Link: Apply now for the Citi® / AAdvantage® Executive World Elite Mastercard®

Co-branded credit cards are big businesses for airlines, and in many cases, a large percentage of their profits come from frequent flyer programs, and the lucrative arrangements they have with banks.

When thinking of premium credit cards, the first cards that come to mind are probably The Platinum Card® from American Express, the Chase Sapphire Reserve®, and the Capital One Venture X Rewards Credit Card.

However, a premium airline credit card arguably gets me as much value as some other premium cards, if not more. I’ll take a closer look at the card in this post.

In this post:

Citi AAdvantage Executive Card Basics For May 2025

American Airlines has co-branded cards issued by both Barclays and Citi, and the most premium card in the portfolio is the Citi® / AAdvantage® Executive World Elite Mastercard®. This card offers the strongest lounge access perk of any airline credit card.

Let’s look at all major aspects of this card, including the welcome bonus, return on spending, benefits, and more.

Welcome Bonus Of 70,000 AAdvantage Miles

The Citi AAdvantage Executive Card has a welcome bonus of 70,000 American AAdvantage miles after spending $7,000 within the first three months.

Personally, I value American AAdvantage miles at ~1.5 cents each, so to me, those miles are worth about $1,050. That’s a solid bonus, especially for a card that also offers a lot of value in the long run.

Note that the bonus miles aren’t available to those who have received a new cardmember bonus for this card in the past 48 months (however, you are eligible if you’ve had a different American Airlines credit card, including if you’ve received a bonus on a different product).

Then there are the typical rules for Citi credit card applications, including that you can apply for at most one card with Citi every eight days, and at most two cards every 65 days.

Annual Fee & Authorized User Fee

The Citi AAdvantage Executive Card has a $595 annual fee. There’s also a lot of value to adding authorized users (as I’ll discuss below). You can expect to pay a total of $175 for up to three authorized users (so potentially under $60 each), and then each authorized user after that costs $175.

Rewards Structure & Earning Loyalty Points

When it comes to spending money on the Citi AAdvantage Executive Card, here’s the rewards structure:

- Earn 10x AAdvantage miles on eligible rental cars booked through aa.com/cards, and eligible hotels booked through aa.com/hotels

- Earn 4x AAdvantage miles on eligible American Airlines purchases; furthermore, after spending $150,000 on the card in a calendar year, cardmembers can earn a total of 5x AAdvantage miles on eligible American Airlines purchases for the remainder of the calendar year

- Earn 1x AAdvantage miles on all other purchases

In terms of the reward for spending, there are potentially better cards for purchasing airline tickets, and also better cards for everyday spending. However, keep in mind that the most compelling reason to spend money on the card is in order to earn elite status with American Airlines. American Airlines uses its Loyalty Points system for status qualification, and credit card spending can help you earn status.

American’s elite requirements are currently as follows, and you earn one Loyalty Point for every dollar spent on an American Airlines credit card:

- AAdvantage Gold status requires 40,000 Loyalty Points

- AAdvantage Platinum status requires 75,000 Loyalty Points

- AAdvantage Platinum Pro status requires 125,000 Loyalty Points

- AAdvantage Executive Platinum status requires 200,000 Loyalty Points

Spending on the Citi AAdvantage Executive Card could earn you elite status, which I know will interest many. That’s the primary reason you’ll want to consider this card.

Earn Up To 20,000 Bonus Loyalty Points

In addition to earning one Loyalty Point for every dollar spent on the Citi AAdvantage Executive Card, you can also earn up to 20,000 Loyalty Points every year just for being a cardmember:

- Earn 10,000 bonus Loyalty Points when you earn 50,000 Loyalty Points with AAdvantage in a status qualification year

- Earn 10,000 bonus Loyalty Points when you earn 90,000 Loyalty Points with AAdvantage in a status qualification year

In other words, if you’d otherwise earn 90,000 Loyalty Points per status year (it doesn’t have to be from spending on the card), then having this card will get you an extra 20,000 Loyalty Points. This could be quite the advantage in terms of earning elite status, qualifying for Loyalty Point Rewards, and even upgrade priority.

The AAdvantage elite qualifying year goes from the beginning of March until the end of February of the following year.

