Yesterday I wrote about the massive changes that United is making to the MileagePlus program for travel as of November 15, 2019.

Essentially they’re following Delta’s lead, as they completely abolish award charts and no longer have a minimum or maximum number of miles that they’ll charge for a given itinerary.

For me the whole point of accruing airline miles is to redeem for aspirational travel. Otherwise I’d just earn cash back, which gives you much more flexibility.

So in light of yesterday’s announcement, I wanted to share my initial thoughts, in no particular order:

How United describes these changes

First of all, now that United has officially communicated these changes to members, it’s interesting to note how they’re describing them. In FAQs about the changes, United answers the question of why they’re making these changes as follows:

Increasing award travel prices for the most in-demand flights lets us offer lower prices on other flights. If your award travel is flexible, these updates will help you make the most of your miles.

I wouldn’t exactly call their logic sound:

- “Increasing award travel prices for the most in-demand flights lets us offer lower prices on other flights.” No, not really — in reality they’re offering lower prices on other flights because they’d cost less if paying cash, and this is something they’ve already started doing.

- “If your award travel is flexible, these updates will help you make the most of your miles.” Yes, I mean I suppose by raising the cost of some award flights by an outrageous amount, you can “make the most of your miles” by being flexible and booking on other flights.

On the plus side, I commend United for not trying to completely spin this as a positive. They don’t acknowledge how bad the changes are, but still, airlines love to spin everything as a positive.

“Great news! Based on customer feedback we’re eliminating legroom making our seats cozier and cutting free food & drinks helping you achieve your summer bod!”

Nonetheless some readers are actually interpreting these changes as a positive. Prolific reader and commenter DCS said in the comments section of the previous post that these changes “would be good for folks who can be flexible!”

Oh DCS, I feel like we’re from different planets…

Anyway, I wanted to share some initial thoughts about these changes, in no particular order:

It’s disappointing United provided no notice of these changes

I know going forward we should expect no transparency regarding United’s award pricing, though I’m disappointed that United decided to make these changes without any advance notice. These changes kicked in from one minute to the next for travel as of November 15.

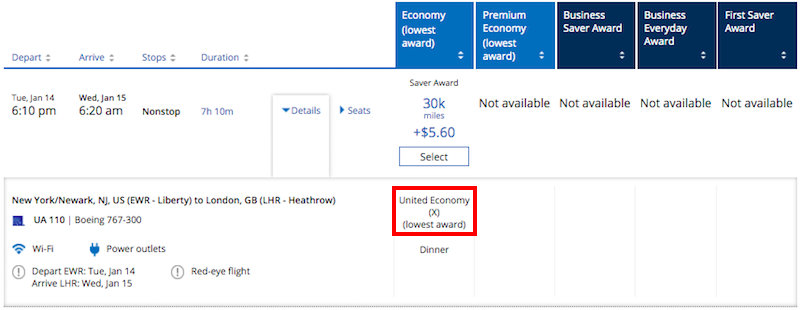

United will still have “saver” award seats on their own flights

This has been a common point of confusion. While United is introducing dynamic award pricing, they will still fundamentally have saver award fare classes. That’s to say that some of the cheapest business class award inventory will still book into the “I” fare class, while some of the economy class award inventory will still book into the “X” fare class, as before.

What’s changing is that the pricing associated with that will no longer be consistent. So United could have saver award seats on the same flight two days apart, and on one date it costs 50% more than the other.

You’ll be able to book United awards at lower rates through partners

In light of the above point, it’s worth noting that we’ll increasingly see arbitrage opportunities for those looking to redeem miles for travel on United. In many cases, MileagePlus will no longer be among the best programs for booking United flights.

If there are saver award seats available, we’ll see circumstances where you’re much better off booking through Aeroplan, LifeMiles, etc., since they’ll continue to have fixed award charts for redemptions on United.

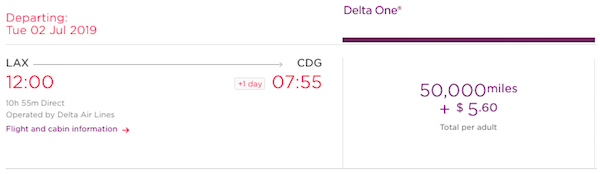

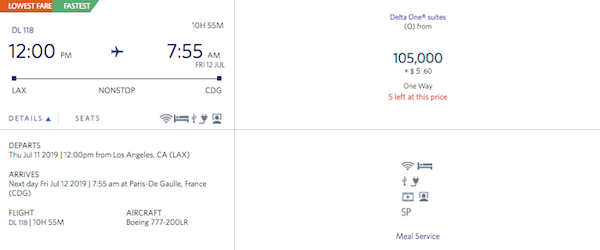

This is no different than what we see with Delta, for example. In some cases Virgin Atlantic Flying Club will charge 50,000 miles for a one-way Delta business class ticket from the US to Europe, when booking the same ticket through SkyMiles would cost more than twice as much.

We won’t see massive changes to partner awards in the near future

In the short term United says that they won’t be changing award pricing on partner airlines, though they’ll also not publish an award chart anymore.

I don’t actually think United will radically devalue redemption rates on partner airlines in the near future. Why? Because it doesn’t cost them much.

Airlines have pretty low internal reimbursement rates, and in a vast majority of cases United is probably paying less than a penny per redeemed mile for partner redemptions. So United doesn’t have any incentive to make partner redemptions significantly worse, since they want you to redeem your miles that way.

Award price increases will be slow and steady

Looking right now at redemption rates before November 15 vs. after November 15, I’m not noticing huge differences. I suspect this is quite intentional, because they don’t want to shock members too much and make it easy for us to compare before and after pricing.

But give it a few months, and United metal redemption rates will in many cases be going way up.

It’s inevitable that American follows United’s lead

With both Delta and United eliminating award charts, I think it’s inevitable that American will as well. Now, I haven’t actually heard anything official so I’m just speculating here, but I feel like it’s a near sure bet.

