For those looking to earn travel rewards for credit card spending, I always recommend doing what you can to earn transferable points currencies. Among those currencies, I’d say Chase Ultimate Rewards more or less sets the standard in terms of its card portfolio.

The Ultimate Rewards program is so incredibly well rounded, thanks to many Chase cards offering big welcome bonuses, valuable bonus categories for spending, and great perks.

In this post I wanted to take a closer look at the seven credit cards that potentially earn Ultimate Rewards points, and just about everything you need to know about them.

In this post:

Why should you care about Chase Ultimate Rewards points?

So many people leave points on the table by not maximizing their credit card rewards. Every time you spend money on your credit card sub-optimally, you’re basically throwing away money.

There are a few things that make earning Chase Ultimate Rewards points worthwhile:

- Chase Ultimate Rewards cards have among the best welcome bonuses of any credit cards, so the points you can earn from these cards add up fast

- Chase has generous credit cards that offer as many as 5x points per dollar spent, so your Ultimate Rewards points balance will add up fast

- Chase Ultimate Rewards points give you a lot of flexibility, since points can be redeemed as cash towards the cost of a travel purchase, or can be transferred to airline or hotel partners to get the most value there

What can you do with Ultimate Rewards points?

How does a night at the Park Hyatt Maldives for 30,000 points sound, where a night would often cost over $1,000?

Or just 60,000 points for one-way All Nippon Airways first class from New York to Tokyo, for a ticket that would cost $10,000 if paying cash?

Or just 13,000 points for an economy ticket from the West Coast to Hawaii on Alaska Airlines or American Airlines?

All of these things are possible with Ultimate Rewards points, if you put in some effort. Obviously right now travel is a bit more complicated than usual, but at a minimum these are all experiences that are hopefully possible in the future.

The Chase Ultimate Rewards “ecosystem”

What impresses me so much about Ultimate Rewards is how Chase has created an unrivaled credit card ecosystem. What do I mean by that?

There are lots of great credit cards out there individually. One of the mistakes people often make when collecting miles and points is that they diversify too much. They’ll have 20,000 points in one account, 15,000 points in another, and 30,000 in another, and they won’t have enough for the reward they want.

What’s great is that with Chase Ultimate Rewards you have access to seven different credit cards that potentially earn these points. So whether you want a personal or business card, or a $550 annual fee or no annual fee card, you have so many cards to choose from. That’s valuable.

What credit cards earn Chase Ultimate Rewards points?

There are three credit cards that directly earn Ultimate Rewards points:

Then there are no annual fee credit cards that earn points that can be converted into Ultimate Rewards points, in conjunction with any of the above cards:

Chase Freedom Unlimited®

Chase Freedom Unlimited®

A bit further down I’ll talk about how you can combine Ultimate Rewards, so that the points earned on the no annual fee cards can be turned into full Ultimate Rewards points, which helps maximize their value.

Now let’s look a bit more closely at the details of each of these cards:

- Priority Pass Membership

- $300 Annual Travel Credit

- TSA PreCheck, Global Entry, or NEXUS Credit

- Primary Car Rental Coverage

- Trip Cancellation/Interruption Insurance

- Trip Delay Reimbursement

- No Foreign Transaction Fees

- 3x points on Dining

- Annual Fee: $795

The Chase Sapphire Reserve is one of the best premium travel rewards cards on the market. The card earns 3x Ultimate Rewards points on dining expenses, and comes with additional benefits like $300 in annual travel credits and a Priority Pass™ Select membership.

- Car Rental Coverage

- Trip Cancellation & Interruption Insurance

- No Foreign Transaction Fees

- Earn 3x points on travel with the first $150k in combined purchases

- Earn 3x points on advertising purchases made with social media sites and search engines with the fir

- Earn 3x points on shipping purchases with the first $150k in combined purchases

- Earn 3x points on internet, cable and phone services with the first $150k in combined purchases

- Annual Fee: $95

The Chase Ink Business Preferred is one of the all-around best business credit cards on the market. It has a big sign up bonus and earns 3x points on many business expenses such as travel, shipping, advertising, and social media purchases.

