I’ve written about the best hotel credit cards offering free nights, either as an annual benefit or as a reward for reaching certain spending thresholds. In many cases, these anniversary free night certificates can more than justify the annual fees on cards, given that they can be redeemed at some great hotels.

For example, both the World of Hyatt Credit Card (review) and IHG One Rewards Premier Credit Card (review) offer anniversary free night certificates that can be redeemed at hotels with nightly rates that are way higher than the cards’ annual fees.

That’s only one perk that potentially makes hotel credit cards useful, though. One of the other awesome things about some credit cards is that they can make it easy to earn elite status.

Nowadays it’s possible to earn top tier elite hotel status with several hotel credit cards, and the opportunities to earn status with credit cards keeps improving.

In this post:

Best hotel credit cards for elite status June 2025

In this post I wanted to take a look at all the ways you can use US-issued credit cards to earn elite hotel status. In some cases, you get status just for having a card, and in other cases, a certain amount of spending is required.

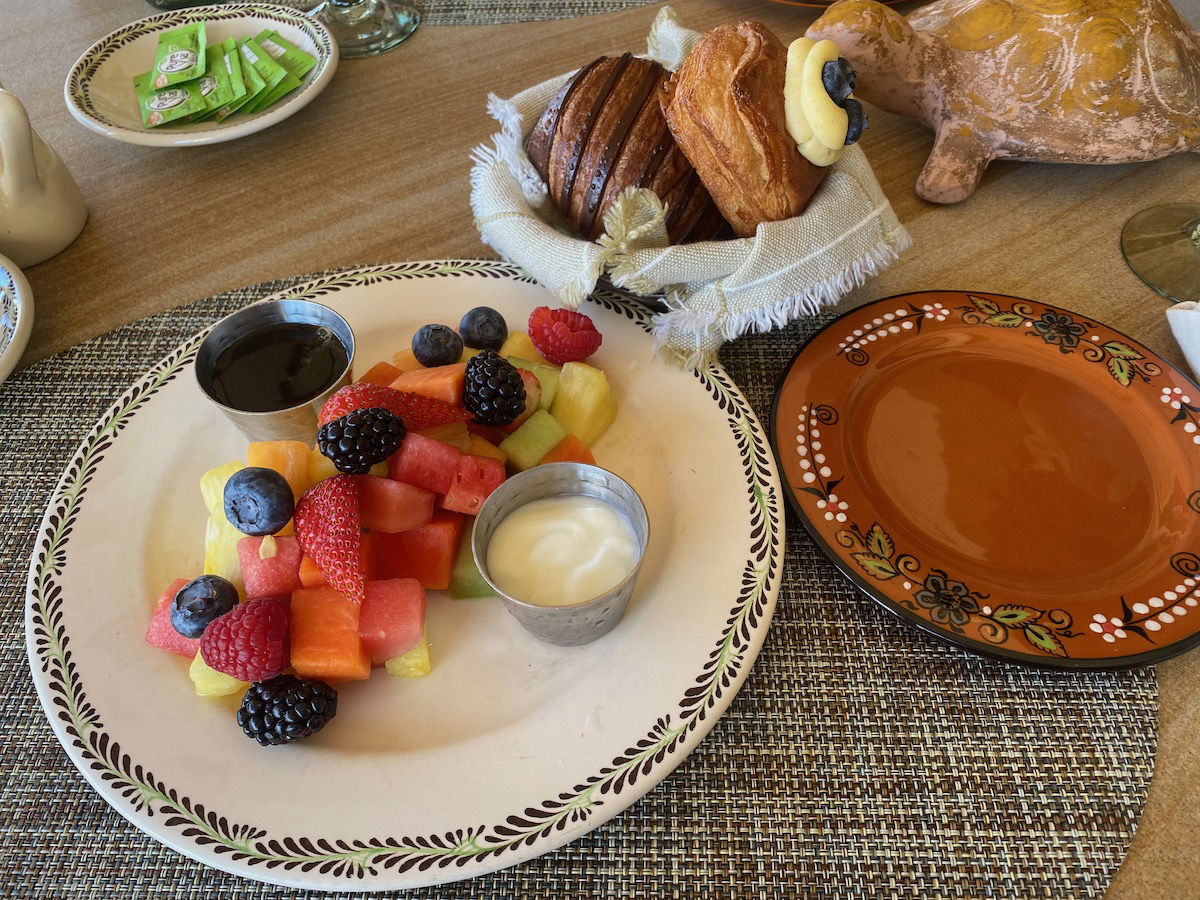

There are potentially all kinds of benefits to hotel elite status, ranging from free breakfast to late check-out to bonus points to suite upgrades. Obviously the higher your status, the better the perks.

