We all have different things we’re looking for in credit cards, and over time those things sometimes change. Maybe our spending patterns change, maybe the perks we value change, and in some cases maybe card issuers make changes to cards that are deal-breakers for us.

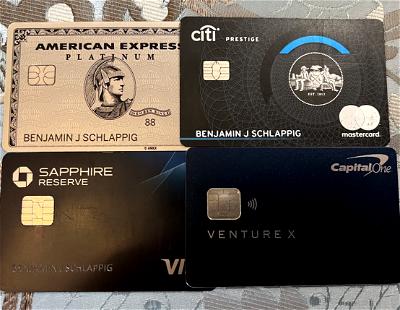

I have over two dozen credit cards, and whenever an annual fee is due, I analyze whether I should keep or cancel the card. If a card isn’t providing ongoing value to me then I don’t keep it. In this post, I wanted to take a look at how to decide whether to keep or cancel a card, and then what to consider if you do decide to cancel a card.

In this post:

How to decide whether to keep or cancel a credit card

The way I see it, there are three big factors to consider when applying for a credit card:

- The acquisition bonus (sign-up bonus, welcome bonus, or new cardmember bonus)

- The return on everyday spending

- Perks for simply being a cardmember

Sign-up bonuses can be a great motivator for getting a credit card, though generally those only apply for the first year, so that doesn’t help your ongoing analysis of whether or not a credit card is worth it.

That’s why it makes sense to decide every year whether or not to keep a card. Personally I hold onto cards either for the perks they offer, or for the return on spending that they offer, or in the case of no annual fee cards, for the positive impact they have on my credit score (more on that below).

Let me provide a bit of background on how I go about doing the math on this.

How do I decide whether to keep cards for the perks?

For me, the math is typically quite straightforward about whether cards are worth keeping for the perks. If I got more value out of the perks on a card in the past year than the annual fee, I keep it. If not, I generally cancel it.

To give a few examples of how I approach the value proposition of cards:

- The IHG One Rewards Premier Credit Card (review) has a $99 annual fee, and offers an anniversary free night certificate valid at a property costing up to 40,000 points, which I consistently use at hotels costing $250+ per night

- The World of Hyatt Credit Card (review) has a $95 annual fee, and offers an anniversary free night certificate valid at a Category 1-4 property, which I also consistently use at hotels that costing $250+ per night

- The Hilton Honors American Express Aspire Card (review) has a $550 annual fee, and I’ve gotten such amazing outsized value with this card, including with the annual free night award, Hilton Diamond elite status, $400 Hilton resort credit, $200 flight credit, and more

- The Capital One Venture X Rewards Credit Card (review) has a $395 annual fee, and offers a $300 annual travel credit, 10,000 anniversary bonus miles, amazing authorized user perks, and so much more

- The Citi® / AAdvantage® Executive World Elite Mastercard® (review) has a $595 annual fee, and offers an Admirals Club membership for the primary cardmember, bonus Loyalty Points, and lots of other perks

The information and associated card details on this page for the Hilton Honors American Express Aspire Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

How do I decide whether to keep cards for the rewards?

Perhaps the trickier math comes with cards that I keep for the return on spending that they offer. To crunch the numbers on that, I look at:

- How many rewards points am I earning for spending on the card?

- What’s the next best option for that spending?

- How much is the annual fee that I’m paying?

- How many perks does the card offer that help offset the annual fee?

Let me give an example. The Chase Sapphire Reserve® Card (review) has a $550 annual fee, and it’s a card that I’ve historically had primarily for the 3x points on dining and travel that it offers.

For the card’s annual fee I’m receiving:

- A $300 annual travel credit, which I value more or less at face value

- Up to $60 in DoorDash credits annually, in the form of a $5 monthly credit

- The ability to maximize my Ultimate Rewards points, since I can combine the points earned on several cards to get the most value with this card

- The card offers a Priority Pass membership, offering airport lounge access around the globe

- The card offers exceptional travel and rental car protection

It can be hard to do exact math here. though I’d say that I value the $300 annual travel credit and up to $60 in DoorDash credits more or less at face value, so the card is really costing me less than $200 per year. Then I consider all the other benefits I get on the card, which I think round out the value pretty well, not even factoring in the points bonus categories.

