Link: Maximize Amex Pay With Points flight bookings with The Business Platinum Card® from American Express

There are several excellent cards earning Amex Membership Rewards points. In general I think the best way to redeem these points is to transfer them to Amex’s airline partners, so you can get outsized value for premium redemptions.

That’s not the only option, though. Amex also has the Pay With Points program, which is another popular way to redeem points, which may prove practical for a lot more people. In this post, I want to take a closer look at how that works.

In this post:

What is Amex Pay With Points?

The Amex Pay With Points program essentially lets you directly redeem your points toward purchases. The value is fixed depending on what you’re looking to redeem for, and the value ranges from very bad to potentially pretty decent, if you know what you’re doing.

Just to give some examples of redemption rates you can expect through Amex Pay With Points:

- Amex points can generally be redeemed for 0.6 cents each toward credit card charges

- Amex points can generally be redeemed for 0.5-0.7 cents each toward gift card purchases

- Amex points can generally be redeemed for 0.7-0.85 cents each toward rental car and hotel purchases through Amex Travel

- Amex points can generally be redeemed for 1.0 cents each toward airfare purchases through Amex Travel

As you can see, the value there varies significantly. For context, I value Amex Membership Rewards points at 1.7 cents each, and that’s thanks to the ability to transfer Amex points to partner airlines, where you can book very expensive first & business class tickets at a reasonable cost with points.

I do think there are circumstances where it can make sense to use Amex Pay With Points, but please don’t use points to wipe out charges or for gift cards, because you shouldn’t settle for just 0.7 cents of value per point. Rather the potential value comes from using Amex points toward airfare purchases, as you can do much better than I’ve outlined above.

Using Amex Pay With Points for flights

If you are going to use Amex points as cash toward a purchase, you’ll get the most value using your points toward the cost of flights, since each point can be redeemed for one cent (or more, as I’ll discuss below).

If you’re going to use this option, there are a few general things to be aware of:

- You must book your airline ticket through Amex Travel (even International Airline Program bookings qualify)

- When you book your flight, the full dollar amount of the flight will be charged to your Amex card, and then a corresponding credit will be applied to your account within 48 hours, reflecting that you redeemed points for the purchase

- You can use Amex Pay With Points to partially pay for an airline ticket, though you need to redeem a minimum of 5,000 Amex points

- If you cancel a flight, you’ll receive a statement credit — if you want Amex points returned to your account, you can contact Membership Rewards to have that done

- For all practical purposes Amex Pay With Points bookings are “paid” tickets as far as airlines are concerned, so flights should be eligible for mileage accrual, and should count toward elite status

Get up to 1.54 cents with Amex Pay With Points

If you’re looking to maximize points, getting 1.0 cents of value per Membership Rewards points probably doesn’t sound exciting. But that’s where one of Amex’s premium business cards come in handy.

Specifically, The Business Platinum Card® from American Express (review) offers a 35% rebate on Pay With Points airline bookings. This can get you up to 1.54 cents of value per point toward airfare. Now, there are some things to be aware of:

- This rebate only applies when booking first or business class travel, or economy travel on your designated U.S. airline (you can designate an airline in your Amex account — this is the same as the carrier you designate for your airline fee credit)

- You can pool your Amex points across all cards and redeem at these rates, assuming you have one of the above cards

- With this redemption option, the Amex Business Platinum offers up to one million points in rebates per year

- You need to have the full Amex points for the redemption upfront (based on the rate of one cent per point), and then the 35% points rebate will post to your account within 6-10 weeks

- With the 35% Airline Bonus benefit, you can get up to 1,000,000 points back per calendar year

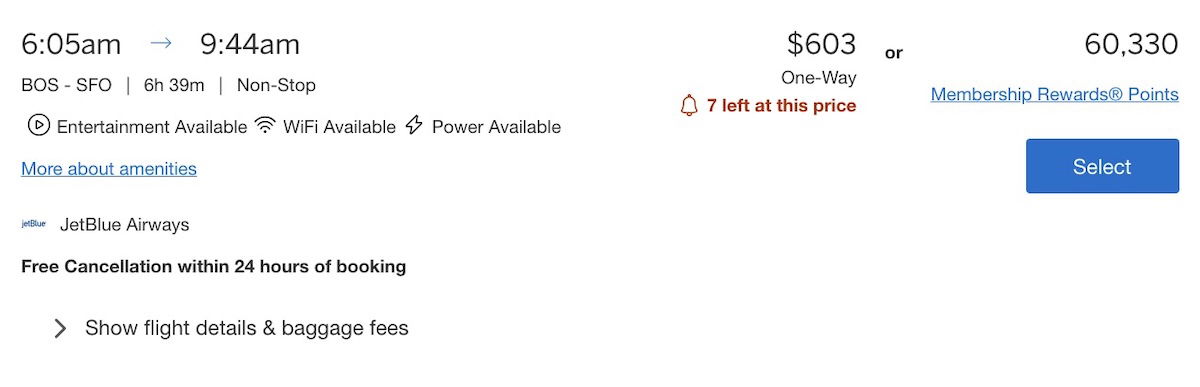

Just to break down the math here, say you want to use Pay With Points for a $603 JetBlue Mint (business class) flight from Boston to San Francisco:

- Regardless of which Amex Membership Rewards points card you have, you’d need to pay 60,330 Amex points for that flight

- If you had the Amex Business Platinum you’d receive a rebate of 21,116 points after the fact, meaning you’d pay 39,214 points in the end

Tip: Stack Amex Pay With Points & Insider Fares

There’s another trick that can get you even more value. Amex has Insider Fares, which are essentially discounted fares on a variety of airlines. The discounts vary, and in some cases they’re substantial, while in other cases there are no savings.

This is available to anyone with an Amex card earning Membership Rewards points, and the Insider Fares will show up as long as you have enough points to cover the entire cost of your ticket. What’s awesome here is that you can stack these opportunities.

In other words, you could get a discounted ticket through the Insider Fares program, and then you could use the 35% Pay With Points rebate on top of that.

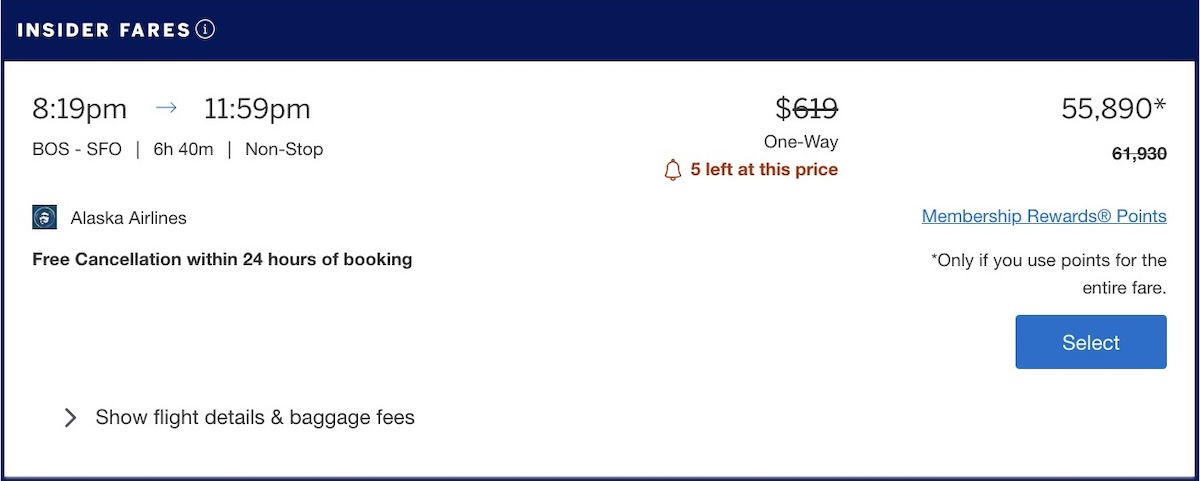

As an example, take an Insider Fare from Boston to San Francisco in Alaska Airlines first class. The standard fare would be $619 (which would require 61,930 Amex points), while the Insider Fare lowers the cost to 55,890 points (the equivalent of $559 worth of airfare).

In addition to the already discounted pricing, if you had the Amex Business Platinum you’d receive a rebate of 19,562 points after the fact, meaning you’d pay 36,328 points in the end.

Redeeming 36,328 points for a flight that would cost $619 is quite a good value, as that’s the equivalent of getting around 1.7 cents of value per mile.

Is Amex Pay With Points for flights worth it?

There’s often a tough balance between maximizing your rewards points for the best value, and just using them for what’s practical. So while there’s no “one size fits all” answer as to whether or not Pay With Points is worth it, here are some general thoughts:

- Please don’t redeem your Amex points for less than a penny each toward statement credits, gift cards, etc., because that’s a terrible use of points

- Personally I’d try to avoid redeeming Amex points for one cent each toward airfare, since that’s still on the very low end of Amex points redemptions

- Amex Pay With Points can be a good deal with The Business Platinum Card® from American Express, as you can get 1.54 cents of value per point

- If you’re going to make a Pay With Points redemption, it could be worth picking up the Amex Business Platinum just for that, since all your points will suddenly get that higher value

- Pay With Points can become a better value if you can book an Insider Fare, or if you’re going for elite status, and value the elite miles you’re getting by booking a “paid” ticket compared to an award ticket

- Pay With Points can be a great option in situations where award availability is tough to come by, but paid fares are good; for example, business class flights to Hawaii are often expensive when redeeming points, but reasonable in cash, making Pay With Points a great option

I can’t emphasize enough that this is an especially popular redemption option with those chasing status, since these Amex Pay With Points flights are considered the same as any other paid fare when it comes to elite status qualification.

