Link: Learn more about the Aeroplan® Credit Card

The Aeroplan® Credit Card (review) is a popular co-branded airline credit card, which is quite lucrative. The card offers a unique Pay Yourself Back feature, which you won’t find on many airline cards. This has been adjusted a bit for 2025, so let’s cover the details of how it works.

In this post:

Chase Aeroplan Card Pay Yourself Back basics

With the Aeroplan Credit Card‘s Pay Yourself Back feature, cardmembers can redeem their Aeroplan points for 1.25 cents each toward any purchase in the travel category. That’s right — it’s possible for cardholders to redeem their Aeroplan points for everything from Spirit Airlines flights, to Four Seasons hotel stays.

To cover some of the basic terms associated with this:

- You can charge any eligible travel purchase to your Aeroplan Credit Card, and then reimburse yourself for that purchase within 90 days from the redemption date

- You’re restricted to redeeming 200,000 points per year this way

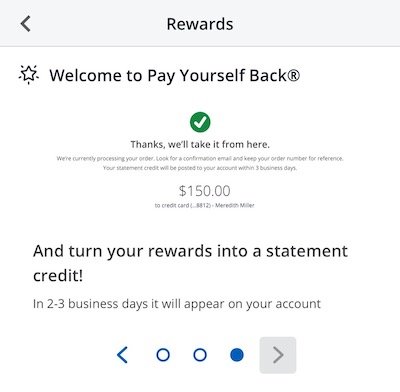

- Statement credits will post to your account within three business days, and will appear on your credit card billing statement within one to two billing cycles

- Eligible travel purchases include airlines, hotels, motels, timeshares, car rental agencies, cruise lines, travel agencies, discount travel sites, campgrounds, passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages

Note that in addition to being able to redeem toward travel at the rate of 1.25 cents per point, you can also use the Pay Yourself Back feature to pay the annual fee, or pay for dining and groceries, with no annual limits. However:

- Annual fee redemptions get you 1.25 cents of value per point

- Dining and grocery store redemptions get you 0.8 cents per point

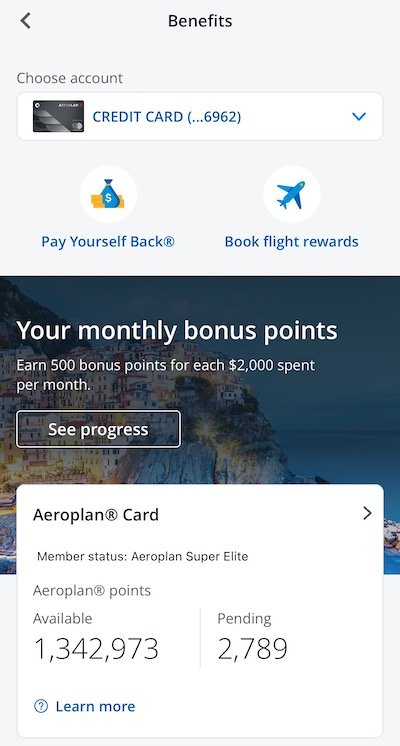

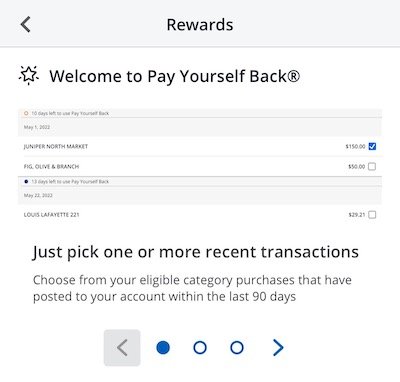

Below, you can see some screenshots of the process of using the Pay Yourself Back feature (sadly this isn’t my account… I don’t have that many Aeroplan points!). When you’re logged into your Chase account, you can just click the “Pay Yourself Back” button.

Then you can select from eligible transactions, to decide which you want to redeem points for.

