credit. So, Lucky is correct, as usual.

Got a direct offer in the mail - applied and instantly approved with 20k credit limit. The mail offer letter didn't mention the $200 vacation credit. Any ideas if I will be eligible for the $200 vacation credit. Thanks in advance.

@ Chris K -- I believe all versions of the offer currently come with the $200 credit, though I can't guarantee that (since I haven't seen the offer).

I was denied despite good 740+ credit stating i had too many revolving account which is now more than 5 however I do pay all of my balances every month and never carries any interest charges maybe that was the reason. Very frustrating.

Ditto for me too except my score 744. I have 2 CO accounts already (one bus, one pers) that have always been paid in full every month. Makes zero sense.

Thanks, Lucky. I finally pulled the trigger on this offer and was instantly approved, using your affiliate link.

770 Credit Score and was approved for a $20,000 credit line.

@ TravelfitForAKing -- Thanks for the support and congrats on the approval!

No problem. I'm always happy to support OMAAT.

Immediate Capital One Venture X rejection; 819 FICO score; fully pay off all balances each month; less than 1% credit usage - told I had too many revolving credit card accounts. Sorry to OMAAT for not getting the referral

Had been also been rejected from the regular Capital One Venture card approximately 18 months ago. Will assume for the same reasons.

Similar experience. 817 FICO, pay in full every month, 1% utilization rate, and I have had the Venture for 2 years. Denied for Venture X because I have too many revolving accounts. I wonder how they define “too many” and why it matters if you’ve demonstrated that you handle all of them responsibly. Oh well, too many excellent cards out there to worry about this one.

I have an existing Capital One VentureOne card. I also have several Amex and Chase cards.

I do not carry balances over and have to work hard to ensure I even show an end of statement balance on my cards to improve my score.

I was just approved for 30k with VentureX with excellent credit.

Excellent credit, turned down for having too many open lines of revolving credit (too many current credit cards.)

Capital One refuses to share how many is considered too many (and actually hilarious to listen to people at CO explain.)

So anyone with DP on how many CO consider too many please share, as i would be open to closing a few cards sitting in a box that only exist to keep credit score stronger.

I was rejected for this card in November for the same reason (with 12 cards at the time). Since then, I've cancelled one card (nothing else has changed materially). Reapplied today on a whim and was auto-approved. No clue if 11 is the magic number or there's some other factor here.

Hi Ben, I watch lot of your videos and read many articles, great info, super helpful. Thank you for everything you do. I applied via OMAAT link, approved instantly.

@ Hari -- Congrats on the approval, and thanks for the support and kind words, I really appreciate it!

I just opened a Venture card in October right before this came out, so I was worried I wouldn't be approved. I made sure my Venture card balance was paid off, waited past Jan 1, and I just used your link today, and it worked! I'm psyched to be able to get these two cards in such a short time. Hopefully my experience can serve as a bullet point for approval times.

@ KW -- Congrats on the approval, and thanks for the data point and support! :-)

Instant approval with a high credit limit and an additional user card for my spouse. This was late Thursday, and the cards should be here via FedEx on Monday. I’m impressed .

Approved immediately. However i have no cc balances.

Denied. Credit scores ~750, 3 credit cards (incl Chase Sapphire Prefered), low average history but all else positive. Said I Never carry a balance. Income ~300k. Sad times

Denied for the same income imput. Let the other two options blank. Have a bunch of credit cards open and pay balances in full. Denied saying I will get a letter in 7 days explaining the reason. This sucks

I was instantly approved about a week ago, but I had frozen my Experian report just before application. I was approved based on Transunion and Equifax.

Weirdest thing is they only hit me on my Transunion.

I checked the airline partners and literally none fly to where I live. Therefore, hard pass.

Do more research. Hint: partner airlines.

Ask where does one live.

Hint: Antarctica comes to mind.

@ K.M. -- As noted by others, I think you're missing out. A couple of things to keep in mind:

-- At a minimum, you can redeem Venture miles for one cent each towards virtually any travel purchase using the Purchase Eraser feature, so there's still value to be had there

-- Don't just look at Capital One's direct airline partners, but look at the airlines that can be booked using Capital One's...

@ K.M. -- As noted by others, I think you're missing out. A couple of things to keep in mind:

-- At a minimum, you can redeem Venture miles for one cent each towards virtually any travel purchase using the Purchase Eraser feature, so there's still value to be had there

-- Don't just look at Capital One's direct airline partners, but look at the airlines that can be booked using Capital One's partner's partners; you can transfer points to British Airways for redemptions on American Airlines, you can transfer points to Air Canada for redemptions on United, you can transfer points to Air France-KLM for redemptions on Delta, etc.

Let me know if you need any more info on that, because I think you're missing out if it's the Capital One partners that are preventing you from picking up the card.

I was instantly approved. My credit score is 800+ and I have about 15 other cards.

