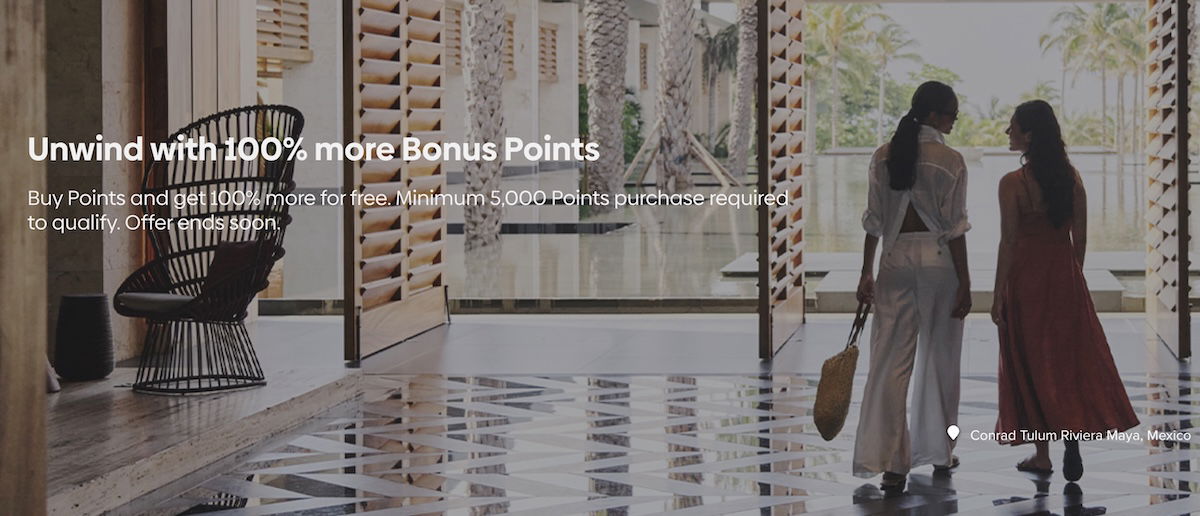

Hilton Honors has just launched its newest bonus on purchased points, which is in line with the best offers we see from the program, and could represent a great value for hotel redemptions.

In this post:

Promotion on purchased Hilton Honors points

Through Thursday, July 24, 2025, Hilton Honors is offering a bonus on purchased points. Different members may be targeted for different bonuses, so you’ll want to log into your account to see what you’re eligible for. It would appear that the best offer is for up to a 100% bonus, which kicks in when you purchase at least 5,000 points in one transaction.

How much does it cost to buy Hilton Honors points?

Hilton Honors ordinarily charges one cent per purchased point, including all taxes and fees. That’s before any discounts or bonuses. If you’re eligible for the 100% bonus and maxed out the offer, you’d receive a total of 320,000 points at a cost of $1,600, which is a rate of 0.5 cents per Hilton Honors point.

When Hilton Honors offers a promotion on purchased points, it’s typically for either a 100% bonus or 50% discount, so this offer is in line with the best deals from the program.

How many Hilton Honors points can you buy?

Hilton Honors lets you buy up to 160,000 points per account per calendar year, before any bonuses. With a 100% bonus, that means you could purchase up to 320,000 points.

Do note that Hilton lets you combine points across accounts at no cost, so in reality you could acquire substantially more points by simply buying them across accounts and then consolidating them.

Which credit card should you buy Hilton Honors points with?

Hilton Honors point purchases are processed by points.com, meaning they don’t count as a hotel purchase for the purposes of credit card spending.

I’d recommend using a card with which you’re trying to reach a minimum spending requirement, or a credit card that maximizes your return on everyday spending, like the Chase Freedom Unlimited® (review), Citi Double Cash® Card (review), or Capital One Venture Rewards Credit Card (review).

When in doubt, review which credit cards are best for buying points and miles.

- Earn 1% cash back when you make a purchase, earn 1% cash back when you pay for that purchase

- $0

- Earn 3% Cash Back on Dining

- Earn 3% Cash Back at Drugstores

- Earn 1.5% Cash Back On All Other Purchases

- $0

- 2x points on purchases up to $50k then 1x

- Access to Amex Offers

- No annual fee

Is buying Hilton Honors points worth it?

There’s potentially huge value to be had buying Hilton Honors points. Hilton Honors sells points at a reasonable cost, has lots of aspirational properties, has good redemptions with a fifth night free opportunity, and elite status is also easy to earn with the program. Hilton’s partnership with Small Luxury Hotels of the World (SLH) is also awesome, and offers great new redemption opportunities.

When you combine those factors, buying points can be a great deal.

How many points do you need for a free night at a Hilton?

