Link: Apply now for the Capital One Spark Cash Plus

The Capital One Spark Cash Plus (review) is a lucrative small business credit card, whether you’re looking to earn cash back or miles.

I picked up this card a couple of years ago, and wanted to share my experience getting approved at the time, for anyone who may be considering applying. This is an especially good time to pick up the card, given the great welcome bonus that is currently available. However, there are some things to consider, like whether you’d rather get this card or the Capital One Venture X Business (review).

In this post:

Why you should apply for the Capital One Spark Cash Plus

The Capital One Spark Cash Plus is offering an incredible welcome bonus where you can earn a one-time cash bonus of $2,000 once you spend $30,000 within the first three months.

Additionally, you can earn a further $2,000 cash bonus for every $500,000 spent during the first year. You can earn this bonus multiple times over the course of your first year of card membership.

Admittedly that’s a big spending requirement. Keep in mind that cash back earned on the card can be converted into Capital One miles, at the rate of one cent per mile, assuming you have it in conjunction with another card, like the Capital One Venture X Rewards Credit Card (review). I value Capital One miles at 1.7 cents each (thanks to all the ways to redeem them), so that makes the card much more lucrative.

It’s not just the welcome bonus that’s great, but this is also just a generally very lucrative card. The card offers a flat 2% cash back with no limits and no foreign transaction fees, making this one of the best cards for everyday spending, and one of my favorite business cards.

While the card has a $150 annual fee, the card offers $150 cash back when you spend $150,000 on the card in an anniversary year, so it’s especially rewarding for big spenders. Think of the card as offering a refund of the annual fee for big spenders.

What are Capital One’s application restrictions?

If you want to pick up the Capital One Spark Cash Plus, what application restrictions should you be aware of? Anecdotally, Capital One has very few consistent application restrictions.

The major restriction to be aware of is that you’re not eligible for the welcome bonus on this card if you have or have had this card, or if you currently have the Capital One Venture X Business. However, if you had the Capital One Venture X Business in the past, you would be eligible.

Aside from the above, eligibility is unrelated to having any other Capital One card. There shouldn’t be any other significant restrictions to be worried about. For example, I’ve had up to four Capital One cards at once, and I also managed to get approved for this card shortly after getting approved for the Capital One Venture X Rewards Credit Card.

If you’re concerned about Chase’s 5/24 rule, applying for this card shouldn’t count toward that five card limit, as the card shouldn’t show on your personal credit report (aside from the application inquiry).

My experience applying for the Capital One Spark Cash Plus

I applied for the Capital One Spark Cash Plus back in 2022, though the application process remains unchanged. I found the process of applying for the Capital One Spark Cash Plus to be pretty straightforward, though of course an instant approval always helps with my perception of application processes. 😉

