| Want to learn more about policies of major transferable points currencies? See my series about Amex Membership Rewards, Capital One, Chase Ultimate Rewards, and Citi ThankYou. |

Citi ThankYou is a popular transferable points currency. There are several excellent cards earning Citi ThankYou points, so these rewards are pretty easy to accrue, and there are great uses of them.

Sometimes the logistics associated with redeeming points can get confusing. In this post, I wanted to go over the basics of moving Citi ThankYou points around, including how you transfer them to airline and hotel partners, how you combine them between accounts, and how you share them with others.

In this post:

How to transfer Citi points to airline & hotel partners

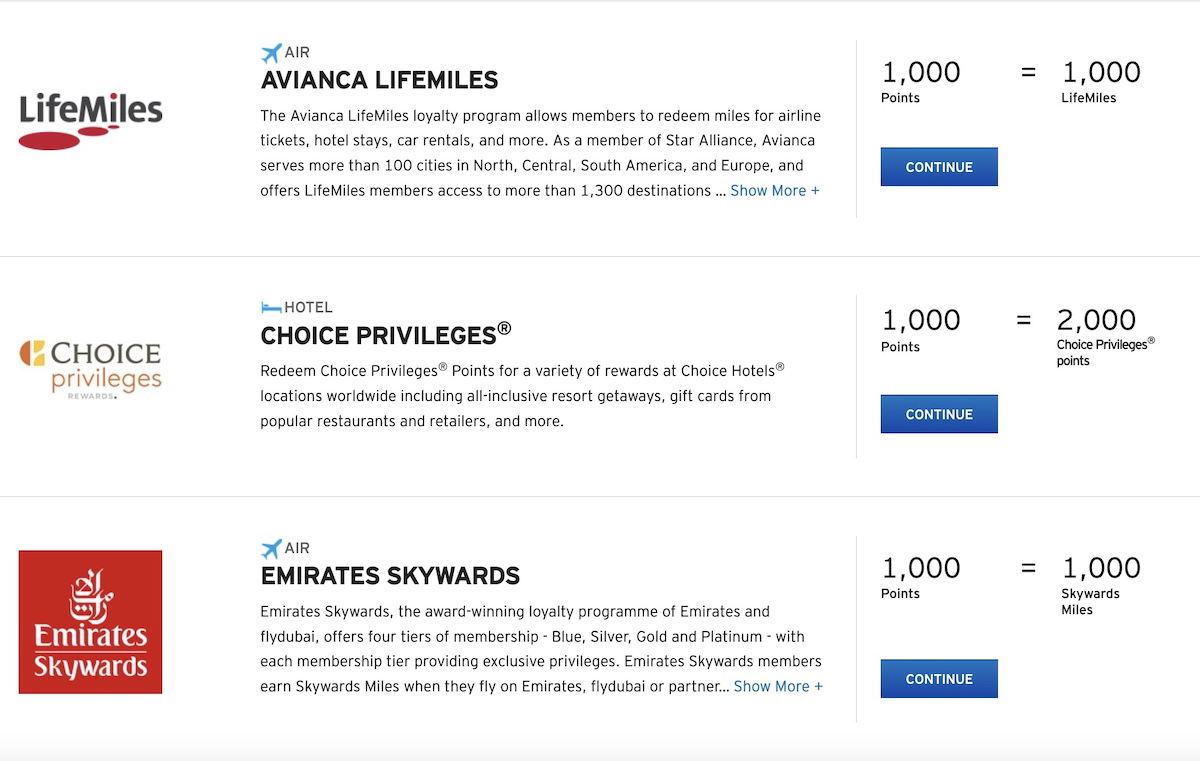

Citi ThankYou points can be transferred to 18 travel partners, including 14 airline loyalty programs and four hotel loyalty programs. Citi ThankYou transfer partners largely overlap with those of other points currencies, and my favorites include Air France-KLM Flying Blue, Avianca LifeMiles, Emirates Skywards, Qatar Privilege Club, Singapore KrisFlyer, and Turkish Miles&Smiles.

