Link: Apply now for the Chase Sapphire Reserve® Card

The Chase Sapphire Reserve® Card (review) is one of the most popular premium credit cards. The card initially launched in 2016, though it recently underwent a full refresh. With this, we’ve seen the card’s annual fee increase considerably, and we’ve also seen a change to the perks, both for better and worse.

In this post, I want to take an updated look at the overall value proposition of the card. I’m going to tackle the question of whether the Chase Sapphire Reserve is still worth it, both in absolute terms, and relative to other cards, including the Chase Sapphire Preferred.

In this post:

What are the benefits of the Chase Sapphire Reserve?

The Chase Sapphire Reserve has a $795 annual fee, and offers a variety of benefits, including the following:

- A massive welcome bonus of 100,000 Ultimate Rewards points plus a $500 Chase Travel credit after spending $5,000 within the first three months

- An excellent rewards structure, including 8x points on Chase Travel bookings, 4x points on direct airline and hotel bookings, and 3x points on dining

- A Priority Pass membership with unlimited visits and the ability to take two guests, access to Chase Sapphire Lounges, and access to select Air Canada Lounges

- A $300 annual travel credit, which I’d basically consider to be good as cash, as it can be applied toward any purchase coded as travel, with no registration required

- A variety of other credits and benefits, which require jumping through some additional hoops; this includes up to $500 in annual hotel credits with The Edit, up to $300 in annual dining credits, up to $300 in annual DoorDash credits, up to $300 in annual Stubhub and viagogo credits, and an Apple TV+ and Apple Music subscription

- The ability to get more value with your Ultimate Rewards points with the Points Boost feature, offering redemptions of up to 2.0 cents per point toward select airline and hotel purchases; this is in addition to being able to transfer points to airline and hotel partners

- Excellent travel coverage and rental car coverage

What has changed about the Chase Sapphire Reserve?

Given that the Chase Sapphire Reserve has been refreshed, perhaps it’s worth briefly recapping what has changed about the card. The above are the benefits of the card’s updated value proposition, but here’s what has been taken away, or changed for the worse:

- The card’s annual fee has increased from $550 to $795, and the cost to add authorized users has increased from $75 to $195; clearly Chase hopes that all of the credits that have been added will make up for that

- The card no longer offers 3x points on all travel purchases; instead, it offers 4x points on direct airline and hotel bookings

- The card no longer offers 1.5 cents of value per point toward all Chase Travel bookings, and instead, Points Boost allows redemptions of up to 2.0 cents per point, but with more limited options

Note that the new fees and perks apply effective immediately for new cardmembers, and as of October 26, 2025, for existing cardmembers (so you’d only pay the higher annual fee on the next anniversary after October 26).

Is the Chase Sapphire Reserve worth the fee?

It goes without saying that there’s no “one size fits all” answer as to whether or not the Chase Sapphire Reserve is worth the annual fee, though let me try to share my thoughts on how to go about deciding whether it makes sense for you.

With the changes that we’ve seen to this card, I imagine that some people will find this product to be more valuable than before, while others will find it to be less valuable than before. Ultimately I think raising the fee and adding more perks that take effort to maximize probably won’t have as much widespread appeal as the old concept, as the card was great for how simple it was.

On the most basic level, the Chase Sapphire Reserve has a $795 annual fee, and I’d consider the $300 annual travel credit to basically be good as cash, since it will automatically be applied to any purchase coded as travel. I would imagine that virtually every cardmember spends at least $300 per year on travel, and it’s the one perk that everyone should be able to maximize.

With that in mind, I’d consider the card to really cost $495 per year to hold onto, before factoring in all the additional perks. The challenge is, it can be hard to figure out how much you value each of the benefits. Let’s talk about that in terms of return on spending, lounge access, and the credits.