Btw, I found the DFW Lounge disappointing. Other than being less crowded and quieter than Centurion, the food choices/quality and service at breakfast time was underwhelming. (I agree less crowded and quieter is significant).

Applied & instant approval. Self-employed, high 700s (sorry, not sure where it's at right now).

@ Stephanie -- Congrats, and thanks for the data point!

Marry me :)

Oh I though high 700s was salary lol - my bad :)

To me, Capital One was never really in the game. The addition of transfer partners helped. But, its reward structure never seemed competitive with those of other issuers. With the Venture X, nothing has changed.

Moreover, a survey of comments would suggest that the Capital One travel portal is no great shakes. Pass.

@ Reno Joe -- While I think this might have been true in the past, personally I don't think it's the case anymore. For example, you can complement the Venture X with the no annual fee SavorOne, and that card earns 3% cash back on dining, groceries, entertainment, and popular streaming services. Those rewards can then be converted into Venture miles, meaning you can earn 3x points.

So is it the lack of being able...

@ Reno Joe -- While I think this might have been true in the past, personally I don't think it's the case anymore. For example, you can complement the Venture X with the no annual fee SavorOne, and that card earns 3% cash back on dining, groceries, entertainment, and popular streaming services. Those rewards can then be converted into Venture miles, meaning you can earn 3x points.

So is it the lack of being able to build a card portfolio that keeps you from getting into the Capital One ecosystem, or what else do you think is uncompetitive?

I have 13+ open credit cards including 4 new cards in the last 2 years. But Iwas instantly approved. I thought the Capital One card was too good to be true - and unfortunately it is. The Capital travel portal stinks; (I dislike Chase's also because they mess up airline reservations and notifications constantly) but the rentacar options are worse than what you get on auto rental websites, and you are required to prepay -...

I have 13+ open credit cards including 4 new cards in the last 2 years. But Iwas instantly approved. I thought the Capital One card was too good to be true - and unfortunately it is. The Capital travel portal stinks; (I dislike Chase's also because they mess up airline reservations and notifications constantly) but the rentacar options are worse than what you get on auto rental websites, and you are required to prepay - no pay later option! And no Hertz! So you can't use your $300 free easily. I am still glad I got this card just for the multiple priority passes (other cardholders get their own too!) but frankly I think the Citi Premier-CitiDoubleCash combination is cheaper and a better value.

@ bickleinny -- If you ask me, booking rental cars through a portal is rarely a good option, given the better discounts and perks available when booking elsewhere. I'd recommend trying to book a flight through Capital One Travel, where pricing should line up with what you'd find directly with an airline, and you can still earn points and take advantage of any elite perks you may have with that airline.

I applied shortly after launch and was approved after jumping through a couple of hoops. It was easy to use my new card to book a flight through the Cap One portal. The price was actually a couple of bucks cheaper than booking directly. This also made full use of the $300 travel credit before the end of the year. The card has almost paid for itself, and I've only had it just a couple of months.

I was declined as well. Perfect credit, but when I called Capital One to ask why, the rep told me they only allow customers to open new credit cards every six months (and I had literally just received my new SparkBiz card three weeks earlier).

I also have the regular Venture, which I opened about eight months ago.

Applied and was declined instantly. 780 because I bought a house in 2021 in San Francisco. I don’t finance anything else, no debt other than mortgage, pay off cards in full each month.

Oh well. Will be a fun read in 7-10 days.

Reason was that 1/3 bureaus was frozen. Unlocked, reapplied, approved instantly.

I just applied for the Venture X card after hesitation due to reading the swings in approvals/denials.

I have 792/789/788 scores.

6 figure income, barely.

1 Cap One card quicksilver $6200 limit

I was instantly approved for 30k and 20.99% which is irrelevant because I pay off card monthly.

I have to say I was shocked and extremely happy to have such a card attached to my credit profile.

Cap One used Experian and had me at 750.

Not instant approval, but a couple hours after submitting the application, I got a congratulations email. $30k @20.99%.

759 credit score. Answered all optional questions. No authorized user. Just dipped under 5/24.

I have an 800+ score and am 5/24 so I am waiting until I drop to 4/24 later this month before pulling trigger.

Also denied instantly today. Credit score around 800, and have the venture card with Capital One. Very disappointing

I was approved yesterday; my data points: 800+ credit score, high income earner, average age ~6-7 years, I always pay off my credit cards each month and noted that on the application, I also said I was not interested in blank checks, and I added my wife as an authorized user. My only other C1 product is a Quicksilver card, but I've had that (in some product branding iteration) for almost 20 years. My last...

I was approved yesterday; my data points: 800+ credit score, high income earner, average age ~6-7 years, I always pay off my credit cards each month and noted that on the application, I also said I was not interested in blank checks, and I added my wife as an authorized user. My only other C1 product is a Quicksilver card, but I've had that (in some product branding iteration) for almost 20 years. My last new CC was opened 2+ years ago and I've got maybe 11 other cards and some store cards.