Airline Partners | Hotel Partners |

|---|---|

Aeromexico Club Premier | |

The process of transferring Citi ThankYou points to partner loyalty programs is easy. To start, just log into your Citi ThankYou account. Make sure you’re logged in under an account that gets you full access to Citi ThankYou partners, like the Citi Strata Premier® Card (review).

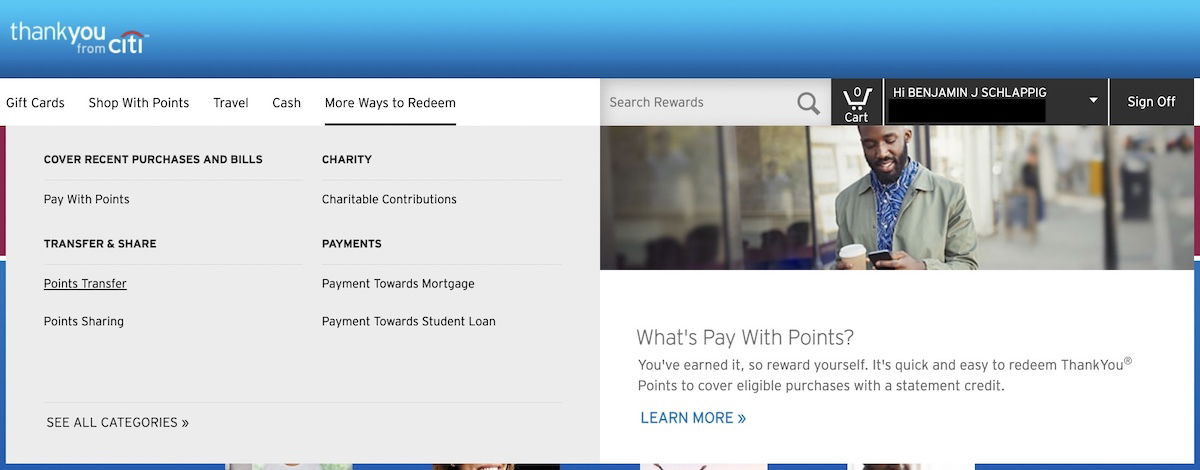

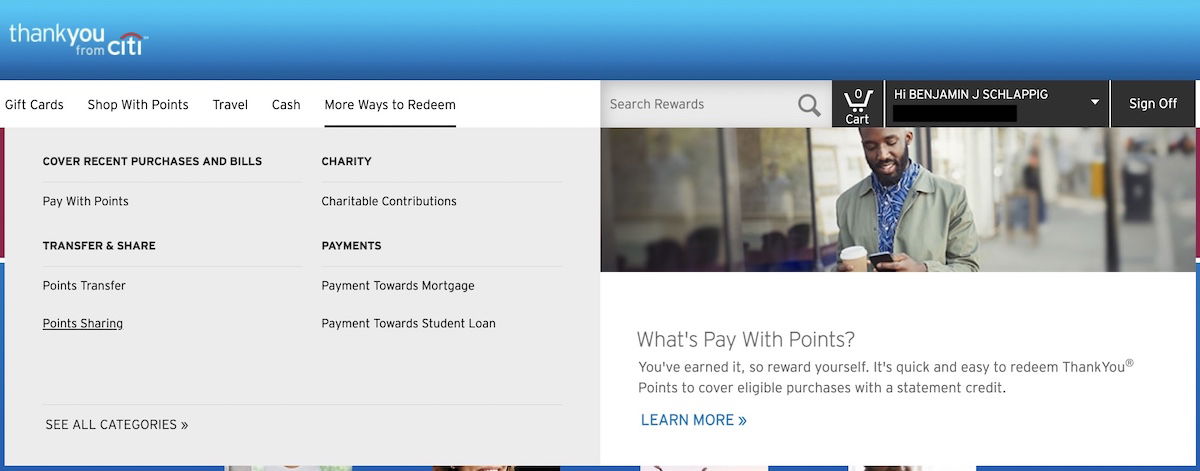

Once you log into your account, click on “More Ways to Redeem,” and then “Points Transfer.”

