Link: Apply now for The New United Quest℠ Card

Chase and United Airlines have a co-brand credit card agreement for both personal and small business cards, which has recently been completely overhauled. The New United Quest℠ Card is a unique card in the portfolio, and I’d argue that it’s potentially the all-around most lucrative. In this post, I want to take an in-depth look at the card, especially with all of the changes that we’ve seen.

In this post:

United Quest Card Basics For May 2025

The United Quest Card is incredibly well-rounded, and while the card has an annual fee, it should be easy to justify based on the extensive perks. Let’s take a look at the welcome bonus, rewards structure, and more.

United Quest Card Bonus Of 70,000 Miles

The United Quest Card is offering a welcome bonus of 70,000 MileagePlus bonus miles plus 500 PQPs after spending $4,000 within the first three months. This is a solid welcome bonus — I value MileagePlus miles at ~1.1 cents each, so to me, those miles are worth ~$770.

Note that you’re eligible for this offer even if you have other United co-brand credit cards. The only people who aren’t eligible for the United Quest Card are those who currently have the card, or those who have received a new cardmember bonus on the card in the past 24 months. The typical Chase application rules apply, including the 5/24 rule (though that’s not consistently enforced anymore).

United Quest Card $350 Annual Fee

The United Quest Card has a $350 annual fee, and there’s no cost to add additional authorized users. For some context as to how that fits into United’s co-brand personal card portfolio:

- The New United Gateway℠ Card (review) has no annual fee

- The New United℠ Explorer Card (review) has a $150 annual fee, waived the first year

- The New United Club℠ Card (review) has a $695 annual fee

As you can see, the United Quest Card has the second highest annual fee, though I’d argue it also has the annual fee that’s easiest to recuperate consistently, thanks to the perks, which I’ll cover below.

United Quest Card Rewards Structure

The United Quest Card has no foreign transaction fees and offers the following return on spending:

- Earn 3x miles on United purchases

- Earn 2x miles on all travel, dining, and select streaming purchases

- Earn 1x miles on all other purchases

While other cards are compelling in the travel and dining categories, those are some of the broadest bonus categories I’ve seen on a co-branded airline credit card.

Earn MileagePlus PQPs Toward Status For Spending

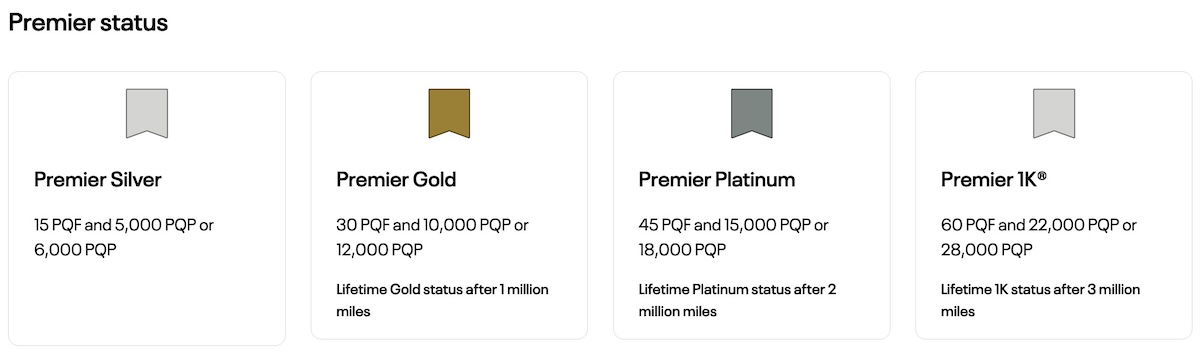

If you want to earn elite status with United MileagePlus, the United Quest Card can help. As a reminder, below are the MileagePlus elite requirements for 2025, with Premier Qualifying Points (PQPs) being one of the primary metrics.

So, how does spending on the card count toward status? The card offers one PQP for every $20 spent on purchases, up to a maximum of 18,000 PQPs per year. That’s pretty good, though if you’re serious about spending on United cards to earn elite status, consider United Club Card (review), which offers one PQP per $15 spent, up to 28,000 PQPs per year.