American has done absolutely nothing to differentiate themselves from the competition, and I don’t see why this would be any different.

United will get away with this

A lot of people are threatening to cancel their United credit card or to fly another airline, and while I totally appreciate (and even agree with) the sentiment, the reality is that I think United will get away with this without much backlash. Why?

- I think we can all agree at this point that frequent flyer programs are all about generating independent profits through non-flying means; so this isn’t about what frequent flyers think, but rather is about what frequent buyers think

- A vast majority of people earning airline miles directly through a co-brand credit card are uninformed consumers; informed consumers would instead use a card earning transferable points, and in some ways those uninformed consumers are better off with these changes, because at least they’ll be able to redeem for something

So my point is that those of us who are smart consumers shouldn’t have been using an airline co-branded credit card for spend before, and still won’t do so after. So while we can complain, I’m not sure the impact will matter much based on what United’s goals are.

Maybe all of this isn’t actually so bad (for now)?

I’m just about the last person on earth who will justify this stuff, but in some ways maybe it’s actually not that horrible, even if the “big three” US programs all follow the same path? I guess I’m more annoyed by this in principle than I am in practice. Hear me out:

- Across the board, US programs have gotten stingier over the years with releasing saver level award space, so it’s true that members may in fact have access to more award space (though at higher costs)

- None of the “big three” US programs have actually been worthwhile for a long time, so it’s not like things are changing terribly overnight; this is just the next step in a sad decline

- Most importantly, for those of us earning transferable points, we have a lot of options

I just want to briefly talk about that last point. With the points I earn with Amex, Chase, Citi, Capital One, etc., I have access to dozens of frequent flyer programs. Sure, globally many of them are going revenue based, but:

- Partner redemptions are typically still not revenue based

- As a result, tons of amazing arbitrage opportunities exist, and will continue to exist

So these changes are bad, but I’m not sure they necessarily change all that much. I’ll continue to earn transferable points whenever possible, and I’ll continue to not go out of my way to be loyal to an airline, because it’s not worth it.

There are two potential things on the horizon that are scary, and if any airline implements them, I’d be very alarmed:

- If airlines introduce truly dynamic award pricing on partner airlines; Delta does this a little on Virgin Atlantic, but that’s the only program I know of that does this, and it’s something that could be a game changer

- If airlines pegged the value of a mile to a certain dollar amount across the board, in which case first & business class redemptions would mostly become completely unaffordable.

Where do you stand on all of this?

I walked away from United after years of loyally saving up miles. Their "loyalty" program is nothing of the kind.

As a Platinum member of United for more than 20 years, I have patronized the airline for all my business and pleasure trips and credit cards, to the point that I had accumulated over $2 million miles, which until last March 2022 would have allow me to purchase the equivalent of 33 one way, first class tickets to Europe or South America (using the mile saver award of roughly 60,000 miles each way).

Unfortunately,...

As a Platinum member of United for more than 20 years, I have patronized the airline for all my business and pleasure trips and credit cards, to the point that I had accumulated over $2 million miles, which until last March 2022 would have allow me to purchase the equivalent of 33 one way, first class tickets to Europe or South America (using the mile saver award of roughly 60,000 miles each way).

Unfortunately, they have now devaluated our miles and instead, if I want to travel the same routes, I have to spend anywhere between 175,000 to 295,000 miles (3 to 6 times more miles) which means that instead of 33 one way trips, I can barely purchase 8 !!!

This is highway robbery!

United is punishing their loyal customers who patronize them for decades, by devaluating their miles to 1/6 of what they used to be worth.

I can assure you that if this doesn't change immediately, I will cancel all my credit cards, stop using United, and will start posting on Twitter and Instagram letting the world know what kind of Airline United is!

I hope that you all start writing complaint letters to them, and all airlines you have miles with, otherwise they will get away with this rip-off without any repercussions.

Mileage plus rewards is a scam. They have jacked up double and in many instances thrice. All merchandise is three times pricier.

Pretty garbage value now from what I can see. I can't even find any flights on Star Alliance metal through United's award search matrix, yet there are plenty of open flights when I go direct to one of the airline's websites.

I realized United MileagePlus points are drastically diminished when compared to November 2019. I used to get $100 worth of merchandise if I spend about 12,500 points. But now as of April 2020 I had to spend 33,000 points to get the same amount. It’s a loss of $200 to the customers. Not sure if anyone realizes. United don’t even have an answer for it. They’re robbing in the name of unknown policy changes etc.

minimum points for a flightr seem to have increased from 12.5k to 14.5k.

and while you used to be able to go anywhere in us for 32.5, now there's no limit.

this devaluation is infuriating

Ach! Just as I was getting the hang of PQDs, and PQMs. My husband has been a Global Services member since 2012 (lots of flights to Asia and the Middle East.) With the new system I don't know what it is going to take to make the top tier. There is a low cap on the number of Premier Qualifying Points given to those with the Chase Explorer card. It would be nice if the...

Ach! Just as I was getting the hang of PQDs, and PQMs. My husband has been a Global Services member since 2012 (lots of flights to Asia and the Middle East.) With the new system I don't know what it is going to take to make the top tier. There is a low cap on the number of Premier Qualifying Points given to those with the Chase Explorer card. It would be nice if the United website gave a few examples on what a Mileage member will get when booking and paying for domestic and international flights.

Where I see a problem with this is that I fly to china every 3 weeks, I fly economy because my company is thrifty ( The owners fly business ). So even though I fly an average of 100,000+ miles a year, I will not make platinum status again due to the $ requirements. My tickets are on average less than $500.00 round trip, so I get plenty of miles, but my dollars spent are...