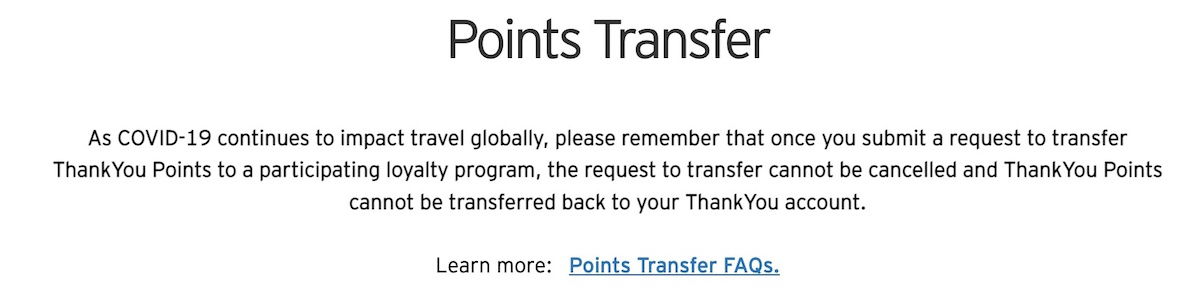

Once you click that, you’ll be on the page that shows all the Citi ThankYou transfer partners. Just select the partner you want to transfer points to, by clicking “Continue.”

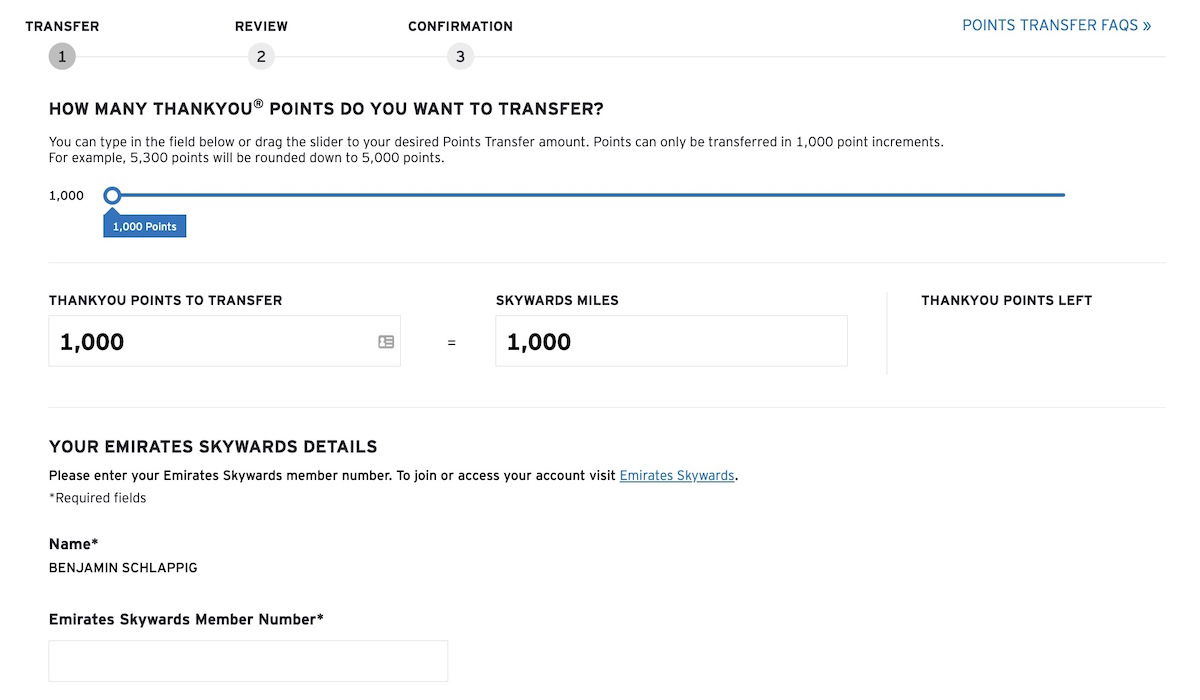

On the next page you’ll see a slider where you can select how many points you want to transfer, in increments of 1,000 points. You’ll also have to enter your loyalty program number. The name on the loyalty program account is already pre-populated with the name on the primary Citi ThankYou account. You can also choose to save your loyalty account number for future transfers, so you don’t have to enter it each time.

