Several weeks ago, Taiwan-based Starlux Airlines launched service to its third destination in the United States. While this service is initially being operated 3x weekly, it will soon be expanded to daily. Let’s take a look at the details, plus the bigger picture competitive landscape, which is pretty remarkable.

In this post:

Starlux Airlines’ flights from Taipei to Seattle

For some background, as of August 16, 2024, Starlux Airlines started flying between Taipei (TPE) and Seattle (SEA). The flight operates with the following schedule:

JX32 Taipei to Seattle departing 8:00PM arriving 4:15PM

JX31 Seattle to Taipei departing 2:10AM arriving 5:10AM (+1 day)

The 6,075-mile flight currently operates 3x weekly. The eastbound flight is blocked at 11hr15min and operates on Sundays, Wednesdays, and Fridays, while the westbound flight is blocked at 12hr and operates on Mondays, Thursdays, and Saturdays.

However, as reported by AeroRoutes, Starlux will soon be expanding service in this market. As of March 1, 2025, Starlux will operate daily flights to Seattle, more than doubling the current capacity.

Starlux uses an Airbus A350-900 for all of its routes to the United States. The airline first started flying to Los Angeles (LAX) as of April 2023, and then started flying to San Francisco (SFO) as of December 2023. Starlux’s A350-900s feature 306 seats, spread across four cabins, including:

- Four first class seats

- 26 business class seats

- 36 premium economy seats

- 240 economy class seats

Starlux is the only airline in Taiwan to offer first class. A350s feature four first class seats, in a 1-2-1 configuration. First class suites feature 60-inch doors and privacy partitions, 32-inch 4K screens with bluetooth audio, zero-gravity seat settings, and personal wardrobes for storing luggage.

Starlux A350s feature 26 business class seats, in a 1-2-1 configuration. Business class seats feature 48-inch doors and privacy partitions, 24-inch 4K screens with bluetooth audio, and zero-gravity seat settings.

Starlux A350s feature 36 premium economy seats, in a 2-4-2 configuration. Premium economy seats feature leg rests and footrest bars, and 15.6-inch 4K screens with bluetooth audio.

Starlux A350s feature 240 economy seats, in a 3-3-3 configuration. Economy seats feature 13-inch 4K screens with bluetooth audio.

I’ve reviewed Starlux Airlines’ A350 business class, which is a very good product, among my favorite business class experiences out there.

Starlux is an Alaska Mileage Plan partner, so it’s possible to redeem Mileage Plan miles for travel on Starlux. However, note that saver level business class award availability is virtually non-existent, so you’ll typically be paying at least 175,000 miles one-way.

Seattle to Taipei is a mighty competitive market

Taiwan is an incredibly competitive aviation market, with three top notch airlines. In addition to Starlux Airlines, you also have China Airlines and EVA Air. What’s kind of unbelievable is the level of competition we’re seeing between Seattle and Taipei, and in particular, how much more competitive it has become in recent times:

- EVA Air operates up to 10x weekly flights in the market, and was the first airline flying between the two airports

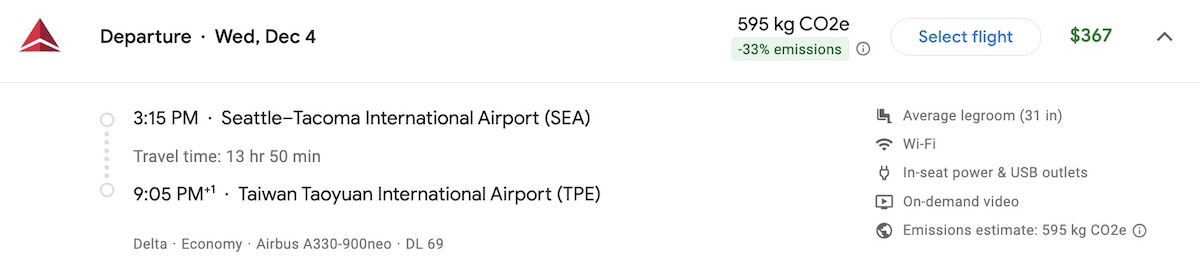

- Delta operates daily flights in the market, which were first launched in June 2024

- China Airlines operates 5x weekly flights in the market, which were first launched in July 2024

- Now we’re seeing Starlux increase service from 3x weekly to daily

It’s pretty wild that over the course of two months, we saw a market go from having one airline to having four airlines. Ultimately consumers are the winners here. I mean, just look at how cheap pricing is between the airports, as Delta has economy fares of under $400 one-way… for a 14-hour flight!

