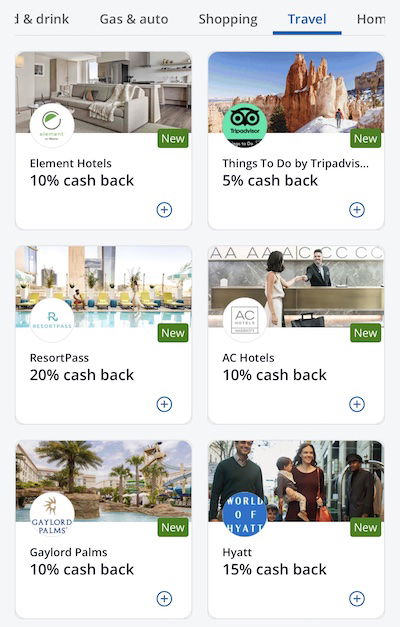

With Chase Offers, you can save money for purchases with select retailers. These promotions are targeted, and you’ll see different bonuses on different card accounts. There’s a great new offer for anyone who is planning a Hyatt stay in the next several weeks. We’ve seen this promotion several times before, though it has been some time.

In this post:

Save up to 15% at Hyatt with Chase Offers

There’s a new Chase Offers deal that can save you money when spending with Hyatt. Let me emphasize that:

- These offers are targeted

- Different accounts may see different versions of the same offer (including different percentage rebates)

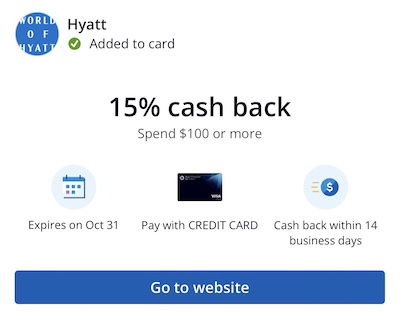

The promotion I see on one of my cards offers 15% back at Hyatt, and the general terms are as follows:

- This is valid when you pay for your stay by October 31, 2023

- You need to spend at least $100 to take advantage of the offer — you can receive up to $37.95 cash back, which you’d earn after spending $253 (all of which needs to be in one transaction)

- This promotion is valid at all domestic Hyatt brands, including Andaz, Grand Hyatt, Hyatt, Hyatt Centric, Hyatt House, Hyatt Place, Hyatt Regency, Miraval, Hyatt Residence Club, Alila, Thompson, The Unbound Collection, Destination by Hyatt, JdV by Hyatt, and Park Hyatt

The ideal cards for these offers

Each Chase card may be targeted for a different Chase Offers deal, though in this case you’ll ideally see the offer on one of the Hyatt co-brand credit cards, based on the return they offer on hotel spending.

This can be combined with virtually any other promotion Hyatt is offering.

How to access Chase Offers

You can see Chase Offers either through Chase’s website or mobile app when logged into your account:

- On the mobile app, click on your profile for a specific card, and scroll to the bottom

- On the website, go to your account summary page, and you should see Chase Offers on the right

Bottom line

There’s a new Chase Offers deal that can save you money on Hyatt stays, and it’s potentially useful. You can save 15% on up to $253 of spending, and most Hyatt brands are eligible for this, which is great. Ideally you’ll see this on a card that offers bonus points on hotel stays as well.

We’ve seen a similar promotion several times now, and I’ve been able to save money each time, so that’s great. As far as I’m concerned, it’s a pretty underrated credit card perk that’s easy to overlook.

Do you see this offer on one of your cards, and if so, do you plan on taking advantage of it?

Does offer work if I would buy Hyatt points on Hyatt website?

I got it on an Ink Unlimited, but hey, $38 is $38 bucks -- I'll take it. I don't think I've gotten a Hyatt offer on an actual Hyatt card since the beforetimes.

DId not get the offer just the Panera....

Regretably, not.

Not on my Chase (WoH) card.

In my experience, Chase is like the "C-" version of Amex Offers: the offers suck and the probability I'll get it is low.

None for me

I didn't get it as usual. Instead I got stuff like 10% back at Panera bread or 10% back at OfficeMax up to $11... What is the point of all this?

Will this work if I pay for a Hyatt Place in Europe also?

Yes, I got it the 15% on my Chase Hyatt card and yes, I will definitely use it.