Link: Apply for the no annual fee Bilt Mastercard®

I finally did it — I applied for the Bilt Mastercard®. I didn’t think I was going to get this card (since I don’t rent), so let me share why I applied, and what my experience was like.

In this post:

Why the Bilt Mastercard is worth getting

The Bilt Mastercard is an innovative no annual fee credit card that’s in a league of its own for renters. The card has an incredible rewards structure for renters. If you have at least five posted transactions per billing cycle, you can earn:

- 3x points on dining, 2x points on travel, and 1x points on everything else (and even more points on the first day of each month)

- 1x points on rent payments without any transaction fees, up to a limit of 100,000 points per year

- While there are many ways that Bilt points can be redeemed, most exciting is the roughly dozen transfer partners, which include World of Hyatt and American AAdvantage

A large percentage of the population rents, so being able to pay your rent by a credit card (and earn rewards) without paying a fee is incredible. On top of that, the card has some additional perks you wouldn’t expect from a no annual fee card, including a cell phone protection benefit, primary rental car coverage, trip delay reimbursement, and more.

On the surface, the card’s value proposition isn’t quite as good for those who don’t rent. The reason I haven’t applied for this card up until now is twofold:

- The card doesn’t have a formal sign-up bonus, which is a big disadvantage compared to many other cards

- I don’t rent, so one of the key selling points of the card doesn’t apply in my case

So, why did I have a change of heart and apply for the card? Readers pointed out two things, which I’ll cover in more detail in separate posts:

- The card seems to have an unofficial sign-up bonus, which is sent to many people the day they receive the card in the mail

- While I don’t rent, I do pay an HOA, and at least anecdotally it seems that most HOAs are also payable by credit card through Bilt without a fee

An opportunity to earn a sign-up bonus and an HOA with a no annual fee card? I’m in!

Read my full review of the Bilt Mastercard.

My experience getting approved for the Bilt Mastercard

What was my experience like getting approved for the Bilt Mastercard? Even though the card is issued by Wells Fargo, the application process is customized to Bilt.

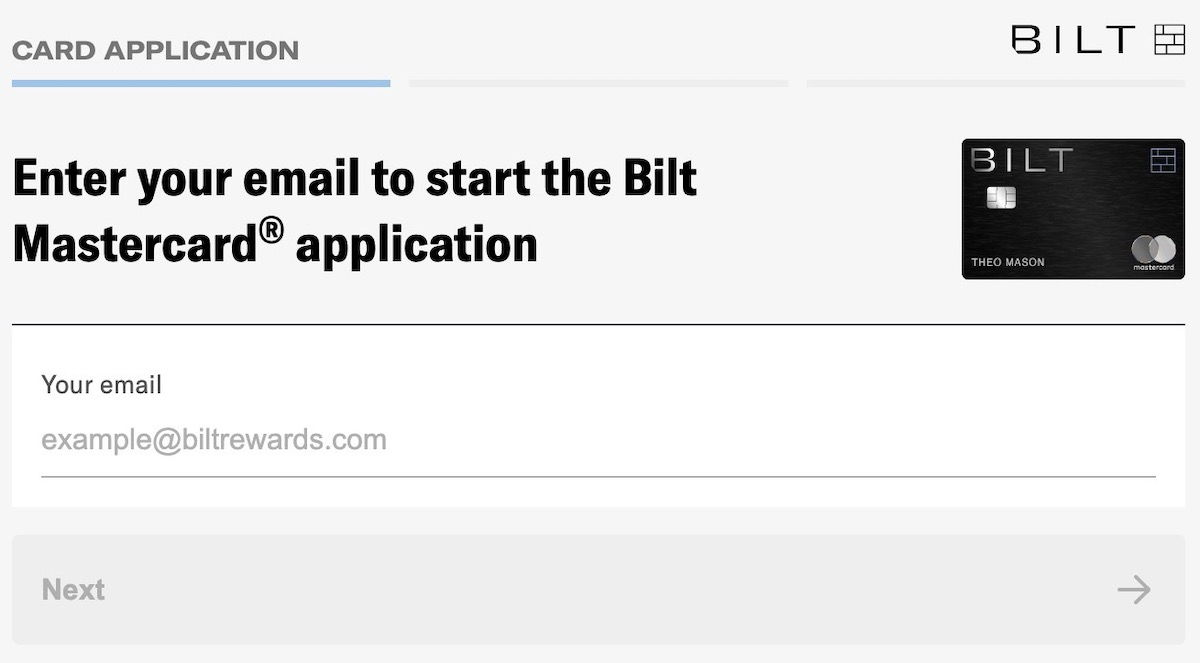

The Bilt Mastercard application process will depend on whether or not you have a Bilt account already (it’s possible to have a Bilt account without actually getting the credit card, as it’s free to join).

