Link: Apply now for the Ink Business Preferred® Credit Card, Ink Business Cash® Credit Card, or Ink Business Unlimited® Credit Card

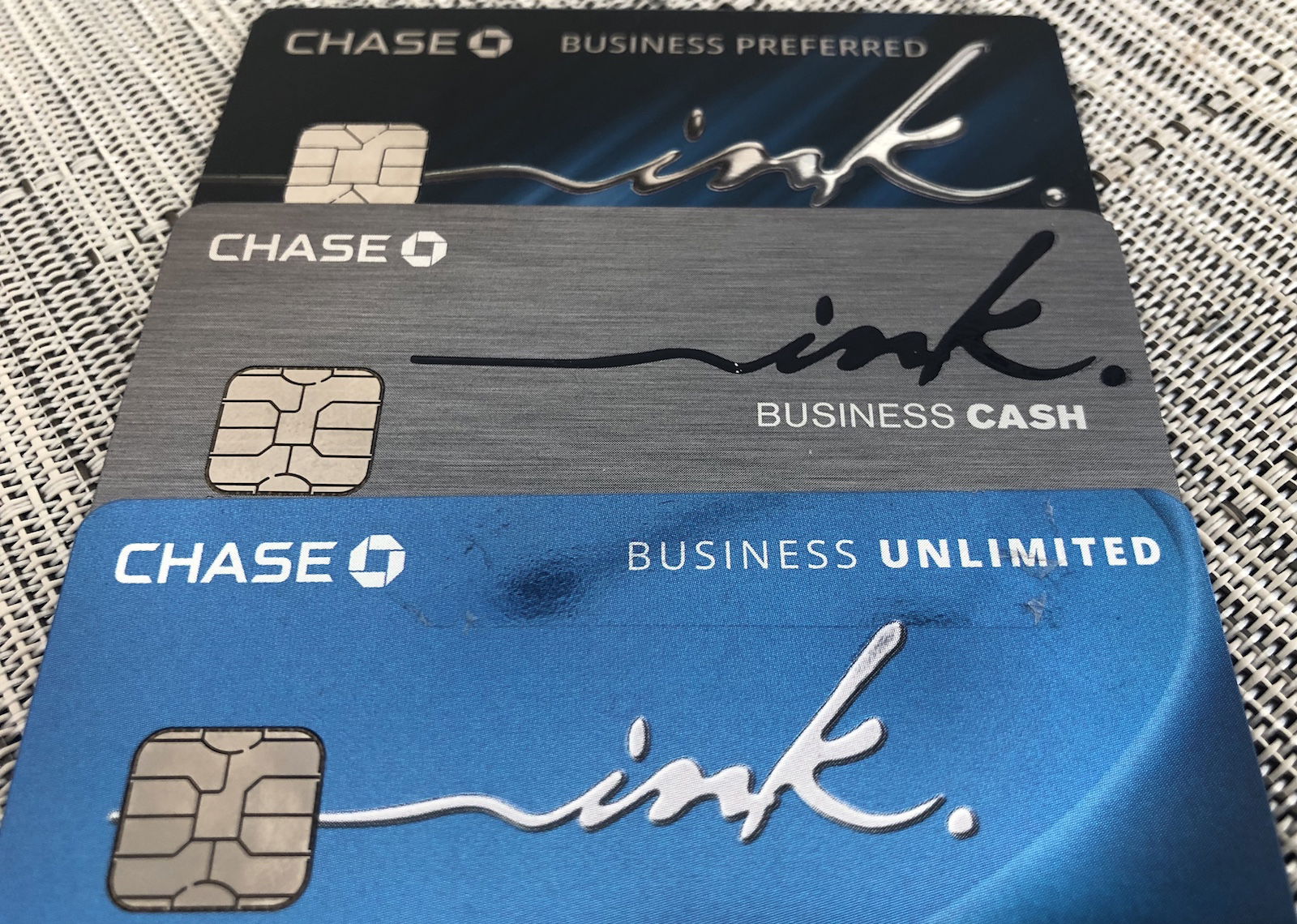

While there are lots of excellent business credit cards out there, I’d argue that the portfolio of Chase Ink Business credit cards — including the Ink Business Preferred® Credit Card, Ink Business Cash® Credit Card, and Ink Business Unlimited® Credit Card — are among the most compelling. The cards have exceptional welcome bonuses, great rewards structures, and valuable perks.

In this post I wanted to cover the basics of these cards. Why are the cards worth having, and how can you maximize your odds of getting approved when applying?