When it comes to return on spending:

- The 8x points on Chase Travel bookings may get more people to book through the portal, though admittedly that comes with some opportunity costs

- The 4x points on direct airfare and hotel bookings is great, and this will no doubt be my go-to card for hotels; it’s a bummer that 3x points was dropped on other travel bookings, as that will disproportionately impact those who book cruises

- The 3x points on dining continues to be a great bonus category that many people value

Then there’s lounge access:

- Admittedly a lot of cards offer a Priority Pass membership, so that’s hardly a differentiator nowadays

- I think the real value comes with Chase Sapphire Lounge access and Air Canada Lounge access, which are unique to this card; the value of that will vary greatly based on your home airport and travel patterns

Then there are the credits beyond the $300 travel credit. Like with so many cards nowadays, there are some hoops to jump through to maximize these credits, so even though they’re potentially worth well over $1,000, I wouldn’t value them nearly that much. For example, based on my own spending patterns and behavior, here’s what I don’t particularly value:

- I don’t place much value on the up to $500 hotel credit, since it’s a semi-annual $250 credit that can be applied toward a minimum of a two night stay at The Edit hotels, which is quite limiting; that’s not to say I won’t use it, but I just don’t factor it into the math on justifying the card

- I don’t really like concerts and events, so the up to $300 Stubhub and viagogo credit isn’t of much value to me

- The up to $300 DoorDash credits are in such small increments (three credits totaling $25 monthly) that I don’t really factor them into the math, even though I try to use them

Meanwhile here’s what I do value:

- While the up to $300 dining credit is fairly limiting, with just hundreds of participating restaurants across the country, the good news is that some restaurants in Miami that I frequent are on the list, so I’ll get full value out of that with just two meals per year

- I currently pay for an Apple Music subscription, so getting that for free will save me money

So between saving $300 on dining and saving well over $100 per year on Apple Music, I’ll come out ahead with these card changes, as that more than offsets the $245 annual fee increase. Even if I had an authorized user on my card (where the annual fee has increased by $120), I’d still come out ahead.

Let me be clear — that’s the math for me, and only for me, based on not actually changing any of my consumer behavior. For other people, the math will work out wildly differently. Some people will be much worse off than before, and some people will be much better off than I am.

What are the best Chase card alternatives to consider?

Let’s say that you’ve historically had the Chase Sapphire Reserve, but are questioning whether it’s still the best option for you. As I said above, some people will be better off after the changes, while others won’t be. What’s the best course of action?

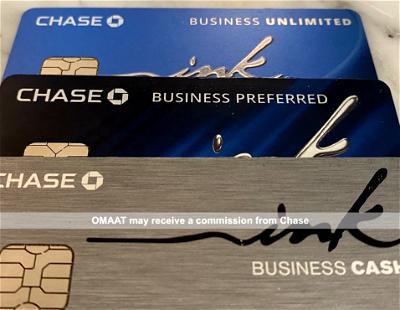

I think there could instead be merit to either downgrading to the Chase Sapphire Preferred® Card (review), or maybe instead focusing on the Ink Business Preferred® Credit Card (review).

On the most basic level, the reason you want to keep one of those cards is that they allow you to unlock the full value of the Ultimate Rewards program. If you have one of those three cards, then you can transfer the points earned on the no annual fee Chase Freedom FlexSM (review), Chase Freedom Unlimited® (review), Ink Business Unlimited® Credit Card (review), and Ink Business Cash® Credit Card (review), to Ultimate Rewards partners.

So let’s talk a bit more about these options.

Downgrade to the Chase Sapphire Preferred

One option is to downgrade the Chase Sapphire Reserve to the $95 annual fee Chase Sapphire Preferred, and this could be compelling. To compare the two cards:

- The Chase Sapphire Preferred also offers 3x points on dining, and even offers 2x points on all travel purchases (so it’s better for non-hotel and non-airfare travel purchases)

- The Chase Sapphire Preferred offers 10% anniversary bonus points, so it’s actually more compelling for dining and everyday spending than the Chase Sapphire Reserve

- The Chase Sapphire Preferred offers a $50 annual hotel credit, which many could get value from

- The Sapphire Preferred also offers great travel protection

- You’d essentially be giving up an incremental Priority Pass membership (not a big deal), access to Chase Sapphire Lounges and Air Canada Lounges (a big deal to some, and not to others), bonus categories like 4x points on direct airfare and hotel bookings, and then the credits that can help offset the annual fee

The question comes down to whether it’s worth paying the higher annual fee (minus the annual travel credit), in order to receive those incremental perks. I shared my math above, so everyone has to do their own number crunching. But there’s no denying that the Chase Sapphire Preferred is a considerably lower cost option for staying in the Ultimate Rewards ecosystem.

