As longtime OMAAT readers can attest to, I’ve long been obsessed with Air Belgium, an airline that launched passenger operations between Charleroi and Hong Kong back in 2018. The airline never made much sense to me, and for that matter, never actually turned a profit.

The company has essentially been on the brink of liquidation since shortly after it launched operations, though somehow always managed to get new investors in order to stay in business. There’s now an update, and it’s the end of Air Belgium in its current form…

In this post:

Some background on Air Belgium’s struggles

For those who aren’t familiar with Air Belgium, let’s start with some background. The airline was founded in 2018, and seemingly hasn’t had success with anything, but despite that, stayed in business for well over six years:

- The airline started service with Airbus A340s, and initially flew passenger flights between Charleroi Airport (outside of Brussels) and Hong Kong; the carrier’s long term plan was to add routes from Charleroi to mainland China, and have that be the focus

- Within a matter of weeks, the airline suspended that route, realizing it wasn’t exactly a great business model; that was the last we ever heard of Air Belgium operating passenger flights to China

- At this point the airline focused on becoming a wet lease operator, operating flights for other airlines that needed extra capacity; the timing of this was good, as many 787s were grounded due to engine issues at the time

- In October 2018, the airline was on the brink of liquidation, and an emergency general meeting was held to decide whether or not to dissolve; the company ended up getting more funding

- In July 2019, the airline announced it would resume regularly scheduled flights, but would fly to the Caribbean instead of China

- In June 2020, the airline announced it would switch from Charleroi Airport to Brussels Airport, and would launch new routes, including flying to Africa

- In July 2021, the airline announced it would acquire two Airbus A330-900neos, and use those for passenger flights, replacing Airbus A340s

- In December 2021, the airline announced it would add Boeing 747-8Fs to its fleet, and expand dedicated cargo operations

- In November 2022, the airline was reportedly on the brink of bankruptcy, but the airline managed to raise some more capital last minute

- In March 2023, the airline cut flights to the Caribbean, as they were unprofitable, and instead focused on Africa

- In September 2023, the airline cut scheduled passenger flights altogether, instead focusing on cargo and wet lease operations

I still think back fondly on my Air Belgium flight from Charleroi to Hong Kong, which had to be one of the most bizarre flights I’ve ever taken. It had a total of just 25 passengers onboard. It’s not often that the below pictures are what a cabin looks like while enroute on a long haul flight.

Air Belgium sold, becomes Air One Belgium

Around a year ago, Air Belgium started a reorganization process, whereby the airline discontinued regularly scheduled flights. Even with these changes, the airline continued to lose money.

As you’d expect when discontinuing regularly scheduled flights, the carrier’s revenue fell drastically, by roughly 40%. In the first half of 2024, the airline had revenue of €156 million, compared to €258 million in the same period the year before. Meanwhile losses totaled €22 million, as Air Belgium operated two freighter Boeing 747s, plus two Airbus A330s.

In September 2024, the airline needed to raise €18 million in order to stay in business, but couldn’t find any interested investors. As a result, the company has been in the process of liquidating, and there’s now an update.

