Link: Apply now for the Marriott Bonvoy Brilliant® American Express® Card

Both American Express and Chase issue co-branded Marriott credit cards. In this post, I want to take a closer look at the Marriott Bonvoy Brilliant® American Express® Card, which is the most premium credit card in the portfolio. This card is quite compelling, and the easiest way to earn Platinum Elite status with Marriott Bonvoy.

In this post:

Marriott Bonvoy Brilliant Card Basics For April 2025

The Marriott Bonvoy Brilliant Card is Marriott’s most premium credit card. While the card has a hefty annual fee, the perks should more than justify the cost, in my opinion. The card even offers Marriott Bonvoy Platinum Elite status, without any sort of a spending requirement. This is a card I have, and that I’ve found to be valuable.

Let’s take a look at all of the details of the card, including the welcome offer, incredible benefits, and more.

Marriott Bonvoy Brilliant Card Welcome Offer

For applications through May 14, 2025, the Marriott Bonvoy Brilliant Card has a limited time welcome offer where you can earn a massive 185,000 Marriott Bonvoy bonus points after spending $6,000 within the first six months.

This is an excellent offer, nearly twice as generous as the offer we saw previously. I value Bonvoy points at 0.7 cents each, which makes the welcome offer worth $1,295 to me.

Marriott Credit Card Eligibility

Given how many American Express and Chase Marriott cards there are, there are some pretty complicated restrictions regarding eligibility for this card.

On the most basic level, the welcome offer is not available to applicants who have had this product, or the Starwood Preferred Guest Luxury Card (which is briefly what this card was known as).

Furthermore, the welcome offer is not available to applicants who:

- Have or have had The Ritz-Carlton Credit Card from JPMorgan or the J.P. Morgan Ritz-Carlton Rewards Credit Card in the last 30 days

- Have acquired the Marriott Bonvoy Bountiful Credit Card from Chase, the Marriott Bonvoy Boundless Credit Card from Chase, the Marriott Rewards Premier Plus Credit Card from Chase, the Marriott Bonvoy Premier Credit Card from Chase, the Marriott Rewards Premier Credit Card from Chase, the Marriott Bonvoy Bold Credit Card from Chase, the Marriott Bonvoy Premier Plus Business Credit Card from Chase, or the Marriott Rewards Premier Plus Business Credit Card from Chase, in the last 90 days

- Have received a new cardmember bonus or upgrade offer for the Marriott Bonvoy Bountiful Credit Card from Chase, the Marriott Bonvoy Boundless Credit Card from Chase, Marriott Rewards Premier Plus Credit Card from Chase, the Marriott Bonvoy Premier Credit Card from Chase, the Marriott Rewards Premier Credit Card from Chase, the Marriott Bonvoy Bold Credit Card from Chase, the Marriott Bonvoy Premier Plus Business Credit Card from Chase, or the Marriott Rewards Premier Plus Business Credit Card from Chase, in the last 24 months

The key thing to understand is that you are eligible for this card (including the welcome offer) if you have the Marriott Bonvoy Business® American Express® Card (review) or Marriott Bonvoy Bevy™ American Express® Card (review).

General Amex Card Restrictions

I find Amex cards easy to be approved for if you have excellent credit. Anecdotally most people I’ve heard from have reported instant approvals on this card, so it really shouldn’t be very tough to be approved for. Just make sure you know that:

- You can be approved for at most two Amex credit cards in a 90 day period

- You can have at most five American Express credit cards at any point (this doesn’t include cards without a preset spending limit)

See this post for all major credit card application restrictions to be aware of.

Marriott Bonvoy Brilliant Card $650 Annual Fee

The Marriott Bonvoy Brilliant Card has a $650 annual fee. You can add additional cardmembers at no extra cost (Rates & Fees).

No Foreign Transaction Fees

The Bonvoy Brilliant Card has no foreign transaction fees (Rates & Fees), so it could be a good option for your purchases abroad.

Earning Points With The Bonvoy Brilliant Card

The Marriott Bonvoy Brilliant Card has some bonus categories, though generally speaking this isn’t a card I’d be using for my everyday spending. However, the card does have a significant incentive to spend $60,000 per year, and the math could work out. Let’s talk about how the bonus categories on the card work.

6x Bonvoy Points At Marriott Hotels

The Marriott Bonvoy Brilliant Card offers 6x Bonvoy points on eligible purchases at Marriott hotels globally.

Since I value Bonvoy points at ~0.7 cents each, that’s the equivalent of a ~4.2% return on hotel spending. Personally, I still prefer to use the Chase Sapphire Reserve® (review) for my Marriott hotel spending, as it offers 3x Ultimate Rewards points.

