Miles Aren’t Free: How To Value Your Redemptions

Miles Aren’t Free: How To Value What You Earn

Miles Aren’t Free: Establishing An Overall Value

Figuring out how to value frequent flyer miles is tricky business. Most people have a vague concept of what a mile is worth to them, but if you press them on it, they don’t really know how they arrived at that number. Worse yet, if you start to question them about how they earn or redeem miles, their past behavior is likely to tell a very different story.

In Part 1 of this series, I showed how to calculate the redemption value for your award tickets so that you can start to think about what your redemption behavior says about how you value a mile.

- If you redeem 25,000 miles for a $500 domestic economy ticket, you redeemed your miles at 2 cents per mile (CPM)

- If you redeem 100,000 miles for a $4,000 international business class ticket, you would have gotten 4 CPM

- Neither of those redemptions is right or wrong, but they do tell us something about how you value miles.

If you are willing to accept a 2 CPM redemption, then that must be the upper bound on your personal mileage valuation. Simply put, if you valued your miles higher than that, you wouldn’t have redeemed that award and would have chosen to pay cash instead. But it could be lower than that. We just don’t know yet.

Now we need to think about establishing a lower bound. To do that, we’ll look at the money and time you invest to acquire miles. But first we have to get past the notion that you got the miles for free.

Miles Are Not Free

It is a commonly held belief that miles and points are free to obtain.

Some people think that the airline, the credit card, or maybe even some shopping portal just gave them the miles, so therefore they don’t come with a cost.

Truth be told, this is probably what leads to sub-par award redemptions. It’s like asking if money grew on trees, would you spend it differently? I say, hell yeah!

There are many ways to earn miles. Let’s talk about the most common ones and the costs associated with each.

Purchasing Miles

Most airlines will flat out sell you miles. The rates can vary all over the place depending upon how and when you buy them, even from the same airline. Much of the time the rates are quite high, meaning that it’s not a very good deal, but sometimes it does make sense to buy miles. In fact, Ben has stated that he books some of his international first class trips using miles that he purchased during sales or promotions.

One such example is Avianca Lifemiles. This obscure frequent flyer program frequently runs sales, where it is possible to buy miles around 1.35 cents each. If you buy them at that rate then you darn well better value them at greater than that. (I am in no way suggesting that you should buy Lifemiles unless you are an expert. There is a lot of value to be had, and also the guarantee of chance for total frustration.)

This was an easy example to start with because you actually end up with a receipt that shows how many miles you bought and how much you spent for them. So clearly they had a cost and calculating the CPM is easy. But let’s face it, most people don’t buy miles, so let’s move on.

Mileage Running

Mileage running is the act of flying solely to earn miles, and was once the cornerstone of the miles and points universe. I recently claimed that mileage running is more or less dead. And now I’m telling you that mileage running is a way to acquire miles. What gives here?

Well, there is one exception. If you find a great mistake fare and can credit those flights to a frequent flyer program that still awards miles based on distance flown as opposed to dollars spent, then you can still mileage run. Unfortunately, the big three US airlines, Delta, United and American have all switched to such a revenue-based scheme now. So, the concept of mileage running is becoming harder and harder.