BUT, got a call today from their fraud department telling me my account was restricted and the only way to remove the restriction was to upload front/back pictures of my driver's license, social security card, and a utility bill. WHAT THE F?! I've never experienced such ridiculous identity verification procedures and I'm not sure I even feel comfortable uploading those pictures to .... wherever they go.

I was denied for having too many active cards, my Fico score is 822, total credit limit 187K credit age 5 years and 4 month, active cards 14.

I am speechless, first time in my life I got denied.

Any explanation??

Same deal here. Blended credit north of 800, strong income and long standing bank account history from days of ING.

Is there an official datapoint somewhere sharing average length of accounts or are people self calculating?

Turned down for having too many open credit cards - yet no indication of how many is too many.

Denied after receiving a direct offer in the mail. They should take some lessons from Amex. If you want to have a "premium" card, maybe don't deny a large number of people with excellent credit and decent income.

Another data point: I was denied, unfortunately. Credit score of around 775, currently at 7/24, including 5 new accounts in the past year, did not have any previous Capital One accounts, and an annual income of $20,000/monthly housing $0.

I have a 823 FICO but have been turned down by Capital One for a Venture, too many inquires, 8.

What a pleasant surprise instant approval $30k line.

Does anyone know if the $100 travel credit is annual or anniversary?

@ John Richard Stewart -- Both the $300 travel credit and 10,000 anniversary miles are per anniversary year (the $300 travel credit applies the first year, while the 10,000 anniversary bonus miles post for the first time on the first account anniversary).

Approved even with a non resident status

I was approved instantly and have over 2 dozen cards open none with a balance. Started a couple years ago with Chase business then moved to open Chase personal then B of A then Amex business & then Amex personal. This is the first Capital one card I have every applied for.

Credit score 814, have a total of 6 credit cards, none with Capital One. Was denied for "too many accounts". I always pay off my balances, so perhaps it's true that they don't want folks like me.

Wow so many comments also great write up

Congratulations Mr. Ben Schlappig

Enjoy this amazing card and keep us informed about it

Applied day 1. Instant approval with $30K limit. I have 10 open credit cards. Credit Karma score 830's.

I am doing a remodeling project and quickly maxed my card. A purchase that would have taken me over $30K was rejected. I used their on-line function (4 minute process) to request a credit limit increase after only having the card a week. I was instantly approved for a $50K limit.

Ben,

PLEASE do NOT lose credibility--how much is Capital One paying you for referrals? You failed to mention the "minimum" spend is one of the largest ever--$10K--and the "travel credit" is extremely limited and difficult to use...Also, one must use Captal One's site to use the "miles"--or cash them out for pennies on the $....PASS.

It's over 6 months quit crying. You can pay your tax bill, allocate monthly expenses, Christmas expenses and vacation expenses.

I am not rich and it is not hard to hit that. For Christ's sakes we did the offer for my wife, and we will do one for me as well and aggregate all the points together.

Pay your tax bill with a credit card? Sure, and pay a 3% fee....Please stop shilling for Capital One.....

What are you even talking about? You can transfer miles to travel partners.

How can a "new" blog article have 256 replies in only 4 hours? Because it's not a new article. It's a recycled Venture X pimp post shilling for signups.

I skimmed the article and found at least 3 factual errors.

Any older article appears on the main page if someone leaves a new comment. Same as on DOC and other websites.

The article is dated two days ago.

Updated comment. It seems from reading comments, capital one doesn't like high income earners. We make 250k + and that's what I put on as income. I see people getting approved that make 50k.or less .maybe I need to app later with less than 100k income listed?

Not sure that is the case. I am in a higher earner category and was approved.

My experience as well.

My wife and I both were denied!

We both have scores over 800 on all 3 bureaus. We have no credit card debt. I have 3 cards with capital 1, my wife has two cards with capital one. we have had those cards for 6 or 7 years. We don't run a ton of spend through them. Most limits on my other cards are between 20k and 50k(chase likes me for sure). We each have maybe 3 credit pulls last 12 months. Not for sure why we got denials.

probably because you have three cards with cap 1 and don't use them much.

WOW I got the Ben Schlappig OMAAT Bump!! :-) always denied from Cap1 until now!

I answered sometimes on the balance ?? because I ran an introductory 0 interest balance on my AmEx Blue Cash Preferred a few months ago just for Cap1's attention ;-)

Great, won't need to park my short term $$ there and just wait for Bask Bank to run a good promo :-)

I applied the other day and got denied. I have great credit but I don't think capital one likes me as they cancelled my quicksilver card for no reason that they would give me. I guess I didn't use their card enough?

I was denied....absurd.

