Link: Apply now for the Chase Sapphire Reserve® Card

The Chase Sapphire Reserve® Card (review) is one of the most popular premium travel rewards credit cards. There are many things to love about the card, including triple points on dining and travel, a Priority Pass membership, access to Chase Sapphire Lounges, Visa Infinite perks, rental car and travel coverage, and much more.

In this post I wanted to focus on the Chase Sapphire Reserve’s $300 annual travel credit, which is the single greatest perk of the card, as it earns you back more than half of your $795 annual fee every year. The way I view it, this means that the card should really only cost you $250 per year to hold onto.

Understandably this perk causes a lot of confusion, since several cards offer travel credits, and some of them have a lot of strings attached. Fortunately, the one on this card is quite straightforward. So let’s go over all of the details of the perk.

In this post:

What is the Chase Sapphire Reserve $300 travel credit?

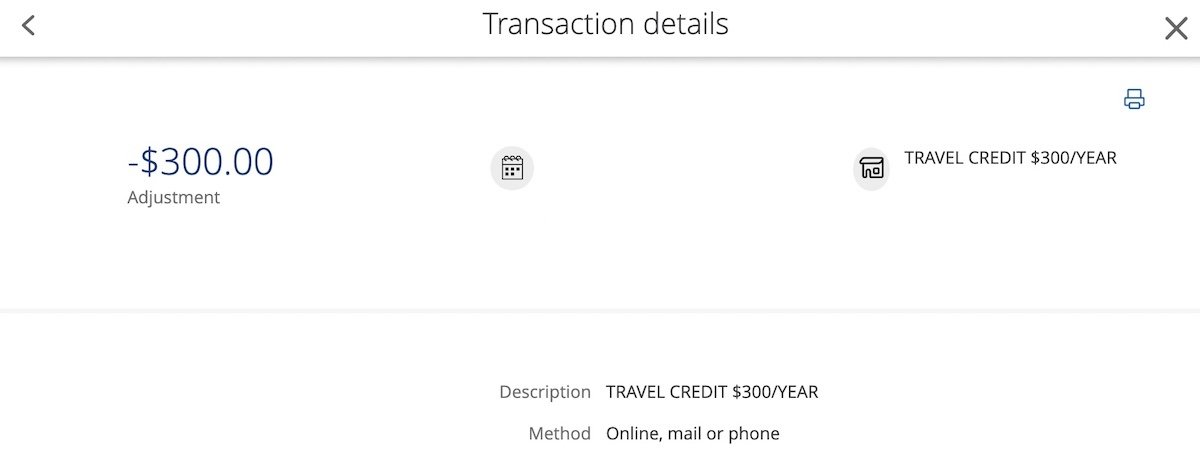

Every cardmember year, the Chase Sapphire Reserve offers a $300 travel credit. This credit is applied to purchases automatically — there’s no need to register — and you can use it over as many purchases as needed until the credit is completely used up. So that can be a single $300 purchase, 10 purchases of $30 each, etc. This comes in the form of a statement credit that posts shortly after you make your purchase.

What qualifies as travel for the $300 travel credit?

What purchases will automatically be credited as travel? The Chase Sapphire Reserve defines travel as including the following purchases:

Merchants in the travel category include airlines, hotels, motels, timeshares, car rental agencies, cruise lines, travel agencies, discount travel sites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages.

Note that this is the same definition that Chase uses for the categories that earn 3x points. As you can see, it’s not just traditional travel purchases that get reimbursed, but also things like rideshare, parking, trains, buses, and more. You can easily use the $300 credit in your day-to-day life.

When do you get the $300 Chase Sapphire Reserve travel credit?

As soon as you activate the Chase Sapphire Reserve, you can immediately start using the travel credit. There’s no waiting period required.

In subsequent years, your $300 travel credit is valid starting on your anniversary account date, which would be 12 monthly billing cycles after you opened the card.

How quickly does the Sapphire Reserve $300 travel credit post?

The credit should post almost instantly after a purchase posts to your statement. For example, my cardmember anniversary is in December, and in early December 2021 I had a $300+ travel purchase that was reimbursed almost instantly. With this benefit, you don’t have to wait for several weeks for the credit to post, or anything.

Does the $300 travel credit impact the minimum spending requirement?

When many people get the Chase Sapphire Reserve they’re trying to reach the minimum spending requirement in order to earn the welcome bonus. How does the $300 you get reimbursed for travel play into that?

Well, the total amount you spend (minus the annual fee) counts toward the minimum spending requirement. So even if you get reimbursed $300 through the travel credit, that $300 in spending would still count toward the minimum spending requirement.

Do you earn triple points for reimbursed transactions?

One of the great things about the Chase Sapphire Reserve is that it offers triple points on dining and travel. So if you spent $300 on travel, you’d ordinarily earn 900 Ultimate Rewards points for that. However, unfortunately you’re not going to be earning triple points for the amount that’s reimbursed.

What happens if you refund a transaction that’s reimbursed?

If you refund a purchase that was reimbursed, then the statement credit should similarly be reversed, and the amount should automatically be applied toward a future travel transaction. However, some report that the statement credit doesn’t get reversed, so this seems like a case of “your mileage may vary.”

