Link: Apply now for the United Club℠ Infinite Card

United Airlines and Chase issue several co-branded credit cards, and in this post, I wanted to take a closer look at the United Club℠ Infinite Card, which is the most premium personal card issued with this partnership.

In this post:

United Club Infinite Card Basics For July 2024

The United Club Infinite Card provides lounge access, incredible perks, and a huge welcome bonus. If you’re a United frequent flyer and value lounge access, this is the card for you.

United Club Infinite Card Offers 90,000 Miles

For applications through August 7, 2024, the United Club Infinite Card is offering a limited time welcome bonus of 90,000 MileagePlus bonus miles after spending $5,000 within the first three months. This is a great bonus with a reasonable spending requirement. I value United miles at 1.1 cents, so to me this bonus is worth $990.

Who Is Eligible For The United Club Infinite Card?

The welcome bonus on the United Club Infinite Card isn’t available to those who currently have this exact card, or have received a new cardmember bonus on the card in the past 24 months. However, you are eligible for this card and the bonus if you have (or have had) any other United Airlines credit cards.

There are also general restrictions when applying for Chase cards, including the 5/24 rule (though that’s not consistently enforced anymore).

United Club Infinite Card $525 Annual Fee

The United Club Infinite Card has a $525 annual fee. This annual fee is no doubt on the steep side, though it’s in line with the fees you’ll find on many premium credit cards. The card also offers a variety of perks for frequent flyers that could more than justify the fee.

Earning Miles With The United Club Infinite Card

The United Club Infinite Card offers anywhere from 1-4x MileagePlus miles per dollar spent, as follows:

- 4x MileagePlus miles for United purchases

- 2x MileagePlus miles on all other travel purchases

- 2x MileagePlus miles for dining at restaurants and eligible food delivery services, including Caviar, DoorDash, GrubHub, and Seamless

- 1x MileagePlus miles for all other eligible purchases

For a co-branded airline credit card, those are some solid bonus categories, and in particular, it’s nice to earn bonus miles on dining purchases. The United Club Infinite Card also has no foreign transaction fees, making it a good option for purchases abroad.

United Club Infinite Card Perks

The area where the United Club Infinite Card really shines is when it comes to perks. The value you get from these perks is what should determine if this card makes sense for you or not. Let’s take a closer look at what perks are offered by the card.

Receive A United Club Membership

Arguably the key benefit of the United Club Infinite Card is that it comes with a United Club membership for as long as you have the card. This offers access to United Clubs and participating Star Alliance affiliated lounges.

Getting the United Club Infinite Card is arguably the best way to get United Club access, especially when you consider that outright buying a membership would ordinarily cost $550-650 per year.

Here you save $25-125 compared to that price, and you get all kinds of other perks with the card.

First & Second Checked Bag Free

The United Club Infinite Card primary cardmember and one companion traveling on the same reservation receive a free first and second checked bag. In order to be eligible for this, you have to pay for your ticket with your United Airlines credit card.

This is a value of up to $360 per roundtrip ticket (assuming two people are checking two bags roundtrip – $40 for the first and $50 for the second).

Premier Access Travel Services

Just for having the United Club Infinite Card, the primary cardmember receives Premier Access travel services when flying with United, including the use of Premier Access check-in lines, priority security lanes, priority boarding, and priority baggage handling.

25% Savings On United Inflight Purchases

If you have the United Club Infinite Card you receive 25% back in the form of an account statement credit on purchases of food, beverages, and Wi-Fi, onboard United. You have to pay with your United Club Infinite Card Card, and your statement credit should post within 24 hours.

Receive Elite Upgrades On Award Tickets (Also For Companions)

MileagePlus Premier members receive complimentary upgrades in most domestic markets when booking a revenue ticket. If you have the United Club Infinite Card, you can also receive your Premier upgrades when redeeming miles for tickets.

Best of all, it’s not only the cardmember who is eligible for upgrades, but if you have the United Club Infinite Card, you can also upgrade a companion traveling on the same reservation. While some other United Airlines credit cards offer upgrades on award tickets, the companion upgrade feature is exclusively available on this card.

Save 10% On United Economy Saver Awards

If you have the United Club Infinite Card you can save 10% on economy award tickets when traveling on United. This is valid for saver level awards for travel within the United States, or between the United States and Canada. The discount applies to all passengers on the same reservation as the primary cardmember, and the miles must be redeemed through the primary cardmember’s MileagePlus account.