Advice for canceling credit cards

I figured it would be useful to provide some tips to consider for those who are in a situation where they plan on canceling credit cards. There are some things to be aware of that could potentially save you all your points, or that could even save you on your annual fee.

With that in mind, below are some things to consider when canceling credit cards, in no particular order.

What downgrade options do you have for your credit card?

Outright canceling a card might not always be the best option. If your reason for canceling a card is its annual fee, know that there are sometimes options to downgrade your card to another card that could add value, often one without an annual fee.

For example, if you have the Chase Sapphire Preferred® Card (review) but don’t want to pay the annual fee anymore, you can potentially downgrade the card to the Chase Freedom FlexSM (review) or Chase Freedom Unlimited® (review).

Typically the option to downgrade a card is only available if you’ve had a card for at least a year.

Know your options if you’re downgrading. It doesn’t always make sense, but if it’s a card you’ve had for a long time, it could be worthwhile to preserve the account history for the sake of your credit score, as I’ll explain in more detail below.

What happens to your points when you cancel a credit card?

Every points currency works differently, so know what happens to your points if you cancel a card. If you’ve earned hundreds of thousands of points with a credit card over the years, it would be awful to cancel your credit card and then find out that all your points are being taken away. Make sure you investigate this before you close your card.

As a general rule of thumb:

- If you have a credit card that accrues points in an airline or hotel loyalty program, you won’t lose your points when you cancel the card; this would include cards that earn United miles, or Marriott Bonvoy® points.

- If you have a card that earns a bank currency (Amex Membership Rewards, Chase Ultimate Rewards, Citi ThankYou, Capital One, etc.), you typically forfeit your points if you close your card; the exception is if you have another card from that points currency, in which case you can typically pool points

To give some examples of that last point, if you have the American Express® Gold Card (review) and it’s the only one you have earning Membership Rewards points, you’d lose your points if you close the card.

Meanwhile, if you cancel that card but also have the American Express® Green Card (review) linked to the same Membership Rewards account, then you could pool your points and keep all of them.

The information and associated card details on this page for the American Express Green Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Similarly, Chase has seven cards that are marketed as earning Ultimate Rewards points. However, only the Chase Sapphire Reserve®, Chase Sapphire Preferred® Card, and/or Ink Business Preferred® Credit Card allow you to transfer points to partners. You can combine points between cards, which you’ll want to do before closing a specific card. Additionally:

- If you are left without any of the seven Ultimate Rewards cards then you’d forfeit all of your points

- If you only have one of the four no annual fee cards, then your points will suddenly only be worth one cent each, which is way less than the value you can otherwise get out of them (though if you get a premium card in the future, you can move the points to that card for extra value)

Every program is different, though. For example, with Citi, you can pool ThankYou points, but if you close a card and transfer points to another card, they expire 60 days after that transfer happens.

Be sure you know the rules, and remember that you can usually transfer out the points before you cancel the card.

Can you be talked into keeping your credit card?

When you call to cancel your credit card, you may be connected to a retention specialist. Depending on the type of customer you are, they may make you an offer to try to get you to keep the card. This could come in the form of a waived annual fee, statement credit, bonus points, a bonus on spending, etc.

This won’t always be offered, but sometimes will be. Before you call to cancel your card, put some thought into what the card is really worth to you, and what it would take to keep you as a customer. That way you’re prepared for the call.

Did you take advantage of all the benefits of a card?

Lots of credit cards offer great benefits, so make sure you take advantage of all of them before closing down a card. For example, The Platinum Card® from American Express (review) offers an up to $200 annual airline fee credit (Enrollment required), which is based on a calendar year.

If you decide you no longer want the card mid-year, be sure you already used the airline fee credit (and other benefits) for the year prior to canceling the card.