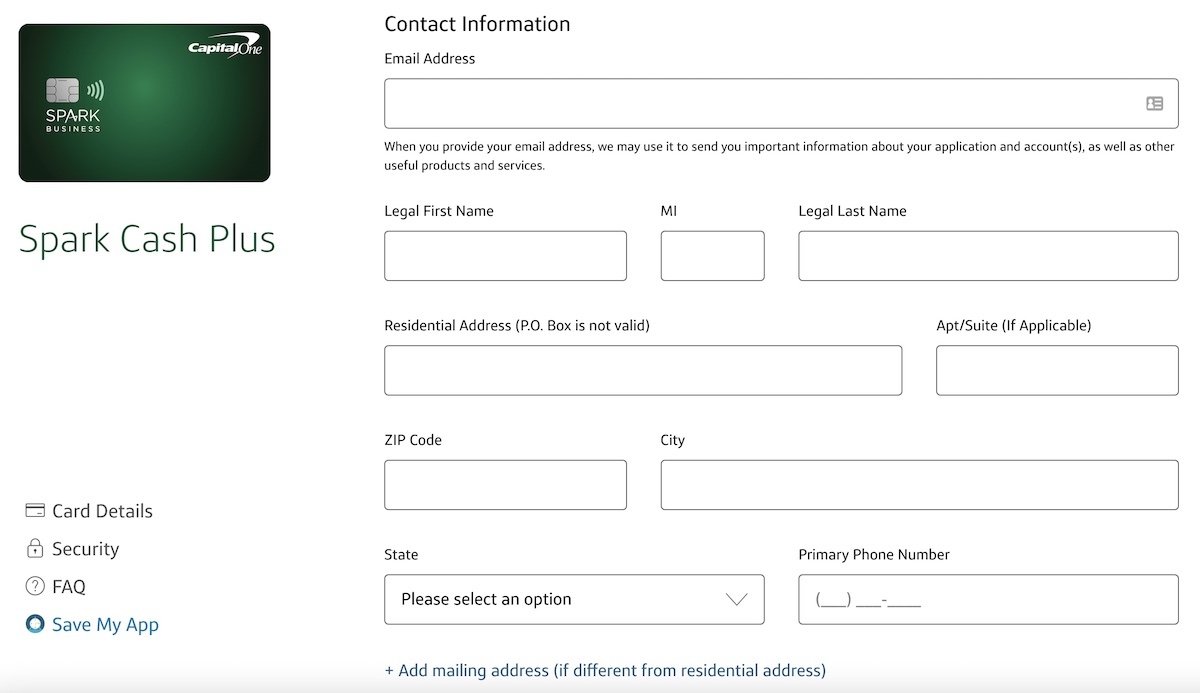

The application consisted of four parts. The first part just asked for personal contact details.

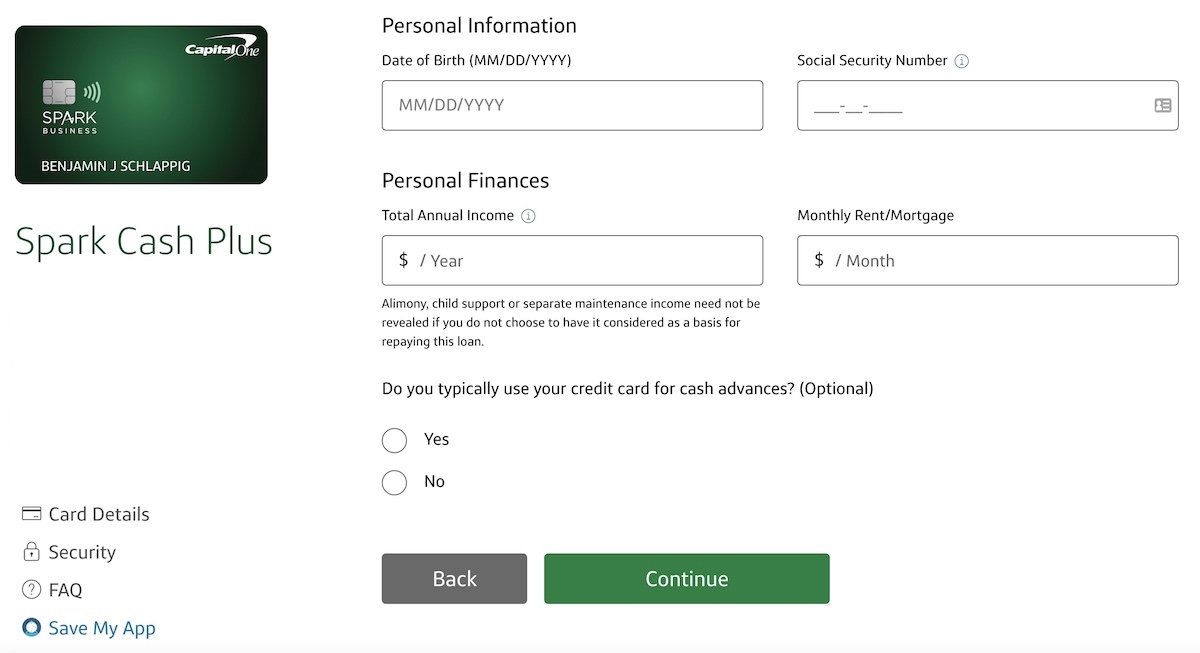

The second part asked for more personal information, including my date of birth, social security number, income, monthly rent or mortgage, etc.