Here are all the options, organized alphabetically by program and then by hierarchy of elite tiers.

Choice Privileges Gold status credit cards

Choice Privileges Gold status ordinarily requires 10 nights per year, but can be earned with the following card:

- Choice Privileges Mastercard, $0 annual fee — status is valid for as long as you have the card

Choice Privileges Platinum status credit cards

Choice Privileges Platinum status ordinarily requires 20 nights per year, but can be earned with the following card:

- Choice Privileges Select Mastercard, $95 annual fee, waived the first year — status is valid for as long as you have the card

There are no cards that offer Choice Privileges Diamond status.

Silver elite status credit cards

Silver elite status ordinarily requires four stays or 10 nights per year, but can be earned with the following card:

- Hilton Honors American Express Card (review), $0 annual fee (Rates & Fees) — status is valid for as long as you have the card

Gold elite status credit cards

Gold elite status ordinarily requires 20 stays, 40 nights, or 75,000 base points per year, but can be earned with the following cards:

- Hilton Honors American Express Surpass® Card (review), $150 annual fee (Rates & Fees) — status is valid for as long as you have the card

- Hilton Honors American Express Business Card (review), $195 annual fee (Rates & Fees) — status is valid for as long as you have the card

- The Platinum Card® from American Express (review), $695 annual fee (Rates & Fees) — status is valid for as long as you have the card, registration required

- The Business Platinum Card® from American Express (review), $695 annual fee (Rates & Fees) — status is valid for as long as you have the card, registration required

- Hilton Honors American Express Card, $0 annual fee (Rates & Fees) — earn status when you make $20,000 in eligible purchases on the card in a calendar year

Diamond elite status credit cards

Diamond elite status ordinarily requires 30 stays, 60 nights, or 125,000 base points per year, but can be earned with the following cards:

- Hilton Honors Aspire Card from American Express (review), $550 annual fee — status is valid for as long as you have the card

- Hilton Honors American Express Surpass® Card, $150 annual fee — earn status when you make $40,000 in eligible purchases on the card in a calendar year

- Hilton Honors American Express Business Card, $195 annual fee — earn status when you make $40,000 in eligible purchases on the card in a calendar year

The information and associated card details on this page for the Hilton Honors American Express Aspire Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

IHG One Rewards Silver status credit cards

IHG One Rewards Silver status ordinarily requires 10 nights per year, but can be earned with the following card:

- IHG One Rewards Traveler Credit Card (review), no annual fee — status is valid for as long as you have the card

IHG One Rewards Gold status credit cards

IHG One Rewards Gold status ordinarily requires 20 nights or 40,000 base points per year, but can be earned with the following card:

- IHG One Rewards Traveler Credit Card, no annual fee — earn status when you make $20,000 in eligible purchases on the card in a calendar year

IHG One Rewards Platinum status credit cards

IHG One Rewards Platinum status ordinarily requires 40 nights or 60,000 base points per year, but can be earned with the following cards:

- IHG One Rewards Premier Credit Card (review), $99 annual fee — status is valid for as long as you have the card

- IHG One Rewards Premier Business Credit Card (review), $99 annual fee — status is valid for as long as you have the card

- The New United Club℠ Card (review), $695 annual fee — status is valid as long as you have the card

- IHG Rewards Select Credit Card, $49 annual fee (no longer open to new applicants) — status is valid for as long as you have the card

The information and associated card details on this page for the IHG Rewards Club Select Credit Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

IHG One Rewards Diamond status credit cards

IHG One Rewards Diamond status ordinarily requires 70 nights or 120,000 base points per year, but can be earned with the following cards:

- IHG One Rewards Premier Credit Card, $99 annual fee — earn status when you make $40,000 in eligible purchases on the card in a calendar year

- IHG One Rewards Premier Business Credit Card, $99 annual fee — earn status when you make $40,000 in eligible purchases on the card in a calendar year

Marriott Silver status credit cards

Marriott Silver Elite status ordinarily requires 10 nights per year, but can be earned with the following cards:

- Marriott Bonvoy Bold® Credit Card (review), no annual fee — offers 15 elite qualifying nights per year, which is more than enough for Silver status