Where I see a problem with this is that I fly to china every 3 weeks, I fly economy because my company is thrifty ( The owners fly business ). So even though I fly an average of 100,000+ miles a year, I will not make platinum status again due to the $ requirements. My tickets are on average less than $500.00 round trip, so I get plenty of miles, but my dollars spent are not high enough to get a good status. That is where the Chase card was a good option, i could hit my PQD waiver and still get status. The pricing for the new premium plus seats is nearly double that of the economy seating, its horse crap that they are doing this to their loyal customers and thinking they can trick them into thinking that it is a better program. I think I am just going to cancel my United / Chase card and tell them to go pound sand, I really don't see any benefit anymore.

"We won’t see massive changes to partner awards in the near future"

Well, United already raised mile requirements for partner flights (EVA, ANA, etc.) in East Asia by 3,000 miles just today, 11/16/2019. The value of my accumulated miles just went down almost 50% by my own estimate in just few months. So, I called to cancel UA credit card today. Why bother earning UA miles anymore?

As a long-time Global Services member, this change is infuriating and done so disingenuously. United have claimed things like you can actually save lots of miles with the new scheme — haven’t seen that yet. I wonder about the legality of the change as my points (over 1M) are now worth less, which certainly feels like a theft. I‘d bet the change costs me over $10K in frequent flier points value, but of course this was United’s aim.

Anybody knows if United upgrade award chart like using 30K United miles to upgrade a Star Alliance partner’s flight from coach (Y/B class) to business class is impacted by this latest announcement as well?

Thanks!

Advertising is a cyclical business . People forget this with regard to social media and all these net enterprises . These points mavens are the same. Saturation points are or have been met. The easy money has been made.

In the past I flew UA all the time - Silver and above. Currently mostly use Alaska. Looking at United MileagePlus was is so disappointing. It is now MileageMinus. Was going to consider the Chase Card, not now.

For those of you who comment that you have 200K miles to burn and don't use them because United sucks anyways......you really really really are missing the boat. Who gives a crap about United, noone that has a brain uses their miles to redeem united flights anyways! Use united.com and search for where you want to go internationally, and use their partner rewards (always more available anyways) to book where you want to go. They...

For those of you who comment that you have 200K miles to burn and don't use them because United sucks anyways......you really really really are missing the boat. Who gives a crap about United, noone that has a brain uses their miles to redeem united flights anyways! Use united.com and search for where you want to go internationally, and use their partner rewards (always more available anyways) to book where you want to go. They have some really really great partners, I just booked a trip from Bali to Jacksonville entirely business class for 80K miles a couple weeks ago, most of it on Turkish air (brand new airplane) and Swiss Air.....

@Pam does the trick/hack still work? AFAIK it hasn’t worked for many months, and certainly didn’t when I tried in December.

It doesn't look like United has waited till Nov 15th for their dynamic pricing. I've been looking at United redemptions to europe and asia and i mostly see 75K "saver economy" awards for flights to India (when the saver level award should be 43.5. Also "saver business" is all but non-existent so seems like they have already dramatically devalued the program.

I can't believe i'm saying this but i'm actually seriously considering switching to Delta,...

It doesn't look like United has waited till Nov 15th for their dynamic pricing. I've been looking at United redemptions to europe and asia and i mostly see 75K "saver economy" awards for flights to India (when the saver level award should be 43.5. Also "saver business" is all but non-existent so seems like they have already dramatically devalued the program.

I can't believe i'm saying this but i'm actually seriously considering switching to Delta, not because their SkyPesos are any better but because i've found Delta's prices to be consistently cheaper for domestic Comfort+ and international Premium plus compared to United/AA.

Delta has close-in dynamic award pricing on China Airlines :( #SkyPesos

I just received an email from LifeMiles that they will modify the required miles for airline tickets within the US, no doubt to align with UA's dynamic pricing

@Ryan A Wolfe - Yes, all flights after Nov 15 are already showing dynamic pricing. Only way to lock in award chart mileages is to book travel prior to 11/15/2019. At least for United flights. Partner flights should still follow award chart mileage levels

If you book travel before the November changeover for a flight after November will the new program be in effect for those flights?

@DSK -- There is no 'flaming' you because we agree on what's real...and disagree on what's unreal and makes you inexplicably 'fearful'.

@DCS--I have been one of your supporters when you talk about the Hilton program through the years, but I am fearful--not certain but fearful--that this will not turn out the way you planned. I know you may be in London but it is 66 degrees in Ithaca in early April today so I think I might have the better end of the deal. Don't flame me.

I've gotten huge value out of the Hilton program....

@DCS--I have been one of your supporters when you talk about the Hilton program through the years, but I am fearful--not certain but fearful--that this will not turn out the way you planned. I know you may be in London but it is 66 degrees in Ithaca in early April today so I think I might have the better end of the deal. Don't flame me.

I've gotten huge value out of the Hilton program. During the past three months, I've been to the Conrad Maldives, the Conrad Bora Bora and the Conrad Fort Lauderdale--all on points or AMEX Certificates. I think the AMEX Hilton Aspire is the best deal out there since I feel like they are literally paying me to take their card. But the value heavily comes from the fact that there is a top limit to the number of points required for Hilton's fanciest resorts if there is a standard room available (and I have always been able to find one and often receive nice upgrades), and in general I can use those AMEX Certificates at the most expensive Hilton properties in the system.

Similarly, I have received good value from United. I have flown on Thai, Lufthansa, SAS and Brussels using MileagePlus in front and will be using MileagePlus to fly in front on Copa soon. I have also used MileagePlus to fly in front (and in back) on United metal. I have also received good value from AA, using Aadvantage miles to fly on Qatar, Cathay Pacific, JAL and Qantas.

However, I have over 370,000 SkyMiles remaining and it is hard to find a good use for them. I laugh when some brag about a great 125,000 SkyMile redemption when the same redemption on United or AA is tens of thousands of points less, on a day-to-day basis. Unless there is a good sale going on, the number of SkyMiles needed to fly in front approaches insane.

RIGHT NOW, partner awards on MileagePlus are unaffected. But, if AA follows the path of United and United follows the path of Delta, I will need to find another hobby. I will say it was fun while it lasted. I hope you (and Lucky) are right. I am fearful I am.