Hilton Honors doesn’t have a published award chart, but rather the program has dynamic award pricing. This means that the cost of a standard free night award can vary depending on the day of the week, time of year, etc.

As a general rule of thumb, Hilton Honors free night awards start at 10,000 points per night, and go up to 200,000 points per night.

Sometimes you’ll see award costs that are way higher than these amounts. In those situations it’s because there’s not a standard room available, so higher pricing kicks in for premium rooms. That’s generally not nearly as good of a use of Hilton Honors points.

What is the Hilton Honors fifth night free benefit?

If you have Hilton Honors elite status (which is easy to earn, as I’ll outline below), you receive a fifth night free on award redemptions. This is a way to stretch your points even further, and whenever possible, I’d recommend making your Hilton Honors award stays in increments of five nights.

To take advantage of this, just log into your Hilton Honors elite account, and go through the process of making an award booking for five nights. When you get to the booking page, you should notice that the cost of the fifth night is automatically deducted.

Tip: Easily earn Hilton Honors elite status

One thing I love about the program is how easy it is to earn elite status with credit cards, including both Hilton Gold elite status and Hilton Diamond elite status. These tiers offer perks like room upgrades, complimentary breakfast, hotel credits, and more. For example:

- The Hilton Honors American Express Aspire Card (review) offers Diamond status for as long as you have the card

- The Hilton Honors American Express Surpass® Card (review) and Hilton Honors American Express Business Card (review) offer Hilton Gold status for as long as you have the card

- The Platinum Card® from American Express (review) and The Business Platinum Card® from American Express (review) offer Hilton Gold status for as long as you have the card (Enrollment required)

The information and associated card details on this page for the Hilton Honors American Express Aspire Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

What are some good uses of Hilton Honors points?

There are so many amazing hotels where you can redeem Hilton Honors points and get great value. Just to give a few examples of what I’ve redeemed for in recent years (not factoring in the fifth night free):

- The Conrad Bora Bora is often bookable for 120,000 Honors points per night; this is a gorgeous resort, and paid rates are often over $1,000 per night

- Zemi Beach House Anguilla is often bookable for 110,000 Honors points per night; this is an awesome Caribbean resort, and paid rates are often over $1,000 per night

- The Waldorf Astoria Beverly Hills is often bookable for 120,000 Honors points per night; this is one of my favorite city hotels in the United States, and paid rates are often over $750 per night

- The Waldorf Astoria Amsterdam is often bookable for 120,000 Honors points per night; this is one of my favorite city hotels in the world, and paid rates are often over $800 per night

- The Waldorf Astoria Los Cabos is often bookable for 120,000 Honors points per night; I’ve stayed here and had an incredible stay, and paid rates are often over $1,000 per night

- The Waldorf Astoria Maldives is often bookable for 150,000 Honors points per night; this is an amazing hotel I’ve stayed at, and paid rates are often over $2,000 per night

As you can tell, it’s not hard to do the math here and realize the potential for outsized value, when you consider an acquisition cost of 0.5 cents per point, and the potential for a fifth night free.

Do Hilton Honors points expire?

Hilton Honors points don’t expire as long as you have at least some account activity once every 24 months. Eligible account activity includes earning or redeeming points, so buying points would even reset the expiration of your points.

How much are Hilton Honors points worth?

Everyone will value points differently, but personally I value Hilton Honors points at 0.5 cents each, and I tend to value points pretty conservatively. As you can see, the pricing here is roughly in line with how much I value these points, and there are ways to get a ton of outsized value with this promotion.

Does Hilton Honors have blackout dates?

Hilton Honors doesn’t have blackout dates on award nights, and all standard rooms are available for award redemptions. So this is about as good of a policy as you’ll find with any hotel group when it comes to award room availability.

How else can you earn Hilton Honors points?

There are lots of ways to earn Hilton Honors points, beyond just staying at Hilton properties or buying the points directly. You can easily earn points by using Hilton Honors’ co-branded credit cards, which also offer great welcome bonuses. These cards include the following:

- Hilton Honors American Express Aspire Card (review)

- Hilton Honors American Express Surpass® Card (review)

- Hilton Honors American Express Business Card (review)

- Hilton Honors American Express Card (review)

While you can also transfer points from Amex Membership Rewards to Hilton Honors, I tend to think this doesn’t represent a very good deal, given how valuable Amex points are.

The information and associated card details on this page for the Hilton Honors American Express Aspire Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Bottom line

Hilton Honors is currently offering a bonus on purchased points, whereby members can receive up to a 100% bonus, which is an opportunity to acquire points for 0.5 cents each. This is as good as deals from the program get. With a short term use in mind, there are plenty of situations where this could represent a good deal.

Do you plan on buying Hilton Honors points with a bonus?

There are currently no responses to this story.

Be the first to respond.