- Earn unlimited 1.5% cash back on all business purchases

- Annual Fee: $0

The Chase Ink Business Unlimited is a great no-fee business credit card that earns 1.5% cash back on all business purchases. That can be converted into 1.5x Ultimate Rewards points with the Chase Sapphire Reserve or Preferred, or the Chase Ink Business Preferred.

- Car Rental Coverage

- Earn 5% Cash Back on internet, cable TV, mobile phones, and landlines on the first $25k

- Earn 5% Cash Back at office supply stores on the first $25k

- Earn 2% Cash Back on restaurants on the first $25k in combined purchases of 2% categories

- Annual Fee: $0

The Chase Ink Business Cash is another great no-fee business credit card. It earns 5% cash back in select categories like office supply stores, internet, and phone services (on the first $25,000 spend in combined purchases each account anniversary year), 2% at restaurants and gas stations, and 1% on all other purchases. That can be converted into Ultimate Rewards points with the Chase Sapphire Reserve or Preferred, or the Chase Ink Business Preferred.

- Earn 5% Cash Back on Travel Purchased Through Chase Travel℠

- Earn 3% Cash Back on Dining

- Earn 3% Cash Back at Drugstores

- Earn 1.5% Cash Back On All Other Purchases

- Annual Fee: $0

The Chase Freedom Unlimited has no annual fee, and has a great earnings structure. The card earns 3% on dining and at drug stores, and earns 1.5% cash back on all other purchases. The cash back earned from this card can be converted to Ultimate Rewards points with the Chase Sapphire Reserve or Preferred, or Chase Ink Business Unlimited.

Earning Chase Ultimate Rewards points

Ultimate Rewards points can rack up much quicker than you might expect, thanks to the big welcome bonuses the cards offer, the bonuses they offer on everyday spending, and even Shop through Chase, which allows you to earn bonus points for purchases you make online.

Which Chase Ultimate Rewards cards earn the most points?

These seven cards all have different relative strengths in terms of the bonus categories that they offer.

The beauty of there being a portfolio of seven cards is that you can mix and match these cards to maximize the number of points you can earn. There are some great Chase credit card duos out there.

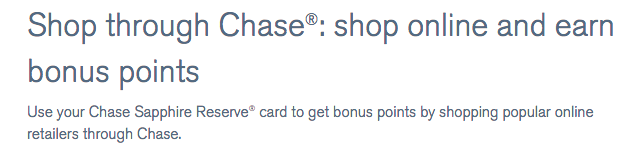

What is “Shop through Chase?”

Shop through Chase can earn you thousands of additional bonus points per year for your online shopping. You can find this feature when you log into your Ultimate Rewards account. The way it works is that the portal partners with hundreds of retailers and offers bonus points for purchases you’d make anyway.

The number of bonus points you can earn with popular retailers varies significantly, but the idea is that just by clicking through to those sites through the Chase website, your purchases will be tracked for bonus points.

I use this all the time to earn more points with popular retailers. Partner retailers include everything from Apple to Neiman Marcus to Walgreens.

How many Chase cards can you have?

There’s not a strict limit with regards to how many of the above seven cards you can have. Theoretically, you could have all seven of these cards if you wanted to.

You’re even potentially eligible to pick up all three of the Chase Ink Cards, and you could receive the welcome bonuses on all of them. The one restriction to be aware of relates to the Chase Sapphire Preferred® Card and Chase Sapphire Reserve® Card.

Specifically, you’re not eligible to apply for the Sapphire Preferred or Sapphire Reserve if you have either of the cards, or have received a new cardmember bonus on either card in the past 48 months.

This restriction doesn’t apply to any of the other Ink Cards, but this is something to be aware of when deciding between the Sapphire Preferred and Sapphire Reserve.

Can you product change between Chase cards?

Assuming you’ve had any of these Chase cards for at least a year, it should be possible to product change them.