350k Annual Income

850 Credit Score with Experian

20k monthly spend

Never carry a balance

No other Capital One Cards

I've been Amex platinum for well over a year and they recently did something to piss me off...so today I applied for the Venture X so I can transfer all of my spending to a new card. Can't believe I was denied.

Just applied and instantly approved for 10k limit (highest I've ever had).

My score is was around 718 with income around only 44k answered no to never carrying a balance. Stoked.

I was denied?!?!?! I have excellent credit (760+) score and dont carry balances on my cards. I answered all their questions including the one where they asked if I carry a balance (I said no) and I was denied. Not sure yet why this happened.

Hector, I hate to say it, but you're not profitable. See, they're hoping you'll pay that 20% interest rate. That's where the real Capital Spendola is.

Data points to help people judge whether to apply or not:

-I have a cap one checking and savings

-I have a quicksilver and venture card

-Applied for Venture x and instantly approved for 15K limit

-Fico score of only 701 according to the approval letter from cap one. I thought it was higher.

-Never carry any balances with cap one and never have

-Good income

Instant approval and don't carry a balance. Had a 3K so current balance across my other cards - maybe that had something to do with it? Also had a request for the front and back of my driver's license (state-issued ID). The card arrived via FedEx a few days later.

I had been denied Capital 1 card with a 820 score then given a limit of $1k a few years ago lol. this credit card company has always been very "low end" to say it nicely. I'm not about to apply for this crap now.

First ever denial.

5/12, 10/24, 3 inquiries in 2 years.

815 CAP1 credit score

Hard inquiry detected from application.

Decided to go for the 150K amex bus plat incognito offer after this denial.

Follow-up to my DENIED comment -

CapitalOne does a HARD inquiry (CreditKarma told me)

I have ALL my credit accounts frozen. So looks like I need to unfreeze some, perhaps TransUnion, maybe all.

Maybe others are having same problem. You may want to do an unfreeze before applying otherwise you will likely be denied.

Applied and was denied. Strange. I have credit score > 815. Very little debt. I do have a Capital One QuickSilver card, also have CapitalOne savings account. On two other cards. Maybe because I entered I do not carry a balance.

I will try to call them to see.

I entered no not carry a balance and was approved.

I received instant approval today (20K limit)

-800+ scores

-3 existing capital one cards (VX will be 4th) plus cap 1 auto loan

-History of carrying balances across 10+ years with cap1, but currently zero balances on cap 1 CCs (and under 5% across all revolving lines).

-9 other CCs including chase sapphire reserve

-I DID answer optional questions

-I frequently fly out of DEN, and the cap 1...

I received instant approval today (20K limit)

-800+ scores

-3 existing capital one cards (VX will be 4th) plus cap 1 auto loan

-History of carrying balances across 10+ years with cap1, but currently zero balances on cap 1 CCs (and under 5% across all revolving lines).

-9 other CCs including chase sapphire reserve

-I DID answer optional questions

-I frequently fly out of DEN, and the cap 1 lounge is scheduled to open in 2022. I was already leaning toward applying, that made it a no brainer.

One other date point....to confirm what a couple of others have posted. I went though the pre-approval tool (soft pull), and was pre-approved for what appeared to be every other card they offer except the VX. I went ahead and applied for it anyway, and they hard pulled all 3, and instant approved.

same here, but Venture X for $30k CL

Ben, How long does it take for the Venture X card to arrive after approval ?

Have you received your card yet ?

Do you have to physically get the card and activate it before you can access the travel portal?

@ AKHU -- It takes a few days after being approved before you can access the Capital One Travel portal.

Thanks for the review. Instant approval here. 789 score + 2 other c1 cards + c1 savings account

I have excellent credit, good incomd & already have a Venture card and was instantly approved. Thanks Lucky!

Instantly denied. 766 credit score on Experian website. 6 figure income, never carry a balance and 4/24. Not sure what these guys want.

Has anyone had success calling Capital One for reconsideration?

This makes me nervous. My score is over 800 but I will also be 4/24 when I apply with six figure income. I almost never carry a balance but I am going to be carrying a balance for like two or three days while I wait for some vendor payments to hit my account. Only other difference I may have is that I have a cap 1 venture card for years. I almost never use it but in anticipation of this app I have run a few minor charges through it just to show some recent activity.

I was instantly denied despite no other current capitol one credit card and >800 credit score :/

Datapoint: 780 fico, 8/24 with some balances on 0 apr (~5k) . Applied through the link here and was asked to verify my income on Friday, so I sent three recent bank statements and got an approval today (Monday) morning.

Correction: credit score 725 based on their letter

CO sensitive to MS on subs?

Do you have to physically get the card and activate it before you can access the travel portal?

I've been trying since approved, but keep getting a message saying "to access Capital One Travel you need an eligible credit card...."