While Starlux has a great product, the airline also has some disadvantages. Starlux’s route network is much smaller than those of competitors, Starlux isn’t part of one of the global alliances (yet), and Starlux also doesn’t have terribly competitive pricing. At least Starlux has a partnership with Alaska Airlines, so the airline has connectivity in the Pacific Northwest.

Bottom line

In August 2024, Starlux Airlines launched a route between Taipei and Seattle. While the service is currently operating 3x weekly, as of March 2025 it will be increased to daily. This is such a competitive market, when you consider that it was historically only served by EVA Air, and within a couple of months we saw three airlines add service as well.

I’m very curious to see how this evolves, and which airline is first to cut (or at least scale back) service. Not that it means anything, but I find it interesting how Delta consistently has the cheapest economy pricing, while also having the highest cost structure.

What do you make of Starlux Airlines’ Seattle flights, plus the overall competition in the market?

Well I want to try StarLux to see if touted services warranted but was in at 255,000 AS with First DCA SFO then Biz to SIN

With daily SEA open, I snagged flts for 85.000 AS miles but with DCA SEA in seat 6D (oh the inhumanity )

So coach then Biz Then SQ Suites to FRA then LH to SFO to really enjoy the seat1K Queen of the Skies. Home on AS First using AS miles. Love my Bank of America AS churning. Safe travels!

Those Starlux departure/ arrival times SEA-TPE are awful. Who wants to leave at 0210 and arrive 0510? If you're visiting, its going to be a long day (after a long night) until your hotel is available. Would love to try them the reverse someday, but I'm coming home next month from HND (DL both ways).

Those are pretty similar to EVA and CI's departure times. As well as for most of their other departures on the West Coast.

This is about optimizing for connecting traffic. If you arrive 5am, you have a full day's schedule to connect passengers onto.

it is inevitable for destinations in NE Asia esp. from the west coast; flights are just not long enough considering the time differences to avoid a middle of the night departure.

And it is also why DL's daytime departures - which parallel UA's daytime bank of flights at SFO - are the preferred time channel for business travel.

Load factors don't matter if you get much higher levels of revenue.

Business people don't want...

it is inevitable for destinations in NE Asia esp. from the west coast; flights are just not long enough considering the time differences to avoid a middle of the night departure.

And it is also why DL's daytime departures - which parallel UA's daytime bank of flights at SFO - are the preferred time channel for business travel.

Load factors don't matter if you get much higher levels of revenue.

Business people don't want to stay up to board at 2 am.

Either you fly nonstop on overnight flights that have reasonable departure and arrival times - which UA does from SFO on its overnight bank - or you fly daytime including via NE Asia hubs - which is what DL and UA both do on their nonstops to NE Asia and via their NE Asia hubs - NRT for UA and ICN for DL.

Interesting to see the CI block times are almost an hour longer than Starlux’ despite also using an A350, and DL’s still almost an hour longer than that with the lower cruise speed of the A330. A 12-hour block time is extremely optimistic. Looks like they’ve adjusted it up to 12h25m in the spring schedule.

on recent days, all 4 airlines have operated the total flight within 5 minutes of each other except for data issues such as bad taxi times.

It appears to me looking at Flightaware data, the time aloft seems to be about 30” longer for DAL. The westbound flights are consistently 13’00 to 13’30 while CI, BR, and JX are more along the lines of 12’15 to 12’45. Seeing about the same 30” difference for the Eastward journeys. This would be consistent with the difference in average cruise speed between the assorted aircraft types.

the A350 does cruise faster which is probably part of the reason why DL appears to be moving to replace the A330NEO over the Pacific with the A350 and use the A330NEOs over the Atlantic.

They didn't have enough A350s when they started the SEA hub but they will now esp. with the conversion of the ex-Latam A350s.