Cancel, and focus on the Chase Ink Preferred

The $95 annual fee Ink Business Preferred is a business card with a massive welcome offer, which also awards 3x points on the first $150,000 of combined purchases per cardmember year on travel, shipping, internet, cable, phone services, and advertising purchases made with social media sites and search engines.

This is a phenomenal card, given that it offers the same 3x points on travel, now making it the best Chase card for non-airfare and non-hotel travel purchases (though with a cap). Of course an important distinction is that this is a business card, while the Sapphire Reserve is a personal card, and the spending you put on the cards should reflect that.

If you canceled the Chase Sapphire Reserve and instead picked this up, you’d potentially save quite a bit in annual fees. You’d still be able to transfer points to partners, and for many people, the rewards structure might even be better.

Bottom line

The Chase Sapphire Reserve is a premium rewards card with a high annual fee, and very strong perks. With the card’s recent refresh, we’ve seen the annual fee increase considerably, but we’ve also seen new perks added, which can help offset that annual fee.

There’s no denying that with the recent changes, it’ll probably take more cardmembers some effort to make the math on the card work. Some people will be way worse off than before, while some people will be way better off than before.

While I’m generally not a fan of the “coupon book” model of justifying annual fees, these changes do objectively benefit me. I’m paying $245 more per year, but I’ll get a $300 annual dining credit that I’ll easily be able to maximize, and I’ll also get an Apple TV+ and Apple Music subscription, which I otherwise (at least partly) pay for.

Admittedly not everyone will be in the same position, and that’s totally fair. For those people, perhaps the Chase Sapphire Preferred is worth another look. You’ll pay a lower annual fee, you’ll still earn 3x points on dining, you’ll receive 2x points on all travel purchases, and you’ll even receive a 10% anniversary points bonus, while still having access to the Ultimate Rewards ecosystem.

Or if you can shift to a business card, the Ink Business Preferred is probably the most compelling option in terms of the rewards structure.

How are you feeling about the value proposition of the refreshed Chase Sapphire Reserve? Can you make the math work, or what’s your updated strategy?

Many blogs are promoting the refershed Reserve card, but I don't think it is worth the annual fee, even when you account for the travel credit. Most of the perks have terms that make it annoying or not valuable to redeem like the hotel credit or restaurant credit. $250/6 months and need to stay two nights in their listed luxury hotels. The redemption will be the same as other Chase cards. Furthermore, the amount of...

Many blogs are promoting the refershed Reserve card, but I don't think it is worth the annual fee, even when you account for the travel credit. Most of the perks have terms that make it annoying or not valuable to redeem like the hotel credit or restaurant credit. $250/6 months and need to stay two nights in their listed luxury hotels. The redemption will be the same as other Chase cards. Furthermore, the amount of points you can earn for different purchase categories has reduced or become more restricted too.

The VentureX card has been mentioned as a viable alternative. After reviewing the card benefits it is, as Ben might say, a no-brainer. I went their site and filled out See if I'm Pre-Approved. Much to my surprise (and frankly shock) they responded that they could not pre-approve me and explained that

"Based on your credit report from one or more of the agencies on the back of this letter, there are too many...

The VentureX card has been mentioned as a viable alternative. After reviewing the card benefits it is, as Ben might say, a no-brainer. I went their site and filled out See if I'm Pre-Approved. Much to my surprise (and frankly shock) they responded that they could not pre-approve me and explained that

"Based on your credit report from one or more of the agencies on the back of this letter, there are too many active credit cards based on your loan history"

I do have many cards (but not that many especially considering this audience) but most of my cards have 0 balance and no activity. Per Ben's guidance I'm keeping the no annual fee cards to keep my authorized credit as high as possible.

Have others experienced this rejection and if so how can one deal with it. The VentureX card is very attractive and I'd love to get it.

