Link: Apply now for the Ink Business Preferred® Credit Card, Ink Business Cash® Credit Card, or Ink Business Unlimited® Credit Card

Chase has some of the all around best credit cards, in terms of the welcome bonuses, return on spending, and perks. In particular, the issuer has some of the best business credit cards out there. These include the following:

- The Ink Business Preferred® Credit Card (review) has a huge welcome bonus and is one of the most well-rounded business credit card

- The no annual fee Ink Business Cash® Credit Card (review) and Ink Business Unlimited® Credit Card (review) also have best-ever welcome bonuses, and are extremely compelling as well; the Ink Unlimited is great for everyday spending, while the Ink Cash is great for bonus categories

- The Ink Business Premier® Credit Card (review) is Chase’s newest business card, and is a rewarding cash back card

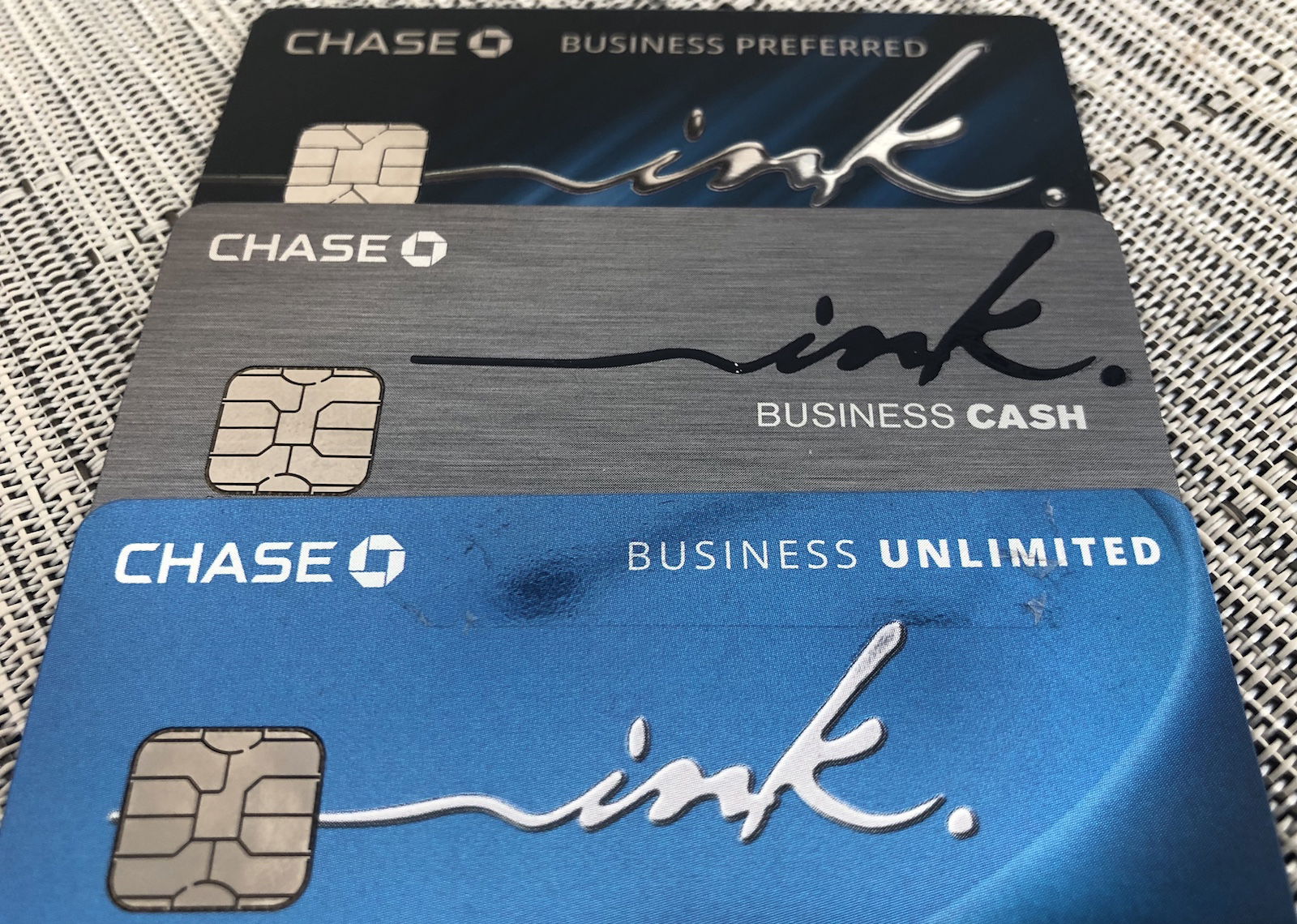

I have three Chase Ink cards, so in this post I wanted to take a closer look at who is eligible for these cards, and how you can go about getting approved for any or all of them.

In this post:

Who is eligible for Chase business credit cards?

Eligibility for a small business credit card is easier than you might think. You don’t need to have a big company, and don’t even need to be incorporated. Even a small side business with limited business revenue makes you eligible for a business credit card, even if you’re just selling things on eBay, do some consulting on the side, have a rental property, or do freelancing, for example.

It goes without saying that you should always fill out credit card applications truthfully.