The A350-900 will actually have fewer seats in DL's A350H configuration than the A330-900. DL...

the A350 does cruise faster which is probably part of the reason why DL appears to be moving to replace the A330NEO over the Pacific with the A350 and use the A330NEOs over the Atlantic.

They didn't have enough A350s when they started the SEA hub but they will now esp. with the conversion of the ex-Latam A350s.

The A350-900 will actually have fewer seats in DL's A350H configuration than the A330-900. DL might reconfigure the A330-900 closer to VS' configuration but they haven't yet. the 339 is better in markets where there are multiple frequencies including to AMS, CDG, FCO and ATH.

There are also rumors that the 359 will be used for the SLC to CDG and AMS flights because of the better performance of the 350 in high and hot situations which SLC sees in the summer.

The 350 is just a better plane. DL didn't have enough of them while the A330NEO was readily available. DL is nearing the end of its A330NEO delivery cycle. It will be interesting to see if they use any of their 20 options for 330NEOs or go all for 350s. I would strongly bet given their willingness to pick up the 35Ks from VS that they are anxious to quickly build their 35K fleet beyond the confirmed 20 aircraft. Since DL announced the order right after the first of this year, they haven't revealed the delivery timeline for the aircraft but that will be done at the end of this year in their annual report that comes out in Feb 2025. by that point, their configuration will likely become public.

Last year I flew on an Alaska Air ticket from SEA to LAX to TPE via Starlux in Business Class. The hard product is very nice. The food and service were nice also but seemed forced and awkward at times. On the way home to SEA I flew business class on Delta from Seoul. The hard product wasn't as nice but the service was so much smoother and more comfortable. My two cents: Delta was better.

hope that delta could start working with its skyteam partner china airlines, maybe the result could be better, as they are the only alliance with two airlines running this route.

I will go out on a not-very-long limb and say that DL's primary objective in NE Asia right now is getting the OZ-KE merger approved by the DOJ and minimizing any concessions that has to be given. If DL had its way, it would probably have added a number of additional ICN flights on its own metal including JFK-ICN and LAX-ICN. CI understands this dynamic.

Whether DL and CI choose to move beyond a simple...

I will go out on a not-very-long limb and say that DL's primary objective in NE Asia right now is getting the OZ-KE merger approved by the DOJ and minimizing any concessions that has to be given. If DL had its way, it would probably have added a number of additional ICN flights on its own metal including JFK-ICN and LAX-ICN. CI understands this dynamic.

Whether DL and CI choose to move beyond a simple codeshare and alliance relationship when the KE-OZ merger is approved remains to be seen but any partnership between DL and CI has to be seen w/in the larger context of DL and KE.

If DL did decide to move forward with a JV with CI, the 3 would be a very powerful force in NE Asia. that is precisely why they are moving slowly and competing w/ each other right now

It's funny how you love to comment that Delta is actively planning to be anti-competitive in their future plans for the JV

it's BIZARRE that you misinterpret so many things, including this.

Are you really this dense or do you love to just stir the pot?

There isn't much room for misinterpreting your comments about Delta purposefully planning to anti-consumer actions after the KE-OZ merger is approved.

Perhaps contemplate what you write before you write it if you're so offended by your own words.

well, yes you did misinterpret.

The KE-OZ merger will concentrate services. No one denies that.

But the US and S. Korea have had open skies for years and there have been new flights added recently. In addition, there have been divestitures of assets to/from a number of countries in order to preserve competition.

The US will do the same since the US- S. Korea market is the largest country - which is true w/...

well, yes you did misinterpret.

The KE-OZ merger will concentrate services. No one denies that.

But the US and S. Korea have had open skies for years and there have been new flights added recently. In addition, there have been divestitures of assets to/from a number of countries in order to preserve competition.

The US will do the same since the US- S. Korea market is the largest country - which is true w/ many countries.

DL might or might not try to add CI into the mix but a JV would further concentrate the market.

I am not trying to predict what DL, KE or CI will do but I am saying to those that keep saying that DL and CI should cooperate further that the DL-KE relationship is of highest importance - and until the OZ merger is approved, it makes no sense to talk about any other partnerships.

Instead of shooting off and accusing people of something they didn't say, how about you learn to ask for clarification and hold your fire?

yeah, I know that's a tall ask but it is what any rational and well-balanced person would do - which probably DOES NOT include you.