Did you wait until the annual fee hit to cancel your card?

While there are some exceptions, generally you’re best off waiting until the annual fee posts before canceling a card.

There’s not much downside to keeping the card till the next annual fee posts, because you never know what kind of offers or benefits your card may offer. Credit card companies often have promotions, so the longer you keep your card open, the better the odds of getting such a promotion.

Is there a grace period to cancel your card after the annual fee posts?

If you notice that your annual fee on your card has been billed, you’re not always out of luck.

With most issuers, there’s some grace period where you can cancel the card and still get a refund of the annual fee. With American Express, Chase, and Citi, you typically have somewhere around 30 days after the annual fee is billed to cancel the card and have the annual fee reversed.

How does canceling a credit card impact your credit score?

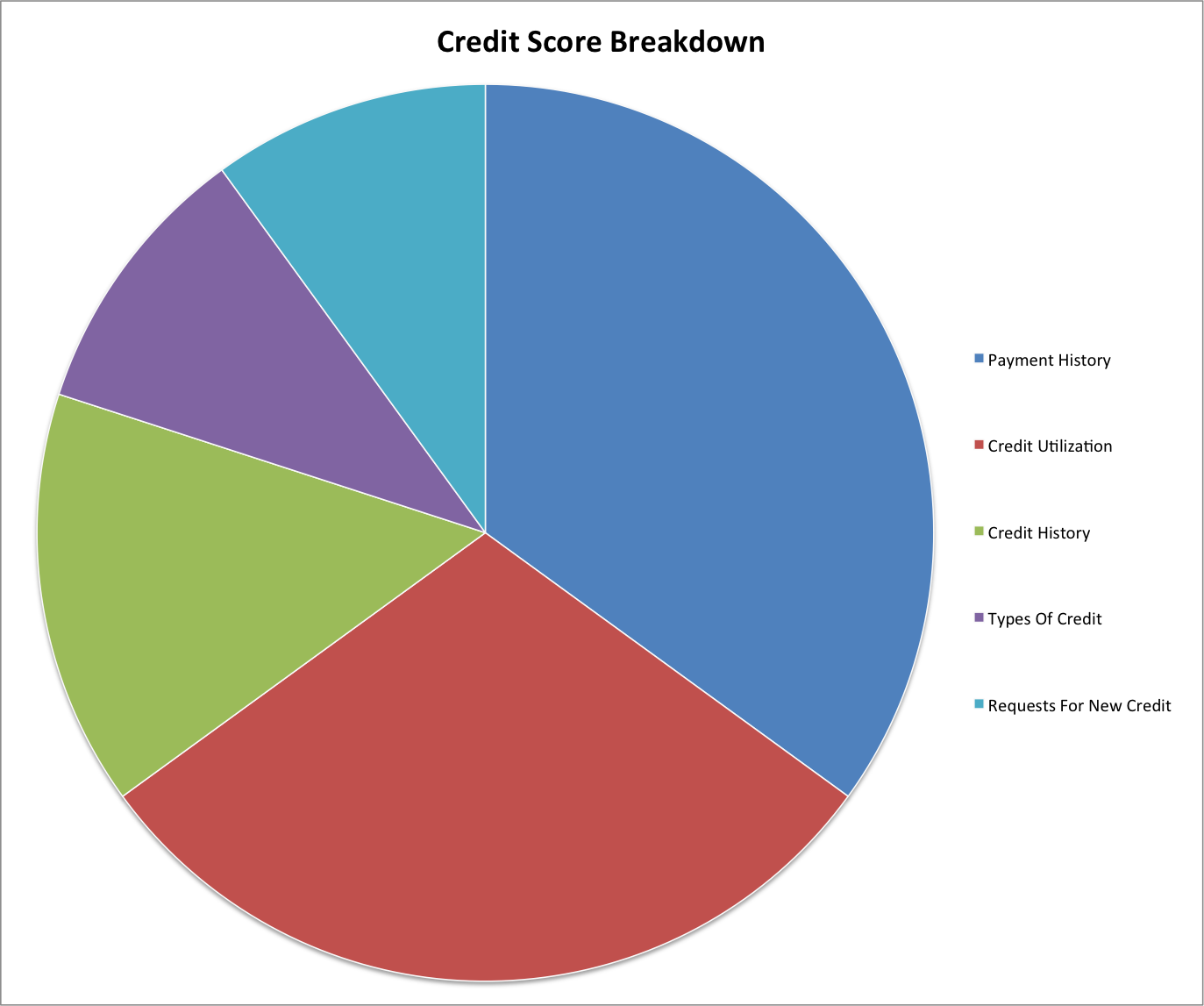

In the “Beginner’s Guide To Miles & Points,” we have a section entitled “How Credit Scores Work.” As explained there, the following factors impact your credit score:

- 35% of your score is made up of your payment history

- 30% of your score is your credit utilization

- 15% of your score is your credit history

- 10% of your score is made up of the types of credit you use

- 10% of your score is your request for new credit

Most people don’t understand the (minimal) impact that opening and closing credit cards has on your score. If you make your payments on time and don’t utilize too much of your credit, that’s 65% of your score right there. As a result, opening and closing cards impact your score as follows:

- Opening cards hurts you when it comes to your requests for new credit (which is only 10% of your score), but helps you when it comes to your total available credit, and hopefully, your credit utilization, meaning that over time having more cards can improve your score

- Closing cards potentially lowers your total available credit, and eventually credit history; if it’s a card you’ve had for a long time and it has a huge credit line, it may impact your score substantially, while if it’s a card only acquired within the past couple of years, it shouldn’t have much of an effect on your score (of course this depends on how many total cards you have, how far back your credit history goes, etc.)

Bottom line

There are lots of valid reasons to want to cancel a credit card, but just be sure you understand what all that entails. Hopefully the above are some useful tips if you find yourself in that situation.

