All of the major credit card issuers have different rules when it comes to applying for their cards. Furthermore, these rules are constantly changing, as banks try to optimize their strategy as to what kind of card members they’re looking for.

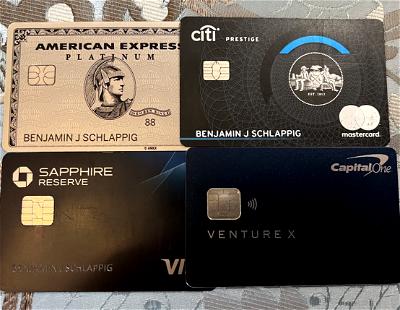

With issuers coming up with more and more rules nowadays for being approved for cards, I wanted to provide an updated rundown of the rules from each of the major card issuers. In this post, I’ll discuss the basics you should be aware of if you want to be approved for a card by American Express, Chase, Citi, Capital One, Bank of America, and Barclays.

In this post:

Keep an excellent credit score & use cards responsibly

Before I get too deep into the rules, there are a couple of things I want to mention upfront.

First of all, this is intended for people with excellent credit. Credit cards can be extremely rewarding, and applying for lots of credit cards can even help your credit. Make sure you do what you can to keep your credit score high, which shouldn’t be too tough when keeping to best practices.

Second of all, you should only sign up for credit cards if you can use them responsibly. This means paying off your balance in full every billing cycle, and not increasing your spending hugely just because you’re not paying cash. Having the right credit cards can help you maximize rewards greatly, though the value of those rewards will quickly be offset if you’re paying 20%+ interest financing charges. So don’t do that.

Lastly, these rules are constantly changing, and I’m also generalizing here, so make sure you always study the terms on the application page of the card you’re considering getting.

With that out of the way, let’s get into it.

American Express application rules

In my experience, American Express cards are among the easiest to be approved for assuming you have good credit. There are also lots of lucrative cards earning Amex Membership Rewards points, which is the icing on the cake.

If you’re new to credit cards, I always recommend starting with Amex, because it’s the issuer that’s often the most generous when it comes to instant approvals, and having these cards can help you further build your credit history over time. In some ways Amex has strict rules for getting approved, while in other cases it doesn’t, so below are the rules to be aware of.

Once in a lifetime rule

The welcome offers on virtually all American Express cards are “once in a lifetime.” That means you can get the bonus on just about every card once, but you can’t get it again in the future. Even if you close a card, you won’t be eligible for the bonus on that card again in the future.

Note that this rule is based on whether you’ve had a card before, and not whether you’ve received a bonus on it. So if you had a card in the past but didn’t receive a bonus, you still wouldn’t be eligible for the bonus.

The good news is that the definition of “lifetime” might not be quite as strict as it sounds. Many report that seven years after canceling a card you’re eligible again, though that’s anecdotal rather than a published rule. Furthermore, sometimes there are targeted offers that don’t include this “once in a lifetime” restrictions.

Five credit card limit

American Express limits people to having five Amex credit cards at any given time. Note that this card limit don’t include cards without a fixed spending limit (often considered to be “hybrid” cards), like the following:

- The Platinum Card® from American Express (review)

- The Business Platinum Card® from American Express (review)

- The American Express® Gold Card (review)

- The American Express® Business Gold Card (review)

Two credit cards every 90 days

You won’t be approved for more than two Amex credit cards in a 90 day period. This limit excludes cards without a fixed spending limit, which are counted separately.

As far as two cards within 90 days goes, it’s generally okay to apply for two credit cards the same day — just expect that one application may be delayed a few days before it’s approved, and that’s fine.

Eligibility check

Amex denies bonuses to certain people based on their history with Amex, beyond the above rules. If this applies to you, you may receive a pop-up during the application process that reads as follows:

Based on your history with American Express welcome offers, introductory APR offers, or the number of cards you have opened and closed, you are not eligible to receive this welcome offer.

We have not yet performed a credit check. Would you still like to proceed?

Capital One application rules

Nowadays there are some phenomenal Capital One cards for earning travel rewards. There are several cards earning Capital One miles, probably the most popular of which is the Capital One Venture X Rewards Credit Card (review) (Rates & Fees). That’s a card that a lot of people are applying for nowadays, so we have a lot of data points about Capital One’s application restrictions.

Let’s look at what you need to know about applications with Capital One.