CapOne is known for its unusual approval criteria. They seem to want people who do not have too many cards and will make CapOne their primary card and / or people with imperfect credit who will run a balance and pay interest charges.

The card now reminds me of the old Entertainment coupon books that were common when I was a kid (no idea if they are still available). You paid a set fee and then got a bunch of coupons which were often 2x1 on entrance fees. Just as with the new CSR you had to calculate if the savings would offset the cost of the book. I do not reside in the US so I am...

The card now reminds me of the old Entertainment coupon books that were common when I was a kid (no idea if they are still available). You paid a set fee and then got a bunch of coupons which were often 2x1 on entrance fees. Just as with the new CSR you had to calculate if the savings would offset the cost of the book. I do not reside in the US so I am finding the CSR coupon book nearly valueless. I will undoubtedly downgrade to the CSP.

Can you recommend another card that offers Priority Pass where the annual fee can more readily be offset for someone who does not reside in the US? I like my lounge access but not for $495 per year.

Added $250 offset for me personally by Peloton and Apple TV+ so a wash. If I can use the dinner credits (decent chance) and Stubhub (maybe), plus a Lyft here or there, pays for itself. Keeping it!

I easily go to over a dozen sporting events a year, so I would have no problem maximizing the $300 StubHub credit, which in addition to the $300 travel credit, would effectively bring my annual fee down to $195.

BUT, and this is a big but, the fine print says the StubHub credit will only apply to StubHub purchases through 12/31/2027. That changes the calculus completely because that credit would only be there for the...

I easily go to over a dozen sporting events a year, so I would have no problem maximizing the $300 StubHub credit, which in addition to the $300 travel credit, would effectively bring my annual fee down to $195.

BUT, and this is a big but, the fine print says the StubHub credit will only apply to StubHub purchases through 12/31/2027. That changes the calculus completely because that credit would only be there for the first two years of the card. It's not an ongoing benefit that I could count on.

No thank you, then.

Lyft is only through 2027 I believe. If your point is that the coupons will be a rotating cast of characters, I think that is a very important consideration when people are considering this card for the long term and not just for a sign-up bonus.

Thorough and thoughtful review.

For me, the challenge is the abandonment of clear/fixed redemption values. This move by Chase is forcing my hand.

It had already been my experience that Chase Travel was priced 15-25% above booking direct (so the points were have been devalued from program initiation). Removing the 1.25/1.5 conversion factors to a floating model will only hide more devaluation, as well as put a higher tax on my personal time to...

Thorough and thoughtful review.

For me, the challenge is the abandonment of clear/fixed redemption values. This move by Chase is forcing my hand.

It had already been my experience that Chase Travel was priced 15-25% above booking direct (so the points were have been devalued from program initiation). Removing the 1.25/1.5 conversion factors to a floating model will only hide more devaluation, as well as put a higher tax on my personal time to use the points. The core value proposition (simple/fair) of the program is gone. Further, when travel plans do get disrupted, it's been my personal experience that Chase travel insurance is ANYTHING but straightforward, and dealing with Chase travel as the middleman for itinerary changes has also been a hot mess.

So, I just got my new Fidelity 2% cash back card, which has no annual fee, no forex fees, and primary car rental insurance.

I'll keep some of my chase cards to keep the 5% cash back on certain categories, but everything else will go to Fidelity, including my Banking relationships.

Bummer. Chase had such a great program in its first iteration, and it was the last program to which I had any loyalty. Free agency all the way now.

It's funny - I just received by Fidelity card today, motivated by similar reasons. The no forex + 2% is underrated, so this is likely going to become my travel card.

I don't see people wanting to hold both the Amex Plat and CSR anymore. It would be too overwhelming to keep track of all the stupid-human-tricks you have to achieve on both cards.

If you're having to do tricks/achievements to justify the card, it's not worth it. Don't overthink it.

The Platinum is an Amex Lounge pass for frequent travelers, and a great 5x airfare earner. That's it. Everything else is just icing on the cake but not *justification of the card*.

Thank you very much for this excellent and fair review!