Applied yesterday, instantly approved. I’ve only had their free card up to now.

@ Peggy -- Congrats!

Plenty of folks with venture one are getting approved. That's a key point

726 score, declined. Certainly too many new cards & inquiries in the past 12-24 months.

woohoo....I got approved to join the club! I used your link, Lucky, so you could get some comp. Time to crash and burn my Ultimate Reward and cancel the Reserve. Hey Lucky, what is the best way to burn Ultimate (420K) in short period?

@ PNWrainyguy -- That's a toughie! Personally my favorite use of Chase Ultimate Rewards points is for World of Hyatt transfers, but I'm also a Hyatt loyalist. Other than that, my favorite transfer partner is probably Singapore KrisFlyer, and you can even earn Star Alliance Gold status if you transfer 250K points there right now.

Lucky, thanks for much for your quick response and sharing. looks like xfer to Krisflyer is the winner; I always want to try biz/first class on Singapore, Cant wait for the ride.

just got my card, to setup priority pass go to:

https://prioritypass.com/capitalone and follow the prompts. straightforward!

Applied, and instantly approved. Notably, this is my 3rd Capital One Card. I'm co-owner on one (from when I was a teen with parents), and the primary on this, and the standard Venture. $30K limit, 16.99% interest.

Retired with ample income and credit scores > 800. Instant approval with $30K

Credit line. Have the Venture card for a while; any reason I should renew when it comes due? Do I need both?

@ SteveK -- There's probably not much benefit to having both, since the Venture X basically offers everything the Venture does, and then some.

Hey guys! I had to leave a comment because I didn't read one comment about a situation like mine here. Score around 710, income $75K/year, I have 5 Capital One cards including a Venture which I got approved in June this year - today I have a $1K balance on my Venture (I pay in full every month). I got immediately approved for $20K! I wanted this card for the sign-up bonus and the priority...

Hey guys! I had to leave a comment because I didn't read one comment about a situation like mine here. Score around 710, income $75K/year, I have 5 Capital One cards including a Venture which I got approved in June this year - today I have a $1K balance on my Venture (I pay in full every month). I got immediately approved for $20K! I wanted this card for the sign-up bonus and the priority pass and I am in!! Woo! There is hope for us simple mortals with good credit :)

TL;DR: check your credit reports, folks.

Applied and was denied instantly. Got the letter electronically saying that it was based on the information on my Equifax report - and it kind of didn't match up with what I expected.

I look up my report and apparently, one of my cards (a Chase personal card) was listed as if I had it maxed out. This was a case where back in June I did...

TL;DR: check your credit reports, folks.

Applied and was denied instantly. Got the letter electronically saying that it was based on the information on my Equifax report - and it kind of didn't match up with what I expected.

I look up my report and apparently, one of my cards (a Chase personal card) was listed as if I had it maxed out. This was a case where back in June I did in fact use up all the credit on it, but have long since paid it off (on time, no interest paid). Yet, Chase did not report this to Equifax. I did not use the card since then. Puzzling and annoying, but hope by putting a small charge and paying it off I can trigger Chase to update my report.

Hi Ben,

I applied using your link. Instant approval.

Great blog with very useful/practical info.

Thanks!

I opened the Venture earlier in 2021, and I was immediately rejected for the Venture X. High credit score, high income... I also have a basic Capital One card I opened years ago, two savings accounts with Cap One as well. Perhaps it's all my other cards with AMEX and Chase, but I've only opened three in the past 24 months.

I was approved instantly for 30K. I have checking and money market w/Cap1 as my primary bank for many years, also former Venture cardholder-that was my primary card for years until I closed it several years ago. I have a score of 800 and only opened 1 card this year (Apple). It seems a common reason some are rejected is frequent recent new card approval. They’re possibly trying to guess if you’ll make this card your daily workhorse.

Instant rejection. CapitalOne is the only issuer that has never allowed me to open a card. I have (had) cards from chase to us bank, AmEx, citi, Barclays, etc. credit score at 800 and make around 200k. Don’t carry a balance. At this point I think I’ll give up on CapitalOne. There’s only so many times I’m willing to have a hard credit pull to be rejected. Last time I got rejected by CapitalOne I...

Instant rejection. CapitalOne is the only issuer that has never allowed me to open a card. I have (had) cards from chase to us bank, AmEx, citi, Barclays, etc. credit score at 800 and make around 200k. Don’t carry a balance. At this point I think I’ll give up on CapitalOne. There’s only so many times I’m willing to have a hard credit pull to be rejected. Last time I got rejected by CapitalOne I ended up getting a new premium card from AmEx so who knows what CapitalOne’s concerns are.

I have 3 Capital One credit cards. They contacted me and asked if I wanted a Venture and all I had to do was say yes and the card arrived in less than a week. So now I have two basic cards and a Venture.

