Link: Apply now for the World of Hyatt Credit Card

I think hotel credit cards are incredibly underrated. They can offer huge perks that more than offset their annual fees, ranging from free elite status to free night certificates, all of which can get you a lot of value.

While I have quite a few hotel credit cards, in this post I wanted to take a look at the hotel credit card that I spend the most money on, given the incentives for putting spending on the card. Best of all, this is a great time to apply for the card.

In this post:

World Of Hyatt Credit Card Basics For April 2024

I’d argue that the World of Hyatt Credit Card is one of the best hotel credit cards out there, thanks to its reasonable annual fee, as well as valuable perks.

What makes Hyatt’s personal credit card so brilliant is that it’s worth having regardless of whether you want to keep it just for the ongoing perks, or whether you want to spend money on it. Let’s take a closer look at what you need to know about this card.

Hyatt Card Welcome Bonus Offer

The World of Hyatt Credit Card currently has a welcome offer marketed as offering up to 60,000 World of Hyatt bonus points, in reality I’d consider the maximum incremental bonus here to be 45,000 points. Specifically:

- Earn 30,000 World of Hyatt bonus points after spending $3,000 on purchases in the first three months

- Earn an additional one bonus point per dollar on purchases that earn one point per dollar, on up to $15,000 spent in the first six months

In other words, if you spent $15,000 on the card within the first six months, you could be earning up to an incremental 45,000 World of Hyatt bonus points, in addition to the points you ordinarily earn from spending. While this isn’t the most exciting welcome offer on earth, it’s better than the previous bonus, and this is ultimately a card you get because of the value that it offers in the long run.

Hyatt Card Card Eligibility & Chase Restrictions

The welcome bonus on the World of Hyatt Card isn’t available to those who currently have a personal Hyatt credit card, or those have received the new cardmember bonus on a personal Hyatt credit card in the past 24 months. However, you are eligible if you have the business version of the card.

On top of that, Chase’s general card application rules apply.

Hyatt Card Annual Fee

The World of Hyatt Credit Card has a $95 annual fee, and it isn’t waived for the first year. You can add additional cardmembers to your account at no extra cost. As I’ll explain below, this annual fee is so worth it even if you don’t spend money on the card, since you get an anniversary free night award.

Earning Points With The Hyatt Credit Card

The World of Hyatt Credit Card offers pretty good points earning opportunities. While this isn’t the card that I use for all of my spending, I strategically spend money on the card, and it works great for for me. How good are the points earning rates?

Hyatt Card 4x Points At Hyatt Properties

The World of Hyatt Credit Card offers 4x points for spending at Hyatt hotels and resorts. While I use the Chase Sapphire Reserve® Card for hotel spending at most other hotel brands (as the card earns 3x points), I always use the World of Hyatt Card for spending at Hyatt hotels.

The 4x points category applies at all Hyatt properties, and even at Small Luxury Hotels of the World properties that are affiliated with Hyatt.

Hyatt Card 2x Points At Restaurants

The World of Hyatt Credit Card offers 2x points for restaurant spending globally, though personally this still isn’t a card I’d use for restaurants, given that some other cards offer 3-5x points.

Hyatt Card 2x Points On Airline Tickets

The World of Hyatt Credit Card offers 2x points on airline tickets purchased directly from airlines. Again, this isn’t the card I’d use for airline tickets, given that some other cards offer 3-5x points.

Hyatt Card 2x Points On Fitness Clubs & Gym Memberships

Hyatt has a focus on wellness, so one of the cool bonus categories is that you can earn 2x points on fitness clubs and gym memberships. For anyone wondering, this also includes group fitness businesses, like Barry’s Bootcamp, SoulCycle, etc.

This is an area where the card’s bonus category is industry-leading, as there aren’t many cards offering bonus rewards on fitness spending.

Hyatt Card 2x Points On Local Transit & Commuting

The World of Hyatt Card offers 2x points on local transit and commuting, which includes ride share services such as Lyft and Uber. Other cards still offer a better return on spending than this card does, though.

Hyatt Card 1x Points On Other Purchases

For categories in which you can’t earn 2-4x points, the World of Hyatt Card offers one World of Hyatt point per dollar spent. Generally speaking there are better cards for everyday spending, though as I’ll explain below, some of the spending bonuses could make it worth shifting spending onto this card.