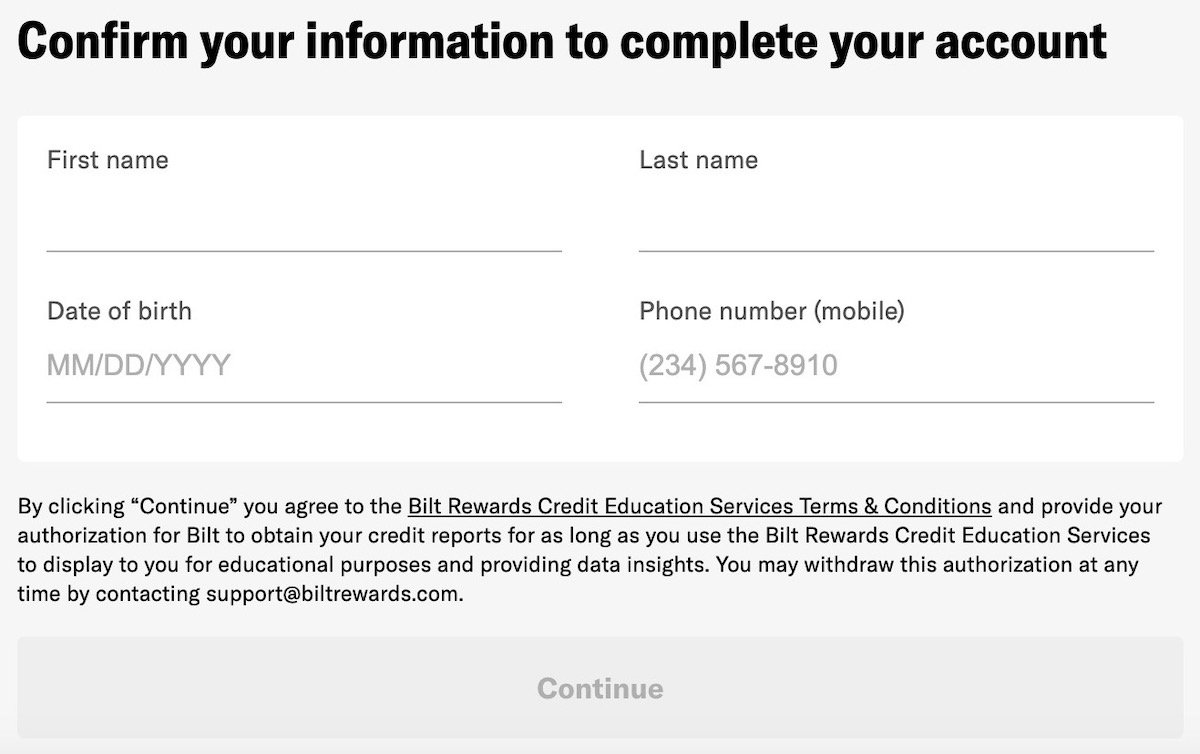

If you don’t yet have a Bilt account, you’ll be asked to create one, which involves providing an email address and password. Then you’ll be asked to provide your first and last name, date of birth, and a phone number. That phone number will have to be verified with a security code.

