Link: Apply now for the Citi® / AAdvantage® Executive World Elite Mastercard®

The Citi® / AAdvantage® Executive World Elite Mastercard® (review) is American Airlines’ most premium credit card. While the card has a $595 annual fee, it offers all kinds of perks, including an Admirals Club membership.

For those looking to qualify for elite status with American AAdvantage, one of the most interesting aspects of the card is the ability to earn Loyalty Points. While most co-branded American AAdvantage credit cards let you earn Loyalty Points, this card offers the ability to earn 20,000 bonus Loyalty Points per year unrelated to spending, which is a perk you won’t find on any other card.

In this post, I want to take a closer look at how that works.

In this post:

Earning Loyalty Points with the Citi AAdvantage Executive Card

Loyalty Points is the name of the system by which you can earn elite status with American AAdvantage. Status with the airline no longer has anything to do with how much you fly, but rather has to do with how many Loyalty Points you rack up, regardless of whether it’s from flying or non-flying activities, like credit card spending.

As a reminder, here are the AAdvantage elite status requirements:

- AAdvantage Gold status requires 40,000 Loyalty Points

- AAdvantage Platinum status requires 75,000 Loyalty Points

- AAdvantage Platinum Pro status requires 125,000 Loyalty Points

- AAdvantage Executive Platinum status requires 200,000 Loyalty Points

Also keep in mind that American has the Loyalty Point Rewards program, allowing you to earn extra perks, like systemwide upgrades, for passing certain thresholds.

So, how does the Citi AAdvantage Executive Card factor into all of this? Let’s talk about how you can use the card to earn Loyalty Points for spending, and also how you can earn Loyalty Points just for having the card.

Earn one Loyalty Point per dollar spent

Like most American Airlines credit cards, the Citi AAdvantage Executive Card offers one Loyalty Point per eligible dollar spent on the card. In other words, spending $200,000 on the card would earn you 200,000 Loyalty Points (and in turn, Executive Platinum).

Note that miles earned from the welcome bonus, as well as miles earned from spending multipliers, don’t earn you additional Loyalty Points. For example, the card earns 4x AAdvantage miles on American Airlines purchases. So while you’d get four redeemable miles per dollar spent on those purchases, you’d only earn one Loyalty Point per dollar spent.

Earn 20,000 bonus Loyalty Points per year

This is where the Citi AAdvantage Executive Card gets interesting, and offers something you won’t find on any other American Airlines credit card. Those who have the Citi AAdvantage Executive Card can earn up to 20,000 bonus Loyalty Points per year, without actually needing to spend a dime on the card:

- Earn 10,000 bonus Loyalty Points when you earn 50,000 Loyalty Points in a status qualification year

- Earn 10,000 bonus Loyalty Points when you earn 90,000 Loyalty Points in a status qualification year

In other words, if you’d ordinarily earn 90,000 Loyalty Points in a year, having this card would earn you 20,000 bonus Loyalty Points. There’s not another American credit card that offers bonus Loyalty Points just for surpassing certain thresholds in the program, unrelated to card spending.

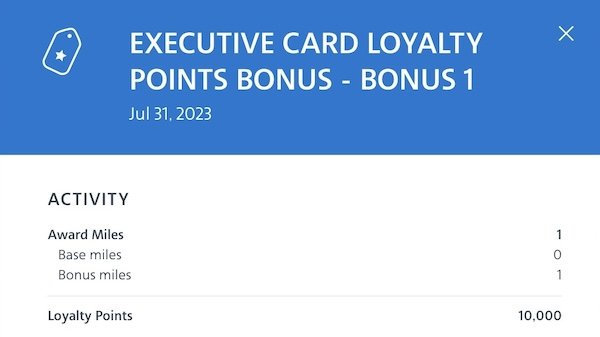

For example, below is a look at how the 20,000 bonus Loyalty Points posted to my AAdvantage account in 2023. This was based purely on having the card, and not based on any credit card spending.