The biggest problem for me, as you said, is that this has now gone from a KISS (keep it simple stupid) card to one where you need to pay attention. For the first time I created a spreadsheet to see if I will get value out of this card.

The X factor is how much you value the lounge access. If you fly enough and...

Thank you very much for this excellent and fair review!

The biggest problem for me, as you said, is that this has now gone from a KISS (keep it simple stupid) card to one where you need to pay attention. For the first time I created a spreadsheet to see if I will get value out of this card.

The X factor is how much you value the lounge access. If you fly enough and value the lounge access, you're going to keep the card. But if you fly out of LGA TB and JFK T4, the X factor really is the Capital One Venture X, which is now the new travel KISS card with lounges in the exact same NYC locations as the CSR lounges (at least once the LGA landing opens shortly).

And I really have no idea what new value I'll get out of the CSR. I value the Edit at close to $0, I think this is much harder to use than the Amex Plat $200 hotel credit for instance. I'm in NYC and the list of Sapphire Reserve restaurants is - limiting?? Feels like one day 12-18 months from now I'll be paying with the CSR anyway and will feel like I randomly got a $150 credit. Stubhub - maybe, but only because some Broadway shows use Stubhub as a platform. I'll get the value from AppleTV not Apple Music, I guess. Will get the Peloton value (for now). Will get the Lyft value through 2027 (if you take 1 Lyft per month that's $120 that is as good as cash). Doordash - maybe will get $30-40 out of it. Air Canada lounge access? Never used it - maybe I'll think about it a bit more now? Maybe not?

The spreadsheet says I am doing ~$300 worse than I was with the old card. But I'm also factoring in the authorized user cost which skyrocketed from $75 to $195. If you have a partner with an authorized user card, that additional $120 is another big knock against these changes. And I don't love the 3x other travel loss as a person in NYC that actually uses transit.

The biggest problem for Chase is that this really is going to turn people off. Feels like the wrong play from the market leader in banking. And you certainly didn't point out here the $75k spend Southwest "benefits" - nor should you have. They are actually insulting their customer base and negatively impact the premium feeling of this card.

So will I keep the CSR? I'm assuming Chase thinks many people will, begrudgingly, hold on to it. I may fall into that camp. Maybe not. Golden opportunity for Capital One here. A bit of an opportunity for Citi (especially as now fully teamed up with AA). Will be fascinating to see what Amex does with the Platinum.

If the card's value is not apparent, drop it. Don't waste your time. Don't wring your hands. Just make sure you're seeing the card's whole picture. For some, the card's value goes way beyond its statement credits and it's worth it.

Thanks for the high level and well intentioned common sense advice.

Of course, isn’t that exactly the problem Chase is now creating with this card? It’s too complicated unless you are a road (well, sky) warrior.

The value proposition really is the lounge access. Domestic first does not get you lounge access. So you can have an assemblage of other credit cards to get lounge access. There’s a dollar value associated with the food/drink...

Thanks for the high level and well intentioned common sense advice.

Of course, isn’t that exactly the problem Chase is now creating with this card? It’s too complicated unless you are a road (well, sky) warrior.

The value proposition really is the lounge access. Domestic first does not get you lounge access. So you can have an assemblage of other credit cards to get lounge access. There’s a dollar value associated with the food/drink per visit, as well as a less quantifiable “special” factor of being in a lounge away from the masses.

There used to be a more straightforward value proposition of every point being worth 1.5c - but that’s now gone as well (well, not until October 2027 for my bank of UR points). I value Points Boost the way I value the Edit - close to $0.

The points category changes I’m not plussed about - I don’t like them but end of the day will probably end up 5k points down, assuming I don’t shift spend to other cards. Not a big deal. I’m not a person constantly chasing SUB’s either.

The travel protection is basically equivalent between CSP/CSR, no? Any notable differences there?

So other than the lounges - isn’t evaluating the statement credits essential to understanding whether the card’s value goes way beyond the statement credits?

I realize that if you are, say, flying domestically from LGA Terminal B 30x a year, you don’t really care about the statement credits, because the primary value you place on the card is the lounge access. It just becomes a more interesting question and analysis at the margins.