What are restrictions on applying for Chase business credit cards?

Chase’s general restrictions on applying for cards are as follows:

- There’s no hard limit on how many Chase credit cards you can be approved for, but rather there’s often a maximum amount of credit Chase is willing to extend you, in which case you may be asked to switch around your credit limits on some cards in order to facilitate an approval

- There are inconsistent data points as to how long you have to wait between applications; my recommendation is to wait 30 days between Chase business card applications to be on the safe side

- Chase business cards are subjected to the 5/24 rule, whereby you typically won’t be approved if you’ve opened five or more new card accounts in the past 24 months; I’ll talk more about how that works below

- You can have (and earn the bonus) on each of the Chase Ink credit cards, so if you have the Ink Business Preferred you’re eligible for the Ink Business Cash, Ink Business Unlimited, and/or Ink Business Premier

How should you fill out a Chase business credit card application?

Those who already have business credit cards are probably familiar with the application process, but for those who aren’t, here’s what you need to know. It can be intimidating to apply for your first business credit card, though even if you’re a small business or sole proprietor, you should be eligible.

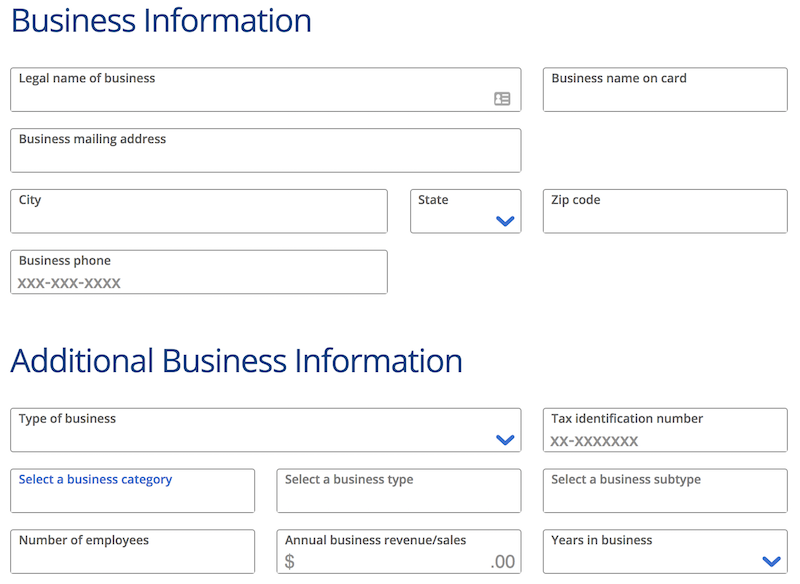

When applying for a Chase business credit card, you’ll be asked the following questions, in addition to the typical personal questions about your income, Social Security Number, etc.:

- Legal name of business

- Business mailing address & phone number

- Type of business

- Tax identification number

- Number of employees

- Annual business revenue/sales

- Years in business

If you’re a sole proprietor, how should you approach this? First of all, and most importantly, answer everything truthfully. I think the concern that a lot of people have is that they think they need an incorporated business, a separate office, etc., in order to be considered for a business card. That’s not the case:

- You can use your name as the legal name of your business

- The business mailing address and phone number can be the same as your personal address and phone number

- If you’re a sole proprietorship, you can select that as your type of business

- For the tax identification number, you can put your Social Security Number

- For number of employees, saying just one is perfectly fine

- For your annual business revenue, be honest about what it is

- For years in business, there’s no shame in saying that it’s new, that it has been one to two years, etc.

How hard is to get approved for a Chase business credit card?

When it comes to getting approved for business credit cards, Chase certainly isn’t the easiest issuer. In general I find American Express business cards to be easiest to be approved for. However, getting approved for Chase business cards isn’t as tough as some people assume, at least if you have excellent credit.

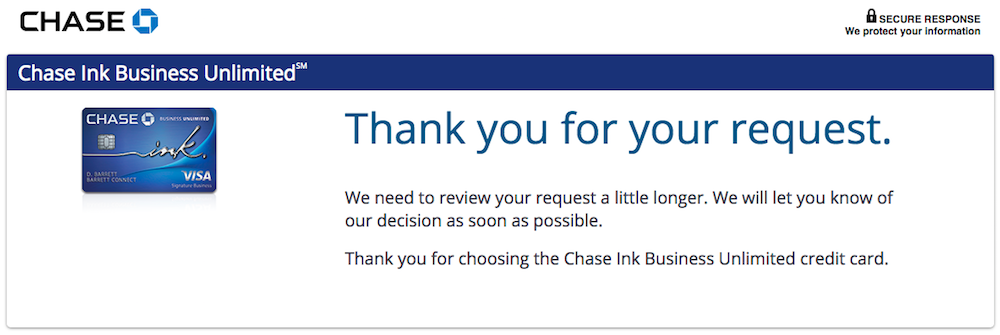

In my experience instant approvals on Chase business cards are fairly rare, so don’t be worried if the approval doesn’t come through right away. You’ll usually get a pending decision response, and then eventually (hopefully) an approval.

For example, I was eventually approved for the Ink Business Preferred, Ink Business Cash, and Ink Business Unlimited, but in each case I didn’t receive an instant decision.

What are the best Chase business credit cards?

There are three especially worthwhile Chase business cards to consider right now, and you’re eligible for all of them, potentially (which means that you can earn the bonus on a version of the card if you already have another version). Having these cards can really help you maximize your points from spending, given the complementary bonus categories these cards have. On top of that, the cards offer fantastic rental car coverage, which is a valuable perk.

First there’s the Ink Business Preferred:

- Welcome bonus: Limited Time 120,000 Ultimate Rewards points after spending $8,000 within three months

- Annual fee: $95

- Return on spend: 3x points on the first $150,000 of combined purchases per account anniversary year on travel, shipping purchases, internet, cable, phone services, and advertising purchases made with social media sites and search engines (the card also offers a cell phone protection benefit)

Then there’s the Ink Business Cash:

- Welcome bonus: Up to $750 cash back (in the form of 75,000 Ultimate Rewards points). Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Annual fee: $0

- Return on spend: 5x points on the first $25,000 of combined purchases per account anniversary year at office supply stores, and on internet, cable, and phone services, as well as 2x points on the first $25,000 of combined purchases per account anniversary year at restaurants and gas stations

Then there’s the Ink Business Unlimited:

- Welcome bonus: $750 cash back (in the form of 75,000 Ultimate Rewards points) after spending $6,000 within three months

- Annual fee: $0

- Return on spend: 1.5x points on all purchases, making this one of the best cards for everyday spending

There are some other excellent co-branded Chase business cards worth considering, including the following:

- Southwest® Rapid Rewards® Performance Business Credit Card (review) — the card offers anniversary bonus points, and an amazing Southwest Wi-Fi benefit