- Marriott Bonvoy Boundless® Credit Card (review), $95 annual fee — offers 15 elite qualifying nights per year, which is more than enough for Silver status

- Marriott Bonvoy American Express Card, $95 annual fee (no longer open to new applicants) — offers 15 elite qualifying nights per year, which is more than enough for Silver status

- Marriott Bonvoy Business Credit Card, $99 annual fee (no longer open to new applicants) — offers 15 elite qualifying nights per year, which is more than enough for Silver status

- Marriott Rewards Premier Card, $85 annual fee (no longer open to new applicants) — offers 15 elite qualifying nights per year, which is more than enough for Silver status

Note that each Marriott Bonvoy member can earn at most 40 elite nights per year from credit cards, with 25 elite nights coming from a personal card, and 15 elite nights coming from a business card.

Marriott Gold status credit cards

Marriott Gold Elite status ordinarily requires 25 nights per year, but can be earned with the following cards:

- Marriott Bonvoy Boundless Card from Chase, $95 annual fee — earn status when you make $35,000 in eligible purchases on the card in a cardmember year

- Marriott Bonvoy American Express Card, $95 annual fee (no longer open to new applicants) — earn status when you make $35,000 in eligible purchases on the card in a calendar year

- Marriott Bonvoy Bevy® American Express® Card (review), $250 annual fee (Rates & Fees) — valid as long as you are a cardmember

- Marriott Bonvoy Business® American Express® Card (review), $125 annual fee (Rates & Fees) — status is valid for as long as you have the card

- The Ritz-Carlton Credit Card, $450 annual fee (no longer open to new applicants) — status is valid for as long as you have the card

- The Platinum Card® from American Express, $695 annual fee — status is valid for as long as you have the card, registration required

- The Business Platinum Card® from American Express, $695 annual fee — status is valid for as long as you have the card, registration required

The information and associated card details on this page for the Ritz-Carlton Credit Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Marriott Platinum status credit cards

Marriott Platinum Elite status ordinarily requires 50 nights per year, but can be earned with the following cards:

- Marriott Bonvoy Brilliant® American Express® Card, $650 annual fee (Rates & Fees) — valid as long as you are a cardmember

- The Ritz-Carlton Credit Card, $450 annual fee (no longer open to new applicants) — earn status when you make $75,000 in eligible purchases on the card in a cardmember year

There are no cards that offer Marriott Titanium or Ambassador status.

Sonesta Travel Pass Elite status credit cards

Sonesta Travel Pass Elite status ordinarily requires 12 nights per year, but can be earned with the following card:

- The Sonesta World Mastercard, $75 annual fee, waived the first year — status is valid for as long as you have the card

World of Hyatt Discoverist status credit cards

World of Hyatt Discoverist status ordinarily requires 10 nights or 25,000 base points per year, but can be earned with the following cards:

- The World of Hyatt Credit Card (review), $95 annual fee — status is valid for as long as you have the card

- The World of Hyatt Business Credit Card (review), $199 annual fee — status is valid for as long as you have the card

World of Hyatt Explorist status credit cards

World of Hyatt Explorist status ordinarily requires 30 nights or 50,000 base points per year, but can be earned with the following cards:

- The World of Hyatt Credit Card, $95 annual fee — the card offers five elite qualifying nights annually, plus two additional elite nights for every $5,000 spent, so spending $65,000 would earn 31 elite qualifying nights, which is more than enough for Explorist status

- The World of Hyatt Business Credit Card, $199 annual fee — the card offers five elite nights for every $10,000 spent in a calendar year, so spending $60,000 would earn you 30 elite nights, which is enough for Explorist status

World of Hyatt Globalist status credit cards

World of Hyatt Globalist status ordinarily requires 60 nights or 100,000 base points per year, but can be earned with the following cards:

- The World of Hyatt Credit Card, $95 annual fee — the card offers five elite qualifying nights annually, plus two additional elite nights for every $5,000 spent, so spending $140,000 would earn 61 elite qualifying nights, which is more than enough for Globalist status

- The World of Hyatt Business Credit Card, $199 annual fee — the card offers five elite nights for every $10,000 spent in a calendar year, so spending $120,000 would earn you 60 elite qualifying nights, which is enough for Globalist status

Wyndham Rewards Gold status credit cards

Wyndham Rewards Gold status ordinarily requires five nights per year, but can be earned with the following card:

- Wyndham Rewards Earner Card, $0 annual fee — status is valid for as long as you have the card

