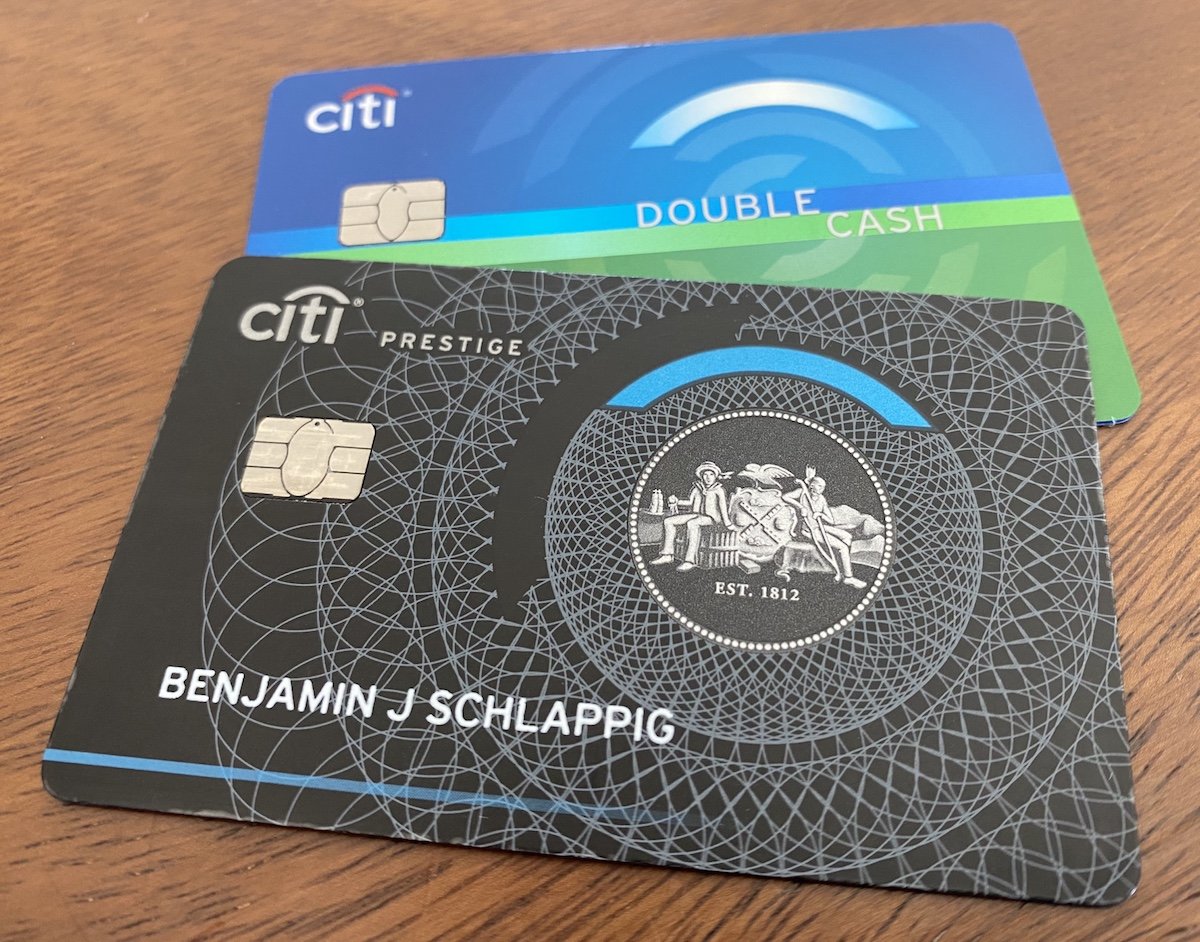

In this post I wanted to talk a bit about the Citi Prestige Card, which is no longer open to new applicants. Despite that, it’s a product that continues to be in my wallet, and I figure it’s at least worth providing some context on why.

In this post:

There’s no way to get the Citi Prestige Card anymore

Let me start with the bad news. Since 2021, the Citi Prestige Card is no longer open to new applicants. Not only can’t you apply for the card directly, but you also can’t product change another card to this. So if you don’t have the card now, you can’t get it (if you already have the card, this might be a reason to think twice about canceling it).

I’m not exactly sure about why Citi discontinued the product. There had been rumors of Citi possibly launching a new premium credit card, so I’m not sure if that was the plan, and then Citi just backtracked, or what.

Regardless, hopefully Citi once again launches a premium card at some point in the future, to compete with products like The Platinum Card® from American Express (review), Chase Sapphire Reserve® Card (review), Capital One Venture X Rewards Credit Card (review), etc.