3x Bonvoy Points On Restaurants & Flights

The Marriott Bonvoy Brilliant Card has some bonus categories that offer 3x points, including for purchases with:

- Restaurants worldwide

- Flights booked directly with airlines

Based on my valuation of ~0.7 cents per point, that’s like a ~2.1% return on spending, which isn’t amazing. Personally, I think there are better credit cards for both restaurant purchases and airfare purchases.

2x Bonvoy Points On All Other Purchases

The Marriott Bonvoy Brilliant Card offers 2x points on all other eligible purchases. Personally, I don’t consider 2x points per dollar spent to be especially compelling since I value that at a ~1.4% return on spending, and there are better cards for everyday spending.

Further Rewards For Spending $60K

The Marriott Bonvoy Brilliant Card allows you to select a Choice Rewards benefit when you spend $60,000 in a calendar year. Specifically, you’re able to choose one of the following:

- Five Suite Night Awards, each of which can be used to confirm a suite upgrade for one night up to five days prior to arrival

- A free night award, valid at a Marriott property costing up to 85,000 Marriott Bonvoy points

- $1,000 off a bed from Marriott Bonvoy boutiques

This is in addition to whatever Choice Benefits you’d ordinarily earn for crossing 50 or 75 elite nights in a year. This could be a real incentive to spend money on the card, especially when you consider the opportunity to get a free night certificate worth up to 85,000 points.

Marriott Bonvoy Brilliant Card Perks

The Marriott Bonvoy Brilliant Card offers a variety of perks, ranging from Platinum Elite status, to an annual dining credit of up to $300, to an anniversary free night certificate. For many people (including me), the benefits more than offset the annual fee on the card. Let’s take a look at some of the benefits offered by the card.

Complimentary Marriott Bonvoy Platinum Elite Status

On an ongoing basis, just for having the Bonvoy Brilliant Card, you receive complimentary Platinum Elite status in the Marriott Bonvoy program. This status ordinarily requires 50 elite nights per calendar year, and offers the following benefits:

- 50% bonus points on hotel stays

- 4PM late check-out

- A room upgrade, including to a standard suite

- Executive lounge access at most brands, assuming the hotel has a lounge

- A welcome gift, including breakfast at many brands

It’s amazing that you can now receive Platinum Elite status just for having a credit card, with no spending required. For what it’s worth, the Platinum Elite status earned with this card (as well as the elite nights) do count toward lifetime Marriott Bonvoy status.

Up To $300 Per Year In Restaurant Credits

Just for having the Marriott Bonvoy Brilliant Card, you receive up to $300 per year in restaurant statement credits. This comes in the form of a $25 credit each month, which you can use for purchases at restaurants worldwide. This benefit is available the first year, and all subsequent years.

This should be easy enough to maximize — if you spend at least $25 a month at restaurants, you should get the full value out of this.

Up To 85K Points Annual Free Night Reward

Another major perk that makes the Bonvoy Brilliant Card worthwhile is that you get a free night award every year on your renewal month, valid for a one-night hotel stay at a property costing up to 85,000 points. You receive your first one of these on your first anniversary.

The free night certificates offered on most other Marriott cards are valid at properties costing up to 35,000-50,000 points per night, so using these at properties costing 85,000 points per night is awesome. This gets you access to all kinds of luxury hotels.

Marriott even lets you top off free night certificates nowadays with up to 15,000 points, so you could redeem these certificates at hotels costing up to 100,000 points.

25 Elite Nights Toward Status

Just for having the Bonvoy Brilliant Card, you receive 25 elite nights toward status annually. Several co-branded Marriott credit cards offer elite nights for being a cardmember, though this is the only card to offer 25 elite nights. Furthermore, you can only receive this benefit on one personal and one business card.

So if you had this card plus the Marriott Bonvoy Business® American Express® Card, you’d start every year with 40 elite nights.

Of course you already get Platinum Elite status with this card, but those elite nights could come in handy if you want to earn Marriott Bonvoy Choice Benefits (like Nightly Upgrade Awards) or go for Marriott Bonvoy Titanium Elite or Marriott Bonvoy Ambassador Elite status.

$100 Ritz-Carlton & St. Regis Property Credit

The Bonvoy Brilliant Card also offers a $100 on-property credit at Ritz-Carlton and St. Regis hotels when you book stays of at least two nights. The catch is that you have to book an “eligible rate,” which is going to be equivalent to the best available/non-discounted rate.

Personally, I don’t consider that to be so valuable. Why?

- You have to book a specific rate, so points stays, discounted member rates, etc., don’t qualify

- All of these hotels belong to Marriott STARS, and some of these hotels belong to Virtuoso, which offer similar benefits

Priority Pass Select Membership

The Bonvoy Brilliant Card offers a Priority Pass select membership (Enrollment required), giving you access to 1,300+ lounges worldwide. You can bring two guests with you into lounges, space permitting. This is a great way to make your airport experience more pleasant.

Do be aware that those getting a Priority Pass membership through Amex don’t receive credits at Priority Pass restaurants.

