Link: Learn more about the Chase Sapphire Reserve® Card

The Chase Sapphire Reserve® Card (review) is a popular premium travel rewards card that lots of people find to be worthwhile. The card also has a phenomenal welcome bonus, so that’s a major incentive to apply for this card.

In this post, I’d like to take a look at what you should do once you’ve applied for the card, received it, and activated it. I think that’s especially worth recapping given that the card has recently undergone a full refresh. While the card has a higher annual fee, it also has lots more perks.

Note that this post isn’t intended to be a comprehensive list of all the perks, but instead, is about the “action items” to consider once you have the card. In no particular order, below are some of the things that you should do once you’ve been approved for and have activated the Chase Sapphire Reserve.

In this post:

Activate your Priority Pass™ Select membership

One of the great perks of the Chase Sapphire Reserve is that it comes with a Priority Pass™ Select membership, which gets you access to over 1,300 airport lounges around the world, including unlimited access to Chase Sapphire Lounges. You can even bring two guests with you into the lounge at no extra cost.

This is something you have to activate, though. To do this, log into your card account, and then go to the “Card benefits” section. Once there, go to the section for “Complimentary airport lounge access.”

There you’ll see an option to activate your membership. Once you select that option, the card should be mailed to you within two to three weeks at your address on file (though often it comes even faster than that).

Note that while the card also offers Air Canada Lounge access, that’s granted by directly showing your card, and has nothing to do with Priority Pass. So no registration is required for that.

Use your $300 travel statement credit

One of the perks that helps with justifying the annual fee on the Chase Sapphire Reserve is the $300 travel credit every cardmember year. This is automatic, so there’s no registration required. Just start spending money on travel, and any spending up to $300 for a purchase categorized as travel (which includes Uber, subway tickets, flights, hotels, etc.) will be reimbursed.

Ultimately it doesn’t matter at what point in a given year you use this, though I know many people prefer to recoup as much of their $795 annual fee as quickly as possible, so this is one way to do that.

If you’re curious about how much of your credit you’ve used, just go to your card dashboard on the Ultimate Rewards website, and it will show you, along with when your next cardmember year starts.

Use your $300 dining statement credit

As one of its new perks, the Chase Sapphire Reserve is offering a $300 dining credit every calendar year. This credit is semi-annual, meaning you can get a $150 credit in January through June, and a $150 credit in July through December.

In theory, there’s no rush with using this, other than trying to recoup as much of the annual fee as quickly as possible. While there’s no registration required to use this perk, the catch is that you’re limited in terms of the number of restaurants at which this can be used — you can find a full list here.

Admittedly the list of eligible restaurants is quite small, and it’s also centered around major cities. That’s why I’d recommend taking a look at the list as soon as you get the card, and thinking about how you can maximize the value of it.

Activate your Apple TV+ & Apple Music subscription

The Chase Sapphire Reserve now offers a complimentary Apple TV+ and Apple Music subscription through June 22, 2027. A one-time activation is required through the Chase website or app, in the “Benefits” tab. If you have an existing subscription and sign up for this, then the previous subscription will automatically be canceled, and will stop billing.

This is a value of $250 annually, so if you’d otherwise pay for that subscription, then this is incredibly valuable.