Basics of the Citi Prestige Card

Now let me cover some of the details of the Citi Prestige Card, including the annual fee, rewards structure, benefits, and more. This card definitely isn’t as lucrative as it used to be, but there’s still value to it, in my opinion.

Citi Prestige Card $495 annual fee

The Citi Prestige Card has a $495 annual fee, and there’s a cost of $75 to add each authorized user. There’s value to adding authorized users, so I’ll talk a bit more about that below. But this fee is roughly in the middle of the pack as far as ultra-premium cards go.

Citi Prestige Card rewards structure

The Citi Prestige Card earns Citi ThankYou points, which is one of the major transferable points currencies. ThankYou points earned on the card can be transfered to airline and hotel partners, which I consider to be the best use of these rewards, given the potential for outsized value.

The card has the following rewards structure, all with no foreign transaction fees

- Earn 5x points on restaurant purchases, including takeout and delivery

- Earn 5x points on airfare and travel agency purchases

- Earn 3x points on hotel purchases

- Earn 3x points on cruise purchases

- Earn 1x points on all other purchases

Citi Prestige Card $250 annual travel credit

To help offset the $495 annual fee, the Citi Prestige offers a $250 travel credit every calendar year. This is super straightforward, as there’s no registration required, and it can be applied toward any purchase coded as travel.

To me this is good as cash, and the way I view it, this really lowers the card’s out of pocket cost annually to ~$245, since just about anyone getting this card should be using the $250 statement credit.

Citi Prestige Card Priority Pass membership

The Citi Prestige Card offers a Priority Pass membership for the primary cardmember, as well as authorized users. With this, you can take up to two guests with you at no extra cost.

While many premium cards offer a Priority Pass membership, what’s noteworthy is that this membership does offer credits at Priority Pass restaurants, unlike premium cards issued by American Express, Capital One, and Chase. That’s a major advantage of this card, and a reason to hold onto it, in my opinion.

Citi Prestige Card Global Entry Or TSA PreCheck Credit

The Citi Prestige offers a Global Entry or TSA PreCheck credit once every five years. Just charge the application fee to your card, and it will automatically be reimbursed. This is a pretty standard benefit on premium cards nowadays.

Citi Prestige Card fourth night free benefit

The Citi Prestige Card offers a fourth night free hotel benefit. Twice a year, you can book a hotel through the Citi Travel portal, and get the fourth night reimbursed. This has the potential to represent a good value, but isn’t a slam dunk, like it used to be.

Up until 2019, the Citi Prestige Card fourth night free benefit was the single best benefit offered by any card. You could use the fourth night free benefit an unlimited number of times, and it could even be used for reservations directly with hotel groups (so you could earn points and elite nights). I can’t even say how many thousands of dollars this benefit saved me over the years, though it’s a shell of its former self at this point.

Citi Prestige Card cell phone protection

The Citi Prestige offers cell phone protection at no additional cost:

- This applies if your phone is stolen or suffers certain damage

- You can be reimbursed for the cost of the repair or replacement

- You can get up to $800 per claim, and there’s a $50 deductible per claim

- Coverage includes up to $1,500 in total yearly benefits for up to five phones on your monthly bill

While that’s a nice perk, the downside is that the card offers only 1x points on your cell phone bill, so you’re forgoing quite a few points by choosing to charge your cell phone bill to the card.

Why I still have the Citi Prestige Card

Back in 2015-2019, just about everyone in the miles & points space had the Citi Prestige Card, as the fourth night free hotel benefit was simply incredible. How do I justify still holding onto the Citi Prestige Card? Here’s how I approach it:

- The card costs me $245 per year to hold onto, when you subtract the easy to use $250 annual travel credit from the $495 annual fee

- This is my go-to card for dining, as the 5x points this card offers in that category is the best return on dining of any major card, in my opinion

- Now that American Express, Capital One, and Chase cards have eliminated credits at restaurants from the Priority Pass perks, this card’s Priority Pass membership just became even more valuable

- Having this card allows me to maximize value with the Citi Double Cash® Card (review), which offers 2x points on everyday spending

This card isn’t some slam dunk for everyone, but between the 5x points on dining and the credits at Priority Pass restaurants, it’s a card that I’m holding onto for the time being.