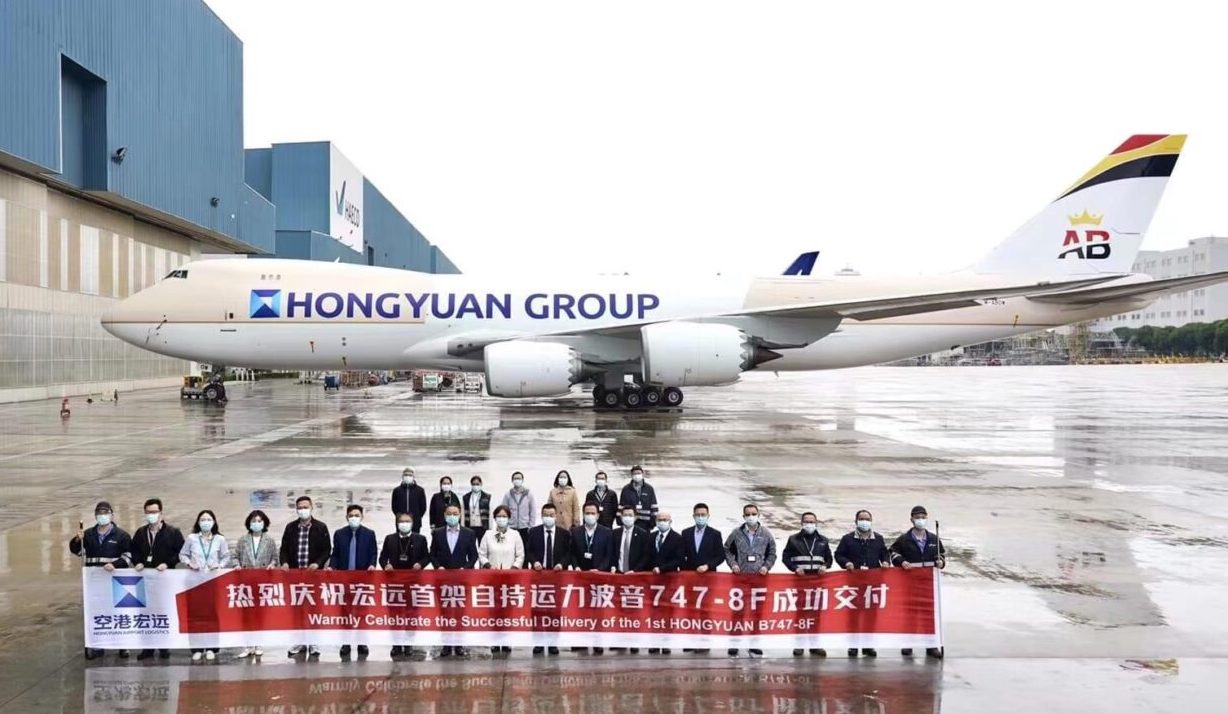

In a bankruptcy sale, Air Belgium has been sold to the sole bidders, Peso and Air One, for a total of $844K. The two companies are taking over Air Belgium’s cargo business, air operator certificate, and about half of the company’s 400 employees. Air Belgium will continue freighter operations, rebranded as Air One Belgium. Air One Belgium will operate four cargo jets, all of which are leased on behalf of CHina’s Hongyuan Group.

Air One International Holdings has close ties to Moldova’s Aerotranscargo and Romania’s ROMCargo, all of which operate 747s. So this adds nicely to the company’s business, without the legacy debt issues that Air Belgium had.

Bottom line

Air Belgium was founded in 2018, and the company was on the brink of liquidation since months after operations started. Despite that, the company stayed in business for well over six years. Air Belgium’s luck finally ran out, though. The company’s assets have now been sold for $844K, and the company’s four freighter jets are being taken over by an existing cargo operator, which will brand the Belgium division as Air One Belgium.

Goodness, what a unique company Air Belgium was, and I’m happy I had the chance to fly the airline back in 2018, for the brief period where it operated its planned business model (which made no sense).

What do you make of Air Belgium finally going out of business?

I bought 3 tickets JHB-Bru just before these flights were abruptly cancelled. I never received a refund, like thousands of other passengers. I'm somewhat surprised the long process of waiting for a financial solution wasn't highlighted in this column. We're all eager to know whether we're going to be refunded or not. Perhaps a subject for a follow-up column?

Flew them JFK to WAW as a wet lease for LOT aboard a A340 several years back. Service was fine. However, even I was questioning their business model at the time with A340 airframes.

When they moved to A330, thought they had a chance via wet leasing and charters.

The whole airline business is a crap shoot. Glad to see some jobs saved in the new legal entity.

Oh well. I had a chance to fly them operating for LOT WAW-YYZ, but they went mechanical in WAW. Ended up LO to LHR then AC home.

Glad some of the employees will have jobs!

Kinda sad. They've managed to stay in business for so long that I began to expect they'd just be around forever, even if always doing something dumb and always on the brink. Plus, their latest and last livery was cool!

At least I flew one of their A340s wetleased to Lot back in 2019, so, like Ben, I was a small part of their storied history.

Who the hell would buy a failing, doomed airline?

"The two companies are taking over Air Belgium’s cargo business, air operator certificate, and about half of the company’s 400 employees. Air Belgium will continue freighter operations...."

The above still has value.

I would believe the AOC is what they wanted. If PESO, who seem to understand how the aviation business works will successfully make it happen. Yes, I saw their A340 working a wet lease for LOT on YYZ-WAW.

We have a long tradition of surrealism maybe this explains that

Does anyone know what happened to the 339s

@ Walter -- It appears that they're in storage, but are headed to Azul in Brazil:

https://www.planespotters.net/airframe/airbus-a330-900-oo-abg-air-belgium/r6km8k

https://www.planespotters.net/airframe/airbus-a330-900-oo-abf-air-belgium/e5o02v

"Air Belgium was founded in 2024"

Um....

@ Julia -- Sorry, I got a bit too early of a start today, even by my own standards. Fixed. :p