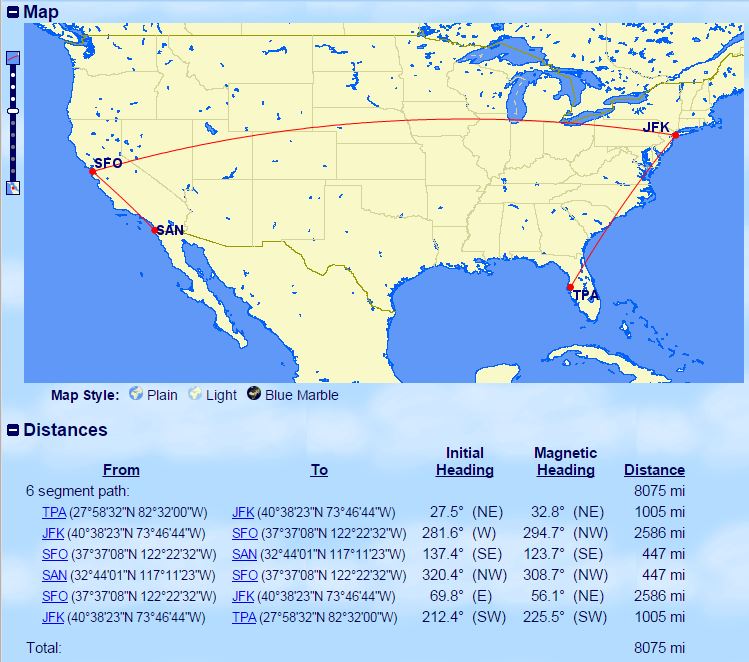

Perhaps the most mileage runnable fare of the past few years occurred this past spring, when American still awarded redeemable miles based on distance flown. American inadvertently sold round-trip business class tickets from Washington, DC to China for $450. Our very own Ben actually did this trip three times, flying back-to-back-to-back trips, mostly for the miles. As an American Executive Platinum member, he earned 49,815 miles for each trip.

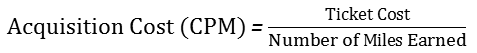

We can easily calculate the cost he paid per mile in a similar way that we calculated redemption value back in Part 1.

He effectively paid 0.9 cents per mile that he earned.

It’s worth noting that this omits all of the other value he received from the trip such as re-qualifying for another year of American Executive Platinum status. I would also say that it leaves out other costs of the trip such as the value of his time, but at least for Ben, mileage runs provide entertainment so we could probably argue that that’s a benefit, not a cost.

At any rate, for this analysis I’m assuming that he flew these trips solely to earn the miles, which gives a rate of 0.9 CPM. That means he must value American miles at more than 0.9 CPM. But most people don’t mileage run either.

Credit Card Spending

Credit cards are probably the most popular way to earn miles these days. Most of us have at least one or two dozen mileage earning credit cards in our wallet at all times. Every time we swipe those cards, we earn miles. Since we didn’t do any work to obtain — I mean, we gotta buy milk and toilet paper somehow — it might seem like they are free. Well, they aren’t.

The reality is that you had a choice as to whether to use that mileage earning credit card or a card that could have paid you cash-back. And those cards have actually gotten quite lucrative lately with some of them rebating up to 2% of our purchases. In cash. Which I hear is king.

So all those miles you’ve been earning by paying with a credit card? Yup, you could have been getting 2% cash-back instead.

That’s like saying that when you bought that new washing machine last week for $500, the salesman offered you a check for $10 or 500 American miles. You looked him in the eye and told him you wanted the miles. Therefore you paid $10 for those 500 miles, meaning you bought them at 2 cents each.

Now before you get all in a huff or say that we’re being inconsistent around here at OMAAT in terms of how we promote credit cards, there are definitely some caveats around this. Specifically, I’m ignoring the sign-up bonus which is often huge and can easily make mileage credit cards more lucrative, at least until the minimum spend is met.

I’m also ignoring category bonuses which can offer up to 5x the rewards — instead of earning one mile per dollar, they might offer five miles per dollar at certain types of stores. Clearly, those can tip the scales back toward mileage earning credit cards.

But let’s keep it simple and assume that regular everyday credit card spend is like buying miles at 2 cents each.

Doing Stupid Stuff

Last week I wrote about how MyPoints is offering 750 miles for opening an account. It literally took about a minute. Are those miles free? Well, it did take you a minute, right?

If you value your time at $60 per hour — hey, I like easy math — then that minute of work costs you $1. And therefore the 750 miles you received were acquired at a cost of 0.1 cent. See, I told you this was a good deal.

Truth be told, there are lots of stupid ways to earn miles, some more or less stupid than others. Personally, I put shopping portals into this category, which I know could get me fired around here for blasphemy. But hear me out.

I don’t actually spend that much money, partially because I’m cheap, but more so because my wife does most of the shopping in our household. (And trust me, I’ve learned that it’s best not to micromanage that process.) Sometimes we shop through a portal, but sometimes we forget. The point is that it takes a wee bit of time, which means those miles aren’t quite free either.

Normal Flying

It’s sort of indicative of the state of the game that I’ve included this at the bottom of the list, almost as an afterthought. The reality is that the majority of miles these days are not earned through flying.

It’s true that a few high value flyers are making bank right now under Delta, American and United’s revenue-based earning scheme, racking up as much as 75,000 miles per ticket for paid premium cabin travel. But those folks are the exception to the rule, the 1%-ers of the flying world.

And they are probably doing it with other people’s money.