The Citi Strata Premier Card is open to new applicants

While the Citi Prestige Card is no longer open to new applicants, the Citi Strata Premier® Card (review) is, and it’s otherwise the most lucrative card for earning Citi ThankYou points:

- The Citi Strata Premier Card is open to new applicants, has a great welcome bonus, and it’s a product many should be eligible for

- The Citi Strata Premier Card has an annual fee of only $95

- The Citi Strata Premier Card has well-rounded bonus categories, as it offers 3x points on dining & restaurants, gas stations & EV charging, supermarkets, airfare, and hotels

- The Citi Strata Premier Card offers a $100 annual hotel credit, whereby you can get $100 off a $500+ hotel stay booked through the Citi Travel portal

Bottom line

For a few years now, the Citi Prestige Card hasn’t been open to new applicants. That being said, it’s a card that many existing cardmembers have held onto, given the value proposition. The card has a $495 annual fee, but offers a $250 annual travel credit, 5x points on dining, a Priority Pass membership with restaurant credits, and more.

I’ve held onto this card for years, and plan to continue to do so. That being said, I’d love to see Citi introduce a new premium card.

Do any other OMAAT readers still have the Citi Prestige Card? Or at least have fond memories of the uncapped fourth night free benefit? 😉

Hey Ben - having a specific issue booking 4th night free and can’t seem to sort out how to resolve.

The program clearly doesn’t allow back to back bookings at the same hotel to be eligible for two 4th night free benefits.

However, when trying to book two consecutive bookings at different hotels, which should each be eligible for a 4th night free, both the website and customer support are being blocked from...

Hey Ben - having a specific issue booking 4th night free and can’t seem to sort out how to resolve.

The program clearly doesn’t allow back to back bookings at the same hotel to be eligible for two 4th night free benefits.

However, when trying to book two consecutive bookings at different hotels, which should each be eligible for a 4th night free, both the website and customer support are being blocked from applying the benefit to the second booking.

Any thoughts on how best to navigate? Thanks!

Hey Ben - having a specific issue booking 4th night free and can’t seem to sort out how to resolve.

The program clearly doesn’t allow back to back bookings at the same hotel to be eligible for two 4th night free benefits.

However, when trying to book two consecutive bookings at different hotels, which should each be eligible for a 4th night free, both the website and customer support are being blocked from...

Hey Ben - having a specific issue booking 4th night free and can’t seem to sort out how to resolve.

The program clearly doesn’t allow back to back bookings at the same hotel to be eligible for two 4th night free benefits.

However, when trying to book two consecutive bookings at different hotels, which should each be eligible for a 4th night free, both the website and customer support are being blocked from applying the benefit to the second booking.

Any thoughts on how best to navigate? Thanks!

I also have this card for years, I accumulated thousand points to transfer to Airline for seat upgrades. Still keeping and using it. Other credit cards can't add points this fast. I am also citi gold, get additional 100.00 annual fee reduction. I use less 4th night free, booking from thank you travel site sometimes cost more than hotel site.

It is unfair that you cannot use your miles for trips to Charlotte from LAX, What is the deal with that.

Ben - do you know if the 4th night free booking counts towards the year in which the booking is made, or the year in which the hotel stay occurs? I made a booking on 12/31/2024 and they're telling me that it counts towards my 2025 4th night benefit since the stay is in 2025, but according to my past recollection that shouldn't be the case. The 4th night benefit wasn't working on the Citi...

Ben - do you know if the 4th night free booking counts towards the year in which the booking is made, or the year in which the hotel stay occurs? I made a booking on 12/31/2024 and they're telling me that it counts towards my 2025 4th night benefit since the stay is in 2025, but according to my past recollection that shouldn't be the case. The 4th night benefit wasn't working on the Citi webstie on 12/31 so I had to make the booking over the phone and they were having major system issues because of the new year I think. Happy New Year!! Thanks!!

hey there is no rental car protection with citi prestige...you should mention that!

Lucky, I believe the cell phone insurance is $1000 per claim. https://www.cardbenefits.citi.com/~/media/CPP/Files/LegalDocs/SOAPI/362203_CRE130_MV6704_Prestige_Updates_2.ashx

What's the point in this article - If there is no way to get the card then why promote this card and tell readers about it.....

Can you NOT read? The title clearly says "Why It’s Still In My Wallet," which, if you had more than two brain cells, would let you know the post is about whether to KEEP the card. It also compares the old card to the new elite card from Citi. Save your keystrokes until you learn to read, then you can post a comment.

As others have noted cardholders with a Citigold bank account only pay $350 AF so net cost is only $100 which gets you....

Priority Pass Restaurant $56 credit every time two people travel

Two years added to a warranty. Stacks with Applecare.

5x points dining (plus 10% if you have the Citi+ card)

Worth keeping just for the PP Restaurant but the extended warranty has saved me several thousand dollars over the years.