Note that you can transfer points between your various card accounts instantly and for free, though we’ll cover that a bit later. If you’re trying to transfer points to a partner loyalty program, you’ll want to do so from the Citi Strata Premier® Card (review). You can easily transfer points there from excellent no annual fee complements like the Citi Rewards+® Card (review), Citi Custom Cash® Card (review), and Citi Double Cash® Card (review).

From there you just have to confirm the transaction, and then it should immediately start to process. See our guide to how long Citi ThankYou points transfers take. Transfers to a majority of partners are instant, though some transfers can take up to two days.

How to combine Citi points between accounts

If you have multiple cards earning Citi ThankYou points, combining the points online is easy. This allows you to redeem all the points you earn with whatever the best redemption options are (for example, you need a premium card to transfer to most Citi ThankYou partners).

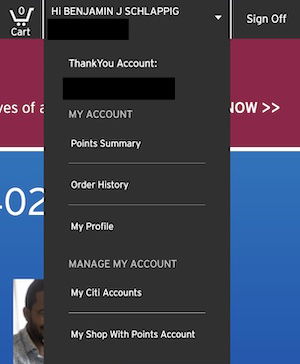

To combine accounts, log into your Citi account, and then scroll over the dropdown at the top that has your name and ThankYou account balance. Then go to the “My Citi Accounts” section.

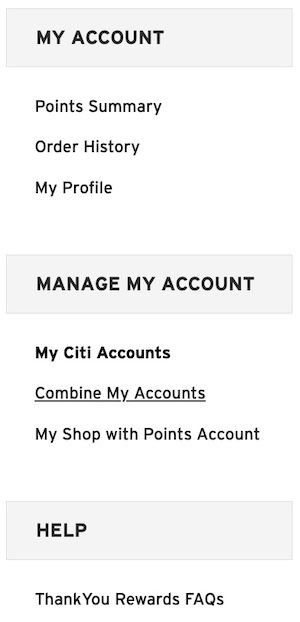

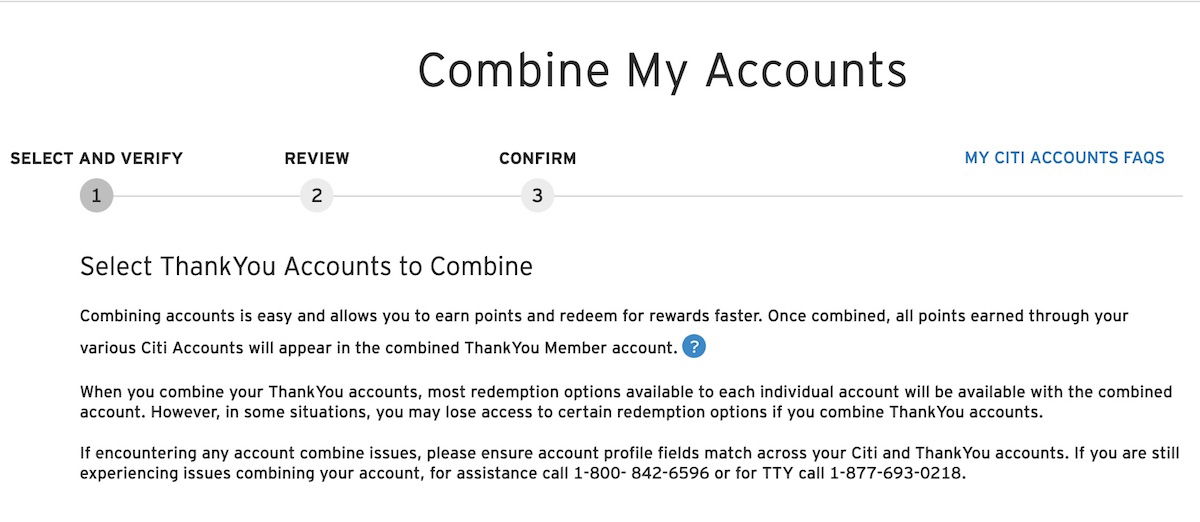

On the next page you’ll want to click “Combine My Accounts.”