Hyatt Card No Foreign Transaction Fees

The World of Hyatt Credit Card has no foreign transaction fees, so it’s an excellent card for purchases abroad. That’s especially true when staying at Hyatts abroad, as well as for dining and commuting outside the US.

Hyatt Card Contactless Pay

The World of Hyatt Credit Card features contactless pay technology. This means you can pay using your card without even swiping it whenever you see the contactless pay symbol.

World Of Hyatt Credit Card Benefits

The area where the World of Hyatt Credit Card really excels is when it comes to the benefits it offers. In my opinion, these benefits more than justify the annual fee, regardless of whether you’re spending nothing on the card, or are spending a significant amount.

The first three benefits below are perks that you get just for having the card, while the two after that can be earned for putting spending on the card.

Hyatt Card Anniversary Free Night

Just for having the World of Hyatt Credit Card you get a Category 1-4 free night award on your account anniversary every year. This will be issued shortly after your anniversary and is valid for 12 months.

Categories 1-4 cover a majority of Hyatt’s properties, and I’ve consistently been able to redeem this for hotels that retail for $250+ per night. This alone justifies the annual fee on the card.

Hyatt Card Complimentary Discoverist Status

You receive Hyatt’s entry-level Discoverist status for as long as you have the World of Hyatt Card. The status will post for the primary cardmember shortly after you are approved. Discoverist status comes with the following benefits:

- Upgrade to a preferred room, when available

- 2PM check-out, when available

- Premium internet

- Daily bottled water

Hyatt Card Five Elite Nights Toward Status Annually

Just for having the World of Hyatt Card you receive five elite qualifying nights toward status annually. You will receive these within eight weeks of being approved for the card (though usually much faster), and in subsequent years they will post within eight weeks of January 1.

This will be useful if you’re hoping to earn Hyatt’s Explorist status, Globalist status, and/or Milestone Rewards. For context, World of Hyatt Explorist status requires 30 elite nights, while World of Hyatt Globalist status requires 60 elite nights.

Hyatt Card Second Free Night When Spending $15,000

While you receive a Category 1-4 free night award annually just for having the card, you can earn a second free night award if you spend $15,000 on the card in a calendar year.

Hyatt Card Two Elite Nights For Every $5,000 Spent

In addition to the five elite nights you get just for having the card, you earn a further two elite qualifying nights for every $5,000 you spend on the World of Hyatt Card. This means that in theory, you could spend your way all the way to Explorist or Globalist status, if you wanted to.

Reaching the $5,000 threshold has nothing to do with the calendar or cardmember year — the counter simply resets every time you spend $5,000, and then you start earning toward your next two elite nights.

Hyatt Card Further Promotions

While there’s no guarantee this will continue to be offered in future years, historically Hyatt has offered additional promotions for those with the World of Hyatt Card, particularly when redeeming points.

For example, in the past we’ve seen World of Hyatt offer summer promotions, whereby card members can earn a partial refund on award nights. Hopefully we see more of these offers in the future.

Hyatt Card Chase Offers Access

One of the great features of Chase cards is access to Chase Offers, which provides savings on purchases with all kinds of retailers. The program has saved me a significant amount of money. For example, once in a while we see Chase Offers deals for 10% savings on Hyatt hotel stays.

Hyatt Card Secondary Car Rental Coverage

The World of Hyatt Card offers auto rental collision damage waiver coverage. Decline the rental company’s collision insurance and charge the entire rental cost to your card.

Coverage is provided for theft and collision damage for most cars in the United States and abroad. Do note that in the US, the coverage is secondary to your personal insurance, though.

Hyatt Card Protection With Trip Delays, Lost Luggage, And More

The World of Hyatt Card offers a variety of other protection when traveling, including:

- Trip Cancellation & Trip Interruption Insurance — be reimbursed up to $5,000 per trip when your trip is canceled or cut short due to sickness, severe weather, etc.

- Trip Delay Reimbursement — if your flight is delayed by more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket

- Lost Luggage Reimbursement — be reimbursed up to $3,000 per passenger if you or your immediate family member check or carry on luggage that is damaged or lost by an airline

- Baggage Delay Insurance — be reimbursed up to $100 per day for five days for essential purchases when your bag is delayed by over six hours

Make sure you check your cardmember agreement for all of the details, since there are terms & conditions.