In this post:

Basics of Chase Ink Business credit cards

Let’s start by covering the basics of Chase Ink Business credit cards, including the welcome bonuses, the rewards structure, the perks, and more. As I view it, these cards are complements rather than substitutes, given that only one card has an annual fee, and they each have different strengths.

These cards also have massive welcome bonuses, so applying for multiple cards can be a great way to earn lots of points with a reasonable spending amount, which can fuel some great travel opportunities.

Note that in this post I won’t be covering the Ink Business Premier® Credit Card (review). While this is a potentially useful card, it exclusively earns cash back, so it isn’t a travel rewards card, unlike the rest of the cards in the portfolio.

Chase Ink Preferred Card basics

The Ink Business Preferred Card has a reasonable $95 annual fee, and the are so many reasons to pick up this card:

- It has a welcome bonus of 90,000 bonus points after spending $8,000 within three months

- It has a generous rewards structure, as it offers 3x points on travel, shipping purchases, internet, cable, phone services, and advertising purchases made with social media sites and search engines, on up to $150,000 in combined purchases per cardmember year

- It offers valuable perks, like cell phone protection, rental car protection, and extended warranty protection

- Having this card gives you full access to the Chase Ultimate Rewards ecosystem, including the ability to transfer points to travel partners

Read a full review of the Ink Business Preferred Card.

Chase Ink Cash Card basics

The Ink Business Cash Card is a valuable no annual fee card, and has a compelling value proposition:

- It has a large welcome bonus of up to 75,000 bonus points — earn 35,000 points after spending $3,000 within three months, and an additional 40,000 points after spending a total of $6,000 within six months

- It has a lucrative rewards structure, as it offers 5x points on office supply stores, internet, cable, and phones services, and up to 2x points on restaurants and gas stations, on up to $25,000 in combined purchases per cardmember year

- It offers valuable perks, like rental car protection and extended warranty protection

- The card only offers the ability to transfer points to Chase Ultimate Rewards travel partners in conjunction with another card

Read a full review of the Ink Business Cash Card.

Chase Ink Unlimited Card basics

The Ink Business Unlimited Card is a useful no annual fee card, and there are several reasons you’d want to consider this card:

- It has a large welcome bonus of 75,000 bonus points after spending $6,000 within three months

- It has a solid rewards structure, as it offers a flat 1.5x points on all purchases, with no limits

- It offers valuable perks, like rental car protection and extended warranty protection

- The card only offers the ability to transfer points to Chase Ultimate Rewards travel partners in conjunction with another card

Read a full review of the Ink Business Unlimited Card.

Basics of Chase Ink Business credit card rewards

The value of the points you earn with Chase Ink Business credit cards varies based on which cards in the portfolio you have. Assuming you have the Ink Business Preferred Card, then all the points you earn on these three cards could be redeemed in one of two ways.

One option is that they could be redeemed for 1.25 cents each toward the cost of a travel purchase through the Chase Travel Portal. If you have the Chase Sapphire Reserve® Card (review), then all the points you earn could be redeemed for 1.5 cents each toward the cost of a travel purchase.

The second choice is that you can convert these points into airline miles or hotel points, using one of the Chase Ultimate Rewards transfer partners, which you can find below.

Airline Partners | Hotel Partners |

|---|---|

IHG One Rewards | |

United MileagePlus | |

If you don’t have either the Ink Business Preferred Card, Sapphire Reserve Card, or Sapphire Preferred Card, then points earned on the Ink Cash Card and Ink Unlimited Card can only be redeemed for a penny each, which isn’t nearly as good. The key to maximizing value is to build up a portfolio of Chase cards.

Chase Ink Business credit credit application & approval tips

With the above out of the way, let’s talk about some of the logistics of applying for and being approved for Chase Ink Business credit cards. The great thing is that you’re eligible for all three cards, including the welcome offers.

For more firsthand examples, see my recent posts explaining Ink Business Preferred Card eligibility and Ink Business Unlimited Card eligibility, and also my experience getting approved for the Ink Business Preferred Card and getting approved for the Ink Business Unlimited Card.

Who is eligible for Chase business credit cards?

Eligibility for a small business credit card is easier than you might think. You don’t need to have a big company, and don’t even need to be incorporated. Even a small side business with limited business revenue makes you eligible for a business credit card, even if you’re just selling things on eBay, do some consulting on the side, have a rental property, or do freelancing, for example.

It goes without saying that you should always fill out credit card applications truthfully.

What are restrictions on applying for Chase business cards?