I think the most important points are to be sure that you understand what closing a card means for your credit score (not much, unless you’ve had the card for a long time), know the downgrade options available to you, and know what happens to the rewards that you earned with your card.

If you’ve canceled credit cards over time, any important tips that I missed?

I think it is important to keep in mind that some perks of a credit card do not apply if you have multiple credit cards giving the same perk. Also, not all perks are created equally. For example, many Amex perks are divided semi annual, monthly, or even more detailed than that. Chase issued priority pass cards have more benefits than others. So many people concentrate on the credit score which is important but closing...

I think it is important to keep in mind that some perks of a credit card do not apply if you have multiple credit cards giving the same perk. Also, not all perks are created equally. For example, many Amex perks are divided semi annual, monthly, or even more detailed than that. Chase issued priority pass cards have more benefits than others. So many people concentrate on the credit score which is important but closing a card won't affect it too much and it will recover soon.

What if you want to cancel a card but want to apply to another one from the same bank/issuer (say Bank of America)? Should you cancel first, wait one month, then apply for the new OR apply first, then cancel old one and transfer credit line?

If you open the new card first you can transition from the old to the new one for example the credit line, automatic charges, rewards, etc.

Be sure not to close a card that allows you to transfer points from it to a partner if that’s important (or potentially combine points from other cards in the same “family” to then transfer to partners). Examples: CSP; CIP; C1VX; Premier; Prestige

Just cancelled my wife's AMEX Hilton Surpass Card a few days before the renewal date since annual fee jumped to $150 and the Priority Pass benefit is gone. Did the same with my card just before the renewal date.

Good discussion. Whether a card is "ultra premium" or just a regular card, Frequent Miler has a great spreadsheet tool to help people assess whether a given card is worth holding. One thing FM emphasizes is overlapping benefits. As an example, if one's "keystone" card is the Amex Platinum, which offers Priority Pass, one should assign zero value to other cards' Priority Pass benefit. This leads one to assess a card's "incremental" benefit.