@cargocult - Very useful info for frequent travelers to/from the UK.

@Donna -- Happy to know there is another soul on reality-based planet! :-)

I’m probably from that other planet like @DCS. I do not however believe that we will be seeing bargain awards like in the good old days but rather flexibility might allow for cheaper award pricing under the new normal of outrageously high award redemptions. Not all of us can fly “wherever” and “whenever” to take advantage of the great alliance partner offerings so our worlds are different. This change is bad, no doubt about it....

I’m probably from that other planet like @DCS. I do not however believe that we will be seeing bargain awards like in the good old days but rather flexibility might allow for cheaper award pricing under the new normal of outrageously high award redemptions. Not all of us can fly “wherever” and “whenever” to take advantage of the great alliance partner offerings so our worlds are different. This change is bad, no doubt about it. And you are correct that buying airline currency (to include placing all spend on a cobranded card) is risky - the value is shifting downward constantly at the sole discretion of the currency managers at the airline. And I agree with @DCS that modeling for one’s personal situation goes a long way to determine which combination of credit instruments is going to work the best. Everything is dynamic, constantly changing multiple times a year.

Recently I’ve dumped two airline cards, one points card and one hotel card, saving $550 a year. When I got those cards, they worked really well for me but not so much now. My small credit union has a $49 card that gives 3 points on all travel and 2 points on everything else along with travel protection, CDW, no foreign tx fees, 50k sign up bonus and redemptions starting at 1000 points and the first year fee waived. Even the small credit unions are beating the big guys.

And, I’m officially a free agent no longer chasing airline or hotel loyalty. It’s very liberating!

The UK Registered Traveller program is superior to using Fast Track at the border as the latter still requires queuing up to talk to a border officer while the former allows one to use the ePassport gates, which are quicker than even Global Entry. US passport holders, among others, will be allowed to use UK ePassport gates starting in June, so Registered Traveller will become redundant.

My 2 cents: I've been let down by award availability on a number of occasions. I would prefer to be paying with miles based on ticket prices and a 0,01$ per mile value for economy and up to double the award chart prices that I am currently using for business or first (since a 0,01$ per mile "price" there would render it worthless), under the condition that all available seats are made available for mile...

My 2 cents: I've been let down by award availability on a number of occasions. I would prefer to be paying with miles based on ticket prices and a 0,01$ per mile value for economy and up to double the award chart prices that I am currently using for business or first (since a 0,01$ per mile "price" there would render it worthless), under the condition that all available seats are made available for mile redemptions, than to continue accumulating miles that I can't redeem, for example, during the holiday season. I realize that my "plan" won't suite many of you, but it would be as transparent as it can get (in terms of cost/benefit) and would likely eliminate some of the online frenzy regarding gathering and redeeming miles (due to maximum availability, plus don't forget that the time spent searching for award space could also be translated into $$).

Well I think this is very similar to what Aeroplan has already implemented few years back . Aeroplan has a reward chart but often many seats aren't available unless you are willing to pay market price meaning double, triple or even more points to get a seat.

@Brian -- If you wish to make a point, it seems to me that you'd do it much more 'efficiently' by completely leaving me out of it because there is a total lack of relevance to my comments.

But I did get an email this morning begging me to get the credit card and up to 60,000 miles.

Still no email from United telling me about the changes. Did anyone else get one?

continued collusion in the air carrier marketplace.

Where should we credit miles earned flying on UA metal now? Probably a blog post in the works about this. Maybe still UA’s program, which we use to redeem flights with partners? That’s what DCS may be suggesting.

I think that a really good analysis for this blog to create is HOW to affectively restructure our "loyalty" away from the Big Three.

1. Do we stop crediting miles to them when on their metal and credit miles to partner airlines instead? Abandon loyalty status for a fairer chart of redemptions and availability? With upgrades all but vanishing and the ability to upsell to domestic F for not much more....why care?

2. Do...

I think that a really good analysis for this blog to create is HOW to affectively restructure our "loyalty" away from the Big Three.

1. Do we stop crediting miles to them when on their metal and credit miles to partner airlines instead? Abandon loyalty status for a fairer chart of redemptions and availability? With upgrades all but vanishing and the ability to upsell to domestic F for not much more....why care?

2. Do we begin to support and fly more airlines like JetBlue and Alaska so as to give them rise to provide more competition and force the hand back to loyalty?

It's clear that the new generation of bean counters sees no value in loyalty for butt in seat regular flyers who log in a few hundred thousand miles on their metal. They are more interested in Mabel in Des Moines who uses their credit cards.

@William "Praying for a recession?"

Why, so the taxpayers can bail out the big Three since we allowed them to grow to the point of being too big to fail without creating havoc in infrastructure?

Pray for continued growth so Richard Branson will start another domestic airline. As well so that JetBlue and Alaska can get bigger.

@DCS my world is efficiency, and sharing with readers there’s alternative ways to gain quick entry into the UK without spending $15K on PQD.

Moreover I’m slightly confused on your world...”waiting for the train to Paddington”...you waste money on the Heathrow Express?

Just adds to the point of collecting credit card points instead and redeeming such rather than transferring to an airline. For those that often travel on the partner airline, I would suggest looking into those reward programs instead. On at least two airline alliances I got much better earnings and redemptions.

@Bryan -- Moreover, fast-tracking through passport control was just contributory icing on the cake, and not one of the reasons for chasing elite status. Just clearing GPUs both ways on this trip, possible only because I am a 1K, has already put me ahead for the year on costs associated with playing the miles/points game...and I still have 4 more GPUs that I am sure will clear on at least two of my planned long-haul trips.

@Bryan - There was no spin when I was handed the pass, which was just a piece of paper that said that I could use the fast-track lane if I so desired. I did and it worked. Period.

In your better alternative (world), I would (a) join something called the UK Registered Traveller program and (b) pay £50 annually, in order to accomplish pretty much the same thing that I did for free, and, IMPORTANTLY,...