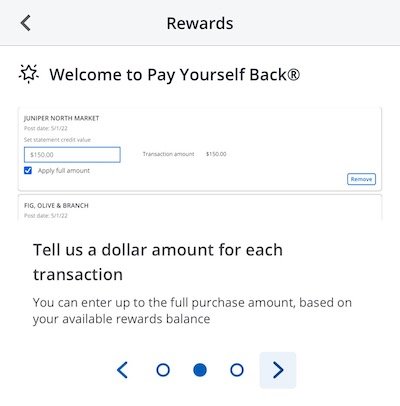

You’ll then be given the option of how many points you want to redeem. You can apply points toward all or part of the purchase cost, assuming you have enough points.

And then you’ll receive confirmation that you’ve initiated the Pay Yourself Back feature, and a statement credit will soon appear on your account.

Can all Aeroplan points be redeemed with Pay Yourself Back?

The Chase Aeroplan Pay Yourself Back feature is exclusively available for those with the Aeroplan Credit Card. One common question, however, is which Aeroplan points cardmembers can redeem through the Pay Yourself Back feature. After all, Aeroplan is a transfer partner with Amex Membership Rewards, Capital One, and Chase Ultimate Rewards.

Do the points have to be earned with the Aeroplan Credit Card, or can you convert points from other currencies and then redeem them this way? I’ve asked Aeroplan contacts about this, and the intention is that this feature be used for points earned with Chase:

- This means you can not only redeem points earned with your Aeroplan Credit Card, but you can also redeem points transferred from Chase Ultimate Rewards to Aeroplan this way

- However, the intention isn’t that points transferred over from Amex Membership Rewards and Capital One be redeemed this way

Now, practically speaking, it’s not like your Aeroplan points balance is broken down into your points acquired through Chase and your points not acquired through Chase. My interpretation would be that some mixing of points is fine, like if you have a small balance of points through other means, as long as you’re acting within the spirit of the program.

So I imagine if you transfer a million points from Amex to Aeroplan and then use those points for Pay Yourself Back, you may be in trouble. Meanwhile, if you have 500,000 Aeroplan points and a small percentage of those were earned through non-Chase means, I can’t imagine that would be an issue. Again, that’s just my interpretation. I always recommend acting within the spirit of these programs, or else you might find yourself in a bad situation.

Why the Aeroplan Pay Yourself Back Feature is valuable

Should everyone with the Aeroplan Credit Card redeem their points using the Pay Yourself Back feature? No, absolutely not. But I think this is also much more lucrative than first meets the eye.

Aeroplan is one of my favorite frequent flyer programs, and personally I value Aeroplan points at 1.5 cents each, thanks to all the amazing ways there are to redeem Aeroplan points. Aeroplan has dozens of airline partners, and on top of that allows stopovers for just 5,000 extra points. Aeroplan points give you incredible potential to redeem for first & business class flights.

However, this Pay Yourself Back feature gives you an impressive amount of flexibility with your Chase Ultimate Rewards points. So if you have a card like the Chase Sapphire Preferred® Card (review), you should now seriously consider picking up the Aeroplan Credit Card.

So, why is this so awesome?

- You’ll get up to 1.25 cents per Chase Ultimate Rewards point if you’re a cardmember

- This is potentially more advantageous than redeeming through Chase Travel℠, since you can truly book however you’d like; you can book your hotel stay directly with your preferred hotel so you can take advantage of loyalty perks and you can even book a hotel rate with your preferred corporate rate code

- While the Chase Sapphire Reserve® Card (review) allows redemptions for up to 2 cents each through Chase Travel℠ with Points Boost, personally I think there could be merit to redeeming points for less and being able to book how you’d like, given all the additional opportunities that opens up

Being able to cash out Chase points for 1.25 cents each, without any sort of a booking method requirement, is quite worthwhile. It’s especially useful for those who want flexibility, and who struggle to maximize points in the traditional way.

The Aeroplan Credit Card is worth another look

If you don’t yet have the Aeroplan Credit Card, I think this card is seriously worth considering.

- The card is offering a welcome bonus where you can earn 60,000 bonus points after you spend $3,000 on purchases in the first 3 months your account is open.

- With the Pay Yourself Back feature, you could use 50,000 points for $625 worth of travel of your choice, with hotels, flights, rental cars, etc.