Ben I love this post

Thank You

This seems like an excellent card with great value. Wonder how Chase and Amex will respond with their respective cards. I am a bit curious, what material is this card made out of? Is it similar to the Platinum or the CSR?

@ David -- The card is made of metal. Personally I don't think we'll see much of a response from Amex or Chase, as both issuers have just refreshed their cards as well, and all have very different value propositions.

Looks like a great card. $10k spend is quite a lift.

Not really. They give you six months, so it ends up being 5k every three months like many SUBs are. Of course if you are picking up other cards during that same period it does limit people who don't have huge amounts of spend.

I love Ben, but this Capital One X Venture stuff is getting old.

No it’s not

Actually this is very useful

No it’s not

Actually this is very useful!

I applied today and was instantly approved. 800+ credit score. Good income. Have many other premium cards but have not opened any in the last year. 30Kl

Don’t know how those of you w a lot of cards got approved. I was turned down even w 800+ credit rating. Got letter today and was told I had too many accounts open w balances (all paid off every month and total utilization around 5% of available credit). BTW I have a total of 11 cards and know many of you have a lot more than that.

Guess I am just blocked from ever getting a Capital One card.

I’m in the same boat here. I was rejected instantly with similar numbers. I’m starting to think I’m on some sort of CapitalOne blacklist. No other issuer has ever denied my applications and I’m very careful to not submit too many applications at any time. The only bank where being responsible with your credit seems to hurt you. At the published APR that may make financial sense for them.

Instant approval with 20K CL. 4/24 and probably sitting at 17 open accounts before this.

Instant approval with $30K credit limit. I am retired with plenty of income and high credit score. Did not fill out optional areas.

I also got instantly approved. I don't have any Capital One credit cards but I forgot that I had a checking and savings account with Capital One. I had one from a previous bank that Capital One purchased a few years ago. I almost forgot I had the account. I have less than $2,500 in checking/savings with them.

I was instantly approved with a $40,000 credit line. I have a 800 FICO.

Denied - 800+ credit, no active loans, balances, etc. Is there a way to call them and ask for re-consideration/

Applied thru link with 780 Credit Score, no C1 cards (cancelled one several years ago), very low utilization, mid six figure income, two new CCs this year (Amex Bonvoy Brilliant and BofA KLM/AF). Pending - asking for income verification. Not sure if it's one of the below or all of it:

Total Annual Income

W-2, Form 1040 or Form 1099 from the most recent tax year

Two consecutive pay stubs issued in the last...

Applied thru link with 780 Credit Score, no C1 cards (cancelled one several years ago), very low utilization, mid six figure income, two new CCs this year (Amex Bonvoy Brilliant and BofA KLM/AF). Pending - asking for income verification. Not sure if it's one of the below or all of it:

Total Annual Income

W-2, Form 1040 or Form 1099 from the most recent tax year

Two consecutive pay stubs issued in the last three months

Three of your most recent consecutive bank statements

Debating whether it's worth the trouble.

For the love of God and all that is good, please stop with the Venture X pimp posts.

I think Capital One has rented the Blog for the week!

Why is that a problem again

Just curious. How does this compare to other middle tier cards such as the Sapphire Preferred? I thought this would be one of the questions asked.

Instead of being a non-stop shill for Capital One, please report on other noteworthy items such as IHG removing cell phone protection and are there other coverage options.

Instant approval for 20K

woohoo. Just received my card!

Stuff that comes with it still doesn't tell me how to activate priority pass, hertz presidents etc

Hmm, well that's clunky.

Once you have the card, nothing will come with it that tells you about how to activate president's circle, priority club etc.

However, it is available, albeit not in the most intuitive place, on the website. From your account homepage go to "Explore rewards" and then go to "Discover Travel". Scroll down and you'll see the various options.

I got immediate confirmation on signing up for President's Circle, but...

Hmm, well that's clunky.

Once you have the card, nothing will come with it that tells you about how to activate president's circle, priority club etc.

However, it is available, albeit not in the most intuitive place, on the website. From your account homepage go to "Explore rewards" and then go to "Discover Travel". Scroll down and you'll see the various options.

I got immediate confirmation on signing up for President's Circle, but on Priority Club it indicates that you have to wait 5-10 days after approval before you can sign up. I tried... but it failed

yawn, repost from yesterday.....

I get that they are paying you, but is reposting this article seriously necessary?

Must be a slow day....

Why do you care

Did not receive or approval. Received will try to reach me via email. If not they will send a letter in 7 to 15 days. 740 to 814 Credit, very high income, less than 5/24. Not sure what this means but hopefully they approve me with some follow up questions. Anyone know if I should proactively reach out to them? Thanks

Update- Approval via email just came through!!! $30K limit!1

same fact pattern as SAM and other high fico, high income, no other cc apps. I called them two times to request a reprocess. Supervisor dont know the algorithms for approval or rejections. They suggested writing a letter to the Utah address. Not doing that.