Earn Up To 10,000 Premier Qualifying Points Per Year

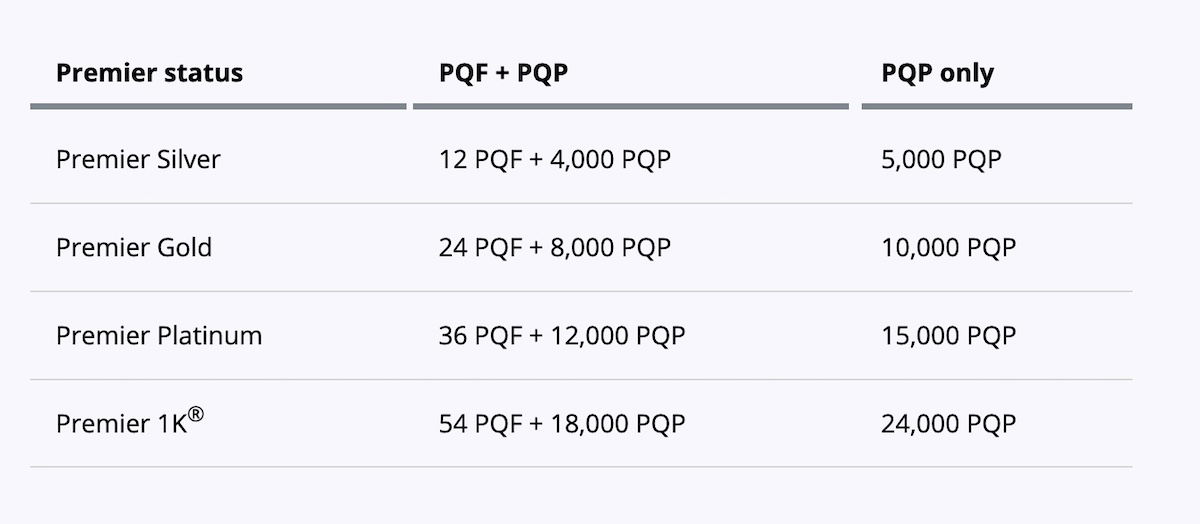

If you want to earn status with United MileagePlus, the United Club Infinite Card can help. The card offers 25 PQPs for every $500 spent on purchases, up to a maximum of 10,000 PQPs per year. For context, below are the United MileagePlus elite requirements for 2024.

Access To More MileagePlus Award Space

If you have the United Club Infinite Card you get access to additional MileagePlus award availability for travel on United. This includes both access to additional saver level award availability, as well as last seat access to United’s standard awards, which are valuable when flights are full.

Receive IHG Platinum Elite Status & $75 Credit

The United Club Infinite Card offers Platinum Elite status in the IHG One Rewards program. This IHG status offers perks like upgrades, bonus points, late check-out, and much more. While it’s not my favorite hotel status, it does come in handy when staying at IHG properties. Cardmembers can register for this perk here by providing the last four digits of their credit card number, plus their MileagePlus number.

On top of that, cardmembers can receive up to $75 in statement credits at IHG properties when charged to the card. This applies for purchases between January 1 and December 31 of a calendar year, and there’s no minimum required to unlock this. In other words, this is the equivalent of $75 worth of “free” spending at IHG properties.

Global Entry, TSA PreCheck, Or NEXUS Credit

The United Club Infinite Card offers a Global Entry, TSA PreCheck, or NEXUS credit every four years. Simply charge the enrollment fee to your card, and it will automatically be reimbursed.

Nowadays quite a few credit cards offer these fee credits, so you can always use this benefit for a friend or family member. They just have to use your credit card to pay, and you’ll automatically receive the statement credit.

Access To The Luxury Hotel & Resort Collection

Having the United Club Infinite Card gets you access to The Luxury Hotel & Resort Collection (LHRC). This offers additional privileges on hotel bookings when using lhrcollection.com.

While this could come in handy, I wouldn’t get too excited about this perk, given that programs like Virtuoso offer similar benefits and don’t require having a specific credit card.

Should You Get The United Club Infinite Card?

The United Club Infinite Card offers some phenomenal perks for travel on United, so if that’s something you care about, this card is worth considering:

- For non-MileagePlus Premier members, having the United Club Infinite Card gets you a first and second checked bag free, Premier Access travel services, United Club access, expanded award availability, inflight savings, discounted economy awards, IHG Rewards Platinum Elite status, a $75 IHG credit, and more

- For MileagePlus Premier members, having the United Club Infinite Card gets you United Club access, upgrades on award tickets (including for companions), expanded award availability, inflight savings, discounted economy awards, IHG Rewards Platinum Elite status, a $75 IHG credit, and more

The math on getting the United Club Infinite Card checks out. Also keep in mind that if you want to downgrade the card to a lower annual fee card in the future, that should be possible once you’ve had the card for at least 12 months. You might as well pick up the card with the best welcome bonus and richest perks, and then you can decide in the future which card makes the most sense for you.