Then you’ll easily be able to link any ThankYou accounts that you have under one online log-in.

There’s one important thing to be aware of. If you close a Citi ThankYou card, the points for the account you closed down will automatically expire after 60 days. This applies even if you still have another Citi ThankYou card open.

So be sure you remember this, or else your points could be forfeited. You can easily avoid this by just transferring the points to an airline or hotel partner, as the points follow that program’s expiration policy once transferred.

This 60 day rule can be rather frustrating, since Amex, Capital One, and Chase, aren’t so restrictive regarding combining points.

How to share Citi points with others

Citi lets you share up to 100,000 ThankYou points per year with any other ThankYou member, which is a great feature. However, there are some restrictions to be aware of:

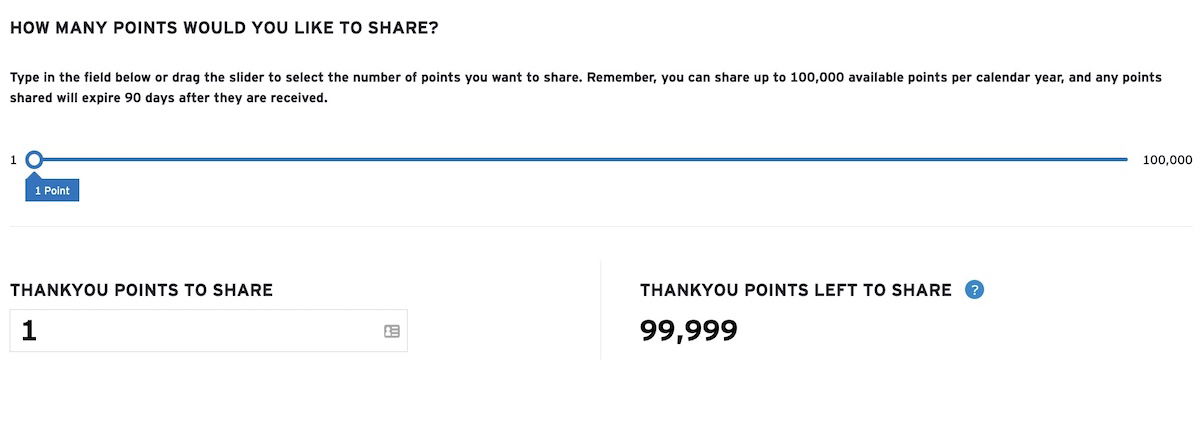

- You can transfer at most 100,000 ThankYou points to another ThankYou member per calendar year (that limit is total, rather than to just one person)

- Each ThankYou member can receive at most 100,000 ThankYou points per calendar year

- Shared points expire 90 days after they’re received, so the member you transfer points to will have a limited amount of time to redeem them; when the member goes to redeem points, those expiring soonest will automatically be pulled first

- The recipient of shared points can’t share those same points with another member

All things considered, this is a generous policy. Capital One is the only other major transferable points currency that lets you transfer your points to another member. This is a good opportunity if you want to transfer your points to a loyalty account that isn’t in your name.