@Bryan - There was no spin when I was handed the pass, which was just a piece of paper that said that I could use the fast-track lane if I so desired. I did and it worked. Period.

In your better alternative (world), I would (a) join something called the UK Registered Traveller program and (b) pay £50 annually, in order to accomplish pretty much the same thing that I did for free, and, IMPORTANTLY, on what is likely my ONLY trip to UK this year? The answer is thanks, but no thanks!

You have no point.

G'day.

@DCS the fast track passes UA/DL try and spin as “elite perks” are hardly worth chasing status for... you can join the UK Registered Traveller program (£50 annually) and breeze thru the automated gates at any UK airport.

PRAYING FOR A RECESSION!!

I hadn't thought much about partner awards not changing. God, I hate flying on United, so if the cost of me flying on ANA or Lufthansa (or even Air Canada) isn't going to change, and I can still go on my international jaunts in business or first via mileage redemption, then I guess that's fine.

Not against frequent flyer-hotel credit cards.

I would ask that the companies differentiate for those who do the travelling, staying 100's of nights in hotels and frequent flying.

Its not against credit cards, just asking for a different consideration to those who staying in the hotels and sitting in the airplane seats.

Is it a dream. Probably, but still a good thought.

For international J redemptions, if AS doesn’t make any big changes to MileagePlan, this could make the program even more valuable for butt-in-seat flying. Earning actual miles flown and up to 125% elite bonuses, and then being able to redeem for 50k for transpacific J! I might even consider making some out of the way connections through SEA this year with my MVP status match!

If UA feels the need to soften the blow at some point, (which it probably won't) a face-saving solution would be to have more frequent sales of miles with higher bonuses (like Avianca). The best they very occasionally offer is 100% bonus. Will we see 125%, 150% ? That sort of cash income is surely more tempting than the pittance they get from sales to the banks.

When Gary Leff complainted about Delta removing the chart I asked this question. Why Does it matter. For example American has a chart. Good luck finding Saver level for most of their flights (on AA metal to Europe for example. How abouf DFW to HKG? When is the last time a business class ticket was offered ont hat route at Low level. The chart makes no difference when no seats are ever available at those...

When Gary Leff complainted about Delta removing the chart I asked this question. Why Does it matter. For example American has a chart. Good luck finding Saver level for most of their flights (on AA metal to Europe for example. How abouf DFW to HKG? When is the last time a business class ticket was offered ont hat route at Low level. The chart makes no difference when no seats are ever available at those levels. My reasoning was not to defend Delta, but to claim for the most part it does not matter if that "low level award" space does not exist. With that beign said I scored some great low level Delta awards since they pulled the chart. Patience and some luck

Lucky--as usual, well reasoned and sage analysis.

Completely agree--overall this is bad for United flyers....and is the reason why we've switched every flight possible to Alaska Airlines over the past few years, while still managing to become United elite flyers simply due to Alaska's limited network.

Delta lost us (18+ years as a Platinum/Diamond on Delta.....flown zero flights on Delta metal in last two years....redemptions are an absolute joke--Delta card has virtually zero...

Lucky--as usual, well reasoned and sage analysis.

Completely agree--overall this is bad for United flyers....and is the reason why we've switched every flight possible to Alaska Airlines over the past few years, while still managing to become United elite flyers simply due to Alaska's limited network.

Delta lost us (18+ years as a Platinum/Diamond on Delta.....flown zero flights on Delta metal in last two years....redemptions are an absolute joke--Delta card has virtually zero spend on it for years). I thought United was going to be my go-to program moving forward. After a few years of great experiences with United, I'm heartbroken at these recent changes....feels like "the Delta treatment" all over again.

Transparency is worthless if the Saver space is never available to take advantage of it. This is probably advantageous for many domestic travelers and for international travel, you're better off using MP miles on partners. I don't see my redemption patterns changing because of this, and I'm hopeful that it leads to more I inventory that those of us redeeming through Aeroplan and LM can take advantage of.

@Adam after 49+ years with my body, I have long realized my body is not the same as the one I joined.

It's the begging of the end.

@SEAguy its AS, not AK, get the IATA airline designator correct and not mention the State of Alaska

It's getting harder and harder to beat a 2.5% cash back card. I haven't been able to beat that domestically for years, and now it's getting harder even for international business class.

I'm glad you're calling it what it is, rather than being brainwashed by the executive and downplaying the elimination of transparency like you did with Hilton (do you know how many sweet spots they have killed silently since then?), which was a disappointment to say the least. https://onemileatatime.com/new-hilton-honors-award-pricing/

There is a hack for avoiding the $75 close-in booking fee so no big deal its removal.

I've been a UA Platinum and have exclusively transferred my Sapphire Reserve points United. I'm going to look closer at other transfer partners. Even better, just buy a ticket for 1.5 cents per point (200k points for $3000 in airfare, which may be a better deal than United miles).

After 25+ years with Mileage Plus, I have long realized the program is not the same as the one I joined. I will still continue to buy UA J/C/D/Z/P fares because United has the most int'l nonstops of any carrier out of NYC. And EWR is the closest airport for me. I am close to 3mm BIS miles so once I hit that I may start to fly other Star Alliance partners. I've learned there...

After 25+ years with Mileage Plus, I have long realized the program is not the same as the one I joined. I will still continue to buy UA J/C/D/Z/P fares because United has the most int'l nonstops of any carrier out of NYC. And EWR is the closest airport for me. I am close to 3mm BIS miles so once I hit that I may start to fly other Star Alliance partners. I've learned there is more to life than miles, and I don't have the time to waste on mileage runs as I have grown older. I will lose my GS status in January 2020 and honestly I am ok with that - the few times I needed GS to rise to the occasion they didn't. When I have a 3 hour layover and the connecting flight is the gate over, GS is always there with the Mercedes. It's life. Seems like the biggest changes are cost of last minute use of miles for award tickets - that was the biggest benefit of the program to me. Easy to be skeptical but let's see how it plays out....