- Southwest® Rapid Rewards® Premier Business Credit Card (review) — the card offers anniversary bonus points, EarlyBird check-in, and savings on inflight purchases

- United℠ Business Card (review) — the card offers phenomenal perks for travel on United, ranging from United Club passes, to priority boarding, to free checked bags

- IHG One Rewards Premier Business Credit Card (review) — the card offers an anniversary free night certificate, IHG One Rewards Platinum status, and a fourth night free on award redemptions

- World of Hyatt Business Credit Card (review) — this card offers a variety of perks, including a $100 annual Hyatt credit, Discoverist status, and the ability to earn elite nights with spending

Is there an ideal order in which to apply for Chase credit cards?

Given that applying for Chase business cards won’t count toward your 5/24 limit, in general, I’d recommend applying for Chase business cards before applying for Chase personal cards.

If it were me, I’d pick up the Ink Business Preferred first (since I consider it to be the most well-rounded of the three cards), and then would pick up either the Ink Business Cash and/or Ink Business Unlimited, depending on whether you prefer to earn 5x points in select categories or prefer to earn 1.5x points across the board.

How does the 5/24 rule impact Chase business credit cards?

Chase has what’s known as the 5/24 rule, whereby you typically won’t be approved for a Chase card if you’ve opened five or more new card accounts in the past 24 months.

One exception is most business cards, including those issued by American Express, Bank of America, Barclays, Capital One, Chase, and Citi, generally won’t count as an additional card toward that limit, because they won’t be shown on your personal credit report.

You will want to check your 5/24 status before applying for a Chase business card. One positive thing is that while Chase business cards are subjected to the 5/24 rule, when you’re approved for them they don’t count as a further card toward that limit.

In other words, if you’ve opened four new accounts in the past 24 months and then apply for a Chase business card, you’ll still be at four cards. If you then apply for another Chase business card, you’ll still be at four cards.

Bottom line

Chase has some fantastic credit cards, and in particular, the issuer has great business credit cards. The lineup of Chase Ink cards have some phenomenal bonuses, and between the Ink Business Preferred, Ink Business Cash, and Ink Business Unlimited, you could potentially earn bonuses of 270,000 Ultimate Rewards points. That’s huge.

Not only do the cards have great initial bonuses, but they have excellent bonus categories, ranging from 1.5x points on all purchases, to 3-5x points in select categories.

Applying for business credit cards in general can be intimidating for new businesses, though I recommend giving it a try using the above tips, and you’ll probably be pleasantly surprised by the results.

Do you have any Chase business cards? If so, what was your experience getting approved for them?

How do you convert the 90,000 points with the business cash card into Ultimate Reward points that can be transferred to partners?

You need either the Ink Preferred, Chase Sapphire Preferred or Sapphire Reserve. One of the 3

Have 5 Chase Ink in past 12 months.( X2 CIC, x2 CIU,x1 CIP).

All apps SSN, SP, but picked a different category off business.(Chase Lending says it doesn't;t look at category) Waited 35-60+ days between each.

Applied Dec 2 2023 for CIC -denied due to much "RISK" Chase assumed false same business since sued same Name(My name), SSN.

I do have an EIN...can I apply for new CIC in Dec 23'(or when?) using same...

Have 5 Chase Ink in past 12 months.( X2 CIC, x2 CIU,x1 CIP).

All apps SSN, SP, but picked a different category off business.(Chase Lending says it doesn't;t look at category) Waited 35-60+ days between each.

Applied Dec 2 2023 for CIC -denied due to much "RISK" Chase assumed false same business since sued same Name(My name), SSN.

I do have an EIN...can I apply for new CIC in Dec 23'(or when?) using same revenue data as previous app and change business name? Sadly, I don;t have w-( to show income since it's legitimately using my SSN 1040/Sch E.

How do I navigate more Chase Biz cards INKS, co-brand like IHG biz, Hyatt biz?

I have CIC/CIU and initial credit limits were pretty low. Does the WoH biz card typically have higher initial limits than the $3-5k on the Inks?