There are some differences in the insurance benefits between the CSR and CSP, you can find more details through a google search.

The biggest ones to me are:

- CSR travel delay insurance kicks in after 6 hours vs 12 hours with CSP

- CSR offers emergency travel medical insurance

- CSS offers emergency travel evacuation insurance

Thanks very much. I mean, they both have a strong set of protections. 6 v 12 hours delay could be meaningful in some situations. I think emergency travel medical / evacuation is much more meaningful, although hopefully very rare situationally. And if you're using UR points with transfer partners for business class tickets to international destinations, don't get that benefit anyway because not using the card for the trip.

Just read the fine print as...

Thanks very much. I mean, they both have a strong set of protections. 6 v 12 hours delay could be meaningful in some situations. I think emergency travel medical / evacuation is much more meaningful, although hopefully very rare situationally. And if you're using UR points with transfer partners for business class tickets to international destinations, don't get that benefit anyway because not using the card for the trip.

Just read the fine print as well and didn't realize that CSR is not primary rental car coverage for NY residents - not sure I've seen that flagged anywhere else! That's a major negative for, well, NY residents.

Specific limitations apply to New York residents: Auto Rental Coverage – inside the United States coverage is secondary to your personal automobile insurance. Lost Luggage Reimbursement – additionally limited to $2,000 per bag and $10,000 for all covered travelers per trip.

Anyway, interesting to dive further into it, but I'm not sure someone is choosing one of these cards over another because of these insurance differences.

well that IS why I cancelled my CSR in April (and was able to get the CSP SUB in May). I think Chase is based in NY, it makes no sense that NY residents lose primary rental car coverage.

Hey Ben. This statement is false: "I think the real value comes with Chase Sapphire Lounge access and Air Canada Lounge access, which are unique to this card." In fact, the Ritz Carlton Credit Card from Chase has provided access to Chase Sapphire lounges from the very beginning, and until recently, Ritz cardholders even had access priority over CSR cardholders. Furthermore, Priority Pass memberships from any credit card still provide one free visit to a...

Hey Ben. This statement is false: "I think the real value comes with Chase Sapphire Lounge access and Air Canada Lounge access, which are unique to this card." In fact, the Ritz Carlton Credit Card from Chase has provided access to Chase Sapphire lounges from the very beginning, and until recently, Ritz cardholders even had access priority over CSR cardholders. Furthermore, Priority Pass memberships from any credit card still provide one free visit to a Chase Sapphire lounge per year, although you're at the back of the line for priority access so you might not actually get in.

I think the uniqueness relates to "and Air Canada." Maybe I'm wrong but I'm not aware of another US-issued credit card that affords Air Canada lounge access.

He used the word "are" afterwards, which is plural and thus suggests he was referring to both Chase and Air Canada lounges.

For me, the loss of the travel category is big. I will need to reevaluate.

I already get 5x for flights on Amex Plat, 4x for dining and supermarkets on Amex Gold, and lounge access to Chase lounges via Priority Pass. Chain hotels are covered thru Marriott, Hyatt and IHG cards.

I'm tempted to check out Capital One offerings.

It's an individual thing. Try the Amex Green for all other travel. Good luck.

Why would you recommend a card (Ink Business Preferred) that is no longer available?

The Ink Business Preferred IS still available.

The Ink Business Preferred is available, it just appears that Ben's embedded link may be broken. Try googling for it.

For Globalist Hyatt spending, which card do you recommend? I see a few options:

1) Book direct with Hyatt using the WoH card, get 5+4=9x WoH points.

2) Book direct with Hyatt using CSR, get 5x WoH points, 4x UR points. Forgo opportunity for free night(s)/EQNs via WoH card.

3) Book via Chase travel portal. Forgo opportunity for free night(s)/EQNs via WoH card.

3a) Hyatt status is not recognized. Receive 8x...

For Globalist Hyatt spending, which card do you recommend? I see a few options:

1) Book direct with Hyatt using the WoH card, get 5+4=9x WoH points.

2) Book direct with Hyatt using CSR, get 5x WoH points, 4x UR points. Forgo opportunity for free night(s)/EQNs via WoH card.

