It’s a new elite year at American AAdvantage, so in this post I want to provide an updated guide to American Airlines’ Loyalty Points program. For context, American made radical changes to its loyalty program in 2022, as the airline completely reimagined how elite status is earned, and eliminated the concept of elite qualifying miles and elite qualifying dollars.

With this program, earning AAdvantage elite status has been significantly simplified, and doesn’t just account for how much you fly with American, but also factors in how much you engage with American’s partners. You can earn top tier status exclusively through credit card spending, if you want to.

In this post I want to cover everything you need to know about the Loyalty Points program for 2025-2026.

In this post:

Earn American AAdvantage elite status with Loyalty Points

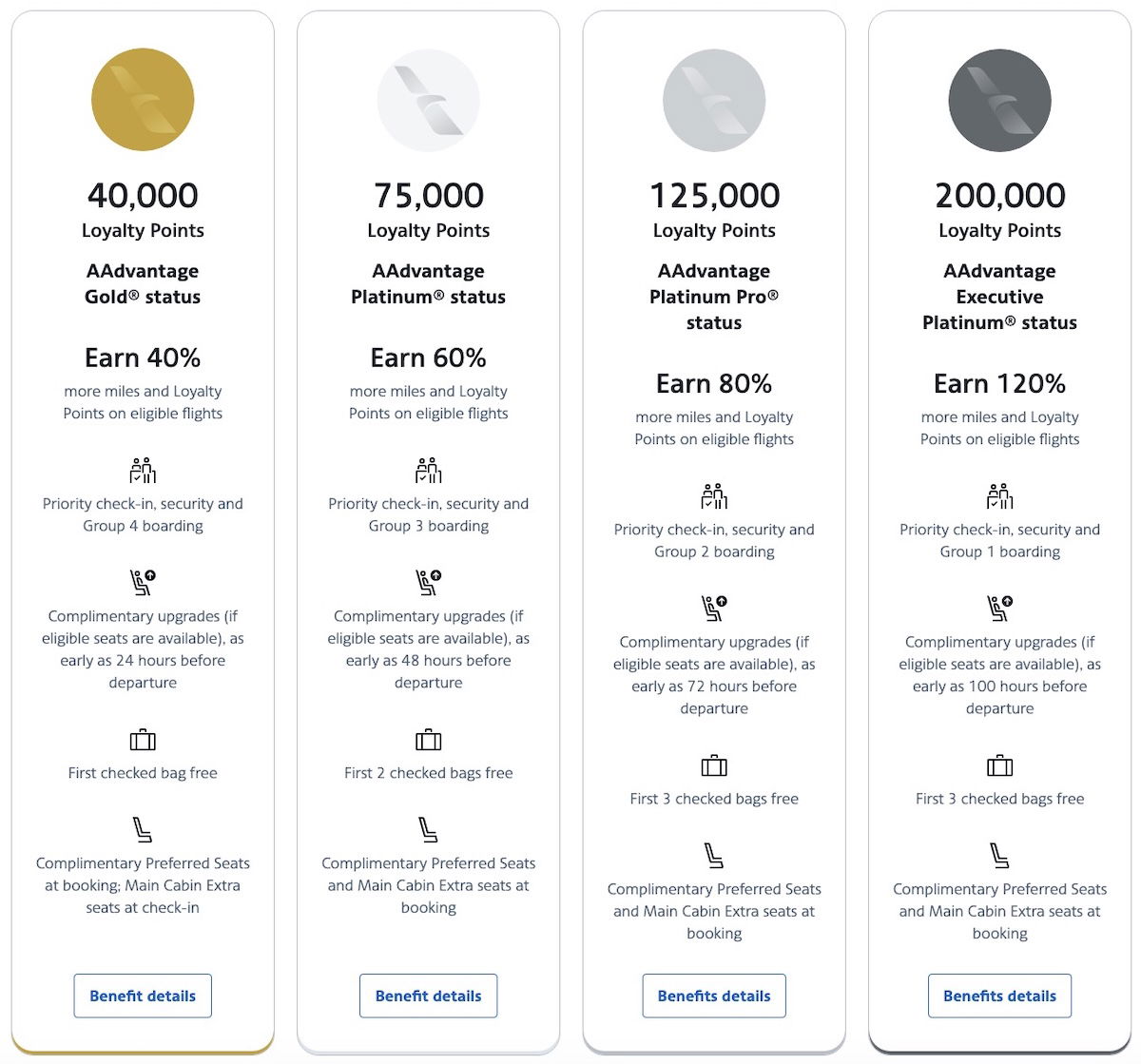

American AAdvantage elite status is earned exclusively based on how many Loyalty Points you rack up. Every qualifying AAdvantage mile accrued earns you one Loyalty Point. For the current program year, AAdvantage elite status requirements are as follows:

- AAdvantage Gold status requires 40,000 Loyalty Points

- AAdvantage Platinum status requires 75,000 Loyalty Points

- AAdvantage Platinum Pro status requires 125,000 Loyalty Points

- AAdvantage Executive Platinum status requires 200,000 Loyalty Points

American’s invitation-only Concierge Key status continues to have unpublished qualification requirements. However, we have reason to believe that some non-flying activity may also be considered toward earning Concierge Key.

Note that with the Loyalty Points program, status is earned between the beginning of March of a particular year and the end of February of the following year, and is then valid through March 31 of the year after that. That means for the current program year:

- You can earn elite status between March 1, 2025, and February 29, 2026

- The status that you earn during this program year will be valid through March 31, 2027

You may be wondering what’s considered “qualifying” for the purposes of Loyalty Points. Yes, spending $200,000 on a credit card would earn you Executive Platinum status, but buying 200,000 AAdvantage miles wouldn’t earn you Executive Platinum status. So let’s go over those details.

How to earn Loyalty Points for flying American Airlines

The most popular way to earn Loyalty Points is by flying with American Airlines. When flying American Airlines:

- You earn 5x base miles per dollar spent, all of which qualify as Loyalty Points; the exception is that basic economy fares only earn 2x AAdvantage miles

- Elite status bonuses also count as Loyalty Points, ranging from 40% to 120%; Gold members get a 40% bonus, Platinum members get a 60% bonus, Platinum Pro members get an 80% bonus, and Executive Platinum members get a 120% bonus

- In other words, aside from basic economy fares, an AAdvantage Gold member earns 7x Loyalty Points per dollar spent, while an Executive Platinum member earns 11x Loyalty Points per dollar spent

- There’s no cap on how many Loyalty Points you can earn with each ticket

How to earn Loyalty Points for flying partner airlines

In addition to being able to earn Loyalty Points for flying with American Airlines, you can also earn Loyalty Points for flying with partner airlines:

- You can earn Loyalty Points for flights on all oneworld airlines, plus Aer Lingus and GOL (travel on other partner airlines earns miles, but not Loyalty Points)

- All the redeemable miles you earn from flying on partner airlines also qualify as Loyalty Points; this includes elite bonuses, which range from 40-120%, as well as cabin bonuses (where you earn miles for flying premium economy, business class, or first class)

For travel on most partner airlines, you earn Loyalty Points based on a percentage of distance flown, factoring in your fare class. Let me give an example.

Say you’re an AAdvantage Executive Platinum member booking an Alaska Airlines first class ticket from Los Angeles to Seattle in the “I” fare class. That flight covers a distance of 954 miles, so how many Loyalty Points do you earn? Based on the mileage earning chart:

- You earn 100% base miles, so that’s 954 miles

- You then receive a 50% class of service bonus, so that’s 477 miles

- You then earn a 120% elite bonus, so that’s 1,145 miles

- Altogether you earn 2,576 AAdvantage miles, all of which would qualify as Loyalty Points

Now, in the meantime, travel on some partner airlines does earn Loyalty Points and miles based on how much you spend, rather than based on how far you fly. For example, American AAdvantage awards Loyalty Points and miles based on this system when traveling on British Airways and Iberia. So you’ll always want to check the partner airline earning chart to see by what method you’ll earn Loyalty Points and miles.

