It’s an unusual year for me when it comes to airline elite status, so in this post, I want to share the strategy that I’m pursuing, since one thing is very different than usual for me this year…

In this post:

I’m working my way up the AAdvantage elite ranks!

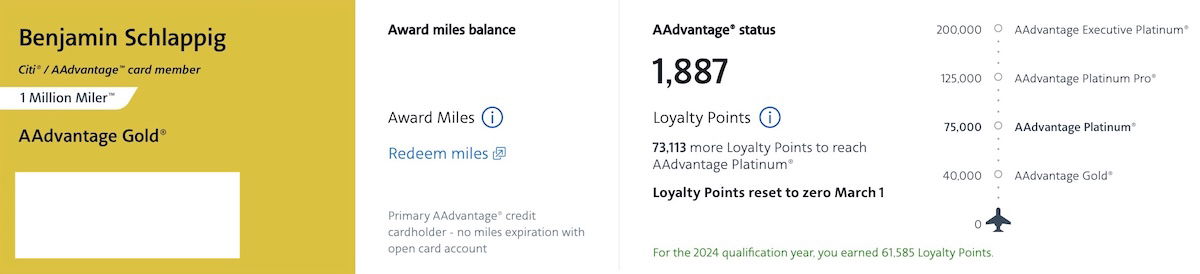

As I wrote about several weeks back, I didn’t requalify for AAdvantage Executive Platinum status for the first time in 14 years. Not only that, but I dropped all the way down to AAdvantage Gold status.

I have mixed feelings about this. On the one hand, status isn’t nearly as valuable as it used to be in terms of perks like upgrades, so I don’t consider it to be much of a loss. On the other hand, as someone who primarily travels internationally, I really value the perks of oneworld Emerald status (particularly, the great lounge access), and it’s something that I think is worth striving for.

When I didn’t requalify for status last year, it’s not that I was giving up on status with American, but instead, I was hoping to qualify a bit more efficiently:

- I’m probably happy just earning Platinum Pro rather than Executive Platinum going forward, since both tiers offer oneworld Emerald status, but the requirements for the former are nearly 40% lower (125,000 vs. 200,000 Loyalty Points)

- I figured it made sense to efficiently qualify for status every two years, rather than ever year; by earning status at the beginning of the current program year (2025-2026), my status will be valid through March 2027

Spending my way to AAdvantage Platinum Pro status

With American’s Loyalty Points system for status qualification, it’s possible to earn elite status through a variety of methods, including credit card spending. With American, you generally earn one Loyalty Point per dollar spent on an eligible co-branded American credit card, and elite requirements are as follows:

- AAdvantage Gold status requires 40,000 Loyalty Points

- AAdvantage Platinum status requires 75,000 Loyalty Points

- AAdvantage Platinum Pro status requires 125,000 Loyalty Points

- AAdvantage Executive Platinum status requires 200,000 Loyalty Points

As you can see, if you wanted to earn elite status exclusively through credit card spending, you’d potentially have to spend $125,000 for Platinum Pro, and that’s the status that I’m aiming for.

One way to get a bit of a shortcut is to have the Citi® / AAdvantage® Executive World Elite Mastercard® (review). If you earn 90,000 Loyalty Points in a program year and have the card (regardless of how you actually earned the Loyalty Points), you’ll receive 20,000 bonus Loyalty Points. That can make a big difference, obviously, since it means you’d only otherwise have to earn 105,000 Loyalty Points for Platinum Pro.

I’m generally opposed to overwhelmingly earning elite status through credit card spending, simply because of the opportunity cost of spending, of being able to earn two transferable points per dollar spent on other cards. But I think I have a pretty good plan now…

I might as well pick up two-for-one elite status

This is where spending money on American credit cards gets even more interesting. The Citi® / AAdvantage Business™ World Elite Mastercard® (review) is the co-branded Citi and American Airlines business card. The card offers several valuable perks, and also has an excellent welcome bonus at the moment, making it an ideal time to apply.

