Link: Apply now for the Citi® / AAdvantage® Executive World Elite Mastercard®

The Citi® / AAdvantage® Executive World Elite Mastercard® (review) is the sole credit card that offers American Admirals Club access. This is American’s most premium credit card, and there are lots of reasons to consider getting this card, from a generous welcome bonus, to the ability to earn 20,000 bonus Loyalty Points per year with no spending requirement on the card.

In this post, I want to go over everything you need to know about this card’s lounge access perks, which is probably the most valuable benefit of the card for many.

In this post:

Citi AAdvantage Executive Card Admirals Club basics

If you’re an American Airlines frequent flyer, then having the $595 annual fee Citi AAdvantage Executive Card is probably worth it. Airport lounge access is a valuable perk for any frequent flyer, whether you’re looking for help in the event of irregular operations, want to grab a drink or snack, or just want a quiet(ish) place to get some work done with Wi-Fi.

What makes the Citi AAdvantage Executive Card so valuable is that it not only offers an Admirals Club membership for the primary cardmember, but also offers Admirals Club access for authorized users (though at a cost). Ordinarily, American charges $700-850 per year for an Admirals Club membership, so this represents significant savings, not even factoring in the authorized user perks.

Let’s break down the details of these perks, starting with the Admirals Club membership for the primary cardmember, and then we’ll talk about the Admirals Club access for authorized users.

Admirals Club membership for primary cardmember

The primary cardmember on the Citi AAdvantage Executive Card receives a full Admirals Club membership:

- You can access Admirals Clubs worldwide when flying American Airlines or a oneworld partner airline the same day (you can even use the lounge on arrival)

- You’re allowed to bring immediate family (spouse, domestic partner and/or children under 18) or up to two guests

- Admirals Club members also receive access to Alaska Lounges, as well as access to dozens of other partner lounges, including lounges of Japan Airlines and Qantas (you can find the full lounge directory here)

- The Admirals Club membership will be tied to your American AAdvantage number, so there should be no need to show your credit card; rather, you just need to make sure your AAdvantage number is linked to your ticket

Since American ordinarily charges $700-850 per year for an Admirals Club membership, you’re saving anywhere from $105-255 per year by paying the card’s annual fee, and that doesn’t even factor in all of the other perks (including the ability to earn AAdvantage elite status through credit card spending, given American’s Loyalty Points system for status qualification).

Admirals Club access for authorized users

The Citi AAdvantage Executive Card allows the primary cardmember to add authorized users, and they each receive Admirals Club access as well. How much does it cost to add authorized users?

- You can add up to three authorized users for a total of $175 (so potentially under $60 each)

- Each authorized user after that costs $175

I think the sweet spot here is adding three authorized users, as that’s like getting someone Admirals Club access for under $60 annually — that’s quite a deal!

Here are the restrictions regarding that lounge access:

- You can access Admirals Clubs worldwide when flying American Airlines or a oneworld partner airline the same day (you can even use the lounge on arrival)

- You’re allowed to bring immediate family (spouse, domestic partner, and/or children under 18) or up to two guests

- Authorized users only get access to Admirals Clubs, and not to Alaska Lounges or other partner airline lounges

- Since authorized users get Admirals Club access rather than an Admirals Club membership, they’ll have to show their eligible credit card when entering clubs; there’s no way to have this linked to your American AAdvantage account

Crunching numbers on Admirals Club credit card perk

The Citi AAdvantage Executive Card has a $595 annual fee, which is $105-255 less than you’d otherwise pay for an Admirals Club membership. So how do I mentally account for the cost of the card, not even factoring in the other perks of the card? There are two ways to view it:

- Frankly, I fly American enough that I’d pay $595 per year for an Admirals Club membership, so getting a discount on it by picking up a credit card is the obvious choice

- I then have the opportunity to add three authorized users for a total of $175; getting three friends and family members lounge access for under $60 each per year is a fantastic deal

Citi AAdvantage Executive Card Admirals Club FAQs

While the above covers the basics of the Citi AAdvantage Executive Card Admirals Club access benefits, I want to answer some of the questions that may arise regarding this perk (and if there are any I missed, please let me know, and I’ll answer them too).

How soon after being approved is your Admirals Club membership activated?

Many people may be considering applying for the Citi AAdvantage Executive Card shortly before taking a trip. How soon after being approved for the card does your Admirals Club membership kick in?

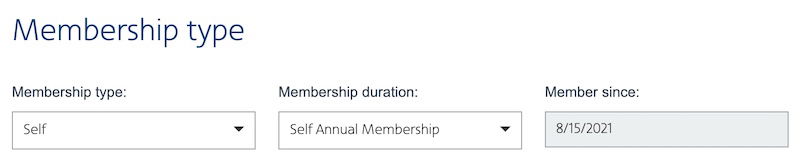

Since the primary cardmember gets a full Admirals Club membership, it’s linked to their AAdvantage account. Many may be surprised to learn that this membership could very well kick in before you even receive your credit card in the mail, and you don’t even need your card to enter a lounge.