The 48 month rule

Capital One recently clarified the rules regarding eligibility for the bonuses on personal cards. Personal Capital One cards now have a 48 month rule, whereby existing or previous cardmembers of a particular card aren’t eligible for a product if they have received a new cardmember bonus for that exact product in the past 48 months.

Note that this only applies to that exact card, so you’re still eligible for the bonuses on different cards. This rule also isn’t published for business cards.

Inconsistent rules

Beyond the 48 month rule, there aren’t any consistent application rules I’ve been able to figure out with Capital One. Now, there are some rumored policies, but I have enough data points that counter these alleged rules that make me feel like they’re not cut-and-dry. Specifically:

- There’s a rumor that Capital One will approve you for at most one card every six months, and that includes personal and business cards; however, I’ve received many data points of people getting multiple cards within that period

- There’s a rumor that Capital One will only let you have two personal credit cards at a time, excluding co-brand cards; however, there are several data points of people having more than two personal Capital One cards

So it’s worth being aware of the belief among some that these restrictions exist, but at a minimum it doesn’t seem like they’re consistently enforced.

Pull from all three credit bureaus

To me this isn’t a big issue and also doesn’t necessarily impact your odds of approval, but Capital One does generally pull credit from all three credit bureaus when you apply for a card. If your credit score is good, this shouldn’t really matter, though I know this is something that some people are concerned about.

Chase application rules

Chase largely has the most lucrative rewards credit cards, though Chase cards are also often the toughest to be approved for. If you want to be approved for a Chase card, there are a few restrictions to be aware of.

The 5/24 rule

Chase has what’s known as the 5/24 rule, where you typically won’t be approved for a Chase card if you’ve opened five or more new card accounts in the past 24 months. This applies to all Chase cards nowadays, including co-brand cards. Do note that most business card applications won’t count toward that limit, though.

Two cards every 30 days

Chase will typically approve you for at most two personal cards in a 30 day period, and at most one business card in a 30 day period. As I said above, Chase is in many ways one of the toughest issuers, so don’t necessarily expect you’ll be approved for two cards in 30 days, though you might be.

No limit on how many cards you can have

Chase doesn’t seem to have a strict limit on how many total cards you can have from the issuer. Rather Chase’s restriction seems to be based on how much total credit the issuer is willing to extend you. Often Chase will let you switch around credit lines on cards to be able to open a new card, in a situation where the company has extended you the maximum amount of credit.

The 24 & 48 month rule

Chase welcome bonuses mostly aren’t once in a lifetime, but rather are based on a 24 or 48 month cycle.

The most common rule on cards is that you’re not eligible for the welcome bonus on a card if you currently have that card, or if you’re a previous cardmember who received a bonus on the card in the past 24 months. For example, this is the rule on the Chase Freedom FlexSM (review) and Chase Freedom Unlimited® (review).

For some cards, this limit is 48 months, though. For example, on the Chase Sapphire Preferred® Card (review) the same rules apply, except it’s based on having received a bonus on the card in the past 48 months.

Family card rules

For most Chase cards, eligibility for a welcome bonus is based on whether you’ve had that specific card before. However, for applications of Sapphire, Marriott, and Southwest cards, further “family” rules may apply.

For example, with the Chase Sapphire Preferred® Card and Chase Sapphire Reserve® (review) you’re not eligible for the bonus if you currently have either of the Sapphire cards or if you’ve received the new cardmember bonus on either of the Sapphire cards in the past 48 months.

Similarly, there are three personal Southwest Airlines credit cards, though you’re only eligible for the bonus on a particular card if you don’t currently have any card in that “family,” or haven’t received a new cardmember bonus on any card in the family in the past 24 months. In other words, you’re not eligible for the bonus on the Southwest Rapid Rewards® Plus Credit Card (review) if you have the Southwest Rapid Rewards® Priority Card (review).

Citi application rules

Citi is somewhere between American Express and Chase when it comes to how difficult it is to be approved for cards. I think the best way to describe Citi is that the issuer can be quirky when it comes to approvals. There are lots of great Citi cards, including cards earning Citi ThankYou points. Let’s take a look at the Citi application rules you should be aware of.

One card every eight days, two cards every 65 days

Citi will approve you for at most one card every eight days, and at most two cards every 65 days. This is a rolling limit.