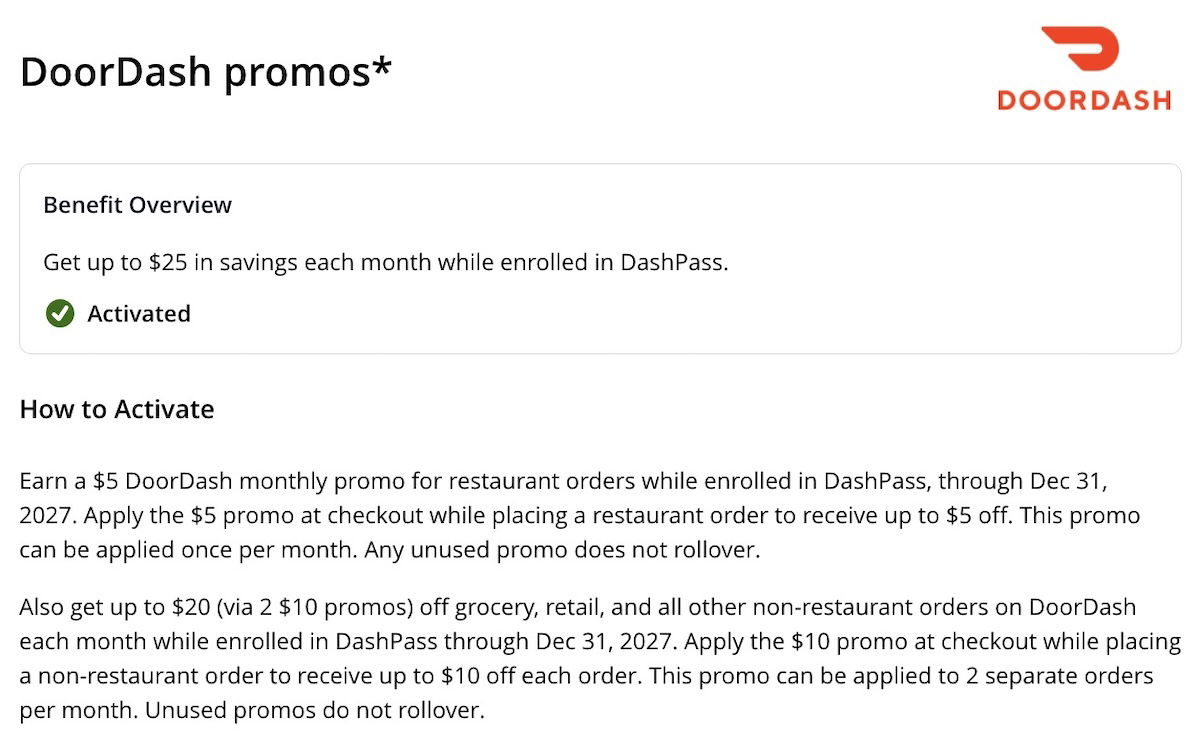

Use your DoorDash DashPass & credits

Chase and DoorDash have a partnership, offering perks for cardmembers. For those with the Chase Sapphire Reserve, this includes:

- A complimentary DoorDash DashPass (must activate by December 31, 2027) for a minimum of one year, offering $0 delivery fees on eligible restaurant and grocery store deliveries (generally you need to spend at least $12 with a restaurant or $25 with a grocery store)

- Through December 31, 2027, receive a $5 monthly promo for restaurant orders, and two $10 monthly promos for grocery, retail, and all other non-restaurant orders

Use your Global Entry or TSA PreCheck credit

The Chase Sapphire Reserve offers a Global Entry, TSA PreCheck, or NEXUS credit once every four years. Global Entry gets you expedited immigration when entering the United States, while TSA PreCheck gets you expedited security when flying select airlines. NEXUS is particularly useful if you make regular land crossings between the US and Canada.

I always recommend applying for Global Entry over TSA PreCheck, since Global Entry automatically gets you access to PreCheck, while the inverse isn’t true.

In the event that you already have Global Entry, note that you can use this benefit for someone else. All that matters is that your card is charged for the fee. There’s no registration required on Chase’s end. Just use your card for the purchase and it will automatically be reimbursed, typically within a few days.

Decide if you want to add authorized users

You can add authorized users to the Chase Sapphire Reserve for $195 each. Authorized users receive their own Priority Pass™ Select membership, plus some protection, like travel and rental car coverage, when making purchases with the card.

Adding authorized users to the card can be a good deal, especially if you know people who would value lounge access, with Priority Pass, Chase Sapphire Lounges, and Air Canada Lounges.. This is something to seriously think about when you pick up the card.

