Link: Apply now for the Chase Freedom Unlimited®

I don’t want to bury the lede — if you collect Chase Ultimate Rewards points and use any personal Chase card other than the Chase Freedom Unlimited® for your everyday spending, you’re not doing it right.

The Chase Freedom Unlimited is one of the all around best cards for everyday spending. It’s a credit card that I have, and it’s one that I think is worth holding onto. The catch is that there’s a learning curve to using this card — for some people this will just be a good card, while for other people this will be an amazing card.

In this post I wanted to provide a detailed review of the Chase Freedom Unlimited, so that I can share why I find it to be so valuable, and how you can maximize value with it.

In this post:

Chase Freedom Unlimited Basics For April 2024

The Chase Freedom Unlimited is part of Chase’s “Freedom” card portfolio, and is an excellent complement to any of Chase’s cards earning Ultimate Rewards points.

The value you get from the card will vary significantly, though, based on what other cards you have. For example, some people might only be earning rewards equivalent to 1.5% back for everyday spending with this card, while others will be earning rewards that they value at 2.5%+, which is among the best rewards rates in the industry.

Chase Freedom Unlimited Welcome Bonus Offer

The Chase Freedom Unlimited currently has a welcome bonus whereby you can earn an additional 1.5% in rewards on your purchases for the first 12 months, on up to $20,000 in eligible spend.

On the surface, points can be redeemed for one cent each, but you can potentially get a lot more value than that, as these points can be converted into Ultimate Rewards points, and I value those at 1.7 cents each. Earning this kind of a return on all of your spending for a year is an unbelievably good deal.

Chase Freedom Unlimited Card Eligibility

Eligibility for the Chase Freedom Unlimited is unrelated to eligibility for any other Chase cards, so you could earn the bonus on this card, and the Freedom Flex Card, etc. The Chase Freedom Unlimited is not available to those who currently have the card, or those who have received a new cardmember bonus on the card in the past 24 months.

Chase’s general credit card application rules apply.

Chase Freedom Unlimited No Annual Fee

The Chase Freedom Unlimited has no annual fee, which is unbeatable. You can also add authorized users to the card for no fee, so that you can accrue rewards for their spending.

Chase Freedom Unlimited Rewards Structure

The Chase Freedom Unlimited has an awesome rewards structure, which not only includes an excellent return on everyday spending, but also includes some valuable bonus categories.

Before we get into this, note that in each case the percentage cash back can be converted into Ultimate Rewards points, at a rate of one cent per point. I’ll talk more below about how that’s possible, but that’s really how you maximize value with the card.

5% Cash Back (5x Points) On Lyft Rides

Through March 2025, the Chase Freedom Unlimited offers 5% cash back on Lyft rides (or 5x Ultimate Rewards points). That’s an excellent return on Lyft spending.

5% Cash Back (5x Points) On Travel With Chase Ultimate Rewards

The Chase Freedom Unlimited offers 5% cash back on travel purchased through Chase Travel℠ (or 5x Ultimate Rewards points). Purchases made outside the Chase travel portal will earn 1.5% cash back (or 1.5 Ultimate Rewards points per dollar).

3% Cash Back (3x Points) On Dining

The Chase Freedom Unlimited offers 3% cash back on dining, including takeout and delivery (or 3x Ultimate Rewards points). This is great for a no annual fee card, as this essentially makes this one of the best credit cards for dining spending.

3% Cash Back (3x Points) At Drugstores

The Chase Freedom Unlimited offers 3% cash back at drugstores (or 3x Ultimate Rewards points). This is an awesome bonus, since drugstores isn’t a category where you otherwise see many cards offering bonuses.

1.5% Cash Back (1.5x Points) On All Other Purchases

The Chase Freedom Unlimited offers 1.5% cash back on everyday spending (or 1.5x Ultimate Rewards points). The 1.5% cash back return isn’t that exciting, given that other cards offer 2% cash back. What is awesome, however, is the ability to earn 1.5x Ultimate Rewards points per dollar spent, as there’s no better Chase card for everyday spending.

Personally I value Chase points at 1.7 cents each, so to me the card offers the equivalent of a 2.55% return on everyday spending, which is awesome.

3% Foreign Transaction Fees

While the Chase Freedom Unlimited is a fantastic card for purchases within the United States, it does have 3% foreign transaction fees, so I don’t recommend using this card abroad.