Valuable Purchase & Travel Protection

One of the perks many people look for in credit cards is good protection for purchases. The United Quest Card has some great coverage in that regard. While you’ll want to consult the card benefits guide, the United Quest Card offers perks like:

- Trip cancelation & interruption insurance

- Trip delay reimbursement

- Baggage delay insurance

- Lost luggage reimbursement

- Auto rental collision damage waiver

- Purchase protection

- Extended warranty protection

United Quest Card Benefits & Perks

Airline co-branded credit cards are primarily about the perks, and the United Quest Card most definitely doesn’t disappoint. Let’s go over the card’s perks, starting with the perks that I find to be most compelling, and which will most quickly justify the annual fee.

$200 United TravelBank Cash Annually

The United Quest Card offers $200 in United TravelBank cash annually, including the year in which you open the account. This should be worth close to face value to anyone who considers this card. Qualifying purchases with TravelBank cash include airline tickets, for travel on United and United Express, so that should be easy to maximize.

Anniversary Award Flight Credits (Up To 10,000 Miles)

The United Quest Card offers an anniversary award flight credit of up to 10,000 MileagePlus miles:

- Automatically receive up to 10,000 miles back in your MileagePlus account after taking an award flight booked with your miles

- The award itinerary must include at least one United-operated flight and must include the primary cardmember on the reservation

- These miles will be deposited in your account within four weeks of each cardmember anniversary

If you redeem miles on United with any frequency, that should get you 10,000 miles yearly. Between that and the $200 annual United credit, I’d argue the annual fee is nearly offset.

Note that you can earn a second award flight credit if you spend $20,000 on the card in a calendar year. That can nicely contribute toward the value proposition of spending on the card.

Up To $180 In Instacart Credits Annually

The United Quest Card offers up to $15 in Instacart credits monthly, up to $180 total each calendar year. This comes in the form of a monthly $10 credit and a monthly $5 credit. This applies for purchases made through Instacart with your United Quest Card, and currently the benefit is valid through December 31, 2027.

If you use Instacart anyway, then this could be worth close to face value. For others, the small increments of the credits will make it hard to get much value.

Up To $150 In JSX Flight Credits Annually

The United Quest Card offers up to $150 back on JSX flight purchases per anniversary year. This comes in the form of a statement credit, and you must use your United Quest Card to make the purchase. JSX is a hop-on jet service, which United owns a stake in. If you fly JSX with any frequency, then this is a great perk.

Up To $150 In Renowned Hotels and Resorts Credits Annually

The United Quest Card offers up to $150 in statement credits each anniversary year for hotel purchases, when you prepay directly through Renowned Hotels and Resorts with your United Quest Card. This is essentially United’s hotel booking platform for select luxury hotels. You can receive extra perks for booking this way, though admittedly there’s also sometimes an opportunity cost to booking this way.

Up To $100 In Credits On Rideshare Purchases Annually

The United Quest Card offers up to $8 back per month on rideshare purchases ($12 in December), in the form of a statement credit, when paying with your card. This allows you to earn up to $100 in statement credits every calendar year, and an annual opt-in is required.

On the one hand, these statement credits are easy enough to use. The catch is that there are probably better cards for rideshare spending in terms of maximizing rewards.

TSA PreCheck Global Entry, Or NEXUS Fee Credit

The United Quest Card offers a Global Entry, TSA PreCheck, or NEXUS credit every four years. Simply charge the enrollment fee to your card, and it will automatically be reimbursed.

Nowadays, quite a few credit cards offer these fee credits, so you can always use this benefit for a friend or family member. They just have to use your credit card to pay, and you’ll automatically receive the statement credit.

Free First & Second Checked Bags

If you ever check bags, having the United Quest Card can get you a free first and second checked bag for you and one companion on the same reservation. The primary cardmember just needs to pay for the ticket with their card and be one of the travelers.

Priority Boarding

As the primary cardmember on the United Quest Card, you can receive priority boarding for you and your companions on the same reservation for United-operated flights. Many people want to board early to be able to secure overhead bin space, so this is a perk that I know many cardmembers value.

25% Savings On Inflight Purchases

You can save 25% on inflight purchases on United if you have the United Quest Card. This will come in the form of an account statement credit, and applies for purchases of beverages, food, and Wi-Fi.

Is The United Quest Card Worth It?

I think the United Quest Card is United’s best value credit card for someone who flies United at least a few times per year and redeems miles sometimes as well.

While the card has a $350 annual fee, the $200 annual United TravelBank cash should lower the “real” annual cost to $150. Then if you redeem 10,000 miles for United-operated flights each year, you’re getting 10,000 additional miles.