How Does The United Quest Card Compare?

The United Quest℠ Card is another popular United Airlines credit card that I think is seriously worth considering. The card has a $250 annual fee, and the perks more than justify that, in my opinion:

- For applications through August 7, 2024, the card is offering a limited time welcome bonus of 70,000 MileagePlus miles plus 500 PQPs after spending $4,000 within the first three months

- The card offers some unique perks, like a $125 annual United credit, plus up to 10,000 miles reimbursed each year when redeeming miles on United; for many, those two perks alone will more than offset the annual fee

- The card offers all kinds of other valuable perks on United, like a free first and second checked bag, 25% savings on inflight purchases, elite upgrades on award tickets, and more

If you’re worried about the annual fee on the United Club Infinite Card, the United Quest Card is a great alternative, especially given how easy the annual fee is to recoup. That being said, the bonus isn’t as good.

Read a full review of the United Quest Card.

How Does The United Explorer Card Compare?

The United℠ Explorer Card is probably United’s most popular co-branded credit card, given the reasonable annual fee and solid perks. I’d take it further and argue that this is one of the most well-rounded mid-range airline credit cards. The card has a $0 introductory annual fee for the first year, then $95, and offers the following perks:

- For applications through August 7, 2024, the card is offering a limited time welcome bonus of 60,000 MileagePlus miles after spending $3,000 within the first three months

- The card’s perks include two United Club passes annually, a free first checked bag, priority boarding, 25% savings on inflight purchases, elite upgrades on award tickets, and more

The United Explorer Card has the most mass appeal of any United Airlines credit card, as the card offers most of the basic benefits people will value when flying United, has a great bonus, and the annual fee is even waived for the first year.

The deciding factor between the two cards should partly come down to whether you value a United Club membership or not. If it’s something you would otherwise pay for, you should get the United Club Infinite Card. If it’s not something you would pay for, I think the United Explorer Card is the better option.

Read a full review of the United Explorer Card.

Bottom Line

The United Club Infinite Card is United’s most premium personal credit card. While the card has a $525 annual fee, it offers incredible perks, including a United Club membership, a free first and second checked bag, upgrades on award tickets (including for a companion), and much more. If you’ve been considering this card, this would be a great time to apply, given the bonus.

If you want to learn more about the United Club Infinite Card or want to apply, follow this link.

United Explorer also has primary coverage like the Infinite card. So no advantage to Infinite for the same coverage.

I believe the Quest card also has primary rental auto coverage like Infinite card.

Two additional comments:

One advantage of the United Club Infinite Card is that for car rentals (not just Avis) that are charged with this credit card, full PRIMARY coverage is covered for the rental; it isn't secondary like many other credit card car rental insurance coverages are.

On the flip side, don't count on reimbursement for Global Entry fees charged with this particular credit card. I charged my renewal for Global Entry on my United...

Two additional comments:

One advantage of the United Club Infinite Card is that for car rentals (not just Avis) that are charged with this credit card, full PRIMARY coverage is covered for the rental; it isn't secondary like many other credit card car rental insurance coverages are.

On the flip side, don't count on reimbursement for Global Entry fees charged with this particular credit card. I charged my renewal for Global Entry on my United Club Card in 2020 after ascertaining that indeed such my card covered such reimbursement. Within two months of that Global Entry fee being paid for with that card, I didn't get any credit at all. I complained to Chase (who manages the card) which sent me back to United which confirmed that indeed I should have been reimbursed. I sent a formal complaint to Chase and they responded “too f*cking bad, we are not going to reimburse” without any explanation. Subsequent communication with United yielded a virtual shrug of their shoulders – sorry, but we can't control Chase.

If I still have that card next year and I renew my Global Entry, it will be interesting to see Chase pulls that same crapola!

Two other things to mention. You also get Avis Presidents Club membership. And Chase allows you to use the pay yourself back feature to cover the annual fee, usually at a decent redemption rate.

Can my wife use the Red Carpet room when we travel together?

Not unless she has a time machine and can travel back to the days before Continental acquired United and renamed the “Red Carpet” lounges to the “United Clubs.”

But yes, your spouse can use the lounge if accompanying you on a United itinerary.