Bottom line

Amex Pay With Points allows you to redeem points at a fixed rate toward a variety of purchases. The best value comes with using Pay With Points for flights, since you’ll get a minimum of one cent of value per point.

Amex Pay With Points for flights starts to really become valuable if you have The Business Platinum Card® from American Express, in which case you can get a 35% rebate on these bookings, getting you up to 1.54 cents of value per point.

Personally I still typically prefer to transfer my Amex points to travel partners for first & business class award redemptions, but for some people this could be worthwhile, and I’ve certainly been increasingly using this option in recent times.

To those with Amex points, how do you feel about the Pay With Points program? Have you ever used it for flights?

Maybe I don’t fully understand this, but my biggest issue with this has been that the base rate of these fares is non refundable. In order to purchase the refundable option, it is almost universally more expensive than booking with the airline directly (even with the 35%) discount. I’ve done it in a pinch, but it feels like a bad value. Question- if I book with points, are the points refundable regardless of whether I...

Maybe I don’t fully understand this, but my biggest issue with this has been that the base rate of these fares is non refundable. In order to purchase the refundable option, it is almost universally more expensive than booking with the airline directly (even with the 35%) discount. I’ve done it in a pinch, but it feels like a bad value. Question- if I book with points, are the points refundable regardless of whether I book the more expensive “refundable” option? Are only the cash fares nonrefundable?

I’ve used it with the Business Platinum when the points cost was sky high and I would rather spend the Amex points than money.

By all means check whether Amex travel offers the same price as booking direct. In one case it was cheaper.

Personally I’d never use it at one cent per point. But I would if I were in the situation where the choice was get a penny a point or miss out on an experience I really wanted.

The problem I have had with the paying with points through the Amex travel center is the dollar cost of the ticket is much more than I can get through the airline direct or through Chase's travel center so it is not usually the best use of points. I often wait until there is a bonus for Amex partners that I will use soon in order to transfer at the best value.

It makes no sense to ever pay with points; just pay as normal, then use statement credit. That way you still get the points on whatever you paid, right? Am I missing something?

I tend to only use points in combination with my annual travel credit to purchase flight tickets.

Chase Sapphire Reserve offers 1.5 cents with portal bookings as well for those that don’t want to get the business card. I have the Biz Platinum but its just another set of credits I have to deal with.

Also worth noting the Centurion offers 50% MR points back up to 3 million per year (i think its 3?).

The business version only. That being said, any points-conscious person who truly understands how either Centurion card works would never want it. A friend had both. I walked her through the value proposition and economics. She cancelled both.

@Ben,

You should also consider the value of the earned airline points you get when booking this way. That makes the math a little more favorable toward MR points redemptions.

True, but if you were to instead buy the ticket outright on your platinum card you'd get 5 Amex points per dollar so that comes into the equation depending on who I'm flying and what my alternatives are. Like if I'm flying United I'm going to get 9 United points per dollar as a Platinum member, but miss out on 5 Amex points.

Because the airline sees the booking as a cash ticket, you will earn airline points. Depending on the airline and your tier status, Amex Business Platinum pay-with-points can have an effective yield of 1.7 to 2 cents per point. Then, factor in Insider Fares.

Then, you need to ask what the value of your points would be if you transferred them to an airline. If transferring is better, you might want to just pay cash for the ticket.

Two problems - at least for me - with trying to use the Biz Plat 35% points discount:

1) Amex Travel doesn't always show every available flight option, so you often end up paying more for a ticket than you would directly with the airline in order to get 35% back.

2) If you have to cancel, the resultant travel credit also has to be booked through Amex Travel, which again leads to often...

Two problems - at least for me - with trying to use the Biz Plat 35% points discount:

1) Amex Travel doesn't always show every available flight option, so you often end up paying more for a ticket than you would directly with the airline in order to get 35% back.

2) If you have to cancel, the resultant travel credit also has to be booked through Amex Travel, which again leads to often paying more for your reissued ticket than you would through the airline. (if your ticket is on United, that airline will allow you to transfer an Amex credit back to them for a $50 fee). And as nice as the Amex Travel folks are over the phone, their reissue process often has to be done with a way-too-long phone call rather than online

Being very new to the points game, compounded by residing on the ‘right side of the pond’ …. this jury is definitely still out.

Due to limited options here, I am persevering with AMEX, unconvinced.

Perhaps there is some mileage in requesting the help of those who ‘might know’ share their experience?