Redeeming World Of Hyatt Points

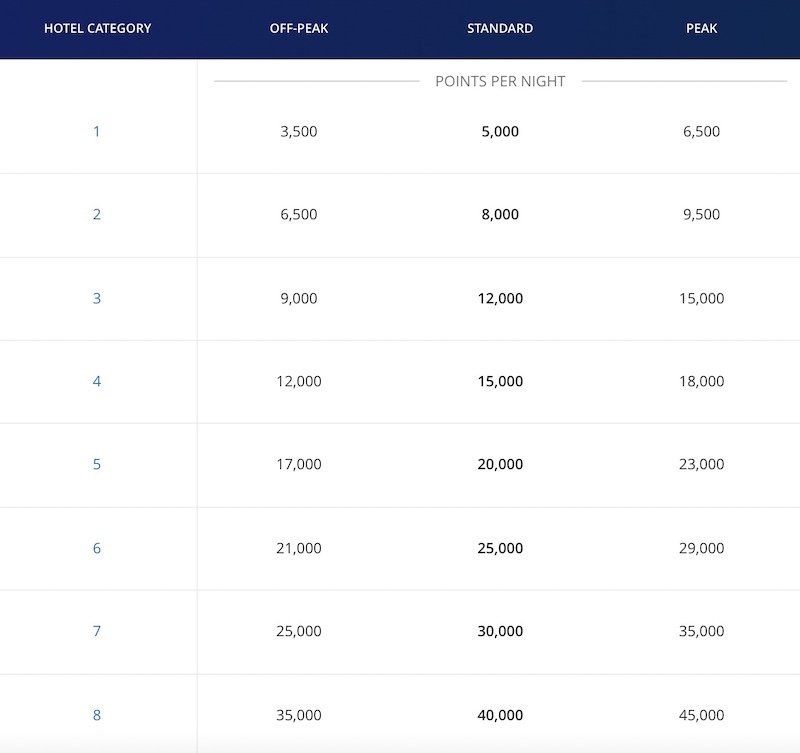

The best value for redeeming World of Hyatt points is using the free night award chart. The great thing is that you earn elite nights for your stay even if you’re redeeming points or using a free night award. Below is the World of Hyatt’s award chart.

There’s value to be had at all levels of the chart. As a general rule of thumb, I try to redeem at properties where I’m getting more than two cents of value per point. That’s because personally I value World of Hyatt points at ~1.5 cents each.

In other words, I’d redeem points at a Category 1 hotel during a standard period when the paid rate is $100+, I’d redeem points at a Category 7 hotel during a standard period when the paid rate is $600+, etc.

There’s so much value to be had at all levels of the award chart, and in particular, I love redeeming at Hyatt’s top properties.

Is The World Of Hyatt Credit Card Worth It?

Let me answer this very simply — if you’re eligible for the card and have any interest in staying at Hyatt properties then yes, the World of Hyatt Credit Card is absolutely worth it. This is a card I personally have, and that I wholeheartedly recommend.

With that simple answer out of the way, let’s talk more about the best strategy to take with the Hyatt Card — how much money should you spend on it, should you be putting all of your spending on this, and more.

Spend $15,000 Per Year On The Hyatt Card

Personally, my approach is to put $15,000 of spending on the World of Hyatt Card every year, and I think that’s a real sweet spot. As mentioned above, you get an anniversary free night award and five elite nights toward status annually just for having the card.

However, by spending $15,000 on the card in a year you receive:

- A second Category 1-4 free night award

- Six additional elite nights toward status, meaning I’m earning a total of 11 elite nights toward status annually with the card

As anyone who is a World of Hyatt Globalist member can attest to, the status is really valuable, and for many of us, the co-branded credit card makes it much easier to earn that status.

But even taking the value of the elite nights out of the equation, say you spend $15,000 on the card in categories on which you otherwise wouldn’t earn bonus points. You’re earning a Category 1-4 certificate that could be redeemed at a hotel costing up to 18,000 points, and that’s generally exactly how I redeem it.

So to me, that’s almost like earning over two World of Hyatt points per dollar spent, which is a great return on everyday spending. The reality is that I do even better than that, since most of that $15,000 of spending is at Hyatt hotels (where I earn 4x points), so the math works out even more favorably.

How Much Do You Have To Spend For Globalist Status?