Update your card for airfare & hotel purchases

One of the best aspects of the Chase Sapphire Reserve is the bonus categories that it offers, including:

- 8x points on all Chase Travel℠ bookings

- 5x points on Lyft rides, through September 30, 2027

- 4x points on direct airfare and hotel spending

- 3x points on restaurants and dining

- 1x points on all other purchases

Once you have this card, make sure you update the card you have on file for airfare and hotel purchases, since I’d consider this to be among the best cards for airfare spending and the best cards for hotel spending.

Consolidate your Chase points to maximize value

Having the Chase Sapphire Reserve can potentially make all of your Ultimate Rewards points more valuable, as it allows you to transfer them to airline and hotel partners, and potentially get more value using the “Points Boost feature.”

So I’d recommend consolidating all your Ultimate Rewards points to your Sapphire Reserve account. That’s especially true if you have no annual fee cards, like the Chase Freedom Unlimited® (review), Chase Freedom Flex℠ (review), Ink Business Unlimited® Credit Card (review), and Ink Business Cash® Credit Card (review).

Take advantage of your rental car perks

Just for having the Chase Sapphire Reserve, you can receive rental car perks with National and Avis. These perks include:

- Complimentary National Emerald Club Executive status, which you can register for here

- Complimentary Avis Preferred Plus status, which you can register for here

Decide if you want to pick up complementary cards

The Chase Sapphire Reserve is valuable because it offers some useful bonus categories. However, you can really supercharge your points earning by complementing the card with another card that can potentially earn Ultimate Rewards points:

- The Chase Freedom Unlimited® offers 1.5x points on all purchases, and the Ink Business Unlimited® Credit Card offers 1.5x points on all business purchases, so they are great complements, and these are among the best cards for everyday spending

- The Chase Freedom Flex℠ offers 5x points in rotating quarterly categories, on up to $1,500 of spending per quarter, plus 3x points at drugstores

- The Ink Business Preferred® Credit Card offers 3x points on the first $150,000 of combined purchases per cardmember year on travel, shipping purchases, internet, cable, phone services, and advertising purchases made with social media sites and search engines.

- The Ink Business Cash® Credit Card offers 5x points on the first $25,000 of combined purchases per cardmember year on office supply stores, internet, cable TV, mobile phones, and landlines, and 2x points on the first $25,000 of combined purchases per cardmember year on restaurants and gas stations

At a minimum, I think the Chase Sapphire Reserve and Chase Freedom Unlimited are one of the best card duos out there — you earn a lot more points, and you’re only paying one annual fee.

Bottom line

The Chase Sapphire Reserve is a popular premium card. We recently saw the card’s annual fee increase, though at the same time, several new perks were added. Hopefully the above is a useful rundown of some of the things you should do after getting approved for the card, in order to maximize value ASAP.

I got the "you may not be eligible for the sign up bonus" message during the application process. I haven't had the CSP card for about 6 months. Is there a specific amount of time that needs to pass before being eligible for the CSR bonus?

Hi Lucky, do you know if you can link any Apple ID to the CSR for the Apple TV/Music benefits??

It is interesting not just currently with Chase but many other providers their premium credit card is not the best anymore for many people.

Chase Sapphire Reserve to do list.

1. Downgrade to Chase Sapphire Preferred.

I always thought the point of the $300 credit was “all travel earns 3x on this card, so put all of your travel on this card, and the $300 is an incentive to make sure you remember to put all travel on this card.” Now that “other travel” earns 1x points and not 3x points, the advice should not be to put all travel on this card. For a credit that presumably was previously redeemed...

I always thought the point of the $300 credit was “all travel earns 3x on this card, so put all of your travel on this card, and the $300 is an incentive to make sure you remember to put all travel on this card.” Now that “other travel” earns 1x points and not 3x points, the advice should not be to put all travel on this card. For a credit that presumably was previously redeemed in full by nearly all CSR holders, I wonder if that changes come 2026. Folks may start putting other travel on a 2x card, book airfare and hotels through higher earning cards/portals, and forget to use all of it. Especially if you use Uber and not Lyft. Not the biggest barrier to entry, but one you have to think about now.