This means that you can call up Chase and you should be able to swap any of the three business cards for one of the other business cards, or any of the four personal cards for one of the four personal cards. When you do this you won’t be eligible for the new cardmember bonus, though.

What are the rules for applying for Chase cards?

Chase’s general restrictions on applying for cards are as follows:

- There’s no hard limit on how many Chase credit cards you can be approved for, but rather there’s often a maximum amount of credit they’re willing to extend you, in which case you may be asked to switch around your credit limits on some cards in order to facilitate an approval

- You can typically be approved for at most two Chase credit cards in 30 days, though there are some inconsistencies when it comes to that; that means you could apply for two credit cards the same day if you want (assuming you haven’t applied for other Chase cards in the past 30 days), or you could space them out

- As mentioned above, you’re potentially eligible for six of the seven cards, including the welcome bonuses (the only cards you have to choose between are the Sapphire Preferred and Sapphire Reserve)

Understanding the “5/24” rule

Chase has what’s often referred to as the 5/24 rule, whereby you won’t be approved for many Chase cards if you’ve opened five or more new cards in the past 24 months. All of the above Chase Ultimate Rewards cards are subjected to this rule. This is more of a general guideline than a strict rule, though. Here’s what you should know about 5/24:

- A vast majority of new credit card accounts will count towards that limit, meaning that opening five or more cards in 24 months will make you ineligible for Chase cards

- One exception is most non-Chase business cards, like The Business Platinum Card® from American Express (review), American Express® Business Gold Card, (review), The Blue Business® Plus Credit Card from American Express (review), etc., don’t count towards this limit; the major exception is Capital One business cards, which do count towards the limit

- There are people who report not having any issues being approved for a card even though they surpassed the 5/24 rule, so it’s not consistently enforced

- This is mostly anecdotal, since Chase doesn’t officially publish this restriction for most cards

- While Chase business cards are subjected to 5/24 (meaning you won’t be approved if you’re at the five card limit), note that applying for a Chase business card doesn’t count as a further card towards that five card limit; that’s to say that if you’re at 4/24 and apply for a Chase business card, you’ll still be at 4/24

See this post for a step-by-step of how to check your current standing with 5/24.

Are you eligible for a Chase business credit card?

Chase’s portfolio of business credit cards is among my favorite aspects of Chase Ultimate Rewards.

Eligibility for a small business credit card is easier than you might think. You don’t need to have a big company, and don’t even need to be incorporated. Even a small side business with limited business revenue makes you eligible for a business credit card, even if you’re just selling things on eBay or have a rental, for example.

When applying for a Chase business card, you’ll be asked the following questions, in addition to the typical personal questions about your income, Social Security Number, etc.:

- Legal name of business

- Business mailing address & phone number

- Type of business

- Tax identification number

- Number of employees

- Annual business revenue/sales

- Years in business

If you’re a sole proprietorship, how should you approach this? First of all, and most importantly, answer everything truthfully. I think the concern that a lot of people have is that they think they need an incorporated business, a separate office, etc., in order to be considered for a business card. That’s not the case:

- You can use your name as the legal name of your business

- The business mailing address and phone number can be the same as your personal address and phone number

- If you’re a sole proprietorship, you can select that as your type of business

- For the tax identification number, you can put your social security number

- For the number of employees, saying just one is perfectly fine

- For your annual business revenue, there’s nothing with having no income (yet)

- For years in business, there’s no shame in saying that it’s new, that it has been 1-2 years, etc.

How do you combine Chase Ultimate Rewards points?

As I explained above, there are three cards that earn Ultimate Rewards points, and four cards that earn points that can be converted into Ultimate Rewards points. The great news is that you can easily combine all of these points into a single Ultimate Rewards account, and then redeem them together.

The easiest way to do this is to make sure that all your Chase cards have the same online log-in. This typically requires setting up your personal cards under a business log-in, since business cards can’t generally be added to a personal log-in. If you don’t have that set up, call Chase online support and they can merge your online log-ins. Once you have it set up, it should be smooth sailing going forward.