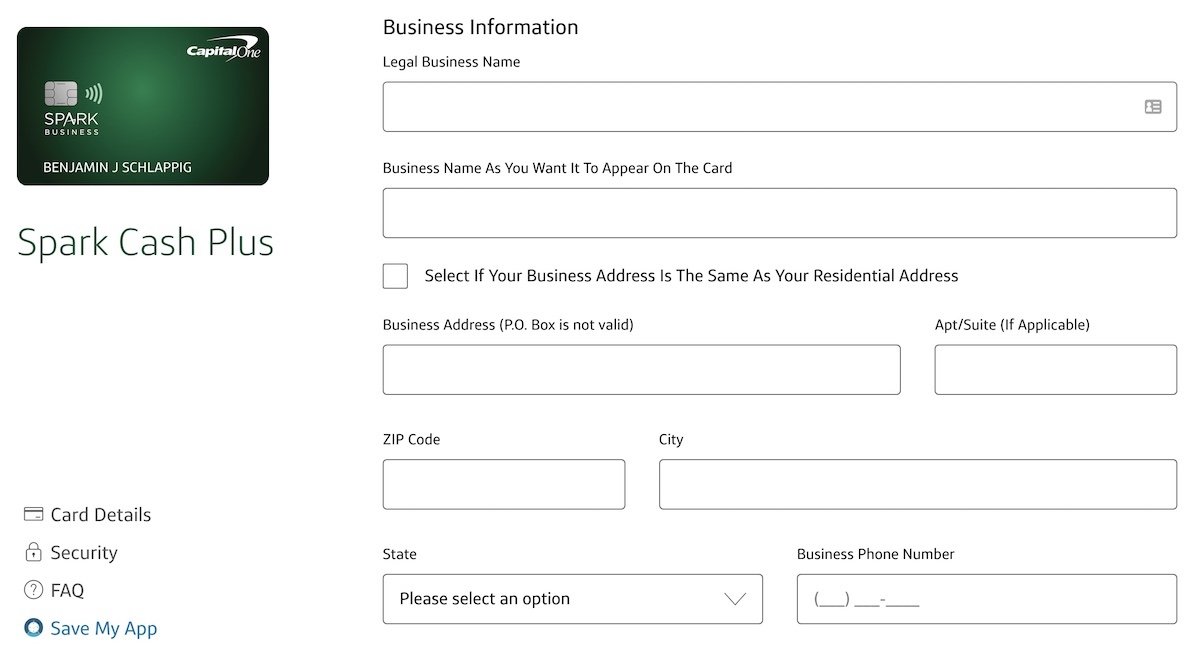

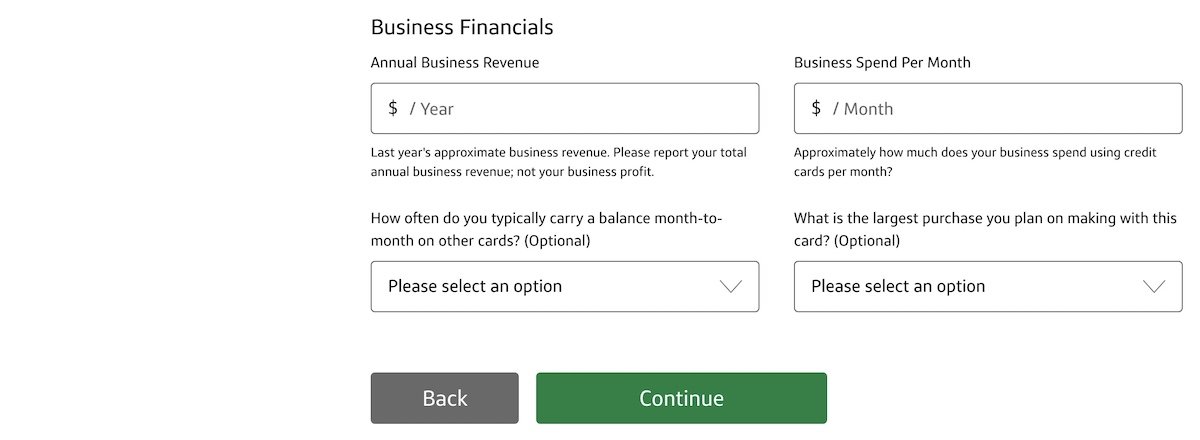

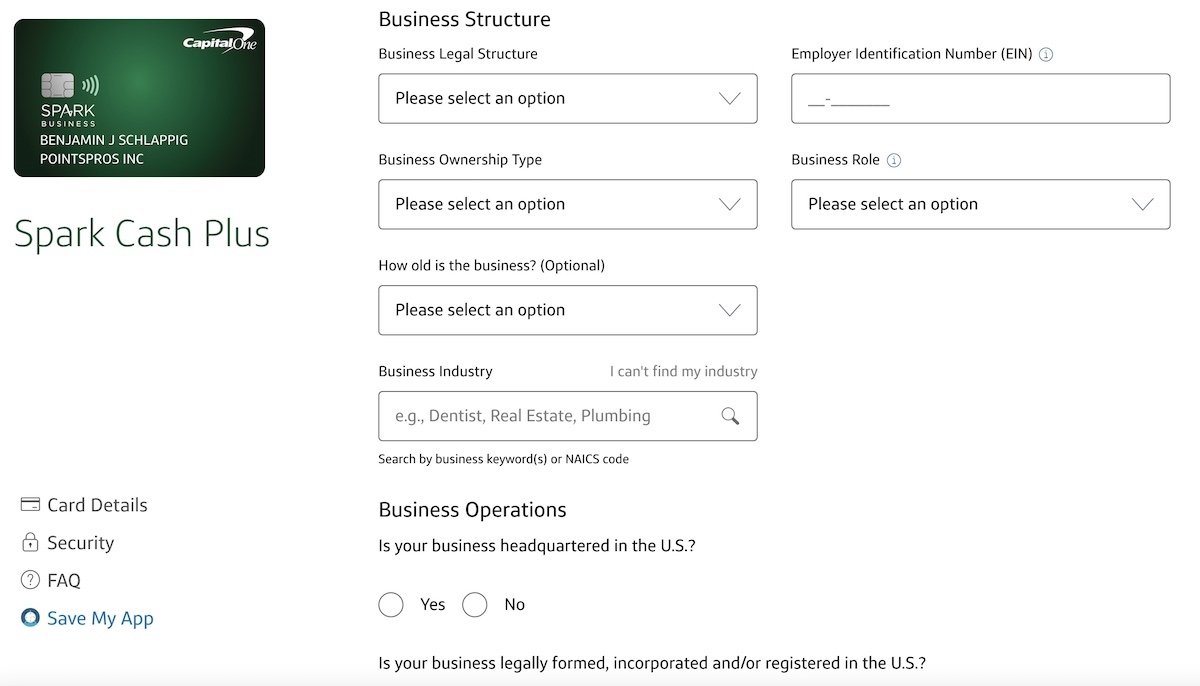

The third part asked for my basic business information, including the business address, business revenue, anticipated spending, etc.

Then the fourth part asked for more information about my business structure, and my role in the company.