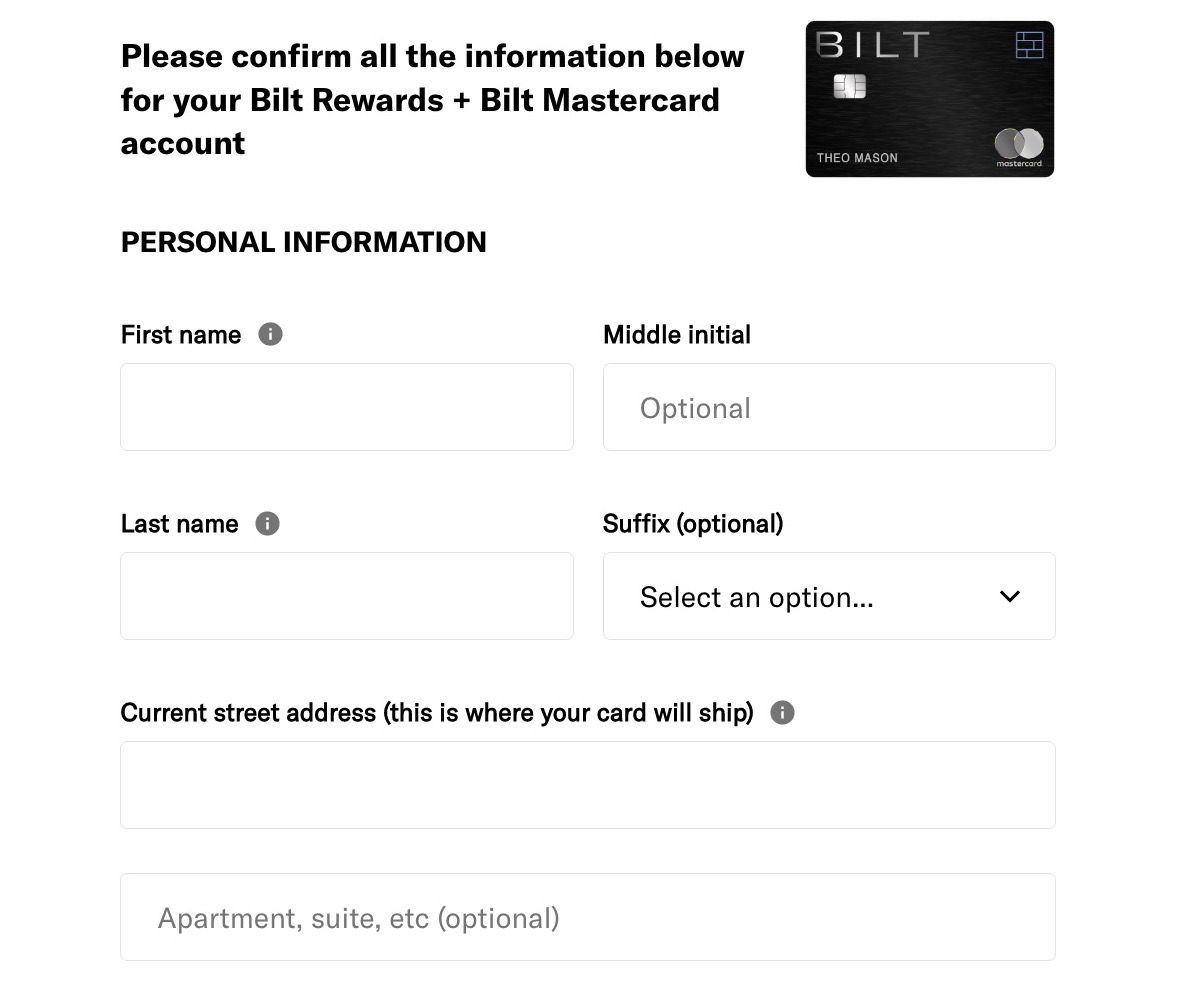

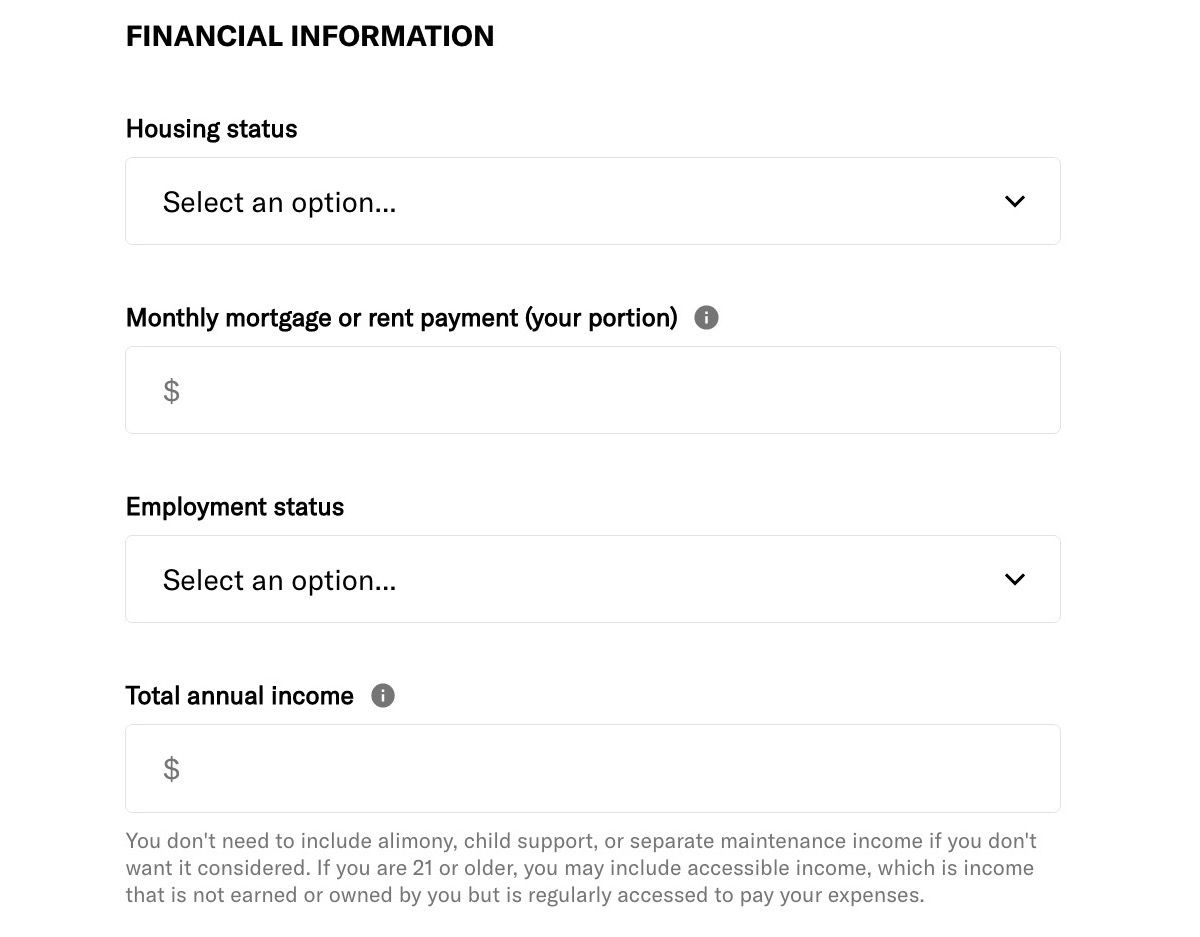

Once the Bilt account is created, the credit card application process is pretty straightforward, and it’s just a single page. You’ll be asked for your name, address, social security number, income, etc.