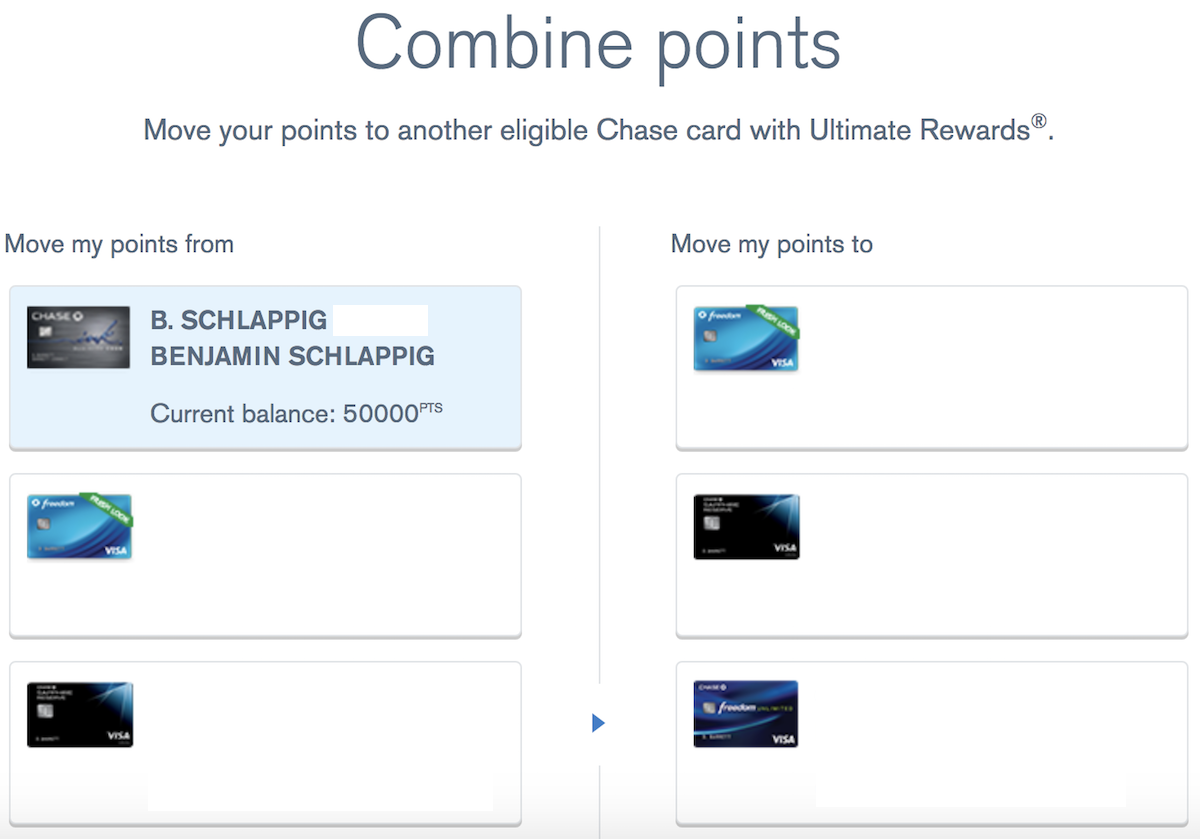

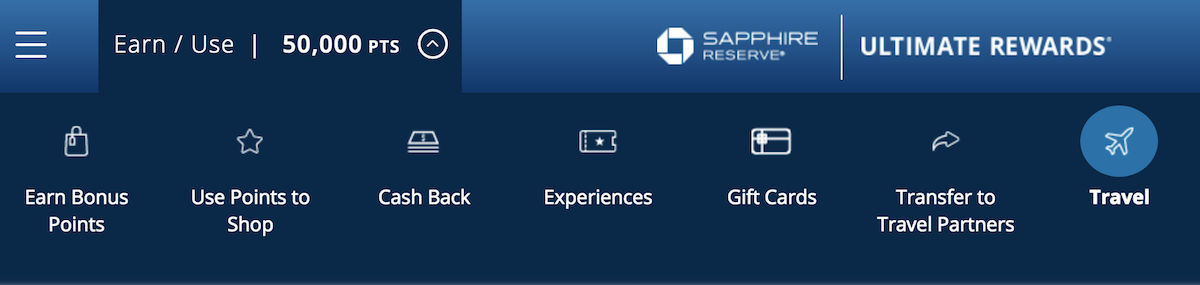

Just log into your Ultimate Rewards account, and on the main page, you’ll see a listing of all the cards you have, assuming they’re linked correctly. Just select the card that has the points that you want to transfer to another card (ideally you’d be transferring from one of the no annual fee cards to one of the premium cards, so you can maximize the value of your points).

Then on the next page click on the “Combine Points” tab, and then you’ll be asked where you want to move points from and to.

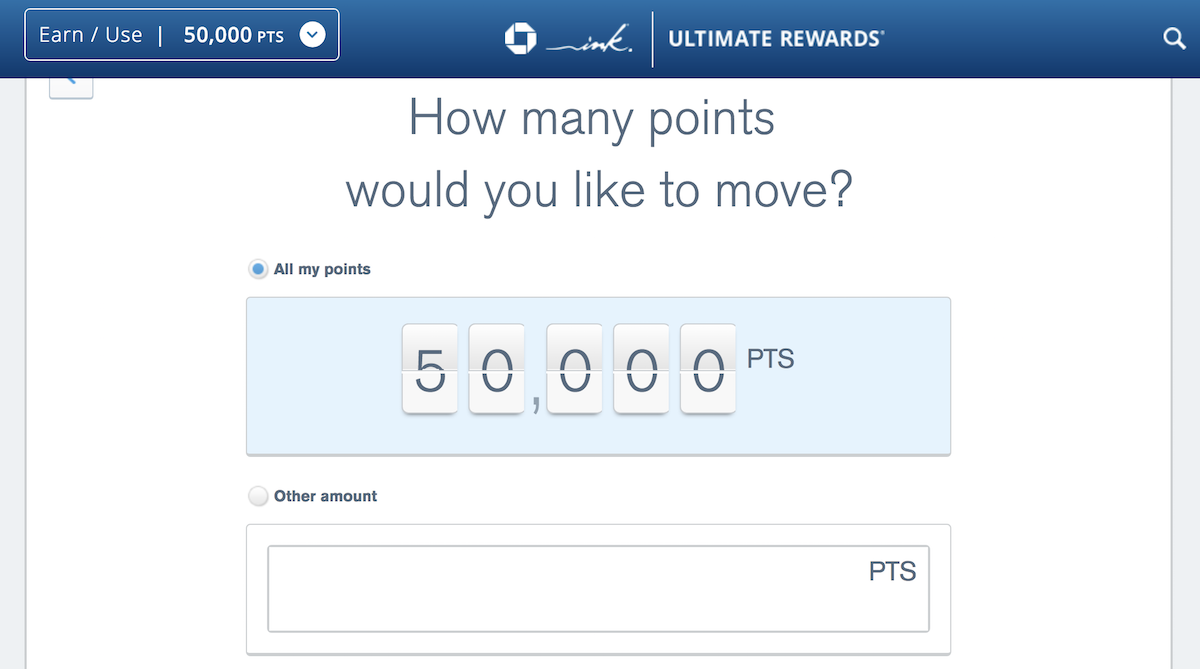

You’ll be asked how many points you want to transfer, and you might as well transfer all of them. You can always transfer them back, and this doesn’t adjust the expiration of your points, or anything.

Then once you’re in the account you transferred points to, you’ll see the points there, including the expanded options for redeeming them (I’ll talk more about redeeming Ultimate Rewards points below).

Can you transfer Chase points to a friend or family member?

In addition to being able to combine points across all of your own accounts, you can also transfer your Ultimate Rewards points to a member of your household or the owner of your company (for a business card).

