There are lots of implications to the new year when it comes to loyalty programs and credit cards, including some benefits being reset. That includes with American Express, where those with an eligible card can receive a new airline fee credit. Based on the cards that I have, this is an opportunity to get hundreds of dollars of value per year.

In this post I want to talk a bit about the current state of Amex airline fee credits, given that it’s a new year, meaning that a lot of peoples’ credits have just reset.

In this post:

What are Amex airline fee credits?

Cards offer a variety of benefits, and in the case of the business and personal version of the American Express Platinum, one of those is an annual airline fee credit. The credit is intended to be used toward airline fees (as the name suggests), and for many of us, benefits like this help offset the annual fees on cards.

American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details.

When are Amex airline fee credits valid?

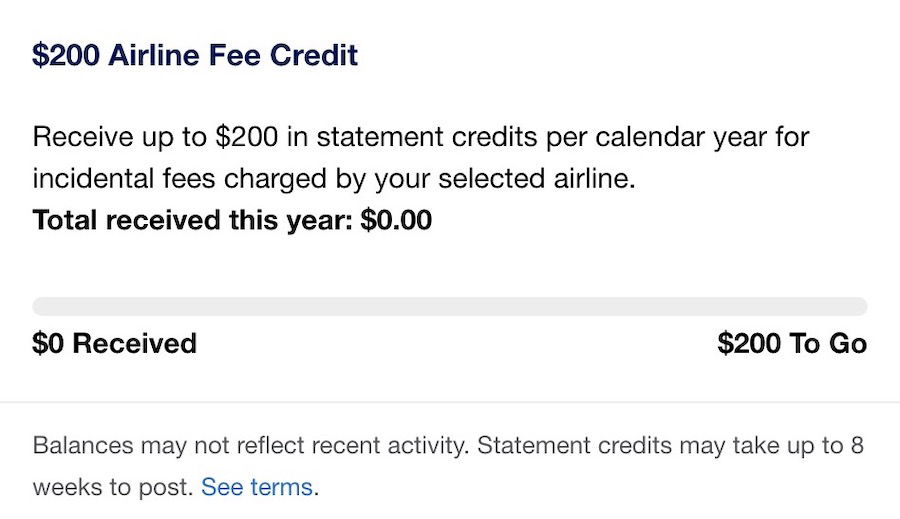

In the case of all American Express cards offering airline fee credits, the validity is based on the calendar year. This is a strict calendar year definition, so it’s not like some other cards, where it’s based on your cardmember year.

With Amex, airline fee credits are valid January 1 through December 31, and it’s a “use it or lose it” situation.

Which airlines are eligible for Amex airline fee credits?

