There’s a lot to love about the Chase Sapphire Preferred® Card (review), including a great return on spending. One of the awesome perks of the Chase Sapphire Preferred is a $50 annual Chase Travel℠ hotel credit, so in this post, I want to take a closer look at how that works.

This might be especially interesting to people at the moment, in light of the increased bonus available on the card, as lots of people should be eligible for the card.

In this post:

What is the Sapphire Preferred $50 hotel credit?

The Chase Sapphire Preferred offers a $50 annual Chase Travel℠ hotel credit. The concept is that those with the card receive a $50 credit toward a hotel stay annually that’s booked through the Chase Travel℠ portal.

While this is quite straightforward, naturally there are some terms to be aware of:

- A statement credit will automatically be applied to your account when your card is used for hotel accommodation purchases made through the Chase Travel℠ website

- The statement credit will be issued up to an annual maximum of $50, with no minimum spending required

- There’s no registration required, but rather statement credits will post to your account within two days after your purchase posts to your account

- For the purposes of this credit, “annual” is defined as the year beginning with your account open date through the first statement date after your account anniversary, and the 12 monthly billing cycles after that each year

How do you redeem the Sapphire Preferred $50 hotel credit?

To redeem your Chase Sapphire Preferred $50 hotel credit, just go to the Chase Travel℠ portal. Once you’re logged in, go to the “Travel” section. Then you’ll see the travel search tool, where you’ll want to select the “Hotels” tab.

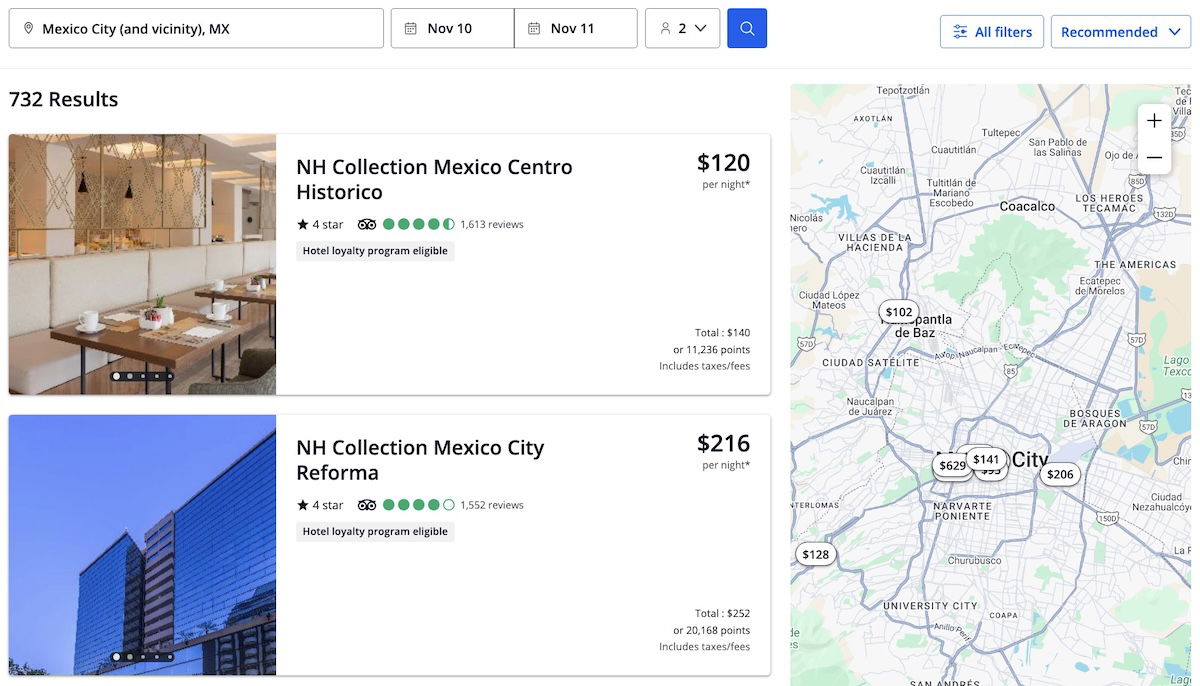

Enter where and when you’d like to stay, and then on the results page, you can filter by price, location, hotel name, star rating, etc.