Chase’s general restrictions on applying for cards are as follows:

- There’s no hard limit on how many Chase credit cards you can be approved for, but rather there’s often a maximum amount of credit the bank is willing to extend you, in which case you may be asked to switch around your credit limits on some cards in order to facilitate an approval

- While you can typically be approved for up to two Chase cards in a 30 day period, that doesn’t usually work when both are business cards; you typically want to wait at least 30 days between business credit card applications to be on the safe side, though there are mixed reports (some people don’t have to wait that long, others have to wait longer)

- Chase has the 5/24 rule, whereby you typically won’t be approved for a Chase card if you’ve opened five or more new card accounts in the past 24 months; however, note that this no longer seems to consistently be enforced

- Regarding the 5/24 rule, the good news is that when you’re approved for a Chase business credit card, that application shouldn’t count as a further card toward the 5/24 limit, given that it won’t show up on your personal credit report

Can you earn the bonuses on multiple Chase business cards?

You must be surprised by how easy it is to earn the bonuses on Chase Ink Business credit cards:

- You can earn the bonus on each individual card, so they’re not mutually exclusive

- You can even get multiple of the same cards for different businesses, so if you already have a particular card for a corporation, you can still get it for a sole proprietorship, for example

- There’s no “lifetime language” with these cards, so you’re eligible for the cards (including the bonuses) even if you had them in the past

How should you fill out Chase business card applications?

Those who already have business credit cards are probably familiar with the application process, but for those who aren’t, here’s what you need to know. It can be intimidating to apply for your first business credit card, though even if you’re a small business or sole proprietor, you should be eligible.

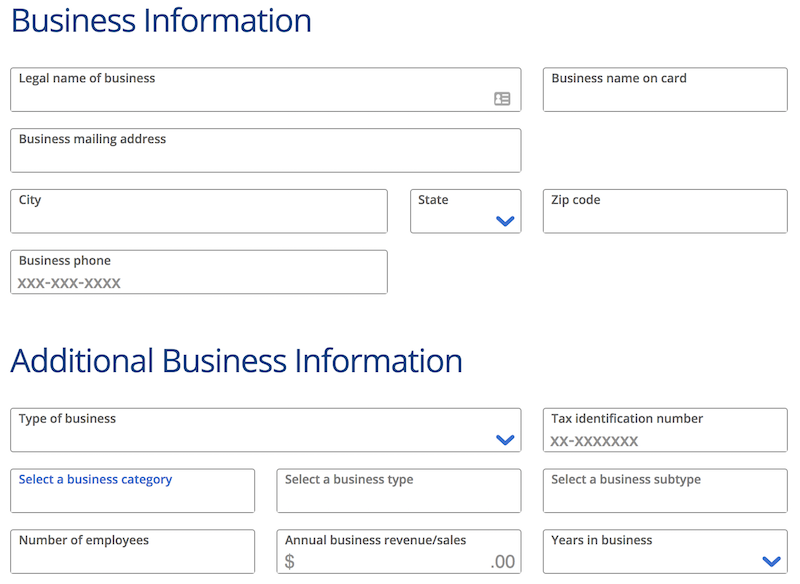

When applying for a Chase business credit card, you’ll be asked the following questions, in addition to the typical personal questions about your income, Social Security Number, etc.:

- Legal name of business

- Business mailing address & phone number

- Type of business

- Tax identification number

- Number of employees

- Annual business revenue/sales

- Years in business

If you’re a sole proprietor, how should you approach this? First of all, and most importantly, answer everything truthfully. I think the concern that a lot of people have is that they think they need an incorporated business, a separate office, etc., in order to be considered for a business card. That’s not the case:

- You can use your name as the legal name of your business

- The business mailing address and phone number can be the same as your personal address and phone number

- If you’re a sole proprietorship, you can select that as your type of business

- For the tax identification number, you can put your Social Security Number

- For number of employees, saying just one is perfectly fine

- For your annual business revenue, be honest about what it is

- For years in business, there’s no shame in saying that it’s new, that it has been one to two years, etc.

How hard is to get approved for Chase business card?

When it comes to getting approved for business credit cards, Chase certainly isn’t the easiest issuer. In general I find American Express business cards to be easiest to be approved for. However, getting approved for Chase business cards isn’t as tough as some people assume, at least if you have excellent credit.