3) Book via Chase travel portal. Forgo opportunity for free night(s)/EQNs via WoH card.

3a) Hyatt status is not recognized. Receive 8x UR points, no Hyatt EQN.

3b) Hyatt status is recognized. Receive 5x WoH points, 8x UR, and Hyatt EQN.

If either 3a/b is in The Edit, potentially receive the $250 credit.

The extra 4x points in 3b probably pushes the decision to CSR, and 3a is useless without elite recognition, but how would you assess the tradeoffs for cases 1 and 2?

@ DBB -- Hah, I like this analysis you're doing. If The Edit is out of the equation, the decision would be between options one and two. I value four Chase points more than four World of Hyatt points, though I'd probably go with the World of Hyatt Card to earn the EQNs, unless I was absolutely sure I didn't need them (but honestly, it's hard to know whether I'll need it or not, especially with rewards for every 10 elite nights).

Thanks Ben!

So if I downgrade my reserve, what happens to my balance of ultimate rewards? Does that go away or is it transferrable?

@ Steve -- They would stay in your account if you simply product change.

Wait sorry if I'm missing something but I'm confused by your math on your own "worth it or not":

$300 Travel + $300 Dining + $100 Apple Music (the rest you said you don't factor into your math, although you may or may not use them) = $700, which is less than the total Annual Fee of $795, but then you proceed to say you'll come out ahead. Are you factoring in the point bonus categories somehow that I missed?

@ Super -- Sorry, the "worth it" part was regarding the before and after math, accounting for the annual fee change. My point was to say that the $245 annual fee increase is offset by the new perks, for my specific situation.

Yes, for me, the card isn't directly break even purely based on the perks. It's worthwhile to me after factoring in the bonus categories, the lounge access, and the travel protection.

Got it, thank you! I'm still debating if it's worth picking up for me, so appreciate your clarification.

Nope, for most people. There, that's not hard at all.

The loss of CSR's travel category can't be understated for me and many others I know. No more extra points on Airbnb, Amtrak, Uber, public transit, and third party booking platforms like HotelTonight. The remaining bonus categories aren't bad but they aren't distinct. I'm getting tired of "premium" cards that don't reward my actual spending.

It's an individual thing. Try the Amex Green for all other travel. Good luck.

I currently have the Reserve Card but in the past few years have not traveled a lot. In addition my big travel expense this year was a 5-figure expedition to Antarctica so the elimination of 3 points for all travel is a big loss for me.

The other big loss is access to lounges though Priority Pass -- although getting into many PP lounges has become problematic because of crowding. If I downgrade to...

I currently have the Reserve Card but in the past few years have not traveled a lot. In addition my big travel expense this year was a 5-figure expedition to Antarctica so the elimination of 3 points for all travel is a big loss for me.

The other big loss is access to lounges though Priority Pass -- although getting into many PP lounges has become problematic because of crowding. If I downgrade to a Preferred card, I can save $700 a year, and use some of that savings to purchase a PP membership directly. A standard membership costs only $75/year and you pay $35/visit. For an infrequent traveler like me, this seems to be a cost effective way of getting PP lounge access. Has anyone had any issues with direct PP membership?

I just realized the effective savings between the Reserve and Preferred cards is only $400 after the travel credit. But I think the math still works out for an infrequent traveler who wants occasional PP access. Have I missed anything else?

A lot, actually :)

For starters, there are other cards that give you PP for $0.

Example - Venture X - $300 credit + 10k anniversary bonus points cover for the $395 AF and PP is there for you free.

@VB: Thanks for the heads-up about Venture-X. I am checking it out at the moment. Does anyone know whether the Venture PP card allows you to being a guest for free or is there a charge?

Thanks

@GBOAC

I was about to get the Venture X to be my primary lounge access card and to check out the Jose Andres Capitol One restaurant at DCA; however, a major change is afoot. It would be nice if they would continue allowing one guest. See below

Starting February 1, 2026, Capital One Venture X cardholders will no longer receive complimentary guest access to Capital One Lounges and Landings. Guests will need to pay $45...