In general, I think it’s tricky to put an acquisition cost on miles earned from normal flying. If you were absolutely going to take that flight anyway regardless of whether you earned miles or not, then perhaps they really were free. If you travel for business and your employer is paying for the travel, they may be free as well.

Then again what if you have a choice when spending your own money.

Maybe you have a choice between flying American and flying Spirit to get where you want to go. Now imagine that everything else is equal, the flight time, the number of stops, the seat, the experience, you name it. (I can barely force myself to type that, but let’s play along.) The only difference is that in one case you earn 3,000 American miles and in the other you earn Spirit miles, which let’s treat as worthless for this analysis.

If the ticket on American costs $150 more than the one on Spirit costs $100, then you essentially paid $50 to earn 3,000 miles. Then using our trusty equation for acquisition cost we can calculate that you paid 1.67 cents for each of those miles.

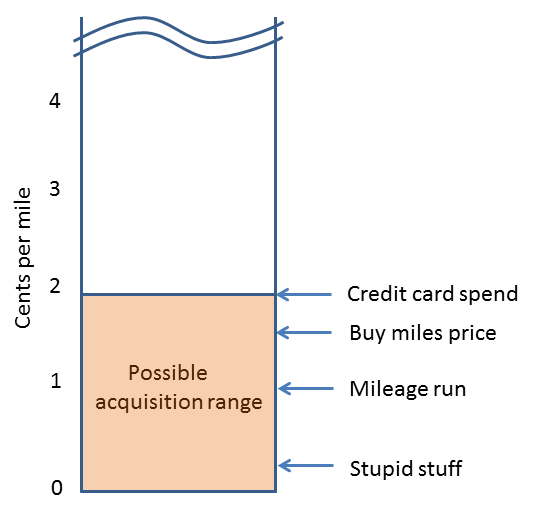

What it looks like..

We can also plot the various costs of acquiring miles just like we did redemption values. Although the graph sort of doesn’t have an upper bound because you can sometimes get some crazy high redemption values, the lower bound is 0 because nobody pays you to take miles. At least not normally.

Interestingly, the most expensive miles in your frequent flyer account may have come from credit card spending — miles you probably thought were free. Bet you didn’t see that coming.

Notice how I never asked you for your valuation of a miles in constructing this graph. Instead, I asked you (or at least imagined asking you) for your earning and spending behavior. As they say, actions speak louder than words.

Bottom Line

Thinking about how much time and money you put into earning miles can give you a lower bound on how you value them — you clearly value them at more than your paid to acquire them, or you wouldn’t have acquired them in the first place.

For many of us, the most expensive miles in our frequent flyer accounts came from spending on our credit cards since we made a choice — conscious or otherwise — to forgo spending on a cashback card in order to earn them. And since your mileage account is one big homogeneous bucket, the highest price you are willing to pay for one of them must set the lower bound on your valuation for all of them.

Next up, I’ll combine what we learned about the price we pay to earn miles in this post with our redemption valuations in the last post to see if we are behaving rationally.

How much will you pay to acquire a mile?

@Mauro

Ciao, va bene?

Yes, you are "almost" correct. But you now could add how much miles you earn with the ticket you buy, doing this equation:

50.000 miles = 680 € – 225 € – (miles earned with paid ticket) = ??? € CPM

But if miles are about to expire, and you have no option to renew the expiration date (I don't know the policy of Flying Blue), just burn the miles!

Enore

Very interesting, thank you!

I have a question: I'm considering to redeem 50.000 Flying Blue miles for an economy flight Rome to Cancun. The flight ticket in economy is 680 €. Using miles it costs 50.000 miles + 225 € for airport and security taxes.

In my opinion, I should deduct the taxes amount from the sum to have a correct idea of the CPM:

50.000 miles = 680 € - 225 € = 455 € CPM = 455 € / 50.000 miles = 0.0091 CPM

Am I correct?

@Echino - It shouldn't really matter what you're willing to pay for something to determine the CPP. If I offer you enough cash back at 2% to get a Chevy Malibu or enough miles to get a Porsche are you going to tell me the value of the Porsche is whatever you would have spent on the Chevy, since you would have never actually spent the money on the Porsche? No, of course not. You'd...

@Echino - It shouldn't really matter what you're willing to pay for something to determine the CPP. If I offer you enough cash back at 2% to get a Chevy Malibu or enough miles to get a Porsche are you going to tell me the value of the Porsche is whatever you would have spent on the Chevy, since you would have never actually spent the money on the Porsche? No, of course not. You'd take the Porsche and say "That's amazing I could have had a Malibu, but instead I got this awesome Porsche that I would have never been able/willing to pay for.