The 48 month rule

Much like with Chase, welcome bonuses aren’t once in a lifetime, but rather there’s a required waiting period. With Citi’s 48 month rule, you’re typically not eligible for the bonus on a particular card if you’ve closed that card or have received a new cardmember bonus on the card in the past 48 months.

This doesn’t apply to all cards, but you’ll see it in the terms of many Citi card applications, like the Citi® / AAdvantage® Executive World Elite Mastercard® (review). This policy typically applies to that exact card, and not any other card in that same “family,” which is good.

Family card rules

Some Citi cards, including the Citi Premier® Card (review), Citi Prestige® Card, and Citi Rewards+® Card (review), have family card rules. In other words, for those three cards:

- You’re not eligible for the welcome bonus on any of those cards if you’ve received a new cardmember bonus on any of them in the past 24 months

- You’re not eligible for the welcome bonus on any of those cards if you’ve closed any of them in the past 24 months

Bank Of America application rules

Bank of America has several credit cards that are interesting to those looking to maximize rewards, including the Alaska Airlines Visa Signature® credit card (review) and Alaska Airlines Visa® Business card (review). Below are the Bank of America application rules to be aware of.

2/3/4 rule

With the 2/3/4 rule, you can typically only be approved for at most two Bank of America credit cards in a rolling two month period, three credit cards in a rolling 12 month period, and four credit cards in a rolling 24 month period.

3/12 rule

Anecdotally you generally won’t be approved for Bank of America cards (business or personal) if you’ve opened three or more new credit cards with all issuers in the past 12 months (much like with the Chase 5/24 rule, most business cards don’t seem to count toward that limit).

The exception is if you have a deposit account with Bank of America, in which case the rule seems to instead be that you can’t be approved if you’ve opened seven or more cards in that period.

Note that this doesn’t seem to be enforced 100% of the time, and there seems to be some flexibility. However, we are now frequently seeing people denied for cards with as few as three inquiries in the past 24 months.

24 month rule

Many Bank of America credit cards have a 24 month rule, where you can’t get a card if you’ve had that card in the past 24 months. Anecdotally that doesn’t apply to many business cards, including the Alaska Business Visa.

Barclays

Barclays has a limited number of co-branded travel credit cards, including some American Airlines and JetBlue Airways cards. Unlike other issuers, Barclays has very few consistent restrictions on approvals.

Inconsistent rules

There are some general Barclays guidelines worth being aware of, though the catch is that they’re pretty inconsistently applied. If you’re considering a Barclays card:

- Barclays sometimes applies a 6/24 rule, whereby the issuer won’t approve you for a card if you’ve opened six or more new cards in the past 24 months (this is similar to Chase’s 5/24 rule)

- If you’re instantly approved for multiple Barclays cards in a day (which can be tough), the hard inquiries may be consolidated into one

- Generally speaking, you’re eligible for the bonus on a Barclays card if you’ve closed the same card at least six months ago, though there’s a lot of inconsistency there

- Barclays may consider your spending on other Barclays cards in deciding whether to approve you for a new one; in other words, if Barclays doesn’t see that you’re spending on your existing card, the issuer may not approve you for another card

Bottom line

As you can see, there’s a huge variance in terms of the rules for getting approved for credit cards with the major card issuers. In all cases, you’ll want to consult the terms listed on the credit card application for the card you’re considering.

Credit card issuers often update their policies as well, and while I’ll try to keep this updated, stuff often changes without us even knowing. If you have any experiences to share with credit card approvals please do, as it’s possible I missed something, and data points are always helpful.

What has your experience been with credit card approvals?

Has anyone had two Lufthansa cards at the same time?

Proud to say I’ve gone 3 months without an application. Stay Strong.

Yeah yeah yeah. Just trying to get under 5/24 ;-)

"With Citi’s 48 month rule, you’re typically not eligible for the bonus on a particular card if you’ve closed that card or have received a new cardmember bonus on the card in the past 48 months."

This is no longer accurate. No penalty against closing a card (at least for the Premier and AA cards, I assume others as well).

I would suggest American Express is not the easiest or whatever from the past. For the past few months and more recently with the Platinum card changes, YMMV greatly with Amex. Pop-ups seem very prevalent. IMO the days of great SUBs, referrals, offers, etc. have seen the day. For me, it's been a great ride, but I'm preparing for the day I cash out and/or narrow down to no fee card(s). Is what it is.

I believe that Citi no longer has the closing of a card reset the timer.