Link: Learn more about the American Express Platinum Card® or The Business Platinum Card® from American Express

American Express Platinum Card® (review) and The Business Platinum Card® from American Express (review) are among the most popular premium cards out there.

The cards have hefty annual fees — $895 for the personal version (Rates & Fees), and $895 for the business version (Rates & Fees) — though if you use the cards right, you should get perks that more than offset it.

The main reason I have these cards is because of the great benefits they offer, including lots of credits. If you’re a new cardmember it can be tough to navigate all these perks, given the sheer number of them that exist.

In this post, I figured I’d talk about what you should do as soon as you get the Platinum Card® in the mail. If you already have the card and have taken advantage of all the perks, then by all means skip this post. Below are some of the major things you should be aware of, in no particular order.

In this post:

Activate your Priority Pass™ Select membership

Just for having the Platinum Card® you get a Priority Pass™ Select membership. However, you need to specifically request the card in order to take advantage of the perk. To do so, register for Priority Pass at this link. (Enrollment required)

You’ll be asked to confirm your information, and then within a couple of weeks should receive your Priority Pass card in the mail.

Activate your Hilton Gold elite status

Just for having the Platinum Card® you get Hilton Honors™ Gold Status, which gets you room upgrades, club lounge access (subject to availability), free breakfast or a food & beverage credit, etc. This benefit is good for as long as you have the card, though you have to register for Hilton Gold elite status. (Enrollment required)

Activate your Marriott Gold status

Just for having the Platinum Card® you get Marriott Bonvoy® Gold Elite Status, which gets you perks like room upgrades, enhanced internet, bonus points, late check-out (subject to availability), and more. This benefit is good for as long as you have the card, though you have to register for Marriott Gold Elite status. (Enrollment required)

Sign-up for Global Entry

One of the perks of the Platinum Card® is a Global Entry or TSA PreCheck credit. I highly recommend getting Global Entry, since that automatically comes with TSA PreCheck, while the inverse isn’t true.

This benefit applies once every 4.5 years for the application fee for TSA PreCheck, or once every four years for the application fee for Global Entry (Global Entry and TSA PreCheck have to be renewed every five years, so this gives you a buffer).

To take advantage of this, just charge the Global Entry or TSA PreCheck fee to your card, and it will automatically be reimbursed. There’s no registration required. You can even use this to pay the fee for a friend or family member, should you already have it.

Sign-up for CLEAR+

One of the benefits of both the Amex Personal Platinum and Amex Business Platinum is that you get an annual credit of up to $209 toward a CLEAR+ membership. To take advantage of this you need to charge the membership fee to your card. (Enrollment required)

CLEAR can save you time at airport security. By having your biometric data confirmed, you can skip the TSA ID check, and instead be escorted straight to the security screening channel.

Designate a preferred airline

One of the benefits of both the Platinum Card® and Amex Business Platinum is that you get an up to $200 annual airline fee credit. To take advantage of this you need to designate a US airline, with the choices including Alaska, American, Delta, Frontier, Hawaiian, JetBlue, Southwest, Spirit, and United. (Enrollment required)

If you’re an existing cardmember, you can select your airline of choice in January of each year, and if you don’t, your previous selection will roll over. If you’re a new cardmember then you can select your preferred airline.

To verify or select your airline of choice, log into your Amex account, and then click on the “Benefits” tab along the top. Then scroll to the section that talks about the airline fee credit, and you’ll see the link to “select an airline.”

Also keep in mind that whatever airline you designate will also be the airline for which your 35% off “Pay With Points” option applies on the Amex Business Platinum. Choose your airline carefully, especially with the business card.

Sign-up for free car rental status

Just for having a Platinum Card® you receive free Avis Preferred Plus, Hertz Gold Plus Rewards President’s Circle, and National Emerald Club Executive status. It’s super easy to sign up. You can register for all of these status levels on this page or by calling Amex customer service. (Enrollment required)

Decide if you want to add authorized users

While the Platinum Card® has a high annual fee, you also have the option of adding authorized users at a cost:

- On the personal version of the card, each authorized user costs $195 (Rates & Fees)

- On the business version of the card, each authorized user costs $400 (Rates & Fees)

Why would you want to consider adding an authorized user? They’ll also get access to Centurion Lounges, Plaza Premium Lounges, Delta Sky Club® when flying Delta, and a Priority Pass™ Select membership, along with Gold elite status, Marriott Gold status, and more. (Enrollment is required for select benefits)

Use your Uber credits (Consumer Platinum only)

The Platinum Card® offers $200 in annual Uber credits. That comes in the form of a $15 monthly Uber credit, and in December you get a $35 credit, all of which can be applied toward U.S. rides or U.S. Uber Eats purchases. To take advantage of this add your Platinum Card® to your Uber profile. An Amex Card must be selected as the payment method for your Uber or Uber Eats transaction to redeem the Amex Uber Cash benefit

Use your hotel credits (Consumer Platinum only)

The Platinum Card® offers an up to $600 annual hotel credit. You receive this in the form of up to $300 semi-annual statement credits valid for prepaid bookings at Fine Hotels + Resorts® or The Hotel Collection properties (two-night minimum stay required), when booked through American Express Travel®.

So while there’s no real rush to use this, this is essentially like a two free $300 hotel stays; just charge the purchase to your card.