How can you track how much of the $300 credit you’ve used?

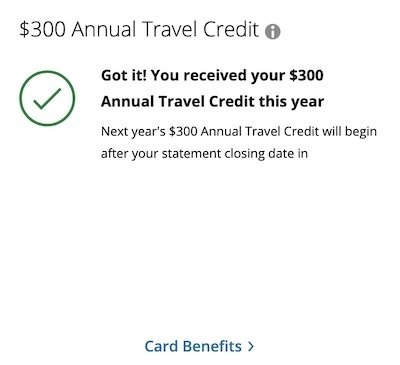

When you go to the Ultimate Rewards homepage and log into your account, click on the “Your Dashboard” section, at the top right of the page. There you should see a section that shows how much of your spending toward the credit you’ve completed, and it will also show when your anniversary year resets, which would be when you get your next credit.

Do most people use the full $300 credit?

There is no published data on this, though I’d have to assume that a vast majority of people with the Chase Sapphire Reserve are fully utilizing the travel credit. That’s why I feel comfortable suggesting that for most users, it lowers the real annual “out of pocket” on the card by well over half.

Let me take it a step further — if you don’t use the full $300 travel credit then this card simply isn’t for you. There are better cards out there for someone who doesn’t spend at least $300 per year on taxis, rideshare, subways, trains, hotels, airlines, etc.

Why doesn’t Chase just lower the annual fee to $250 instead?

This is a logical enough question. If most people are so easily using this credit, then why not just lower the annual fee to $250, which would probably make the card even more popular? There are two reasons for this:

- Chase wants more wallet share — Chase wants you to use your card as much as possible, and card issuers know that if they’re reimbursing you for certain purchases, you’re more likely to actually use your card and have it at the front of your wallet

- Chase doesn’t want to cannibalize its portfolio — Chase also has the Chase Sapphire Preferred® Card (review), which has a $95 annual fee and is also extremely rewarding; Chase doesn’t want to completely cannibalize that card, so by going after two different consumers in terms of annual fees, Chase is able to do that

How does this compare to the Amex Platinum credit?

Both The Platinum Card® from American Express (review) and The Business Platinum Card® from American Express (review) offer a variety of credits as well. One of the credits they both offer is an annual up to $200 airline fee credit (Enrollment required). There are a few things that make this credit not as good, though:

- The credit is for up to $200, rather than $300

- The credit only applies to airline fees, rather than all travel purchases (and airline fees has a very specific definition)

- Registration is required, and you have to designate an airline for which you want to use the credit

While the $200 airline fee credit is only a small part of the Amex Platinum suite of benefits, that aspect of the card is in no way competitive, in my opinion.

How does this compare to the Capital One Venture X credit?

The Capital One Venture X Rewards Credit Card (review) is a popular premium credit card. The card has a $395 annual fee, and offers a $300 annual travel credit. How does that credit compare?

- The credit is the same amount as on the Chase Sapphire Reserve

- The major catch is that the credit can only be used through the Capital One Travel portal, toward flights, hotels, and rental cars

- The credit is also applied at the time that you make the travel purchase, so it’s not an after the fact reimbursement, like with Chase

- So this credit isn’t quite as valuable or flexible, but then again, the Capital One Venture X also has a significantly lower annual fee, and offers some amazing authorized user perks

Bottom line

Many people are deterred by the $795 annual fee on the Chase Sapphire Reserve. However, as I’ve often said, what makes this card so special is that it’s a $795 annual fee card for people who don’t usually pay such high annual fees.

That’s because in reality, this card should be “costing” most people $250 per year, after factoring in the $300 of value they’ll get out of the travel credit. This credit isn’t a gimmick like you might find on some other cards, where you have to register, can only be reimbursed for very specific transactions, etc.

Instead with this benefit all travel coded purchases, up to $300 per cardmember year, will be reimbursed. If you have this card then you should get full value out of this awesome benefit.

“Paying” just $250 per year for triple points on dining and travel, a Priority Pass membership, the ability to redeem points for 1.5 cents each, and much more, is a bargain. That’s what makes the Chase Sapphire Reserve so great.

For more on the best Ultimate Rewards credit cards, see this post.

What has your experience been with the Chase Sapphire Reserve $300 travel credit?

Hey Ben-

Any creative way to use the travel credit for 2024 if I have no planned travel (as in none), and that includes no hotel stays, etc. Can you purchased a hotel chain gift card or an airline gift card that would count? Or just speculatively purchase an airline ticket which is cancelled an then held by airline as travel credit ??

Thanks !!

Here is the funny part of $300.00 travel "credit". If you cancel your trip for which you used part of that $ 300.00 you WILL NOT get the travel credit back. I used $ 28 for booking fees, cancelled the trip but the $28 dispersed from the $300 credit for good. Be aware!

Are you able to use the $300 travel credit towards airline club lounge membership annual fee?

This is a great benefit of the card because it automatically applies and there are no restrictions like on other cards. There are a few other cards that also have flexible travel reimbursements beneifts but not many.

I got the CSR when it was first offered, with a 100k point bonus. Essentially the $300 travel credit works like clockwork. It is as simple and user-friendly as it could possibly be.