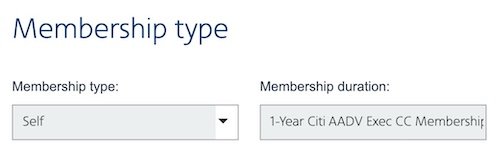

Fortunately, there’s an easy way to tell if your Admirals Club membership has been activated. To figure it out, pretend that you’re signing up for an Admirals Club membership. Go to this page, enter your AAdvantage number, last name, and password.

If your account has already been updated to reflect the Admirals Club membership, you’ll see that the next page shows “1-Year Citi AADV Exec CC Membership.”

If it hasn’t been updated, you’ll see that it gives you the option of choosing what kind of membership you want to purchase.

Note that this only works for the primary cardmember. Since the authorized users don’t get a full Admirals Club membership, they wouldn’t show up as being eligible online. Authorized users need to present the physical Citi AAdvantage Executive Card, since there’s no membership linked to their AAdvantage account.

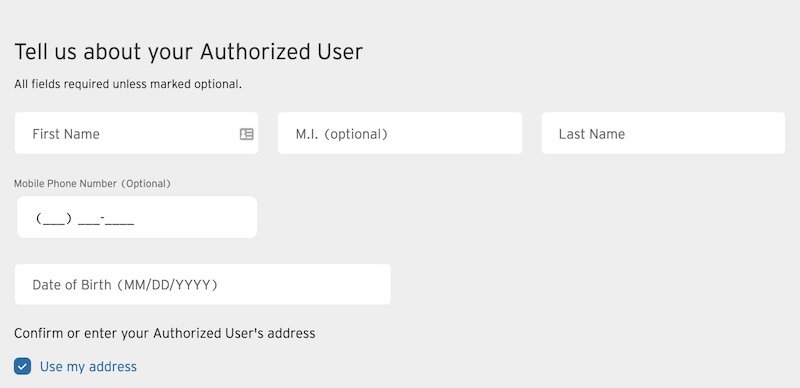

How do you add authorized users to the Citi AAdvantage Executive Card?

Adding authorized users to the Citi AAdvantage Executive Card is super easy, and can be done directly on Citi’s website. Follow this link to access the part of the Citi website where you add authorized users, and then log into your account.

On the next page, you’ll be able to manage authorized users, including adding and removing them.

You’ll just need their name to add them, and you have the choice of whether or not you want to give them permission to access your online account.

Does Citi let you set a lower spending limit for authorized users?

Any authorized user on the Citi AAdvantage Executive Card will have full access to your credit line, so be sure you trust them. There’s no way (at least not that I know of) to set a lower limit on an authorized user’s account, and any charges they incur will be your responsibility.

Is there an age limit for Citi AAdvantage Executive Card authorized users?

While Citi has no formal age limit on how old authorized users need to be, you need to be 18 to access Admirals Clubs through the Citi AAdvantage Executive Card. This ultimately comes down to whether or not the agent at the entrance asks for your ID (which they very well may).

What happens if you’re already an Admirals Club member?

In the event that you have an existing Admirals Club membership that you paid for, and you get approved for the Citi AAdvantage Executive Card, what happens? Assuming you have 60 or more days remaining on your current membership, you’ll receive a pro-rated refund, based on the number of days remaining in your membership.

This will happen automatically to your original form of payment, though it can take up to 12 weeks.

What happens if you cancel your Citi AAdvantage Executive Card?

If you cancel the Citi AAdvantage Executive Card, all Admirals Club benefits will immediately be terminated. This means the primary cardmember will lose their Admirals Club membership, and authorized users will lose Admirals Club access.

Is there a better credit card for airport lounge access?

The Citi AAdvantage Executive Card is without a doubt the best card for accessing American Admirals Clubs, so it’s a card that’s worthwhile for American frequent flyers. However, there are other cards that offer access to a larger selection of airport lounges, assuming you’re not determined to access American lounges.

Just to present a few other options:

- The Capital One Venture X Rewards Credit Card (review) offers a Priority Pass membership and access to Capital One Lounges

- The Chase Sapphire Reserve® Card (review) offers a Priority Pass membership and access to Chase Sapphire Lounges

- The Platinum Card® from American Express (review) offers the most comprehensive lounge access program of any card, between a Priority Pass membership (Enrollment required), access to Amex Centurion Lounges, access to Delta Sky Club® when flying Delta same day, and more

Bottom line

The Citi AAdvantage Executive Card is the best credit card for accessing American Airlines Admirals Clubs. The card not only offers an Admirals Club membership for the primary cardmember, but also offers Admirals Club access for authorized users, which you can add at a reasonable cost.

Hopefully the above answers any questions people may have had about how this benefit works. If there’s anything I didn’t cover, let me know!

If you have the Citi AAdvantage Executive Card, what has your experience been with its value?

My Qatar Visa also provides access - so… not the only card!

How many of us remember which lounge (that doesn't exist anymore) is in the article's anchor image on the home page? Hint: the Card did not provide access to that lounge. :-)

@ Lee -- Hah, wait a second, you're talking about the featured image? It's the D30 Admirals Club in Miami. :-) I'm curious which one you thought it was, as I always love some lounge trivia.