- This in my opinion the most innovative co-brand airline card we’ve seen in terms of the rewards structure, the spending bonuses, the ability to earn status, and the general perks

Even if you’re not huge into Aeroplan, I think most would agree that being able to now redeem these rewards to erase virtually any travel purchase is a phenomenal opportunity.

Bottom line

The Aeroplan Credit Card has a valuable Pay Yourself Back feature. Cardmembers can redeem Aeroplan points for 1.25 cents each toward almost any travel purchase (up to 200,000 points per year), by using their points to erase the cost of that purchase. While savvy travelers can get well over 1.25 cents of value per Aeroplan point, I think this is a pretty exciting option for the Chase Ultimate Rewards ecosystem overall.

Do you see value in the Aeroplan Credit Card’s Pay Yourself Back feature?

This is a pretty painful nerfing of what has been my favorite way to redeem Chase Ultimate Rewards points. I have been able to transfer to Aeroplan with a 30% bonus when doing so strategically, and this means I'm getting 1.625 cents per Ultimate Rewards point in value when redeemed for travel. This has come in handy for booking the independent local hotels I prefer vs. international chains, especially given the much lower cost in...

This is a pretty painful nerfing of what has been my favorite way to redeem Chase Ultimate Rewards points. I have been able to transfer to Aeroplan with a 30% bonus when doing so strategically, and this means I'm getting 1.625 cents per Ultimate Rewards point in value when redeemed for travel. This has come in handy for booking the independent local hotels I prefer vs. international chains, especially given the much lower cost in points terms.

I get why Chase is doing this. It can't be profitable for them vs. spending my points unoptimally. Still, this takes a lot of incentive out of participating in the Ultimate Rewards ecosystem which is a lot less competitive than in the past. My Chase points balance is <100k. I'll be dropping below 5/24 this year, but for the first time, I'm wondering whether it's really worth passing up other offers in order to preserve Chase optionality.

Couple of comments:

1. As noted by @farnorthtrader, sometimes it is possible to buy Aeroplan points for less than 1.25 cents, essentially getting a discount on prepaid travel. Discount is not huge, especially if you factor in the opportunity cost of parking money in points when even the no-risk return rate was around 5% last year. Also, Aeroplan sells point in CAD while pay yourself back is in USD, so this will keep working as...

Couple of comments:

1. As noted by @farnorthtrader, sometimes it is possible to buy Aeroplan points for less than 1.25 cents, essentially getting a discount on prepaid travel. Discount is not huge, especially if you factor in the opportunity cost of parking money in points when even the no-risk return rate was around 5% last year. Also, Aeroplan sells point in CAD while pay yourself back is in USD, so this will keep working as long as the exchange rate doesn't go back too much.

2. With the current transfer bonus (20% + 10% if moving at least 50k points), direct redemption value of Ultimate Rewards points becomes 1.3*1.25=1.625 cents (up to the max amount). Why would anyone want to use them at 1.5 cents and deal with the extra layer of buying through Chase Travel (which is handled by Expedia, with their "computer says no" customer service).

@Henry, this appears to now be "permanent", however, they have amended the terms to say that they can change the maximum amount of redemptions anytime they like.

Bit of a beef with this as it is hard to plan when you have no idea how many points can be used for this. Last year I purchased about half a million points (at 1.14 cents each) with the full intention of using PYB at 1.25...

@Henry, this appears to now be "permanent", however, they have amended the terms to say that they can change the maximum amount of redemptions anytime they like.

Bit of a beef with this as it is hard to plan when you have no idea how many points can be used for this. Last year I purchased about half a million points (at 1.14 cents each) with the full intention of using PYB at 1.25 cents each to pay for business travel (on AC). While I was cognizant that they could restrict the amount used for this in 2025, I was hoping there would at least be a warning so that I could use what was needed. Luckily, I am down to about 175,000, so my plans weren't foiled but a warning would have been nice. Now, there can be no advance planning as they can change it whenever they want

Is this permanent or is it still expiring at the end of the year unless they extend it?