I understand this site is very US-centric, but to be clear the Citi Prestige Card is still being issued in Australia and Asia, including Malaysia, Singapore and India.

Not being issued in India. Citi sold its consumer businesses in India (including credit cards) to Axis Bank a few years ago and the Prestige was migrated to a newly created Axis card.

This was just a great card during its heydays. Save thousands on hotels each year with the fourth night free. You can even book Amans, Eden Rock at St Barts with this card and get fourth night free. One time I booked Four Seasons Bogota which had third night free promotion and I also got fourth night free from this card. It was amazing! Unfortunately it's no longer the case. :(

We enjoy our prestige card and earn many miles with it. You can earn 10x miles on hotel/rental cars until the end of 2025 and for those that say the portal costs more, just call them to get it price matched! Also some cruises, mainly Uniworld is 5x miles and any travel related category like tours is 5x. To bypass a 2nd card fee, just have your spouse add and use apple pay for purchases....

We enjoy our prestige card and earn many miles with it. You can earn 10x miles on hotel/rental cars until the end of 2025 and for those that say the portal costs more, just call them to get it price matched! Also some cruises, mainly Uniworld is 5x miles and any travel related category like tours is 5x. To bypass a 2nd card fee, just have your spouse add and use apple pay for purchases. I use the 4th night for hotels that avg $500+ a night to max the benefits to try and save $1K which more than pays for the annual fee. Citi removing the travel protection shouldn't be a deal breaker because if your traveling aboard you need a health insurance policy and adding on travel protection costs nothing. Occasionally there is 5x grocery, drug store miles bonuses :) Love this card!

Can you say more about calling to price match? Match to what rate exactly? How does this work on the phone? Has this worked 100% of the time?

I feel like I'm missing something here. Is this card coming back and that's why we're revisiting it? I have FOMO on this card and hope that's true.

@ Chris -- Unfortunately not, or at least I have no inside info. The reason I wrote this post is because I sometimes reference the card (like when talking about the best cards for a Priority Pass membership).

I realized that all my posts about the card have outdated information, so it made sense to at least have one post I can link to about the current state of this card.

I still have this card and use it for Dining and airfare purchase, although people should keep in mind that Citi took away the travel protection benefit on this card so any airfare purchase does not come with trip delay, lost baggage, etc.

The 4th night free benefit is pretty much useless now. I haven't been able to use this benefit in years because consistently, the price on the thankyou portal is higher than...

I still have this card and use it for Dining and airfare purchase, although people should keep in mind that Citi took away the travel protection benefit on this card so any airfare purchase does not come with trip delay, lost baggage, etc.

The 4th night free benefit is pretty much useless now. I haven't been able to use this benefit in years because consistently, the price on the thankyou portal is higher than booking direct to the point that it negates the 4th night free.

I really do hope that Citi revamps the benefits on this card and brings it back.

“Why It’s Still In My Wallet”

That’s a really, really low bar.

Still love the card but the Citi travel site for hotel bookings is terrible. Pricing is higher than direct booking almost always; and a feature also makes it seem deceptive: Whenever hotels and prices are displayed on the search page, prices are really much higher when clicking onto an individual link to select a room. Anyone experienced this too? Got any hacks for searching for accurate or best value pricing for the hotel free night benefit?

Yup it's always more expensive to book on Thankyou portal than direct.

When combined with the 10% back from the Rewards+ card, the value is significant.

Yes, rub it in for those who don't have this card.

Next the 49 IHG, 0 Savor, to name a few.

Really brilliant reminder about the Priority Pass benefit. Prompted me to ask them to resend me that Priority Pass card. Thanks Ben

If I recall, this card also offered Admiral's Club access when if first came out.

And free rounds of golf.

Yep - it was how I got AC membership while it lasted.

We have the card and our annual fee is only $350 due to a Citigold relationship bonus. At an effective $100 AF that makes keeping the card a no-brainer.

Fond memories of confused cashiers trying to figure out how to swipe the card in its first design. That showed how badass and special I was. I was living in Durham, NC at the time, so I was easily impressed. I now live in Manhattan, NY and nothing impresses me anymore.

4th night free was especially lucrative when the rate for night 4 was much higher than all other nights.

Correction. You get 5x on travel agency purchases, NOT just on airfare. For example, hotels.com and viator.com purchases code as travel agency, so you get 5x, along with some rail companies in Europe (I tried some in the Netherlands and the Czech Republic). I'm sure there is much more, be the data point you want to see :)

citi please wake up and do something about the gaping hole the prestige left behind