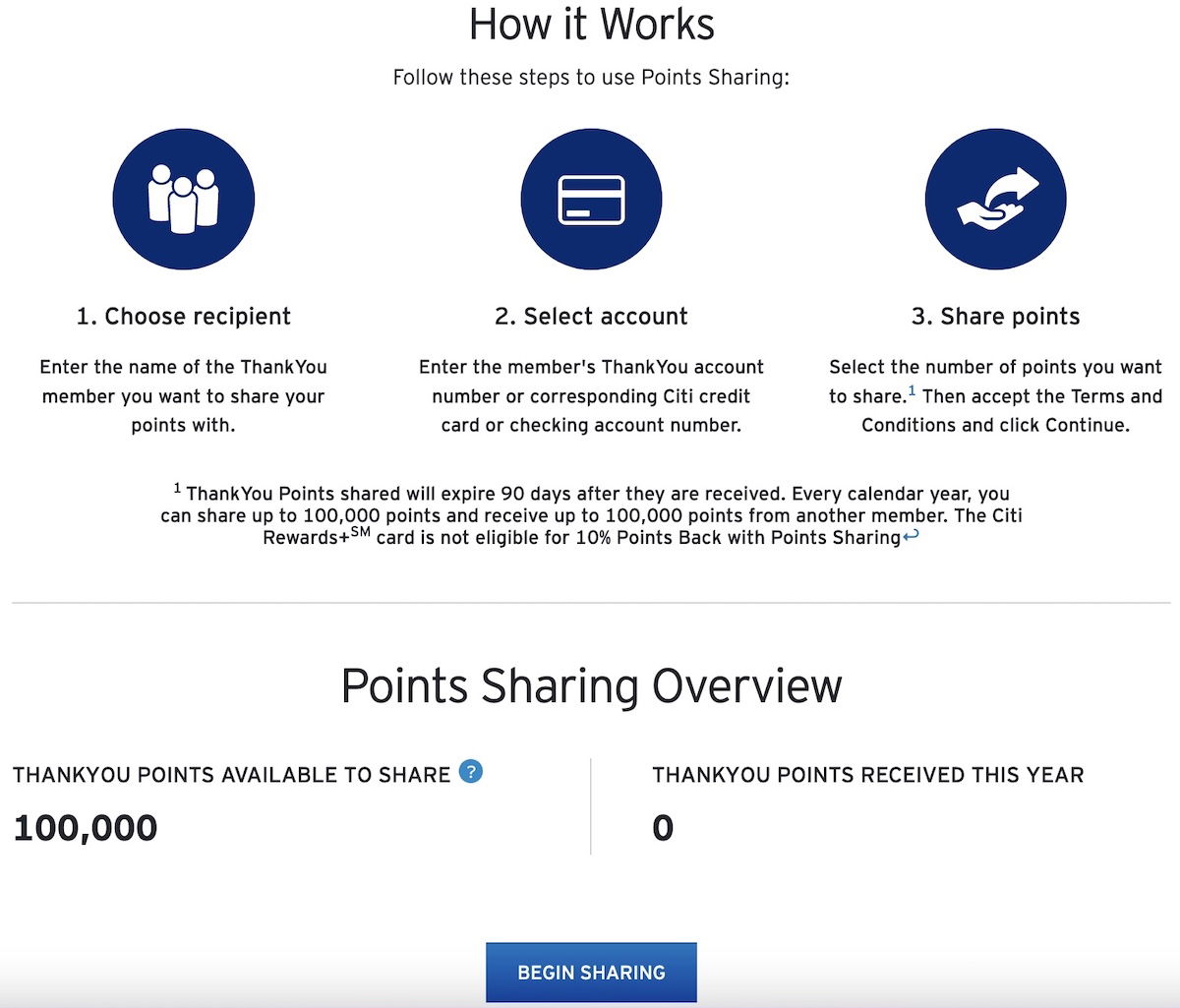

How do you go about doing this? Once you log into your account, click on “More Ways to Redeem,” and then “Points Sharing.”

There you’ll get a summary of how many points you can still transfer for the year. Click on the “Begin Sharing” button to start the process.

There you’ll first see a slider asking how many points you want to transfer.