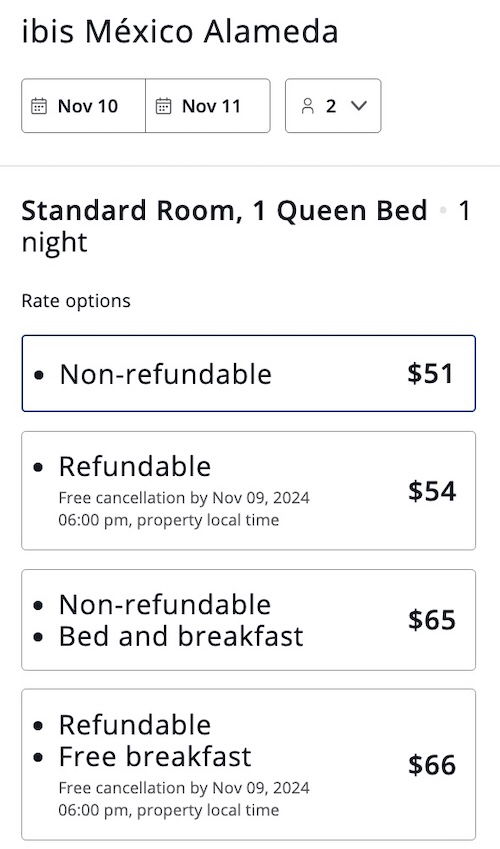

Once you select a hotel, just go through the booking process. Make sure you choose to pay with cash rather than points, or else you won’t receive the statement credit.

There’s nothing further required to unlock the statement credit — just make sure you charge the purchase to your Chase Sapphire Preferred, and you’ll automatically receive a credit, up to the $50 limit.

Is it worth using the Sapphire Preferred $50 hotel credit?

The upside of using the Chase Sapphire Preferred annual hotel credit is obvious — you can save up to $50 on a hotel stay. So why wouldn’t you want to book through the Chase Travel℠ portal? There are a couple of main downsides:

- Since the Chase Travel℠ portal is an online travel agency, this is considered a third party booking, so you generally won’t earn points or receive elite benefits if you’re staying at a major chain hotel

- While the Chase Travel℠ portal has competitive pricing, in some cases you’ll get better rates when booking directly with a hotel; some hotels have discounts for loyalty program members, AAA members, seniors, etc.

Personally, my strategy for using the Sapphire Preferred hotel credit would be as follows:

- Try to use it for a stay at an independent hotel, where you’re not forgoing points or elite benefits

- Try to use it for a stay that costs as close to $50 as possible, so the opportunity cost is the lowest compared to the rates you may find elsewhere

- In some cases it could still be worth using the credit at a chain hotel; for example, if you have a one night stay at a Hyatt Place that costs $80, it could be worth forgoing elite perks in order to knock $50 off the price

I absolutely think there’s value in this credit, though I also think it’s important to be strategic about how you use it.

Bottom line

The Chase Sapphire Preferred has lots of amazing benefits, and the $50 annual credit is one of them. The card offers a $50 annual hotel statement credit that can be used through the Chase Travel℠ portal. This is a fairly new benefit, so I know there has been some confusion about how it works. Hopefully the above clarifies any questions there may have been.

I’d recommend using the hotel credit strategically, and if used correctly, this should recoup more than half of the annual fee on the card.

What do you make of the Chase Sapphire Preferred hotel credit, and if you’re a cardmember, how do you plan on using it?

My problem is I never know my anniversary date and Chase really doesn’t make it easy to find this. I seriously spent about 20 minutes looking for it on both their app and website without success. So I never know when my credit is going to expire. They should make this easier.

Look through your past statements to see when they last charged you a membership fee. That should be your anniversary date.

I used the credit recently for a 1 night stay at the Radisson at Heathrow. I’m not in the Radisson loyalty program so didn’t care about losing those benefits. Cost including taxes & fees was USD 92, so it only cost $42 after deducting the credit. Credit was automatically and immediately applied to my account without any hassles. So I was very satisfied with how this worked out.

My card annual date is around May 1 so the $50 credit will reset at that date. However, whenever I search hotels within Chase travel whether the rate is refundable or non-refundable your card is charged the date of booking. If you decide to cancel a refundable rate, the charges will be refunded. The issue is I have a stay coming up in May I plan to use but I cannot book anything until after...

My card annual date is around May 1 so the $50 credit will reset at that date. However, whenever I search hotels within Chase travel whether the rate is refundable or non-refundable your card is charged the date of booking. If you decide to cancel a refundable rate, the charges will be refunded. The issue is I have a stay coming up in May I plan to use but I cannot book anything until after May 1 which results in last minute booking where rates skyrocket or no vacancy.

Thanks for posting this. I'm fairly adept at tracking the benefits of my cards, but I completely missed this one! Spreadsheet updated!

You can book a refundable hotel and cancel it after you receive the credit. While Chase has every right to claw it back, historically they haven’t done so. That makes the Sapphire Preferred a $45 card before even factoring in DashPass and the $10/month credit with New Verticals retailers on DoorDash.

Basically if that card were a law firm it would be as baller as Davis Polk & Wardwell