How to earn Loyalty Points for credit card spending

Most American AAdvantage credit cards issued by Barclays and Citi earn Loyalty Points:

- You earn one Loyalty Point for every base mile earned on the card, which would generally be the rate of one Loyalty Point per dollar spent

- Welcome bonuses don’t count as Loyalty Points

- If you’re spending in a category that’s bonused, you only earn Loyalty Points for the “base” spending, meaning one Loyalty Point for every dollar spent; in other words, if a card offers two AAdvantage miles per dollar spent on American Airlines flight purchases, you still only earn one Loyalty Point

But long story short, spending $200,000 on a co-branded American Airlines card, whether it’s the no annual fee American Airlines AAdvantage® MileUp® (review) or the $595 annual fee Citi® / AAdvantage® Executive World Elite Mastercard® (review), would earn you Executive Platinum status.

Also keep in mind that having American’s most premium credit card can earn you up to 20,000 Loyalty Points per year, without actually having to spend anything on the card.

If you’re curious about the cutoff for credit card spending counting toward a particular program year, it’s not about the closing date of the credit card statement, but rather it’s about when the transaction shows up on your credit card statement.

See this post for all the details on earning Loyalty Points with credit cards.

How to earn Loyalty Points for other partner activity

As far as non-flying activities go, there are some other partners beyond credit cards that allow you to earn qualifying Loyalty Points. Specifically, base miles earned with the following partners can earn you Loyalty Points:

- Platforms: AAdvantage Dining, AAdvantage eShopping, SimplyMiles

- Hotels: AAdvantage Hotels, Hyatt, Marriott, IHG, Marriott Vacations, RocketMiles

- Cars: aa.com/car, Avis, Budget, Payless, Hertz, Dollars, Thrifty, Alamo, National, Sixt

- Cruises & vacation packages: bookaacruises.com, aavacations.com

- Retailers: Shell, WeWork, Vinesse, FTD, Vivid Seats, NRG Energy, Reliant Energy, Xoom, Miles for Opinions

Even if you hadn’t considered these programs in the past, these could be worth another look, as you can rack up Loyalty Points based on your everyday purchases.

What activity doesn’t earn Loyalty Points?

There are several types of activity that don’t earn Loyalty Points, including:

- Buying, gifting, or transferring miles

- Government taxes, fees, and other charges associated with buying airline tickets

- Conversion of another program currency to AAdvantage miles (for example, converting Marriott Bonvoy® points, rather than selecting Bonvoy points as your earnings preference for stays)

- For AAdvantage credit cards, welcome bonuses don’t qualify, and neither do “accelerators” or “multipliers” (like extra miles for each dollar spent in certain categories)

- Miles earned with Bask Bank, which offers AAdvantage miles based on how much money you have deposited

I find these exclusions to be interesting. I’m not surprised that buying miles doesn’t count toward Loyalty Points, though at the same time, I don’t follow the logic of that:

- Presumably American selling AAdvantage miles directly to consumers is higher margin than when American sells miles to partner programs (whether it’s Citi or SimplyMiles)

- I suppose the logic is that American thinks it would be too easy to earn status that way, and doesn’t want to do that; but what does and doesn’t qualify really doesn’t fully make sense

American AAdvantage Loyalty Point Rewards

American AAdvantage offers Loyalty Point Rewards, whereby AAdvantage members can select the perks that matter the most to them at 11 different Loyalty Points thresholds. These rewards include perks like systemwide upgrades, bonus miles, and much more.

The 11 tiers for the Loyalty Point Rewards program are as follows (and below I’ll talk a bit more about what they are):

- 15,000 Loyalty Points

- 60,000 Loyalty Points

- 100,000 Loyalty Points

- 175,000 Loyalty Points

- 250,000 Loyalty Points

- 400,000 Loyalty Points

- 550,000 Loyalty Points

- 750,000 Loyalty Points

- 1,000,000 Loyalty Points

- 3,000,000 Loyalty Points

- 5,000,000 Loyalty Points

Loyalty Point Rewards at 15,000 Loyalty Points

When earning 15,000 Loyalty Points, you receive Group 5 boarding for the membership year, and can select one of the following:

- Priority check-in, security, and Group 4 boarding for one trip

- Five preferred seat coupons

- 1,000 Loyalty Points toward status

- A personalized luggage tag

Loyalty Point Rewards at 60,000 Loyalty Points

When earning 60,000 Loyalty Points, you receive:

- Avis Preferred status

- A 20% Loyalty Points bonus on spending with AAVacations, AAHotels, AAdvantage eShopping, AAdvantage Dining, and SimplyMiles

Loyalty Point Rewards at 100,000 Loyalty Points

When earning 100,000 Loyalty Points, you receive:

- Avis President’s Club status

- A 30% Loyalty Points bonus on spending with AAVacations, AAHotels, AAdvantage eShopping, AAdvantage Dining, and SimplyMiles

- World of Hyatt Discoverist status

Loyalty Point Rewards at 175,000 Loyalty Points

When earning 175,000 Loyalty Points, you can choose one of the following:

- Two systemwide upgrades

- 20,000 bonus miles, or 25,000 bonus miles for AAdvantage credit card members

- Six Admirals Club day passes

- A $200 trip credit, or $250 for AAdvantage credit card members

- A $250 donation to a partner charity

- The ability to gift AAdvantage Gold status to two people

- 35,000 AAdvantage miles toward a Mastercard Priceless Experience (only for AAdvantage credit card members)

- 5,000 Loyalty Points toward status

- World of Hyatt Explorist status

Loyalty Point Rewards at 250,000 Loyalty Points

When earning 250,000 Loyalty Points, you can choose two of the following:

- Two systemwide upgrades

- 20,000 bonus miles, or 30,000 bonus miles for AAdvantage credit card members

- Six Admirals Club day passes

- An Admirals Club membership (this requires both choices)

- A $200 trip credit, or $250 for AAdvantage credit card members

- A $250 donation to a partner charity

- The ability to gift AAdvantage Gold status to two people

- A selection of Bang & Olufsen products (this requires both choices)

- A Flagship Lounge single visit pass, or two passes for AAdvantage credit card members

- 35,000 AAdvantage miles toward a Mastercard Priceless Experience (only for AAdvantage credit card members)

- 15,000 Loyalty Points toward status

- World of Hyatt Explorist status

Loyalty Point Rewards at 400,000, 550,000, and 750,000 Loyalty Points

When earning 400,000, 550,000, or 750,000 Loyalty Points, you can choose two of the following at each threshold:

- One systemwide upgrades

- 25,000 bonus miles

- An Admirals Club membership (this requires both choices)

- A $200 trip credit, or $250 for AAdvantage credit card members

- The ability to gift AAdvantage Platinum status

- A selection of Bang & Olufsen products (this requires both choices)

- Two Flagship Lounge single visit passes

- One Flagship First Dining visit pass

- 40,000 AAdvantage miles toward a Mastercard Priceless Experience (only for AAdvantage credit card members)

- A World of Hyatt Category 1-4 free night award

Loyalty Point Rewards at 1,000,000 Loyalty Points

When earning 1,000,000 Loyalty Points, you can choose one of the following:

- Four systemwide upgrades

- The ability to gift AAdvantage Platinum Pro status

- A mileage rebate of 100,000 AAdvantage miles

- 150,000 AAdvantage miles toward a Mastercard Priceless Experience (only for AAdvantage credit card members)

- A World of Hyatt Category 1-7 free night award

Loyalty Point Rewards at 3,000,000 Loyalty Points

When earning 3,000,000 Loyalty Points, you can choose one of the following:

- Six systemwide upgrades

- The ability to gift AAdvantage Executive Platinum status

- A mileage rebate of 300,000 AAdvantage miles

- 350,000 AAdvantage miles toward a Mastercard Priceless Experience (only for AAdvantage credit card members)

- A World of Hyatt Category 1-7 free night award

Loyalty Point Rewards at 5,000,000 Loyalty Points

When earning 5,000,000 Loyalty Points, you can choose one of the following:

- 10 systemwide upgrades

- The ability to gift AAdvantage Executive Platinum status

- A mileage rebate of 500,000 AAdvantage miles

- 550,000 AAdvantage miles toward a Mastercard Priceless Experience (only for AAdvantage credit card members)

- A World of Hyatt Category 1-7 free night award

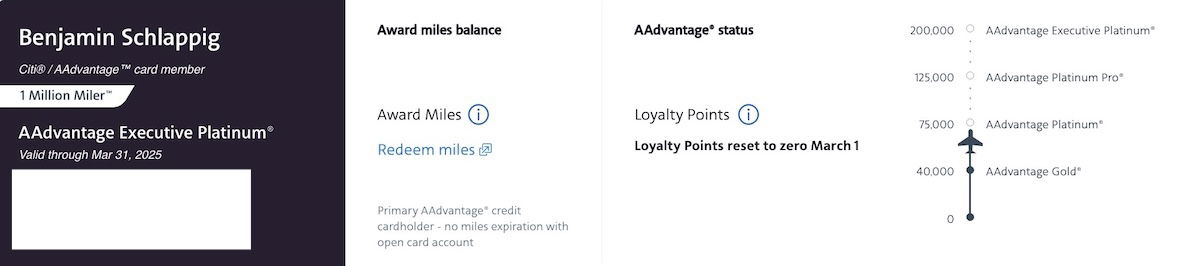

How to see your AAdvantage Loyalty Points total

You can always easily see your AAdvantage Loyalty Points total by logging into your AAdvantage account, either through aa.com or the American Airlines app. There’s a simple graphic that shows your status toward qualifying for the various Loyalty Points thresholds.

You can click on the “Activity” tab to see a breakdown of the Loyalty Points you’ve earned for all your AAdvantage accruing activity.

Loyalty Points determine upgrade priority

Complimentary upgrades are one of the best perks of airline elite status (well, at least in theory). Loyalty Points can play into your odds of getting upgrades. American Airlines upgrades are prioritized first by elite status, and then by your rolling 12-month total of Loyalty Points.

In other words, the more Loyalty Points you rack up on an ongoing basis, the higher your upgrade priority will be within your elite tier. Nowadays all AAdvantage elites are eligible for complimentary upgrades within North America, and upgrades even extend to companions.

However, there are lots of people eligible for upgrades and limited seats to upgrade to, so higher elite status and a higher Loyalty Points total really makes a difference for clearing into an available seat. Then again, so many first class seats nowadays are snagged with American’s aggressive cash upgrades., and there just aren’t that many seats to upgrade to.

How to earn American AAdvantage Million Miler lifetime status

American AAdvantage has lifetime elite status, whereby you can earn the following elite tiers for life:

- Lifetime AAdvantage Gold status requires one million miles

- Lifetime AAdvantage Platinum status requires two million miles

- Lifetime AAdvantage Platinum Pro status requires four million milers

- Lifetime AAdvantage Executive Platinum status requires five million miles

Miles toward Million Miler are calculated based on the distance flown for American marketed flights, or base miles earned for travel on eligible partner marketed flights. That means you can’t earn lifetime status through credit card spending (as an example).

Crunching the numbers on AAdvantage Loyalty Points

How hard is it to earn AAdvantage elite status with the Loyalty Points program? Let’s just crunch some basic numbers on earning Executive Platinum status, just as an example:

- If you’re earning 11x Loyalty Points per dollar spent on American flights, you’d have to spend ~$18,200 per year on flights to earn Executive Platinum status

- Executive Platinum status is even harder to earn if you’re starting from scratch, since you don’t earn the same 120% mileage bonus from the start; you’d have to spend over $27,000 on flights to get to Executive Platinum status from scratch

- On the other end of the spectrum, spending $200,000 per year on a co-branded credit card would also earn you Executive Platinum status (or even less, when you factor in the Loyalty Points bonuses offered by some cards)

- To take a hybrid approach, if you’re an Executive Platinum member you could spend $100,000 per year on a co-branded credit card and spend ~$9,100 per year on flights to maintain Executive Platinum status

- The catch is that if you want benefits like systemwide upgrades, you need to aim for an extra 50,000 Loyalty Points above Platinum Pro or Executive Platinum (you’ll need 175,000 Loyalty Points and 250,000 Loyalty Points, respectively)

Why American shifted to the Loyalty Points system

Some road warriors are confused and frustrated about why American increasingly incentivizes qualifying for status through non-flying means. The reality is that this reflects how American makes money. Flying is incredibly low margin for airlines. American makes much of its profits through non-flying means, including the AAdvantage program.