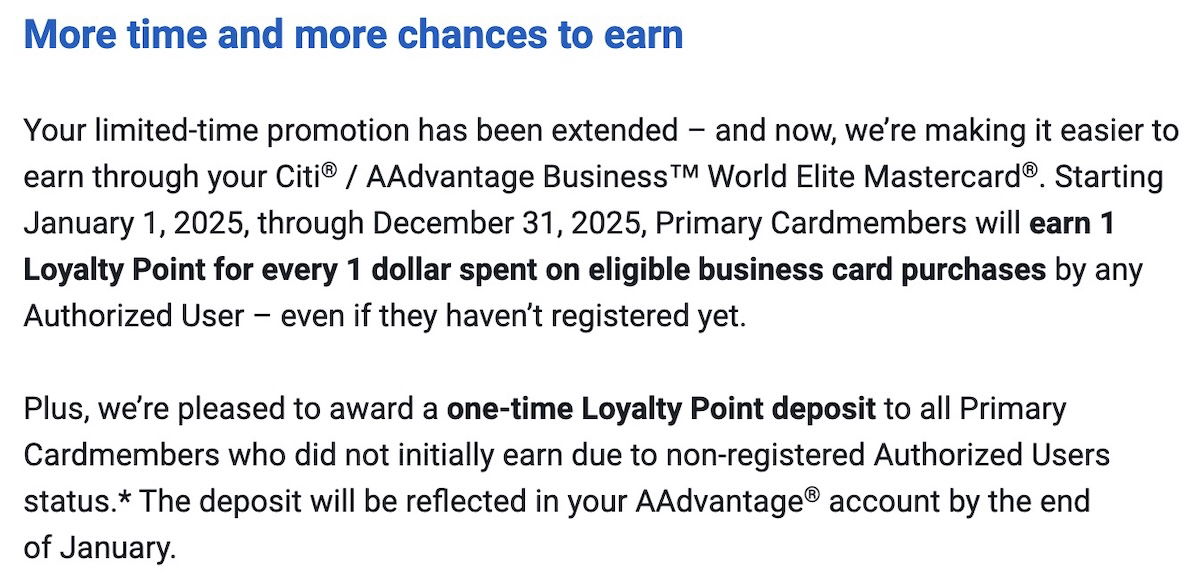

There’s a quirk to the card, though, when it comes to authorized user rewards. On this card, the authorized user ordinarily earns the Loyalty Points for their spending, and not the primary cardmember.

The catch is that there’s a limited time (currently through the end of 2025, but it might be extended), targeted promotion, that offers the ability to double dip. For those who are targeted (and it seems to be widely targeted), both the primary cardmember and authorized user earn Loyalty Points for spending. It basically means you earn two Loyalty Points per dollar spent, just in different accounts.

If I’m going to be spending money on American credit cards, then I might as well pick up status for two people, rather than one. That way Ford can also earn oneworld Emerald status, as he often travels alone as well.

Does double dipping make more spending lucrative?

If I’m going to earn Platinum Pro status for two people through credit card spending, does it then make sense to put even more spending on the card? Let’s say, hypothetically, that two people have 125,000 Loyalty Points, and have earned Platinum Pro, and let’s say they’re eligible for the double dip promotion on credit card spending.

This is where American’s Loyalty Point Rewards program comes into play, which offers incremental perks for passing certain Loyalty Points thresholds. For example:

- When you earn 175,000 Loyalty Points, you can select two systemwide upgrades or 25,000 AAdvantage bonus miles

- When you earn 250,000 Loyalty Points, you can select four systemwide upgrades or 60,000 AAdvantage bonus miles

If you’re getting those rewards for two people, the value of that really adds up. So if you were to spend your way from 125,000 to 250,000 Loyalty Points (so $125,000 in spending), your status would go from Platinum Pro to Executive Platinum, and you’d receive a total of 12 systemwide upgrades or 170,000 AAdvantage bonus miles (since both people are earning the Loyalty Points).

When you combine that with one mile per dollar spent, that means you’d be earning 290,000 AAdvantage miles for $125,000 in spending, which is well over two miles per dollar spent, better than you’d get on most transferable points cards.

Let me emphasize that I’m approaching this more as a general exercise than anything else, as I’m not sure if I can complete that spending. But I do think the math checks out, surprisingly, as I don’t consider there to be an opportunity cost, compared to using a card that earns two transferable points per dollar spent.

Bottom line

For the first time in a long time, I didn’t requalify for Executive Platinum status with American AAdvantage. That’s not because I’m totally giving up on the status, but just because I wanted to earn the status a bit more efficiently.

My plan is to now (mostly) spend my way to Platinum Pro status. The interesting twist to this is that the Citi AAdvantage Business Card has a targeted promotion offering Loyalty Points double dipping for the remainder of the year, for both the primary cardmember and authorized user.

This is awesome, since it’s basically an opportunity to get two-for-one elite status. Given the Loyalty Point Rewards program, I’d argue that it even makes incremental spending beyond that quite lucrative, thanks to the bonus miles and/or systemwide upgrades.

Anyone else using this double dipping opportunity to earn AAdvantage status?

As a 25+ years chairman preferred (USAir), consigiere key member and now a measly executive platinum, I only care for the lounge access. We pay for our 2-3 European business class (~140,000 points), and with the regular credit card spending and 20,00 bonus points, we land at 230-240k points per year. The only thing that sucks is the “rewards”. They are meaningless crap for for one who travels a lot. It is not until you...

As a 25+ years chairman preferred (USAir), consigiere key member and now a measly executive platinum, I only care for the lounge access. We pay for our 2-3 European business class (~140,000 points), and with the regular credit card spending and 20,00 bonus points, we land at 230-240k points per year. The only thing that sucks is the “rewards”. They are meaningless crap for for one who travels a lot. It is not until you hit 250k points that they are anything meaningful..