No Foreign Transaction Fees

The Citi AAdvantage Executive Card has no foreign transaction fees, so this can be a good option for purchases abroad.

Citi AAdvantage Executive Card Lounge Benefit

One of the main reasons you may want to get the Citi AAdvantage Executive Card is because of the lounge access perks that the card offers. Having this card is the best way to access Admirals Clubs. Let’s discuss how that works.

Receive An Admirals Club Membership

The primary cardmember on the Citi AAdvantage Executive Card receives a full Admirals Club membership. That in and of itself is a reason this card makes sense.

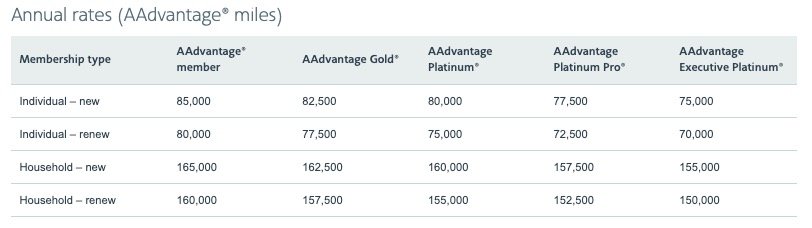

Ordinarily, if you buy an individual Admirals Club membership you’ll be paying anywhere from $700 to $850 per year, depending on your AAdvantage status, and also depending on whether you’re a new member or are renewing your membership.

By getting an Admirals Club membership with the Citi AAdvantage Executive Card you’re saving $105-255 right off the bat.

Note that while you can redeem miles for an Admirals Club membership, this represents a terrible value, as you’re getting just a cent of value per mile.

This is a full Admirals Club membership, so you don’t even have to bring your credit card, as your membership will be linked to your AAdvantage number:

- You can access Admirals Clubs worldwide when flying American Airlines or a oneworld partner airline

- You’re allowed to bring immediate family (spouse, domestic partner and/or children under 18) or up to two guests

- Admirals Club members also receive access to Alaska Lounges, as well as access to dozens of other partner lounges, including lounges of Japan Airlines and Qantas (you can find the full lounge directory here)

Note that Admirals Club members don’t get access to Flagship Lounges, as that access is determined based on the ticket you purchased rather than any membership.

How Soon Is Your Admirals Club Membership Activated?

Many people may be considering applying for the Citi AAdvantage Executive Card shortly before taking an American Airlines trip. How soon after being approved for the card does your Admirals Club membership kick in?

Since the primary cardmember gets a full Admirals Club membership, it’s linked to their AAdvantage account. Many may be surprised to learn that this membership could very well kick in before you even receive your credit card in the mail, and you don’t even need your card to enter a lounge.

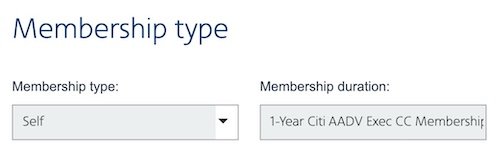

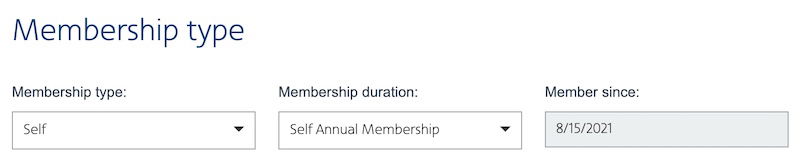

Fortunately, there’s an easy way to tell if your Admirals Club membership has been activated. To figure it out, pretend that you’re signing up for an Admirals Club membership. Go to this page, enter your AAdvantage number, last name, and password.

If your account has already been updated to reflect the Admirals Club membership, you’ll see that the next page shows “1-Year Citi AADV Exec CC Membership.”

If it hasn’t been updated, you’ll see that it gives you the option of choosing what kind of membership you want to purchase.

Note that this only works for the primary cardmember. Since the authorized users don’t get a full Admirals Club membership, they wouldn’t show up as being eligible online. Authorized users need to present the physical Citi AAdvantage Executive Card, since there’s no membership linked to their AAdvantage account.