FICO 830 applied and was instantly denied. Waiting for denial letter for reason.

Denial letters rarely say the actually reason, however Cap1 generally won't talk to you about the denial until you receive the letter.

Mine gave reasons including too many open accounts (I have 11 cards but not sure what is “too many” for Capital One). BTW under 5% utilization, paid off every month and over 800 credit rating.

Also said I had applied for too many cards recently. Again no definition of “too many” or “recently”. Think I have gotten either 3 or 4 cards in past 12 months.

Capital One is dead to me. Heard...

Mine gave reasons including too many open accounts (I have 11 cards but not sure what is “too many” for Capital One). BTW under 5% utilization, paid off every month and over 800 credit rating.

Also said I had applied for too many cards recently. Again no definition of “too many” or “recently”. Think I have gotten either 3 or 4 cards in past 12 months.

Capital One is dead to me. Heard they are quirky w approval and shutdowns. Also a friend was hung out to dry when he tried to dispute a rental that couldn’t be taken due to COVID (contract clearly said he should have gotten a refund and Capital One wouldn’t do anything for him) so he dropped it and got the Chase Sapphire Preferred card.

Outside of sign up bonus no great loss. Crappy company.

any credit application/inquiry within 6 months?

Would there be any reason to hold onto the Venture card once you get the X? I certainly can’t see it if so.

@ Jim R -- Not any obvious reason I can think of. The Venture X offers all the perks of the Venture, and then some.

I have two reasons:

1) I'd be applying primarily for the 100k sign-up bonus. The long-term value proposition (5x flight, 10x hotel, and $300 annual credit being captive to the Cap1 portal) just isn't there for me as I avoid 3rd-party booking portals like the plague.

2) My existing Venture card is grandfathered at only $59/year. And, the Venture already provides 5x on Hotels via the Cap1 portal should I ever decide to use that avenue (highly unlikely).

Instant approval, though with a high interest rate and lower than expected CL. I tried to access the travel portal but was denied since I do not have a qualifying card???

First time with Capital One, and not off to the greatest start.

@ Brodie -- Congrats on getting approved! You should have access to Capital One Travel in the coming days, it can just take a while for the system to be updated. I imagine you should be able to access it when you receive the card.

Coming Brodie

Also you have Gold status as well

I got declined and have no idea why. Don't know if having gotten 3-4 credit cards in past year triggered something w them. I'm over 800 credit score but also retired (with a sizable stock portfolio that generates substantial income which I listed and that may have thrown them) also put down no mortgage/rent (wrote a check for my last house and haven't had a car payment in 20 years since always pay cash). Also,...

I got declined and have no idea why. Don't know if having gotten 3-4 credit cards in past year triggered something w them. I'm over 800 credit score but also retired (with a sizable stock portfolio that generates substantial income which I listed and that may have thrown them) also put down no mortgage/rent (wrote a check for my last house and haven't had a car payment in 20 years since always pay cash). Also, never carry a balance which I've heard is an issue with them. Have well over $300,000 in credit lines around around a dozen cards and rarely over 5% utilization.

Will be interesting to get their letter and see the reason. Frankly, I was just trying to add the bonus but have CSR, Amex Platinum, Amex Gold, etc etc so well covered. Coming out of Chase 5/24 in January so likely will get a few more w them. Have 5 Amex personal cards so probably tapped out there.

Kudos for packing so many brags in one post. Having 12+ open credit cards likely contributed to your rejection.

I have more than 12 open personal cards and I doubt that will cause any issue if I apply for this one. I have a relationship with Capital One for years as well. I think he was only trying to supply a data point. Plenty of people dont want three credit hits and they know Cap One to be weird. I still think they are somewhat weird.

Instant approval with $30,000 CL.

831 score. Only one new card in last year(Amex Plat). 8 open cards (personal.)

never carry balance but left amount spend and balance questions blank.

Applied through link here.

@ BenA -- Congrats on the approval, thanks for the data point, and appreciate the support!

Voice Over IP

————————

Primary number is google voice VIOP number, which sometimes is, lets say, heavily discouraged by some financial institutions.

Any data points on successful applications through Google Voice number? No hiccups on the OPT/SMS validations etc?

Ona related note, also always using VPN, and the VPN causes more problems than VOIP.

So for example if I apply now and do NOT have the VPN employed, the IP will be clearly overseas. Doubt anyone will look to see the IP is a popular vacation resort mind you.

I could apply with a USA based IP, however VPN detection tools can often interfere with any automated approval processes.

so your saying that if im out of the country i shouldnt use a vpn?

what should i do?

do they need to reach me via sms or can i still put in my us cellphone number?