Here are the terms associated with this:

You can move your points, but only to another Chase card with Ultimate Rewards belonging to you, or one member of your household or owner of the company, as applicable. If we suspect that you’ve engaged in fraudulent activity related to your credit card account or Ultimate Rewards, or that you’ve misused Ultimate Rewards in any way (for example by buying or selling points, moving or transferring points with or to an ineligible third party or account, or repeatedly opening or otherwise maintaining credit card accounts for the sole purpose of generating rewards) we may temporarily prohibit you from earning points or using points you’ve already earned. If we believe you’ve engaged in any of these acts, we’ll close your credit card account and you’ll lose all your points.

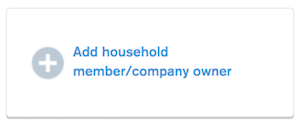

If you want to transfer points to someone, go to the “Combine points” page, and then at the bottom right of the page you’ll see an option to “Add household member/company member.”

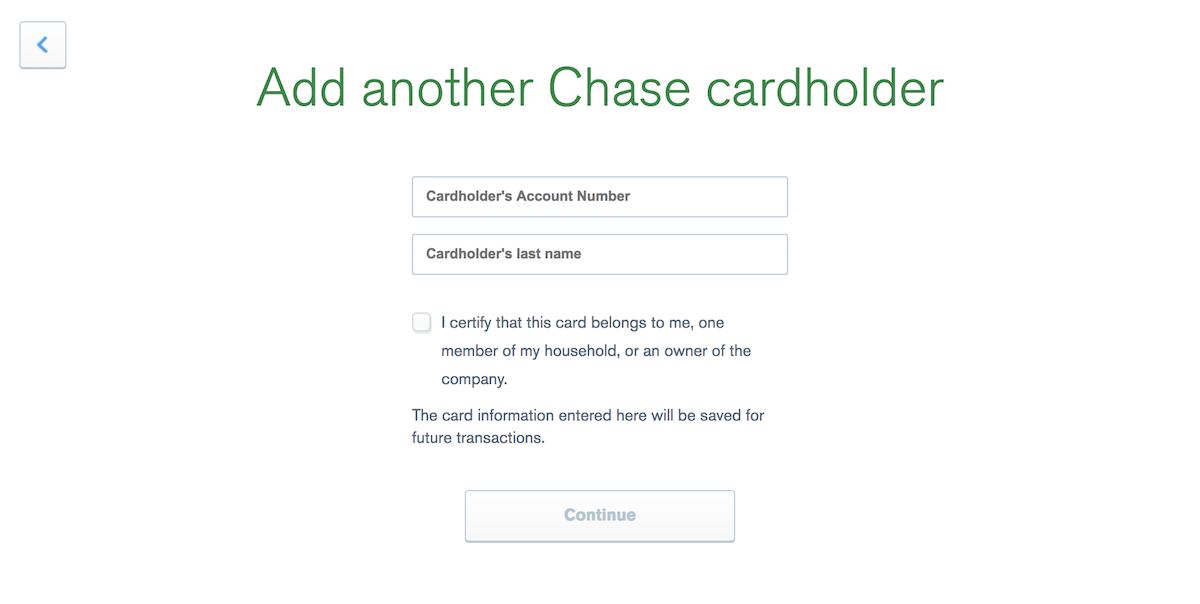

Click that, and then you’ll be asked to enter the account number and last name of the person you wish to transfer points to, which would either be a member of your household or the owner of the company.

For the most part, Chase uses the honor system here (in the sense that they don’t typically ask for verification of the business or household relationship), though I wouldn’t recommend trying anything creative. If they suspect that you’re transferring points in a way that violates the rules, they may shut down your account. So you won’t want to make transfers to multiple accounts.

Can you transfer points to someone else’s loyalty account?

Chase now lets you transfer points to a travel loyalty program belonging to one additional household member or the owner of a company who is also listed as an authorized user on your card account.