If you’re looking for a great card with no foreign transaction fees, consider the Chase Sapphire Preferred® Card or Chase Sapphire Reserve® Card.

How To Maximize The Chase Freedom Unlimited

The Chase Freedom Unlimited offers 1.5% cash back on everyday purchases, and 3-5% cash back in select bonus categories. However, if you’re looking to earn travel rewards, you can get a significantly better return on spending than that.

Turning Cash Back Into Ultimate Rewards Points

While the Chase Freedom Unlimited is a cash back card, in reality the card earns Ultimate Rewards points. You earn 1.5x points per dollar spent, and then ordinarily each point can be redeemed for one cent cash back. That’s how Chase arrives at the valuation of 1.5% cash back with the card.

However, if you have the Chase Freedom Unlimited in conjunction with another card that earns “premium” Ultimate Rewards points, then you can do significantly better. These cards include the following:

- Chase Sapphire Preferred® Card (review)

- Chase Sapphire Reserve® Card (review)

- Ink Business Preferred® Credit Card (review)

With one of those cards, suddenly your points are much more valuable. Transferring points between cards is easy and can be done online. You can learn more about that process in this post.

Redeem Ultimate Rewards Points For 1.25-1.5 Cents Toward Travel

There are a couple of ways to redeem Ultimate Rewards points. The first is that you can redeem Ultimate Rewards points toward the cost of a travel purchase through the Chase Ultimate Rewards website:

- If you have the Sapphire Preferred or Ink Business Preferred, points can be redeemed for 1.25 cents each toward a travel purchase

- If you have the Sapphire Reserve, points can be redeemed for 1.5 cents each toward a travel purchase

That increases the value of your points by 25-50% right there.

Transfer Ultimate Rewards Points To Airline & Hotel Partners

Personally, the way I like to redeem Ultimate Rewards points is to transfer them to airline and hotel partners, which include the following:

Airline Partners | Hotel Partners |

|---|---|

Aer Lingus AerClub | IHG One Rewards |

Air Canada Aeroplan | Marriott Bonvoy |

Air France-KLM Flying Blue | World of Hyatt |

British Airways Executive Club | |

Emirates Skywards | |

Singapore Airlines KrisFlyer | |

Southwest Rapid Rewards | |

United MileagePlus | |

Virgin Atlantic Flying Club |

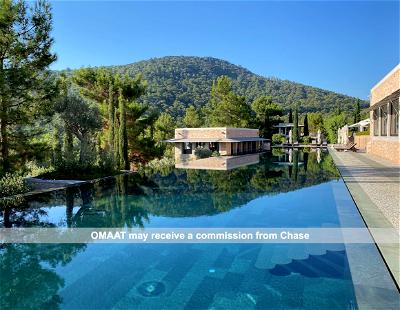

This can be the best way to redeem points toward premium travel experiences. If you want to redeem for first or business-class travel or stay at luxury hotels, this option is for you.

Chase Freedom Unlimited Card Benefits

For a no annual fee card, the Chase Freedom Unlimited offers an excellent welcome bonus and generous rewards structure, and on top of that there are also some perks that are potentially useful.

Extended Warranty Protection

With the Chase Freedom Unlimited you can extend the time period of your United States manufacturer’s warranty by an additional year, on eligible warranties of three years or less.

Purchase Protection

With the Chase Freedom Unlimited you’re covered for new purchases for 120 days against damage or theft of up to $500 per claim and $50,000 per account.

Credit Journey

With Chase Credit Journey you get unlimited access to your credit score and more. This is free for Chase customers, including those who have the Chase Freedom Unlimited.

Chase Offers

One of the great features of Chase cards is access to Chase Offers, which provides savings on purchases with all kinds of retailers. This program has saved me a significant amount of money.

Contactless Pay

The Chase Freedom Unlimited features contactless pay technology. This means you can pay using your card without even swiping it whenever you see the contactless pay symbol.

Is The Chase Freedom Unlimited Worth It?

If you’re in the Chase Ultimate Rewards ecosystem, then picking up the Chase Freedom Unlimited is a must. That’s especially true with the current welcome bonus, which is exceptionally rewarding. However, the key is to have the card in conjunction with either the Chase Sapphire Preferred or Chase Sapphire Reserve, so that you’re really maximizing your rewards.

