Earlier I wrote about how to decide whether to pay cash or redeem miles for flights, and in this post I wanted to take a look at how to decide whether to pay cash or redeem points for hotel stays.

I often see people on the fence about whether they should pay cash or redeem points for hotel stays, especially as hotel loyalty programs increasingly move closer to being revenue based. While the math is sometimes straightforward, other times it isn’t. So let’s discuss some of the things that you should consider.

In this post:

Redeeming points vs. paying cash for a hotel stay

Admittedly in some cases the decision of whether to pay cash or redeem points for a hotel stay is obvious.

Of course you should redeem 30,000-40,000 World of Hyatt points for a night at Alila Ventana Big Sur, if the stay would otherwise cost $2,000+ per night. Other times the math isn’t so straightforward. For example, should you redeem 80,000 Hilton Honors points for a night at the Waldorf Astoria Bangkok, if the rate would be $400 per night?

Let’s go over some of the things that you should consider when trying to decide.

How much would a hotel stay cost total?

The first thing to consider is the total amount a hotel stay would cost you if paying cash. This might sound obvious, but there are a few things to consider:

- Look at the taxes, fees, and service charges, as these are generally charged if paying cash, but not if redeeming points; some places have taxes & service charges approaching 30%, so in those situations that could greatly change the math

- Consider any resort fees or destination fees being charged by hotels; some hotel loyalty programs (including Hilton Honors and World of Hyatt) don’t charge these when redeeming points

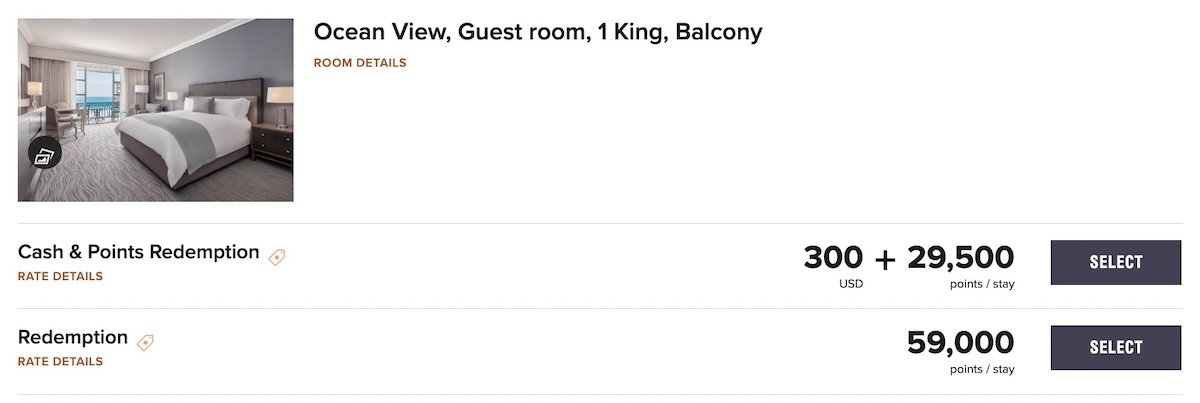

For example, let’s use a redemption at a random Ritz-Carlton in Mexico for one night, where the cost is 59,000 Bonvoy points.