@Lucky -- We already were living on different planets from Day One, and considering what's transpired since that Day One, I much prefer the planet I am on because it's proved to be reality-based.

Anyway, I just arrived at LHR, flying UA out of EWR in Polaris Biz thanks to a GPU, then thanks to an invitation handed out by a FA as we were landing, I fast-tracked through passport control, and am now just...

@Lucky -- We already were living on different planets from Day One, and considering what's transpired since that Day One, I much prefer the planet I am on because it's proved to be reality-based.

Anyway, I just arrived at LHR, flying UA out of EWR in Polaris Biz thanks to a GPU, then thanks to an invitation handed out by a FA as we were landing, I fast-tracked through passport control, and am now just waiting for the train to take me to the London. Contained in what I just described are some of the benefits of having an airline elite status, UA in particular, that are my reasons for continuing to patronize loyalty programs.

As for the changes that you are complaining so loudly

about my take, as I've urged after every major change, was that each of us has to do some 'modeling' (or whatever one does to figure thingd out) to get a sense of how one would be affected.

For me, these changes are completely unimportant and meaningless because -- by design -- I DO NOT REDEEM ANY UA MILES FOR AWARD TICKETS ON UA METAL. I earn miles on paid UA flights, like the one that just brought me to London, then I use the earned miles to redeem award tickets on *A carriers, invariably.

See? For some of us, the sky has not fallen. A couple of years from now it will be like nothing happened at all because the proposed changes won't be any worse than those that were predicted when HHonors went "rogue" by switching to a revenue-based system. HH has not only survived, it is now the dominant hotel loyalty program.

Why am I so sure things won't be as bad as predicted with respect to UA? Simple: UA is not yet ready to kill its "Golden Goose", so the effects of these changes will not be as dramatic as self-anointed travel gurus would have us believe...

Train for London Paddington approaching...

G'day.

Delta's claim to have no close-in fees is disengenuous. For example, SFO-ATL costs 55,000 miles 3 days out; 25,500 miles 21 days out - a mileage premium worth $300-$400; much more than the former $75 close-in booking fee.

(To ensure a fair comparison, I checked fare bucket availability on Delta for 3 days out. The cheaper fare buckets are still available on many nonstop flights. So the only explanation is dynamic pricing that values miles...

Delta's claim to have no close-in fees is disengenuous. For example, SFO-ATL costs 55,000 miles 3 days out; 25,500 miles 21 days out - a mileage premium worth $300-$400; much more than the former $75 close-in booking fee.

(To ensure a fair comparison, I checked fare bucket availability on Delta for 3 days out. The cheaper fare buckets are still available on many nonstop flights. So the only explanation is dynamic pricing that values miles at about 1 cent each.)

We can't yet know if UA will also price close-in awards prohibitively higher than 21 day advance awards.

(As a UA million miler, I became a free agent about six years ago. So about the only thing left for me to do is relinquish my "UAPhil" handle.)

I’m glad I booked my Christmas Holiday travel last week. The outbound flight increased 10,000 miles per person and the return 6,000 miles per person.

For what it's worth, I have United silver status and have not received any notice by email from United about these changes. I just checked my spam folder, too.

As soon as the economy tanks again these airlines and hotels will be begging us to come back.

Once everyone goes to revenue based redemptions, predictions for how premium cabins get filled? Sure, there will still be business travelers, and a few people will still redeem miles. But there will be lots of seats left over. Elite upgrades? Fixed-price (dollar or miles) upgrades, day of or in advance? Nonrevs? Empty cabins?

How do you think this will affect the excursionist perk? I know it had choice uses, but I feel like this really makes it useless since finding routings that made sense for me was dependent on knowing what saver awards I could potentially find and working within my point totals.

Also do you think this devalues Chase UR at all? I know you said redeeming on United outside of partners was already a bad...

How do you think this will affect the excursionist perk? I know it had choice uses, but I feel like this really makes it useless since finding routings that made sense for me was dependent on knowing what saver awards I could potentially find and working within my point totals.

Also do you think this devalues Chase UR at all? I know you said redeeming on United outside of partners was already a bad proposition, but it was still and option where you new the potential award costs. Now it's just going to be a crap choot

@echino. Alaska is already there domestically, they just seem to get a pass because they have fixed partner redemptions (some of which are good value for aspirational travel if you can find availability for the dates and number of seats you need). Their AK metal award pricing is dynamic and they are charging more (folks often get less than a penny a point these days) but somehow they fly under the radar while Jet Blue’s...

@echino. Alaska is already there domestically, they just seem to get a pass because they have fixed partner redemptions (some of which are good value for aspirational travel if you can find availability for the dates and number of seats you need). Their AK metal award pricing is dynamic and they are charging more (folks often get less than a penny a point these days) but somehow they fly under the radar while Jet Blue’s pegged price and Delta’s highly variable pricing take all the arrows. A family that mostly flies domestic should cut most bloggers’ values for Alaska miles by half, and put the AK credit card in the sock drawer except when buying AK tickets.

@Cj United is Continental. From day one of the merger Continental management has been in charge. United is in name only. Smisek was COs CEO and Munoz was on COs board pre merger. They kept names, United, Global Services, 1K, MileagePlus, etc. Continental was a good airline under Bethune, that changed dramatically under Smisek

So maybe that's why Chase is offering me 5x United points on my United credit card for an easy $2K of targeted spend?

Definitely no longer any reason for anyone to purchase UA miles in one of their never ending sales. It's also made it easier for me to drop the Chase Sapphire as only accumulated those points to transfer to United. Loyalty is dead, free agency is the only way to go. I find devaluations to be tolerable (not desired), but making stuff up randomly does not float my boat. Oh well, I hate flying with UA so even more reason to avoid them.