Wyndham Rewards Platinum status credit cards

Wyndham Rewards Platinum status ordinarily requires 15 nights per year, but can be earned with the following card:

- Wyndham Rewards Earner Plus Card, $75 annual fee — status is valid for as long as you have the card

Wyndham Rewards Diamond status credit cards

Wyndham Rewards Diamond status ordinarily requires 40 nights per year, but can be earned with the following card:

- Wyndham Rewards Earner Business Card, $95 annual fee — status is valid for as long as you have the card

Bottom line

It’s pretty remarkable that nowadays you can earn valuable status with Hilton, Marriott, Sonesta, and Wyndham, just for having a credit card (without a spending requirement), and with Hyatt and IHG you can earn valuable status with credit card spending.

On top of that, there are many mid-range credit cards that offer status just for having the card, which can be valuable as well. For example, it’s really easy to earn Gold elite status, and that gets you perks like free breakfast at most brands, bonus points, and more.

If you are going to spend money on your hotel credit card to earn status, just make sure you consider the opportunity cost of that spending.

Which credit cards do you find to be most valuable for earning elite hotel status?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: Hilton Honors American Express Card (Rates & Fees), The Business Platinum® Card from American Express (Rates & Fees), The Hilton Honors American Express Business Card (Rates & Fees), The Platinum Card® from American Express (Rates & Fees), Marriott Bonvoy Brilliant® American Express® Card (Rates & Fees), Marriott Bonvoy Bevy® American Express® Card (Rates & Fees), Marriott Bonvoy Business® American Express® Card (Rates & Fees), and Hilton Honors American Express Surpass® Card (Rates & Fees).

There is also the Best Western credit card to give status

Going off of one of the other comments, with them selling the status through credit card spend or paying a credit card annual fee this creates all kinds of other issues. Lower chance of upgrades, higher chance of overcrowding in lounges, longer lines for elite check in, etc. The hotels don't always do a good job at managing such things.

Why post about the most basic status (silver in most groups) when that entitles you to almost nothing.

And yet… even with all the status in the world, you still have to prompt front desk staff for the two free water bottles.

Honestly maybe a lot of this is geography dependent and Ben just has relatively good experiences. But here on the West coast, status seems quite irrelevant. Room upgrades rarely occur due to high occupancy rates. Free breakfast is nice but honestly so many hotels have daily rates that include breakfast...

And yet… even with all the status in the world, you still have to prompt front desk staff for the two free water bottles.

Honestly maybe a lot of this is geography dependent and Ben just has relatively good experiences. But here on the West coast, status seems quite irrelevant. Room upgrades rarely occur due to high occupancy rates. Free breakfast is nice but honestly so many hotels have daily rates that include breakfast for maybe $5 more than the advanced prepay rate that I’d hardly consider that a big perk. Faster points accumulation due to multipliers is the only perk that holds meaningful value imho.

There’s a longstanding concern around devaluing loyalty programs when you sell status for cash value. I don’t see credit cards being any different. I’m not spending with the hotel chain - I’m spending with a bank that is giving them money. Zero loyalty other than me indirectly paying them.

With that said, this industry is now so fractured that the incentives are really starting to show. Multiple Hyatt properties are engineering ways to make sure...

There’s a longstanding concern around devaluing loyalty programs when you sell status for cash value. I don’t see credit cards being any different. I’m not spending with the hotel chain - I’m spending with a bank that is giving them money. Zero loyalty other than me indirectly paying them.

With that said, this industry is now so fractured that the incentives are really starting to show. Multiple Hyatt properties are engineering ways to make sure we can’t redeem benefits that are stated as available through the program. If you ever have a charge that doesn’t code correctly, neither the card company nor loyalty chain will put the work in to properly resolve. I have this sensation that in 10 years, everything is going to be like Delta’s program: loyalty in name only.

It makes me appreciate cash back or cash-value transaction programs more as benefits decrease.

I was with you until this statement: “ If you ever have a charge that doesn’t code correctly, neither the card company nor loyalty chain will put the work in to properly resolve.”

Can’t speak for Chase, but Amex does a great job fixing such issues.

Chase has fixed many purchase code errors for my Chase IHG CC. Never had any major issues with that. Always able to get it fixed by messaging Chase.

“It’s pretty remarkable that nowadays you can earn valuable status with Hilton, Marriott, Sonesta, and Wyndham, just for having a credit card”

We have different definitions of the word ‘earn’…