Yesterday, I first looked at "pre-approval" offers on CapOne and the venture X was not provided to me as an option. Then I just applied for card right after with instant approval & $30K credit limit. Plenty income, credit score in high 700's. I have over 17 open credit cards (opened a Chase card a few months ago), do not carry balances. Had a capital one card years ago, but it was closed for inactivity....

Yesterday, I first looked at "pre-approval" offers on CapOne and the venture X was not provided to me as an option. Then I just applied for card right after with instant approval & $30K credit limit. Plenty income, credit score in high 700's. I have over 17 open credit cards (opened a Chase card a few months ago), do not carry balances. Had a capital one card years ago, but it was closed for inactivity. I also have a CapOne 360 Checking/Savings account that I've had for many years and use it occasionally (back when it was ING Direct)

Similar situation here. Instant approval with 30k cl - my 1st card application with Cap One. Don't think the previous banking relationship mattered, but I did have Cap One 360 checking & savings accounts - ironically both were zeroed out 2 years ago. I logged in and checked my pre-approval offers - the Venture X wasn't 1 of the 3 listed. Additional DP - opened 3 personal cards in the last 12 months, 4/24, 850...

Similar situation here. Instant approval with 30k cl - my 1st card application with Cap One. Don't think the previous banking relationship mattered, but I did have Cap One 360 checking & savings accounts - ironically both were zeroed out 2 years ago. I logged in and checked my pre-approval offers - the Venture X wasn't 1 of the 3 listed. Additional DP - opened 3 personal cards in the last 12 months, 4/24, 850 FICO, no balances on my 12+ open CC accounts. I've been meaning to close my Sapphire Reserve for the last year or so - this helps with pulling the trigger and saying adieu to the Reserve after 5+ years. Good luck on your applications everybody!

Have 815 score, plenty income, have Sappire Reserve, Pretige, etc. I do not carry a balance. Was denied.

Join the club

Like TJ, I too have CapOne 360 Checking & Savings accounts (albeit dormant with $0 balance for last 2 yrs) - my login still works and I checked my pre-approval offers. Venture X didn't show up in the pre-approval list, but I was instantly approved for it all the same. I was also prompted to link my new Venture X account to my existing login for the CapOne 360 Checking/Savings account. FICO 850; 4/24; don't carry a balance on any of the 12 open personal cards.

As a data point, I tried to apply for venture a few weeks ago and was denied. I have a lot of cards, yes (amex gold/plat, csr etc) but an excellent score and have never carried a balance. I was denied instantly, the first denial I've had in quite some time. Maybe I'll try for this new X card in a couple months but I'm a bit wary now!

Does anyone know if you get the food option with the Priority Pass like CSR? Or is it just the access to the clubs?

@ Susan Krebs -- You can also use it for Priority Pass restaurants. Hope that helps.

Will you be doing a comparison of this card with the CSR card? I'm seriously considering dropping the CSR in favor of this card (especially since the increase in fees on the CSR) but I'm wondering how things like rental car insurance and other travel insurance coverage compare.

in case this is helpful. I used to have the CSR and downgraded it to the Chase sapphire (classic with no AF) and the travel insurance coverage is VERY similar with some coverage limits lower. But it was excellent, especially for a no AF card.

Instantly approved using your link, Lucky!

@ Derek -- Congrats, and thanks for the support! :)

I applied for the Capital One Venture X card and got instantly approved, I added an authorized user as well and left the last two optional questions in regards to credit card information blank. They sent me a text message to verify my phone number and the card was instantly added to my Capital One mobile app. I got a 30K credit line similar to the one on my Chase Sapphire Reserve card. My credit...

I applied for the Capital One Venture X card and got instantly approved, I added an authorized user as well and left the last two optional questions in regards to credit card information blank. They sent me a text message to verify my phone number and the card was instantly added to my Capital One mobile app. I got a 30K credit line similar to the one on my Chase Sapphire Reserve card. My credit is excellent (800+) and I normally carry no balance. I also have the Costco Citi card which I regularly use and an AMEX with no annual fee.

I applied for the Capital One Venture X card and got instantly approved, I added an authorized user as well and left the last two optional questions in regards to credit card information blank. They sent me a text message to verify my phone number and the card was instantly added to my Capital One mobile app. I got a great credit line similar to the one on my Chase Sapphire Reserve card. My credit is excellent (800+) and I normally carry no balance.

@ Lucky do you have a contact for reconsideration denial?

Was Denied - credit score of 842, high income, never carry a balance, one AA card about 3 months ago, only card in the last 2 years - heavy user of Chase cards. I had Cap 1 venture 5 years ago.

Credit Score circling 800. I have about 14 open credit cards, 5 of which have been opened within the last year or so (I'm always trying to gain the best value and earn rewards to the max). I have a Cap One Quicksilver, Savor One, Venture One and now this one, after having JUST upgraded my Venture One to a Venture (prior to learning of this Venture X card), applied online and got instantly approved...