@GBOAC

I was about to get the Venture X to be my primary lounge access card and to check out the Jose Andres Capitol One restaurant at DCA; however, a major change is afoot. It would be nice if they would continue allowing one guest. See below

Starting February 1, 2026, Capital One Venture X cardholders will no longer receive complimentary guest access to Capital One Lounges and Landings. Guests will need to pay $45 per visit, with a discounted rate of $25 for those 17 and under. Children under 2 will remain free. To regain complimentary guest access, cardholders need to spend $75,000 on their card in a calendar year, which allows for two complimentary guests at Capital One Lounges and one at Landings.

Also, while primary cardholders will still be able to access Priority Pass lounges, complimentary guest access will be eliminated. Instead, guests will be charged a per-visit fee of $35, according to Upgraded Points. Authorized users will also lose complimentary lounge access unless they pay an additional $125 annual fee for each authorized user.

@Rico:

Thanks for the update Priority Pass guest access. My husband and i have travel planned this fall through IAD so we should be able to enjoy the C1 lounge there.

@VB: Thanks for the heads-up about Venture-X. I am checking it out at the moment. Does anyone know whether the Venture PP card allows you to being a guest for free or is there a charge?

Thanks

I wish the edit was more robust. Spent some time comparing to FHR last week and it truly pales in comparison both to quantity and variety of properties

Couldn't you book a cruise through Chase Travel and get 8x?

Like you, I don't calculate The Edit or Door Dash. I may use these but it's not automatic. There are many great restaurants in San Diego and I use the Apple services. I've never used Stub Hub but I do go to concerts and sporting events so this could be a win but stub hub is usually more expensive than buying tickets directly.

...Couldn't you book a cruise through Chase Travel and get 8x?

Like you, I don't calculate The Edit or Door Dash. I may use these but it's not automatic. There are many great restaurants in San Diego and I use the Apple services. I've never used Stub Hub but I do go to concerts and sporting events so this could be a win but stub hub is usually more expensive than buying tickets directly.

I currently have the Ink Preferred so can easily cancel the Reserve next year if I find the benefits aren't worth the fee.

@ Buzz -- You can book some cruises through Chase, though you might be limited in terms of the cruise lines you can book, and you might get a better overall value elsewhere, so it all depends.

We've always booked our cruises through agencies that specialize in cruises and who have been able to find us great offers and upgrades. In addition, many cruise lines offer a discount for shareholders. It's unlikely I would ever think of going through Chase Travel for cruises. Am I possibly missing out on deals -- I don't know???

Cruises booked through Chase Travel earn 8x. Pricing will vary as with everything else.

If one were to downgrade or cancel the Reserve, is there any strategy to ensure the UR points sitting in the Reserve account don't get wiped out?

@ Oscar Buzz -- If you downgrade to another card earning full Ultimate Rewards points (like the Sapphire Preferred), it should be automatic, and there should be no issues. Alternatively, if you have another Chase card, you can always temporarily move them there, and then move them back to your new card.

With all of the high fee cards, basically you need to decide if you are a person who

1) Already interacts with the brands/services being subsidized, or are willing to move a lot of your purchasing to the service (such as the travel portal)

2) Can regularly use the status/lounge/other benefits that come with the card without any kind of monetary outlay

For Sapphire, if you regularly visit Chase lounges, use Apple Music,...

With all of the high fee cards, basically you need to decide if you are a person who

1) Already interacts with the brands/services being subsidized, or are willing to move a lot of your purchasing to the service (such as the travel portal)

2) Can regularly use the status/lounge/other benefits that come with the card without any kind of monetary outlay

For Sapphire, if you regularly visit Chase lounges, use Apple Music, Lyft, and are willing to book a lot of Chase travel portal and use the card on hotels and dining, it is still a super valuable card. If not, downgrade or switch. For me, it is marginal at best.

Amex Platinum is the same way. I regularly use Delta and Amex Lounges, regularly use Uber, Equinox, Saks, and the various other portals, and get some value out of the status. So it is a no brainer. For others, it will be marginal.

What no longer makes sense is having a bunch of these cards as you have to remember too much, make sure you are purchasing with several brands/services, etc.