For how long can a small airline with no real business plan stay afloat? Well, for quite some time, it would appear, at least if you’re Air Belgium. The airline is once again looking for new investors to stay in business.

In this post:

What is Air Belgium?

For those not familiar, Air Belgium is an airline that was founded in 2018. In the roughly five years since the airline launched, it has already transformed several times:

- The airline started service with Airbus A340s, and initially flew between Charleroi Airport (outside of Brussels) and Hong Kong; the carrier’s long term plan was to add routes from Charleroi to mainland China, and have that be the focus

- Within a matter of weeks, the airline suspended that route, realizing it wasn’t exactly a great business model; that was the last we ever heard of Air Belgium operating passenger flights to China

- At this point the airline focused on becoming a wet lease operator, operating flights for other airlines that needed extra capacity; the timing of this was good, as many 787s were grounded due to engine issues at the time

- In October 2018, the airline was on the brink of liquidation, and an emergency general meeting was held to decide whether or not to dissolve; the company ended up getting more funding

- In July 2019, the airline announced it would resume regularly scheduled flights, but would fly to the Caribbean instead of China

- In June 2020, the airline announced it would switch from Charleroi Airport to Brussels Airport, and would launch new routes, including flying to Africa

- In July 2021, the airline announced it would acquire two Airbus A330-900neos, and use those for passenger flights, replacing Airbus A340s

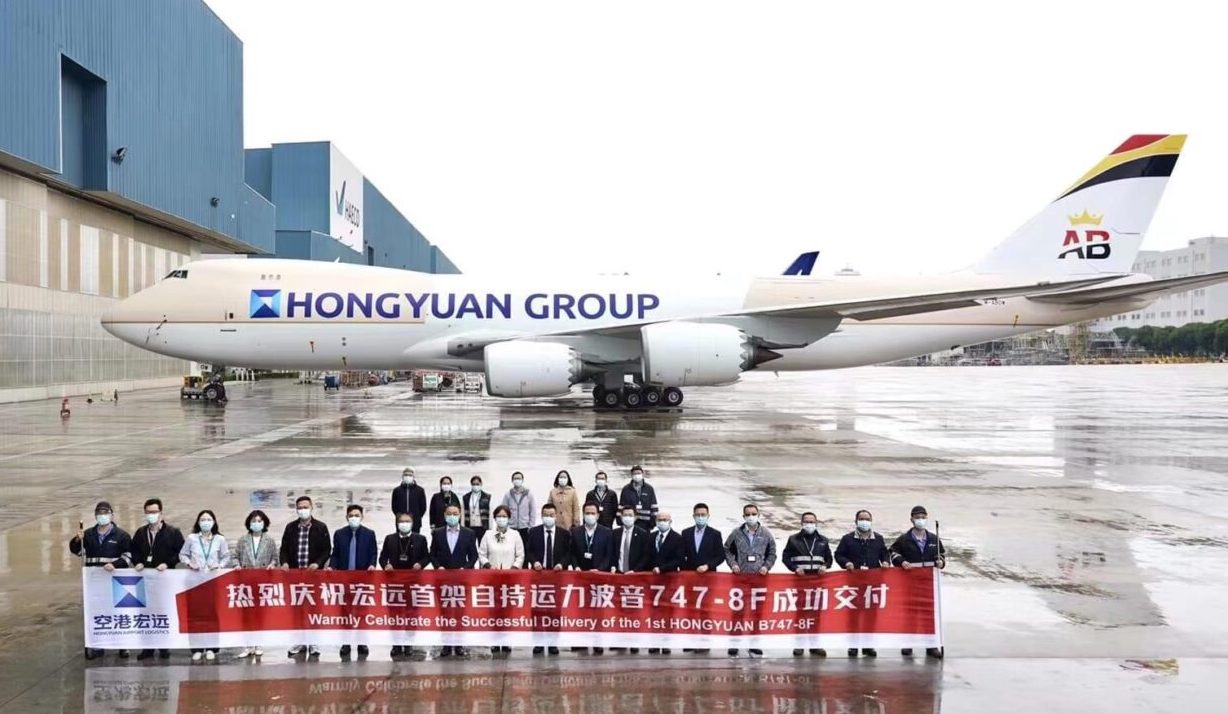

- In December 2021, the airline announced it would add Boeing 747-8Fs to its fleet, and expand dedicated cargo operations

- In November 2022, the airline was reportedly on the brink of bankruptcy, but the airline managed to raise some more capital last minute

- In March 2023, the airline cut flights to the Caribbean, as they were unprofitable

I still think back fondly on my Air Belgium flight from Charleroi to Hong Kong, which had to be one of the most bizarre flights I’ve ever taken. It had a total of just 25 passengers onboard. It’s not often that the below pictures are what a cabin looks like while enroute on a long haul flight.

So where does that leave Air Belgium at this point?

- The airline operates some cargo flights on behalf of Hongyuan Group, and has two Boeing 747-8Fs that are used for that

- The airline flies A330s with limited frequencies to Africa, but has little consistency with its scheduled passenger service

- The airline sometimes operates on a wet lease basis on behalf of other airlines, including currently flying British Airways’ route between London and Chicago

Air Belgium reports huge losses for 2022

2022 was a good year for most airlines around the globe… but not Air Belgium. As reported by La Libre, the airline has just revealed its 2022 financial results, and they’re rough. During the year, the airline had revenue of €228 million, with expenses of €302.8 million. In total, the airline had a net loss of €44.6 million.

Air Belgium blames the loss on the high cost of fuel, the unfavorable exchange rate between the EUR and USD, and… the situation in Ukraine?