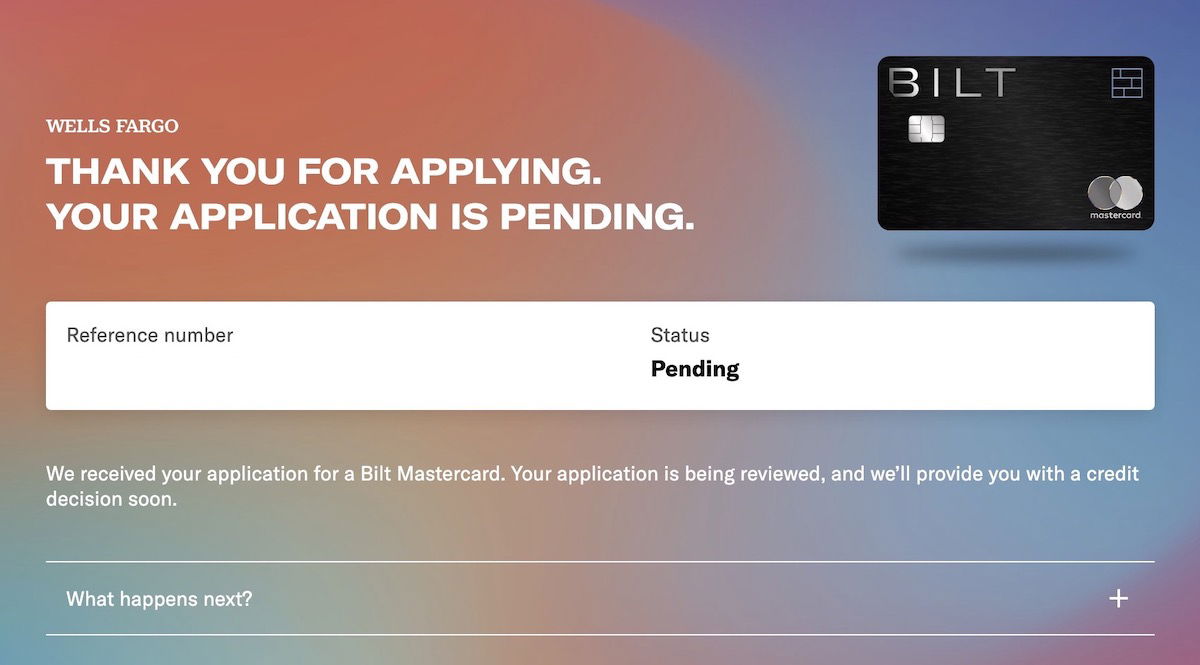

Upon completing my application, I initially received a “pending” notice, with a reference number. I figured it would be a few days until I got approved, or maybe even that I would get denied, for whatever reason.

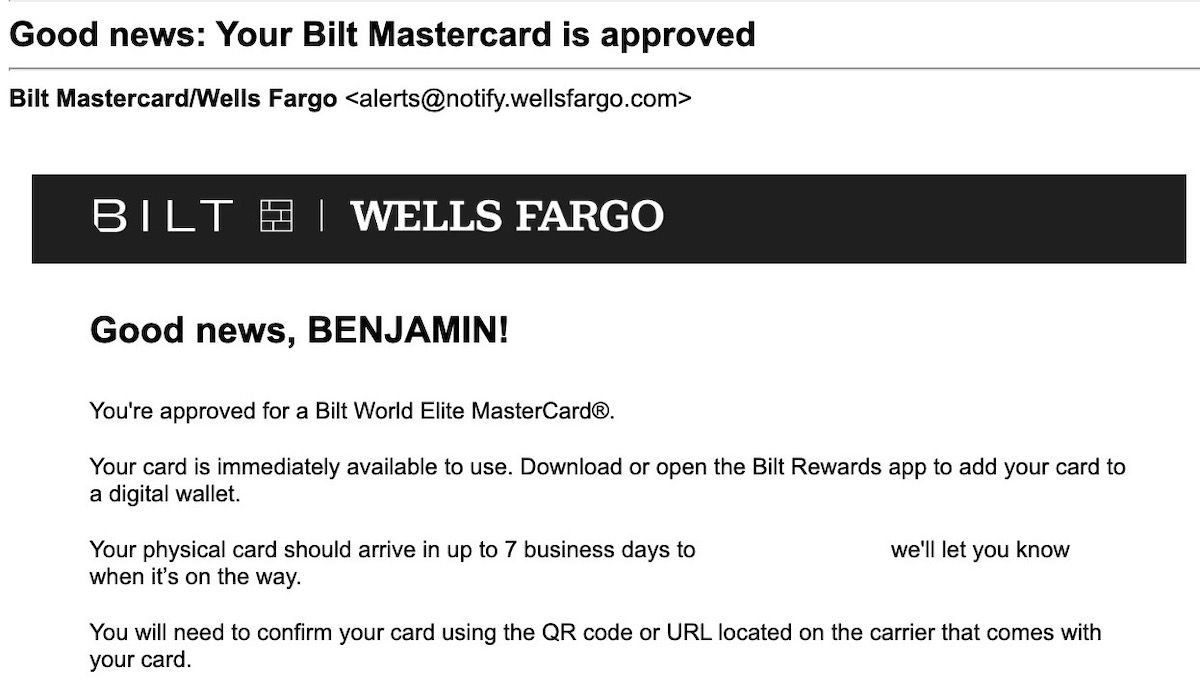

However, literally within five minutes I received a notice indicating that my application had been approved. I was even given a massive credit line.

As soon as my card was approved, I was already issued a virtual card number, which I could use to make purchases.

Getting the Bilt Mastercard in the mail

The Bilt Mastercard showed up in the mail three days after I was approved, which was pretty quick. Nowadays most credit cards (even premium ones) don’t exactly come with an exciting welcome packet, so by comparison the Bilt Mastercard has nice packaging, if that’s something you care about.

This could be expanded, with the card located on the left, and a QR code for getting the card activated located on the right.

I’m excited to take this card for a spin, and share my experience.

Bottom line

I’m giving the Bilt Mastercard a try. While the card has been a no-brainer since launch for those who rent, it looks like there could be value for others as well, and I look forward to exploring that. I found the Bilt Mastercard application process to be pretty straightforward, and so far am pleased.

If you’ve applied for the Bilt Mastercard, what was your experience like?

What bureau was credit pulled from?

Bilt points are useful, and I put up with their points because it's the only way I can earn points on rent. However, the card has been an annoyance:

- I've had two separate instances of fraudulent transactions on the card, which no other card of mine has had.

- The 5 transaction minimum is per statement period, which sounds fine, but is realistically incredibly annoying. I have to remember to spend on...

Bilt points are useful, and I put up with their points because it's the only way I can earn points on rent. However, the card has been an annoyance:

- I've had two separate instances of fraudulent transactions on the card, which no other card of mine has had.