Tim

If you don’t like what you write, don’t write it. Trying your usual misdirection and lame attempts at attacks doesn’t change what you wrote above that anyone can read.

It’s quite simple. You seem to believe Delta is actively pursuing actions that DOT would deem anti competitive in an attempt to get the KE-OZ merger approved. Its already anti competitive by the very nature of the purpose of it but you then said...

Tim

If you don’t like what you write, don’t write it. Trying your usual misdirection and lame attempts at attacks doesn’t change what you wrote above that anyone can read.

It’s quite simple. You seem to believe Delta is actively pursuing actions that DOT would deem anti competitive in an attempt to get the KE-OZ merger approved. Its already anti competitive by the very nature of the purpose of it but you then said delta that has no controlling ownership stake in KE’s parent company yet is still purposefully withholding smart business decisions because the US government would deem them anti competitive

Read what you write, buddy

You’re right though. Delta is acting in a very anti consumer manner but that’s pretty normal for delta and skypesos

"There isn't much room for misinterpreting your comments about Delta purposefully planning to anti-consumer actions after the KE-OZ merger is approved."

Come on dude, you're really reaching with this one.

Max is right on this one. Not much of a read to figure out what Tim is trying to say here.

Delta is not running routes that are good for its business because it's worried about how the US government would view those planned routes in light of the KE-OZ merger and DL JV. That's pretty much the definition of trying to play the government and hold back on profitable decisions when you're worried about anti-competitive analysis from the government.

Forgot to also mention, Starlux is increasing to 10x weekly service at LAX as well. @Ben, might be notable to call that out.

There's no choice. It's EVA or nothing. It's Star, so I'll go far.

Blind brand loyalty such as this is so bizarre.

From the August data, the poorest performer on this market right now is Delta, but not yet at the point of folding. Latest LFs showed they are at low 80%s. CI and JX are basically at the same with almost 88%, BR is maintaining its 90%+. Since Alaska is codesharing/interlining with all 3 Taiwanese airlines, I suspect they are being propped up by Alaska's dominant market position in SEA.

SFO has seen a 10% decrease...

From the August data, the poorest performer on this market right now is Delta, but not yet at the point of folding. Latest LFs showed they are at low 80%s. CI and JX are basically at the same with almost 88%, BR is maintaining its 90%+. Since Alaska is codesharing/interlining with all 3 Taiwanese airlines, I suspect they are being propped up by Alaska's dominant market position in SEA.

SFO has seen a 10% decrease in traffic across the past 2 months, down to only 81%. Delta's daytime route is likely causing some attrition to BR/UA's daytime routes.

UA is reducing capacity this winter, so we may not see a return to double daily from them in SFO, so what remains to see is when CI and JX increase to daily service what happens.

Ultimately, TPE capacity needs to be looked at holistically from the West Coast market and not individual airports. There is a ton of capacity between LAX/SFO/SEA/YVR. All with multiple daily flights across carriers.

I agree and assume SFO will likely lose either one UA or EVA daily frequency (or both). At the same time, it is peak season for Taiwan. Operating at the low 80's LFs is a troubling sign for the months to come.

Reading between the lines, Delta SkyMiles is not a generous program, but there is wide open Delta One saver seat availability between SEA - TPE in October, November (blacks out between Thanksgiving -...

I agree and assume SFO will likely lose either one UA or EVA daily frequency (or both). At the same time, it is peak season for Taiwan. Operating at the low 80's LFs is a troubling sign for the months to come.

Reading between the lines, Delta SkyMiles is not a generous program, but there is wide open Delta One saver seat availability between SEA - TPE in October, November (blacks out between Thanksgiving - Christmas), and post New Years until the end of February. There is economy saver seat availability almost daily outside of Thanksgiving - Christmas until May 15th. Given dynamic pricing and the cash pricing Ben refers to, this suggests loads are much lower for both business and economy in the off-peak at almost certainly unprofitable levels.

Not sure if the policy still applies but foreign registered aircraft could not fly direct to Taiwan including flights using Chinese airspace, from the UK China Airlines is the only carrier that flys direct to TPE. I think a lot of traffic via the US is originating from the EU which contributes to a stable PAX feed.