That means if you want to transfer points to someone’s loyalty account directly, they’ll need to be an authorized user.

Redeeming Chase Ultimate Rewards points

What makes Ultimate Rewards points so valuable is how many options there are for redeeming the points, whether you’re looking for a flight, hotel stay, or other travel purchase. You can also redeem for cash (as I’ll discuss below), though that’s not how I’d choose to redeem these points.

The value of the points earned on these cards differs. Generally speaking, you can redeem these points as either cash back towards the cost of a purchase, or convert them into airline or hotel points with a partner program. Here’s a chart showing the different values of the points:

Chase Sapphire Reserve®

Chase Sapphire Reserve®

Chase Sapphire Preferred® Card

Chase Sapphire Preferred® Card

Ink Business Preferred® Credit Card

Ink Business Preferred® Credit Card

Ink Business Cash® Credit Card

Ink Business Cash® Credit Card

Ink Business Unlimited® Credit Card

Ink Business Unlimited® Credit Card

Chase Freedom Unlimited®

Chase Freedom Unlimited®

The great news is that you can always pool points, and the value you get from the points across all seven cards is based on the most valuable card you have.

So as long as you have the Chase Sapphire Reserve®, Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card, the points you earn across all seven of these cards can be converted into airline miles or hotel points with any of the Chase Ultimate Rewards partners.

If you’d rather redeem your points towards the cost of a travel purchase with no blackout dates, then ideally you’d have the Chase Sapphire Reserve®, which allows you to redeem points for up to 2 cents through Chase Travel℠ with Points Boost. Meanwhile, if the highest card you have is the Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card, then you can redeem points for up to 1.75 cents each towards the cost of a travel purchase through Chase Travel℠ with Points Boost

Spending Chase Ultimate Reward points

You generally have two ways you can redeem Ultimate Rewards points efficiently:

- You can redeem them as cash towards the cost of a travel purchase

- You can transfer them to Chase’s airline and hotel partners

If you’re willing to put in the effort and know what you’re doing, you can definitely get the most value by transferring points to a partner, given the huge potential for outsized rewards, for first & business class travel, as well as for stays at five star hotels.

For others, being able to cash in points for up to 2 cents each towards a travel purchase through Chase Travel℠ with Points Boost could be a great value as well.

Chase Ultimate Rewards airline and hotel partners

Chase Ultimate Rewards points can be transferred at a 1:1 ratio to the following 14 programs, including eleven airline programs and three hotel programs:

Airline Partners | Hotel Partners |

|---|---|

IHG One Rewards | |

See this post for details on how long Chase Ultimate Rewards points transfers take.

Redeeming points for cash back or gift cards

You could redeem Ultimate Rewards points for gift cards or cash back, though it’s not a good deal. When using this redemption option you get at most one cent of value per point, which is significantly less than the value you get if redeeming for travel or transferring to an airline or hotel partner.

Ultimate Rewards points are excellent travel rewards cards, but wouldn’t be my go-to option if you want a cash back card.

What’s the best starter strategy for Chase points?

For someone who is just getting started with credit cards and points, I think the Chase Sapphire Preferred® Card is an unbeatable starter card.

- It has a low $95 annual fee

- It offers 3x points on dining and online groceries, and 2x points on travel, which are popular bonus categories for many

- Having this card lets you unlock Ultimate Rewards points, since you can transfer the points to airline and hotel partners

- It offers great car rental coverage

- If the card works out well for you but you want the Chase Sapphire Reserve®, you can always upgrade to that card after a year

Alternatively, if you travel a lot and value lounge access, just start with the Chase Sapphire Reserve®.

While the card’s $795 annual fee might sound high, the card offers a $300 annual travel credit that can be used towards any purchases coded as travel, it offers triple points on dining and 4x points on direct air/hotel bookings, a Priority Pass™ Select membership that gets you access to 1,300+ lounges around the world, and more.

If you’re eligible for a business credit card, I think the Ink Business Preferred® Credit Card is a great option. It has incredible bonus categories, an excellent cell phone protection plan, and more.