The carrier’s losses keep widening, and the airline has now lost €91.6 million since it was founded. But folks, don’t worry. Air Belgium assures us that it will return to profitability this quarter (Q3 2023), despite not actually having much of a business plan.

New investor could take 49% stake in airline

Air Belgium is of course looking for new investors, and has reportedly received a binding offer from a Chinese company for a €14.4 million cash injection in exchange for a 49% stake in the airline. That would value the airline at close to €30 million. On the one hand, that’s very little for an airline, and greatly dilutes the equity that other investors have. On the other hand, that seems like €30 million too much.

Here’s the thing — it’s one thing if Air Belgium had some amazing turnaround plan, but it doesn’t. The airline has tried just about everything, and losses have only widened. Yet the airline is anticipating profitability later shortly. I just don’t understand the world anymore…

Bottom line

Air Belgium’s financial situation keeps getting worse. The small airline reportedly lost €44.6 million in 2022, with cumulative losses of €91.6 million since the company was founded. The airline has tried just about every business model short of opening a lemonade stand, and hasn’t had much success.

Now Air Belgium is looking for new investors, and conveniently intends to be profitable very shortly.

How much longer can Air Belgium stay afloat?

I flew them via a LOT wet lease from New York to Warsaw several years back. All was fine, service was good.

Might be better for them to focus on transatlantic or trans asian wet leasing and charter work. The A340 were just too big. The A330 is more focused. Schedule service is just too competitive.

I never really understood what Air Belgium was supposed to be. A FSC, LCC, a charter airline, or a wet least operator? They remind me of the recent iterations of Eastern Airlines. Maybe Air Belgium should just focus on DoD charters.

I don't think they ever made up their mind either hence the financial troubles. There was never a need for a second long-haul airline in a country as small as Belgium.

Belgium is one of my favorite countries to be in, so I'm sad to see this airline struggle so. Seems like there are people running it who lack a calculated plan for success. The concept does have merit; Brussels has been reduced to not much more than a budget airline appendage of LH - but with this African network that probably keeps them going. OTOH, there are niches in the African and trans-Atlantic markets that...

Belgium is one of my favorite countries to be in, so I'm sad to see this airline struggle so. Seems like there are people running it who lack a calculated plan for success. The concept does have merit; Brussels has been reduced to not much more than a budget airline appendage of LH - but with this African network that probably keeps them going. OTOH, there are niches in the African and trans-Atlantic markets that can be tapped that Brussels Airlines have passed up. And, Brussels itself is rather conveniently located within a 2 hour train ride from Amsterdam, Paris and parts of NW Germany. In concept, this could be a success IF it had the right leadership.

Where in Africa is there opportunity that Brussels Airlines doesn't already fly? They have West Africa stitched up.

As much as I love Belgium the reality is it can barely support one carrier, much less two. From SABENA to the current incarnation Brussels Airlines; it's been a decades long saga of bailouts from public or private sources. I wouldn't put a single Euro in this venture.

Ill slap bang give em a couple lazy fittys for a handy in the back, why you say no euro for them.

you nasti

Also the "Smart" McKinsey Advisors for SwissAIR

Isn't it now owned by LH Group? They know what they are doing.

SN has probably the largest West African network of any European airline. Though BRU isn't a huge hub, it can feed pax from Africa, through BRU to other LHR hubs and destinations. I've always thought that was SN's attraction for LH Group.

They haven't tried launching flights to the U.S.. Maybe that should be their next strategy. Partner with a U.S. airline for connectivity and fly to JFK. I'd say AA or B6, given that they both don't fly to BRU. DL could work to, as they would get better market share in BRU (they currently have a daily flight out of JFK).

United flies multiple routes into BRU, mostly on 777-300ERs during the summer (with...

They haven't tried launching flights to the U.S.. Maybe that should be their next strategy. Partner with a U.S. airline for connectivity and fly to JFK. I'd say AA or B6, given that they both don't fly to BRU. DL could work to, as they would get better market share in BRU (they currently have a daily flight out of JFK).

United flies multiple routes into BRU, mostly on 777-300ERs during the summer (with Brussels Airlines being a star alliance partner). I assume Air Belgium could make JFK work with connectivity beyond JFK.

They can and should blame the Ukraine, with the Russian Airspace not available, it put them into a great advantage. Northern China routes like PKX-LHR adds a whopping 3 hours in-air comparing between CZ and BA. The amount of fuel, crew, airplane utilization cost associated with these totally unnecessary operation hours puts the fatal blow.

Yeah, but really how much of a market is there for travel to the PRC from Belgium? I can't imagine much and they had trouble attracting flies on those flights before Ukraine or the Wuhan flu ever started.

The earlier model of Air Belgium was to rely on mass order from cheap Chinese tour groups visiting the EU that always prefer direct flights. Charleroi won't be a concern for these groups as well as they always have a bus.

Their plan to rely on Chinese tourism failed in 2018, years before Russian airspace was closed to EU airlines.

Nice livery.

They are having success on the Brussels to Johannesburg and Cape Town routes clearly

As flights are full and ticket prices are increasing, I guess after 9 months of operation this route might help push the airline into profitability in 2024, still not so sure if it’s enough to achieve profitability in Q3 2023

James Asquith, Global Airlines lol

I was just about to suggest a codesharing agreement with Global Airlines.

I wish I had that kind of money to light on fire

If the airline owns the aircraft, the new investors might be getting a pretty good deal on some aircraft

If they can't make money in 2023 wet leasing aircraft to airlines like BA who retired too many aircraft during the pandemic and are desperate for more aircraft and staff amid massive demand, they never will.

Agreed. Wetleasing is the only viable business model I can think of.

Belgium is a market far too small for two longhaul carriers.