@Ben where do you see this promotion show up - in AA or in Citi?

It showed in my AA business account (AA.com). It did not require registering and language seemed like it applies to everyone.

Same for me

If you would have completed the BA status match you would have been OWE till

4/26. This OWE would have given you access to the AA Flagship on AA domestic flights.

I’m considering opening the business version of the card and using it for income tax payment as I’d easily get to Platinum Pro that way. I figured, I have to spend that money anyway, an extra ~2% of fees for status and points is worth it, when I’d otherwise get nothing…

Ben, use your Executive card for a hotel booking via AA hotels early in the qualification year. A two-night stay at the LAX Hilton is $467 (including tax). It will earn 467 LPs from the card and 9700 LPs from the portal for a total of 10167 LPs (that's nearly 22X LPs). It will earn roughly 14000 award points (that's nearly 30X award points). Who cares about foregoing a Hyatt stay?

Is oneworld Emerald worth $125,000 in locked spending on AA? The major benefit is getting First Class lounges when flying Business or Economy, and free seat selection on OW airlines. Ignoring how many CC sign-up bonuses you can get with that much spend, just straight intelligently maximizing existing CC point categories could get you hundreds of thousands to millions of CC points, enough to redeem thru a CC travel portal for the cash value of...

Is oneworld Emerald worth $125,000 in locked spending on AA? The major benefit is getting First Class lounges when flying Business or Economy, and free seat selection on OW airlines. Ignoring how many CC sign-up bonuses you can get with that much spend, just straight intelligently maximizing existing CC point categories could get you hundreds of thousands to millions of CC points, enough to redeem thru a CC travel portal for the cash value of multiple business class or first class flights + any associated seat selection costs. And that's the lowest possible use case.

I think that it’s worth it for the sole reason that for now there is no other way to earn AA points. I have personally over the years got some good redemptions from AA. Much better than delta or United

Using various techniques, Ben's actual spending might only be $75k. Compared to a 2X transferable points card, he'd be losing 75k points per year. What are 75k points worth to *him*? If it's 2cpp, then his opportunity cost is $1500. Given the amount of travel *he* does, is access to first class check-in and first class lounges worth $1500 to *him*? It seems it is worth it to Ben. And, maybe it's worth it to someone with a super-abundance of points.

You forget that he's also spending $1,200 for 2 years of the exec card, so is his total spend is $2,700. Add the fees for the other card, and it's probably closer to $3,000 for 2 years of One World Emerald.

Is it worth to him? If enough people are convinced to open cards using his commissioned links because of this post, absolutely yes!!

And, there is a practical limit to the number of new cards/SUBs one can get in a year. What does one do beyond that? I've hit the end of the line at Amex and I don't get NLL offers. Chase has capped Ink cards to four per year. Wanting simplicity, I'm not going to chase a gaggle of different airline cards.

You failed to mention that the Barclay Silver card - gives you 15K LP total in steps of $20K/20K/10K spend. And since the Citi Exec card gives bonus based on LP earned (not spend) spending $50K on Barclay Silver - you get the 15K LP plus the 10K from Citi Exec. Go to 90K LP by any method give you the extra 10K LP,

Exactly. And, if a person books *certain* hotels with the Executive card via the AA hotel portal, one earns 1 LP on the card but as much as 10 LPs via the portal (plus north of 14x award points). Yes, one will forego the almighty Hyatt booking. But, what's the higher priority? Also, let's not forget the Shopping Portal during Mother's Day Week -- watch for bonuses.

Barclay silver doesn't reward both the primary and authorized user with LPs spent from the AU's card. So not the same. Two people earning the same LP with the same spend is game changing.

Dang that's a nice play on loyalty points with the promo that allows the double dipping to mentioned. Gets me thinking to do that for myself and my Player 2!

I see this promotion to earn points on authorized users accounts in my AA app. However, when I click the link, it takes me to a non-functioning page at exploreamerican.com (“That page seems to have taken flight.”)

Anyone else experience this issue and have a work-around to actually get registered?

I'm having the same experience.

Same

Same. I called AA about it, they forwarded me to the help desk who proceeded to put me on hold and then hang up on me. Clearly they have no idea what's going on with this promotion. I have also been waiting 4 weeks since my AU's statement closed and the LPs havent posted. Yes, I know the T&Cs say 8-10 weeks, but usually nothing actually takes that long with AA, and the fact that the phone reps seem clueless about this promotion makes me nervous.

I chatted with the businessAA rep and took screenshots to confirm the promo and I do see it in my business account even though I had the same issue when clicking thru on the app. I think you're good. It's probably taking longer because it's being done manually as this is very outside the box.

Same