So it’s entirely rational that American would want to give people an incentive to engage in the activity that’s profitable and high margin. After all, it’s more or less pure profit when you book a hotel through American’s portal, or use a co-branded credit card.

See this post for more on why this program makes sense.

Bottom line

We’re now into the new American AAdvantage elite year. Status is awarded based on how many Loyalty Points you accrue, rather than based on how many miles you fly, or how much you spend on flights. Loyalty Points can be earned through flying, credit card spending, and activity with AAdvantage partners. Hopefully the above answers most of the questions that people may have about the program.

Do you have any questions about American’s Loyalty Points system that I haven’t answered?

Can I purchase loyalty points directly from American Airlines, I need 25,813 to reach gold. What is the cost?

Pretty sure you can only buy miles, not points. A good place to ask those questions is on Reddit in r/AAdvantage

Ben,

I received lifetime Executive Platinum status last week because I have in excess of 5,000,000 miles. Can you confirm that I will receive four (4) Systemwide upgrades as a result? There seems to be some confusion about this.

@ Canescruiser -- First of all, congrats on lifetime Executive Platinum! You won't receive four systemwide upgrades on an ongoing basis, since you don't qualify via Loyalty Points annually. You should have already received some systemwide upgrades when you passed the five million mile threshold, so I don't believe you'd get any additional ones.

American Airline executives really screwed up the program with Hyatt.

Probably why Hyatt wanted out, because it was so badly managed by American Advantage.

I am having a difficult time getting the information on Hyatt. Is there somewhere I can go to get the information. I am weighing Marriott against Hyatt. Marriott does not give loyalty points, I believe Hyatt does but do not know the formula. Any help would be appreciated.

@Lucky two decent AA promos for March. Flagship pass with a premium flight purchase (domestic first appears to count in most fare buckets). Also +500 LPs for each segment in March, up to 5k. Registration required for both.

Ben, AA didn't 'completely reimagine how elite status' was earned, it changed it. For better, or for many, for worse. Using 'imagine' and 'American Airlines' in the same sentence is, should I say, 'imaginative'.

I compared AA loyalty points with DL and UA and found it is simpler and better. I am a Platinum Pro in 2024 so I need to spend $22223 on tickets (fees excluded) to get to Executive Platinum. When I become EP, I only spend $18182 (fees excluded) to on tickets to retain the status.

At Delta, I found it doesn't matter what the status I have in the previous year, it is always...

I compared AA loyalty points with DL and UA and found it is simpler and better. I am a Platinum Pro in 2024 so I need to spend $22223 on tickets (fees excluded) to get to Executive Platinum. When I become EP, I only spend $18182 (fees excluded) to on tickets to retain the status.

At Delta, I found it doesn't matter what the status I have in the previous year, it is always required to spend $28000 (fees excluded) to get 280000 MQD and get the Diamond status.

At Unite, I can deal with the PQF and PQP but the PlusPoints are complicated.

I agree AAAdv is much easier to comprehend. I have given up trying to understand UA's and I could only understand DL's when they made the change last year. I just made AA gold for the first time due to work travel and one personal international trip. To reach gold again, I know that all I need to spend is roughly $5,700. Now I understand gold doesn't really mean anything as a status level, but...

I agree AAAdv is much easier to comprehend. I have given up trying to understand UA's and I could only understand DL's when they made the change last year. I just made AA gold for the first time due to work travel and one personal international trip. To reach gold again, I know that all I need to spend is roughly $5,700. Now I understand gold doesn't really mean anything as a status level, but given that I have to purchase the least expensive tickets on the company's dime, this is all I will be able to reach most likely.