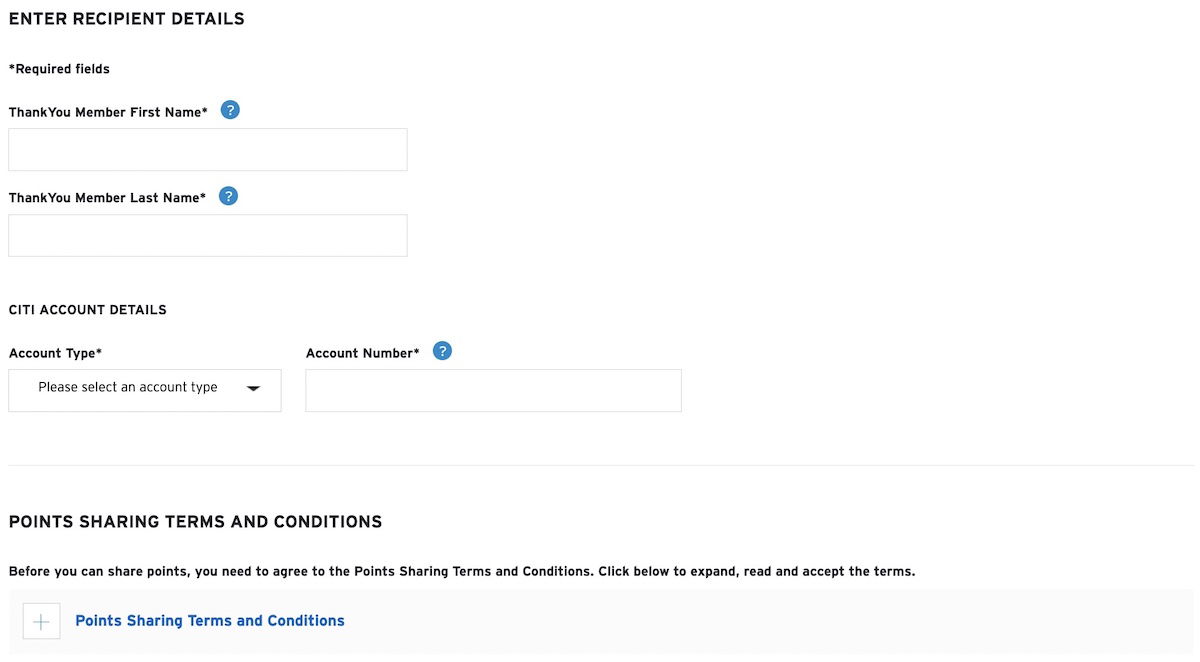

Then you’ll have to enter the ThankYou member’s first name and account number for where you want to transfer points. From there it should be an instant process.

Bottom line

Citi ThankYou is a valuable points currency, as it has quite a few useful airline and hotel partners. Hopefully the above is a useful rundown of how you can transfer, combine, and share Citi points with others.

The process of transferring points to airline and hotel partners is easy, as it is with most transferable points currencies. The same is true when combining points between Citi accounts, which can be done online at any point. The ability to share Citi points is an advantage of the program, but comes with restrictions — you can transfer up to 100K points per year, and points expire 90 days after they’re transferred.

To Citi cardmembers, what has your experience been with transferring, combining, and sharing points?

Question I combined my points is there a 90 days expiration to use them

It took 5 full days before my points were transferred from Citi to EVA Air.

This post is very helpful.

One comment regarding the combine points process: the current website does not appear to match the description and screenshots (at least for this US PC user w/ chrome).

Further, in my situation there was no way to execute the combination online. I had to call to complete the step. However, it was completed easily over the phone in about 10 minutes.

Thanks again for all the helpful info!

Keep in mind that there is a hard expiration for any points after 3 years, no way to extend it!

If I close my Citi Prestige card do I lose my citi double cash card points?

Is there any restrictions on shared ThankYou points? For example, can those shared points be transferred to airline miles before their expiration (assuming the recipient of shared points has a Citi credit card that allows such transfer on earned points)? I assume that's the case, but I've never tried it myself.

A couple years ago, Citi offered a one-time transfer of TYP to AA miles (a test I assume?). Would be nice if they could work out the internal challenges between Citi cards and the AA / Citi co-branded cards and adopt AA as a regular TYP transfer partner. Wishful thinking I suppose...

Managed to take advantage of that for a JAL F flight from ORD-HND. Sure hope that comes back as well!