Bottom line

Regardless of whether you’re new to miles and points or a veteran, Chase has created one of the most lucrative credit card currencies there is with Ultimate Rewards. Hopefully, the above acts as a good resource if you’re trying to figure out anything about the currency.

What other questions do you have about Chase Ultimate Rewards?

Ben - question for you. I have accumulated many Ultimate Rewards points through both the Sapphire Reserve and a Chase Ink Business Unlimited card.

Recently, I closed the Sapphire Reserve account as I felt the $550 annual fee was too much - leaving me only with the Ink card.

Recently, I tried to move UR points into an airline frequent flyer account and this was not possible on the Ultimate Rewards website. When I called...

Ben - question for you. I have accumulated many Ultimate Rewards points through both the Sapphire Reserve and a Chase Ink Business Unlimited card.

Recently, I closed the Sapphire Reserve account as I felt the $550 annual fee was too much - leaving me only with the Ink card.

Recently, I tried to move UR points into an airline frequent flyer account and this was not possible on the Ultimate Rewards website. When I called Chase, they told me that I must have a Sapphire card in order to do this ...

Is this new or has this always been the case?

I thought that the Ultimate Rewards points were a transferrable currency that did not require possessing a specific card, in this case a Sapphire card.

Any insight you have would be greatly appreciated!

The problem with Chase business cards is that the terms explicitly state that the card is to be used only for business expenses. (Other banks' business cards don't make that explicit stipulation.) Many play fast and loose with that rule, but that's what they say. That makes it hard for some of us to meet minimum spend if we don't have a lot of business expenses.

One thing to note as well is that the Ink Business Cash is a no-fee card that offers 5x rewards at office supply stores. So, one can go to Staples, buy a couple thousand USD worth of Amazon gift cards, and get 10,000 points for it; that means effectively getting 5x points on Amazon purchases.

And yes, while one should hate oneself for giving Jeff Bezos more money, you're better off giving it to him...

One thing to note as well is that the Ink Business Cash is a no-fee card that offers 5x rewards at office supply stores. So, one can go to Staples, buy a couple thousand USD worth of Amazon gift cards, and get 10,000 points for it; that means effectively getting 5x points on Amazon purchases.

And yes, while one should hate oneself for giving Jeff Bezos more money, you're better off giving it to him rather than Elon "I am literally a hateful insane whack job" Musk. :) :) :)

Anyone ever get approved for more than 1 CIP at same time? I have multiple businesses that each spend > 20k/month. If I’m going to migrate to this ecosystem, I’d like to do

It all at once. Ideally, I’d obtain chase ink cash card for each to put the 5x category spend on each LLC cash card.

Is this possible?

You can apply for multiple Chase business cards at the same time and sometimes it's best to do so because all inquiries will be on the same day and age off at the same time.

However, if you have that type of volume for each business, I'd suggest opening a business checking or savings account with Chase, a seed fund with a few hundred dollars (tax collected from sales is a good start), and then...

You can apply for multiple Chase business cards at the same time and sometimes it's best to do so because all inquiries will be on the same day and age off at the same time.

However, if you have that type of volume for each business, I'd suggest opening a business checking or savings account with Chase, a seed fund with a few hundred dollars (tax collected from sales is a good start), and then ask for a relationship manager at the branch. (This requires going in person.)

Explain to the RM that you have multiple businesses with a $20K monthly spend and would like to use Chase credit products. If the RM applies to you versus an online application, you'll receive higher limits, allowing more spending on ads or inventory.

(Have all your docs with you. This also assumes that no other owners have more than 20% stakes in any of the businesses. Otherwise, they'll have to apply with you. Also, you'll want a 730+ score and realize the inquiries will lower your score by 5-10 points each (although I believe it will only count three inquiries if done on the same day. You'll want to verify that.)

Removing the dining bonus on Pay yourself back is the final straw for me on the CSR and all my chase cards. All spending is going on non chase cards in 2023.