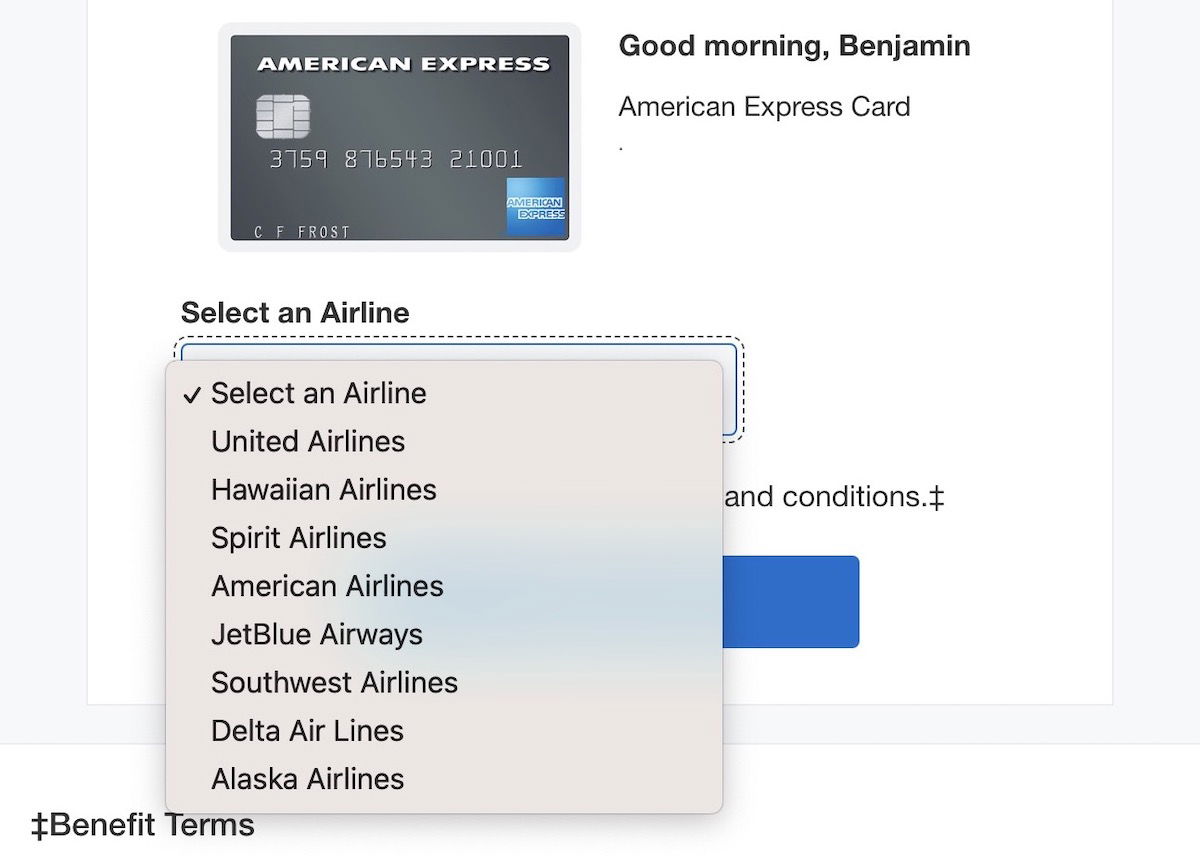

You can designate one of the following airlines as your airline of choice for this benefit:

- Alaska Airlines

- American Airlines

- Delta Air Lines

- Hawaiian Airlines

- JetBlue Airways

- Southwest Airlines

- Spirit Airlines

- United Airlines

Which Amex cards come with airline fee credits?

The following two premium cards issued in the United States offer airline fee credits, in the following increments:

- The Platinum Card® from American Express (review), which has a $695 annual fee (Rates & Fees), offers an up to $200 annual airline fee credit (Enrollment required)

- The Business Platinum Card® from American Express (review), which has a $695 annual fee (Rates & Fees), offers an up to $200 annual airline fee credit (Enrollment required)

What can Amex airline fee credits be used for?

Per the terms, the annual airline credit can be used for purchases made directly with airlines, excluding the following:

Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees.

While there are no guarantees that this will continue to be possible, historically some items outside of those categories have been reimbursed. For example, I’ve purchased JetBlue tickets in small amounts (under $100 or so), and those were automatically reimbursed. That’s not to say it will work for others, but it worked for me, and wasn’t even intentional.

The American Express forum on FlyerTalk has individual threads dedicated to reimbursement reports for each airline, including Alaska, American, Delta, Hawaiian, JetBlue, Southwest, Spirit, and United. It can be worth looking there for inspiration on some of the best uses, as you might be surprised by what some people report having luck with.

While it varies by airline and situation, often baggage fees, award ticket fees, change and cancelation fees, seat assignment fees, lounge passes, inflight food and beverage purchases, etc., qualify for reimbursement.

How do you register for Amex airline fee credits?

Your eligible airline purchase should be automatically reimbursed when charged to a qualifying card, assuming you’ve designated an airline for this benefit.

Each year you have to designate an airline for your airline fee credit. You can change your designated airline once per year, in January, so you can now change your designated airline, if you’d like.

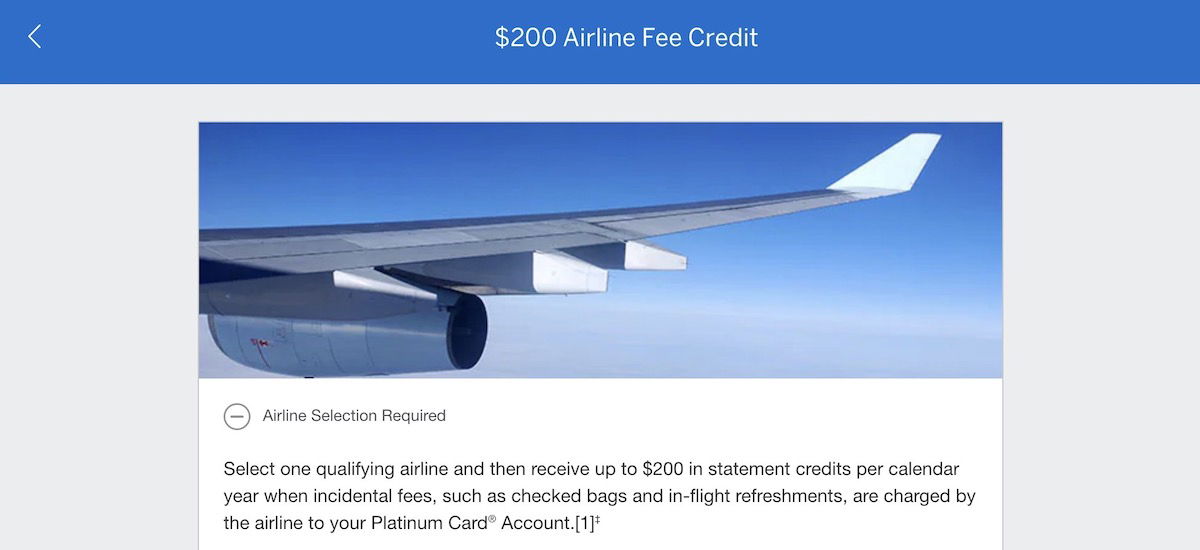

To verify or select your airline of choice, log into your Amex account and select an eligible card, and then click on the “Benefits” tab along the top of the page.