The fundamental flaw in the aspirational travel value arbitrage blog model is that discussing an opportunity closes that opportunity - we're seeing that now with domestic legacy programs.

I agree with DCS's take from yesterday with the clarification that the "good" is dependent on availability opening up similar to LUV and JBLU's model. If you're someone already generating beaucoup miles (butt-in-seat, cc-spend) you'll most likely be a "winner" through the winnowing of seat competition.

In...

The fundamental flaw in the aspirational travel value arbitrage blog model is that discussing an opportunity closes that opportunity - we're seeing that now with domestic legacy programs.

I agree with DCS's take from yesterday with the clarification that the "good" is dependent on availability opening up similar to LUV and JBLU's model. If you're someone already generating beaucoup miles (butt-in-seat, cc-spend) you'll most likely be a "winner" through the winnowing of seat competition.

In a weird way and in a sign of the times, that TPG Marriot Bonvoy argument was kind of correct.

And here I was just last week considering canceling my Citi Advantage Gold card and keeping my Chase Mileage Plus card. Time for a re-think.

This kind of stealth devaluation is disgraceful

Since you can't get a result until you log into your account, doesn't this open UA to claims of discrimination? ie, person A you are charged 30k miles, while person B you are charged 50k miles for the same itinerary.

Understandably, they are tracking/logging your search history, but messed up IMHO!

Also my mantra has always been, don't waste UA miles on UA flights.

@Marc:

"AA will, of course, follow suit. It’s blatantly obvious that DL, UA, and AA have been in collusion for years."

Show me the proof. I am not an industry apologist, but what you allege is a crime that people can go to prison for. Perhaps you are not aware, but competitors pricing and providing terms and conditions in a similar fashion is evidence of competition as much as it is of collusion.

For...

@Marc:

"AA will, of course, follow suit. It’s blatantly obvious that DL, UA, and AA have been in collusion for years."

Show me the proof. I am not an industry apologist, but what you allege is a crime that people can go to prison for. Perhaps you are not aware, but competitors pricing and providing terms and conditions in a similar fashion is evidence of competition as much as it is of collusion.

For example, when a gas station matches pricing on gas to track what its competitor a block away is equally indicative of competition as it is of collusion. But when you announce to the world that an antitrust violation - yes, a crime, has occurred rather than competition, you need some strong sauce. Anything else would be reckless and irresponsible.

Show me that strong sauce.

Is Alaska going the same way in the near future, what do you think? Time to burn my Alaska miles?

@ Ben -- Please post if you can find any substantial premium cabin transcon domestic space using partner miles, on routes like EWR-SFO/LAX, ATL-SFO, IAD-SFO/LAX, ORD-SFO/LAX.....

@ Gene -- I typically only see that a few days out.

Makes the quirky AS Mileage Plan program even more attractive.

The removal of the 75 USD close in fee is good news for someone who only redeems on partner airlines :)

We are all going to die.

I guess we were due for this. As Lucky points out, I think the redemption (outright/upgrade) on partner airlines still can make sense. I wonder if the saver availability will be better or worse now with the card. Otherwise, it won't make sense to have the card anymore.

As for whether American will follow suit, why wouldn't they?

Delta keeps earning record profits with the leader in dynamic award pricing. It doesn't seem to have hurt their loyalty. But, of course, they are operationally superior these days, and have a great route network.

There seems to be little downside for doing so.

Look at Southwest. Award program practically pegged to their miles to a dollar amount and has some of the worst operational...

As for whether American will follow suit, why wouldn't they?

Delta keeps earning record profits with the leader in dynamic award pricing. It doesn't seem to have hurt their loyalty. But, of course, they are operationally superior these days, and have a great route network.

There seems to be little downside for doing so.

Look at Southwest. Award program practically pegged to their miles to a dollar amount and has some of the worst operational records in the industry (3% of all flight cancelled and 20% of all flights delayed in March). And they practically have a cult following.

Its just a matter of time before American makes the change. They would be stupid not to.

@ Michael: They won't get rid of close-in booking fee. Introducing dynamic pricing lets them incorporate even higher close-in booking premium into award price, so they don't need charge it as a separate fee. So they are definitely getting worse in term of charging higher prices for close-in booking. The only consequence of getting rid of the old style $75 close-in booking fee is eliminating one of the main benefits of United Club card, which...

@ Michael: They won't get rid of close-in booking fee. Introducing dynamic pricing lets them incorporate even higher close-in booking premium into award price, so they don't need charge it as a separate fee. So they are definitely getting worse in term of charging higher prices for close-in booking. The only consequence of getting rid of the old style $75 close-in booking fee is eliminating one of the main benefits of United Club card, which they need to replace with an equally significant benefit.

You might enjoy this - a restaurant critic writes about giving bad reviews (he is a beautiful writer, so some of his worst reviews are wonderful):

https://www.theguardian.com/books/2018/sep/22/jay-rayner-bad-restaurant-reviews-some-just-deserve-it

And Boeing’s not unexpected news:

https://www.theguardian.com/business/2019/apr/05/boeing-737-max-aircraft-production-cut-nearly-20-per-cent

This really hurts the ultra-loyalists. The one's who will take a connection instead of a direct flight just to stay loyal to one of the Big 3.

For heavy travelers, it sucks and its another slap in the face, and I feel their pain.

But, as you concluded above, its just another compelling argument to be a 'free agent'. That means maximizing miles on each and every alliance and pay cash for your travels....

This really hurts the ultra-loyalists. The one's who will take a connection instead of a direct flight just to stay loyal to one of the Big 3.

For heavy travelers, it sucks and its another slap in the face, and I feel their pain.

But, as you concluded above, its just another compelling argument to be a 'free agent'. That means maximizing miles on each and every alliance and pay cash for your travels.

Status is nice for regular flyers, but for leisure travelers like myself, chasing status in an era of dynamic pricing just doesn't make sense.

Neither does accumulating miles. It definitely makes more sense to earn and burn.