Just to cover some of the basic questions people may have about this perk:

- Bonus Loyalty Points will officially post within 8-10 weeks of meeting the Loyalty Points requirement; however, in practice they seem to post much faster than that

- You can earn at most 20,000 bonus Loyalty Points from from this card per status qualifying year, not accounting for the Loyalty Points you earn for spending (the status qualifying year goes from the beginning of March until the end of February of the following year)

- You’re still eligible for this benefit if you open your card during the status qualifying year; so you don’t need to have the card open at the start of the membership year to qualify for this, but rather the bonus Loyalty Points will post retroactively

- The first threshold of 10,000 bonus Loyalty Points counts toward the second threshold; in other words, if you earned 80,000 Loyalty Points outside of this benefit, you’d earn 20,000 bonus Loyalty Points, since the first bonus of 10,000 Loyalty Points would trigger the second bonus (by getting you to 90,000 bonus Loyalty Points)

How valuable is this Loyalty Points perk?

If you’re going for elite status with American AAdvantage, how valuable is the opportunity to earn Loyalty Points with the Citi AAdvantage Executive Card?

When it comes to earning one Loyalty Point per dollar spent, I’ve written in the past about my thoughts on the value proposition of that:

- I don’t think it’s worth spending your way all the way to elite status, though at the margins I think it could be worthwhile (say you’d earn 125K Loyalty Points through flying, and then earn 75K Loyalty Points with a credit card, to earn Executive Platinum)

- There’s just such an opportunity cost to spending on an American credit card. vs. another card that might be more rewarding in terms of everyday spending, bonus categories, etc.

I think the more interesting question is the value proposition of earning up to 20,000 Loyalty Points just for having the card. If you’d otherwise earn 90,000 Loyalty Points per year, is that alone a reason you should get this card?

- The card has a $595 annual fee, so if you don’t value any of the perks of the card, that would be like “buying” Loyalty Points for just under three cents each (without any corresponding redeemable miles); I wouldn’t consider that to be an amazing deal

- Loyalty Points are most valuable if they help you reach a specific threshold (either for elite status or Loyalty Point Rewards), though keep in mind that the higher your Loyalty Points total, the higher your upgrade priority

- Personally I wouldn’t get the card exclusively for the 20,000 bonus Loyalty Points, though rather I’d view it as part of a suite of benefits; personally I find the annual fee justifiable based on the Admirals Club membership, the 20,000 Loyalty Points, and all of the other perks, including up to $360 in credits annually with Avis/Budget, Grubhub, and Lyft

- If I had to put a valuation to the 20,000 bonus Loyalty Points, I’d probably say that to me they’re worth $200-300

Bottom line

The Citi AAdvantage Executive Card is American’s most premium credit card. In addition to the card offering one Loyalty Point per dollar spent, you can also receive up to 20,000 bonus Loyalty Points per year just for being a cardmember, assuming you earn at least 90,000 Loyalty Points.

This is the only American credit card that offers bonus Loyalty Points without any sort of a spending requirement. So if you’re into the AAdvantage program, that perk is a reason to seriously consider the card, in addition to all the other benefits.

What do you make of the Loyalty Points perks offered by the Citi AAdvantage Executive Card?

I value this 20K LP in a different way. I am an Exec Plat with AA and I would have had to spend $1,667 on air fare on the Citi Exec card to earn those 20K LP (the cash spend and the math will be a bit different considering the taxes and fees don't count towards the 11X multiplier but would count in the 1 LP per dollar spent). To me, this cash outlay savings...

I value this 20K LP in a different way. I am an Exec Plat with AA and I would have had to spend $1,667 on air fare on the Citi Exec card to earn those 20K LP (the cash spend and the math will be a bit different considering the taxes and fees don't count towards the 11X multiplier but would count in the 1 LP per dollar spent). To me, this cash outlay savings of $1,667 is the value of the 20K LPs benefit. Of course, as you mentioned, its valuable if going for Emerald status.

Agree - I view the 20K LP as a valuable benefit. Combine that with the Barclay Silver 15K LP for $50K Speed - that is 35K LP. I do like the 4X miles for AA purchases (Barclay is only 3X) - all helps - I redeem lots of AA miles - at the low levels for international premium travel.

You can pretty much sneeze and make it to gold status. I miss priority boarding. One thing I’m not used to since leaving American for United / LX /LH is being seated in row 44 and once boarding starts I can expect to be onboard to my seat in about 35 minutes . It’s nice to board quickly . I’m seated in the back of the bus now.