Once there, scroll down until you see the section that lists the airline fee credit benefit, and then click “Change Selected Airline” (if you’d like to do that.

On the next page you can scroll down, and then you’ll see the selection of airlines that you can pick.

The top of the “Benefits” page should also have a tracker that shows how much of your credit you’ve used so far this year.

If you already designated an airline last year, that will be the default one this year, so if you want to keep it you don’t have to do anything. But if you haven’t designated an airline in the past or want to change your selection, you’ll want to edit it.

Keep in mind that for The Business Platinum Card® from American Express, the airline you choose is the same one for which you’ll get 35% off when redeeming points with the “Pay With Points” feature. You’ll want to choose your airline carefully.

Should Amex update the airline fee credits benefit?

When I write about the Amex airline fee credit, there are often comments from readers about how it’s time that Amex update this benefit. The Amex Platinum was the original premium credit card, though it’s interesting to see how much less restrictive travel credits are on other premium credit cards:

- The Chase Sapphire Reserve® Card (review) offers a $300 annual travel credit that’s valid toward any travel purchase charged to the card, with no registration required

- The Capital One Venture X Rewards Credit Card (review) offers a $300 annual travel credit that’s valid toward any purchase through Capital One Travel, and the discount is applied at check-out

By comparison, the Amex credit is highly restrictive, given that it only applies toward fees, that you need to register, need to designate an airline, etc. This benefit has gotten even less valuable since the start of the pandemic, since most airlines have eliminated or cut change fees, which these credits apply toward.

While all of that is true, I think it’s important to acknowledge that the Amex Platinum offers an incredible number of credits, and it’s pretty clear that these benefits are designed to have a lot of breakage, or else the economics wouldn’t work out.

The Amex Platinum potentially offers over $1,800 in credits annually, and the intent is presumably that not all cardmembers maximize each of those perks. In other words, the restrictions around all of these benefits are likely by design. I wouldn’t expect Amex to ever replace a $200 airline fee credit with a flat $200 airline credit, for example.

Bottom line

While I hate when the year “resets” in terms of elite status, I do love picking up new annual airline fee credits thanks to the Amex cards I have. If you have an Amex Platinum Card, you can go ahead and designate your airline of choice, and then start taking advantage of your 2025 credits… if you can figure out uses.

How do you plan on using your 2025 Amex airline fee credits?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Business Platinum® Card from American Express (Rates & Fees), and The Platinum Card® from American Express (Rates & Fees).

Works for Delta if you book the flight with Delta gift card for partial payment. Hope this works this year too on Delta

I used this benefit last year to get $200 reimbursed for an Alaska Lounge+ membership, which combined with another $100 off the price due to my status on AS.

I used to use it for food and wifi when I mainly flew United. Sadly those items don't code correctly for their Alaska equivalent. Nonetheless, I'm happy with the Alaska Lounge+ membership!

Hi Ben. This statement is incorrect: “The following two premium cards issued in the United States offer airline fee credits.” The Hilton AMEX Aspire card comes with a $50 airline credit every quarter as well. You should edit the post.

That's true, and I agree it should be mentioned.

That said, the Hilton credit is good on any airline (not just the Chosen one), and can be applied to anything - so it's much more versatile / no hoops to jump through compared to the ones discussed here.

There is also a $50 per quarter airline credit on the Hilton Aspre AmEx cc

Very helpful post, Ben. Each year I struggle to use my $200 credit because I have dedicated credit cards for almost every US airline I fly, and I want to use that card in order to get my free checked luggage. Your link to the threads on Flyertalk discussing how to use the AMEX credits was very helpful as well.

Good post, Ben. Personally I just do four $50 United Travel Bank reloads over the course of several weeks, waiting for each credit to post before making the next purchase. I'm not brave enough to do a single $200 refill but it's the same net result. I used to mess around with AS upgrade offers and the like but got tired of having to contact Amex support to manually post the credit.

I also do United travel bank deposits. I do $100 at a time and usually do them just a day or 2 apart. Worked last year and if doesn’t this year $200 isn’t worth worrying about as I’ll just use it on a United flight. Not worth sweating the small stuff IMHO.

I too have been hesitant to do $200 at once in TravelBank but $100 increments have worked for me multiple times so that’s what I do now.

You can't even do $200 in one shot. You must do 2x $100.