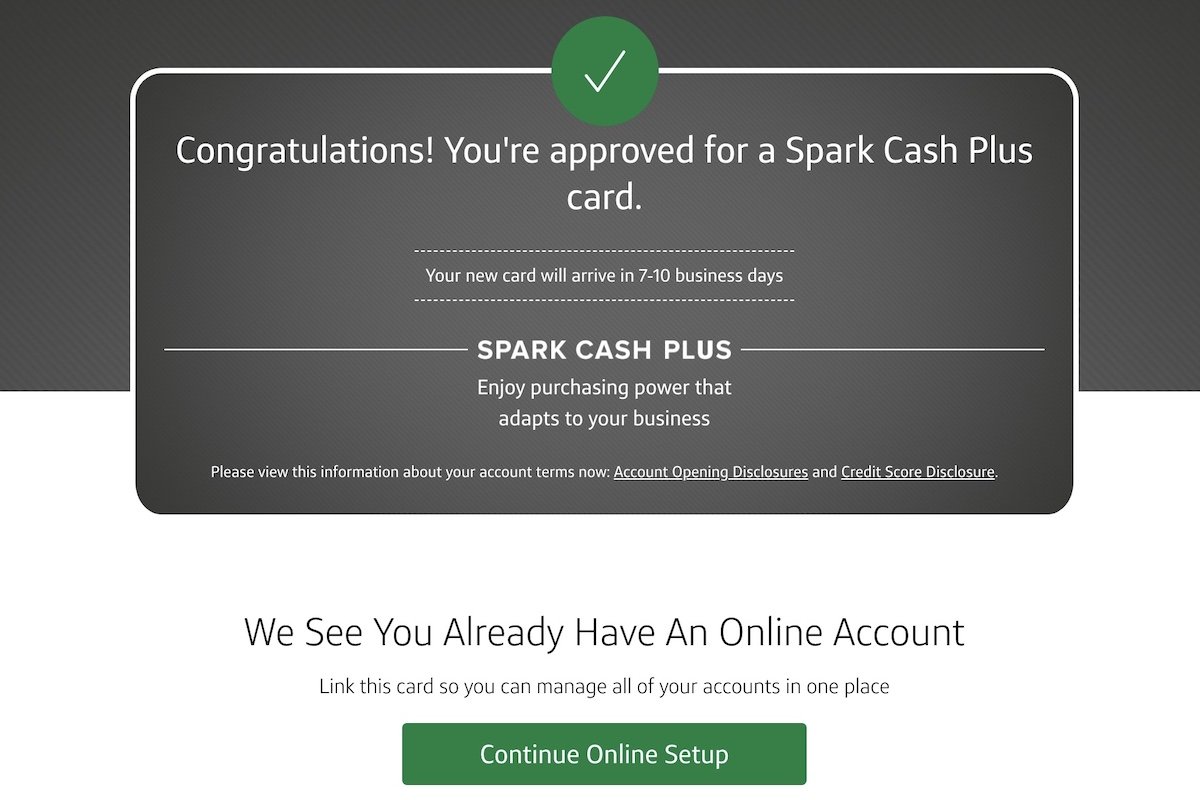

Then there were a couple of pages of disclosures, and a summary of my application. I then hit submit, and received an instant approval, which you can’t beat!

Since the Capital One Spark Cash Plus is a charge card, there’s no pre-set spending limit, and as a result there was no credit limit listed on the page. I could then immediately link my new card to my existing Capital One online account, so that I could start managing my account.

Spark Cash Plus vs. Venture X Business

If you’re considering applying for the Capital One Spark Cash Plus, the main consideration is whether you’d prefer this or the Capital One Venture X Business. There are many reasons to apply for the Capital One Venture X Business. The card has a $395 annual fee, but that’s pretty easy to justify when you consider all of the perks of the card:

- The Venture X Business has a welcome bonus where you can earn 150,000 miles once you spend $30,000 in the first 3 months.

- The Venture X Business offers unlimited 2x miles on every purchase; you can book through Capital One Travel to earn 5x miles on flights and 10x miles on hotels and rental cars, all with no foreign transaction fees and no preset spending limit

- The Venture X Business offers a $300 Capital One Travel credit plus 10,000 anniversary bonus miles every year, which in my opinion justifies the annual fee on an ongoing basis

- The Venture X Business offers a Priority Pass membership and Capital One Lounge access for the primary cardmember

So, which of these two cards makes the most sense? As I see it, the Capital One Spark Cash Plus is the better option in terms of having a superior welcome bonus at the moment, and if you value the ability to redeem your rewards as cash back however you’d like, rather than just toward travel. It’s an especially worthwhile option if you are a big spender, since you can get a statement credit equal to the annual fee.

Meanwhile I think the Capital One Venture X Business is the better bet if you value travel rewards and lounge access, and are happy to redeem your rewards for travel.

Personally I moved from the Spark Cash Plus to the Venture X Business, but both cards are valuable for certain consumers.

Bottom line

The Capital One Spark Cash Plus has a generous welcome bonus, which can be converted into Capital One miles as well, in conjunction with another card. While the spending requirement is significant, picking up this card could be well worth it for anyone who is looking for a business card and can pull off the spending.

If you’re considering this card, the only thing to decide is whether you’d rather get this or the Capital One Venture X Business, since they are generally mutually exclusive (at least in terms of getting the cards at the same time).

If you applied for the Capital One Spark Cash Plus, what was your experience like?

Thanks for the informative post! I wan to get this card for 1099 quarterly taxes, but I've heard that large charges can get declined on C1 business cards if they exceed your "spending power"---meaning they do have some kind of limit, but you don't know what it is. If I make a big tax bill my first charge, do you think I'd run into this problem?

Does anyone know whether you can get the bonus on this card if you have had this card before? Lucky has two conflicting posts: one indicating that you cannot get the bonus if you had the card: https://onemileatatime.com/deals/capital-one-spark-cash-plus-bonus/#can_you_get_approved_for_the_capital_one_spark_plus and one (this one) indicating that you only cannot get approved if you current have the card. Thanks!

I don’t understand. You say you successfully applied for the card in 2022 which I assume meant you received a bonus. But earlier you said if you’ve ever had the card you’re not eligible for the bonus. What am I missing?

I think that Ben is just simply sharing his experience when he applied for the card earlier. It does not seem like he canceled the card and applied for it again.

I had the same question

PSA: Reports suggest that Capital One has a 4/24 rule. Best of luck.