So, saving points for that big redemption just really doesn't make any more sense than giving an airline any more loyalty than just flying them when the price and timing is right.

@Michael,

They essentially have to do this - they are going revenue-based so in the future close-in tickets will simply cost vastly more miles than advance bookings, there would be no point in maintaining a separate cash fee. I wouldn’t even read that as a clear positive.

Amazing that they are doing this - as others have pointed out, Delta gets away with this by providing clearly superior operational performance and on-board experience. Why on...

@Michael,

They essentially have to do this - they are going revenue-based so in the future close-in tickets will simply cost vastly more miles than advance bookings, there would be no point in maintaining a separate cash fee. I wouldn’t even read that as a clear positive.

Amazing that they are doing this - as others have pointed out, Delta gets away with this by providing clearly superior operational performance and on-board experience. Why on earth would anyone in a non-captive United market now choose to join/use Mileage Plus? They’ve just eliminated any remaining loyalty proposition.

I would say AA cannot be so stupid as to follow Delta and United here but given their recent efforts at decimating their onboard experience and brand value, of course they will.

AA will, of course, follow suit. It's blatantly obvious that DL, UA, and AA have been in collusion for years.

if this means more award seats, I don't mind paying 20% more for them if there is more space.

Sadly, I fear that we'll eventually see price-hikes of 200-300%, just like we did with Delta, and no more waitlisting for awards, which was one way to 'force' saver award availability on United if you had high status.

"United doesn’t have any incentive to make partner redemptions significantly worse, since they want you to redeem your miles that way."

If that's the case, why (under the current system) do *A partner awards cost more than UA awards? For instance, 70k for a one way business class partner award USA-Europe, but 60k for an equivalent UA award.

There’s absolutely nothing good about having no award chart. Transparency is gone. Anyone who wants to fly with miles is now in a situation where they won’t know their true costs until they actually book.

With award charts we know exactly where the flights should be costed for saver space.

With frequent flier programs making billions in profits for the airlines, you would think they would make it easier for their program members...

There’s absolutely nothing good about having no award chart. Transparency is gone. Anyone who wants to fly with miles is now in a situation where they won’t know their true costs until they actually book.

With award charts we know exactly where the flights should be costed for saver space.

With frequent flier programs making billions in profits for the airlines, you would think they would make it easier for their program members to redeem points and not harder.

American will likely follow. I challenge them to not follow, however. They should differentiate themselves from the dynamic award pricing and no award chart airlines.

As someone who has had over 200K of UA miles for the past 5 years, my immediate reaction to United's move is so what -- since United never seemed to have any availability especially Saver for international travel. So I have viewed my miles as greatly devalued anyway.

Although I did recently score a seat in business on an AC 787 YYZ-SFO for 25K miles

This is unfortunately a race to the bottom, and is what happens when we end up with an oligopoly.

Can someone explain how this can be a good thing from a passenger perspective?

Also you forgot to mention they are getting rid of the $75 close-in ticketing fee. That is definitely a positive even if the rest is terrible news.

It strikes me as strange to give a big middle finger to your most engaged members.

Maybe bloggers should speak up against this ? They like to promote junks for commission and always paints rosy pictures! This is a scam. The airline would advertise something when they promote their cards and what you have to spend and you can use miles for this or that trip but in reality and once you earn the miles. It is different . There is lack of saver awards and it cost 20 times more...

Maybe bloggers should speak up against this ? They like to promote junks for commission and always paints rosy pictures! This is a scam. The airline would advertise something when they promote their cards and what you have to spend and you can use miles for this or that trip but in reality and once you earn the miles. It is different . There is lack of saver awards and it cost 20 times more then what they advertise and then they rip off you off further with more devaluations like this.

Chase is becoming uncompetitive compared to AMEX and Citi. I think they really should (must) increase the multiplier on Sapphire Preferred (to 3x) and Reserve (to 4x).

Last year UA destroyed the Hertz earning opportunity and now this. AA destroyed its loyalty program years ago with massive devaluation and curtailed award availability. United, although beat AA in its devaluation, it remained a better value for a while until this bad news.

my only co-branded cards, B6 and WN

Bad move, I really don't know what to do now with my 982 miles???? I have not considered UA for flying for years. I did transfer UR points to UA for an NH domestic flight last month, but I can't recall the last time I was on a UA plane, revenue or award. I am a free agent since 2012.

Boy I miss Continental

@Ben I was referring to this: https://viewfromthewing.boardingarea.com/2018/10/26/sec-filing-shows-american-airlines-loses-money-flying-on-loyalty-program-earns-profit/

In my opinion this is AA's chance to make a comeback. While AAdvantage is far from perfect (very far, in fact) if they continue to have a fixed rate award chart, despite their lack of award availability and good partner redemptions like QR, EY, CX, JL, etc. I think they will have a serious value proposition compared to DL and UA

UA is now the worst of both worlds. At least on DL you get...

In my opinion this is AA's chance to make a comeback. While AAdvantage is far from perfect (very far, in fact) if they continue to have a fixed rate award chart, despite their lack of award availability and good partner redemptions like QR, EY, CX, JL, etc. I think they will have a serious value proposition compared to DL and UA

UA is now the worst of both worlds. At least on DL you get all the advantages of flying Delta (entertainment, good service, etc.). United is now bad all around...

My United visa card sits on a nightstand, and haven't flown with them in over a year. Still have about 200k points to burn, but oh well. There are better airlines around.

Call me crazy, but I think AA is starting to realize that the devalued AAdvantage is costing them business. They’ll probably delay the change for a couple years while marketing themselves as “the last of the old school programs” (much like they did with “a mile flown is a mile earned”). If there’s a recession in that time, and the airlines get more hungry for business, it may be another business-cycle until AA follows suit. But yes, the change is still “inevitable”.

@ Pat -- Interesting. I'm curious what makes you think AA realizes the devalued AAdvantage is costing them money? None of their actions seem to reflect that, in my opinion, though I might be missing something.