Dee - i am not sure where you got "it provides some ammo against those who prefer the cash-back cards" from in the post. if anything, there is encouragement to use a 2% cash back card.

BEAUTIFULLY written and a much needed article! Most folks talk about “traveling for free” but this is not the truth. I need to share this with others that I have been trying to educate on how to travel for less. Plus, it provides some ammo against those who prefer the cash-back cards. If people put the math to it, you make more money with the airline miles than the cash-backs depending on how you use it. Education is the key – thanks once again!

I don't think they disagree with you mbh, it's just that the ¢pm for signup bonuses is SO lucrative that it's just implied. Take Chuck's example, 53k AA miles for $3000 in spend means I've foregone $60 cashback to earn those miles. At an acquisition cost of only 0.1 ¢pm, it's barely worth mentioning.

If you play this game correctly, you're either always earning a signup bonus, a category bonus, or an annual bonus.

I still think some of you are still missing the point. If you live on sign up bonuses, and meet the min. spend (let's say an average of 2k/month), you are GIVING UP the chance to earn $40. So, it's free in that it didn't cost you anything out of pocket, but you gave up the possibility of making cash for exactly the same amount of effort. That's a cost, in my book. (I still do it, but I'm measuring what I do with my miles against that .02 standard at every step.)

Andrew -- I'm glad you got something out of it. Thanks for the feedback!

I've made plenty of 25,000 mile redemptions that offset $500 of real money that was about to come out of my pocket. Nothing wrong with that either.

@TRAVIS - good article. I think it would have been great it would have paraphrased that if one would 'liked to travel as IF they were spending 4,000$, then the CPM value really stands out"..

Most ordinary folks would not spend $4k on a ticket, but can be convinced to have the mind set to use miles where it is most valuable, which is what Ben has been trying to drive the point home.

@TRAVIS - good article. I think it would have been great it would have paraphrased that if one would 'liked to travel as IF they were spending 4,000$, then the CPM value really stands out"..

Most ordinary folks would not spend $4k on a ticket, but can be convinced to have the mind set to use miles where it is most valuable, which is what Ben has been trying to drive the point home.

At the end of the day, there will always be people who will be delighted to continuously redeem miles for $500 tickets because that's value for them, while there is that 1% like Ben who love to live in the clouds literally, and show people the way, if they choose too.. nothing wrong in either option, just personal comfort zones.

On a personal note, I used to be that person who used to redeem miles for 500$ tickets, till 2014. I now look to see how I can ENJOY travel with the best utilization of miles using all the strategies that are being presented to me.

So thank you Travis , Ben , Tiffany for showing the way !

Andrew F

Unless you're freelancing or retired, mileage run miles will be the most expensive one. The calculation failed to account for the opportunity cost of time spent (hundreds of dollars in salary lost per day, inconvenience for other family members...)

That is the reason most people don't do mileage runs even if they know how to.

I like the economics analysis, but the whole concept of value to each individual kind of messes up the objectivity of the valuation. @echino, there is a market value that is clearly established for these flights and what you would pay for them is only relevant to that value to the extent that you control that market price (which is effectively nil). I will repeat an analogy that has been written elsewhere. If somebody is...

I like the economics analysis, but the whole concept of value to each individual kind of messes up the objectivity of the valuation. @echino, there is a market value that is clearly established for these flights and what you would pay for them is only relevant to that value to the extent that you control that market price (which is effectively nil). I will repeat an analogy that has been written elsewhere. If somebody is going to give you a $100k Mercedes, but you would never buy a $100k Mercedes, you would only buy a $2K used Chevy, it doesn't make the $100K Mercedes worth $2K. The value of the Mercedes (or the business or first class ticket) has already been established by the market. Being objective, in economics, that is the only value that can be used. Only you can decide whether 100,000 miles is a good price for a business class ticket or 50,000 is a better price for an economy ticket, but once you buy it, the market value you got for your redemption is the same for everybody.

@TheRewardBoss has it exactly right, unless you can go big on MS (say $10-20k per month), the average person is better off just signing up for 3-4 cards every quarter and perpetually be spending to meet sign up bonuses. If you spend more than that, spend as much as you can in bonus categories and put the rest of the spending towards the signup bonuses.