- The 5 transaction minimum is per statement period, which sounds fine, but is realistically incredibly annoying. I have to remember to spend on this card, since my other cards have better bonus categories (e.g. 2x on Venture X, 4x on Amex Gold, etc). Moreover it doesn't work for the edge cases: I was just traveling internationally for 3 weeks and didn't spend on this card while traveling. Midway through my travels, I got a fraudulent transaction, so they mailed a replacement card, which sat in my mailbox until I got back. Then I got an email (at least that was proactive) saying that I need to make more transactions to earn points. I couldn't even buy an online gift card because the new card wasn't active. When I contacted customer service, they said they can't tell me what my statement period is (??), but that I've already made enough transactions this period to earn points. This makes no sense!

- When I've tried to contact customer service, I've had multi-day waits via email. I can get on the phone with Chase inside of ten seconds.

- I have a fantastic credit score with other cards with high limits. I haven't applied for too many cards recently. Yet my Bilt credit line is painfully small, so small that I can't even put my rent on the card (must use the ACH protect). I'm relatively young and value the utilization denominator increasing with each credit card app, and this _almost_ wasn't worth the additional hard inquiry.

Overall, I get why Ben advertises this card -- it's definitely an interesting product. But they're clearly still having teething problems that the established players have solved. Still feels like a start-up's user experience.

What bureau did they pull from ??

Could you explain to a newbie how one could pay for rent (which needs to be submitted via bank wire) using this? Thank you!

Bilt allows an option to have a check mailed to your landlord. If not, Bilt creates a unique-to-you pseudo-"checking account" with a routing number and an account number, just like a standard checking account, that you can use as input for a transfer.

We have a CO-OP and pay our maintenance through Click Pay like many renters and Condos which is like an HOA. Does anyone know if this is covered for BILT?

In case you still don't know, yes. I pay mine through ClickPay with Bilt.

Also no mention before of

Hyatt X Bilt promo

About:

https://www.biltrewards.com/editorial/post/hyatt-explorist-trial-status-on-us-this-rent-day

To take part in the status challenge, here’s what you need to do:

Enroll in World of Hyatt

Link your World of Hyatt account to Bilt Rewards in the Bilt app under the “Travel” tab

Between March 28th through April 1st, choose “Unlock Elite World of Hyatt Trial Status” on the Rent Day tab in the Bilt app and...

Also no mention before of

Hyatt X Bilt promo

About:

https://www.biltrewards.com/editorial/post/hyatt-explorist-trial-status-on-us-this-rent-day

To take part in the status challenge, here’s what you need to do:

Enroll in World of Hyatt

Link your World of Hyatt account to Bilt Rewards in the Bilt app under the “Travel” tab

Between March 28th through April 1st, choose “Unlock Elite World of Hyatt Trial Status” on the Rent Day tab in the Bilt app and register.

Bilt Members will receive a confirmation by April 17, 2023. Once enrolled, you’ll have from April 17, 2023 to July 16, 2023 to enjoy World of Hyatt Explorist status.

To extend your status, you’ll need to complete the following:

Stay 10 qualifying nights during the challenge period to keep Explorist status

Stay 20 qualifying nights during the challenge period to achieve Globalist status

Once completed, you will maintain your respective status until February 29, 2025.

Because it’s over.

But not even a whisper when it was! And today Bilt offers 8x (charged on the card) on select dining in select cities but no mention, either. I don’t understand all the hush-hush on this card on this site but perhaps that will change now that Ben finally found out some particulars & dove in.

Because it’s over.

TPG is also today writing about this card... It really feels like Bilt launched some kind of a campaign with bloggers to give this card more attention.

I'M SHOCKED, SHOCKED THAT WOULD HAPPEN.

/s

@ CardCardsCard -- It seems that Bilt had some embargoed info that went out today, as the company does every so often, and that's why several other people wrote about it?

I didn't receive that embargoed information, and didn't write about it. As I commented in response to someone else, no one at Bilt has asked me to write anything, and I haven't been given any further incentive to promote the card vs. the past.

...@ CardCardsCard -- It seems that Bilt had some embargoed info that went out today, as the company does every so often, and that's why several other people wrote about it?

I didn't receive that embargoed information, and didn't write about it. As I commented in response to someone else, no one at Bilt has asked me to write anything, and I haven't been given any further incentive to promote the card vs. the past.

I just find the card much more interesting after a few things that readers pointed out, and I'm sharing my experience. I tend to write more about the things that I'm enthusiastic about, whether it's Hello Kitty flights or good credit cards.

Hi Ben,

Thanks for the clarification! Your posts def helped as I applied for the card.

I think @Lucky is on a revenge app crusade after being denied by Citi.

That's why they say rebound relationship doesn't always work.

I asked Bilt support what kind of payments are allowed with ACH method and they replied:

Bilt Rent Account (routing and account numbers) is just for rent and rent-related transactions like the ones listed below:

HOA Fees

Security Deposit

Electric Bill

Gas Bill

Water Bill

Condo Fees

College Living/University Housing (not paid as part of tuition)

Cable

Internet

Cell Phone Payment

Application Fee

No way can you use it for utilities! Did they really say that?

Yeah I’d actually want it if that’s true.

Electric Bill?

Gas Bill?

Water Bill?

Cable?

Internet?

Cell Phone Payment?

All of those are consider rent-related in my own property?

I applied for the card in March, I'm not a renter, I'd read that HOA fees are eligible and I can confirm with a yes. My first payment with the Bilt card went through on April 1st.