Add Authorized Users for Admirals Club Access

The Citi AAdvantage Executive Card also offers Admirals Club access for authorized users. As I explained above, you can add up to three authorized users for a total of $175, which potentially comes out to under $60 per authorized user. I’d say that’s a real sweet spot, since securing lounge access for friends and family for under $60 each is an amazing value.

Note that authorized users receive Admirals Club access and not a membership, so there are the restrictions:

- They’ll need to present their authorized user card to access the lounge, since they don’t have a membership tied to their AAdvantage number

- They need to be flying American Airlines or a oneworld partner airline the same day to access lounges

- They can bring immediate family (spouse, domestic partner and/or children under 18) or up to two guests

- They can’t access partner lounges, including Alaska Lounges

For the purposes of accessing Admirals Clubs this is more or less the same as an outright membership.

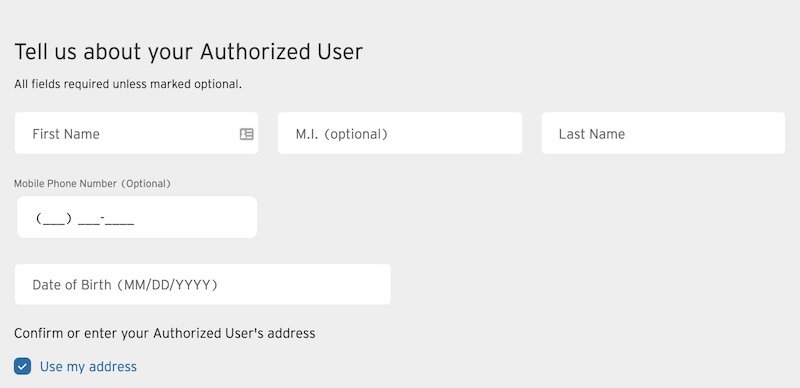

How To Add Authorized Users To The Citi AAdvantage Executive

Adding authorized users to the Citi AAdvantage Executive Card is super easy, and can be done directly on Citi’s website. Follow this link to access the part of the Citi website where you add authorized users, and then log into your account.

On the next page, you’ll be able to manage authorized users, including adding and removing them.

You’ll just need their name to add them, and you have the choice of whether or not you want to give them permission to access your online account.

Make sure you trust all your authorized users, since any charges they incur will be your responsibility.

Citi AAdvantage Executive Card Benefits

The primary reason to get the Citi AAdvantage Executive Card is because of the great welcome bonus, ability to earn status with spending, ability to receive 20,000 Loyalty Points annually just for being a cardmember, and Admirals Club benefit.

However, the card offers some other perks that could add a lot of value for card members. These perks range from priority check-in, to early boarding, to a Global Entry or TSA PreCheck fee credit, or credits with Avis, Budget, Grubhub, and Lyft.

Below is what you need to know about all the other perks of the Citi AAdvantage Executive Card.

First Checked Bag Free

Those with the Citi AAdvantage Executive Card receive a first checked bag free on domestic American Airlines itineraries not just for themselves, but also for up to eight companions traveling on the same reservation. There’s no need to actually pay for the ticket with your Citi AAdvantage Executive Card — you just have to make sure it’s linked to your AAdvantage account (this benefit applies for the primary cardmember only).

American ordinarily charge $40 for the first checked bag, so that’s a $80 value per person roundtrip (and if you had eight companions all checking a bag, that would be a value of $720).

Priority Check-In, Priority Screening, Early Boarding

For being the primary cardmember on the Citi AAdvantage Executive Card you receive several valuable airport benefits, including priority check-in, priority airport screening, and early boarding. These are all features that can save you time and money.

There’s no need to show your card, as these perks should automatically be reflected with your ticket when you have your credit card linked to your AAdvantage account (which is automatic when you’re the primary cardmember).

Up To $120 Back With Avis & Budget Annually

Just for having the Citi AAdvantage Executive Card, you can receive up to $120 back on eligible Avis or Budget rentals every calendar year. Just charge an eligible purchase to your card each year, and you’ll receive a statement credit up to the $120 limit. This can be used toward a single rental or multiple rentals. If you rent with Avis and Budget with any frequency, this could be worth face value.