Not quite accurate use of terminology. EVA has "direct" flights to LHR via BKK, but yes CI is the only one with nonstop flights.

Yeah I believe it’s a “technical stop” which is or was allowed by the Chinese

the stop in bkk has nothing to do with china lol, china airlines is a Taiwanese airlines same as Eva, just with a stupid name

@Alex yes but the CI aircraft avoids Chinese airspace

Money is on delta blinking first. I think there should be more focus on demand for TPE than SEA. Delta is using their unique schedule bc of US feed but that assumes 1) TPE as a final destination which is extremely limiting since they aren't coordinated with partner flights banks and 2) doesn't acknowledge that feed can be transfered to other major gateways. If Delta wants to stay in this game, they need to coordinate...

Money is on delta blinking first. I think there should be more focus on demand for TPE than SEA. Delta is using their unique schedule bc of US feed but that assumes 1) TPE as a final destination which is extremely limiting since they aren't coordinated with partner flights banks and 2) doesn't acknowledge that feed can be transfered to other major gateways. If Delta wants to stay in this game, they need to coordinate better with China Airlines. I'm not a big fan of China Airlines but their network in E and SE Asia is quite admirable.

Seattle's strength (vs other potential gateways to Taiwan) is it's location in the NW corner of the lower 48, making it a reasonable connection point. Combine that with it being the main hub of AS and you do have some feed. It's a business center with some tech that would generate business on such a route. So there's that. Is it enough to feed 4 airlines enough revenue to make this work? I tend to...

Seattle's strength (vs other potential gateways to Taiwan) is it's location in the NW corner of the lower 48, making it a reasonable connection point. Combine that with it being the main hub of AS and you do have some feed. It's a business center with some tech that would generate business on such a route. So there's that. Is it enough to feed 4 airlines enough revenue to make this work? I tend to doubt it. Starlux will get feed from AS which will be key. DL will get similar feed from it's own network via SEA. So, people connecting from the interior west or parts of the midwest may find a connection at SEA to work in this case. It would be quicker and more direct than flying via SFO or LAX (which will rely on the large local demand in each market).

Personally, I think 4 is too many airlines serving this route. China Airlines would seem to be the likely first one to blink, though pride may prevent this. It will be interesting to watch, that's for sure.

I wonder if they ever will expand to Europe...

they did talk about a Europe plan in their pre-listing meeting, if I remember correctly it should be no earlier than 2026.

Just guessing... China Airlines will drop out. It's only hope is if Delta drops out instead.

Starlux could blink and change its schedule but probably won't (TPE-SEA late afternoon arrive early afternoon; SEA-TPE mid afternoon arrive early evening). Delta currently has a different schedule than the others due to its feed is to and from the US, not beyond Taiwan.

As of August, the latest data, China Airlines is performing the 2nd best by LF, albeit only 0.1% more than JX. Since BR/CI are interlining with Alaska, they are being supported by having stronger domestic feed than Delta.

However, based on the latest data, if they maintain similar LFs and no major dips over the winter season, it could possible to sustain this many carriers.

CI and BR also have large connecting networks out of Taipei, and there is a sizeable Asian population in Seattle.

JX has feed on both ends - domestic connections from Seattle and connections to rest of Asia (albeit on a much smaller network) out of Taipei.

DL also has domestic feed in Seattle which helps but they don't really partner closely with CI for connections beyond TPE. DL prefers to funnel connections via ICN. In...

CI and BR also have large connecting networks out of Taipei, and there is a sizeable Asian population in Seattle.

JX has feed on both ends - domestic connections from Seattle and connections to rest of Asia (albeit on a much smaller network) out of Taipei.

DL also has domestic feed in Seattle which helps but they don't really partner closely with CI for connections beyond TPE. DL prefers to funnel connections via ICN. In the long run, I imagine if the TPE route doesn't work well enough, they can just go back to connecting folks via ICN to serve TPE.

Not sure why anyone would fly Starlux or Eva when they can taken THE WORLD'S MOST PREMIUM AIRLINE

Taiwan is clearly a strong market but there is likely overcapacity at some times of the year. The same 3 Taiwanese airlines plus a US airline fly from SFO while the same 3 also flying from LAX.

unless a competing airport is taking over the capacity connecting South East Asia and the states, or China and US suddenly decide to increase capacity, they are far from overcapacity.