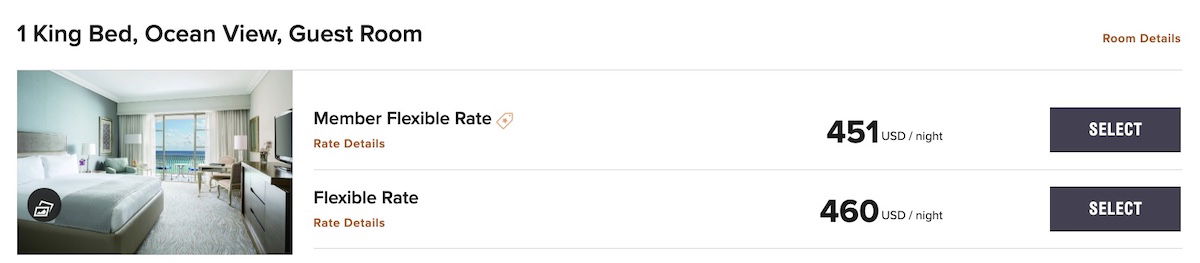

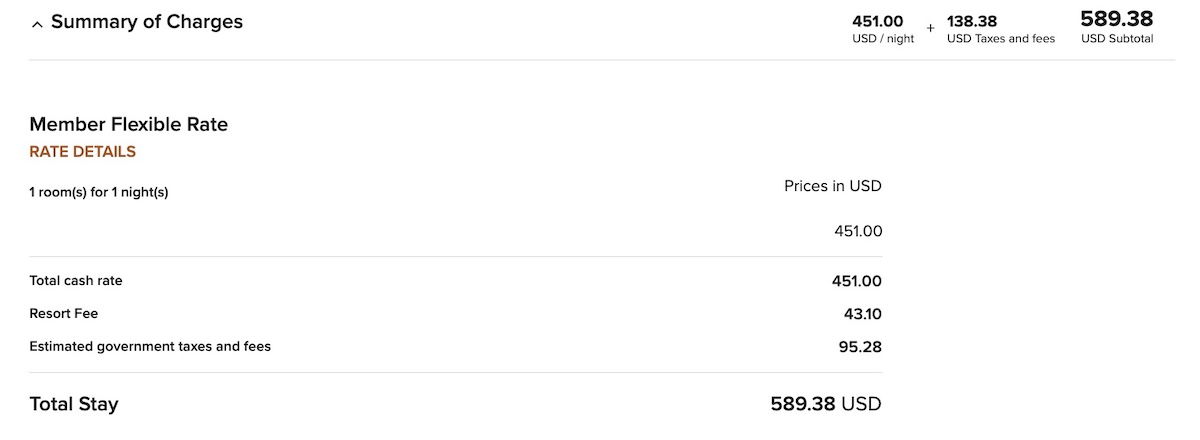

The cash rate is $451, so you’re getting “just” ~0.77 cents of value per point.

However, if you then look at the total charges, you’ll see that after taxes and service charges, the stay would cost $589 if paying cash. You’re now getting ~1.0 cents of value per point, which is much better.

How much do you value points?

I’ve shared my valuations of the major hotel points currencies. I absolutely don’t claim my valuations are correct, but I think everyone should consider how much they value points based on their own situation.

If your answer is “I acquired points for next to nothing, and that’s also what I value them at,” that’s totally fine. At a minimum, I know it’s useful for people to at least hear someone’s valuation as a starting point for how to decide whether to pay cash or redeem points.

How many points are you forgoing if you redeem?

Calculating how much value you’d get from your points with a hotel stay isn’t just as simple as dividing the revenue cost and the points cost. When you redeem points, you also have to consider the points that you’re forgoing by redeeming points rather than paying cash.

For example, as a Marriott Titanium member with the Marriott Bonvoy Brilliant® American Express® Card (review), I earn 23.5x Bonvoy points per dollar spent with Marriott:

- I earn 10x Bonvoy base points per dollar spent with Marriott

- As a Titanium member I earn a 75% points bonus, which is a further 7.5x Bonvoy points per dollar spent

- For paying with the Bonvoy Brilliant Card, I earn a further 6x Bonvoy points per dollar spent

I value Bonvoy points at ~0.7 cents each, so to me a return of 23.5x points per dollar is equivalent to a ~16.5% return. This all assumes that there aren’t further bonus points opportunities, as the major global hotel groups sometimes have further promotions.

Using the same Ritz-Carlton example above, if I were to pay cash I’d earn a total of ~11,500 Bonvoy points (23.5x points on the $451, plus 6x points on the $138 in taxes & service charges), which I value at ~$80. In other words, I’d consider that hotel stay to really cost me $509 rather than $589.

What are you giving up by redeeming points?

Nowadays most hotel groups are good about honoring elite benefits and awarding elite nights for award stays, so there’s not usually going to be a huge difference on that front when it comes to paying cash vs. redeeming points.