I use CPM just to determine how good of a...

@TheRewardBoss has it exactly right, unless you can go big on MS (say $10-20k per month), the average person is better off just signing up for 3-4 cards every quarter and perpetually be spending to meet sign up bonuses. If you spend more than that, spend as much as you can in bonus categories and put the rest of the spending towards the signup bonuses.

I use CPM just to determine how good of a redemption it is knowing that if I get a bad CPM, I could have used the miles on a better redemption. CPM on redemption has almost nothing to do with my cost of earning miles.

Miles ARE almost free if you get them via credit card signup bonuses, by far the most lucrative method but not mentioned in this post. For example, 50,000 AAdvantage miles for getting a Citi credit card and spending $3000 and then canceling; it doesn't get much better than that. And you don't necessarily have to wait 18 months between applications.

Earning miles by buying stuff, or flying...how retro.

Thanks Marc. Glad you enjoyed it.

Echino -- wasn't really saying that it's the retail price that determines CPM. If you read the previous post, I go into detail about that topic, and how it only matters what you would pay for it. I'm with you -- I won't buy business class (unless it's a mistake), so those lofty CPM's are just eye candy to me. Sounds like you have a really good handle on what a mile is worth to you, which is great.

Nice post.

Echino, you're confusing cost and value. The "cost" is actually something like $60, assuming a $3K minimum spending requirement for the miles and that you have a 2% cash back card. You do have one of those, right? Just because one low-level use results in a $250 value (one cent) doesn't somehow magically add an additional, or any, "cost" to a higher-value use, such as an airfare redemption (maybe two cents?).

Excellent post as always and agreed with your take that that pts earned from normal credit card spend comes at (an opportunity) cost of 2c per pt. However, you note above "I’m ignoring the sign-up bonus which is often huge and can easily make mileage credit cards more lucrative." Wouldn't you agree that the sign-up bonus is the single biggest aspect of point-earning that you would be ignoring?

I can't recall the specific post,...

Excellent post as always and agreed with your take that that pts earned from normal credit card spend comes at (an opportunity) cost of 2c per pt. However, you note above "I’m ignoring the sign-up bonus which is often huge and can easily make mileage credit cards more lucrative." Wouldn't you agree that the sign-up bonus is the single biggest aspect of point-earning that you would be ignoring?

I can't recall the specific post, but I believe you had mentioned that you typically sign up for 2-3 credit cards per month. With typical minimum spends >$3,000 each, it would always be a constant monthly cycle of hitting minimum spends on new cards instead of putting spend on existing cards.

That said, I wouldn't agree that I am paying 2c per pt since I am constantly hitting minimum spends on new cards. I would argue that most of the time, I am paying $0.001 per pt (e.g. earn 53k AA miles after $3k spend on new citi aa signup, opportunity cost @ 2% = $60. 53k / $60 = $0.001). I would suspect there are more readers out there that fit our shoes than that of conservative Joe putting all spend on his citi double cash back card.

Now, for the cost of obtaining miles, I get most of my miles via credit card signup bonuses. Those are truly free to obtain. However, it does not mean the miles are free. There is an opportunity cost. I got 25,000 free Amex MR points on credit card signup, but I could use those 25,000 points to offset $250 of my Amex bill ("tripflex pay with points"). So the miles really cost me a minimum of 1.0 CPM, they are not free.

"If you redeem 100,000 miles for a $4,000 international business class ticket, you would have gotten 4 CPM"

Not really. You touched on that in your previous post, but here it is: I am never going to pay $4,000 for a ticket. If I have to pay cash, I would buy a $1,000 economy ticket instead. I would maybe pay $500 max for an upgrade to business class. I know nobody is selling upgrades for...

"If you redeem 100,000 miles for a $4,000 international business class ticket, you would have gotten 4 CPM"

Not really. You touched on that in your previous post, but here it is: I am never going to pay $4,000 for a ticket. If I have to pay cash, I would buy a $1,000 economy ticket instead. I would maybe pay $500 max for an upgrade to business class. I know nobody is selling upgrades for so low, but the fact is I would never pay more. So for me, the value of 100,000 miles international business class ticket is really $1,500, at most. That is 1.5 CPM. Again, this is my personal valuation, and it will be different for others, especially those who are, in real life, willing to pay more of their own cash (not employer's) for business class tickets.

I like your writing Travis! Great analysis!