TSA PreCheck Or Global Entry Credit

The Marriott Bonvoy Brilliant Card offers a statement credit for Global Entry (once every four years) or TSA PreCheck (once every 4.5 years). You’re eligible for either program, but not both. Simply charge the membership fee to your card, and it will automatically be reimbursed. It doesn’t matter who the fee is being paid for, as long as you charge it to your eligible card. (Enrollment required)

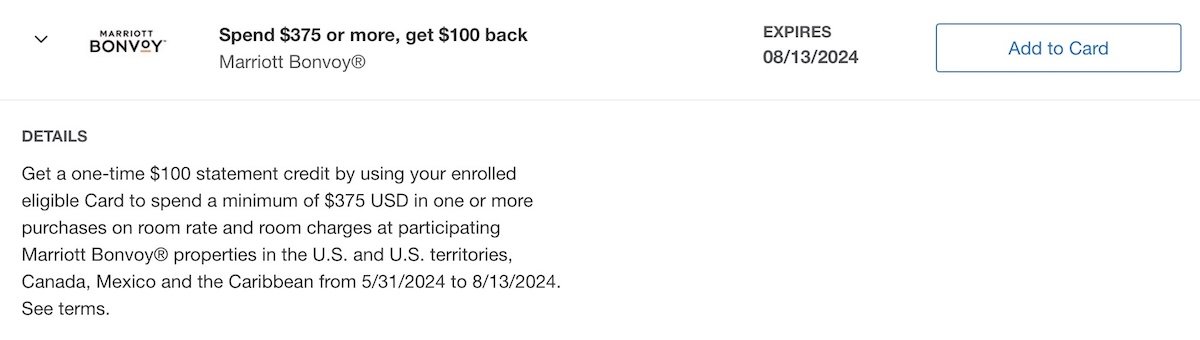

Amex Offers

One of the great features of Amex cards is access to Amex Offers, which gives members savings on purchases with all kinds of retailers. There’s huge value to be had in getting as many Amex cards as possible so that you can get these offers on multiple cards.

Is The Marriott Bonvoy Brilliant Amex Worth It?

If you stay at Marriotts with any frequency, the Bonvoy Brilliant Card is a slam dunk, in my opinion. The biggest perk is Platinum Elite status, so getting that just for having a credit card is huge.

Even beyond that, though, the annual fee is easy to justify. I consider the $300 restaurant credit to more or less be worth face value, while I think the free night certificate valid at a property costing up to 85,000 Bonvoy points is easily worth $350.

To me, that’s an excellent deal. The card has plenty of other perks that are also potentially valuable:

- The card offers a Priority Pass membership, giving you access to 1,300+ lounges around the world

- The card offers 25 elite nights toward status annually, which can help you achieve higher elite tiers, or receive Choice Benefits

- The card offers a TSA PreCheck or Global Entry fee credit, which is useful for security and immigration

Marriott Bonvoy Brilliant Vs. Bonvoy Bevy Card

American Express has two personal co-branded Marriott cards, with the other card being the Marriott Bonvoy Bevy™ American Express® Card (review), which has a $250 annual fee (Rates & Fees). Many people may be trying to decide between these two cards, so which is more compelling?

- The Bonvoy Bevy Card is arguably the best for Marriott spending, as it offers 6x points per dollar spent, plus 1,000 bonus points per Marriott stay

- The Bonvoy Bevy Card offers Gold Elite status just for being a cardmember plus 15 elite nights toward status annually

- The Bonvoy Bevy Card doesn’t offer an anniversary free night award just for being a cardmember, but instead you have to spend $15,000 on the card per calendar year to get a free night award; that free night award is worth up to 50,000 points

I prefer the Bonvoy Brilliant Card, since I think it’s worth paying for the Platinum Elite status and the valuable free night award. On top of that, the $300 restaurant credit also helps offset the annual fee. Some may feel differently, but I think the choice here is pretty obvious.

Bottom Line

The Marriott Bonvoy Brilliant Card is Marriott’s most premium credit card. The card has a $650 annual fee, but offers perks like Platinum Elite status, an up to $300 annual restaurant credit, an annual free night certificate valid at a property costing up to 85K points, and much more. Add in all the money-saving offers available with Amex Offers, and you should easily come out ahead with this card.

If you’ve been considering applying for this card, now would be the time to do so, given the elevated welcome offer that’s available.

If you want to learn more about the Marriott Bonvoy Brilliant Card or apply, follow this link.

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: Marriott Bonvoy Brilliant® American Express® Card (Rates & Fees), and Marriott Bonvoy Bevy™ American Express® Card (Rates & Fees).

Too many Plat and above Elites on Marriott already - they keep reducing lounges.

One strategy is to get this card and keep it for 10 years until you earn lifetime Platinum Status with bonvoy. Then, cancel the card.

You still need 600 Elite Night Credits.