Enroll for digital entertainment credits (Consumer Platinum only)

The Platinum Card® offers up to $300 in annual digital entertainment credits. The way this breaks down, you get up to $25 in statement credits each month when you use your Platinum Card® for eligible purchases on Disney+, a Disney+ bundle, ESPN+, Hulu, The New York Times, Paramount+, Peacock, The Wall Street Journal, YouTube Premium, and YouTube TV when you purchase directly from one or more of the providers. This is a great deal if you otherwise have subscriptions with one (or more) of these services. (Enrollment is required for select benefits)

Enroll for Equinox credits (Consumer Platinum only)

The Platinum Card® offers up to $300 in statement credits each year on a digital or club membership at Equinox. (Enrollment required)

This will be useful to those are Equinox members or have an Equinox location close to them, while for others this probably won’t be worth it. You need to enroll for the Equinox benefit.

Enroll for Walmart+ credits (Consumer Platinum only)

The Platinum Card® offers a $12.95 monthly credit toward a Walmart+ membership, which covers the entire cost of it. You need to enroll for the Walmart+ benefit.

Enroll for Saks credits (Consumer Platinum only)

The Platinum Card® offers up to $100 in annual Saks credits. That comes in the form of a $50 credit in the first half of the year, and a $50 credit in the second half of the year. Those apply to purchases made in-store or online with Saks. You need to enroll for the Saks benefit.

Use your Dell credits (Business Platinum only)

As of July 1, 2025, enrolled cardmembers can receive up to $150 in statement credits on US purchases made directly with Dell, and an additional $1,000 statement credit after spending $5,000 or more on those purchases from July 1 through December 31, 2025 (and for each calendar year thereafter) (Enrollment required)

Use your wireless credits (Business Platinum only)

The Amex Business Platinum Card offers $120 in annual wireless credits, in the form of a $10 monthly statement credit toward purchases made directly from any U.S. wireless telephone provider. (Enrollment required)

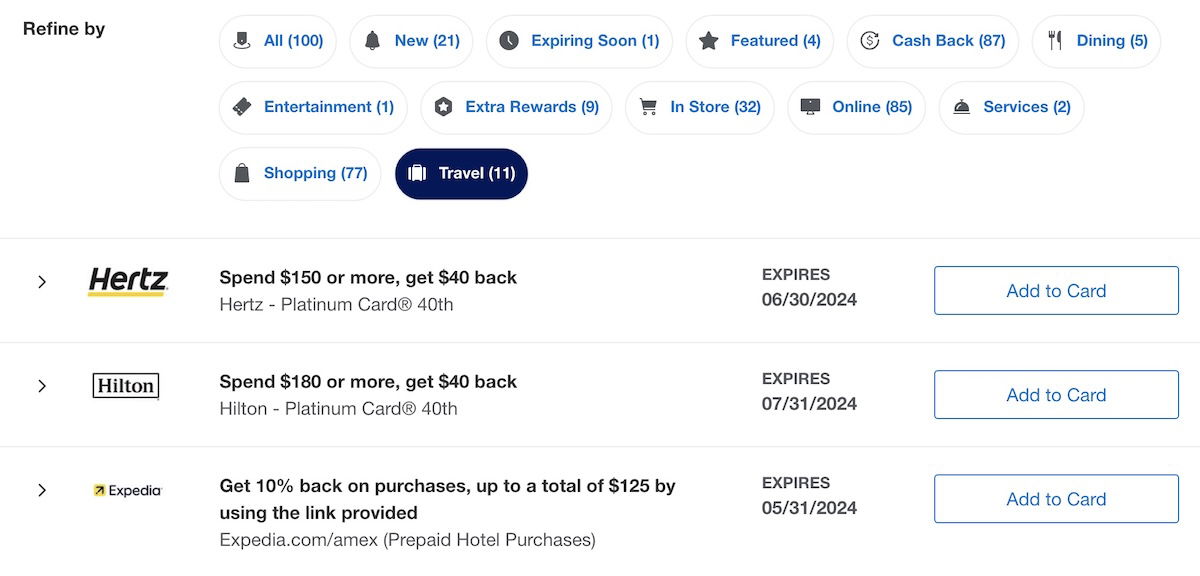

Start loading Amex Offers

One of my favorite perks of Amex cards is the Amex Offers program. With this, you can save money and earn bonus points on all kinds of purchases with American Express.

To take advantage of this, log into your account and scroll down, and you’ll see all kinds of offers. Start adding them to your account and then using your card for purchases where you can score discounts or bonus points.

I earn a significant number of points and cash back using this.

Bottom line

There are so many great perks to both the Platinum Card® and Amex Business Platinum, to the point that it can be overwhelming at first. While there’s a lot more to uncover, the above are the first things I’d do when you get this card in the mail.

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Business Platinum® Card from American Express (Rates & Fees), and American Express Platinum Card® (Rates & Fees).

Lucky USA Amex Platinum card holders. European card holders suffer from the lack of benefits from AE as compared to their USA counterparts.

Presumably a lack of competition in Europe for AE.

Very useful content, Ben, as Amex itself does not provide this guide to its customers. Even though some of the Amex Platinum benefits are gimmicky (the targeted offers feature drives me nuts), there is still a ton of value.

This article perfectly explains why I will stay away from The AMEX coupon book and continue with the Chase Sapphire Reserve and U.S. Bank Altitude Reserve.

Shoprunner is free for all now. No cost. It also has basically no stores of significance.

Saks requires $200 for free shipping now.

Careful on clawbacks of the amex FHR credit if you need to make a change after year's.

Priority pass is such a turd most places.