At that point, you’ve already close to recouping the card’s annual fee, and that doesn’t account for perks like up to hundreds of dollars in credits (admittedly it takes some effort to maximize them), free checked bags, savings on inflight purchases, and much more. On top of that, there’s the card’s excellent welcome bonus, which gets you a lot of value shortly after getting the card.

So yeah, I think this card is worth it, but how does the value proposition compare to United’s most popular credit card?

United Quest Card Vs. United Explorer Card

Many people may be trying to decide between the United Quest Card and the United Explorer Card (review). I think the United Quest Card is the better choice, but let me provide a quick comparison.

The advantages of the United Explorer Card are the following:

- The United Explorer Card has a $0 introductory annual fee for the first year, then $150, compared to a $350 annual fee on the United Quest Card

- The United Explorer Card offers two United Club passes annually

However, virtually everything else about the United Quest Card is either equal or significantly better:

- The United Quest Card offers an annual $200 United TravelBank cash benefit, which the United Explorer Card doesn’t offer, and that should be worth face value to most

- The United Quest Card offers up to 10,000 MileagePlus miles back each year on award redemptions, which the United Explorer Card doesn’t offer (at least without a spending requirement)

- The United Quest Card offers two checked bags free, while the United Explorer Card offers only one checked bag free

- The United Quest Card offers larger credits, including with rideshares, JSX, Instacart, hotels, and more

In the long run, the United Quest Card is more compelling because of the additional perks that should help offset the annual fee for a vast majority of savvy consumers.

The only consumer who should consider the United Explorer Card is someone who values the United Club passes but doesn’t redeem miles at least once per year for United-operated flights.

Bottom Line

The United Quest Card is arguably the most compelling card in the Chase and United lineup. While the $350 annual fee sounds high, the $200 annual United TravelBank cash, plus the 10,000 miles you can earn when redeeming miles, should help offset the annual fee. Then you’re left with lots of other great benefits, including up to hundreds of dollars in credits.

If you’re looking for a United card with strong perks and an annual fee that’s easy to justify, this is the card to consider.

If you want to learn more about the United Quest Card or want to apply, follow this link.

If I currently have the card, cancel it, and apply for a new one before the deadline - if I'm approved would I qualify for the new bonus (I originally opened this card 3-4 years ago). Thanks!

By the rules, yes. Only criteria are you cannot be a current cardmember, and you cannot have earned a bonus in the past 24 months. There's definitely a possibility though that your new application will be denied if you cancel and immediately apply again, as that will stick out to the credit card company as somebody trying to game the system. If you currently are getting value out of the card, I wouldn't risk it....

By the rules, yes. Only criteria are you cannot be a current cardmember, and you cannot have earned a bonus in the past 24 months. There's definitely a possibility though that your new application will be denied if you cancel and immediately apply again, as that will stick out to the credit card company as somebody trying to game the system. If you currently are getting value out of the card, I wouldn't risk it. And if you do cancel, I'd probably forget about taking advantage of this offer and wait at least a year or two until the next increased bonus is offered.

Could you tell me what I need to "do" to get these? My understanding is:

- travel bank credit: do nothing, automatically arrives in United travel bank

- 10k miles "discount" - Is really a rebate like before, not sure why they changed it to "discount." But I just need to book an award flight and it will credit back the way the 5k ones do now?

- Ride share - Need...

Could you tell me what I need to "do" to get these? My understanding is:

- travel bank credit: do nothing, automatically arrives in United travel bank

- 10k miles "discount" - Is really a rebate like before, not sure why they changed it to "discount." But I just need to book an award flight and it will credit back the way the 5k ones do now?

- Ride share - Need to "activate" it in the chase mobile app, then add the quest as one of my payment methods in uber?

Is this all correct? I get a little exhausted doing all this stuff for each card.

@ Daniel -- You're correct about the TravelBank credit and rideshare credit. The 10,000 mile discount seems to be a voucher that'll be deposited in MileagePlus accounts, and can then be redeemed.

Thanks for answering, Lucky. But it's too many coupons. Especially if the mileage rebate is just another coupon that I will forget to use.

Seems like the entire business model of these cc's is changing to monthly/quarterly credits that are fairly difficult to redeem, and that way they can count on breakage. Sigh.