Agreed with Starwalker. I've taken multiple flights from SFO and they're almost always full, even in off-season.

Wrong, Timbits. It's one real airline (it's part of Star, after all), two pretend airlines, and a credit card company that flies planes and is run by a homophobe.

ORD, are you suggesting Ed Bastian is a homophobe? There are plenty of legit critiques about what Delta does well and poorly, but Ed Bastian a homophobe? You'd kind of having to know nothing about the airline leadership to say that.

ORD is a deeply insecure individual with an inferiority complex to what they deem "coastal elitists". Probably most well known for their one-sided beef with JetBlue and the state of New York. I really wouldn't give them any attention outside of the ranting of a delusional vagrant.

There are a couple deeply insecure people in the comment section obsessed with an airline. ;)

Wow an expansion was not what I expected. And Ben's points about Delta are right. Wouldn't be surprised to find out this route isn't working out all that well for them if one way Y is sub $400 with their higher US-based cost structure. Makes sense though: there are a lot of very good options (JX, BR, CI) that I would take before DL, and at least one of them is likely to be available...

Wow an expansion was not what I expected. And Ben's points about Delta are right. Wouldn't be surprised to find out this route isn't working out all that well for them if one way Y is sub $400 with their higher US-based cost structure. Makes sense though: there are a lot of very good options (JX, BR, CI) that I would take before DL, and at least one of them is likely to be available at a good price at any given time so there's basically no chance I'd be on DL SEA-TPE

Some load factor data from the Port of Seattle on this route:

Eva (only carrier):

- Jan: 88.7%

- Feb: 86.9%

- Mar: 97.2%

- Apr: 96.5%

- May: 96.9%

Delta enters the market in June - that month:

- Eva: 97.8%; Delta: 88.9%

China Airlines then enters the market in July - that month:

- Eva: 92.4%; China Airlines: 88.5%; Delta: 83.8%

Starlux then enters the market...

Some load factor data from the Port of Seattle on this route:

Eva (only carrier):

- Jan: 88.7%

- Feb: 86.9%

- Mar: 97.2%

- Apr: 96.5%

- May: 96.9%

Delta enters the market in June - that month:

- Eva: 97.8%; Delta: 88.9%

China Airlines then enters the market in July - that month:

- Eva: 92.4%; China Airlines: 88.5%; Delta: 83.8%

Starlux then enters the market in August - last month:

- Eva: 93.0%; China Airlines: 87.8%; Starlux: 87.7%; Delta: 82.2%

Couple takeaways:

- SEA-TPE LFs are historically highest from March - Sept (makes sense why Starlux goes daily next March). Eva’s LFs have dropped ~3-4% after China Airlines and Starlux entered the market (no drop w/ Delta)

- Surprisingly, Delta has the lowest LFs. Break-even is generally ~80% for a US carrier - w/ seasonality it is very likely Delta will fall below that threshold from Oct - Feb given they're at ~83% in August. Delta's concern should be is they're marginally above in peak season w/ Starlux just entering (and likely unprofitable for half the year) and planning to expand capacity, this route will likely not be profitable

Airlines that have load factors above 90% likely sell last minute tickets through consolidators - which means low fares.

Delta's original choice of the A330-900 probably was because they know the market would be soft in the off-peak season but there isn't any indication that it is any softer for them than it is for United out of SFO.

DL says that they will upgrade SEA-TPE to an A350 next year and there are persistent...

Airlines that have load factors above 90% likely sell last minute tickets through consolidators - which means low fares.

Delta's original choice of the A330-900 probably was because they know the market would be soft in the off-peak season but there isn't any indication that it is any softer for them than it is for United out of SFO.

DL says that they will upgrade SEA-TPE to an A350 next year and there are persistent rumors that an A350 pilot base is coming to SEA as A330-900s will be shifted to transatlantic flying and off the Pacific; the conversion of the ex-Latam A350s to DL standard adds 9 A350s on top of the dozen plus new delivery A350s that DL is getting in 2024 and 2025. The A350 has more premium select plus business class seats so DL probably recognizes that they can fill those seats - regardless of what happens in coach.