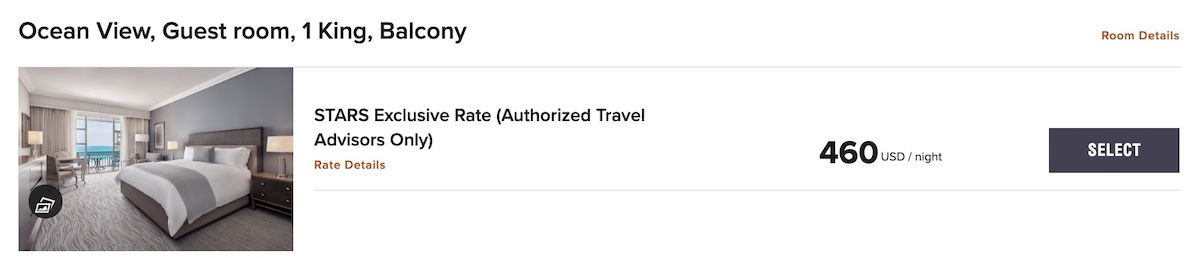

If you’re staying at a high-end hotel, another consideration is whether your stay would qualify for a program that offers additional perks on paid stays at the flexible rate. For example, this could include everything from Amex Fine Hotels + Resorts®, to Hilton for Luxury, to Hyatt Privé, to Marriott STARS & Luminous, to Virtuoso.

Let’s use the same Ritz-Carlton example above. The Marriott STARS rate would be $460 per night, and for booking that you’d receive a $100 hotel credit once per stay, daily complimentary breakfast (which Marriott Platinum members and above don’t otherwise receive at Ritz-Carlton), a room upgrade, and more.

Everyone will value those perks differently, but those could add quite a bit of value, and could make paying cash the better value.

What are you giving up by paying cash?

While there are some advantages to paying with cash, there are also situations where there are further benefits when redeeming points.

For example, World of Hyatt Globalist members receive free parking on award stays, but not when paying cash (this also applies to Guest of Honor bookings).

Beyond that, loyalty programs like Hilton Honors and Marriott Bonvoy offer a fifth night free on award redemptions, while that’s not generally offered when paying cash. So you should also factor that math into the overall equation when deciding what represents a better value.

Bottom line

There’s no absolute right or wrong answer as to whether paying cash or redeeming points is the best value for a given hotel stay. In general, I recommend comparing the all-in cost when paying cash (including taxes & service charges) to the points cost, then deciding how much you value points, and then subtracting the points you’d be forgoing if you redeemed points.

There are some other potential considerations, like if you’re staying at a luxury hotel, where a program could score you extra perks without it costing you extra, when that’s not possible for those redeeming points.

What’s your approach to deciding whether to redeem points or pay cash for a hotel stay?

I stay at Hilton's without my wife but under her name/Diamond status. Since I pay cash the hotels aren't real strict about her checking in. I tell them she is coming later. I don't think they would be so forgiving if I was staying on points or award nights.

I calculate the value differently. I know what I usually redeem points for and then that gives me a value and I base it on that. If the value is close then I usually redeem if not then I usually do not.

One must consider outside options such as staying at non chain hotels for the price you are paying. Often I find booking them gives much better value so my loyalty is mostly by credit cards and I have tons of points. When I want to redeem for a good value most places do not offer the award rate. Before COVID there were many cases I could rack up points via various promotions but that hasn't...

One must consider outside options such as staying at non chain hotels for the price you are paying. Often I find booking them gives much better value so my loyalty is mostly by credit cards and I have tons of points. When I want to redeem for a good value most places do not offer the award rate. Before COVID there were many cases I could rack up points via various promotions but that hasn't happened much these days. So I don't see much value in them. However I still keep staying at IHG because of their large footprint and recent redemption value.

Ritz Cancun isn’t a thing

@Ben- Good luck getting to the Cancun Ritz Carlton with Marriott points, unless Kempinski Hotel Cancún takes Marriott points....

Don't forget considering the price of a comparable hotel. If an equivalent hotel next door is $200 an the Hilton is $500, you're not getting as much value as you think.