@ dion b -- Thanks for the data point! :-)

I was waiting at an airport and bored, so I applied and got approved in a couple of minutes. Then I ran into a major snag. My apartment payment portal doesn't allow for manual entry of banking details, which means I have to use this as a credit card and get nailed for fees. The pseudo-account number and routing number is a great thing, though. I've got such a great credit line on this that...

I was waiting at an airport and bored, so I applied and got approved in a couple of minutes. Then I ran into a major snag. My apartment payment portal doesn't allow for manual entry of banking details, which means I have to use this as a credit card and get nailed for fees. The pseudo-account number and routing number is a great thing, though. I've got such a great credit line on this that I'm going to switch my utilities, cable, and travel to this card. Thanks, Ben.

@ ORD_Is_My_Second_Home -- You can also have Bilt send a check on your behalf to your landlord, which is another way to pay and earn miles without paying anything extra, as you'll be charged on your card for that with no additional fee.

Yeah, but I just don't like the five-day delay. I'll have to use that option to avoid the fees. And I have to remember who to make a check out to and what address to send it to.

Picked up the card at your recommendation and got it today. No bonus offer for me, unfortunately.

As other commenters have also noted, I read the fine print and it says that 5 transactions/month are required to get the full points value for rent (otherwise only 250 points are awarded). Still seems worth it, but it would be good if you mentioned that in the post. It really affects the overall value proposition of the card.

I take it back - I did get the bonus 5x points for 5 days offer via text and email after I activated the card. Too bad it came after I plunked down a fair bit of dough on a big dental bill...

@ ezra -- Hah, the timing worked out really well for me, as I got the card just before the tax deadline, and I pay my taxes by credit card.

@Ben,

Was there a cap on the 5x ? The rent day 2x is capped to 10k points for example.

"I’m excited to take this card for a spin, and share my experience."

Come on, dude. I respect your hustle, but it isn't like you to post with such little transparency. You clearly applied at least a week ago (if not more) if your card has already arrived. It's also completely unlike you to not share info on your bonus, or info on paying your HOA, which seems to be your biggest selling point to...

"I’m excited to take this card for a spin, and share my experience."

Come on, dude. I respect your hustle, but it isn't like you to post with such little transparency. You clearly applied at least a week ago (if not more) if your card has already arrived. It's also completely unlike you to not share info on your bonus, or info on paying your HOA, which seems to be your biggest selling point to non-renters.

I understand this is a business and that I don't have to read your articles if I don't want to, but this seems, to quote your ethics policy, very "pay-for-play." Bilt has clearly asked you to put up multiple posts, hence why we're in the dark about the two most pertinent points from this post. As Donald Trump once said to Sasha Baron Cohen, "It sounds like a good idea and I hope you make a lot of money."

@ Jerry -- I'm sorry that this is your perception, but that simply doesn't reflect reality. No one at Bilt has asked me to write anything. I've had affiliate links for the card for a year, and absolutely nothing has changed. I promise you that's the truth, so hopefully you can believe me.

Why did I finally apply for the Bilt Mastercard? Well, because of the comments that readers left on my post last week...

@ Jerry -- I'm sorry that this is your perception, but that simply doesn't reflect reality. No one at Bilt has asked me to write anything. I've had affiliate links for the card for a year, and absolutely nothing has changed. I promise you that's the truth, so hopefully you can believe me.

Why did I finally apply for the Bilt Mastercard? Well, because of the comments that readers left on my post last week when I published a review of the card, referencing the "secret" sign-up bonus, and more. I waited nearly a week to write about applying because I wanted to make sure that my experience matched what readers told me before sharing misinformation.

I think each of those two points is important enough to have a separate post, since there are some important details that need to be covered.

The secret SUB has literally been written about since last October on other blogs! And you posted that HOA was specifically NOT covered in January on your’s & I believed you until I dug deeper. If anything, I feel like you could have cared less about this product & accordingly did little homework on it & really dropped the ball. Expected better, Ben, but hope your experience with Bilt provides as much value as it has for P2 & I.

@Jerry; Unless there are multiple Jerry's, which is totally possible, I thought you said recently that you trust Ben over anyone else. Also is Ben not slightly points/bonus driven and financially savvy? Could he have applied after the Citi denial, as Eskimo surmised? Sure. That's his choice. Otherwise I don't see the issue. He mentioned he was an owner and therefore the card wasn't a fit for him with it being geared towards renters. Then...

@Jerry; Unless there are multiple Jerry's, which is totally possible, I thought you said recently that you trust Ben over anyone else. Also is Ben not slightly points/bonus driven and financially savvy? Could he have applied after the Citi denial, as Eskimo surmised? Sure. That's his choice. Otherwise I don't see the issue. He mentioned he was an owner and therefore the card wasn't a fit for him with it being geared towards renters. Then learned he can pay his home expenses on it, so he changed his mind. Only God knows for sure but I think we can trust him on this one.

@Karen, you're correct, that was me. When it comes to Ben, I trust his reviews more than anyone. I said that and I mean it. Part of why I hold Ben in such a high regard is his ethics policy, and this Bilt series seems to run counter to it. Trusting someone doesn't mean they're infallible, and this Bilt post seems less genuine than what I'm used to seeing from OMAAT. Of course that's my opinion, and I'm probably wrong.

@ Jerry -- I very much appreciate you reading and for trying to hold me accountable. I respect your opinion a lot, because obviously you're not a troll (meanwhile I don't really care what those think who only complain, no matter what).

So I'm sorry if the tone seemed off here, but I can promise from the bottom of my heart that I'm being honest here.

Last week I just decided to update my Bilt...

@ Jerry -- I very much appreciate you reading and for trying to hold me accountable. I respect your opinion a lot, because obviously you're not a troll (meanwhile I don't really care what those think who only complain, no matter what).