Up To $120 Back With Grubhub Annually

Just for having the Citi AAdvantage Executive Card, you can receive up to $120 back on eligible Grubhub purchases every calendar year. This comes in the form of up to $10 in statement credits with Grubhub each billing cycle. Just charge at least that much to your card from Grubhub each billing cycle, and you’ll receive the credit.

Up To $120 In Lyft Credits Annually

The Citi AAdvantage Executive Card offers up to $120 in Lyft credits every year. This comes in the form of a $10 Lyft credit each month after taking three eligible rides. Admittedly this requires quite a bit of effort to use, so not everyone will get value from that.

Global Entry Or TSA PreCheck Credit

The Citi AAdvantage Executive Card offers a Global Entry or TSA PreCheck credit once every four years. Simply charge the purchase to your card and it will automatically be reimbursed. You don’t have to be the one signing up — you can always pay for a friend or family member who is signing up instead.

Personally, I always recommend applying for Global Entry, because Global Entry automatically comes with TSA PreCheck, while the inverse isn’t true.

World Elite Mastercard Perks

The Citi AAdvantage Executive Card is a World Elite Mastercard, meaning that it comes with quite a few benefits you may not be familiar with. In addition to the concierge service, there are also savings and other perks with a variety of businesses, ranging from DoorDash, to HelloFresh, to Lyft.

Is The American Executive Card Worth It?

The Citi AAdvantage Executive Card is a lucrative card that I personally have and also recommend, but only if you’re a frequent flyer with American. If you fly American with any frequency then an Admirals Club membership is valuable, and this is the best way to get an Admirals Club membership. There can even be value in adding up to three authorized users, which will cost a total of $175, as they’d get Admirals Club access as well.

In addition to lounge access, the card offers up to 20,000 Loyalty Points per year (even without spending money on the card), which can make a big difference for anyone chasing status with American. Furthermore, the card offers up to $360 in various credits per year, which can help offset the annual fee. Not everyone will get full value out of that, but there are definitely ways to earn some savings there.

Is This The Best Card For Lounge Access?

The Citi AAdvantage Executive Card is the best card for lounge access if you’re a frequent flyer on American Airlines. However, if you fly a variety of airlines, I think going with another premium card is a better option:

- The Chase Sapphire Reserve (review) offers a Priority Pass membership and access to Chase Sapphire Lounges

- The Capital One Venture X (review) offers a Priority Pass membership and access to Capital One Lounges

- The Amex Platinum (review) offers a suite of lounge access perks, including a Priority Pass membership, access to Amex Centurion Lounges, and access to Delta Sky Clubs when flying Delta same day (Enrollment required)

Note that none of those cards gets you access to any American Airlines Admirals Clubs, though.

Bottom Line

The Citi AAdvantage Executive Card isn’t for everyone. If you’re not a frequent flyer on American then you shouldn’t consider this card. However, if you are a frequent flyer on American then this card is totally for you.

While Admirals Clubs aren’t anything to get too excited about, there’s still huge value in the complimentary snacks and drinks, free Wi-Fi and quiet places to sit, and access to an agent in the event your flight has irregular operations.

Even beyond the Admirals Club membership, the card offers other useful perks, like the ability to earn Loyalty Points, priority services with American, and the ability to receive credits with Avis, Budget, Grubhub, and Lyft. I’ve had the Citi AAdvantage Executive Card for years, and love it.

Can I stack the Citi LP perks with the LP perks with the 15k bonus LPs I earn via my Barclays Aviator Silver?

It would be a great card if access to Admirals Club wasn't restricted to those flying American or OW... At least with Centurion, Chase or C1 lounges, you don't have this restriction. It's a shame because I would love having access to the DCA lounge.

Do the 10k LP bonuses work if you get the card after hitting one of the thresholds. Assuming I already have 100k Plus LP for the year, will I get 20k additional points right away or will that only be an option in the following year

@ Steve -- You could still get the 20K points for this year. :-)

Ben, it's worth noting that the *portal* side of points (separate and addition to the Card's side of points) on the bookings via AA Hotels can be highly efficient. Stays of three or four days at modestly to moderately priced properties can yield over 10X miles and Loyalty Points per dollar . . . on top of the 10X the Card earns . . . for a total of over 20X miles per dollar. For some, this can be a tremendous card. (Not so good for high-end hotels.)

@ Lee -- That's a great point, thanks!