I wanted to look a bit more closely at the best strategy to take with the Chase Freedom Unlimited.

Tip: Complement With Sapphire Preferred Or Reserve

I can’t emphasize enough that having the Freedom Unlimited in conjunction with either the Sapphire Preferred or Sapphire Reserve is probably the best card combo you can have. That’s because not only can you combine the benefits of the two cards, but this greatly increases the value you get from your Freedom Unlimited points.

For example, if you have the Sapphire Reserve and Freedom Unlimited:

- You’re paying a single $550 annual fee on the Sapphire Reserve

- You’re earning 3x points on dining, travel, and drugstores, and a minimum of 1.5x points on all other purchases

- You’re getting a $300 annual travel credit

- You’re getting a Priority Pass membership, giving you airport lounge access

- You get travel protection, no foreign transaction fees, and car rental coverage

- You get a Global Entry, NEXUS, or TSA PreCheck credit

Quick Comparison: Freedom Flex Vs. Freedom Unlimited

There are currently two Chase Freedom products you can apply for — the Chase Freedom Unlimited and Chase Freedom FlexSM Credit Card (review). Both cards have no annual fees, so what are the major differences between the cards?

- The Freedom Unlimited offers 1.5x points on all purchases, so is great for everyday spending

- The Freedom Flex offers 5x points in rotating quarterly categories on up to $1,500 of spending per quarter, so it’s extra great if you spend money in those categories

The cards otherwise have overlapping bonus categories, like offering 3x points on dining and drugstores, etc.

Personally I think both cards are worth having. If I could just have one, though, I’d probably choose the Freedom Unlimited, since it’s better for everyday spending.

Quick Comparison: Freedom Unlimited Vs. Ink Unlimited

Chase has two “Unlimited” cards — the Chase Freedom Unlimited and the Ink Business Unlimited® Credit Card (review). These cards are very similar — both have no annual fee, and both offer 1.5x points. So, what’s the difference?

- The Freedom Unlimited is a personal card, while the Ink Unlimited is a business card

- The Freedom Unlimited offers 5x points on travel purchased through Chase Travel℠, and 3x points on dining and drugstore purchases, while the Ink Unlimited doesn’t

- The Ink Unlimited offers better car rental protection and a bigger upfront bonus

Other than those differences, the two cards are very similar. I have both of these cards (yes, I have a lot of Chase credit cards).

What About The Citi Double Cash Card?

The Citi Double Cash® Card (review) is probably the closest competitor to the Freedom Unlimited, regardless of whether you’re looking to earn points or cash back.

The Citi Double Cash also has no annual fee and offers 1% cash back when you make a purchase, and 1% cash back after you pay for that purchase in the form of ThankYou points. So you’ll earn two cents back on the dollar, rather than 1.5.

Since I value Citi ThankYou and Chase Ultimate Rewards points roughly equally, this could also be an attractive card for everyday spending.

The reason some people may still prefer the Freedom Unlimited is because of the Chase Ultimate Rewards ecosystem. On top of that, the Freedom Unlimited has bonus categories, which the Citi Double Cash doesn’t have.

Bottom Line

The Chase Freedom Unlimited is a key card to maximizing your overall Chase Ultimate Rewards strategy, in conjunction with the Sapphire Preferred or Sapphire Reserve.

The Chase Freedom Unlimited has no annual fee, and offers a minimum of 1.5x points per dollar spent. Let me make my advice as concise as possible here: if you have the Sapphire Preferred or Sapphire Reserve, then you absolutely should have the Freedom Unlimited so you’re maximizing your return on everyday, non-bonused Chase spending.

If you want to learn more about the Chase Freedom Unlimited or apply, follow this link.

Does the double points promotion also apply to Chase travel which would make it 10X for the first year?

Great card! Posted on the other article but I just moved to the US, opened a chase account, made a deposit, and got this card as a first credit card with no credit history here. Will hoard the points and get the Sapphire Reserve a bit further down the line. Thanks for highlighting

I love this card. One of the best in my portfolio for general use. And Chase is very good to work with ... whether tech glitches or 'raising credit limit' requests. Chase is winning the loyalty game with me, and other assets are heading their way.

Can you apply for this Freedom Unlimited card/double bonus offer if you are an authorized user on your spouse’s Freedom Unlimited card?

@ Stuart -- Yep, you'd be eligible for the card, including the bonus.