So I'm sorry if the tone seemed off here, but I can promise from the bottom of my heart that I'm being honest here.

Last week I just decided to update my Bilt Mastercard review for the first time in nearly a year, as Bilt increased the annual rent limit from $50K to $100K. Then readers pointed out that there was an unofficial sign-up bonus. Then someone messaged me and told me that HOAs can also be paid with Bilt. And I'm sure you can appreciate how I then saw value with the card.

I'm writing a lot about Bilt at the moment because this is the first time I'm really having firsthand experience with the card. I tend to write about the things that interest me most at a given point, and at this moment I'm finding this card interesting.

Like I said, I can promise that nothing has changed regarding my relationship with Bilt, no one asked me to write anything, and this isn't sponsored content. I'm just sharing what interests me.

This was a hidden gem but bloggers getting on it is a guarantee of nerf within 6 months.

Gary has been pushing this way too much. A nerf on a mediocre card at best that will get him to solicit less would benefit his site.

Truth to be told @Amritpal Singh.

They will nerf not because of bloggers, it's because they ran out of VC money.

But if you want Bilt to thrive and keep the benefit, you would need to get even more people to join the Bilt ecosystem, such...

Gary has been pushing this way too much. A nerf on a mediocre card at best that will get him to solicit less would benefit his site.

Truth to be told @Amritpal Singh.

They will nerf not because of bloggers, it's because they ran out of VC money.

But if you want Bilt to thrive and keep the benefit, you would need to get even more people to join the Bilt ecosystem, such as the help of bloggers. Landlords will pay Bilt to find tenants who would pay good rent money, probably at a premium.

You are their product, not the credit card.

Which bureau did it pull from when you applied?

Be aware that their "Travel" category is really narrowly defined so it's mostly useful as a card for dining besides rent.

What things do they not think are travel that are unusual?

"bus lines, passenger railways/trains, taxicabs and limousines, rideshares, ferries, timeshares, travel agencies, online travel sites, real estate agents, vacation rental platforms (e.g. VRBO, Airbnb), campgrounds, boat lease/rental, motor home/recreational vehicle rental, toll bridges and highways, parking lots, and garages are not included."

Most notably, online travel sites and travel agencies, ride share, taxi, tolls. These are all counted as travel by Chase. I've been burned several times and therefore usually only use this card for...

"bus lines, passenger railways/trains, taxicabs and limousines, rideshares, ferries, timeshares, travel agencies, online travel sites, real estate agents, vacation rental platforms (e.g. VRBO, Airbnb), campgrounds, boat lease/rental, motor home/recreational vehicle rental, toll bridges and highways, parking lots, and garages are not included."

Most notably, online travel sites and travel agencies, ride share, taxi, tolls. These are all counted as travel by Chase. I've been burned several times and therefore usually only use this card for dining and rent now.

Looking forward to a follow up post after you pay HOA fees to see if it works!

Doesn't Bilt have a partnership with point.me, which you are affiliated with? Surprised you didn't mention that because its a useful feature.

Would be nice if the Bilt version of point.me wasn't limited to the miles programs that Bilt allows you to transfer to (i.e., if it could search Delta SkyPesos as well).

Hi Ben, What sign up bonus did you receive? I didn't get one and want to know if it's worth it to call them to inquire. Thanks!

I got it on Monday and had following bonus:

As a thank you for being a Bilt Member, we’re excited to offer you 5X points on all of your eligible purchases (excluding rent) for the next 5 days starting Monday, April 17.1

That’s 5X on meals, online purchases, trips, gas, and much more. Up to 50,000 points.

Ah, I received that as well. Glad to know it wasn't like a 25K bonus points I might have missed out on. Thanks.

Great for paying rent and painless points accrual on same.

Chintzy, spending is rounded down for points, so if a purchase ends in .99, you get the lower dollar amount.

Wells Fargo also seems to have problems with identifying spend into the proper categories for bonus spend.Raised this issue previously with no result or resolution.

No fee card, even with drawbacks 8/10...so far.

You’re gonna love Rent Day! Great time to load up on dining gift cards (Starbucks, Sweetgreen, etc.) and use the card for any 2X purchases you’d normally put on the Venture X.

Not to mention, the card also stacks with Simplymiles!

Aside from it being a Wells Fargo card (and there's a lot of recent historical hate with that brand), did you do any digging before signing up? I ask because I was considering this card too until I came upon thread after thread on Reddit where people had their card number stolen and repeatedly used. While credit card theft happens all the time, these users all claim they barely used the card...implying someone inside Wells...

Aside from it being a Wells Fargo card (and there's a lot of recent historical hate with that brand), did you do any digging before signing up? I ask because I was considering this card too until I came upon thread after thread on Reddit where people had their card number stolen and repeatedly used. While credit card theft happens all the time, these users all claim they barely used the card...implying someone inside Wells Fargo was able to get their account details. Pretty scary!

@Sean,

Not accurate at all. It was a BIN attack and the same fraud occurred on citi cards as well.

My brother has the BILT card, and same thing happened to him. I could not find the article, but I read about hackers using the same type of computer programs / processors that crack your password, doing this with credit card numbers. According to the article, the more characters, like a password, the longer to to crack.

This article claims that since the only characters in credit cards is numbers, this makes it a...

My brother has the BILT card, and same thing happened to him. I could not find the article, but I read about hackers using the same type of computer programs / processors that crack your password, doing this with credit card numbers. According to the article, the more characters, like a password, the longer to to crack.