I’ve had some people ask if it’s worth using this credit card to spend your way to Globalist status, which requires 60 elite nights. If you were to earn Globalist status from scratch, you’d need to spend $140,000:

- You get five elite nights toward status annually just for having the card

- You’d earn two more elite nights for every $5,000 spent, so spending $140,000 would earn you 56 elite nights, for a total of 61 elite nights

Personally I’d never spend all the way to Globalist status, but rather I’d use a hybrid approach, and would earn Globalist status partly through credit card spending and partly through actual stays. After all, if you’re not actually staying a significant number of nights, what’s the point of earning the status?

Is Hyatt Globalist Status Worth It?

Globalist status is my favorite top-tier hotel status, and it comes with all kinds of awesome perks. Many of the benefits are tied to the Milestone Rewards program, but just to give you a sense of what you could receive if you earned 60 elite nights in a calendar year:

- Unlimited complimentary suite upgrades, subject to availability at check-in

- Five confirmed suite upgrade awards, each of which can be used to confirm a suite upgrade at the time of booking for a stay of up to seven nights, when available

- Complimentary breakfast and/or club lounge access

- Guaranteed 4PM late check-out, except at resorts

- An additional Category 1-4 and Category 1-7 free night award

- Three Guest of Honor awards, whereby you can gift your Globalist perks to friends or family, each valid for a stay of up to seven nights

- Waived resort/destination fees on all stays, and free parking on award stays

- Access to My Hyatt Concierge

I’ve been a Hyatt loyalist for well over a decade, and have consistently had great experiences.

Other Options For Earning Hyatt Points

While the World of Hyatt Card is awesome, I’d note that it’s not the only way to earn World of Hyatt points. You can also transfer over points from Chase Ultimate Rewards at a 1:1 ratio, which is one of my favorite uses of those points. There could be value in using:

- The Chase Sapphire Reserve® Card (review), which offers 3x points on dining and travel

- The Chase Sapphire Preferred® Card (review), which offers 3x points on dining, streaming services, and online grocery store purchases, and 2x points on travel

- The Ink Business Preferred® Credit Card (review), which offers 3x points on the first $150,000 spent annually on travel, shipping purchases, internet, cable and phone services, and advertising purchases made with social media sites and search engines

- The Chase Freedom Unlimited® (review), which in conjunction with one of the above cards earns 3x points on dining and drugstores, and 1.5x points on all other purchases

- The Chase Freedom FlexSM Credit Card (review), which in conjunction with one of the above cards earns 5x points in rotating quarterly categories, and 3x points on dining and drugstores

See this post for all the best ways to earn Hyatt points.

How Does The World Of Hyatt Business Card Compare?

The World of Hyatt Business Credit Card (review) could be a good option for any small business looking to earn Hyatt points or status. Here are some key aspects of the card:

- It offers a larger welcome bonus, so you can earn more points quickly

- It has a $199 annual fee, which is more than twice as much as on the personal card

- It offers up to $100 in Hyatt credits every anniversary year; receive a $50 statement credit twice when you spend $50 at a Hyatt with the card

- It offers five elite nights toward status for every $10,000 spent in a calendar year

- It offers Discoverist status for as long as you have the card, for you and five employees

- If you spend $50,000 on the card in a calendar year, you can receive 10% back on subsequent award redemptions, up to 20,000 points back per year

Personally I think the personal card is generally more rewarding, though the business version of the card earns you elite nights at an accelerated rate.

Bottom Line

The World of Hyatt Credit Card is an exceptional hotel credit card. It’s a card I have, and a card I spend at least $15,000 on per year.

The card is worth having even if you don’t plan on putting spending on it — you get an anniversary free night award you can use at a hotel that costs significantly more than the annual fee, you get complimentary Discoverist status, and you get five elite nights toward a higher status tier.

Beyond that, it can be worth putting spending on the card, thanks to the unique bonus categories (4x points on Hyatt stays and 2x points on fitness and gyms), as well as the additional elite nights and second free night award.

If you want to learn more about the World of Hyatt Credit Card or apply, follow this link.

I am due the next 2 nights for 5K spend on the personal card, which was completed this January. They have not posted, so I secure messaged Chase. Agent is saying that spend is based on calendar year, which is not spelled out anywhere in the T&C, and also in my experience the spend rolls over. I’ve had this card since they changed it in 2018. Do you have any info? Who should I ask to handle this at Chase?