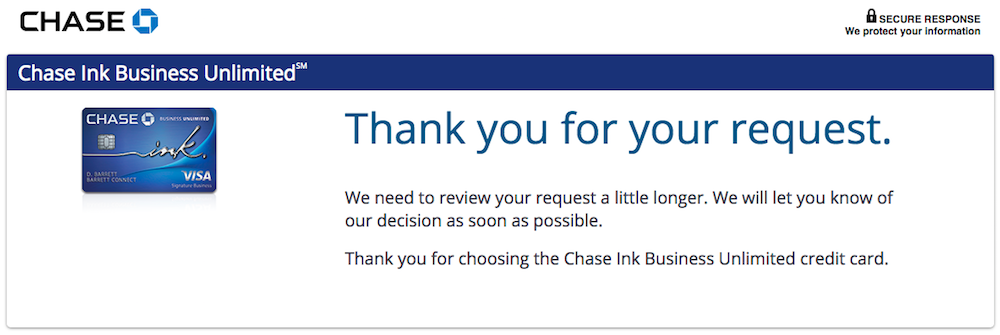

In my experience instant approvals on Chase business cards aren’t that common, so don’t be worried if the approval doesn’t come through right away. You’ll often get a pending decision response, and then eventually (hopefully) an approval.

Still, sometimes instant approvals do come through, and it’s always exciting when that happens. Just don’t be surprised if it doesn’t.

How does the 5/24 rule impact Chase business credit cards?

Chase has what’s known as the 5/24 rule, whereby you typically won’t be approved for a Chase card if you’ve opened five or more new card accounts in the past 24 months (however, there are increasingly reports that this is no longer enforced).

One exception is most business cards, including select cards issued by American Express, Bank of America, Barclays, Capital One, Chase, and Citi, generally won’t count as an additional card toward that limit, because they won’t be shown on your personal credit report.

One positive thing is that while Chase business cards may be subjected to the 5/24 rule, when you’re approved for them, they don’t count as a further card toward that limit.

In other words, if you’ve opened four new accounts in the past 24 months and then apply for a Chase business card, you’ll still be at four cards. If you then apply for another Chase business card, you’ll still be at four cards.

How can you get approved for all three Chase Ink Cards?

If your goal is to be approved for all three Ink cards, your best strategy is “slow and steady,” as they say. I’d recommend applying for the cards a bit over 30 days apart, at the absolute fastest. If you apply for the first card on day one, apply for the second card on day 35 (or so), and then the last card on day 70 (or so). Or maybe wait even longer between applications.

If it were me, I’d definitely recommend making the Ink Business Preferred Card first, since it’s the all-around most lucrative card.

Then you have to decide whether the Ink Business Card Card or Ink Business Unlimited Card is a better option for you as the second card to apply for. If it were me, I’d probably apply for the Ink Business Unlimited Card, given that it offers 1.5x points on all purchases, so it nicely balances the 3x points categories on the Ink Business Preferred Card.

I’d note that while this is how it’s supposed to work, Chase also sometimes has limits on how much credit can be extended to someone, so it’s totally possible that Chase will approve you for two of these, but not the third. Everyone’s situation will vary.

Bottom line

Chase has some fantastic credit cards, and in particular, the issuer has great business credit cards. The lineup of Chase Ink Business credit cards have some phenomenal bonuses, and between the Ink Business Preferred Card, Ink Business Cash Card, and Ink Business Unlimited Card, you could potentially earn bonuses of 240,000 Ultimate Rewards points. That’s huge.

Not only do the cards have great initial bonuses, but they have excellent bonus categories, ranging from 1.5x points on all purchases, to 3-5x points in select categories.

Applying for business credit cards in general can be intimidating for new businesses, though I recommend giving it a try using the above tips, and you’ll probably be pleasantly surprised by the results.

Do you have any Chase business cards? If so, what was your experience getting approved for them?

Unless you need to separate charges on to a business card I think generally speaking you can get a similar return or a greater return on other cards for what this is offering. Furthermore unless you spend a lot of money in those categories that give the bigger bonus it is probably not worth it.

Hello, my name is Bill, and I’m a points and miles-oholic

Some day I’ll quit but not before trying to get another Ink card. Still getting 5x UR on cell service with Ink Plus. ;-)

Almost 1,000,000 points/miles so far this year

My first Round the World trip in 2013 was only ~260,000 AA miles and included 3 CX 1st 1 BA First and New AA B77W first.

Now days takes...

Hello, my name is Bill, and I’m a points and miles-oholic

Some day I’ll quit but not before trying to get another Ink card. Still getting 5x UR on cell service with Ink Plus. ;-)

Almost 1,000,000 points/miles so far this year

My first Round the World trip in 2013 was only ~260,000 AA miles and included 3 CX 1st 1 BA First and New AA B77W first.

Now days takes lot more miles and much harder availability. Time to find a new hobby ;-)

OTOH I’d love to know your referral rate from each credit card review post??? I often use your referral links because I like your blog and I believe it gets better results than cold applying

My best to your family!