This article claims that since the only characters in credit cards is numbers, this makes it a bit easier. Then, to make it even easier, the hackers look for credit cards with a smaller number of issued cards. The first four to six numbers are constant. They identify if it is a Visa, MC, AE, etc, along with the issuer and the bank. All BILT cards will have the same starting numbers. Then the rest of the numbers identify the account with the last being a "check digit" . Smaller issued cards may have a smaller number of accounts and therefore less characters, reducing the time needed to identify a valid account number.

BILT is a relatively new card with a smaller group of potential users. It may have fewer account numbers because of this, and therefore be a better target for hackers.

Does anyone know if being asked to verify ID and selfie picture a good sign of being approved for bilt mastercard? I would think if they did not want to approve me they wouldn't ask for extra documents

Did you end up getting the card? I just applied for mine and got approved instantly. Not even a pending review or waiting to verify anything. And it's my highest limit credit card too. Just wow. I'm excited to finally earn points on rent.

Wells Fargo, eh? Any chance the credit card-issuing branch of Wells Fargo has more scruples than the rest of the bank?

@don

That's not how hacking works. Maybe in the movies where the hackers are typing frantically and all kinds of nonsense are matrix scrolling on the screen. In the real world I wouldn't care if your log in requires 10 characters or 400. I would just bypass authentication altogether and look for weaknesses in the intermediate layer to spoof you.

I know it says you have to post at least 5 transactions each cycle to keep your points, but I have only ever used it for rent payments (1 payment per cycle), and have all of my points. I even transferred to Flying Blue a few months ago for my first use of these points and there were no issues. Just curious if others have the same experience.

Hmm sorry I don’t buy it… there’s way better cards out there that you most likely have in your wallet already (category bonus wise). Seems very sponsored post

@ Malte -- It's not a sponsored post, though I do have affiliate links for the card (which I've had for around a year, so absolutely nothing has changed on that front). I'm not sure what you don't buy? What I'm sharing is that the reason I finally picked up this card is because I can seemingly pay my HOA with the Bilt Mastercard and earn points. That's worth quite a bit to me.

Are...

@ Malte -- It's not a sponsored post, though I do have affiliate links for the card (which I've had for around a year, so absolutely nothing has changed on that front). I'm not sure what you don't buy? What I'm sharing is that the reason I finally picked up this card is because I can seemingly pay my HOA with the Bilt Mastercard and earn points. That's worth quite a bit to me.

Are you doubting that being able to pay my HOA by credit card is worth something to me, or that it's possible? Not sure I understand your skepticism...

Not for paying rent/mortgage/HOA fees, etc without a surcharge/credit fee, unless you are very, very lucky. I've been using it for over a year (not by choice, my building requires it or wire/ACH, so the card is a no-brainer), and this card is actually pretty great for paying rent.

Sponsored, probably, but what isn't in this space? OMAAT is a business. However, idk if there are better no-fee options out there that earn 3x on dining and can transfer to both Hyatt and AA. If you're over 5/24 it makes sense in my opin. And if you pay rent it's a no brainer even if under ...

If you make a statement like there are way better cards out there but don't specify which cards and why it's better it tells me you have nothing but you sort of maybe misremembered something better in an ad you read. It's like anti vaxxers going around saying there are lots of data out there to not get a vaccine but really they have no clue what's out there and their "data" is their neighbor jim who hasn't bother to work in the last 10 years of his life.

So did you get an "unofficial" sign up bonus? I also applied for the card a couple of months ago and didn't get anything...

@ Clem -- I did indeed! Will share the details in a separate post.

so how do you pay your HOA dues with this card if your HOA doesn’t already take credit cards?

They will mail a check on your behalf.

@ brianna hoffner -- I'll share my experience in a separate post, but it's the same as paying rent with Bilt. When you log into your Bilt account, you'll see a linked bank account which you can use to make your payment electronically. Bilt will see the transaction from that account, post the card to your card, and will then reward you with points. If there's not an option to pay electronically with an account,...

@ brianna hoffner -- I'll share my experience in a separate post, but it's the same as paying rent with Bilt. When you log into your Bilt account, you'll see a linked bank account which you can use to make your payment electronically. Bilt will see the transaction from that account, post the card to your card, and will then reward you with points. If there's not an option to pay electronically with an account, Bilt will send a check on your behalf, and award you with points.

As I understood, even if there is a way to pay by credit card unless the property is a Bilt Partner- they will mail a check. Bilt Partner properties also accept credit cards via different portals such as real page but if you pay this way- you will be assessed a fee. You pay your rent via the Bilt portal regardless of property being a partner or not and even in partner properties- the transaction...

As I understood, even if there is a way to pay by credit card unless the property is a Bilt Partner- they will mail a check. Bilt Partner properties also accept credit cards via different portals such as real page but if you pay this way- you will be assessed a fee. You pay your rent via the Bilt portal regardless of property being a partner or not and even in partner properties- the transaction is completely off the Mastercard interchange.

This has been my biggest turnoff to be honest. It's a glorified online bill pay service similar to ones offered by your deposit banks.

You have to designate one rent payment address in your Bilt account, but it does not need to be a Bilt partner. They give you an ABA routing number and account number to pay any landlord by ACH, but the charge appears on your Bilt statement, without any service fees. Not sure what happens if you use the ACH credentials somewhere else (i.e, a second monthly rental charge or health insurance, etc).

The above explanation is more confusing . For my HOA I can sign up for automatic ACH, by giving them a voided check. Is this what Bilt does? provide a virtual number for ACH autopay enrollment?

Apologies for the confusion. Bilt does not provide a voided check, but they provide an ABA routing number and a virtual checking account number. I use it for rent, so no direct experience as to whether it works for HOA fees (or anything else). The charge then appears on your Bilt card account statement.