US carriers in general have a much higher chance of getting business travel revenue than their foreign counterparts.

DL's flight is timed to provide feed from across the US just as is true with UA at SFO; DL is retiming its flight this fall to provide even more feed potential. The Taiwanese carriers are all focused on connecting beyond Taiwan which is a smaller and more competitive market than the US market.

All that is fine, but if Delta's LFs drop like Eva's have historically from Oct-Feb, that means low-mid 70's LF for half the year. That's unprofitable no matter what you sell up-front. Even in peak season we're seeing 82% w/ low Starlux capacity - a slight drop (likely) and we're talking break-even in peak season.

Given the West Coast business centers of LA and SF and the East Coast NYC have comparable capacity as Seattle...

All that is fine, but if Delta's LFs drop like Eva's have historically from Oct-Feb, that means low-mid 70's LF for half the year. That's unprofitable no matter what you sell up-front. Even in peak season we're seeing 82% w/ low Starlux capacity - a slight drop (likely) and we're talking break-even in peak season.

Given the West Coast business centers of LA and SF and the East Coast NYC have comparable capacity as Seattle (w/ Eva also serving Chicago), how much US business travel is unserved? Why choose Seattle over LAX, SFO, JFK, or ORD? Business travel from Taiwan will prefer local carriers, so this market will be competitive. Not sure I agree it will be easy to run close to 100% LFs up-front for Delta.

Also FYI, SFO has 2.5x the capacity of Seattle but the same LFs. There is far more demand in both business and local which will help United vs Delta.

To my point, there is saver availability for SEA-TPE in business readily available in Oct and Nov, and then in Jan and Feb: https://frequentmiler.com/good-availability-from-us-to-taipei-on-delta-one-from-98000-skymiles-83300-for-delta-cardholders/

That suggests demand is not amazing up-front in low-season. With likely low 70's LFs, the financials are obvious.

those are all nice statements in theory but the reality is driven by actual facts - some of which we may never know including the actual profitability for each airline.

The Taiwanese airlines are all competing for the same traffic given the time channels.

US-Taiwan demand is heavily concentrated in a few markets but that is true w/ just about every country.

US carriers have the advantage not only in getting business travel...

those are all nice statements in theory but the reality is driven by actual facts - some of which we may never know including the actual profitability for each airline.

The Taiwanese airlines are all competing for the same traffic given the time channels.

US-Taiwan demand is heavily concentrated in a few markets but that is true w/ just about every country.

US carriers have the advantage not only in getting business travel demand but also in serving the ones and twos of demand spread across multiple markets. Even the AS codeshare - not a JV - can't match the online connectivity that DL has which could be matched by a JV but none exists in the market now.

You're funny daddy...your reality has NEVER been driven by actual facts...especially when it comes to the galaxy's #1 PREMIUM airline!

funny that you and your illegitimate ilk are the ones that branded DL as you see it and not me.

Most people can figure out that you are a sore loser that can't participate in the conversation on your own merits.

To be fair, SEA's LFs are somewhat sustainable if maintained, it's clear that SFO has taken a hit with a 10% decrease in overall LFs across the last two months.

I see this as more of rebalancing capacity across the hubs. EVA was doing as many as 4 flights in a day from SFO, which is crazy to think about since even many major EU hubs don't get as much daily service.

Your airline is a horrendous flaming bag of dog waste with customer service straight out of a women's prison movie, your planes (especially the ones from the criminal conspiracy in Toulouse) are flying dumpsters and the garbage that fill them, and your CEO is a homophobic hypocrite who can't even craptalk well. So shut up, Dunn, and go off to your job of providing oral pleasure to anyone wearing a widget.

take your meds dude

Tim with the "Owned by Delta" tattoo on his butt cheek will refute this with fantasy.

The when Delta drops the route he'll say he told us so.

Makes sense... why would you fly DL when you could fly one of three different airlines which are actually premium?

"why would you fly DL when you could fly one of three different airlines which are actually premium?"

Or better still, why do people keep asking this question about any airline, when the answer is always the same?

Contracts, FFP/Elite/CC benefits, network, pricing, timing, or just plain wanting to based on habit. The answer never changes, why is it so hard to comprehend?